Are you finding yourself struggling to delegate work, maintain work quality, and drive productivity across your team as your accounting firm grows,?If you struggle in these areas, It could be due to a lack of standardization of your accounting workflows and processes.

In this article, we cover 8 accounting workflow checklists that you can use to streamline your accounting workflows and scale your firm.

You can read through the whole article or click on any topic on the table of contents that you’d like to jump into.

You may be wondering, “How can accounting workflow checklists help my firm?”

Here are the top three benefits you’ll encounter once you switch to using efficient checklists:

We all know delegation is tricky.

Sometimes it feels easier just to do things yourself rather than go to the hassle of getting someone else to do it properly. Even if you think you’ve explained the whole process to your employee, something always gets left out or forgotten. This results in a lot of back and forth that drains your energy and wastes time.

When your time is wasted, your entire business suffers.

If you’re not completing your tasks properly and on time, your clients will be understandably upset and may take their business elsewhere.

After all, you’re handling their money!

An accounting workflow checklist alleviates this problem by giving your staff a step-by-step process and all the information needed to complete the client’s work quickly. They will literally have a straightforward guide to follow every time, which will prevent them from leaving things out or having to ask you questions. You’ll be able to focus on your own projects, knowing your employees are completing their projects with little to no input from you.

As your firm grows, it is vital that you can guarantee all your clients consistent deliverables every time.

If you can’t, it will cause rework and clients will get upset and potentially take their business elsewhere.

Unfortunately, as your firm grows and you hire more employees, it becomes harder to ensure consistent work quality for all clients since you’re no longer doing everything yourself.

You have to delegate client work to your new staff members if you want to take on more clients and continue to grow your firm. However, new staff members typically make mistakes due to a lack of experience.

Thankfully, accounting workflow checklists can solve this problem!

By implementing accounting workflow checklists, you can provide your staff with a step-by-step process to follow and all the information they need to ensure the work gets done correctly every single time. Just as if you were doing it yourself! This results in consistent client deliverables for all your clients every time no matter who does it.

(You may be interested in learning about Accounting Workflow Management)

Using accounting workflow checklists streamlines your accounting processes, which will tremendously increase the productivity of your firm.

This happens in multiple ways:

As you can see, there are tremendous benefits in store for you when you implement accounting workflow checklists.

By now, you may be wondering what some of these checklists look like and how to implement them into your firm.

Keep reading to find out!

Let’s look at eight accounting workflow checklists you should use in a typical firm, and how they can be useful to you.

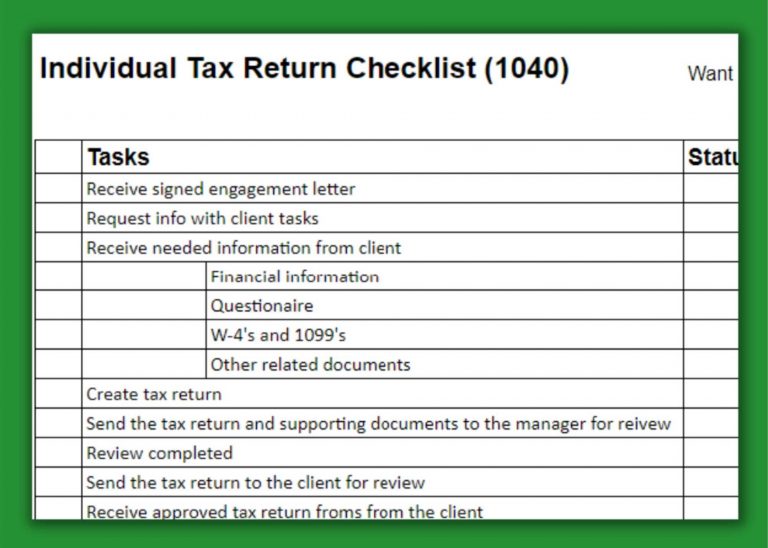

It’s crucial to do your client’s tax returns in a streamlined fashion.

Without a clear checklist to follow, your team may forget to get key documents or information from your client. This delays the process, particularly if your client is bad at getting back to you.

Delays are a big no-no, as you are likely already very busy in tax season, and have many clients who all need their taxes filed by the due date.

A checklist helps you make sure the tax returns go through both an internal and a client review.

We get it—the review process often feels monotonous and maybe unnecessary. But think about the implications of making a mistake on your client’s tax return: Not only do you lose their money, but you also lose their trust and potentially their business.

That’s a place no accounting firm wants to be at!

A good checklist also helps you financially. Your checklist should begin with getting a signed engagement letter from your client so all your expectations regarding money and timelines are agreed upon before you even begin, and it should end with you ensuring payment.

Looking for a good checklist to get started? Download our free individual tax return (1040) template, business tax return (1120) template, or business tax return (1065) template.

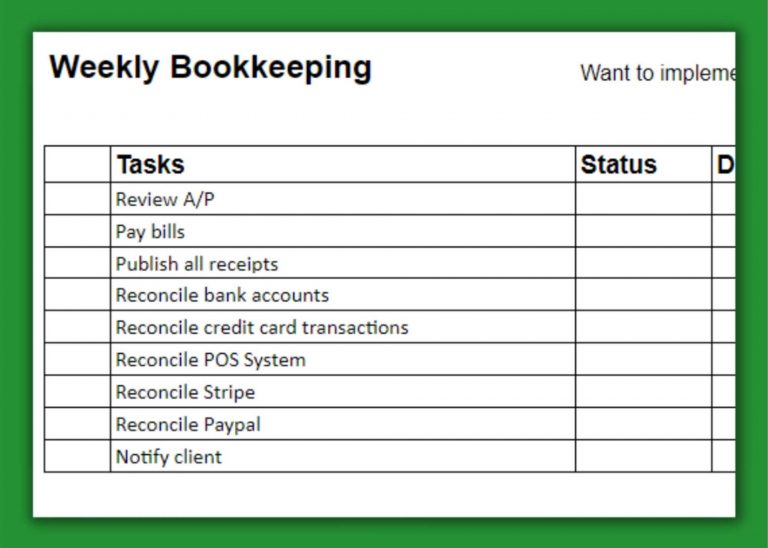

As you take on more clients, having a way to standardize your monthly bookkeeping process becomes a vital part of properly scaling your firm.

After all, if your team doesn’t have a good monthly bookkeeping process, then you are probably struggling with quarterly reports, year-end reviews, and other critical bookkeeping tasks.

Clients who ask you to do their monthly bookkeeping want a few key things from you:

Failing to show consistency on a monthly basis is one of the quickest ways to lose clients, so it is critical that everyone on your team is addressing the same items each month.

A monthly bookkeeping checklist ensures that no matter which one of your employees takes on the task, everything gets done in a consistent fashion. This includes:

If your team needs an effective monthly checklist to help keep your monthly bookkeeping efficient, then download our free templates!

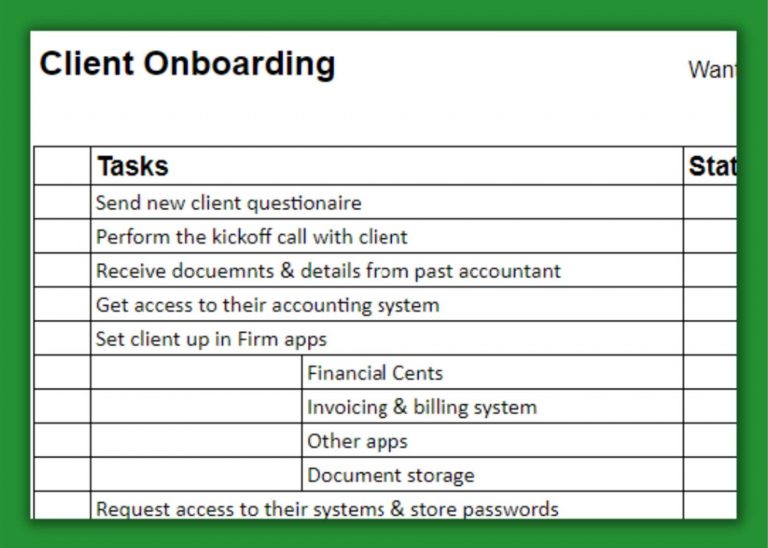

Acquiring new clients is always exciting!

But, if you don’t have a good onboarding process in place, it can also be chaotic.

From the get-go, you need to make sure your client perceives your company as organized, consistent, and trustworthy.

Research shows if people see you as good or competent in one area, it creates a “halo effect” which makes them assume your company is great in other areas as well.

Conversely, you don’t want to come across like you’re scrambling around, suddenly remembering information you need from them that you forgot to request previously. This makes them more likely to assume your company has other negative traits as well.

You want to come across as professional, with a list of exactly what you need from them.

At the same time, you don’t want a cumbersome onboarding process that requires tons of time from your client. You want to get the information you need, but you don’t want to waste time getting information you don’t need or won’t use.

This is why you need a client onboarding checklist, so you know exactly what you need from your clients: no more, and no less.

Where can you find a good checklist to get you started? Right here, at Financial Cents! Download our free client onboarding checklist here.

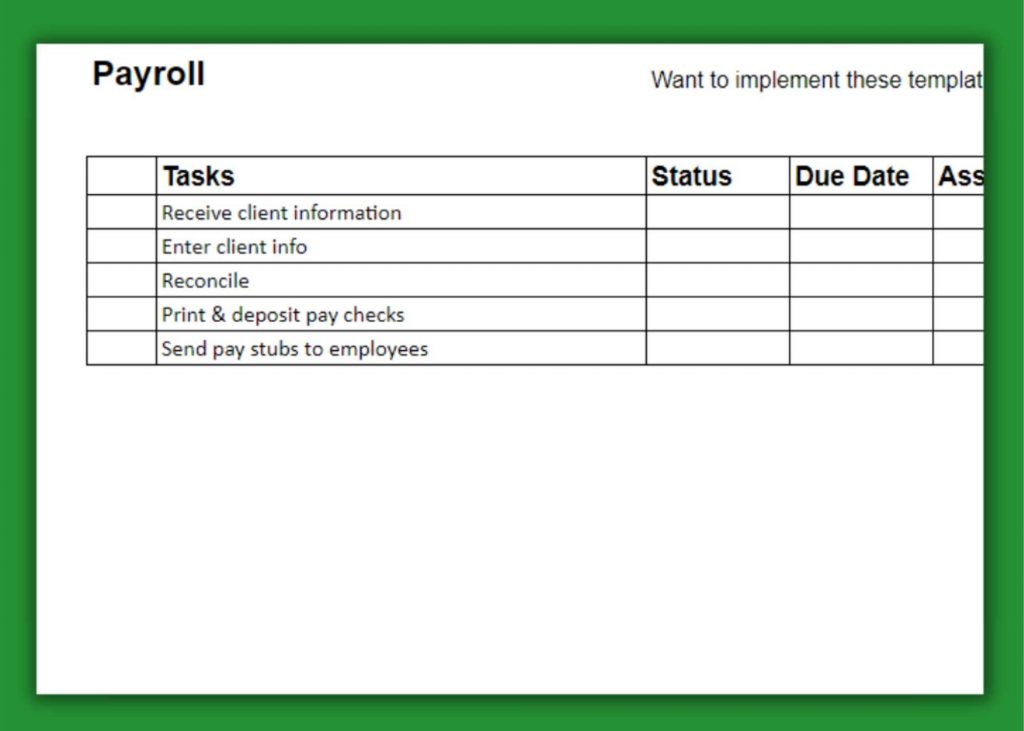

Remember: If you miss payroll deadlines, you’re hurting real people who financially depend on their paycheck coming exactly when it’s supposed to come.

Not only that, but late payments are illegal. Your client could face steep fines, and you, as their accountant could also be held liable.

Using a payroll checklist is the best way to ensure payroll is completed consistently, on time, and without discrepancies.

Good news! We’ve created a free payroll checklist template to get you started!

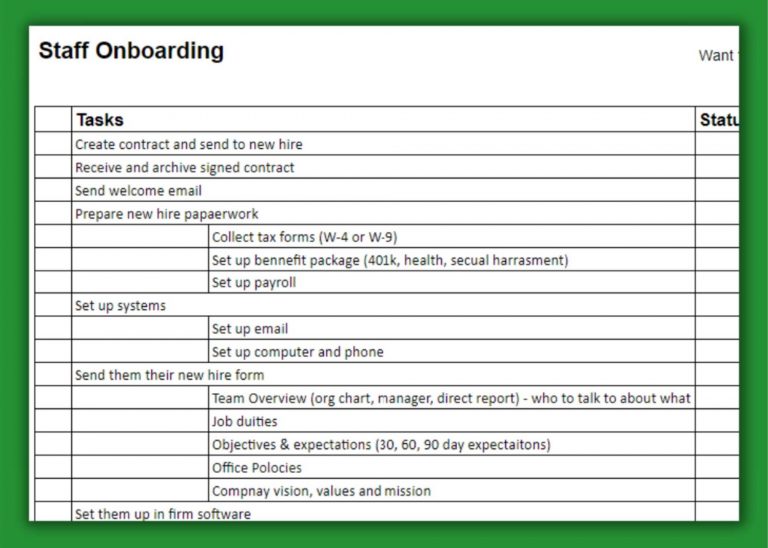

As your firm grows and you hire more people, it becomes crucial to have a good staff onboarding system in place. New hires who feel overwhelmed, confused, and undervalued are unlikely to want to stick around long-term.

But if you follow a good checklist and do things right the first time, you’ll acquire staff who stay for the long haul, learn the system well, and contribute to a company culture of professionalism and consistency.

Make sure your checklist includes clear expectations for the beginning of the hiring process, like signing a contract and sending a welcome email.

After that, make sure you outline a systematic process for ensuring your new employee has a clear understanding of their role with the company, that you’ve acquired proper paperwork from them for payment and tax purposes, and that they’re properly set up with company systems (like email and phone).

Finally, train your new employees to use company software, such as Financial Cents, Quickbooks, and other programs standard to your firm and your clients.

By following a checklist, your employees will feel like they’ve joined a professional organization where they are truly valued and part of a team.

At the same time, you’ll be onboarding new staff who are fully prepared to take on clients and show them the same professionalism you have just demonstrated in your staff onboarding process!

To get you started, we are offering a free staff onboarding template.

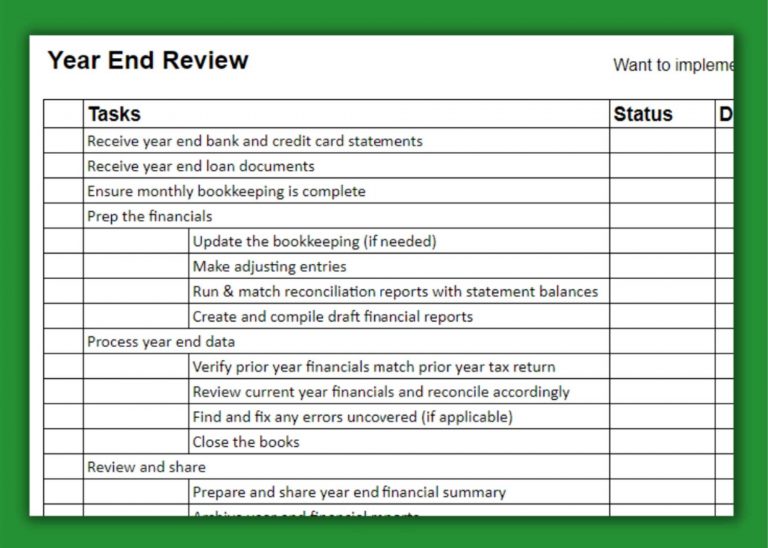

When it comes to your year-end review, your client is counting on you to find any and all errors that may have occurred in the previous year.

Everything needs to reconcile, and all discrepancies need to be resolved.

Furthermore, your year-end review has a tight deadline.

For these reasons, it’s crucial to have a solid year-end review checklist to consult as you conduct a year-end review for your client. Any errors slipping through the cracks could cause financial headaches down the line for you and your client, causing your client to lose trust in your firm.

Using a detailed checklist helps your firm stay on top of issues as you conduct year-end reviews for your clients. And when you stay on top of issues, you’ll be able to complete the reviews in a timely fashion, establishing your firm as dependable, consistent, and trustworthy.

At Financial Cents, we’ve created a free year-end review template that we guarantee you’ll find useful.

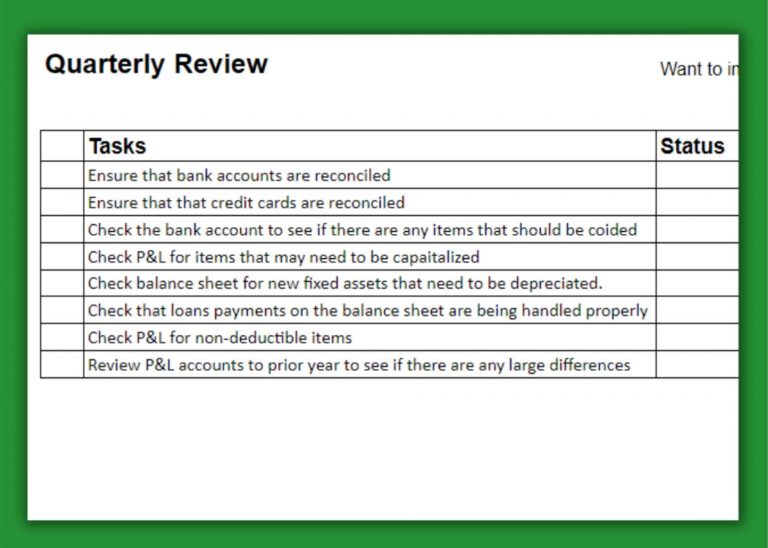

Instead of leaving everything until the end of the year, it’s helpful to conduct quarterly reviews for your clients so there isn’t such a crunch at the end of the year.

It’s also helpful for your clients to know sooner rather than later if there are any discrepancies needing to be resolved.

By using a simple quarterly review checklist, you can go through the quarterly review process smoothly and efficiently. Both your employees and your clients will be less stressed and, ultimately, trust you and your firm more.

Check out our free quarterly review template here!

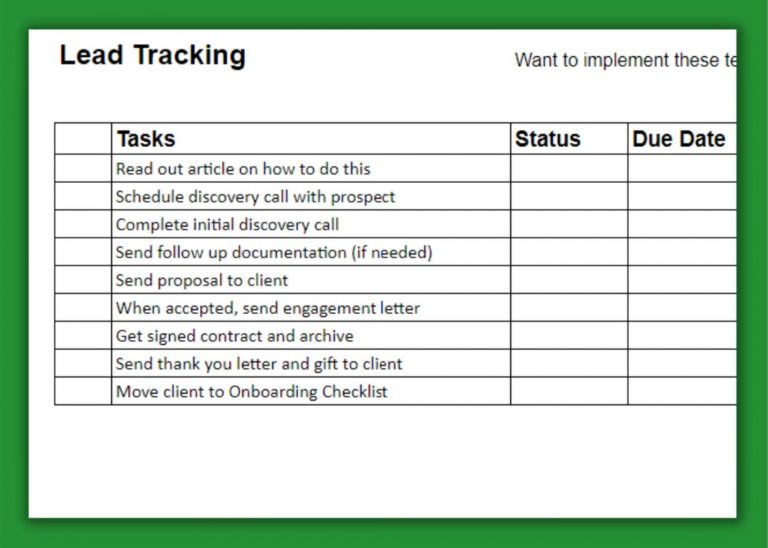

As a growing firm, it’s important to keep track of potential new clients. Your firm should implement a system to:

At Financial Cents, we’ve created helpful tools to help you create a lead tracking checklist and systematically keep track of potential new clients!

We’ve already established how accounting workflow checklists are vital to your team’s productivity. But what if there’s more to the system than just following a checklist?

You should be thinking broadly here – not just about individual checklists, but also about the tools you use to implement the checklist.

Financial Cents accounting workflow software not only provides the checklists but also helps you implement them in the most productive way possible.

How so?

Well, first of all…

When working with multiple checklists, it is sometimes difficult to keep track of them all. Financial Cents solves this problem by keeping everything in one place, where anyone on the team has access to them at any time.

Not only does this make it easier for you to keep track of what your employees are working on, but it also makes it easier for your employees to quickly access all their checklists for all their projects.

Keeping everything in one central location benefits the entire team, and makes collaboration easier.

Without the right tools, delegation is a cumbersome process. It’s difficult to keep track of exactly who is working on what project. You may inadvertently give one employee too much work, and another employee too little.

Conversely, you may be unaware when an employee is burnt out, while another employee spends their time doom scrolling the news.

Financial Cents helps you streamline your delegation process. It allows you to see, at a glance, who is working on what and gives you an idea of who you should delegate to.

It also allows you to delegate quickly and simply, with the click of a button.

Accounting firms handle so much work at once that it is challenging to keep on top of them and all their deadlines. Unfortunately, because of this sometimes client work slips through the cracks.

Financial Cents makes it easy for you to check, not just who is working on what, but where they’re at in the process, and when it is due.

When the whole team has access to all their work and checklists, it creates an environment where employees can easily stay on task and get their work done on time.

If a client inquires about where your firm is at with their work, you can immediately check on the status and relay the information to your client, whether or not you are the one working on their work. You will always have instant visibility into who is working on what, the status of the work, and when everything is due with Financial Cents.

With all your employees working within the same software, delegating appropriately, and keeping track of work status, it is much easier to hit your accounting deadlines.

And we all know how satisfying it is to leave the office knowing we aren’t forgetting any important client work or deadlines!

Are you ready to implement accounting workflow checklists that will help your accounting firm become more streamlined, efficient, and easier to scale?

Here at Financial Cents, we’d love to help you out!

Curious about our software? Watch our four-minute demo video or start your free trial today.

We’re so excited for you to join us!

A cloud-based solution that makes it easy for accounting firms to manage client work, collaborate with staff, and hit their deadlines

Register to start a 14-day trial