If you’ve ever balanced a trial balance, prepared financial statements, or double-checked a journal entry, you’ve relied on the accounting equation, whether you realized it or not.

As an accountant, you need the accounting equation because it’s the foundation of how financial information is recorded, tracked, and reported. It ensures every transaction makes sense mathematically and logically. It’s how you know the books are balanced, and how you can spot when they’re not.

Every asset, liability, and equity account you manage ties back to this equation. It’s the reason double-entry accounting works, and it’s the starting point for every financial statement your clients or stakeholders depend on.

What Is the Accounting Equation?

The accounting equation explains how a company’s assets are financed. The equation shows you that everything a business owns (its assets) is financed either by borrowing money (liabilities) or by using the owner’s or shareholders’ investment (equity). It’s calculated as:

Assets = Liabilities + Equity

This simple formula is the foundation of double-entry accounting. It ensures that every financial transaction you record keeps the books in balance, because every debit has a corresponding credit. It’s your starting point for evaluating a company’s financial position and verifying that its accounts are in order.

You use this equation every time you prepare a balance sheet. Why? Because the balance sheet is a real-world snapshot of this formula in action. Assets are listed on one side, while liabilities and equity make up the other, and both sides must always match. If they don’t, something’s off, and it’s your job to find out why.

Breaking Down the Components

To fully understand the accounting equation, you need to look at each part it’s made of. Here’s a quick breakdown of assets, liabilities, and equity, and how they might show up in your world.

Assets

Assets are everything the business owns or controls that has value. Think of cash in the bank, office equipment, inventory, or even unpaid customer invoices.

You’ll often divide assets into two categories:

- Current assets: These are expected to be used up or converted to cash within a year. Examples: cash, accounts receivable, inventory.

- Non-current assets: These stick around longer than a year. Think of property, vehicles, or long-term investments.

As an accountant, you track your client’s assets to understand what resources are available to the business right now and what will support it long term.

Liabilities

Liabilities are what the business owes to others. This could be a loan from the bank, unpaid vendor bills, or taxes due.

Like assets, liabilities fall into two groups:

- Current liabilities: Obligations due within a year, such as accounts payable, salaries payable, or short-term loans.

- Non-current liabilities: Debts or obligations due in more than a year, like long-term loans or bonds payable.

You need to monitor liabilities carefully to make sure the business can meet its financial obligations without running into cash flow trouble.

Equity

Equity represents the owner’s or shareholders’ claim on the business after liabilities are subtracted from assets. It includes the capital invested in the company and the profits it has kept over time.

Equity changes when:

- The business earns a profit (equity increases)

- The business takes a loss (equity decreases)

- The owner takes money out (equity decreases)

You can think of equity as the business’s net worth. When you prepare a balance sheet, this is what remains after assets cover all liabilities, and it helps tell the story of how the business is performing over time.

How the Accounting Equation is Calculated & Applied (With Examples)

You don’t just memorize the accounting equation; you apply it every time a transaction takes place. Let’s walk through some simple examples to see how the equation works in common scenarios.

Initial Setup

Let’s say you’re setting up the books for a brand-new business. There are no previous transactions, just a clean slate. Now, the business owner contributes $5,000 in cash to get things started. This is known as owner’s capital or owner’s equity, and it’s the first transaction you record.

Here’s how it plays out in the accounting equation:

- Assets (Cash) increase by $5,000

- Liabilities remain at $0 (because the business hasn’t borrowed anything yet)

- Equity (Owner’s Capital) increases by $5,000

The accounting equation will be calculated as such: $5,000 (Assets) = $0 (Liabilities) + $5,000 (Equity)

The business has gained something of value, but it didn’t come from a loan or revenue. It came from the owner, which means it’s equity.

From your perspective as the accountant, this transaction confirms two things:

- The business now has an asset (a thing of value) it can use to operate and finance its activities.

- That cash isn’t a liability; it belongs to the owner until it’s used, invested, or withdrawn.

So even before the first sale, invoice, or expense, the accounting equation is already doing its job: keeping track of where the money came from and where it currently sits.

Let’s walk through a few examples to show how different transactions play out while managing your client’s books.

Purchasing an Asset

Let’s say the business uses $2,000 of that $5,000 in cash to buy a laptop for business operations. This is a straightforward asset-for-asset transaction.

Here’s what changes:

- Cash (Asset) decreases by $2,000

- Equipment (Asset) increases by $2,000

- Liabilities remain unchanged at $0

- Equity remains unchanged at $5,000

The updated equation will now read: $5,000 (Assets: $3,000 Cash + $2,000 Equipment) = $0 (Liabilities) + $5,000 (Equity)

Even though one asset decreased and another increased, the total value of assets remains the same, and the books are still balanced. From your point of view as the accountant, this transaction shows the movement within the asset section.

Earning Revenue

After setting up the business and buying a laptop, your client is ready to start generating income. Let’s say they complete a service for their client and they get paid $1,000 in cash.

Here’s how the transaction affects the accounting equation:

- Cash (Asset) increases by $1,000

- Liabilities remain unchanged at $0

- Equity increases by $1,000 (because revenue boosts retained earnings, which is part of equity)

The updated equation will now read: $6,000 (Assets: $4,000 Cash + $2,000 Equipment) = $0 (Liabilities) + $6,000 (Equity)

Once again, the books stay balanced.

From your perspective, this is a key transaction. You’re not just bringing in cash, you’re increasing the business’s value. Revenue doesn’t go into a “revenue” account in the equation itself; it flows into equity, typically through retained earnings. That’s how the accounting equation reflects business growth.

This example also highlights how you, as an accountant, trace the impact of income not only on cash flow but also on the owner’s stake in the business.

Pay an Expense

If your client pays $300 for their monthly internet and software subscriptions, it is an ordinary operating expense for the business. The transaction will impact the equation.

- Cash (Asset) decreases by $300

- Liabilities remain unchanged at $0

- Equity decreases by $300 (because expenses reduce profit, which reduces retained earnings)

The updated equation will now read: $5,700 (Assets: $3,700 Cash + $2,000 Equipment) = $0 (Liabilities) + $5,700 (Equity)

Even though they’re spending money, the books remain in balance. This transaction reflects the cost of doing business, and although it reduces the company’s profit (and by extension, equity), it doesn’t touch liabilities.

Pay Off a Liability

Now, let’s say your client previously took out a $1,000 short-term loan from a bank to help with initial startup costs. They’ve been operating for a while, and it’s time to pay back $500 of that loan using the available cash.

Here’s what changes:

- Cash (Asset) decreases by $500

- Liabilities (Loan Payable) decrease by $500

- Equity remains unchanged

The updated equation will now read: $5,200 (Assets: $3,200 Cash + $2,000 Equipment) = $500 (Liabilities) + $4,700 (Equity)

The total on both sides of the equation still balances.

This is a liability-reducing transaction. You’re simply settling an existing obligation with an asset (cash). Since you’re not incurring a new expense or earning income, equity stays the same.

Owner Withdrawal / Dividends Paid

Let’s say the owner decides to take $700 out of the business for personal use. This is treated as a draw (in a sole proprietorship) or dividends (in a corporation), and it reduces equity, not an expense.

Here’s how it affects the accounting equation:

- Cash (Asset) decreases by $700

- Liabilities remain unchanged at $500

- Equity decreases by $700 (specifically, a reduction in owner’s capital or retained earnings)

The updated equation will now read: $4,500 (Assets: $2,500 Cash + $2,000 Equipment) = $500 (Liabilities) + $4,000 (Equity)

Once again, the equation remains in balance.

This transaction doesn’t go through the income statement. It’s not treated as an expense because it’s not a cost of running the business, it’s a reduction in ownership interest.

Clients can often get confused in this area. Your role is to correctly classify these withdrawals so the financials reflect the business’s actual performance and financial position.

The Accounting Equation in Action (Double-entry Accounting)

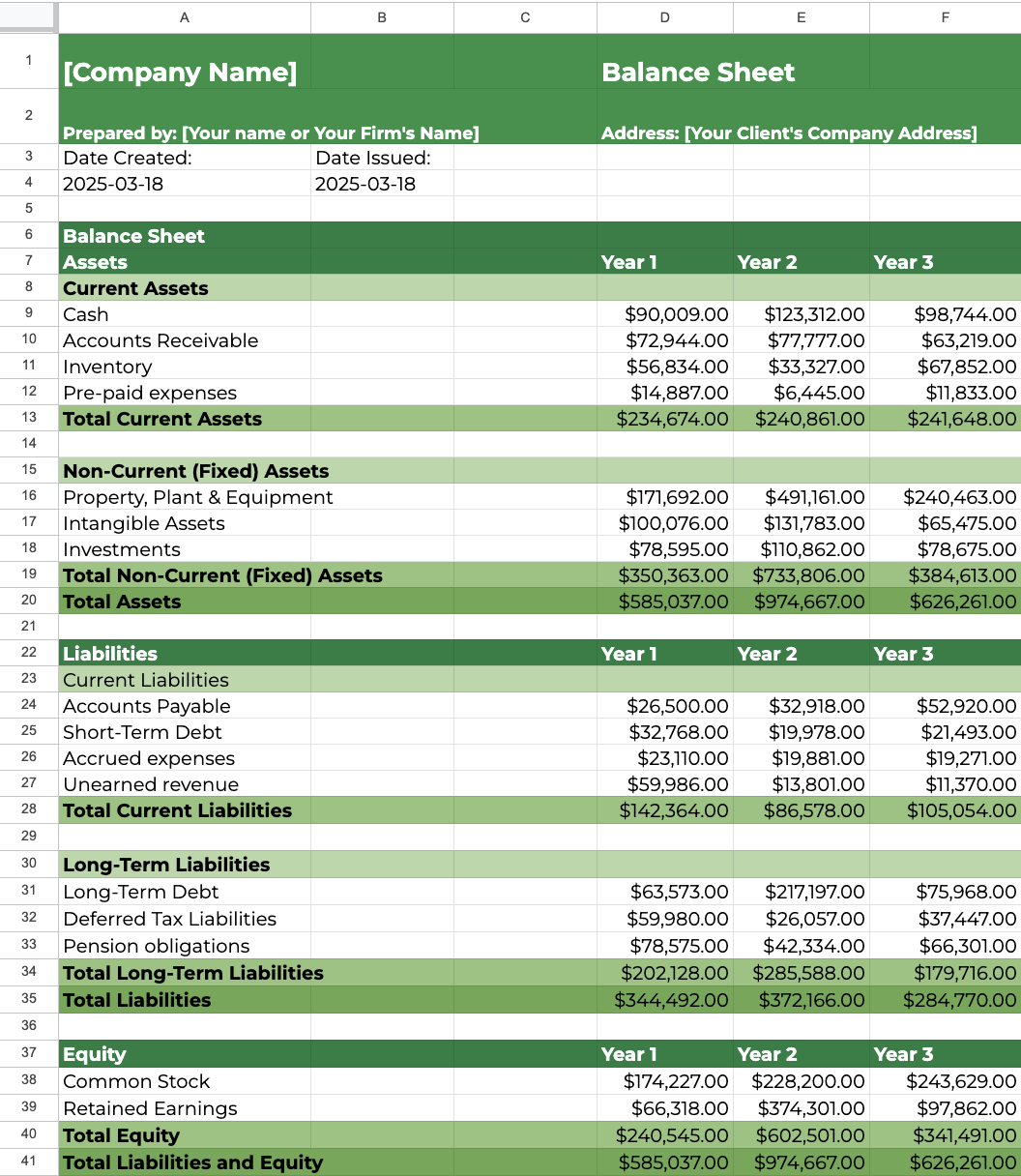

Now that you’ve seen individual transactions play out, let’s step back and look at the bigger picture. The balance sheet you see below is a live demonstration of the accounting equation in motion:

Download our Free Balance Sheet Template

This isn’t theory. It plays out every time your client moves money, makes a sale, or takes on debt. The double-entry system ensures that every transaction affects at least two accounts, so the books always stay balanced.

Take Year 1, for example. You’ll notice the business has $72,944 in Accounts Receivable and $90,009 in Cash. If a customer pays an invoice during the year, cash goes up while accounts receivable go down by the same amount. Nothing changes in total assets, it’s just a shift within the asset category. But it’s still a two-sided entry: debit cash, credit accounts receivable. Same value, different form. And importantly, no effect on liabilities or equity in this case.

Now look at Year 2, where Property, Plant & Equipment jumps to $491,161, while Short-Term Debt drops to just $19,978 and Long-Term Debt increases significantly to $217,197. This tells you the business likely took out a long-term loan to invest in fixed assets. Here, assets went up, but so did liabilities. One side of the equation rises, and so does the other. Still balanced.

Even earnings feed into this equation. Retained earnings jump from $66,386 in Year 1 to $374,301 in Year 2. That reflects net profit being reinvested in the business. The increase in equity corresponds to growth in assets like cash or receivables, or possibly a reduction in liabilities. Whatever the case, the change didn’t happen in isolation. It’s always mirrored elsewhere in the books.

As a quick refresher:

- When you earn revenue, cash goes up, and equity increases.

- When you pay an expense, cash goes down, and equity decreases.

- When you repay a loan, cash decreases, and liabilities decrease.

- When the owner withdraws funds, cash goes down, and equity goes down.

Why the Accounting Equation is Fundamental

You’ve seen how the accounting equation plays out in transactions, but why is this simple formula the cornerstone of your work as an accountant?

1. It’s the foundation of double-entry accounting

Every transaction you record affects at least two accounts. The accounting equation is what makes that possible. It ensures that for every increase, there’s a corresponding decrease, or another increase, somewhere else. That balance is what keeps your books trustworthy.

2. It forms the basis of the balance sheet

The structure of a balance sheet is built directly from the equation: Assets = Liabilities + Equity. Each side reflects a different part of the business’s financial story, and both must always match.

3. It ensures accuracy

The equation acts as a built-in error-checking tool. If your books don’t balance, it’s a signal that something’s off, a missed transaction, a misclassification, or a data entry error. It helps you catch mistakes early.

4. It reveals the financial structure

By looking at how a company’s assets are funded, through debt (liabilities) or owner/shareholder investment (equity), you gain insight into its financial health, risk level, and operational strategy.

5. It supports better decision-making

Whether you’re advising a client, preparing for an audit, or analyzing cash flow, the accounting equation gives you a clear snapshot of the company’s financial position. That’s essential for both internal strategy and external reporting.

6. It ensures compliance

Staying aligned with the accounting equation means you’re also adhering to key accounting principles, like consistency, reliability, and accuracy. It keeps your work in line with financial reporting standards and stakeholder expectations.

Common Mistakes to Avoid

Even with a solid understanding of the accounting equation, it’s easy to make errors that throw off your records. Here are a few common pitfalls to watch for:

1. Misclassifying items

One of the most frequent errors is treating an owner’s draw or dividend payout as an expense. Remember, these reduce equity, not net income. Misclassifying them can distort your income statement and overstate business expenses.

2. Assuming only one side of the equation changes

Every transaction affects at least two accounts. If you’re only adjusting one side, say, recording a cash expense without reducing equity, you’re breaking the double-entry rule. Always ask: what’s the second impact?

3. Ignoring accrued liabilities or retained earnings

It’s easy to overlook liabilities that haven’t been paid yet, like wages payable or accrued interest. Similarly, forgetting to update retained earnings when closing out income can lead to balance sheet inaccuracies over time.

4. Not understanding how equity changes over time

Equity isn’t static. It shifts with every profit, loss, draw, or reinvestment. If you treat equity as a fixed number, you risk misrepresenting the business’s financial position. Always consider how operational activity flows through to equity via net income and distributions.

Best Practices for Staying Accurate

To keep your accounting equation (and your books) in check, consistency is key. Here are a few habits that help you stay on top of the numbers:

1. Maintain up-to-date records

Timely data entry is good practice and essential. Recording transactions as they happen reduces the risk of forgetting details or making errors when backtracking later.

2. Use accounting software with a general ledger

Manual accounting spreadsheets can work, but purpose-built accounting tools do the heavy lifting. A solid general ledger system ensures that every transaction hits the right accounts and flows through the equation correctly.

3. Reconcile accounts regularly

Bank reconciliations, loan schedules, and inventory counts are your first line of defense against hidden discrepancies. Regular reconciliation keeps your records clean and your reports trustworthy.

4. Review equity changes frequently

Don’t treat equity as an afterthought. Keep an eye on how profits, losses, and owner distributions affect it. This helps prevent misstatements and gives you better visibility into the business’s true value over time.

5. Standardize with clear workflows

Having a set process for recording, reviewing, and approving transactions ensures consistency, especially when working in teams or managing multiple clients. It also minimizes the chance of steps being skipped under pressure.

Stay Ahead of Client Work with the Right Tools

By now, you know the accounting equation isn’t just something you memorized back in school; it’s the logic behind every journal entry, every balance sheet, and every client report you create. When you truly understand how assets, liabilities, and equity interact, you’re in control. You can catch errors faster, explain financials clearly, and keep things running smoothly.

But understanding the accounting equation doesn’t make the rest of your job any easier.

You’re still trying to juggle client work, deadlines, emails, follow-ups, staff check-ins, and maybe even running your firm on top of it all. That’s a lot. And it gets messy, especially when you’re tracking everything across spreadsheets, sticky notes, and your inbox.

That’s where using a practice management tool like Financial Cents makes a real difference.

Designed specifically for accounting firms, it helps you stay organized without the manual follow-up. You can track every client task using simple, repeatable workflows and stay ahead of deadlines without constantly checking your calendar. It also gives you instant visibility into what your team is working on, so nothing is missed or forgotten. Plus, with automated client requests, you spend less time chasing documents and more time getting actual work done.

When you’re organized behind the scenes, the work feels less chaotic, and clients feel it too. If you’re tired of just keeping up and want to actually stay ahead, Financial Cents makes that possible.

Use Financial Cents to manage your firm’s workflow.