Times are changing fast in the accounting industry.

Accounting tasks that once filled hours of your workday are now being automated, leaving many accounting professionals wondering, “What’s next for me and my practice?”

For some, this shift might feel like a threat. But for the savvy accountant or tax pro, it’s a golden opportunity to transform your practice into a million-dollar business.

Eric Green, a tax representation expert and founder of Tax Rep Network, knows this firsthand. At WorkflowCon 2024, a yearly Accounting Workflow conference organized by Financial Cents, he shared his actionable blueprint for turning what might currently feel like a grind into a thriving, scalable, and highly profitable business.

The way to get to a million dollars, to be blunt, is to take your practice and make it a business,"

Eric Green explainedThe key lies in adapting, automating wherever possible, and pivoting toward high-value services that your clients genuinely need. It’s about shifting your mindset, and thinking like a business owner—not just a tax preparer.

Whether you’re tired of the constant stress during tax season or simply looking to grow your income without working 80-hour weeks, this article will show you exactly how to scale your practice and position yourself as a leader in tax representation services.

The way to get to a million dollars, to be blunt, is to take your practice and make it a business,"

Eric Green explainedMost tax professionals are overworked and underappreciated. You spend your days sorting tax returns, dealing with demanding clients, and constantly putting out fires. It’s time to break free from this hamster wheel and see the bigger picture.

The ability to take your practice from wherever it is now and build a million-dollar practice is very doable," Eric Green said. “But first, you need to understand the landscape and recognize the opportunity."

The Tax Representation Goldmine

Did you know that there are 11.3 million non-filers in the United States?

That’s not to mention over 15 million taxpayers with balances due. These numbers aren’t just statistics—they’re a massive opportunity for tax professionals to step in and provide valuable services.

The truth is, many of these taxpayers are overwhelmed and unsure where to turn. They’re not just looking for someone to crunch numbers—they’re looking for a lifeline. And this is where you come in. Eric Green explained:

The IRS is turning on automated enforcement, and people need help. There’s a huge need right now"

Shift from Practice to Business

When you’re running a practice, you’re likely doing most of the heavy lifting yourself. You’re the one meeting clients, handling their cases, chasing payments, and putting out fires. While this might work for a while, it’s exhausting and unsustainable. Plus, it limits your growth because your income is tied directly to your time.

A business, on the other hand, operates independently of you. It’s a machine with systems, processes, and automation that do the work for you—or at least most of it. In Green’s words,

You have to stop being the doer and start being the builder"

The first step to achieving this is to start seeing your accounting firm as a product.

Imagine you’re preparing your practice to sell (even if you never intend to). What would make it more valuable to a potential buyer? The answer is almost always systems. Buyers don’t want to purchase a practice that’s completely reliant on the owner—they want a scalable, efficient operation that runs smoothly.

If you’re doing $250,000 a year and want to grow, the answer isn’t to work harder—it’s to build systems that do the work for you"

Eric GreenLeverage Automation

Think about the repetitive tasks you handle every day: onboarding clients, drafting engagement letters, processing payments, preparing tax returns, and managing client communications. They’re necessary, but they don’t require your expertise.

Automation takes these time-consuming tasks off your plate so you can focus on what truly matters: growing your practice, delivering premium services, and building relationships with high-value clients.

“To grow to a million-dollar firm, you have to free yourself from the day-to-day grind. Automation is how you do that,” Green explained.

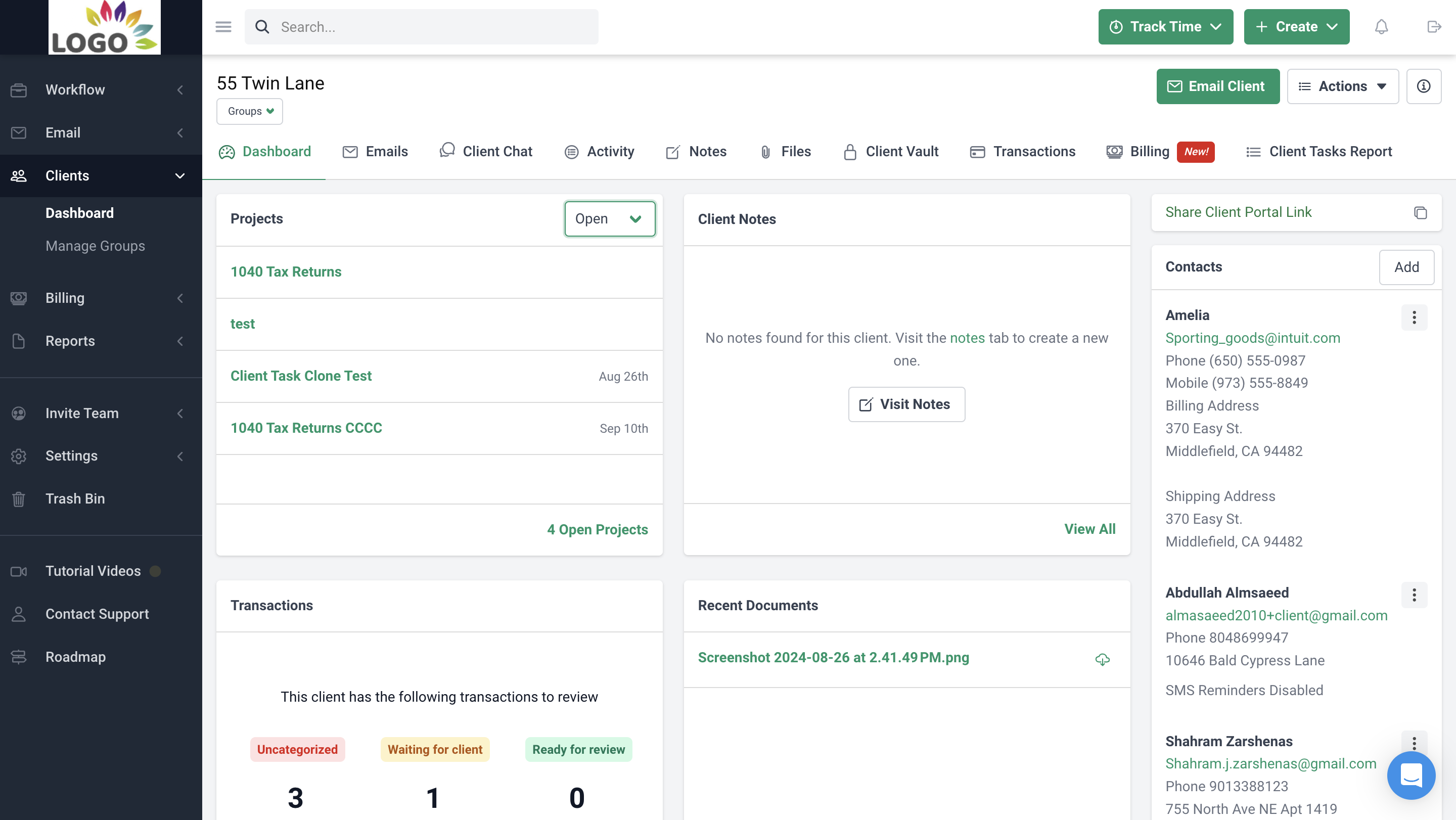

This is where a practice management software like Financial Cents comes in.

With Financial Cents, you can automate processes like:

- Client Onboarding: With its new proposal feature, you automate key parts of your workflow from the moment the client accepts your proposal, so there’s no more redundant data entry or scattered information. That way, you spend less time on administrative tasks and more on the strategic aspects of client relationships.

- Document Collection: With an effective and easy-to-use client portal, you can collect and organize client documents securely. No more chasing clients or dealing with paper files.

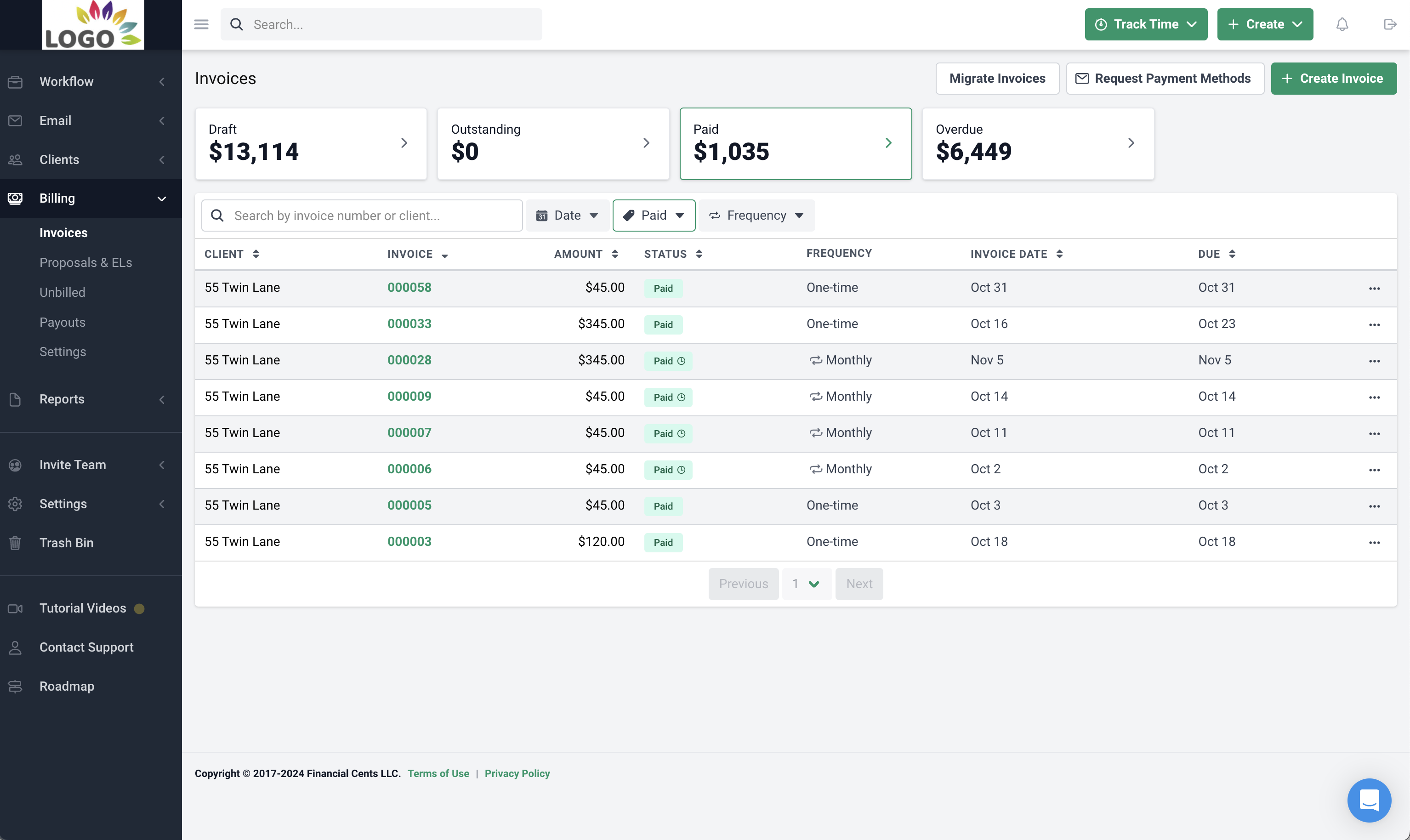

- Payment Processing: Automate invoicing and payment reminders with the Billing feature. You’ll never have to waste time chasing late payments again.

As a practice management software, Financial Cents allows you to:

- Track all your cases and ensure nothing falls through the cracks.

- Use templates for different types of services (e.g., penalty abatements, IRS audits, or offers in compromise). These templates standardize your workflow and ensure every team member knows exactly what to do.

- Monitor deadlines and case progress in real-time.

I used to worry about missing deadlines or forgetting steps in a case. Now, with templates and workflow tools, everything runs like clockwork."

Eric GreenOffer High-Value Services

High-value services set you apart because they leverage your expertise in ways that automation simply can’t replace.

IRS representation, for example, is a prime opportunity.

One of the major advantages of focusing on IRS representation is that it requires a unique set of skills—skills that most tax preparers and accountants already have or can easily acquire. As Eric Green put it, “If you can prepare a tax return, we can teach you how to make an offer in compromise. It’s not that complicated, but it’s incredibly valuable to the client.” The key is not only to learn these services but to position them as premium offerings that clients perceive as critical to their financial well-being.

But IRS representation is just the beginning. High-value services extend beyond tax problem resolution. CFO-level engagements are another significant opportunity. Green explained that many small businesses need the expertise of a CFO but can’t afford one full-time.

By offering part-time or fractional CFO services, you provide a critical resource for businesses to improve their financial health, make smarter decisions, and achieve long-term success. These engagements typically command higher fees and establish your firm as a trusted advisor rather than just a tax preparer.

Tax planning is another area where you can deliver immense value.

Tax preparation itself is often just the “scorecard”—it’s the planning that makes the real difference. High-value tax planning allows you to proactively work with clients throughout the year, not just during tax season, to minimize their tax liabilities, optimize cash flow, and create strategies that align with their financial goals. This is where you get to be creative, analytical, and deeply impactful, setting yourself apart from firms that only focus on compliance.

Offering high-value services transforms the way clients perceive your firm. You’re no longer just a tax preparer or accountant—you’re a problem solver, a strategist, and an advisor. And this shift doesn’t just benefit your clients; it benefits you as well.

Enjoy the Benefits of Transformation

When you automate and focus on premium services, you get your life back. That’s the real payoff,"

Eric GreenImagine it’s tax season, a time that used to send your stress levels through the roof. But now:

- Your clients are seamlessly uploading documents to your automated organizer.

- Your tax prep workflow software handles the work while your team focuses on review.

- Payments are already processed upfront, so there’s no chasing overdue invoices.

- And you? You’re not burning the midnight oil. You’re golfing, spending time with family, or planning your next business move.

This transformation isn’t just about making more money (though that’s certainly a big part of it). It’s about creating a business that works for you instead of one that consumes your every waking hour.

Another exciting benefit of this transformation is that your tax firm becomes a valuable asset. Unlike traditional practices that are tied to the owner’s efforts, an automated, scalable business can operate independently. That’s a game-changer when it comes to valuation.

“Most accounting practices are valued at one-time gross revenue,” Green said. “But a fully automated, cloud-based practice is valued at a multiple of EBITDA because it’s a business that anyone can pick up and run.”

Imagine building a firm that not only generates a million dollars in revenue but also commands a significant premium if you ever decide to sell.

Once you’ve reached this stage, it’s time to think about what’s next. Do you want to:

- Expand your services further?

- Open additional locations?

- Take on a mentorship role and help other tax professionals transform their practices?

- Or simply enjoy the freedom and financial security you’ve worked so hard to achieve?

There’s no right or wrong answer—it’s your business and your life.

Conclusion

The demand is there. People need your help. And if you set your business up the right way, the sky’s the limit"

Eric GreenThe journey to a million-dollar tax firm starts with a single decision: the decision to move forward. You don’t need to have all the answers today, but you do need to take that first step.

With millions of taxpayers needing help resolving IRS issues and businesses struggling to navigate financial complexities, you are uniquely positioned to provide solutions.

With the right systems like Financial Cents in place, you’re well equipped for the growth you desire.