Sure, you’ve landed the perfect new accounting client – congratulations. But before celebrating with a high five, remember a proverbial handshake isn’t enough to ensure a long-term partnership with your new client. To truly set the stage for success, you need an accounting engagement letter.

This detailed document outlines expectations, duties, and services in crystal-clear terms, safeguarding both you and your client from uncertainty and potential “scope creep.”

But where do you start? This article guides you through the nitty-gritty of constructing your accounting engagement letter. We’ll dissect its key elements, from service specifics to billing terms, empowering you to draft a document that fosters a thriving client-accountant relationship.

What is an Accounting Engagement Letter?

Simply put, an accounting engagement letter serves as a formal binding contract between an accountant and their client, outlining the services, fees, and responsibilities of each party.

It’s a formal agreement that spells out what you will do, how much it’ll cost, and what your responsibilities as an accountant are to your client. It’s a win-win for both sides to have an accounting engagement letter to keep things clear and avoid any confusion that might lead to possible disputes.

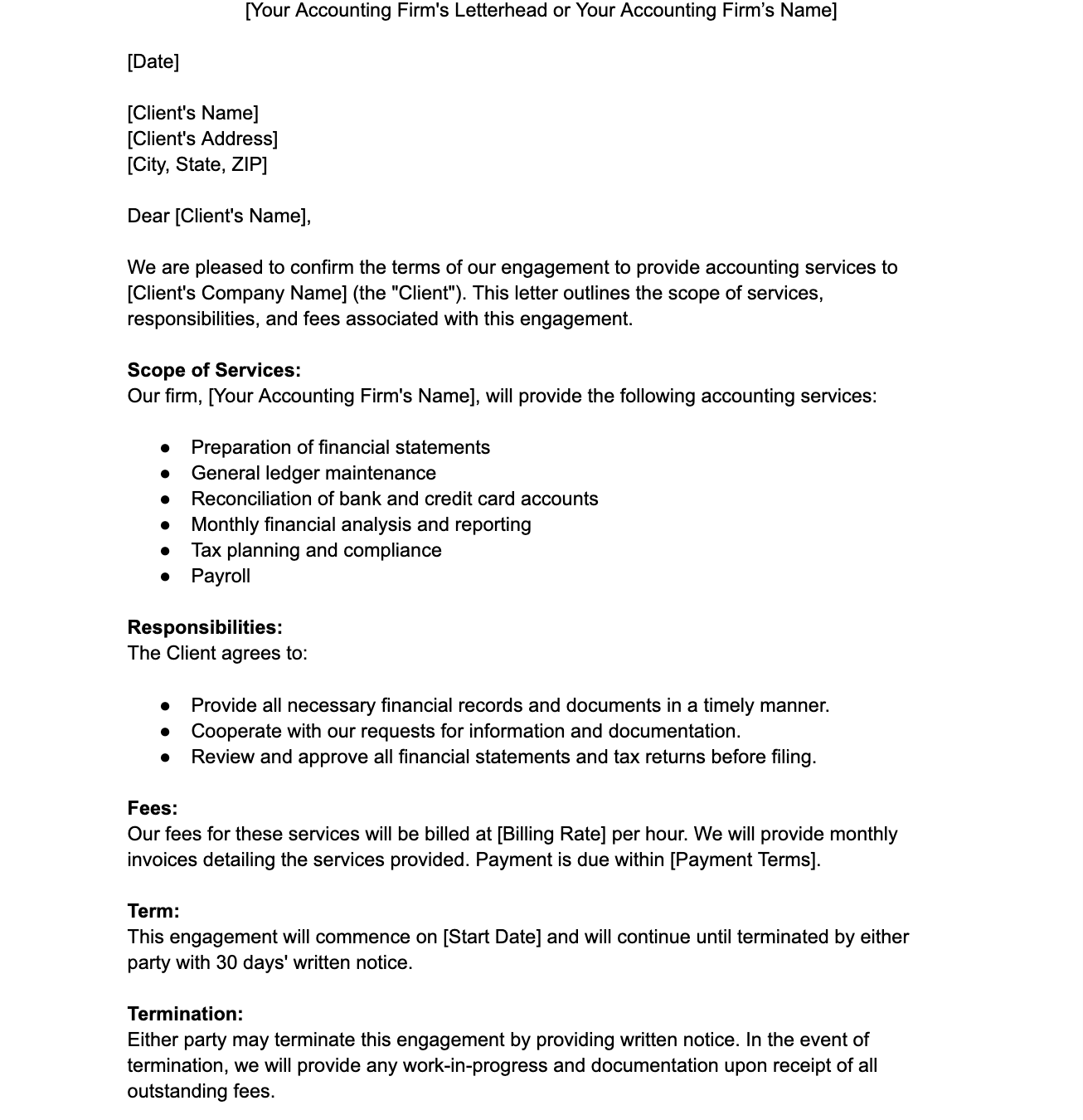

Download for Free: 5 Accounting Engagement Letter Templates

Essential Elements of an Accounting Engagement Letter

Before writing your accounting engagement letter, it is important to know the basic elements that are commonly found in them and avoid mistakes that might jeopardize your relationship. Let’s discuss them below.

Client and accountant identification

First off, identifying both parties in the accounting engagement letter ensures everyone involved understands who they are working with and the nature of the professional relationship.

It prevents confusion down the line, especially if multiple clients are involved or the client is a company. You’ll know who exactly you’re entering into an engagement with.

Identifying both parties helps solidify and authenticate the engagement as a formal agreement that is legally binding on both parties. This means that in the event of a dispute, the accounting engagement letter can be tendered as evidence of the existence of a contractual relationship between both parties.

Aside from that, many professional liability insurance policies for accountants require accountants to produce engagement letters with proper client identification.

Effective date and engagement period

The second most important element after stating the identification of parties is the engagement period. Specifying the engagement’s start and end points avoids ambiguity and ensures both parties understand the duration of their responsibilities.

Knowing this engagement period helps your client plan and budget accordingly for your services, while it helps you schedule your workload and distribute effectively among team members of your firm.

This agreed time frame prevents confusion especially if your services span across fiscal years or involve ongoing tasks like year-end audits, or accounting advisory services.

Both you and the client understand the duration of the engagement. This sets expectations for service delivery, fee payment, and communication throughout the period.

Scope of services to be provided

Once the parties have been identified and the engagement period set, it’s crucial to outline in clear and specific language the services that you’ll be providing to the client.

This section will vary depending on the type of accounting services that you provide. It could range from bookkeeping, tax filing, auditing, estate planning, etc.

When writing this section, ensure that all anticipated services, or even seemingly minor ones are covered in the engagement letter. You don’t want any mixups down the road. For instance, if the core service you provide is tax preparation and filing, you can include any other client accounting services that you anticipate your client will need during the engagement period.

Avoid vague terms like “financial consulting” or “tax assistance” when defining your scope. Instead, be specific about the exact tasks involved, such as “monthly bookkeeping and reconciliation,” “preparation of individual tax returns,” or “analysis of internal controls for fraud prevention.”

If there are any limitations to the scope of your services such as investment recommendations, or forensic accounting, it’s good practice to clearly define these limitations in this section.

Fee structure and billing arrangements

Another important element to include is the fee structure and billing arrangement for the engagement period. This not only sets a predictable payment structure that allows you to track and bill for income but also helps you determine if you’re adequately compensated for the services you’re providing.

When writing this section, think of all the possibilities that might occur with billing arrangements. How often will the client be billed for the services? This could be monthly, quarterly, or annually. What methods will the client be able to use to pay their fees? What happens if the client does not pay their fees on time?

All these instances should be adequately covered in the accounting engagement letter to protect yourself or your firm from being shorthanded.

Client responsibilities and obligations

While an engagement letter is typically provided by you to your clients, it also states specific responsibilities and obligations that the client must adhere to create a successful, long-lasting business relationship.

This section sets clear expectations for what the client needs to do to contribute to the process. What documents will the client provide? What are the timelines for delivery of such documents? What financial information is needed for you to provide accounting services? How will the client communicate with you or your firm? In what instances will you decline to offer your professional services? This could be fraud, omission, or the commission of criminal acts.

Be sure to request all financial information and documentation needed. This includes bank statements, invoices, receipts, payroll records, contracts, and tax documents. Also, state in clear terms the repercussions of your clients not meeting their obligations to you as their accountant.

Confidentiality and privacy considerations

In this section of the engagement letter, define what constitutes confidential information and state how this information and the privacy of your client will be upheld. Confidential information could include financial records, tax returns, business plans, and any other information deemed sensitive by the client.

Also, specify the limitations to such confidentiality. For instance, there may be situations where confidentiality is overridden, such as legal requirements to report fraud or comply with court orders. Clearly state these exceptions in the letter.

Furthermore, include the security measures that you will undertake to protect client data. This could include password-protected files, encryption, restricted access, and secure data storage.

Let your client know how data will be stored and transmitted. Will it be stored electronically, in physical files, or a combination of both?

Termination terms and conditions

In the instance that you or your client wish to terminate the engagement, lay out the grounds under which termination can occur. For instance, dissatisfaction with services, missed deadlines, or failure to meet expectations can be grounds for a client to terminate the engagement while non-payment of fees, conflict of interest, or the client’s failure to provide necessary information can be grounds for you to terminate the agreement as your client’s accountant.

Whatever the grounds for termination may be, specify any required notice period for termination by the client and outline how you will return or dispose of client records and documents upon termination, ensuring compliance with data privacy regulations.

Limitation of liability and dispute resolution

This element in an accounting engagement letter is quite nuanced with significant implications for both the accountant and the client. Its importance is two-pronged which is to limit the financial responsibility that you owe to the client in the case of negligence or breach of contract; and outline the process for resolving any disagreements that may arise.

By including this element in your engagement letter, you can protect yourself from substantial financial burdens in unforeseen circumstances – death, pandemic, act of God – that are out of your reach.

Also, you can outline the process for dispute resolution whether negotiation, mediation, arbitration, or litigation, depending on the terms you and your client agree upon.

While these essential elements are common in many accounting engagement letters, they’re not entirely exhaustive as you can add other elements depending on the type of agreement. Elements like agreed deliverables, communication protocols, or third-party access to client data can also be included in an accounting engagement letter.

Best Practices for Writing an Accounting Engagement Letter

Use clear and concise language

This is one document where clarity is of the utmost importance. No need for abbreviations, slang, or technical terms with varied meanings.

Make sure to state in clear language what your duties are to the client, what you expect from them, the services you’ll provide, how you’ll charge them, and the start and end date for the engagement.

Avoid technical jargon and legal complexities

While writing this engagement letter, refrain from using cryptic terms, technical accounting jargon like “amortization” “accrued value” “materiality” or confusing big words.

The essence of this letter isn’t to impress your client with your accounting knowledge or verbose grammar. It’s to help them understand in the simplest of terms what the terms of your relationship will look like.

Employ a conversational tone and maintain professionalism

Needless to say, it is important to maintain a high level of professionalism while writing this letter but don’t just stop there. Make it conversational.

How do you do so? Use “you” instead of “the client” or “the recipient” when addressing your client. Aim for a natural, friendly tone, like you would if you were talking face-to-face with your client. Get to the point quickly, don’t let them drown in paragraphs of unnecessary information.

Structure the letter logically and ensure easy readability

Optimize your letter to be easily readable and understandable. You want your client to have complete clarity and not be confused as to what their responsibilities are or what the grounds for termination are.

Structure your letter to follow a cohesive outline that is common with such agreements.

Thoroughly proofread the document for errors and inconsistencies

Nothing screams unprofessionalism or creates doubt in your abilities as an accountant like an engagement letter that is riddled with grammatical errors, inconsistencies, or misspellings. Be sure to proofread your engagement letter multiple times before sending it to your client.

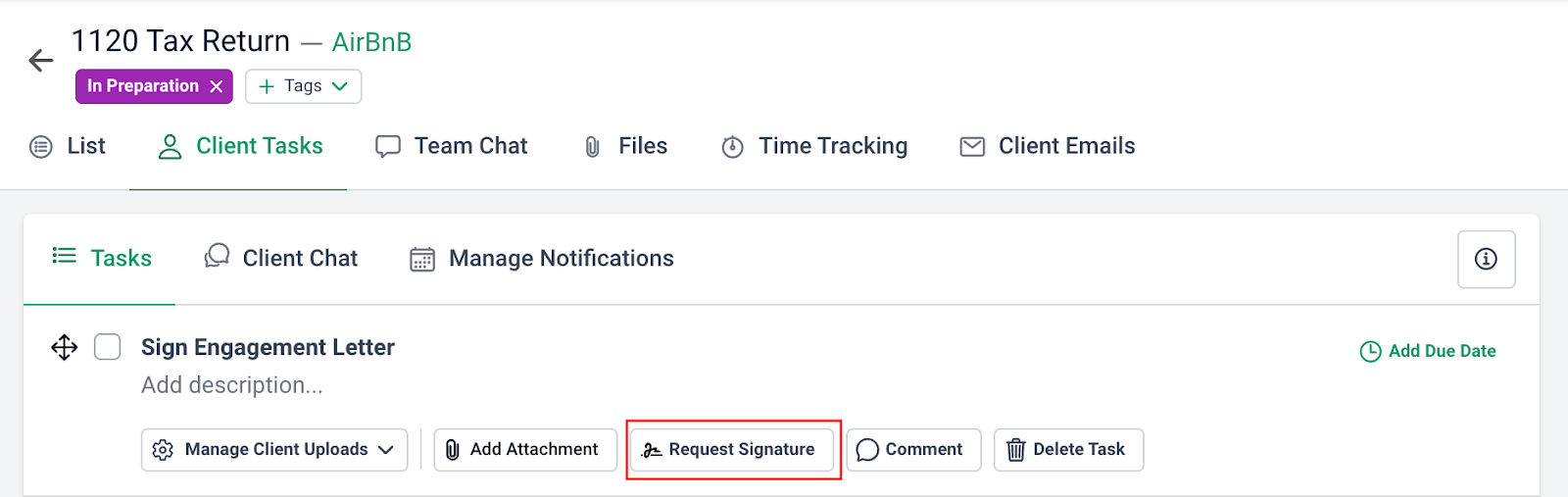

Simplify Your Engagement Letter Through E-Sign

While the act of physically signing an engagement letter held a certain weight and formality in the past, it’s become increasingly cumbersome and inefficient for both clients and firms.

This is because clients need access to a printer and scanner, which can be inconvenient or even unavailable when using wet signatures. Also, sending documents back and forth via mail or courier and maintaining secure storage for physical documents adds significant time and expense to the entire process.

All these steps contribute to a significant delay in onboarding new clients which not only slows down the start of the engagement but also creates a frustrating experience for clients.

To combat this, many have turned to technology to expedite the electronic signing of documents. This rings true in the real world as nearly half (43%) of accountants feel technology enhances their client relationships and satisfaction, while a strong majority (54%) use it to expedite service delivery, according to a Sage survey.

With e-signatures, clients can electronically sign documents directly from their computers or mobile devices, eliminating the need for printing, scanning, and mailing. This not only eliminates time-consuming steps but also reduces paper waste, speeds up the onboarding process for new clients, and offers convenience.

With our e-signature features, you can easily send your engagement letter to your clients and get them signed electronically in a matter of minutes.

To do this, you’ll need a Financial Cents account – If you don’t already have one, this is as good as any time to get one.

Once in your dashboard, all you need to do is navigate to a specific client task, request a signature, upload the relevant engagement letter, and select the name of the person that’ll be signing.

You may be interested in:

Final Thoughts

Remember, accounting engagement letters form the cornerstone of a smooth and successful relationship between you and your clients. They define expectations, responsibilities, and terms of service, ensuring everyone is on the same page from the outset. But a generic letter won’t do for every client – every engagement is unique, and your letter to each client should reflect that.

Ready to craft your own tailored engagement letter? We’ve prepared sample engagement letter templates to help you get started. Download them, customize them for your specific needs, and create a successful engagement for every client.

Then, use Financial Cents to manage your accounting practice for all your exciting new clients.