What Are Billable Hours?

Billable hours refer to the time an accountant or accounting firm spends performing tasks that can be directly invoiced to a client. This concept is central to service-based industries where professionals track their working hours for billing purposes. In accounting, activities such as preparing financial statements, auditing, and tax filing are examples of billable tasks. Each hour worked is tied to a specific hourly rate, forming the basis for client invoicing.

Why Billable Hours Matter in Accounting

Accurate tracking of billable hours affects profitability, client relationships, and operational efficiency. Here are key reasons it matters:

- Revenue Generation: Time is a resource; every billable hour represents potential revenue. Firms can significantly boost their bottom line by optimizing time management and maximizing billable hours.

- Transparency: Clear records build trust with clients by showing detailed billing. Clients appreciate seeing how their fees correspond to work performed, reducing disputes and strengthening relationships.

- Performance Insight: Firms can assess staff productivity and optimize workflows. Tracking billable hours highlights areas where efficiency can be improved or additional resources are needed.

- Resource Allocation: Better time management leads to improved capacity planning. Firms can better allocate staff to high-value tasks when they have clear visibility into time usage.

Calculating Billable Hours

To ensure you’re properly compensated for your work, follow these steps to calculate billable hours accurately:

1. Identify Billable Tasks

Clearly define what qualifies as a billable task. Typical billable activities in accounting firms include:

- Bookkeeping & Reconciliation: Recording transactions, reconciling bank statements, and closing monthly books.

- Tax Advisory & Preparation: Preparing tax returns, offering strategic tax planning, and handling compliance issues.

- Financial Consulting: Providing insights on cash flow, profitability, and financial forecasting.

- Client Meetings & Communication: Time spent discussing financial matters, answering queries, and offering guidance.

To prevent revenue loss, be clear on what is non-billable, such as administrative work, internal meetings, or professional development.

2. Track Time Accurately

Manually tracking time can lead to underreported hours, missed billables, and lost revenue. Instead, automated time-tracking tools can be used to log work in real-time.

- Best practices for accurate tracking:

- Log time immediately after completing a task.

- Categorize tasks properly to distinguish billable from non-billable work.

- Set reminders to track time consistently.

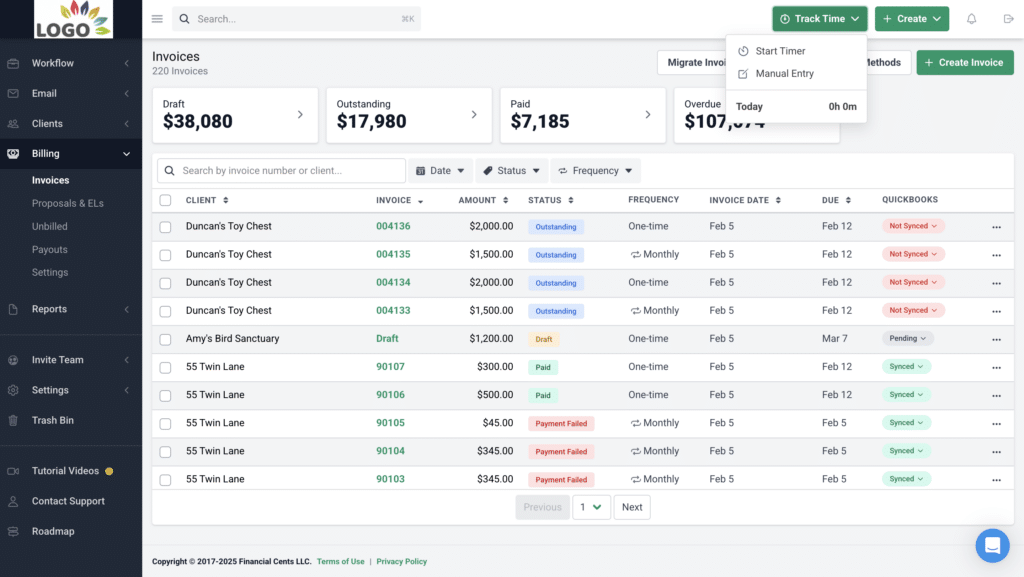

You can use accounting practice management software with time-tracking features like Financial Cents.

3. Apply Hourly Rates

Once you have your tracked hours, multiply them by your hourly rate to calculate the amount due. If your firm uses tiered pricing, ensure each service is billed at the correct rate.

Example:

- Bookkeeping: $75/hour

- Tax Advisory: $150/hour

- Financial Consulting: $200/hour

Setting competitive rates ensures profitability while aligning with industry standards.

4. Generate Detailed Invoices

Transparency in invoicing builds client trust and reduces disputes. A detailed invoice should include:

✔ A breakdown of services provided

✔ Hours worked for each task

✔ Hourly rate and total amount

✔ Any additional fees or expenses

Using automated invoicing tools ensures accuracy, speeds up billing, and reduces manual work.

Challenges in Managing Billable Hours

Despite its importance, tracking billable hours has challenges that can affect profitability.

1. Inaccurate Time Tracking

One of the biggest challenges you may face in managing billable hours is inaccurate time tracking. Relying on memory to log hours often results in missed billable time, reducing your revenue. Manually entering time can lead to errors, inconsistencies in invoices, and even client disputes. You may also find yourself unintentionally rounding down your hours or forgetting to track small tasks, further impacting your profitability. Without precise records, it becomes difficult to analyze productivity and optimize workflows. To avoid these issues, you should implement automated solutions that accurately capture and record your time.

Solution: Implement automated time-tracking software that integrates with your accounting system to capture time spent on client work.

2. Non-Billable Overload

Spending too much time on non-billable activities can seriously cut into your profitability. Administrative tasks like answering internal emails, scheduling meetings, and handling internal documentation may seem minor, but they can quickly add up to hours of unpaid work. It’s easy to underestimate how much time these tasks consume, which reduces the total number of hours available for revenue-generating work. To maximize your billable hours, consider analyzing your workflow, delegating administrative tasks, or automating routine processes whenever possible.

Solution: Delegate administrative tasks or use workflow automation to reduce non-billable time. In 2023, firm owners reported spending 50% less time on manual (non-billable) tasks after implementing workflow automation.

3. Scope Creep

Scope creep happens when you take on work outside the original agreement without additional compensation. A client may ask for a quick revision, an extra report, or additional support, and before you know it, you’ve spent hours on unpaid labor. You risk losing revenue if you don’t set clear boundaries and track additional work properly. To prevent this, establish clear terms in your client contracts, communicate expectations upfront, and ensure any extra work is documented and billed accordingly.

Solution: Define clear boundaries in engagement contracts and track every minute spent on extra work. Here’s a sample accounting engagement letter that you can use.

Overcoming Common Challenges

To streamline billable hour management, implement these strategies:

1. Use Automated Time-Tracking Tools

Tools like Financial Cents, QuickBooks Time, Toggl, and Harvest help eliminate manual errors by tracking time directly from tasks and projects.

2. Implement Clear Policies

To prevent confusion and ensure consistency, you must establish clear policies on billable versus non-billable work. Without clear guidelines, you might underreport your billable hours or misclassify tasks, leading to lost revenue. Define these policies in detail, communicate them to your team, and provide training to reinforce them. You can improve accuracy and profitability when everyone understands what should be tracked and billed.

3. Set Realistic Deadlines

Setting realistic deadlines helps you stay efficient and avoid scope creep. Poorly planned schedules can result in rushed work, missed deadlines, and increased stress for both you and your clients. By properly structuring your project timelines and allocating enough time for each task, you can ensure everything stays within scope. Using accounting project management software can help you track deadlines, monitor progress, and distribute workloads evenly to prevent burnout while maximizing your billable hours.

4. Review Time Tracking Reports Regularly

Regularly reviewing time tracking reports allows you to spot inconsistencies, catch excessive non-billable work, and maintain accurate records. If you’re spending too much time on administrative tasks or forgetting to log certain activities, a routine review will help you identify and fix these issues before they affect your bottom line. By conducting weekly or monthly audits of your time logs, you can ensure that every billable hour is accounted for and that your processes remain efficient.

Billable Hours vs. Alternative Pricing Models

1. Value-Based Pricing

With value-based pricing, you charge clients based on the perceived value of your services rather than the time spent on a task. Instead of focusing on hours worked, you price your services based on the results you deliver. This model works well for high-impact services such as strategic financial planning, where the outcome is far more valuable than the time it takes to execute. By using value-based pricing, you can increase your profitability while eliminating the pressure of meticulous time tracking. However, you’ll need to carefully structure your pricing to ensure that your fees reflect the true value you provide.

2. Project-Based Pricing

Project-based pricing allows you to charge a fixed fee for a specific scope of work, regardless of how much time you spend on it. This approach gives your clients predictable costs and simplifies billing for you. It works well for well-defined projects like payroll setup, tax return preparation, or accounting system migrations. However, if a project takes longer than expected, you may find yourself doing extra work without additional pay. To avoid this, make sure you clearly define the project scope, set realistic expectations, and include provisions for additional charges if necessary.

3. When to Use Each Model

| Pricing Model | Best Use Cases | Pros | Cons |

| Billable Hours | Ongoing services with variable scope (e.g., tax advisory) | Flexible, transparent | Requires meticulous tracking |

| Value-Based Pricing | High-value advisory services | Higher profitability, outcome-focused | Hard to standardize |

| Project-Based Pricing | Defined projects with clear deliverables | Predictable revenue, easy to manage | Less flexibility |

Linking Billable Hours with Pricing Strategies for Accountants

Hourly Billing

Hourly billing is one of the most traditional pricing models in the accounting industry. It directly ties your revenue to the number of hours you work, making it ideal for services with unpredictable scopes, such as tax advisory, compliance work, and financial consulting. Since clients pay based on actual hours worked, this model ensures you get compensated fairly for your time. However, tracking every billable hour is essential to avoid revenue loss. Using automated time-tracking tools can help you log your time accurately and ensure you aren’t missing out on potential earnings.

Hybrid Models

A hybrid pricing model combines multiple billing structures to optimize your revenue and client satisfaction. You might charge an hourly rate for routine services while offering value-based or fixed fees for specialized work. For example, you could bill tax preparation by the hour but charge a flat fee for strategic financial planning. This approach provides flexibility and allows you to adjust pricing based on the type of service and client needs. By mixing billable hours with alternative pricing models, you can maximize your earnings while reducing the need for constant time tracking.

Flat-Rate Fees with Add-Ons

Flat-rate pricing involves charging a set fee for standard services while billing additional work separately. This model makes pricing more predictable for clients while ensuring you get paid for extra work. For instance, you might offer a bookkeeping package at a fixed monthly rate but charge separately for historical clean-up work or custom reporting. This approach helps you prevent scope creep while giving your clients a clear understanding of what’s included in their fees. To make this model work effectively, clearly define what services are covered in the flat-rate fee and establish pricing for any additional requests.

Using an accounting proposal software or engagement letter software makes it easy for you to include addons to your invoices.

Final Thoughts: Harnessing the Power of Billable Hours

Billable hours are more than a billing mechanism; they reflect how efficiently an accounting firm manages its time, resources, and client relationships. Properly tracking and leveraging them alongside innovative pricing models enhances profitability, transparency, and client satisfaction. The right balance of billable and non-billable work, supported by technology, ensures sustainable growth, higher productivity, and a competitive edge in the accounting industry.

Reduce time spent on non-billable tasks, track billable time and automate payments collection with an all in one practice management software for accountants – Financial Cents.