Running a successful accounting firm requires a constant dedication to learning. You and your team must stay current on the latest trends and tools to maximize revenue and stay ahead of the curve.

The landscape is evolving rapidly, with accounting client needs, regulatory requirements, and the constant change of systems for getting work done. The Future of Jobs Report 2023 highlights this, finding that 85% of businesses acknowledge the importance of new technologies and digitalization in business growth and leveraging these tools to scale their operations.

Tax and accounting services are another key driver for success. A Financial Cents’ survey of accounting firm owners shows tax accounting as the second-highest revenue driver for accounting firm owners in 2023. To effectively serve your clients, ongoing education is essential, ensuring you’re up-to-date with changing federal, state, and local tax laws.

In this article, we’ll help you find free online accounting courses with Certificates you can take to improve your chances of making more money and growing your firm.

Factors to Consider When Selecting a Course

-

Course Content and Format

Every course is equal to the sum of its topics. Reviewing the curriculum of any course will show you whether the free accounting course can fill your knowledge gaps.

Similarly, online accounting courses come in written, audio, and video formats. Each format caters to different learning styles – consider what works best for you.

-

Certificate Upon Completion

Certificates are evidence that you have acquired a skill or knowledge. Some certifications might even be necessary to qualify you to offer some accounting services (such as public accounting).

Some free accounting courses allow you to learn freely but require payment for the certificate, while others provide free education and certification.

-

Instructor

A qualified instructor can significantly enhance your learning experience. Look for instructors with proven experience and knowledge in the accounting area you’re interested in.

Instructors with practical insights have likely faced the challenges you are currently facing. They are more effective at helping you find the answers you need.

Seasoned instructors are aware of “the curse of knowledge” where someone assumes everyone has the same level of understanding. Effective instructors present information in a clear manner, ensuring all attendees grasp the concepts.

-

Learning Style & Duration

Most free courses are self-paced, allowing you to learn at your preferred speed. Some other courses may require you to complete the modules in a specific timeframe. Both options have their advantages and disadvantages. Be sure to choose a style that works for your schedule.

-

Resources

Some courses provide teaching materials like e-books, accounting templates, and quizzes. These materials can make a course more engaging and easier to understand. Some downloadable materials also help you learn more about the course, even after you have completed it.

The 10 Best Free Accounting Courses Online with Certificate

1. Certificate in Accounting and Finance

The Certificate in Accounting and Finance course is an intermediate course offered by the Oxford Home Study Centre.

Created from the same quality of materials as their paid courses, this free course helps accounting professionals build the knowledge, skills, and confidence they need to improve their quality of work and or run their accounting firms.

Why You Should Take It

This course breaks down important accounting concepts (like profit and loss statements), establishes the role of working capital in business operations, and showcases how you can use cash flow statements for business analysis.

Course Curriculum

Its topics include:

- Introduction to Accounting

- Subsidiary books of accounting

- How to create a profit and loss account

- How to prepare a cash flow statement

- How to prepare a balance sheet

| Duration | 200 hours |

| Instructor | All OHSC accounting courses are taught by accounting experts. |

| Certificate – Paid | This course allows you to claim one of the following certificates (costs range between $10 and $120).

|

2. Accounting Ethics

Ajay Pangatka’s Accounting Ethics course seeks to help accounting professionals and financial controllers address the challenges of communicating their client’s financial health. The course explains ethics in accounting and corporate culture while establishing the importance of professional accountability and internal control in maintaining public trust.

The course is free with a LinkedIn Learning or LinkedIn Premium subscription.

Why You Should Take It

Regulatory compliance (which ensures accurate financial reporting) is vital to the integrity of the accounting profession. This course empowers the accounting professional to leverage internal controls for reliable financial information.

Course Curriculum

The course modules include:

- Values, Ethics, and Governance: defines ethics, objectivity, transparency, and accountability within the accounting profession.

- Ethical Responsibility for Business: establishes the differences between legal and ethical choices and explains ethics as a code of conduct for accountants.

- Accounting Ethical Responsibilities: explains ethical consideration and code of conduct in accounting and internal controls and audit.

| Duration | 50 Minutes |

| Instructor | Ajay M. Pangarkar, CTDP, FCPA, FCMA

Co-founder of CentralKnowledge |

| Certificate – Free | Free certificate upon completion |

3. Setting Up Accounting Processes and Workflows

Unlike most courses in this list, this course moves away from core accounting knowledge to the systems that enable accounting professionals to get work done.

As one of the courses in Financial Cents’ Accounting Workflow Academy, Setting Up Accounting Processes and Workflow equips you with the tools you need to manage your client’s work efficiently.

The course is self-paced, and its insights are easy to implement, allowing you to learn and apply its lessons in stages.

Why You Should Take It

The instructor, Kellie Parks, teaches accounting professionals to build systems that unlock efficiency, consistency, and accountability in their firms. Her community, The Workflow WateringHole, is home to 5000+ accountants, bookkeepers, and CPAs finding new ways to boost productivity and increase revenue.

This course also gives you access to Financial Cents’ community of accounting firm owners with whom you can learn and grow your firms.

Course Curriculum

The course comprises twelve videos addressing all aspects of accounting workflows, including:

- Introduction to Accounting Processes and Workflows.

- Understanding Accounting Process Components.

- The policies and procedures for documenting workflows.

- Key Workflows to Build.

- Naming Conventions in Accounting Workflows.

- Workflow Design and Optimization.

- Client Collaboration and Communication.

- Workflow Software and Tools.

- Automation Opportunities in Accounting and Workflow Processes.

- Training and Change Management.

- Monitoring and Performance Measurement.

| Duration | 2 hours |

| Instructor | Kellie Parks, CPB

Founder of Calmwaters Cloud Accounting and an advocate of the capability of cloud accounting to streamline and organize accounting firms. |

| Certificate – Free | Free certificate upon completion. |

4. Managerial Accounting: Cost Behaviors, Systems, and Analysis

This course teaches accountants how to create and communicate financial information in line with corporate decision-making. It shows accountants how to help their clients make the best of what-if situations using tools like cost-volume-profit (CVP) analysis.

This course allows you to progress onto a degree program at the University of Illinois at Urbana-Champaign.

Why You Should Take It

Understanding activity-based costing (one of the topics in this course) will empower you to help your clients make the best purchase decisions to grow their businesses.

Course Curriculum

The course modules include:

- Introduction to Managerial Accounting: explains fundamental costing concepts.

- Costing Systems I – Elements and Design: focuses on the best ways to use costing systems and the role of overhead cost in cost information.

- Costing Systems II – Activity-Based Costing: gives examples of activity-based costing and its advantages and disadvantages.

- Cost-Volume-Profit (CVP) Analysis: explains how managers can use CVP to proffer solutions to what-if problems.

| Duration | 20 hours |

| Instructor | Gary Hetch, Ph.D

Gies College of Business |

| Certificate – Free or Paid | Paid certificate upon completion. |

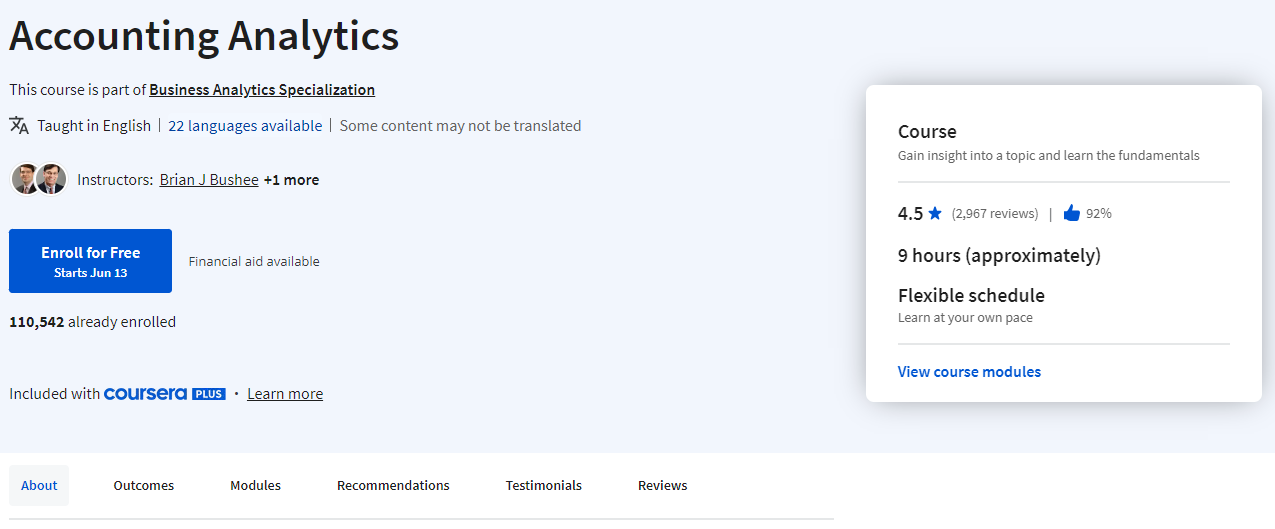

5. Accounting Analytics

The Accounting Analytics course was created by the University of Pennsylvania to teach accountants core accounting concepts like ratio analysis. This knowledge helps accountants to understand their clients’ competitive advantages and forecast future financial statements.

Other noteworthy aspects include earnings management and prediction models.

Why You Should Take It

The course also covers revenue manipulation in financial reporting, which positions you to spot inflated revenues or deflated liabilities in Financial Statements. The course also features simulated examples that can help your real-world application of the lessons learned.

Course Curriculum

Its modules include:

- Ratios and forecasting: includes lessons on the sources for financial statement information, ratio Analysis, forecasting, and accounting-based valuation.

- Earnings management: includes revenue recognition red flags (revenue before cash collection, revenue after cash) and expense recognition red flags (capitalizing vs. expensing, reserve Accounts, and Write-Offs.

- Big data and prediction models: includes lessons on discretionary accruals (model and cases), discretionary expenditures (models, refinements, and cases), and fraud prediction models.

- Linking non-financial metrics to financial performance: includes lessons on the steps involved in linking non-financial metrics to financial performance, setting Targets, incorporating analysis results in financial models, and using analytics to choose action plans.

| Duration | 9 hours |

| Instructor |

|

| Certificate – Free or Paid | Free certificate upon completion. |

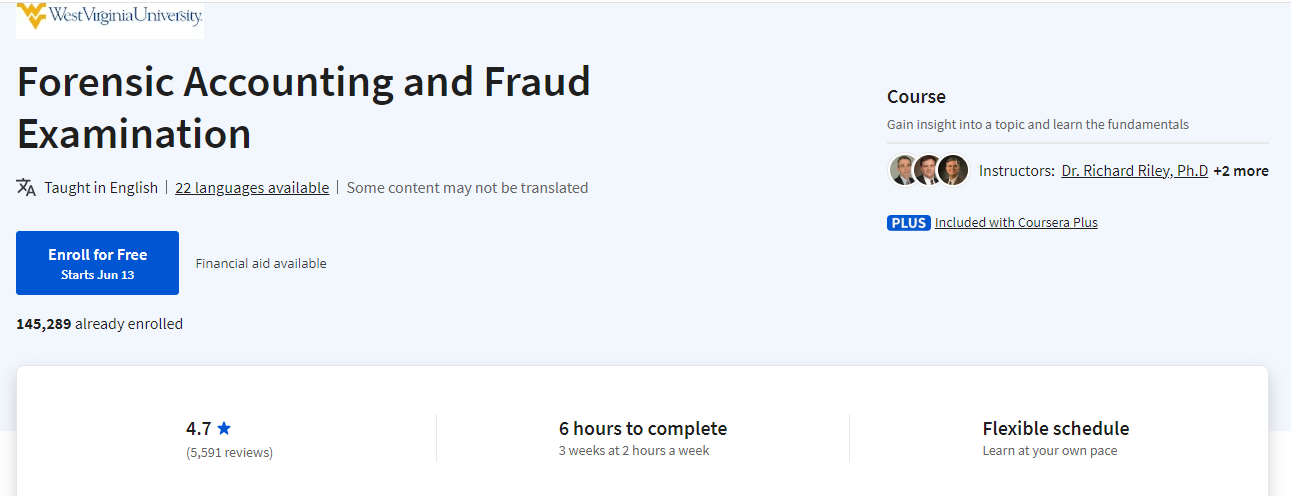

6. Forensic Accounting and Fraud Examination

This introductory course to fraud examination and forensic accounting will enable you and your staff to understand the reality of fraud, the perpetrators of fraud, and the ways they go about it.

The course also explores the skills an accountant needs to detect fraud and catch fraudsters. This program is rich in information and allows a flexible learning schedule.

Why You Should Take It

This course will empower you with fraud detection, internal control, fraud Investigation, and forensic Accounting skills to protect business organizations from fraudsters.

Course Curriculum

- Accidental fraudsters: shows the effect of fraud and the role of people who commit fraud unintentionally.

- The predator fraudster: explains how you can protect businesses from predator fraudsters using internal controls.

- Big data, Benford’s law, and financial analytics: this topic shows how to use tools like data analysis and Benford analysis to identify fraudulent activities.

- Cybercrime and Money Laundering: Contemporary Tools and Techniques: shows the stages and techniques criminals use to launder money.

- Whistleblowing: covers the importance and reality of whistleblowing.

| Duration | 6 hours to complete (3 weeks at 2 hours a week) |

| Instructors | Dr. Richard Riley, Ph.D, West Virginia University

Dr. Richard Dull, Ph.D, West Virginia University John Gill, J.D., CFE, West Virginia University |

| Certificate – Free or Paid | Free certificate upon completion |

7. Internal Auditing: Fundamental Principles and Concepts

This course is designed to help auditing professionals (or aspiring internal auditors) sharpen their skills.

It starts with explaining the types and various aspects of internal audit and continues to discuss internal audit reports. It also delves into the detailed process of conducting an internal audit.

Why You Should Take it

This course will teach you how to prepare a draft and conduct audit reporting, prepare an audit summary, and understand the role of working papers.

Course Curriculum

Its modules include topics like:

- Fundamentals of Internal Auditing

- Conducting the Internal Audit

- Preparing the Audit Report

| Duration | 3 hours |

| Instructor | Exoexcellence Consultants’ team of auditors. |

| Certificate – Free or Paid | Free certificate upon completion |

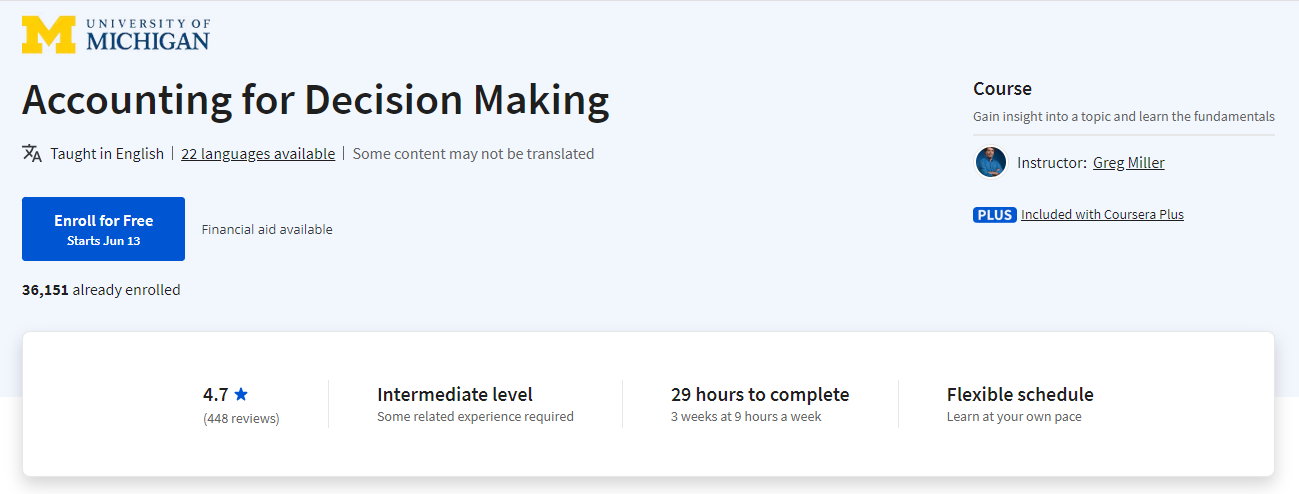

8. Accounting for Decision-Making

This intermediate course teaches accountants how to value a company by identifying what they have (assets) and how they can use it to make decisions that improve their financial position.

This course explains revenue and accounts receivable and the rules of cost of goods sold and inventory. The course is flexible and allows you to learn at your own pace.

Why You Should Take It

This course is ideal for those interested in accounting valuation as it helps them understand the role of cash flow statements and ratios in valuing companies according to GAAP.

Course Curriculum

The course modules include:

- The Accounting Cycle and Bookkeeping: Foundational Tools for a Deeper Understanding.

- Revenue, Accounts Receivable, Inventory, and Cost of Goods Sold.

- Long-Lived Assets.

- Liabilities and Stockholders’ Equity.

- Cash Flow Statements.

| Duration | 29 hours |

| Instructor | Greg Miller, Professor of Finance. |

| Certificate – Free or Paid | Free certificate upon completion. |

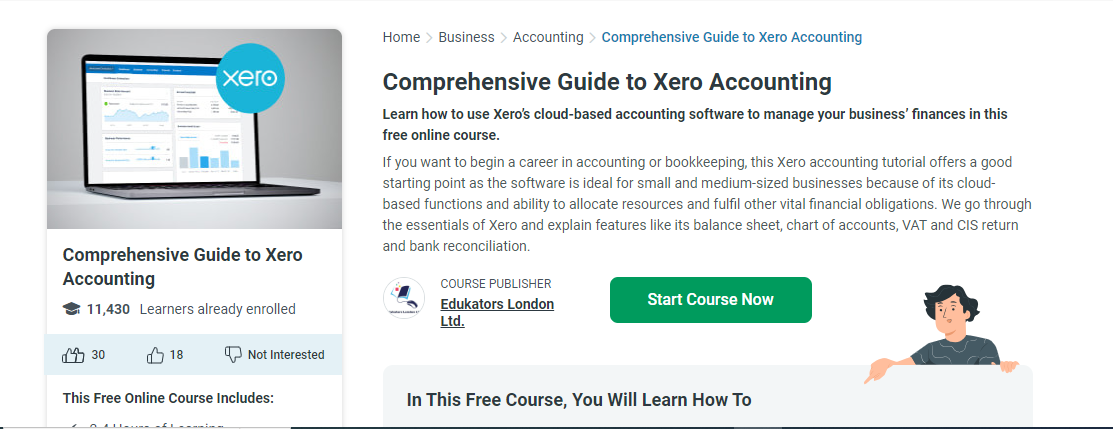

9. Comprehensive Guide to Xero Accounting

As one of the most popular accounting softwares, this course teaches accounting professionals how to use Xero’s business accounting features (like balance sheet, chart of accounts, VAT and CIS return, and bank reconciliation) to meet their client’s financial reporting obligations.

Why You Should Take it

This course is ideal for accountants who need help understanding how Xero performs accounting tasks like adjusting the nominal ledger.

Course Curriculum

Its modules include

- Xero Accounting Basics: teaches how to use Xero to manage accounting data.

- Getting a Grip on Basic Banking: teaches how to master the basics of bank transactions, payments, and account reconciliation, including Xero VAT setup.

- Advanced Xero Features: Covers how to prepare a depreciation journal, profit & loss reports, and monitor cash flow in Xero.

| Duration | 3-4 hours |

| Instructor | Edukators London Ltd.’s team of accounting industry professionals |

| Certificate – Free or Paid | Free certificate upon completion |

10. Accounting for the Charity Sector

Charity accounting is uniquely different, and conventional accounting professionals will struggle with the principles that govern the not-for-profit and corporate social responsibility (CSR) sectors. This course prepares you for the growing accounting needs in the not-for-profit sector.

This course is insightful and based on real-world situations to expose you to modern tools and techniques that leverage your conventional background.

Why You Should Take It

Economic activities in the charity sector are rapidly growing. The time is right to position your firm to provide services for organizations in this sector.

Course Curriculum

Its modules include:

- The Concept of Charity Accounting: focuses on the concepts, standards, policies, and principles of charity accounting.

- Statement of Accounts: focuses on the structure and content of financial statements.

| Duration | 3 hours |

| Instructor | Alpha Academy is a continuing professional development firm. |

| Certificate-Free or Paid | Paid certificate upon completion |

Stay Ahead of the Curve in the Accounting Industry with Free Accounting Courses

The accounting profession is constantly evolving. New technologies, regulations, and client needs emerge all the time. Enrolling in free accounting courses increases understanding of new concepts and acquisition of new skills that make you and your team members more relevant to clients.

These courses, often taught by industry experts, will not only boost your knowledge but will also enable you to manage your work, clients, and team to get work done more quickly, efficiently, and profitably.

Click here to register for the Accounting Workflow Academy and equip your team with all they need to get work done to your standard.

Thank you, I am grateful to discover this website to enhance my career

It’s never too late to start. Thanks for course recomendation

You are welcome Aisyah