There’s nothing quite like that sinking feeling when your client’s books don’t match their bank statements. Whether it’s missing transactions, duplicate entries, or timing differences that throw everything off, these discrepancies can complicate your month-end close process and force your team to spend extra hours tracking what went wrong instead of working on other client projects.

That’s where bank reconciliation comes in. It’s a key step in the month-end close that helps you verify every transaction and confirm that the books match the bank, giving you and your clients a reliable view of their cash position.

According to the Association of Certified Fraud Examiners, 32% of business fraud cases involve weak internal controls, like skipping regular reconciliations. But even when fraud isn’t a concern, reconciliation helps keep your records accurate and your reports dependable.

To make the process easier, we’ve created a free bank reconciliation template for Excel and Google Sheets. It’s built for accounting and bookkeeping professionals who want a clear, repeatable process, without starting from scratch.

What is Bank Reconciliation?

This is the process of comparing your client’s accounting records to their bank statement to make sure the balances match. If there’s a difference, you investigate the cause, make any necessary adjustments, and ensure everything is accurate and up to date.

These differences happen for various reasons like timing. For example, your client might have recorded a payment that hasn’t cleared the bank yet, or the bank may have charged a fee that isn’t in the books. Or sometimes it’s just a simple data entry error.

While bank reconciliation is one of the most common types of reconciliation, it’s not the only one. Accountants also reconcile:

- Credit card statements to match charges and payments

- Vendor or supplier accounts to ensure that bills and payments line up

- Customer accounts to confirm that payments received match invoices sent

Each type of reconciliation helps confirm that financial records are accurate and complete, but reconciling bank reconciliation is especially important because it directly affects cash flow and financial reporting.

Why Reconciling Bank Account Matters

Bank reconciliation is one of the most important checks for accuracy in your client’s financials. It matters because it:

Helps Detect Errors, Fraud, or Missing Transactions

Mistakes happen. Transactions might get entered twice, skipped entirely, or posted to the wrong account. On top of that, unauthorized withdrawals, forged checks, or fraudulent charges can slip through unnoticed. Regular reconciliation helps you spot these red flags early. It gives you a chance to fix small issues before they grow into larger problems or compliance risks.

Ensures Books Match the Actual Bank Balance

Reconciling ensures that what’s in your client’s books reflects what’s actually in the bank. Without it, you might be working with outdated or incomplete data, especially if there are outstanding checks, delayed deposits, or bank-only entries like fees and interest.

Crucial for Accurate Financial Reporting

If you’re generating reports with unreconciled data, there’s always a risk that those reports are wrong. Bank reconciliation gives you confidence that your reports (like the balance sheet, cash flow statement or accounting compilation report) are built on accurate, up-to-date numbers. This is especially important for decision-making, tax prep, and advisory services.

Maintains Audit Readiness and Compliance

Auditors, lenders, and tax authorities all want to see that your records are backed by clear, documented proof. A regular reconciliation process creates a reliable audit trail. It shows that your firm takes internal controls seriously and reduces the risk of having to scramble for explanations later.

Your Free Bank Reconciliation Excel Template (+Google Sheets)

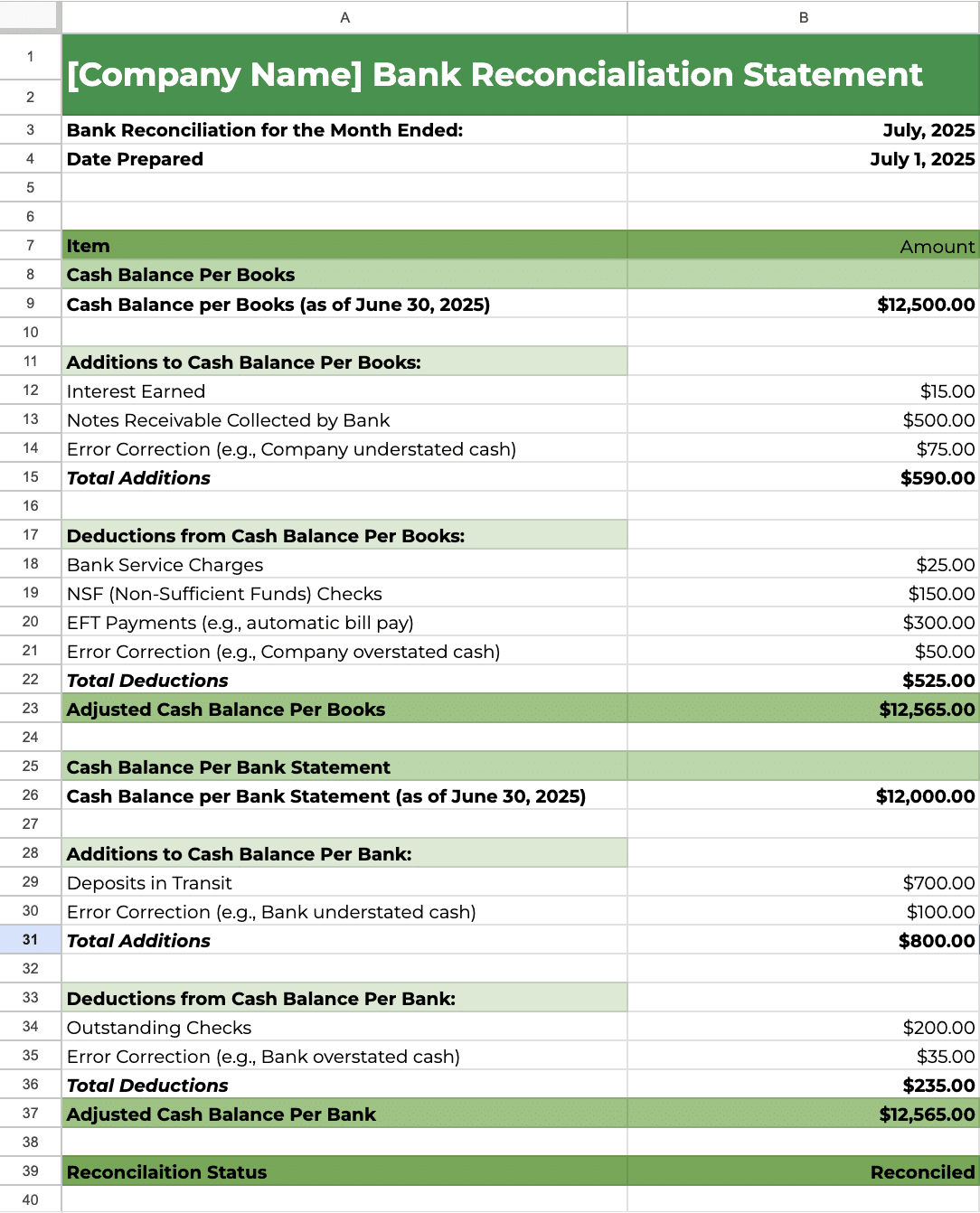

Our free template is built to make the reconciliation process simple, accurate, and fast. It includes two main sections, Cash Balance Per Books and Cash Balance Per Bank Statement, each broken down into additions, deductions, and automatically calculated adjusted balances. You’ll find fields for common entries like interest earned, deposits in transit, outstanding checks, bank charges, and error corrections, all organized in a clear, step-by-step layout that mirrors standard reconciliation practices.

What sets this template apart is the built-in formulas. It automatically calculates total additions and deductions for both the book and bank sections, and compares the final adjusted balances. If the balances match, the status field displays “Reconciled”; if not, it shows “Not Reconciled.” This saves time, reduces manual errors, and provides immediate clarity on whether your reconciliation is accurate.

Bank Reconciliation Template

Common Causes of Bank-Book Discrepancies

Knowing what causes bank-book discrepancies helps you spot them more easily and prevent them from happening again. So, here are the most common reasons.

Timing Differences

These occur when you record a transaction in the books before the bank processes it. They’re not necessarily errors, just delays in processing. They typically show up in the following ways:

- Deposits in Transit: These are deposits that have been recorded in the books but haven’t yet appeared on the bank statement. This usually happens when deposits are made at the end of the month, but the bank doesn’t process them until the next business day. For example, if a client deposits checks on the 31st, they may not hit the statement dated that same day.

- Outstanding Checks: These are checks that your client has issued and recorded, but the recipients haven’t cashed or deposited them yet. Until the bank clears those checks, the bank balance will show more cash than the books do. This is especially common with mailed checks or vendor payments that sit uncashed for weeks.

Items Recorded by Bank, Not Yet by Company (Or Vice Versa)

The second category is transactions that one party has processed, but the other hasn’t yet entered. These gaps are easy to miss if you’re not reconciling regularly. There are five ways this discrepancy can happen:

- Bank Service Charges: Banks often deduct fees like monthly maintenance charges, wire transfer fees, or overdraft penalties directly from the account. These deductions don’t appear in the books unless they’re manually entered or automatically imported, which many clients overlook.

- Interest Earned: If the account earns interest — such as with a savings or money market account — the bank may credit it monthly. If this isn’t recorded in the ledger, the book balance will be understated.

- NSF (Non-Sufficient Funds) Checks: When a client deposits a check that later bounces due to insufficient funds, the bank removes the amount from the account. If your client doesn’t reverse the original deposit in their books, it creates a mismatch and inflates cash on hand.

- Automated Payments/Collections: Recurring bank transactions like loan repayments, payroll withdrawals, software subscriptions, or auto-billed vendor payments might not be recorded in the books until after reconciliation. Similarly, recurring customer payments (e.g., from a billing platform) may show up in the bank account before your client manually records them.

- Bank Errors: Although rare, banks can make mistakes, like duplicating a transaction, omitting a payment, or misapplying funds to the wrong account. If you spot something in the bank statement that doesn’t match any client activity, don’t assume the books are wrong; it could be the bank.

- Company Errors: Errors on your client’s side are more common. These include transposing numbers (e.g., entering $1,250 as $1,520), posting the same transaction twice, omitting a transaction entirely, or categorizing it incorrectly. Even a small manual error can throw off the entire reconciliation.

Walkthrough: How to Reconcile Bank Accounts

Once you know what causes mismatches, reconciliation becomes much easier to handle. Here’s a step-by-step process you can follow for each client:

Step 1: Get the Bank Statement

Start by pulling the official bank statement for the period you’re reconciling, typically for the previous month. This statement should include:

- The opening and closing balances.

- A full list of all deposits, withdrawals, and fees.

- Any interest or penalties applied during the period.

Step 2: Open the General Ledger Software or Accounting Records

Next, access the client’s accounting software or general ledger. Navigate to the same bank account reflected in the statement and filter transactions for the exact period shown on the bank statement.

Make sure you’re seeing:

- The running book balance for that account.

- A full list of all income and expense entries.

- Any manual journal entries affecting cash during the period.

Step 3: Compare Deposits

Start matching the deposits shown in the bank statement with those in the books. Go line by line:

- Match amounts and dates. They don’t need to be identical, but should be close (e.g., a deposit made on Jan 31 might clear on Feb 1).

- Mark any matching transactions as reconciled.

- Flag deposits in the books but not on the bank statement. These may be deposits in transit.

- Flag deposits on the bank statement but missing from the books. These may be unrecorded customer payments, interest income, or errors.

Step 4: Compare Withdrawals

Now go through the bank withdrawals: checks, transfers, ACH payments, credit card settlements, etc.

- Match each withdrawal with an entry in the books.

- Check for duplicate entries. Sometimes, a recurring payment might be recorded twice.

- Identify any checks or payments recorded in the books but not yet cleared the bank. These are outstanding checks or pending bank transfers.

- Watch for charges recorded by the bank but not in the books. These include automated vendor payments, subscription fees, or bank service charges.

Step 5: Identify and Explain Discrepancies

By this point, you’ll likely have a few unmatched transactions. Create a list of:

- Timing differences (like outstanding checks or deposits in transit).

- Bank-only transactions (like service charges, interest, NSF reversals).

- Company errors (missed entries, incorrect amounts, misposted transactions).

- Potential bank errors (rare, but worth flagging if something seems off).

Step 6: Make Adjusting Journal Entries

Once you’ve identified all unmatched items, update the general ledger to reflect accurate activity. This might include:

- Adding missing income or expense transactions.

- Recording bank fees or interest.

- Reversing bounced payments (NSF checks).

- Correcting any duplicate or inaccurate entries.

- Applying payments correctly if misposted.

Each adjustment should be supported by documentation, either a note in the software, a journal memo, or attached bank records.

Step 7: Save and Document the Reconciliation

Once you’ve completed the reconciliation:

- Save a copy of the bank statement.

- Save the reconciliation summary or worksheet.

- Note the reconciliation date and any open items to follow up on (e.g., uncashed checks).

If your firm uses workflow software like Financial Cents, you can store all reconciliation records by client and assign follow-up tasks to your team.

Best Practices for Reconciliation

Here are the best practices to help you maintain high-quality reconciliations across all clients.

Reconcile Regularly

Perform reconciliations at least once a month, ideally as part of your month-end close process. For high-volume accounts or cash-sensitive businesses, consider reconciling weekly or even daily.

Frequent reconciliation:

- Reduces the number of transactions to review at once.

- Makes it easier to catch and resolve discrepancies quickly.

- Ensures financial reports are always based on real, up-to-date numbers.

Keep Meticulous Records

Every reconciliation should include the bank statement, a copy of the reconciliation report or worksheet, notes explaining any discrepancies, and supporting documentation for adjustments (e.g., invoices, receipts, memos).

Having complete documentation ensures transparency and makes audit prep much easier. It also protects your firm if a client later questions a correction or adjustment.

Consider Using Accounting Software for Automation

Manual reconciliations are time-consuming and prone to human error, especially when managing multiple clients. Accounting software can:

- Import bank transactions automatically.

- Suggest matches for deposits and payments.

- Flag duplicates or unusual activity.

- Generate reconciliation reports instantly.

While software doesn’t replace your review, it does cut down the manual work and reduces the risk of missed transactions.

Separate Duties

If possible, separate roles within the financial process such that one person records transactions, another initiates or approves payments, and a third handles reconciliations. This segregation of duties helps prevent fraud and ensures there’s a clear chain of accountability.

Don’t Delay Reconciliation

The longer you wait, the harder it is to resolve discrepancies. Clients may forget what a transaction was for, and supporting documents can get lost. Build reconciliation into your firm’s monthly workflow to stay consistent.

Keep Digital Records Organized

Create a standardized file structure for each client. For every period, save the bank statement, a dated reconciliation file, notes or journal entry logs, and any supporting PDFs or screenshots.

These organized records help with handoffs between team members, prepare you for audits, and give clients confidence in your process.

Ensure Smoother Reconciliations With Financial Cents

Financial Cents can streamline your workflow, improve consistency, reduce manual effort during reconciliation. This makes the whole process easier and faster, which is helpful if you’re performing reconciliations for multiple clients monthly.

Here’s how Financial Cents helps.

Workflow Management and Automation

With Financial Cents, you can create custom bank reconciliation workflow templates that outline every step, from importing bank statements and matching transactions to reviewing discrepancies and posting journal entries. You can also start with one of the ready-made templates from the Financial Cents Template Library. This ensures a consistent approach to reconciliation, reducing the risk of errors and maintaining quality across your entire client base..

You can also assign specific tasks to individual team members. They’ll be notified automatically when it’s their turn to step in, keeping the process moving without the need for manual check-ins.

Automate Recurring/Repetitive Tasks

You no longer have to recreate reconciliation checklists every month. Financial Cents supports recurring projects, which automatically generate the full task list (with due dates and assignments) on a schedule you define, freeing your team from repetitive setup.

Automate Client Requests

Chasing down bank statements or missing transaction details can delay the entire reconciliation process. With Financial Cents, you can easily request documents through the client portal, whether it’s for a bank statement, explanation of a charge, or supporting documentation.

You can also schedule automated reminders that follow up on your behalf until the client uploads what you need. No more manual check-ins or waiting on emails.

Document Storage

Financial Cents keeps every bank statement, reconciliation worksheet, journal entry, and supporting document stored securely in one centralized location. Your entire team can access what they need, without digging through inboxes or local folders.

There’s no storage limit, so you can upload as many documents as needed for each client, across every period. It’s organized, searchable, and built to support collaboration.

Deadline Tracking

Financial Cents’ workflow dashboard gives you a clear, real-time view of all reconciliation tasks across your firm. At a glance, you can see what’s completed, what’s pending or overdue, and who’s responsible for each step.

This visibility makes it easy to monitor progress, manage workloads, and stay ahead of deadlines, so nothing falls through the cracks and you don’t miss any client deliverables.

Team Collaboration

When questions or issues come up during reconciliation, your team can communicate directly within Financial Cents. Team members can tag each other, leave comments on specific tasks, and keep all discussions in context, right where the work is happening.

This cuts down on email chains and back-and-forth messages, making collaboration faster, clearer, and easier to track.

Make Reconciliations Easier for Your Firm

Reconciliation is important because it helps catch errors, prevent fraud, and ensures your client’s cash records reflect reality. By understanding the common causes of discrepancies and following a consistent step-by-step process, you can keep every account clean, accurate, and audit-ready.

Using a standardized template makes the process faster and more reliable. But if you’re managing reconciliations across multiple clients, a template alone isn’t enough.

That’s where Financial Cents comes in. It helps you:

- Standardize reconciliation workflows across your team.

- Automate routine tasks and client follow-ups.

- Store records and supporting documents in one place.

- Track progress and meet every deadline with ease.

If you’re ready to simplify and scale your month-end close, try Financial Cents today.