There are two main accounting methods: cash and accrual. And the method a business uses shapes how it reports profitability, manages taxes, and makes business decisions.

But not every business gets to decide which to use. The Internal Revenue Service (IRS) or Generally Accepted Accounting Principles (GAAP) can determine which method to follow. For instance, if a business earns more than $26 million in average annual gross receipts over the last three years, the IRS doesn’t allow them to use the cash method. And if a business needs to follow GAAP, say for an audit or investor reporting, it must use the accrual method.

That’s why your firm needs to understand both methods inside and out. When you know how each one works, what the pros and cons are, and when to apply them, you can give better advice and manage client work more efficiently.

In this guide, we’ll explore the differences between cash and accrual accounting, when to use each, and how to manage both across your client base.

What Is Cash Basis Accounting?

Cash basis accounting is a method where revenue and expenses are recorded only when cash actually changes hands. That means:

- You record income when the client gets paid, not when they send an invoice.

- You record expenses when they pay a bill, not when the expense is incurred.

It’s a simple, straightforward approach that’s often used by freelancers, consultants, and small businesses with average annual gross receipts under $26 million or those that don’t carry inventory or deal with complex credit transactions.

Many small businesses prefer cash basis because it closely reflects actual cash flow. If there’s money in the bank, income has been recognized. If not, it hasn’t. That makes it easier for clients to track what they’ve earned, what they’ve spent, and what they owe, without dealing with receivables, payables, or accrual adjustments.

What is Accrual Accounting?

Accrual accounting recognizes income and expenses when they happen, not when the payment hits the account.

That means:

- You record revenue when the work is done or the product is delivered, even if the customer hasn’t paid yet.

- You record expenses when they’re incurred, not when the business pays the bill.

This method gives a more accurate picture of a business’s financial performance because it matches revenue and related expenses in the same period. It follows the matching principle, which is a core concept in accrual accounting and the foundation of GAAP.

Most larger businesses and any company that follows GAAP are required to use accrual accounting. It’s also the go-to method for a business that has (or seeks) external investors, lenders, or auditors, has inventory, and exceeds IRS limits for using the cash method.

Key Differences Between Accrual and Cash Basis Accounting

Here’s a side-by-side comparison of the main differences between accrual and cash basis accounting.

| Category | Accrual accounting | Cash basis accounting |

| Revenue recognition | Record income when it’s earned, regardless of when cash is received. | Record income only when the client receives payment. |

| Expense recognition | Record expenses when they’re incurred, even if payment happens later. | Record expenses only when the client pays the bill. |

| GAAP compliance | Required under GAAP. Mandatory for public companies and most larger businesses. | Not GAAP-compliant. Typically used by small businesses that don’t need audited statements. |

| Complexity | More complex. Requires tracking accounts receivable (AR), accounts payable (AP), and adjustments. | Simpler to maintain. Tracks only cash inflows and outflows. |

| Tax timing | Income and expenses are recorded when they occur, so tax timing aligns with activity, not cash flow. | Income and expenses are recognized when cash changes hands, which can affect when taxes are owed. |

| Financial accuracy | Gives a fuller and more accurate picture of long-term profitability and performance. | Provides a clear but short-term view of cash flow which can distort profitability. |

| Common use | Used by mid-sized to large businesses, firms following GAAP, and those seeking funding or audits. | Common among small businesses, freelancers, and service providers with simple operations. |

The biggest difference between these two methods is timing. Cash basis tracks money when it enters or leaves the bank. Accrual accounting tracks income and expenses when they occur, regardless of when payment happens.

This means that cash basis might show a strong profit in one month (because a big invoice got paid), even if most of the work happened earlier. Accrual accounting smooths that out by matching income and expenses to the right period, which makes it better for performance tracking and planning.

Cash basis is easier to maintain and explain, but accrual gives stakeholders a much more complete and useful financial picture.

Pros and Cons of Cash Basis

Cash basis accounting works well for many small businesses, especially those with simple operations and no need for GAAP-compliant reporting. But it has limitations that make it unsuitable for more complex clients. Here are its pros and cons.

Pros

- Easy to implement and understand: Cash basis accounting follows a straightforward rule: record transactions only when cash moves. That makes it simple for your team to manage and for clients to understand.

- Clear picture of cash flow: Because the books reflect only actual cash inflows and outflows, it’s easy for clients to see how much money they have on hand at any time.

- Often cheaper to manage: You don’t have to track AR, AP, or accrual entries. That usually means fewer steps during month-end close and a lower service cost for clients.

Cons

- May misrepresent profitability: Cash timing can skew results. A strong month might just mean several clients paid at once, not that the business actually performed better during that period.

- Not GAAP compliant: Cash basis doesn’t meet GAAP standards, so it can’t be used by businesses that need audited financials or standard reporting for lenders and investors.

- Not allowed for certain businesses: The IRS limits who can use the cash method. It’s not allowed if:

- The business carries inventory as a material income‑producing factor.

- The business has average annual gross receipts over $26 million (indexed for inflation).

Pros and Cons of Accrual Basis

Accrual method, on the other hand, is usually the only option for bigger businesses, and has the following pros and cons.

Pros

- More accurate financial picture: Accrual accounting matches income and related expenses in the same period, so financial reports reflect actual performance, not just cash flow. This helps your clients see whether their operations are truly profitable, even when payments haven’t yet cleared.

- Required for audits, investors, and lenders: If your client plans to seek funding, undergo an audit, or follow GAAP standards, accrual accounting is a must. Lenders and investors want to see the business’s financial position based on earned revenue and incurred expenses.

- Enables long-term financial planning: Because it records revenue and expenses when they occur, accrual accounting makes it easier to project future income, track margins, and plan budgets. It helps with more accurate forecasts and more strategic decision-making.

Cons

- Requires more detailed bookkeeping: Accrual means tracking AR, AP, and making period-end adjustments like accruals, deferrals, and reconciliations. It demands a higher level of bookkeeping effort and review.

- Can show profit even when cash is tight: A client might appear profitable on their income statement but still struggle with cash flow if invoices haven’t been collected. This can confuse clients who equate profitability with available cash.

- More complex tax reporting: Tax filing under the accrual method can be more complicated, as it often requires timing adjustments and additional reconciliations to ensure income and expenses align with the correct periods.

You may be interested in:

When Should a Client Use Cash vs. Accrual?

Choosing the right accounting method depends on the client’s size, goals, and compliance requirements. Some clients will be eligible for both methods, but that doesn’t mean both are equally useful. Here’s a practical way to evaluate which one fits.

Use cash basis if:

- The business is small, simple, and under $26M in gross receipts: The IRS allows most small businesses under this threshold to use cash basis accounting. It’s easier to manage and makes sense for firms that handle a high volume of small, low-complexity clients.

- The business doesn’t carry inventory: If inventory is a material income-producing factor, the IRS generally requires the accrual method. But if your client runs a service-based business and doesn’t sell physical products, cash basis usually works fine.

- The business isn’t seeking external funding: Investors and lenders typically require GAAP-compliant financial statements, which means accrual accounting. If your client doesn’t plan to seek outside funding or undergo audits, cash basis can be perfectly suitable.

Use accrual basis if:

- The client needs GAAP compliance: Any business preparing audited financial statements, seeking financing, or reporting to external stakeholders must use accrual accounting to meet GAAP requirements.

- The business sells on credit or has significant AR/AP: Any business that invoices customers or gets billed by vendors on payment terms should use accrual accounting to reflect the real financial picture, including outstanding obligations and earned income.

- The business is planning to grow, get funding, or be acquired: Accrual books allow for more accurate forecasting, margin tracking, and financial reporting. If your client is scaling, pitching to investors, or planning for acquisition, accrual accounting supports those goals with cleaner, more transparent financials.

- The business carries inventory (per IRS rules): If inventory is a material part of operations, the IRS generally requires the accrual method. This ensures that cost of goods sold (COGS) and related revenues are matched in the same reporting period.

Accrual vs. Cash: A Side-by-Side Example

Let’s say a client completes a $5,000 project in January and sends the invoice right away, but doesn’t receive payment until February. That same month, they receive a $200 electricity bill, which they also pay in February.

Here’s how the transaction would look under each method:

Cash basis:

- January:

- Revenue: $0

- Expense: $0

- Profit: $0

- February:

- Revenue: $5,000 (cash received)

- Expense: $200 (bill paid)

- Profit: $4,800

Under cash basis, January shows no income or expenses, making it look like the business did nothing that month. February, on the other hand, looks very profitable, even though the work was done weeks earlier.

Accrual basis:

- January:

- Revenue: $5,000 (earned)

- Expense: $200 (incurred)

- Profit: $4,800

- February:

- Revenue: $0

- Expense: $0

- Profit: $0

Under accrual accounting, the income and expenses are both recognized in January, the period when they actually occurred. This ensures that reports reflect reality, not just cash movement.

For your firm, this difference matters when advising clients. Cash basis can overstate or understate profit depending on when money comes in or goes out.

Accrual accounting gives a more accurate view of the business’s performance in each period, which is especially important for forecasting, tax planning, and decision-making.

Best Practices for Firms Managing Both Methods Across Clients

Below are three best practices to help your team manage both methods efficiently.

1. Set Clear Policies per Client

Document the client’s accounting method from the start. This should appear in the engagement letter, onboarding records, and their internal client file. If a client switches methods later (e.g., from cash to accrual as they grow), log when the change happened and what adjustments were made.

This avoids common issues like inconsistent reporting, tax misstatements, or applying the wrong workflows during monthly close.

2. Use Checklists for Closing Processes

Month-end and year-end processes differ between cash and accrual clients. Use standardized closing checklists that are tailored to the method in use. This keeps your workflow consistent and prevents mistakes, no matter which accountant handles the account.

For cash basis clients, focus on reconciling cash transactions, posting payments, and confirming there are no unrecorded receipts or disbursements.

For accrual clients, include steps for reconciling AR and AP, posting accrued expenses, reviewing prepaids, and adjusting deferrals.

3. Train Staff on Both Methods

Make sure everyone on your team understands how to work with both cash and accrual clients. Even if some staff specialize in one, they should know:

- When to record revenue and expenses under each method.

- How to handle unpaid invoices and bills.

- Which accounts require review or adjustment at period-end.

- What triggers method-specific workflows (e.g., AR/AP aging for accrual).

Offer regular training sessions or create internal resources like short Loom videos or SOPs that explain key differences and workflows. That way, your team stays confident and consistent no matter the client.

Choose the Right Method and Tools for Clients

Choosing between cash basis and accrual accounting for a client depends on their business size, growth goals, industry, and compliance requirements.

Cash basis accounting works well for smaller businesses with simple operations and no inventory. It’s easier to manage and gives a real-time view of cash flow, but it can distort profitability and isn’t GAAP-compliant.

Accrual accounting offers a more accurate financial picture by matching income and expenses to when they occur. It’s required for businesses that carry inventory, earn over $26 million in average annual gross receipts, or need to comply with GAAP.

As a firm owner, you’re likely managing a mix of both. Each client’s needs are different, and switching between accounting methods across engagements can complicate your internal processes.

That’s where Financial Cents comes in. It’s an accounting practice management software that helps your team stay organized, consistent, and efficient.

With it, your firm can:

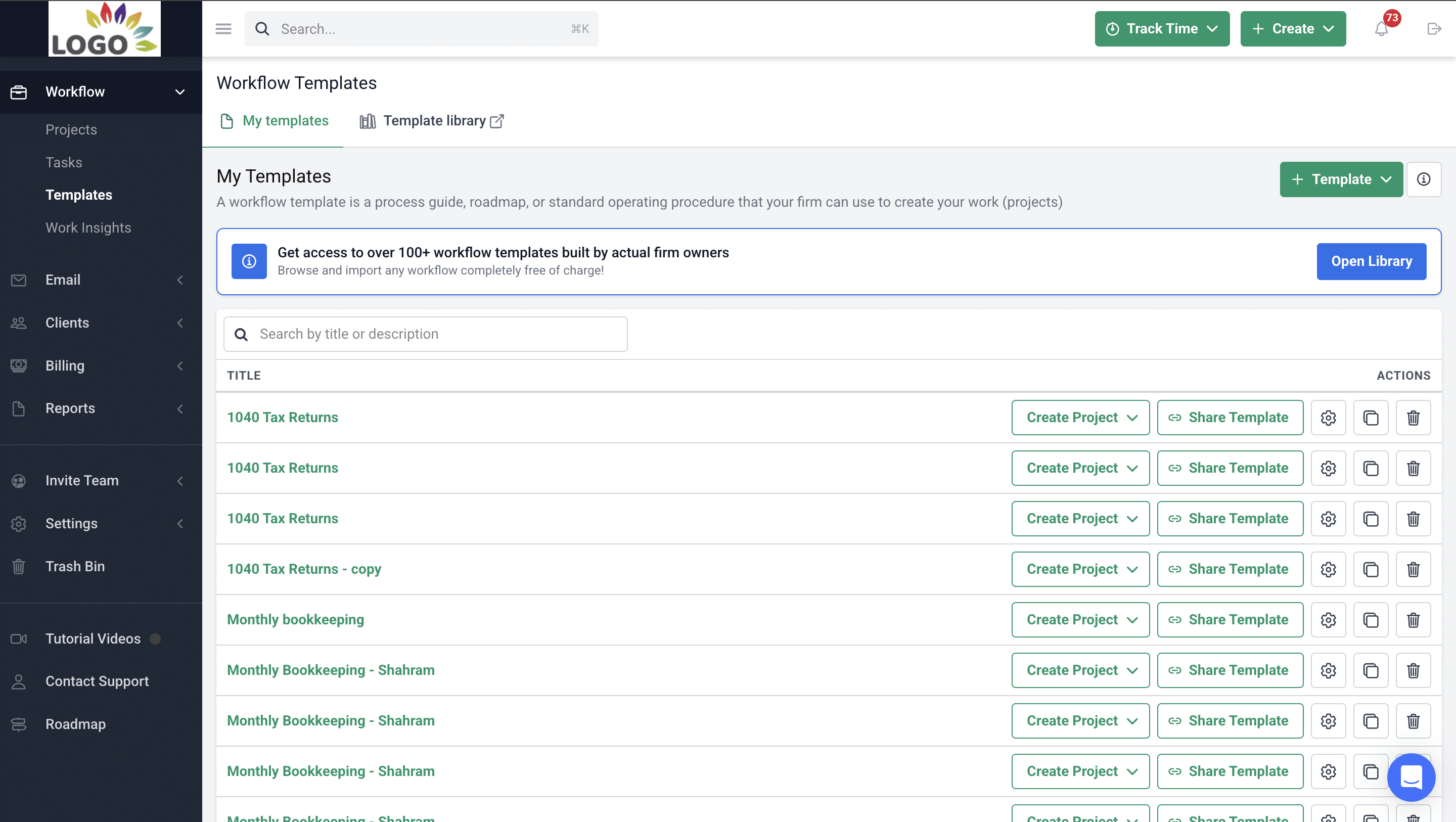

- Standardize workflows

You can create standardized workflows for every service you offer, whether that is monthly bookkeeping, payroll, sales tax filings, or accrual-based cleanup work. Financial Cents also has over 250 pre-built accounting workflow templates you can download and customize. Or you can build your own from scratch or with AI assistance and save them as reusable templates.

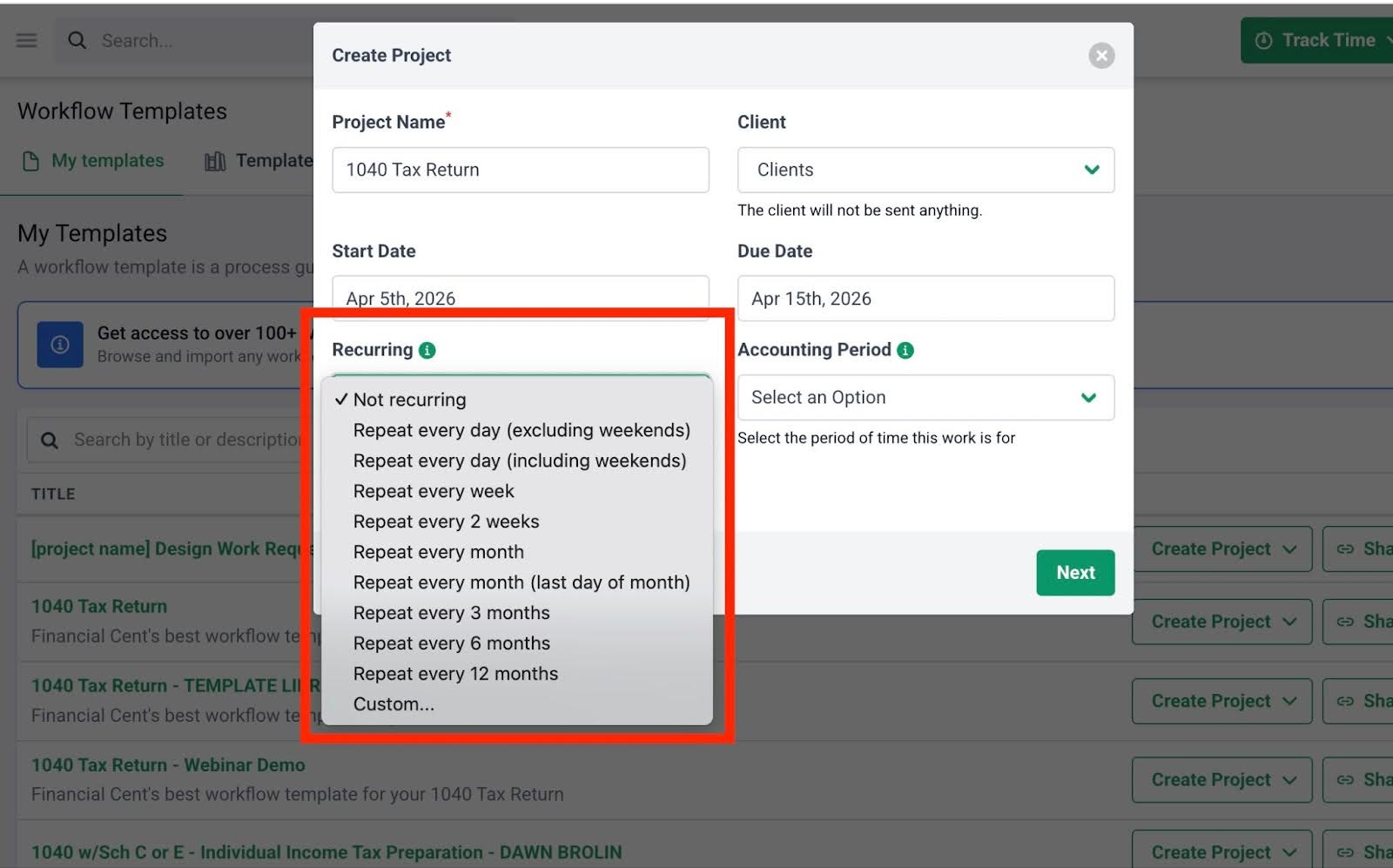

- Automate recurring tasks

Financial Cents can automatically handle recurring work. Projects that repeat weekly, monthly, or annually can be set to auto-generate without you having to create them each time. Project status updates and client reminders can also run on automation, saving you and your team from doing repetitive admin work.

- Track deadlines and deliverables

When it comes to tracking deadlines, Financial Cents gives you complete visibility into what’s due today, this week, or next week. Due date reminders notify your team before things slip, so you can reassign tasks or reprioritize work before it becomes a problem. This makes it easier to stay on top of recurring tax deadlines, compliance filings, and ad hoc deliverables.

- Track time and bill clients

You can also track time right inside the platform. This makes it easy to see which team members are working on what, how long tasks take, and how to tie time back to billable work. Because the time tracking and billing features are connected, you don’t have to switch tools or chase spreadsheets to reconcile hours with invoices.

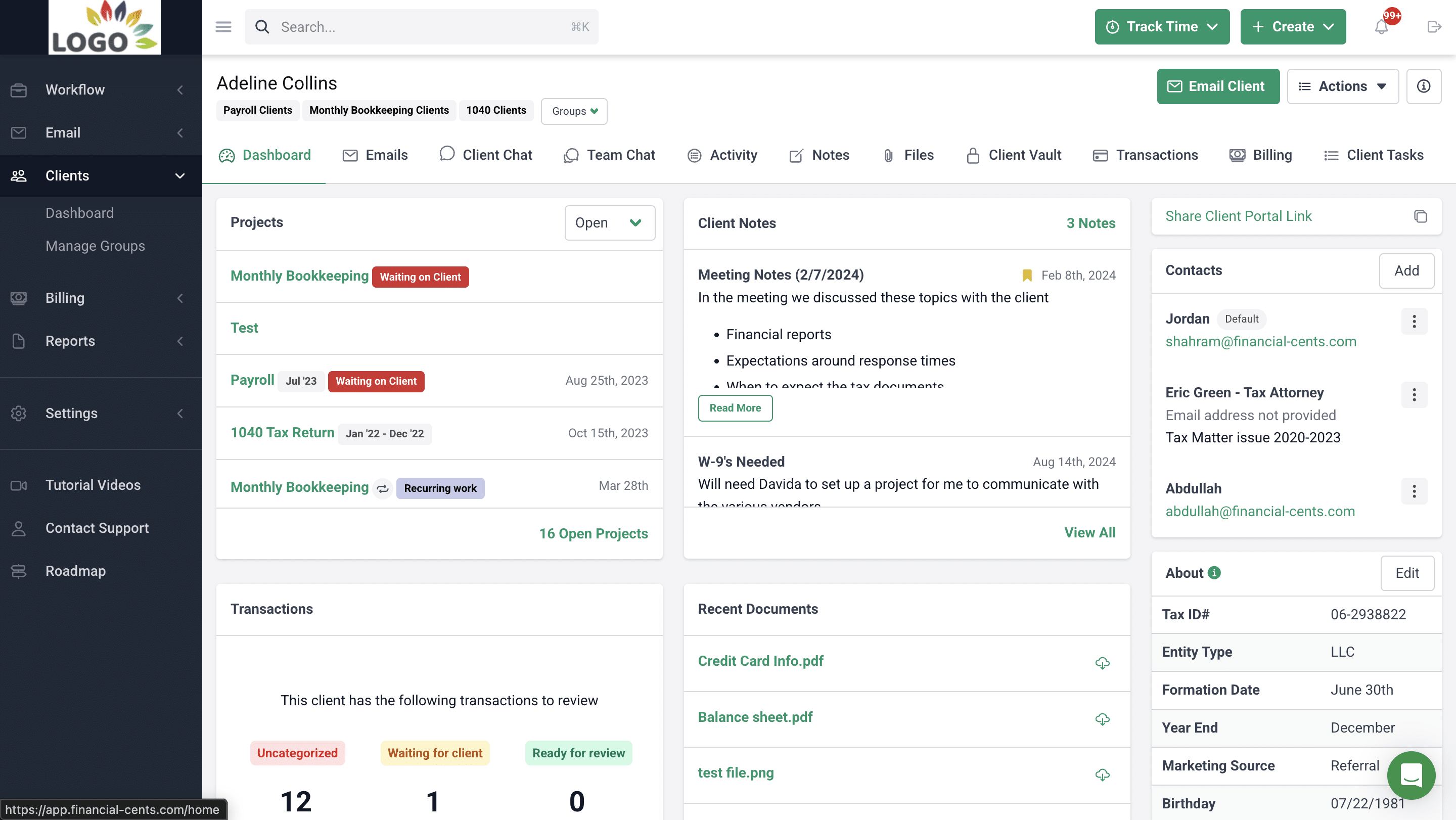

- Manage clients

Managing client communication is simpler with Financial Cents. Instead of emailing back and forth, your team can send document requests through the client portal. If clients don’t respond, Financial Cents sends automated reminders until they do. Inside each client profile, you’ll see notes, task progress, client info, and messages, so your team doesn’t have to dig through inboxes or Slack threads to find what they need.

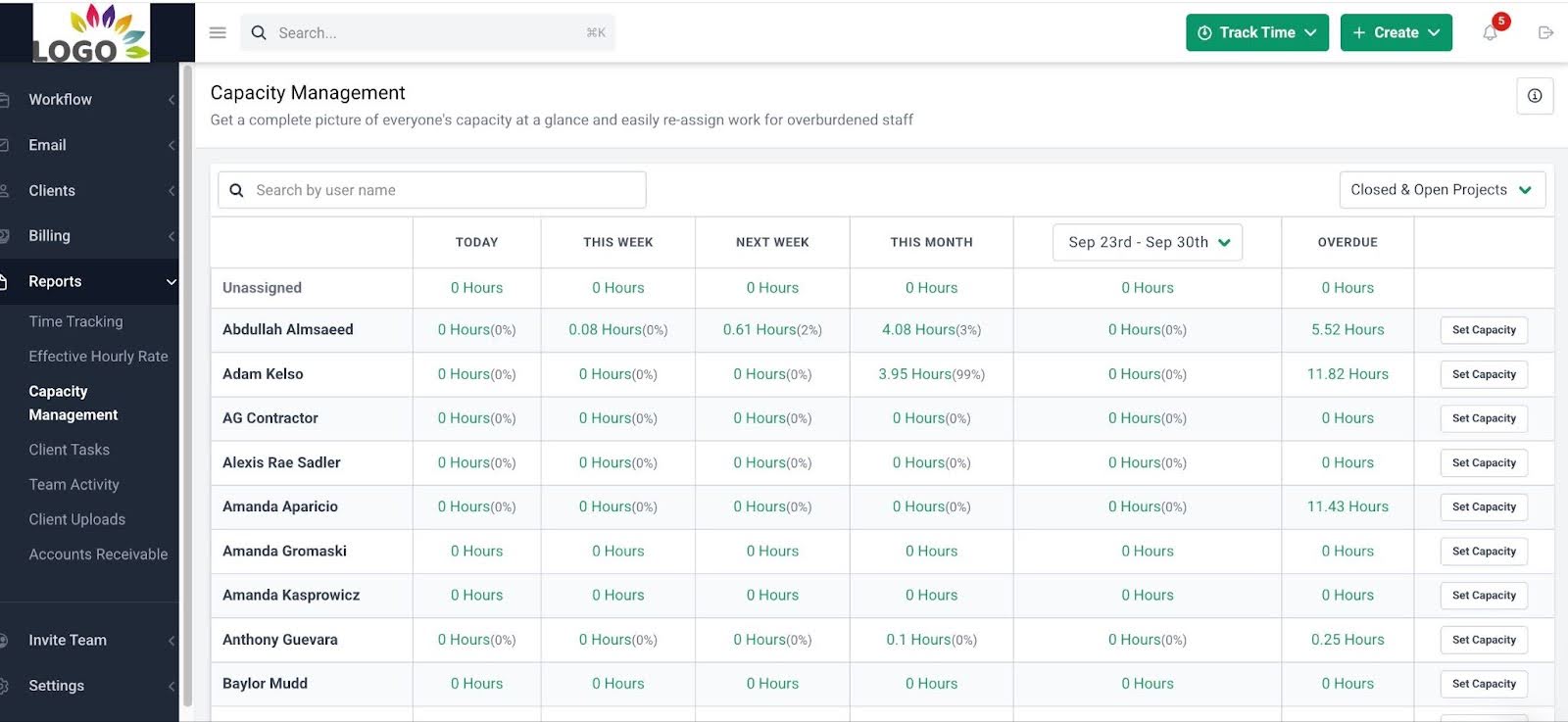

- Gain visibility across the firm

As a firm owner, you get full visibility across your firm with our software. The workload view shows what each staff member is working on and what’s overdue. Capacity reports show all the work assigned to team members and help you reassign tasks based on who has bandwidth. This makes it easier to balance workloads, avoid burnout, and make sure nothing falls through the crack.

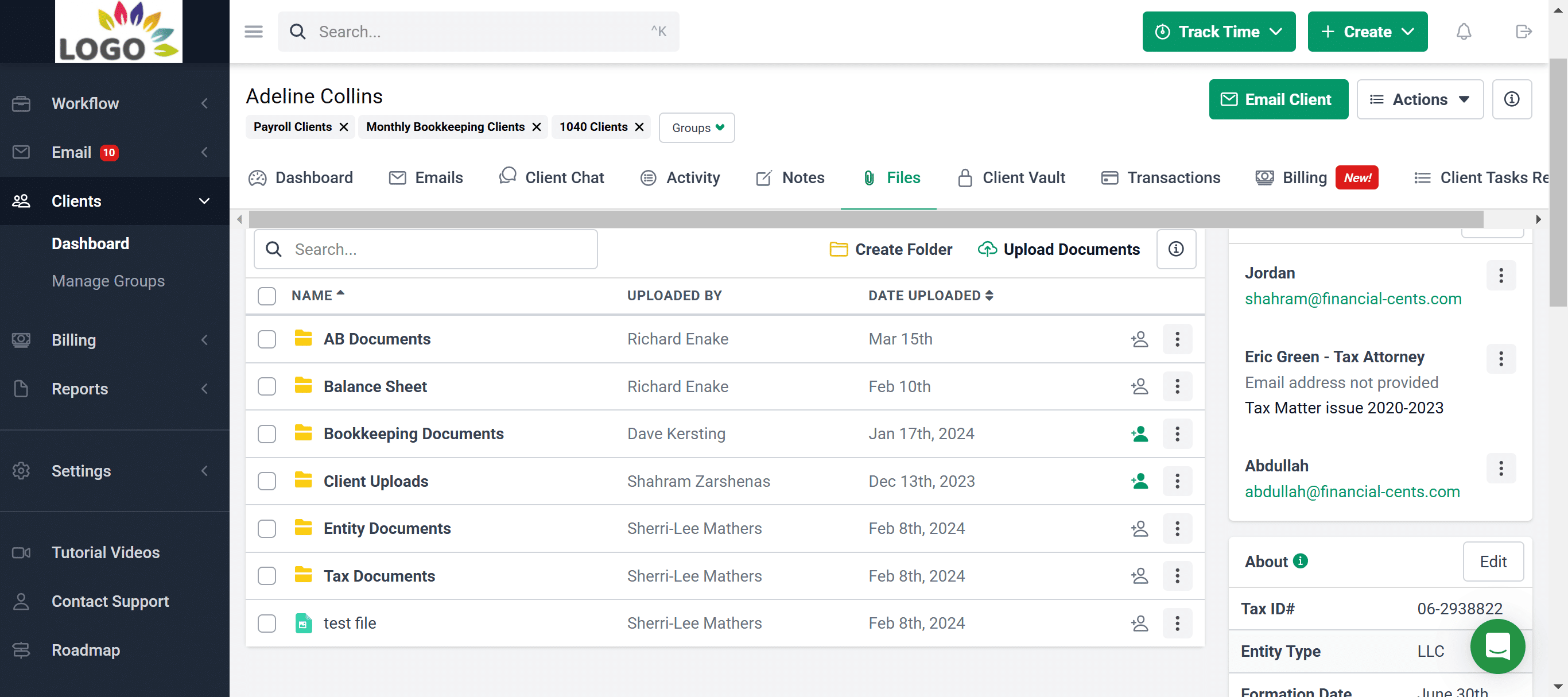

- Securely store client documents

Your team can also securely store client documents in each client’s profile. Files are organized, easy to access, and protected by enterprise-grade security that meets SOC II, SOC III, and GDPR standards. If your firm operates in the U.S., Canada, the U.K., or Australia, Financial Cents also gives you the option to store data within each region to stay compliant with local data privacy laws.

- Collaborate with team members and clients

Collaboration stays organized, too. Every project and client profile has its own space for comments, notes, and team chat. Team members can mention each other, leave context-specific instructions, and see what’s already been done, without having to ask or interrupt someone else’s work.

Explore how Financial Cents can help you improve your accounting processes and manage your firm. Start a Free Trial.