My favorite example of AI's benefits was when the SEC vs Ripple decision was reached. I pasted the PDF document into Claude AI and asked for an executive summary explaining why the judge made that decision. It did surprisingly well and was much faster than reading the 60-page document."

Blake Oliver, CPAAs industries continue to figure out where to apply AI in their businesses, the accounting industry has found ways to leverage it for accurate data analysis, document review, and automation of repetitive tasks—through AI accounting software.

According to the State of Accounting Workflow Automation Report, this has helped accounting firms to standardize their work quality and complete client work faster.

This article explores the top accounting AI tools (and their use cases) in 2025.

The Basics of AI Technology in Accounting

Artificial Intelligence (AI) uses technologies (such as machine learning, deep learning, speech recognition, and computer vision) to create algorithms that empower machines with human intellectual capabilities.

Its ease of use has made the technology acceptable by practically every industry. “There are so many ways you can use AI, and it is so deceivingly simple that you sometimes don’t know where to start.”–Shahram Zarshenas, Financial Cents CEO.

However, there has also been a fair bit of skepticism around the technology. Some accounting firms are concerned about its impact on accounting professionals, while others are unsure of its security, reliability and sustainability.

When used well, “AI’s job will be to quickly bring to your attention the most relevant information from the most relevant materials so that you can form your conclusions in a much more efficient manner.” –Jason Staats, CPA.

Whatever you think of AI, there is no downside to learning how it works. If anything, it ensures you’ll remain relevant when it develops beyond your expectations.

I believe that a lot of the firms that don't adopt AI could fall behind because other firms that will adopt it will be able to provide a better client experience. They will be able to be more efficient and profitable and can reinvest their time to grow more effectively."

Shahram Zarshenas, CEO of Financial CentsBenefits of AI Accounting Systems

a. Increased Efficiency and Productivity

AI does in seconds what takes accounting professionals hours to complete. This allows your team to focus on quality assurance and fine-tuning its output to your standards.

For example, Financial Cents’ AI features enable users to tell ChatGPT the type of client email they want to send, and ChatGPT will create it in seconds.

b. Improved Accuracy and Reduced Errors

Unlike humans, who are driven by emotions, AI lacks the feelings and biases that distort human interpretation of data, making it more accurate at scale.

c. Enhanced Decision-Making with Data-Driven Insights

AI is trained to search the web and databases (at lightning speed) to provide the information you need in the way you need it.

This makes decisions from such research more reliable. “I’ve seen firms ask AI about the most profitable niches for accounting firms, and AI will give them the top results.

They can take it further by asking about the biggest pain points businesses in these niches have. AI will give them the top accounting challenges. From that, the firm owner can position their services for those niches.” —Shahram Zarshenas, Financial Cents’ CEO.

d. Better Client Service Through Automation

AI reduces customer service costs by automating repetitive tasks, such as common client inquiries, which allows your team to focus on advanced client concerns.

According to Shahram Zarshenas, more businesses are implementing AI as their intercom chat support. It attends to customers who need urgent answers and cannot wait (even for a few minutes) for the responses of a client support staff.

The Top 10 Accounting AI Software

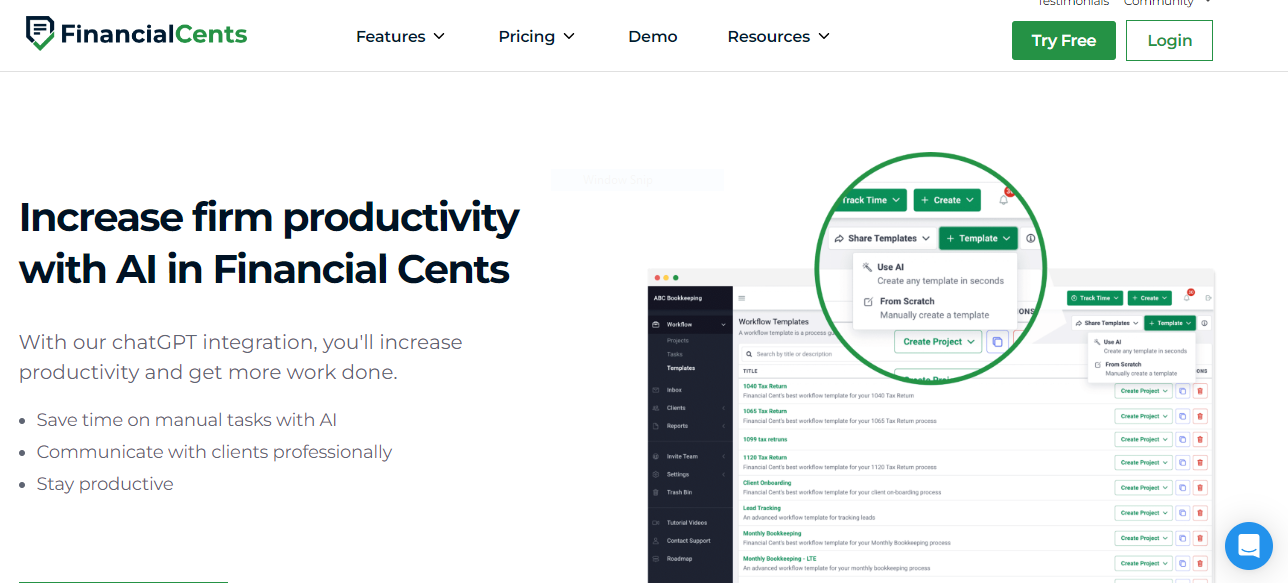

1. Financial Cents

Financial Cents is an accounting practice management software that seeks to help accounting and bookkeeping firm owners manage every aspect of their firm in one place.

That is why it has swiftly implemented features that enable its users to access ChatGPT while doing client projects.

These Features include:

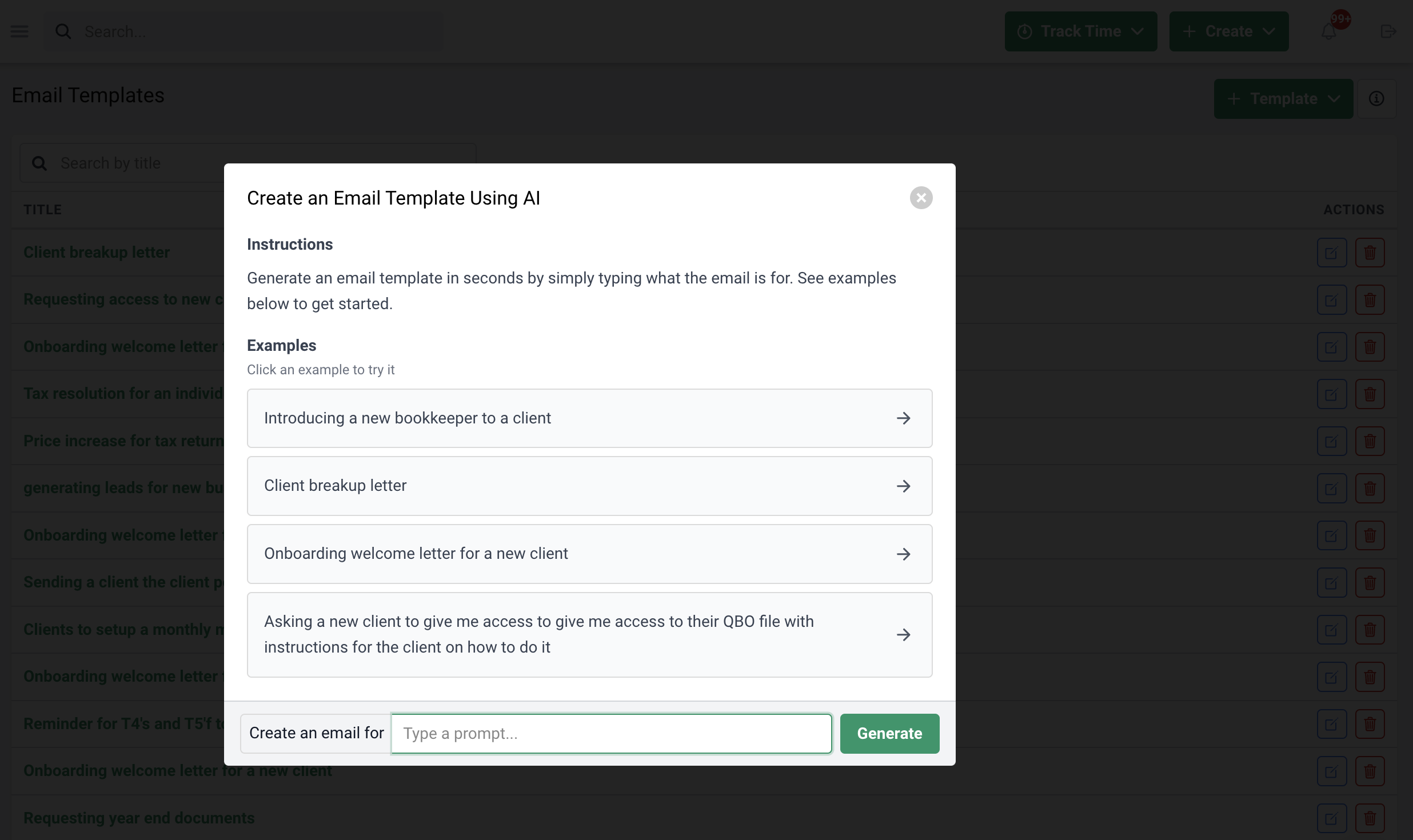

- AI Emails: create client email templates for current and future client communication efforts within seconds.

The best part of the AI email feature is the ability to save it for future client communication needs. You wouldn’t need to recreate the same email twice.

- AI Workflow Templates: create step-by-step guides for completing your accounting projects in seconds.

You can also save the workflow templates you create with ChatGPT for future reference, keeping your work quality consistent at all times.

You can use this feature to:

- Research how to complete any accounting project (or task)

- Create tasks for a new project you have created in Financial Cents.

For example, accountants can ask ChatGPT to create the steps involved in the tax returns of a married couple (filing jointly) who own 20 rental properties. ChatGPT will outline the steps of this process, and the accountant can customize it as they see fit.

Price

- Solo Plan: $19/month per user (annual plan).

- Team: $49/month per user (annual plan).

- Scale Plan: $69/month per user (annual plan).

Free Trial

14 day free trial.

Pros

|

Cons

|

Reviews

Financial Cents has:

2. ChatGPT

ChatGPT uses natural language to help accounting and bookkeeping professionals find answers to challenges and get ideas that help them get work done faster.

Its chat interface allows users to exchange conversations (prompts) and request help with the task they are working on.

Its capabilities include:

- Content Generation: type the kind of content you want to create. It will generate the content.

- Meeting Summaries: paste meeting transcripts into the chat to get summaries.

- Web Browsing: search the web for answers through ChatGPT.

- Data Analysis: upload data for analysis and create charts and tables.

- Voice Chat: activate voice conversations using the headphone icon.

Price

- Free: $0

- Plus: $20/month

Free Trial

Not available

Pros

|

Cons

|

Recommended:

Reviews

ChatGPT has:

4.6 (out of 5) stars on Capterra

4.7 (out of 5) stars on G2

3. Botkeeper

Botkeeper automates tedious bookkeeping tasks to give bookkeeping teams more time to focus on what matters. It uses machine learning and historical data to categorize transactions on its own.

Its features include

- Smart Connect: links your clients’ financial accounts in the US and Canada together to access their financial information easily.

- Transaction Manager: apart from data categorization, this feature learns from your input to tailor its services to your needs.

Price

- Accounting Partner Basic: $155

- Accounting Partner Advanced: $215

Free Trial

Not available

Pros

|

Cons

|

Reviews

Botkeeper has:

4.4 (out of 5 stars on Capterra and G2)

4. Vic.ai

Vic.ai addresses the operational challenges of Accounts Payable teams by streamlining the process from invoice processing through payment.

The tool boasts of reducing invoice processing time by 80% and maintains 97 to 99 percent accuracy.

Its features include:

- AI Invoice Processing: data extraction and General Ledger (GL) coding that works with all invoice formats quickly and accurately.

- Invoice Coding Workflow: Vic.ai learns your invoice coding workflow to replicate and speed it up.

- PO Matching: Vic.ai matches POs with corresponding documents to flag off issues of concern for human review.

- Payments: Vic.ai supports all types of payments (ACH, check, virtual cards, etc. and helps with securing payment discounts to help you manage cash flow.

- Analysis and insights: performance metrics that improve AP workflows.

Price

- $1490.00 per month

- Enterprise: Custom pricing

Free Trial

Not available

Pros

|

Cons

|

Reviews

Vic.ai has 4.8 (out of 5) stars on G2

5. Dext Prepare

Dext Prepare offers AI data capture, processing, and publishing features for bookkeeping teams that want to reduce paperwork processing time and focus on client service.

This tool ensures that the information in your receipts, invoices, and bank statements are automatically extracted, processed, and published to your accounting software so that you can spend your time analyzing the numbers and making decisions.

Its features include:

- Data-driven Insights: gives you visibility into your client’s data, enabling you to guide them to success and growth.

- Expense Management: snaps financial documents for analysis and processing into your accounting software.

- Expense Reports: AI-powered functionality that tracks and manages employee expenses and reimbursements.

- Mobile: data capture and processing on the go.

Price

- Essential: $199.99/month

- Advanced: $214.99 /month

Free Trial

14-day free trial

Pros

|

Cons

|

Reviews

Dext Prepare has:

4.2 (out of 5) stars on Capterra

4.6 (out of 5) on G2

6.Datarails

Datarails’ financial planning and analysis software provides actionable insights that help your clients grow their businesses.

It automatically consolidates data, financial reporting, and planning without leaving your formulas in Excel spreadsheets.

Its features include

- Storyboard: uses generative AI to tell the stories behind a company’s financial data.

- FP&A Genius: a single source of truth for all FP&A questions about budgeting, expenditure, variance, and forecasts.

- Automatic Data Collection: automatically collects data for P&L, balance sheet, and cash flow statements.

- Scenario Modeling: helps you prepare for best and worst-case scenarios.

Price

Prices are tailored to individual users based on need and firm size.

Free Trial

Not available

Pros

|

Cons

|

Reviews

Datarails has:

7. Blue Dot

Blue Dot is a VAT compliance platform that helps finance teams manage unstructured transactions to maximize tax refunds.

The ability to track international taxable benefits makes Blue Dot suitable for businesses with branches in multiple countries.

Its features include:

- VAT BOX: Calculate your client’s VAT spend based on their country’s tax regulations.

- Taxable Employee Benefits: Analyzes expenses that are likely to be affected by taxable employee benefits.

- Advanced E2E: integrates with your expense management workflow using relevant financial data to review and validate your data.

Price

Custom pricing

Free Trial

Not available

Pros

|

Cons

|

Reviews

Blue Dot has 4.7 (out of 5) stars on G2

8. Intuit Assist

Intuit Assist is a generative AI that provides personalized recommendation and error-checking services across Intuit products–Quickbooks, TurboTax, CreditKarma, and MailChimp.

The AI solution is adaptable to the functionality of the host application (QuickBooks, Turbotax, etc).

Its features include

- Invoice Reminders: Identify due invoices and create personalized reminders to help businesses receive payment faster.

- Connect with experts: Intuit Assist connects you to experts when you need human expertise.

- Invoice Generator: add the business and order information, and Intuit Assist will generate a draft invoice that you can customize as you see fit.

Price

Intuit Assist is covered in the normal QuickBooks prices:

- QuickBooks Ledger: $8/month per subscription

- Simple Start: $9/month

- Essentials: $13.50/month

- Plus: $19/month

- Advanced: $38/month

Free Trial

A 30-day free trial is available through QuickBooks or Turbotax

Pros

|

Cons

|

Review

Not available

9. Docyt

Docyt provides real-time accounting services and insights that help firms make enlightened decisions. It automates tasks like data entry, invoice processing, expense categorization, and account reconciliation, freeing you up to apply the insights for strategic goals.

Its features include:

- Multi-Location Accounting: for managing businesses in multiple locations from one place without missing out on up-to-date insights.

- Tax Reporting: Docyt automates the transfer of money from one company to another, easing tax reporting.

- Merchant Processor and Cash Deposit Tracking: helps to catch errors and discrepancies.

- Consolidated Financial Reports: provides monthly, quarterly, and yearly aggregate financials on your client’s businesses.

- Document extraction & understanding: Docyt AI understands which information to extract (and reconcile) from receipts and invoices.

Price

Its end-to-end accounting plan: is $299 per month. Contact their sales representatives to confirm.

Free Trial

A free trial is available.

Pros

|

Cons

|

Reviews

Docyt has:

4.6 (out of 5) stars on Capterra

4.9 (out of 5) stars on G2

10. HighRadius

HighRadius is an Accounts Receivable collection software that helps accountants reduce their clients’ DSO and optimize cash flow.

Its AI features continuously learn from your data to improve a company’s order-to-cash process.

Its features include:

- Proactive Collections Worklist: analyzes and ranks a company’s customers to determine their chances of delinquency.

- Auto-Transcription: transcribes collection calls into text for easy note-taking.

- Automated Task Creation: analyzes calls and creates tasks for relevant action items automatically

- Automated Correspondence: manages collections with automated reminders and notices.

- Smart Send: leverages AI to understand the best time to reach a customer with an email.

Price

Custom pricing based on your size and use cases.

Free Trial

A free trial is available

Pros

|

Cons

|

Reviews

HighRadius has:

4.4 (out of 5) stars on Capterra

4.3 (out of 5) stars on G2

Factors to Consider When Selecting an AI Accounting Tool

a. AI Functionalities

Any AI tool you’re considering must be able to accept text, speech, or image inputs and process them into information that solves a problem for you.

b. Integration

The more of the other project-critical tools you can use with an AI accounting software solution, the better for your team. That reduces the struggle to go from one app to another trying to move information around.

c. Ease of use

AI accounting software should be easy to use. A poor user interface requires a learning curve that might prevent you from maximizing the tool.

d. Price

Price, in this case, is more relative. The amount you can pay for an AI accounting solution depends on the problems it will solve for you.

If ChatGPT saves you 10 hours of work a week, and your 10 hours are worth $1000, the $20 you will have to part with to use its premium features will not mean much to you.

e. Data Privacy and Security

Jason Staats recommends doing the same due diligence for potential AI tools as you would do with any other cloud accounting software solutions.

What is the data retention policy? Can you clear your data from their system when switching to another tool? Will your data be used to train the AI model?

These questions will help you understand which information you can put into the system and when to anonymize the information.

f. Scalability

Nobody wants an AI solution that would become irrelevant as their firm grows. The size of the firms currently using a tool can tell you whether it will be relevant to your firm in the future.

g. Customization

Customization ensures that an AI tool will be fully adopted in your business. This is why accounting-specific solutions are generally better than generic software.

Accounting-specific software is designed with your unique needs in mind, while generic solutions strive–unsuccessfully–to carry every industry along.

Wondering Where to Start Your AI Implementation?

One way to ease into AI in accounting is by using accounting software that has AI features.

There's an element of AI that your Tech Partners will enable for you. The features Financial Cents is shipping is a good example of how it's never been more important to ensure you hitch your wagon to the right tech partners."

Jason Staats, CPAIn Financial Cents, AI solutions are integrated seamlessly into the practice management features. For example, while creating workflow templates, you can use the AI feature to outline the steps involved in any accounting work in seconds, saving you the time and energy to rack your brain.

Similarly, you can use the AI feature to create the emails you need for client communication, saving you the writer’s block that comes with such tasks.

Financial Cents is always looking for ways to use technology (including AI) to help you:

- Creating and managing projects and collaborating (with your staff) in one place.

- Manage client information and collaborate to strengthen your client relationships.

- Time Tracking to get work done and receive payment faster.

- Manage team capacity to do more meaningful work and retain your best talents.

Use Financial Cents to stay relevant with the AI practice management features your firm needs to grow.

Thanks for the article! These AI accounting softwares seem like an excellent fit for my own small business accounting UK.