“How do I price my bookkeeping services?” As a new bookkeeping firm, we bet this question is one you’ve been thinking about. We know finding the sweet spot between fair and profitable pricing is difficult. You’re worried about undercharging clients, undervaluing your services, and coming off as unprofessional or a rookie because you lack a clear pricing structure.

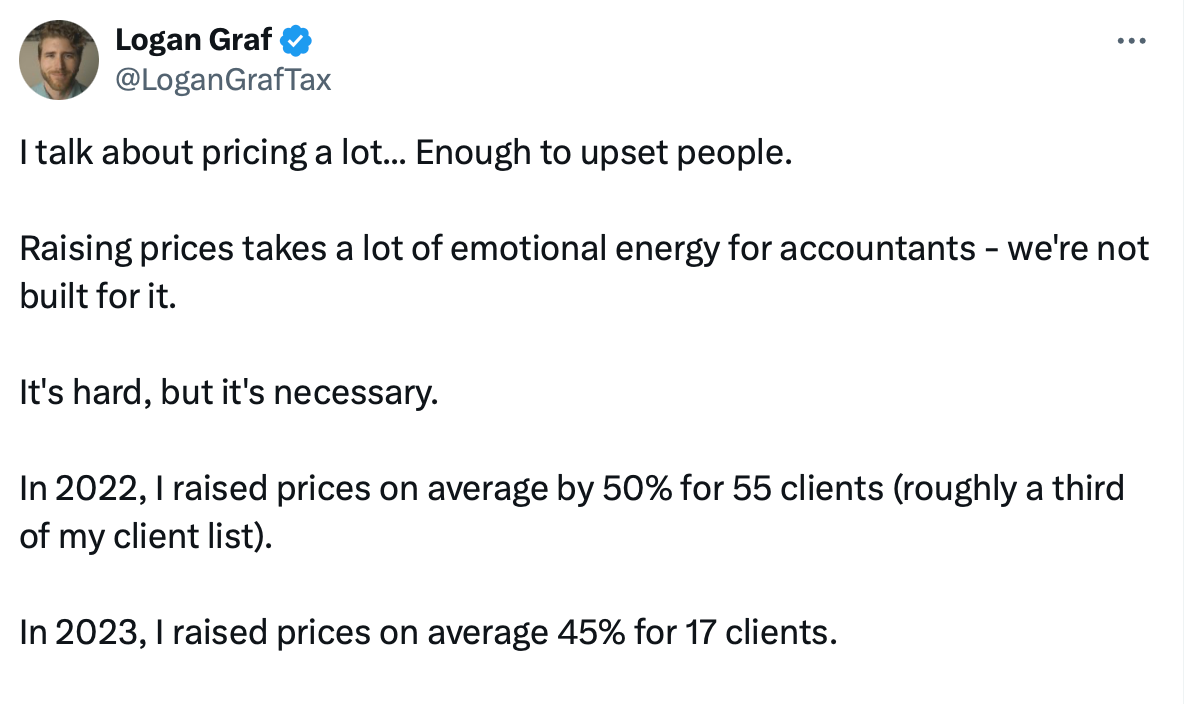

Even if you’re already an established firm and have been in the game awhile, your pricing is still important. You can’t use the same rates as when you started. It’s not practical, and you’re leaving a lot of money on the table. Instead, as your firm grows and you gain more experience, you should review and update your rates. As Logan Graf, CPA firm owner, said in a tweet, “it’s hard, but worth it”:

So how do you ensure you’re setting the right rates, i.e., one that is clear and fair for all? By using a bookkeeping pricing template. It guides you in creating a pricing structure that works well for you and your clients.

We’ve included a free template you can download and use immediately, plus tips to help you get the most out of it. Let’s get into it.

Benefits of Using a Bookkeeping Pricing Template

Using a pricing template is beneficial for so many reasons like the following:

Provides a Framework

A template serves as a solid foundation for your pricing strategy. It guides you through the essential factors to consider, ensuring you don’t overlook important elements like service packages, client size variations, and overhead costs. This approach helps you create a well-rounded pricing structure that reflects your true value.

Saves Time

Clients have different needs and so often need customized pricing. Now, creating a new pricing structure for each client who needs it would take a lot of time, effort, and resources. But a template promotes efficiency. It provides a pre-built framework that allows you to customize service packages and pricing based on client needs quickly. This frees up valuable time for more profitable activities.

Creates Consistent Pricing

Consistency is important. With a template, you can ensure all your quotes and proposals follow the same structure and format, regardless of the client or the team member in charge of servicing the client. This demonstrates professionalism on your part and helps build trust with the client.

Improves Client Communication

A clear and detailed pricing document makes communication with clients easier and better. There’s no back-and-forth trying to explain the rates to them since the document is self-explanatory.

Elements Your Bookkeeping Pricing Template Should Have

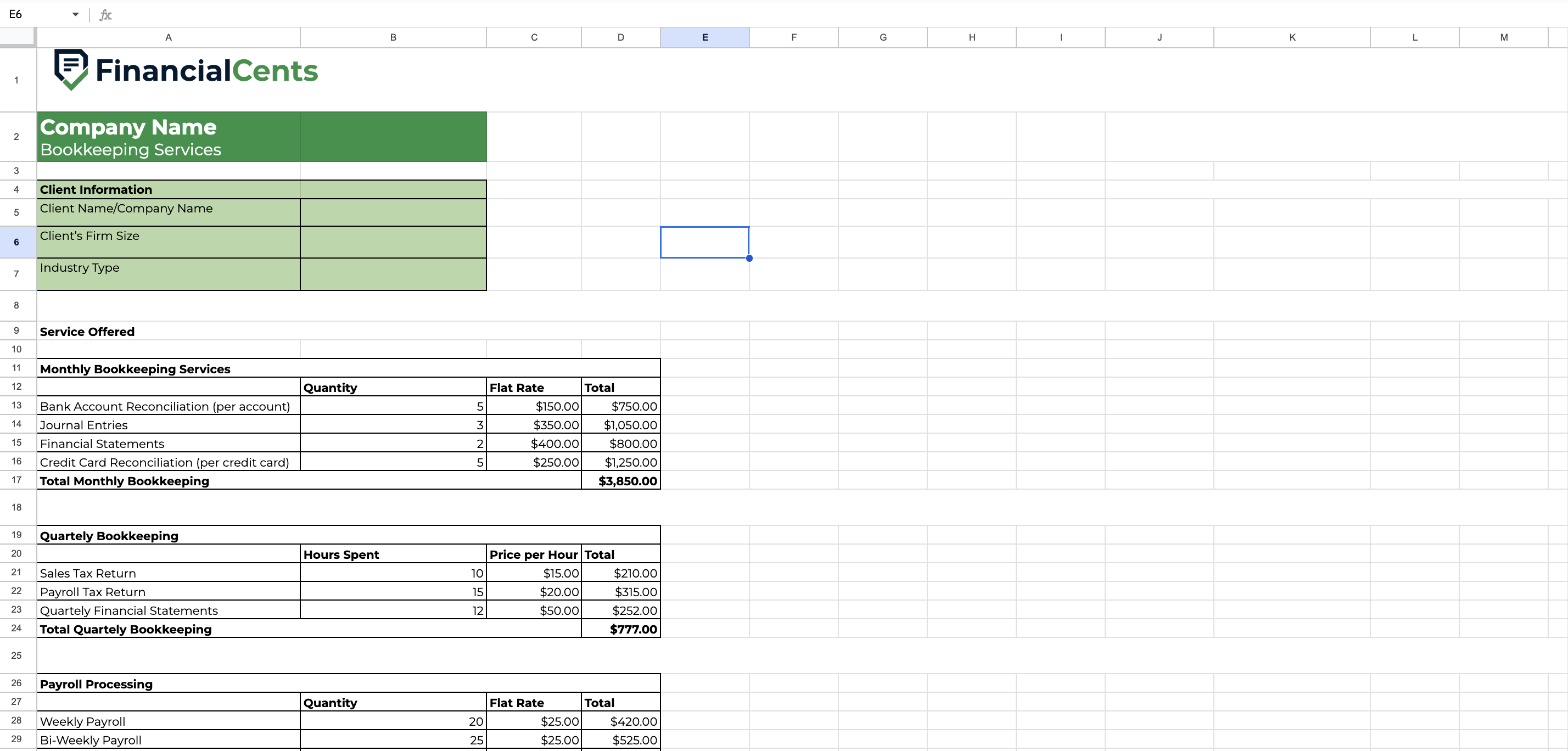

A good pricing template should cover three major sections: the client information, the services you offer, and your rates. Let’s look at them individually.

1. Client Information

This is the first section, and it’s all about the client. It’s usually found at the top of the pricing template. It should contain the following:

- Client Name/Company Name: Anytime you send your pricing document to a client, it should contain their name (or company name). This is great for easy reference and adds a personal touch.

- Client’s Firm Size: Next, state the client’s business size. Options include a solopreneur, small business, and medium business. Aside from stating this in the document, it’s important for you to understand the size and structure of their business as it helps you tailor your service packages and pricing accordingly. Smaller firms may require basic bookkeeping, while larger ones might need full-charge bookkeeping or specific add-on services.

- Industry Type: What’s the client’s industry? Are they in retail, e-commerce, professional services, etc.? Add it to your pricing document. Knowing the industry allows you to estimate time requirements and adjust your pricing accordingly, as industries with specific regulations or complex transactions may require additional expertise and warrant higher rates.

2.Service Packages

This section outlines the specific bookkeeping services you offer to clients. Common service packages include:

- Basic Bookkeeping: This package might cover tasks like bank reconciliation, accounts payable/receivable management, and basic financial reporting.

- Full-Charge Bookkeeping: A more comprehensive package that could encompass everything in basic bookkeeping, plus advisory services, payroll processing, tax preparation assistance, and financial statement analysis.

- Payroll Processing: For clients who require dedicated payroll management, you can offer this as a standalone service or bundled with other packages.

3. Costing and Rates

Here’s where you define the pricing structure for your various service models. You can offer more than one pricing model. It all depends on the client’s needs and budget.

- Hourly Rate: Ideal for clients with unpredictable bookkeeping needs. This model charges clients based on the actual time spent working on their accounts.

- Weekly Rate: Suited for clients with a consistent workload. This offers a fixed weekly fee for a predetermined set of services.

- Flat Rate: This model charges a fixed monthly fee for a specific set of bookkeeping tasks. It works well for clients with predictable monthly transactions. The flat fee can be based on a per-transaction basis or a tiered pricing structure.

- Project-based Rate: Ideal for one-off projects like system cleanup or initial setup of a new bookkeeping system. This charges a fixed fee for the entire project scope.

- Tiered Pricing: This allows you to offer different service packages at various price points. Each tier might include a specific set of services with a corresponding flat fee.

- Estimated Time per Task: Having a rough idea of how long typical tasks take for different client sizes helps you calculate accurate prices for various service packages. This will allow you to set realistic expectations and still ensure profitability.

Basic Bookkeeping Pricing Template

Here’s a glimpse of what our pricing template looks like:

The beauty of this template lies in its dual functionality. It lets you structure your pricing based on hourly rates or flat fees. The former factors in your price per hour and the estimated number of hours required per month to complete the project. While the latter offers a clear and upfront cost and allows you to define your pricing based on quantity or unit (e.g., number of transactions processed).

This template also incorporates automatic calculations to maximize your time and ensure accuracy. Simply input your chosen rate (hourly or flat fee) and the estimated time required for each service. The template will then calculate the total cost for that specific service.

Remember, this is just a template. Feel free to customize it to reflect your specific service offerings, expertise, and target clientele. You can always add or remove from it.

Bookkeeping Pricing Template

You can also consider using our Bookkeeping services pricing calculator tool to quickly calculate the prices for your services.

Key Considerations When Using a Free Bookkeeping Pricing Template

Keep the following tips in mind when using this template.

Identify Your Ideal Client

The first thing to do is define your target market. Who are the ideal clients you want to attract and work with? Understanding your ideal client profile allows you to tailor your service packages, pricing structure, and marketing efforts to resonate with their specific needs.

Understand Your Services

Be clear and specific about the bookkeeping services you offer. This includes everything from bank reconciliation and accounts payable/receivable management to payroll processing and tax preparation assistance.

Having a well-defined service list helps you determine the time and resources needed to deliver each service effectively, directly impacting your pricing structure.

Estimate Time Requirements

Develop a rough estimate of the average time it takes to complete tasks for different client sizes and needs. This is necessary for setting realistic pricing for your various service packages. Consider factors like transaction volume, industry complexity, and the level of bookkeeping expertise required.

Factor in Your Expenses

Don’t forget to account for all your overhead costs when setting your rates. This includes software subscriptions, bookkeeping software fees, continuing education and training, professional insurance, and even office supplies. By factoring in these expenses, you ensure your pricing structure covers your business costs and allows you to turn a profit.

Conduct Market Research

Conduct thorough research on the average bookkeeping rates in your area for similar services competitors offer. This will give you a benchmark to ensure your pricing is competitive while reflecting your value proposition. Our firm revenue report has details on how much firms in different locations are making, how long they’ve been in business and the services that drive the most revenue.

Focus On the Value You Deliver

As your firm grows and you start building a reputation, move away from hourly rates to value-based pricing. According to Mark Wickersham, “Value pricing is about setting a price based on the value to the customer not based on how many hours something takes.” This enables you to charge a premium for your services and become profitable.

Final Thoughts

To grow and scale your firm, you need to expand your service offerings and offer more value. Go beyond basic bookkeeping and into advisory or client accounting services (CAS).

You also need to embrace technology. A tool like Financial Cents automates many of the repetitive tasks that you have to perform, such as requesting documents from clients and following up with them. This makes your team more efficient and improves profitability.

Financial Cents has a time-tracking feature that makes hourly tracking easier. Furthermore, you can automate invoice creation and receive payments from your clients using our billing feature. It also integrates seamlessly with Quickbooks. This ensures you get paid accurately for the time you invest and streamlines your billing process.