As a solo accountant, we understand that your job can sometimes be overwhelming. You’ve got deadlines looming, complicated tax rules to follow, and clients wanting to chat or hop on a call.

You thought an accounting workflow software was the solution you needed—a tool that would make your life easier by helping you get things done faster and with fewer mistakes. You began exploring different software options, excited by the prospect of a simpler work life. But soon, you realize it’s not as easy as it seems.

Even after finding what seems like the perfect software, you’re still left with more questions than answers: Which workflow features should you prioritize? Can the software’s settings be customized to suit your unique needs? This confusion can lead to frustration, slow your productivity, and even make you question whether the software is worth the effort.

As overwhelming as this might be, we’re here to lighten the load. We know you have limited time to get work done, so, in this article, we’ll show you how to avoid accounting workflow software overwhelm and get on track to tackling big-picture challenges for your clients.

Before you take the plunge…

Understand The Needs of Your Solo Firm

Before diving headfirst into any accounting workflow software, it’s crucial to evaluate your solo firm’s specific needs and pain points. This foundational step will help you determine how the software can address your challenges and streamline your operations so you can better manage your time.

As Stacey Feldman aptly puts it,

We make every decision through the lens of scalability. We want to grow our firm to, you know, four or five times what we are today. And we don’t want our systems to hinder us in that process."

Assess Your Current Processes

To start with, assess your current processes. How do you currently handle client onboarding, invoicing, time tracking, and financial reporting tasks? How do you manage your time between balancing multiple clients, tax seasons, and administrative tasks? Do you spend more hours emailing or video chatting with clients about their inquiries, requests, and document exchanges than on actually doing the work?

Identify areas where you spend excessive time and encounter frequent errors or neglect due to workload imbalance.

Identify Your Pain Points

Next, write down your pain points. What challenges do you face regularly? Are there tasks you dread or that consistently cause bottlenecks in your workflow?

Understanding your frustrations will help you find workflow software that directly addresses those issues. For instance, if you realize that you spend most of your billable hours communicating with clients and are still burdened with creating invoices for those hours, you can look for workflow software that automates data entry and invoicing.

Conduct a Workflow Self-Assessment

After identifying your pain points, conduct a workflow self-assessment to pinpoint where workflow software can make a difference.

Think about the answers to these questions before you start:

- What are your primary business goals? Are you looking to increase revenue, improve client satisfaction, or free more time for strategic tasks?

- What are your biggest challenges? Are you struggling with time management, client communication, or staying organized?

- Where do you spend most of your time? Are you bogged down by administrative tasks, or are you focused on high-value activities?

Identify Key Areas for Software Assistance

Lastly, when evaluating workflow software for your solo accounting firm, focus on the key areas that align with your needs.

Do you need to organize and stay on top of your daily responsibilities? Focus on task management features that let you streamline your work with customizable workflows and checklists.

Struggling to track the time you spend on client tasks accurately? Look for time-tracking features that automatically record your hours for precise billing. Is managing client information and communication becoming a challenge? Consider client management features that centralize your client data and interactions in one easy-to-access place.

Need to monitor the progress of client work and ensure everything is caught up? Look for project tracking features to keep everything on schedule. Want to save time on billing? Consider automated invoicing features that generate and send invoices based on your tracked time and completed tasks. Struggling with meeting deadlines? Focus on due-date management features that help you track upcoming deadlines and manage overdue projects efficiently.

The secret sauce is to avoid getting distracted by the many features available and look for what specifically addresses your needs.

Phil McTaggart, a former partner at an accounting firm and now a solo accountant, understood the importance of this process when he started his solo firm, Shine A Light Accounting Service (SALAS). He sought affordable yet equally reliable workflow software to track work, manage clients, and streamline processes.

I left the firm where I was a partner and quickly got onto Financial Cents."

Phil McTaggartAs a firm of one, McTaggart recognized the risk of forgetting important client information and tasks necessary to deliver an authentic, memorable client experience. By setting up workflows with Financial Cents’ templates, he has kept track of client projects and information without missing a beat.

If you’re a solo accountant seeking an affordable and reliable accounting workflow solution, Financial Cents is an excellent option. With a customized plan starting at just $9 per month (on the annual plan), it provides an economical yet powerful tool to help you manage your workload efficiently while maintaining high standards of client service.

Overcomplicated software can be a major headache, so always look for tools that are easy to understand and use. Avoid tools packed with unnecessary features that can slow you down. A user-friendly workflow software will help you maximize your time and effort.

After you buy the software…

Congratulations, you’ve selected and bought an accounting workflow software for your solo firm! To avoid feeling overwhelmed about using it, start by using the essential features that align with your needs.

Below, we walk you through how to quickly get your solo firm set up in an accounting workflow software without feeling overwhelmed. We will use Financial Cents as an example since it offers all the features you need to manage your solo firm in an easy-to-use interface..

Set Up Simple and Easy-to-Follow Workflows

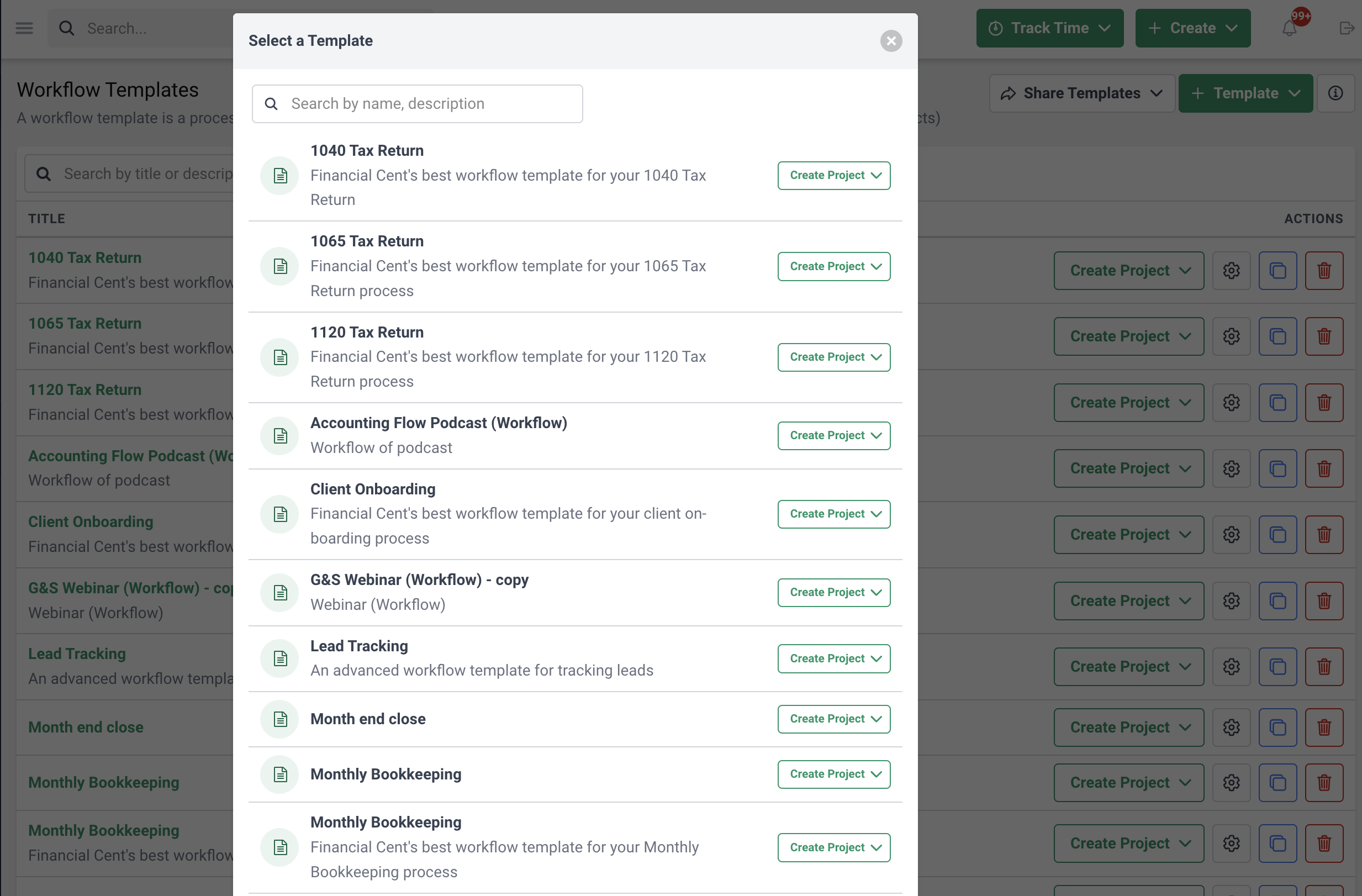

When you sign up for Financial Cents, you can immediately start using pre-designed workflow templates for various accounting tasks.

These templates cover everything from accounts payable checklists to tax preparation and accounting engagement letters, giving you a clear, step-by-step process to follow.

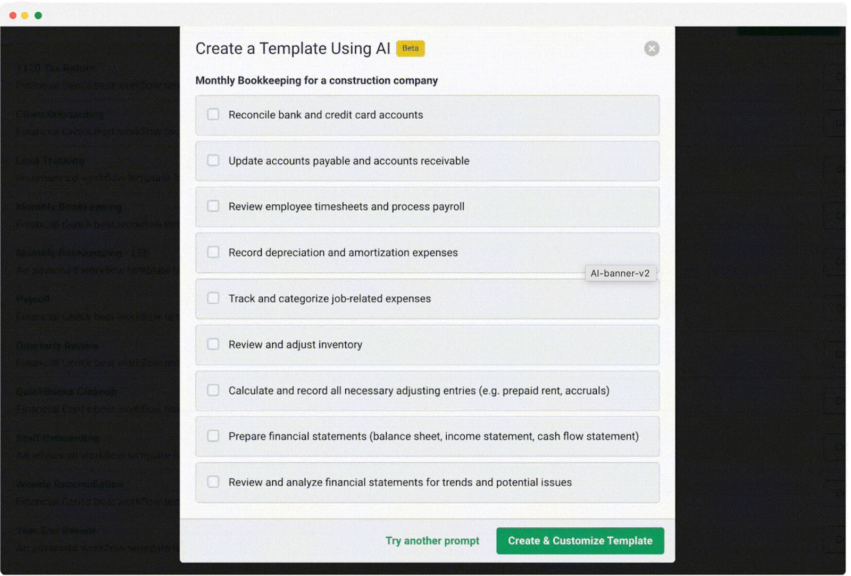

In addition, our AI-powered feature (ChatGPT Integration) helps you create personalized workflows tailored to your specific needs. This allows you to quickly build efficient workflows without starting from scratch.

Furthermore, our new Template Sharing feature makes it easy to share and receive workflow templates from your peers. Instead of creating workflows from scratch, you can quickly access and use templates others have already created. This saves you time and ensures you’re using tried-and-tested workflows that work for others in the accounting field. With this feature, you can collaborate with fellow accountants, get new ideas, and further streamline your processes.

Keep Track Of Tasks With A Workflow Dashboard

Our workflow dashboard is designed to help you stay organized and on top of your tasks. With a clear, user-friendly interface, the dashboard gives you an at-a-glance overview of everything you need to do.

You can easily see all your ongoing tasks, upcoming deadlines, and overdue items in one place. This makes it simple to prioritize your work and ensures that nothing falls through the cracks.

The dashboard also allows you to track the progress of each task, so you always know what’s been completed and what still needs attention. This helps you manage your time more effectively, stay focused, and meet your deadlines consistently.

Store Client Information For Easy Access

Financial Cents simplifies the process of collecting necessary documents and details from clients. You can request files directly through the software, and clients can upload them securely.

Everything is stored in an organized manner, so when it’s time to work on a project, you have all the information you need. This reduces back-and-forth communication and speeds up your workflow.

Watch this tutorial on how to get client documents faster

Onboarding new clients can be time-consuming, but our software streamlines the process. From the moment a client signs on, you can easily gather all the required information, set up their account, and integrate them into your workflow. You can also import and auto sync all your clients into Financial Cents from QuickBooks Online, using our QBO integration.

The onboarding process becomes faster and more efficient, allowing you to start working on their projects sooner and providing a professional experience that builds client trust right from the start. Meaning your workflow software can also serve as an accounting client onboarding system.

With our customized solo plan, you can get all this for $19/month (on an annual plan).

Get Help and Learn From Others

To maximize the benefits of accounting workflow software, it’s important to take a proactive approach to learning and utilizing all the available tools. Here are a couple of ideas we highly recommend.

- Join the User Group of Your Chosen Workflow Software

One of the best ways to enhance your experience with any software is by joining its user community. For example, if you choose Financial Cents, joining the Financial Cents User Group on Facebook can be incredibly valuable.

This group is a community of fellow accountants who use Financial Cents and share tips, tricks, and best practices. It’s a space to ask questions, find solutions to common challenges, and stay updated on the latest features and improvements.

- Ask Questions and Learn from Your Peers

Don’t hesitate to ask questions and learn from other firm owners like you. Consider joining a community like the Accounting Workflow Club where you can connect with other accountants navigating similar challenges. Sharing experiences and learning from peers can provide new insights and help you discover more efficient ways to manage your workflow.

- Dedicate a Few Hours Weekly to Learning the Software

To truly master your workflow software, it’s important to set aside time each week to learn and explore its features. While it may seem like a time commitment, the long-term benefits are worth it. This will save you time and reduce stress in the long run, allowing you to focus more on growing your business and serving your clients.

We recommend checking out our YouTube channel if you’re unsure where to start. There, you can learn how to use our software and get valuable tips on managing your practice from fellow accountants.

- Get Training in Workflow Management

Investing in workflow management training is another crucial step in getting the most out of your software. Many platforms, including Financial Cents, offer training resources to help you understand not just how to use the software but also how to optimize your workflows for maximum efficiency.

Conclusion

So far, we’ve covered several tips to help you avoid feeling overwhelmed when using accounting workflow software. We hope you find these suggestions useful and put them into practice.

Sign up for Financial Cents to manage your solo firm. With its user-friendly design, essential features, and affordable pricing, Financial Cents is a powerful tool for staying organized, saving time, and upholding high standards of client service.