As an accountant or CPA, you’re well aware that 1099 forms are essential tools in the realm of tax compliance. These forms report various types of income received by individuals or entities who aren’t your client’s employees, such as independent contractors, freelancers, or service providers. The IRS relies on these forms to track income that isn’t captured through traditional payroll reporting, ensuring that all taxable income is properly reported.

The IRS takes these filings seriously, and so should you. Missing deadlines or filing incorrect information can lead to penalties, IRS scrutiny, and unhappy clients—things no accountant wants to deal with.

That’s why having a clear, step-by-step process is key. This guide walks you through everything you need to prepare 1099s efficiently. Plus, we’ve included a free 1099 preparation checklist to make your job even easier.

What is a 1099 Form & Who Needs to File?

A 1099 form is an IRS tax document used to report income paid to someone who isn’t an employee. Businesses use these forms to tell the IRS, “Hey, we paid this person for work, and they need to report it as income.”

The most common types you’ll deal with are:

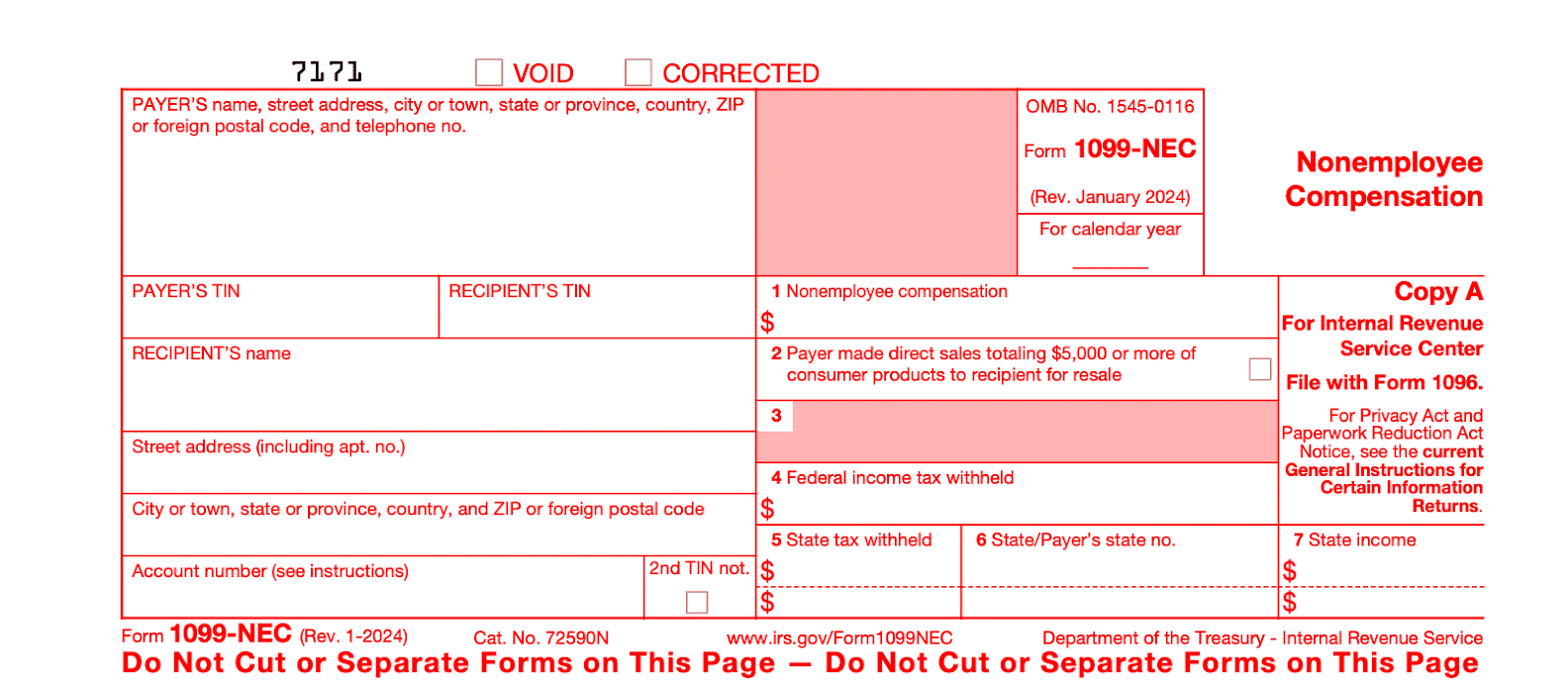

- Form 1099-NEC – Used to report payments of $600 or more to independent contractors for services.

- Form 1099-MISC – Used for other types of payments, like rent, legal fees, or prizes.

Who Must File?

If your client’s business paid $600 or more to a non-employee in a given tax year, they must issue a 1099-NEC. Some exceptions exist (like payments made via credit card or PayPal, which get reported on Form 1099-K instead), but in most cases, if they hired and paid an independent contractor directly, a 1099 is required.

Deadlines & Penalties

Here’s what to take note of:

- January 31 – 1099-NEC must be sent to recipients and filed with the IRS.

- February 28 (paper filing) or March 31 (e-filing) – Deadline for Form 1099-MISC

Late or incorrect filings can mean penalties ranging from $50 to $260 per form, depending on how overdue they are. If the IRS believes there’s intentional disregard, the penalties skyrocket. Accuracy is of the most importance as wrong information can trigger IRS notices or audits for your clients.

Getting 1099s right means keeping your clients compliant and avoiding headaches. With a clear system in place (like the 1099 checklist we’re about to dive into), the process doesn’t have to be stressful.

Your Step-by-Step 1099 Tax Preparation Checklist

To make preparation as smooth as possible, we’ve put together this step-by-step 1099 tax preparation checklist (designed by a tax professional) to help you stay organized and compliant. By following these steps, you’ll ensure that your clients’ filings are accurate, complete, and submitted on time. Plus, you can grab the full 1099 checklist at the end of this section for easy reference.

Identify 1099-Eligible Vendors

The first step in the 1099 process is figuring out who needs one. This involves reviewing the business’s records to identify vendors and service providers who meet the IRS filing requirements. Here’s what to check:

Review the general ledger: Look for payments made to non-employees (contractors, freelancers, landlords, etc.) totaling $600 or more over the year. Payments for services, rent, and legal fees often require a 1099.

Check the vendor’s entity type: Generally, corporations are excluded, except in cases where the payments involve legal or medical services. Sole proprietors and LLCs (unless taxed as an S or C corporation) usually need a 1099.

Review Transaction Data

Once you’ve identified 1099 eligible vendors, the next step is to ensure that all payment records are accurate.

Verify payments by vendor: Cross-check the general ledger with vendor payment records to confirm that every eligible vendor has been accounted for. Look for misclassified transactions too. Sometimes, payments for materials, reimbursements, or goods can get lumped in with service payments. Only payments for services (and certain other taxable expenses, like rent or legal fees) should be reported on a 1099. If a vendor’s total payments look off, dig deeper. Were some payments made by credit card (which should not be reported on a 1099-NEC)? Were any payments accidentally recorded under the wrong vendor? Make adjustments as needed.

Confirm Vendor Information with the Client

Before finalizing 1099 filings, it’s crucial to double-check vendor details with your client to catch any missing or incorrect information before it’s too late.

Send a list of 1099-eligible vendors to the client: Provide a clear report that includes vendor names, total payments, and any missing details. This gives the client a chance to review and confirm accuracy.

Request missing W-9 forms: If any vendors haven’t provided a Form W-9, now is the time to request it. This form collects the vendor’s legal name, address, Taxpayer Identification Number (TIN), and entity classification—all essential for accurate reporting.

Allow time for client feedback: Don’t wait until the last minute. Give the client enough time to review the list, address any concerns, and return missing W-9s before filing deadlines. This step ensures that all vendor records are complete, accurate, and IRS-compliant, reducing the risk of rejected filings or IRS notices down the road.

Create 1099 Drafts

Now that vendor information is confirmed, it’s time to generate draft 1099s. This internal review process helps catch errors before the final submission.

Using tax practice management software like Financial Cents, create draft versions of Form 1099-NEC or Form 1099-MISC based on recorded payments. Each form should include:

- Total payments made to the vendor during the tax year.

- Federal income tax withheld (if applicable).

- Vendor details, including name, address, and Taxpayer Identification Number (TIN).

Review the Drafts for Accuracy

Before sharing the drafts with your client, conduct a detailed internal review to catch any potential errors. Start by double-checking payment amounts against financial records to confirm that only eligible transactions are included. Next, verify the vendor classification, ensuring that corporations are excluded. Finally, cross-reference W-9 details with the draft forms, confirming that the vendor’s name, TIN, and address match exactly. Taking the time for this internal review reduces the risk of errors.

Send Drafts to the Client for Review

Once the internal review is complete, provide your client with a summary of the draft 1099s for final verification. This step allows them to confirm that amounts, vendors, and classifications are correct before submission. Along with the drafts, include a checklist of key details to review, such as vendor names, TINs, and payment totals. Encourage your client to carefully inspect the forms, as errors at this stage can still be corrected.

Implement any Necessary Corrections Based on Client Feedback

If your client flags any errors or missing details, update the records before finalizing the forms. This could involve updating vendor information, adjusting misclassified payments, or addressing missing W-9 details.

Keeping open communication with the client during this step is crucial. Once all corrections are made, conduct one final review to confirm that everything aligns correctly.

File 1099s with the IRS

Once the draft 1099s have been reviewed and finalized, it’s time to officially file them with the IRS.

- For 1099-NEC forms, the deadline is January 31, regardless of whether you’re filing electronically or by paper.

- For 1099-MISC forms, the deadline is February 28 for paper filings and March 31 for electronic submissions.

To streamline the process, use the IRS FIRE system or an IRS-approved e-filing service. If submitting paper forms, include Form 1096, which serves as a summary report.

In addition to filing with the IRS, businesses must also send copies of 1099 forms to their vendors by January 31. This ensures that recipients have ample time to report their income accurately on their own tax returns.

Keep Copies of Filed 1099s and Supporting Documentation

After filing the final 1099 forms with the IRS and distributing copies to vendors, it’s essential to maintain accurate records for your client. This ensures that you have a reliable audit trail in case of any future inquiries or discrepancies. Keep copies of all filed 1099 forms, including the IRS submission confirmation if filed electronically, and any W-9 forms you received from vendors.

Also, retain any communication related to the 1099 preparation process, such as emails with vendors about missing information or changes to payment amounts. These documents will be invaluable for future reference and help protect your client from potential IRS audits or penalties. It’s a good practice to store these records in a secure, organized digital format or physical files.

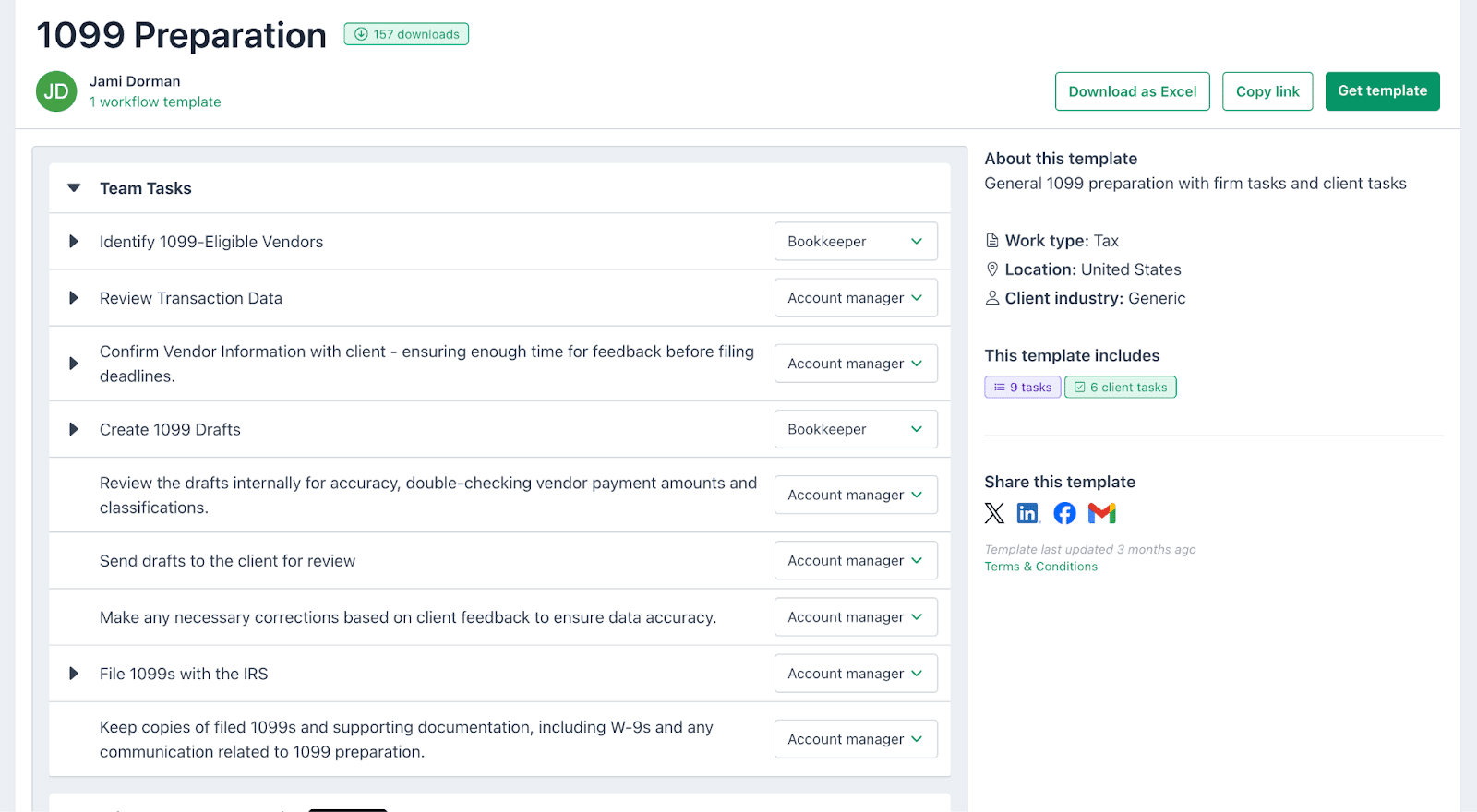

Free 1099 Preparation Checklist Template

To make your preparation process even easier, download this 1099 checklist prepared by Jami Dorman, a Tax professional that you use for your clients.

This template is designed to keep you organized and ensure no steps are missed. It even includes a section for client tasks, so you can easily track follow-ups with your clients and stay on top of all the necessary details.

You can download the checklist as an Excel file, or if you’re using Financial Cents, you can seamlessly integrate it into your workflow there.

Common Mistakes to Avoid When Filing 1099s

Here are some common pitfalls to watch out for when preparing 1099 forms for your clients:

- Failing to Collect W-9 Forms Before Making Payments

One of the biggest mistakes is not collecting W-9 forms from vendors before making payments. Without this form, you don’t have the necessary details—like the vendor’s Taxpayer Identification Number (TIN) or business name—to fill out the 1099 correctly. - Using Incorrect TINs or Business Names

Another mistake is using incorrect TINs or business names on the 1099. Always double-check the W-9 information and ensure that the vendor’s name matches their TIN. Incorrect TINs can cause filing errors that need correction. - Missing Filing Deadlines

Missing the filing deadlines can lead to significant penalties. The deadline for filing 1099-NEC is January 31, and for 1099-MISC forms, it’s typically February 28 for paper filing or March 31 for electronic filing. Always keep track of these dates in your tax practice management software to avoid costly mistakes. - Reporting Payments Made Via Credit Card

Lastly, remember that payments made via credit card or third-party payment networks (like PayPal) should not be reported on Form 1099-NEC. These payments are typically reported on Form 1099-K by the payment processors. Mixing them up can lead to errors in reporting.

Prepare and File Your 1099s Effectively with Financial Cents

Financial Cents helps you streamline the process of preparing 1099 for your clients to ensure accuracy and save valuable time. Here’s how it works:

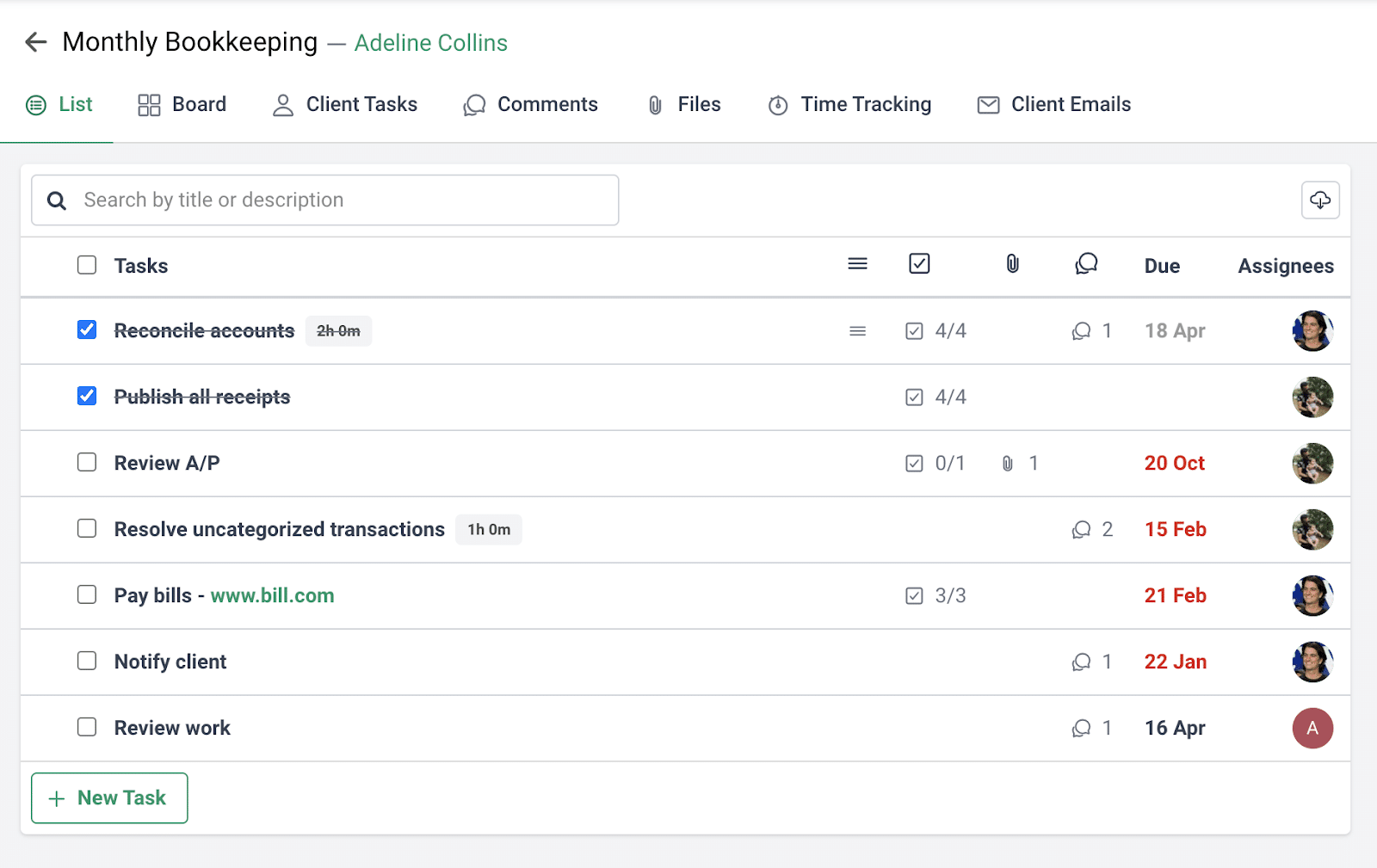

Workflow Management and Automation

Financial Cents helps you standardize processes and manage workflows efficiently. You can set up workflows specifically designed for 1099 preparation, ensuring that each step of the process is followed accurately, every time.

For instance, you can browse through our selection of tax-related workflow templates or create your own (as shown in the video below) with a step-by-step process for each client, outlining tasks like identifying eligible vendors, reviewing payment data, collecting W-9 forms, and filing with the IRS.

Bulk Create 1099 Projects

Rather than creating individual 1099 projects one by one, Financial Cents allows you to bulk-create 1099 projects for multiple clients at once. You can create a 1099 project workflow, and save it as a template which can then be used for multiple clients instead of starting from scratch.

Also, Financial Cents offers the ability to bulk edit projects. This feature makes it easier to update assignees, due dates, and other important project details across multiple tasks. Simply go to the workflow dashboard, select the projects, and click on “Bulk Actions” to update items like project titles, internal due dates, and accounting periods. This feature ensures that changes can be made efficiently, so you can quickly adjust the necessary information, whether you’re switching assignees or updating project timelines.

Automate Recurring Projects

With Financial Cents, you can automate recurring tasks related to 1099 preparation. For example, if you have clients with vendors who need 1099s every year, you can set up recurring 1099 projects that automatically populate the required tasks. This automation not only saves time but also ensures that nothing is forgotten, making your process much more efficient and consistent year after year.

Task Delegation

With Financial Cents, you can easily delegate tasks to your team members. Whether it’s reviewing vendor information, sending follow-ups for missing W-9s, or double-checking payment records, you can assign specific responsibilities to ensure nothing gets overlooked.

Work Tracking and Collaboration

Financial Cents allows you to collaborate in real-time with your team using the ‘comments tab’ and clients using the client chat feature, making it easy to monitor who’s done what and what’s still pending. This keeps everyone on the same page and speeds up the process.

Automate Client Requests

Financial Cents helps you automate client requests, such as sending reminders for missing W-9s or confirming vendor details. This reduces the back-and-forth emails and saves you time, making the whole process smoother and more efficient.

Due Date Tracking

Due Date Reminders – Easily stay on top of deadlines

Stay on top of important deadlines with the due date tracking feature. You’ll get reminders for upcoming filing dates, so you never miss the January 31 deadline for sending 1099s to vendors or the February/March IRS filing deadlines. This keeps your filings timely and compliant.

Conclusion

Preparing and filing 1099s requires careful attention to detail, from collecting W-9 forms and verifying vendor information to ensuring accurate reporting and meeting IRS deadlines.

Financial Cents can streamline this process by offering task delegation, collaboration tools, automated client requests, and due date tracking. Ready to simplify your 1099 filing process? Book a demo or start a free trial of Financial Cents today to see how it can help your firm stay organized, efficient, and on top of all deadlines.