Bodies don’t make money; value makes money."

Geraldine Carter, Business Coach & Founder, Geraldine Carter, LLC.Take a moment to reflect on that. What does it mean to you?

This powerful statement captures a solid truth for all accounting firm owners and CPAs: the countless hours you spend juggling client calls, looming deadlines, and financial planning don’t directly create the value that prompts clients to pay you. They are merely the means to an end. The real value emerges when your tasks are completed—when tax returns are filed on time and when you submit your clients’ financial reports.

However, it’s easy to get caught up in those daily tasks. You may spend so much time on the “means” that it prevents you from achieving the freedom you need to enhance your firm’s profitability.

Fortunately, WorkflowCon 2024 is here to help you scale!

This year’s theme centers on unlocking your firm’s potential for operational freedom and profitable growth—a freedom that streamlines your operations and creates the time needed for higher-level strategies like innovation, business development, and expansion.

After all, you’re in accounting to make money for your firm.

But why should you care about operational freedom? Let’s explore that in detail below.

10 Key Benefits of Operational Freedom for Accounting Firm Owners

Work-Life Balance: With operational freedom, you can finally reclaim your personal time. How does a 15-hour workweek sound to you? Impossible? It isn’t. There are even people like Geraldine Carter who specialize in helping CPAs like yourself cut down to 40, 25, or even 15 hours a week without losing revenue.

You can delegate responsibilities, trust your team to handle them, and avoid burnout. This balance not only helps you enjoy life outside of work but also keeps you energized and focused when you’re on the job.

Scalability: You can streamline your processes and create efficient workflows. This means you can grow your firm, expand your client base, and still provide the same high level of service that keeps your clients coming back. You won’t feel overwhelmed, and your team can work more effectively, allowing you to focus on what matters.

Focus on Strategic Growth: You can free up valuable time to focus on strategic initiatives. This means you can explore new service offerings or even venture into new markets. Perhaps you decide to add consulting services for clients looking to optimize their financial strategies.

Or, if you’ve been serving small businesses in your local area, you might consider expanding your reach to e-commerce businesses or startups. You could research their unique needs, understand their pain points, and tailor your services to meet those needs. Instead of getting bogged down by daily tasks, you can think bigger and make decisions that drive your firm’s growth.

Increased Profitability: When you achieve operational freedom, you’re able to streamline your operations. This means you can manage your costs better and increase your productivity, which directly boosts your profitability.

For example, instead of spending hours each month manually tracking payments and sending invoices, you can set up an accounting workflow tool like Financial Cents to do it for you. This saves you time, reduces errors, and allows you to focus on providing value to your clients. As a result, you can take on more clients without working more hours, which means more revenue for your firm.

Employee Empowerment: When you give your staff the freedom to take ownership of their roles, you create a more self-reliant and capable team. This means letting them make decisions, solve problems, and take the lead on projects.

Imagine one of your accountants taking the initiative to streamline the process of filing tax returns. Instead of waiting for your approval at every step, they propose a new workflow that saves time and reduces errors. Not only does this free you up to focus on bigger-picture strategies, but it also boosts their confidence and job satisfaction. When your team feels empowered, they’re more engaged, motivated, and ready to contribute to the success of your firm.

Reduced Dependence on the Owner: One of the key benefits of achieving operational freedom is that it reduces your firm’s dependence on you as the owner. This means your firm can run smoothly even when you’re not around, whether due to unexpected absences, vacations, or other commitments.

Instead of worrying about client calls and urgent deadlines while you’re taking a well-deserved week off to recharge, you have a reliable team and streamlined processes in place. Your staff can handle client inquiries, complete necessary tasks, and keep everything on track without your constant oversight.

Better Client Service: When you embrace operational freedom, you create optimized workflows that can significantly improve the way you serve your clients.

For example, a client calls with a question about their financial statement. With streamlined processes in place, you can easily access their information and give them a clear answer on the spot. This prompt, efficient service impresses your clients and makes them feel valued and understood. As a result, they’re more likely to stick with you for the long haul, boosting your client retention and building stronger relationships.

Adaptability and Flexibility: Operational freedom helps your firm become more agile, allowing you to quickly respond to changes in the market or your clients’ needs. If a new tax law is enacted, you can easily adjust your services to help clients navigate the changes without feeling overwhelmed. This responsiveness not only keeps your clients happy but also positions your firm as a trusted resource in times of change.

Improved Firm Valuation: When your firm can operate independently—without you being involved in every detail—it becomes more valuable. Investors or potential buyers see that your firm has systems in place that allow it to run smoothly, which makes it more attractive. If you decide to sell your firm one day, buyers will be more interested in a practice with established workflows and a reliable team, rather than relying heavily on you for day-to-day operations.

Personal Fulfilment: Lastly, when you have operational freedom, you can finally pursue those personal passions or explore new ventures you’ve always dreamed about while your firm keeps running efficiently.

Maybe you’ve always wanted to learn how to play the guitar or take up painting. With more time, you can sign up for lessons or dedicate weekends to getting creative. Or perhaps you’ve thought about starting a side business or volunteering for a cause you care about. With the extra time and mental space, you can dive into these interests, bringing more joy and balance into your life.

Ultimately, operational freedom allows you to be more than just an accountant. It also allows you to be well-rounded and enjoy life outside of work.

How To Unlock Operational Freedom In Your Accounting Firm

Unlocking operational freedom in your accounting firm is all about making smart choices and setting up your business for success. Here are some key steps you can take.

Standardized Processes: To kick things off, focus on creating standardized processes or workflows for the common tasks in your firm. Have a simple checklist or a set of guidelines that everyone on your team can follow.

When everyone knows the best way to handle each task, it not only saves time but also cuts down on confusion and mistakes. You’ll find that your team can work more efficiently, and clients will appreciate the consistency in service.

Plus, standardized processes make it easier to onboard new team members. With clear procedures in place, they can jump right in and understand how things work without needing constant supervision.

Streamlined Processes: Start by taking a close look at your current processes. Are there repetitive steps or tasks that don’t add value? Eliminate unnecessary steps, automate low-level tasks, and reduce redundancies to save valuable time and energy. For example, if you find that multiple team members are entering the same client information in different places, consider creating a centralized system to prevent that duplication. The goal is to make sure everyone is on the same page and that tasks flow seamlessly from one person to the next.

When your operations are running like a well-oiled machine, you’ll find that you have more time to focus on building client relationships, strategizing for growth, and developing your team.

Hiring and Delegating: Hiring the right people can help you achieve operational freedom. How? Look for candidates who have the necessary skills and fit well with your firm’s culture.

You need to ask yourself, who do I need to hire? Why do I need to hire them? What will they contribute on a daily basis to move the firm forward? - "

Nicole Davis, CPAFind individuals who share your values and vision–making it easier to work together toward common goals. When you have the right talent on board, it sets the stage for collaboration and innovation, which can boost your firm’s performance.

Once you’ve built a solid team, don’t hesitate to delegate tasks. Trusting your team to take on responsibilities is essential for freeing up your time.

Using the Right Tech Stack: When it comes to running your accounting firm, using the right tech stack is important. Think of it as the foundation for your operations. Invest in technology that fits your needs. Most importantly, invest in automation, especially for repetitive tasks that take up so much of your time—like data entry and report generation.

This reduces the chances of human error, giving you more confidence in the work you deliver. Plus, the right tools can help you manage client relationships better, making it easier to stay on top of communications and deadlines.

Focus on a niche: Instead of trying to serve everyone, think about narrowing your focus to a specific industry or client type. As Rachel Fisch, CPB, Principal at Realty Tax, suggests: “What kind of people are your clients? What are their personalities?”

This specialization allows you to tailor your services to meet the unique needs of that audience.

For example, if you choose to work with small businesses, you can develop a deep understanding of their challenges and provide solutions that truly resonate. Clients appreciate when their accountant “gets” them, and this can set you apart from the competition.

When you hone in on a niche, you’ll also find that your operations become more efficient. With a clear target market, you can streamline your processes and create standardized offerings that fit your clients perfectly. You can create templates, develop specialized marketing strategies, and even use specific software tailored to that niche.

Get training on workflow management: When you and your team understand how to effectively manage workflows, you’ll see a boost in productivity. Everyone will be aligned and focused on the same goals, which means less confusion and more streamlined operations.

If you’re seeking comprehensive training, the Accounting Workflow Academy by Financial Cents is an excellent option. With over 6,000 accountants and bookkeeping professionals already benefiting from this academy, you can be confident that you’re learning from industry leaders. You’ll also gain access to a community of fellow accounting workflow enthusiasts, where you can ask questions, share resources, and provide feedback.

How WorkflowCon 2024 Can Help Your Accounting Firm Achieve Operational Freedom

Understanding the value of operational freedom is the first step; now, it’s time to take action.

Your next move? Register for WorkflowCon 2024.

If you’re ready to free up more time for big-picture business tasks, WorkflowCon 2024 is the event for you. Specifically designed for accounting firm owners, this conference delivers actionable tips, expert advice, and proven strategies to help you streamline operations, improve efficiency, and increase profits. It’s a unique opportunity to learn how to run your firm more smoothly while focusing on what truly drives growth.

With track-based sessions and a lineup of seasoned CPAs and professionals, this event is packed with insights from industry leaders who have decades of experience managing successful firms. The keynote speaker, Dawn Brolin, CPA, CFE—a member of the Intuit Tax Council and named one of Accounting Today’s Top 100 Most Influential People in Accounting—will bring her two decades of experience as a respected educator and motivator to WorkflowCon 2024.

You’ll also hear from other professionals like Kellie Parks, CPB (Owner, Calmwaters Cloud Accounting), Linda Lee Hahn (Partner, Olsen Hahn Accounting Ltd), Brandon Hall, CPA (CEO & Managing Partner, Hall CPA LLC), Logan Graf, CPA (Owner, The Graf Tax Co PLLC), and many more.

Throughout this two-day virtual accounting event, these speakers will be sharing their insights on achieving operational freedom, mastering workflow efficiency, automating processes, and scaling your business. With different speakers featured each day, there’s always something new to learn, so you won’t want to miss a single session.

What can you expect from WorkflowCon 2024?

You can expect to gain a deeper understanding of how to systematize your firm so that it runs smoothly, even when you’re not involved in the day-to-day operations. This is key to freeing up your time and energy to focus on bigger, strategic goals—like scaling your business.

In addition to that, you’ll get practical, actionable tips from leading CPAs and professionals who’ve been in your shoes. They’ll share their proven strategies for standardizing processes that will empower your team to work more effectively and improve overall client satisfaction.

Whether scaling for you means hiring new staff, preparing for an acquisition, reducing your hours, or reaching new revenue milestones, these experts will help you figure out how to make it happen.

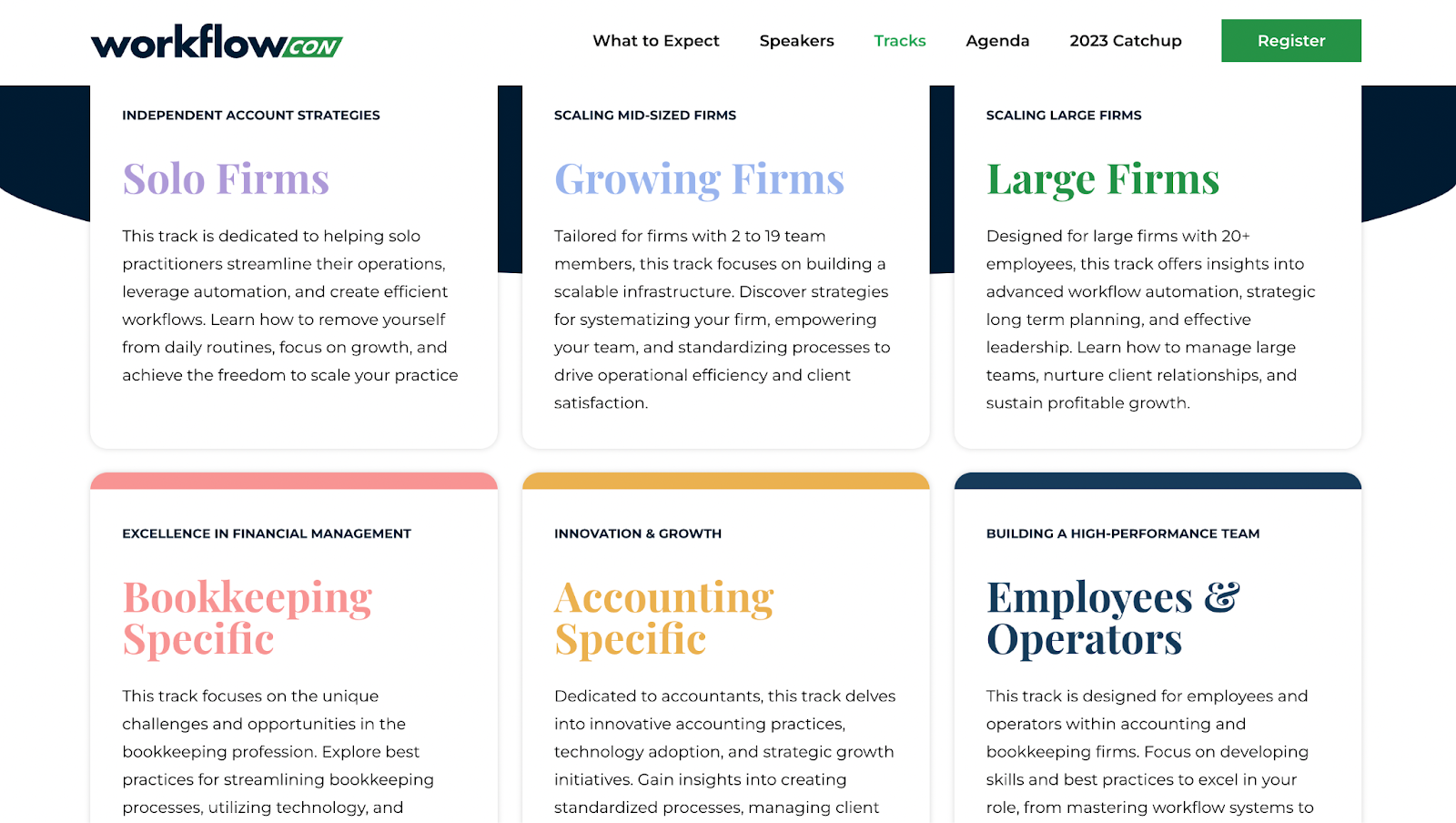

Remember, this is your chance to learn directly from the experts who’ve been where you are and can help you take your firm to the next level as a solo firm, a growing practice, or a large firm.

The learning tracks are designed for the needs of different firms.

This is your chance to gain insights that can truly change how you run your firm. Don’t miss out on WorkflowCon 2024.

Conclusion

Operational freedom is essential for you as an accounting firm owner. It allows you to scale your business and increase profits by giving you the time and space to focus on what matters—growing your client base and enhancing your services. When your operations are streamlined, you can make strategic decisions that drive success and lead to lasting growth.

If you’re ready to unlock this potential, WorkflowCon 2024 is the perfect opportunity for you. This is where you’ll connect with industry experts and other firm owners who understand your challenges. You’ll gain practical insights and strategies that you can immediately apply to transform your business.

Don’t miss this chance to learn, network, and take your firm to the next level.

Join us at WorkflowCon 2024, and let’s make operational freedom a reality for your firm! We’re excited to see you there!