A Comprehensive Tax Preparer Checklist for Clients (+ Free Template)

Author: Financial Cents

Reviewed by: Stacey Feldman, CPA

In this article

How demanding is tax season for your firm?

If you’re like most firms, the answer is likely “very demanding.” Handling tax returns for a substantial client base can be stressful, particularly when ensuring that all clients provide the necessary documents and information for tax preparation.

Given the volume of client work during tax season, it’s possible to overlook missing client documents until later in the process, causing delays and additional stress for everyone involved.

The solution to this challenge is to implement a detailed tax preparer checklist for your clients. This checklist serves to ensure that you have all the required information from your clients upfront, saving time and reducing delays in the tax preparation process.

In this guide, we present a comprehensive tax preparer checklist that you can share with your clients to collect all the necessary information. By incorporating this checklist into your workflow, you can enhance efficiency, minimize the risk of errors, and ultimately provide your clients with a smoother tax filing experience.

Tax Preparer Checklist for Clients – Document Collection

Something to note: this checklist is generic. It’s only meant to serve as a starting point. Before using it, modify it to your specific needs, the client’s condition, and the requirements of your tax preparation process.

1. Personal & Contact Information

In order to accurately prepare clients’ tax returns and mitigate the risk of errors that could lead to audits or penalties, it is essential to gather specific information from them. Collect the following personal information:

- Full Legal Name

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Date of birth

- Correct mailing address, phone number, and email address

- Proof of identification (driver’s license, passport, etc.)

- Marital Status

2. Dependent Information

In the next phase of the tax preparation process, it’s crucial to obtain information about your clients’ dependents. This information is often necessary to determine tax benefits, filing status, exemptions, and deductions. Additionally, details such as the relationship and age of dependents play a key role in verifying their eligibility according to IRS regulations.

- Full Legal Name

- Social Security Number or Taxpayer Identification Number

- Date of Birth

- Relationship to the Taxpayer (e.g., child, relative)

3. Income sources

To enhance accuracy in reporting income, determining deductions and credits, and ensuring compliance with tax laws, it’s essential to gather data about your clients’ sources of income, irrespective of their employment status. Obtain the following information:

- W-2 forms from all employers

- 1099 forms for other income sources (e.g., interest, dividends, self-employment, retirement income, unemployment compensation statements, etc.)

- Records of any other income, such as rental income, prizes, or gambling winnings

- Schedule K-1 forms for investments in partnerships, S Corporations, or trusts

4. Deductions and credits

Certainly, assisting clients in minimizing their tax liability or maximizing their tax refund is a valuable service that can enhance your client relationships. To achieve this, explore potential deductions with your clients, including:

- Receipts for medical expenses, charitable donations, and mortgage interest

- Records of education expenses, student loan interest, and childcare costs

- Proof of homeownership for property tax deductions

- Proof of state and local tax payments

To support additional credits, request additional information from your clients:

- Proof of child care expense for child tax credit

- Documentation of adoption

- Information on taxpayer’s income, filing status, and number of qualifying dependents to see if they qualify for Earned Income Tax Credit (ETIC)

- Evidence of post-secondary education for the Lifetime Learning Credit

- Receipts for installing certain energy-efficient improvements or using renewable energy sources in the home for Residential Energy Efficient Property Credit or the Nonbusiness Energy Property Credit

5. Other relevant documents

There are some other documents you might need that don’t fall into the categories above. These include:

- Previous year’s tax return (if available)

- Bank statements and investment account summaries

- Records of any major life events, such as marriage, divorce, or birth of a child

- Information about any business income or expenses for the self-employed (if applicable)

- Capital gains and losses

- Foreign income and assets information

- Health insurance coverage

Communication Tips for Tax Preparers

Effective communication is the bedrock for a successful relationship between you and your clients. It’s key to delivering a seamless tax preparation experience for them. Here are a few tips to provide great service.

1. Be clear when communicating about required documents

Tell your clients exactly what documents you need from them and why. This will help them understand the process better and help you secure their cooperation.

2. Address client questions and concerns effectively

Be available to answer any questions they may have. Respond to their messages or calls promptly to show they are important to you. Speak respectfully and be as thorough as you can when explaining. Alison Ball (VP of Marketing and Communications at Bookkeep) shared some tips to help you exceed client expectations in this regard. She said to:

- “Answer the phone!

- Provide clarity (WHAT is needed and WHEN is it due.)

- Understand they are busy running their business, and accounting or tax is not their highest priority.

- Reduce (or eliminate) the use of Email – everyone hates it.

- Provide explanations in PLAIN ENGLISH (no jargon!)

- Be PROACTIVE with advice.”

3. Set realistic expectations for refunds or liabilities

You also must be transparent and inform them about the factors that can affect their refund or tax liability, such as changes in income, deductions, or credits. This will help manage their expectations and prevent any surprises from the outcome of the tax filing process.

The Efficient Way to Get Documents from Clients

One constant thing you’ll have to deal with is collecting documents from clients. But it’s not always the easiest or fastest thing to do. The client might be busy, forget, or find your document-sharing process complicated.

Whatever the reason, this problem is one Financial Cents solves for accounting firms like yours. Our software provides an easy and efficient way to get documents from clients. Plus, automatic reminders for when they neglect to do so.

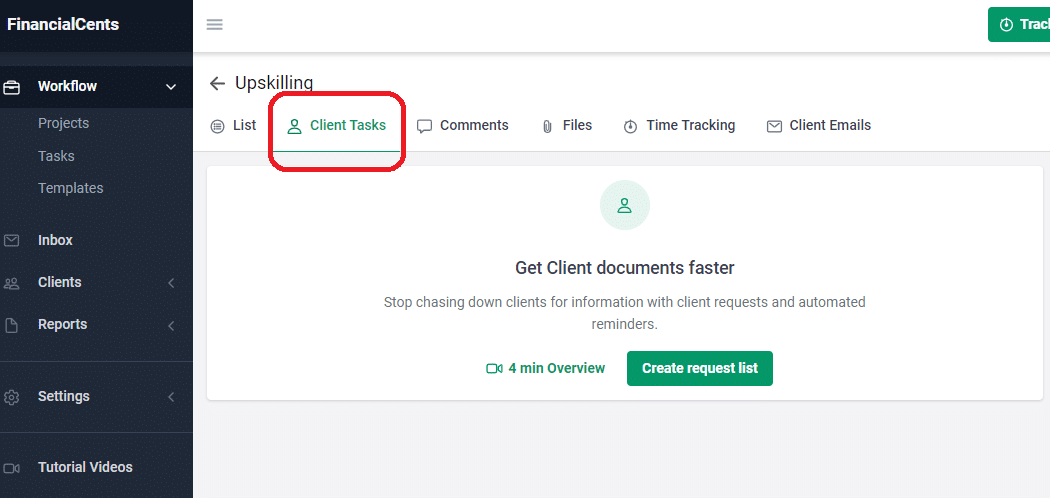

How to Request Documents from Clients in Financial Cents:

- Open the client’s project, click on ‘client task’ and ‘create a request list.’

- Fill in the required details, and add a due date. The system will automatically notify the client of your request. But what if they don’t send the documents on time?

- Set automated reminders by clicking on ‘manage notifications’ and setting a start date and reminder frequency. That’s it.

As you can see, it’s probably a more efficient way than the process you currently have. Your clients don’t need a password to access our password-less portal. They just have to click the magic link that will be sent to their email and input the verification code also sent to their email.. It’s much more convenient for them and makes them more willing to use the tool.

Use Financial Cents to Manage Your Firm

When dealing with multiple clients, it can be hard to keep up. There’s a high chance of things falling through the cracks, leading to low client satisfaction rates. Ultimately, this can affect the reputation of the firm and revenue.

Instead of suffering from this problem, use Financial Cents to streamline client data collection, meet deadlines, and manage your accounting practice. Over 1000 accounting, bookkeeping, and CPA firms trust us because of how effective our tool is. So why not join these 1000+ firms?

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features of a Great Accounting Document Management System

Here’s all you need to know about an accounting document management system and how it can make you more organized and save…

Apr 26, 2024

5 Simple Time-Saving Tips for Managing Uncategorized Transactions

Manually resolving multiple uncategorized transactions steals valuable time from accountants and bookkeepers. But there’s a solution. Here are five simple, time-saving tips…

Apr 24, 2024