Tax season, AKA peak season in the accounting industry, is usually stressful for accounting firms. During this busy period, many accountants get overwhelmed and face burnout.

The reason is simple. It’s constant juggling between preparing clients’ taxes, worrying about receiving clients’ documents on time, ensuring document accuracy, and filing taxes by the deadline.

It’s more complicated for new clients as you first must provide a seamless onboarding experience in addition to all you have to do for them. This entails understanding their unique financial situation, gathering all the necessary information, and ensuring a smooth transition into your tax preparation process before you start managing their tax.

And if your firm provides more than tax services, you also have to balance tax preparation with other accounting services you offer, like bookkeeping or financial statement preparation.

Managing all these responsibilities is intense and demanding. However, what if there was a way to make tax season less stressful and help you handle the workload efficiently?

That’s where having a tax preparation workflow comes into play.

By implementing a well-designed workflow, accounting firms can streamline processes, reduce stress, and enhance productivity even during the busy season.

In this guide, we explore what a tax preparation workflow is, its key components, and how to automate it.

What is a Tax Preparation Workflow?

A tax workflow is the process of preparing and filing clients’ taxes. It includes a series of steps and tasks you must complete in a specific order to ensure accuracy and compliance with tax regulations.

By following a structured workflow, you can consistently complete all tasks, reducing the risk of errors and improving efficiency. It also allows for easier scalability as you can handle a larger volume of clients, contributing to firm growth.

What Should Be in Your Tax Preparation Workflow?

Here is a general step-by-step tax workflow for preparing and filing clients’ taxes.

1. Onboard client and gather information

The tax return workflow typically starts with client onboarding. It’s where you gather all necessary information, including financial documents, personal information, and other supporting files related to the client’s economic activities during the tax year. You can also our use comprehensive tax preparer checklist template for clients to get all the information you need from your clients.

2. Organize and verify documents

Next, review the documents to ensure they are accurate and complete. Organize the documents in a central location so everyone involved in the tax preparation process can access them when needed. Having an accounting CRM like Financial Cents makes storing and organizing data easy.

3. Create tax return project in tax software

Create a project for the tax return in your software and set up the client’s profile by entering their information (name, address, social security number, etc) and selecting the appropriate tax forms. Then enter the client’s financial data into your tax preparation software. Double-check your entry to avoid errors.

4. Perform tax calculations

Use the client’s financial information to calculate their taxable income. This involves determining their total income from wages, investments, or self-employment earnings. It also includes identifying applicable deductions, credits, and exemptions to minimize tax liabilities. Your tax preparation software can automatically perform tax calculations based on the client’s financial information you input. Or you can do those calculations yourself.

5. Conduct a quality control check

After the initial calculations, double-check the work. This means reviewing the prepared tax return to ascertain it’s accurate and adheres to tax laws. This process helps minimize errors and reduces the risk of penalties.

6. Consult with the client

Before filing, you can chat with the client to discuss the details of the return, explain any complex tax issues, provide tax planning advice, and address any questions or concerns the client may have. This consultation allows the client to provide additional information or make necessary corrections so you’re both on the same page.

7. Finalize and file the tax return

Once the client has approved the work, file the tax return electronically or by mail with the appropriate authorities by the deadline.

8. Communicate with the client

After filing the tax return, inform the client about the status and any further actions they must take. You should also give them copies of the filed return and follow up with them to resolve any issues.

9. Archive the project in your software

Now, archive the project for future reference and easy retrieval. This allows you to maintain organized records of completed tax returns and easily access them when needed. Or, if it’s a regular repeat project, you can just set it up to recur based on your schedule instead of creating a new project every time.

10. Invoice the client

Depending on your pricing structure (hourly-based, project-based, retainership, or value-based pricing), invoice the client for the services you’ve provided. You can track billable & non-billable hours and send invoices easily in Financial Cents.

Save More Time Through Tax Preparation Workflow Automation

Automation is the key to optimizing your workflow. It helps you save valuable time otherwise spent on basic manual tasks so you can refocus that time on providing other high-value services.

To start automating, you need a to use a suitable accounting workflow software to automate each step. Preferably an all-in-one software with all the features an accounting firm needs like a CRM, client request feature, workflow & capacity manager, time tracker, etc. One such tool is Financial Cents, and we show you how you can use it to automate various tasks in the tax preparation workflow process.

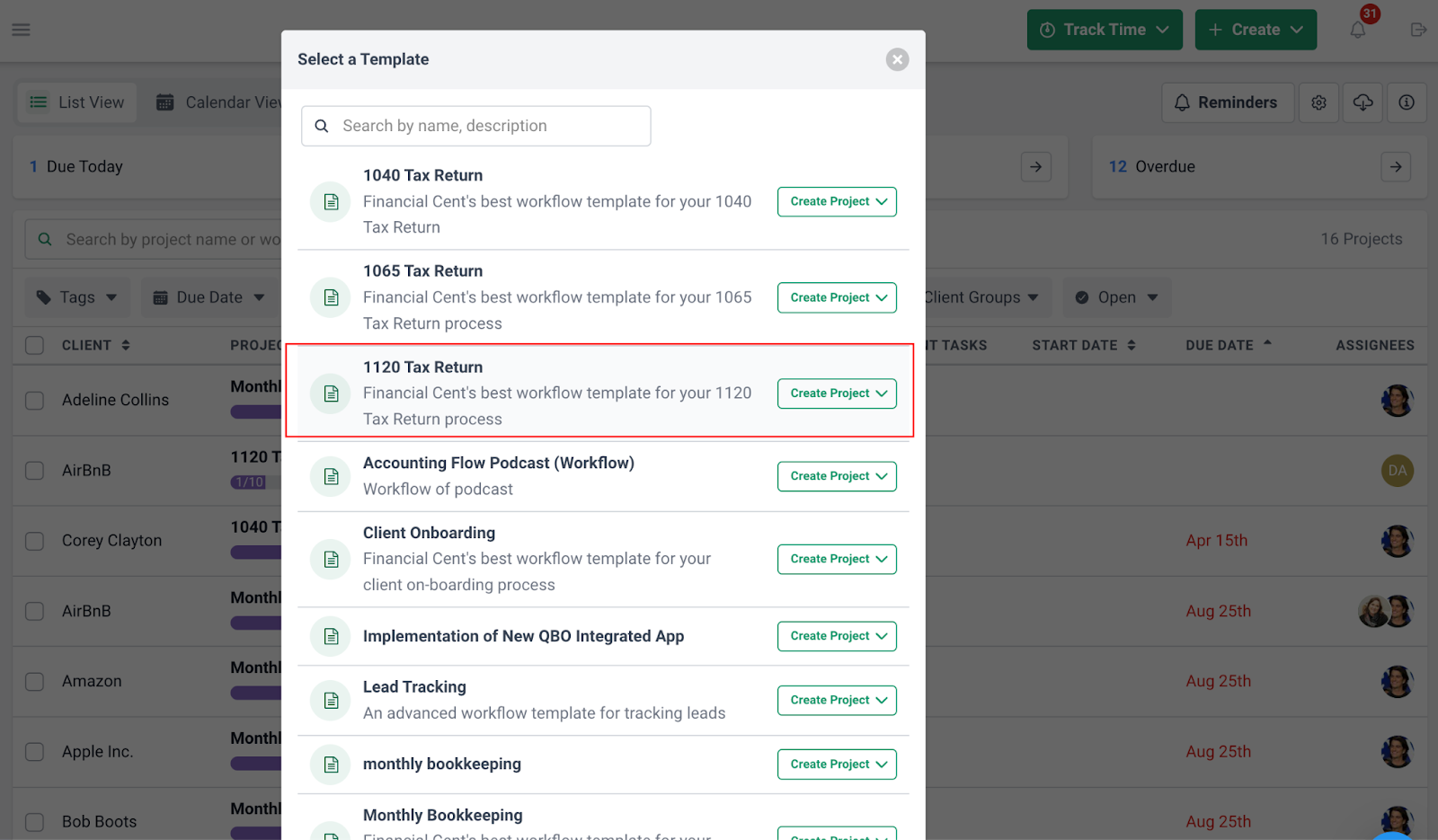

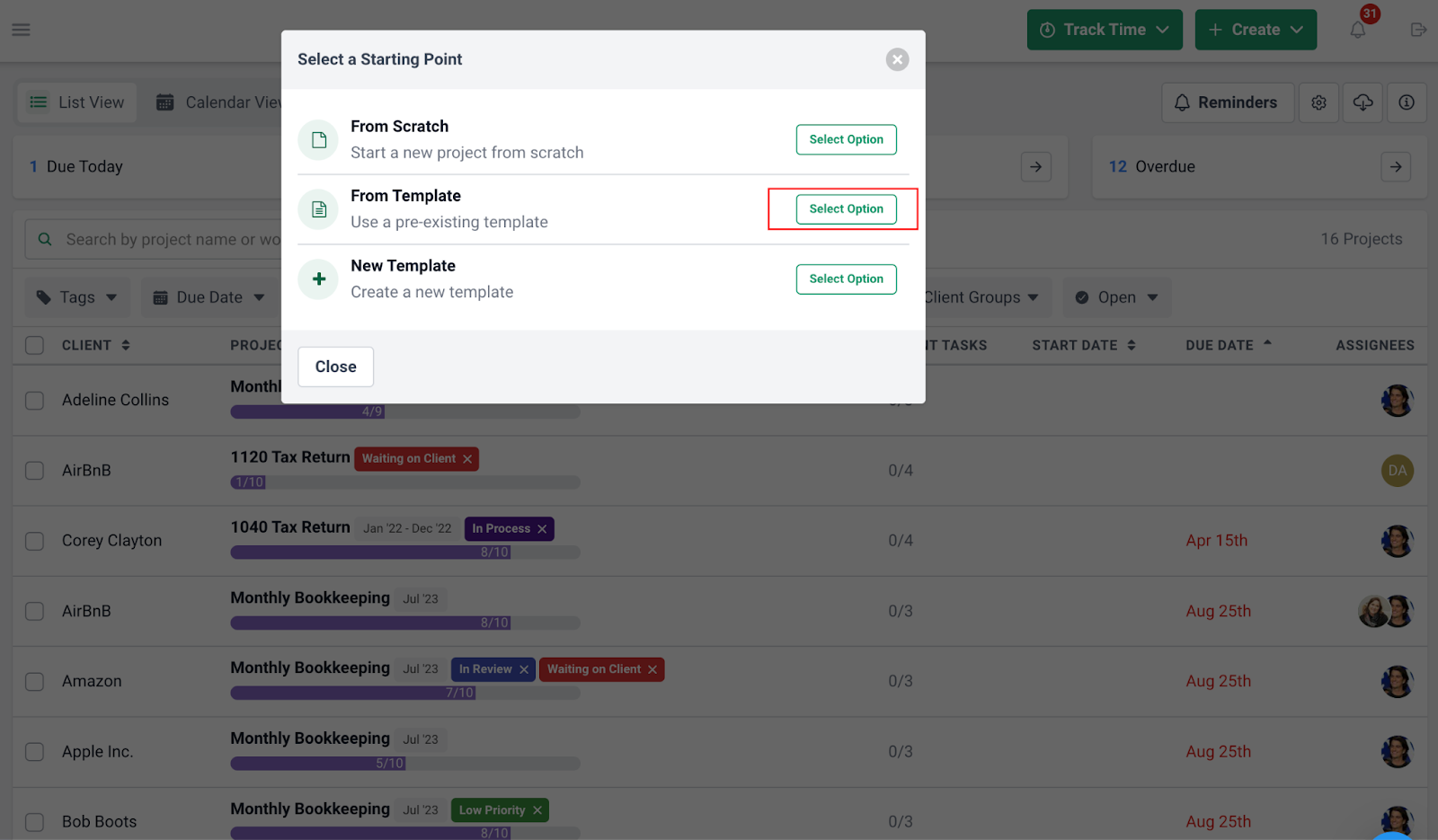

Import, create, or use a prebuilt workflow template for tax preparation

Templates are life savers. They help you skip the time-consuming task of creating a workflow from scratch. Instead, they provide a ready-made framework you can customize to fit your firm’s specific needs. This reduces setup time and effort significantly.

Financial Cents has a library containing 40+ free templates, from tax forms to client questionnaires to amend tax return templates.

If you don’t want to use our templates, you can create your own template for future use. You can also import existing workflow templates you’ve been using in Excel or shared spreadsheets too.

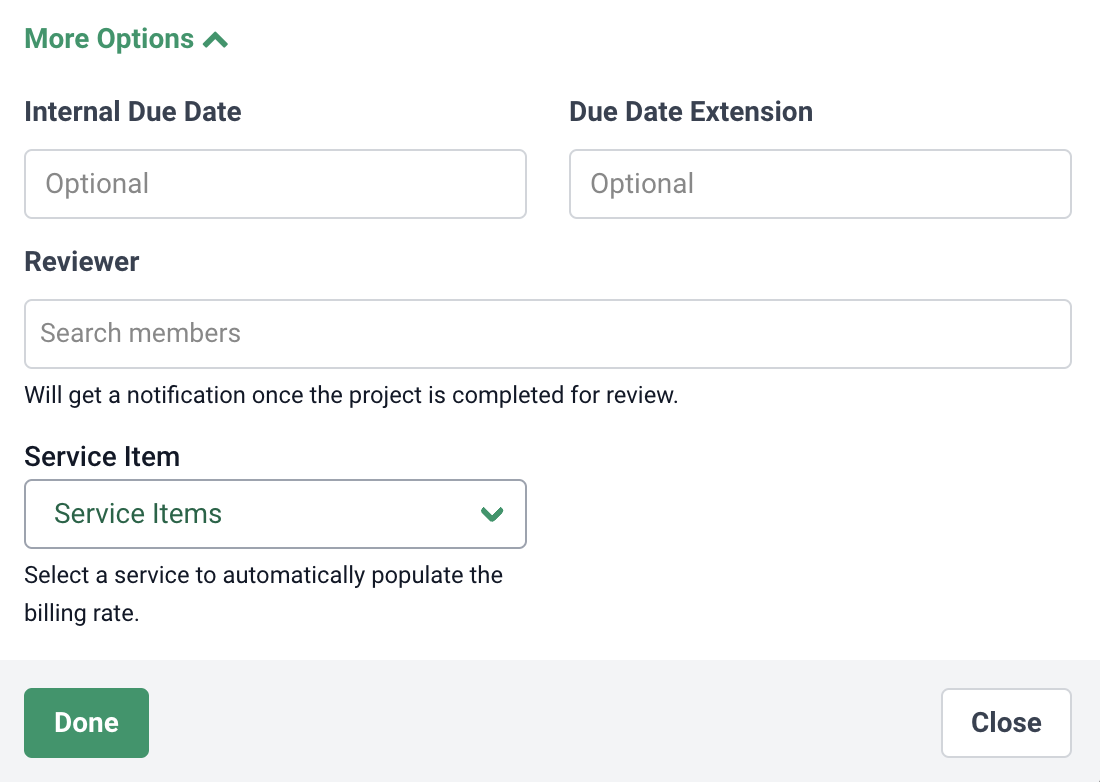

Choose your due date and set reminders

If your firm is large or you have many clients, it’s easy to get disorganized, leading to missing deadlines. The effects of this are disastrous. On the business front, it taints reputation, decreases client satisfaction, leads to loss of clients, and stalls growth. It causes last-minute rushes and associated stress among employees.

However, by setting due dates and reminders, you can plan, prioritize tasks, and ensure you complete them on time.

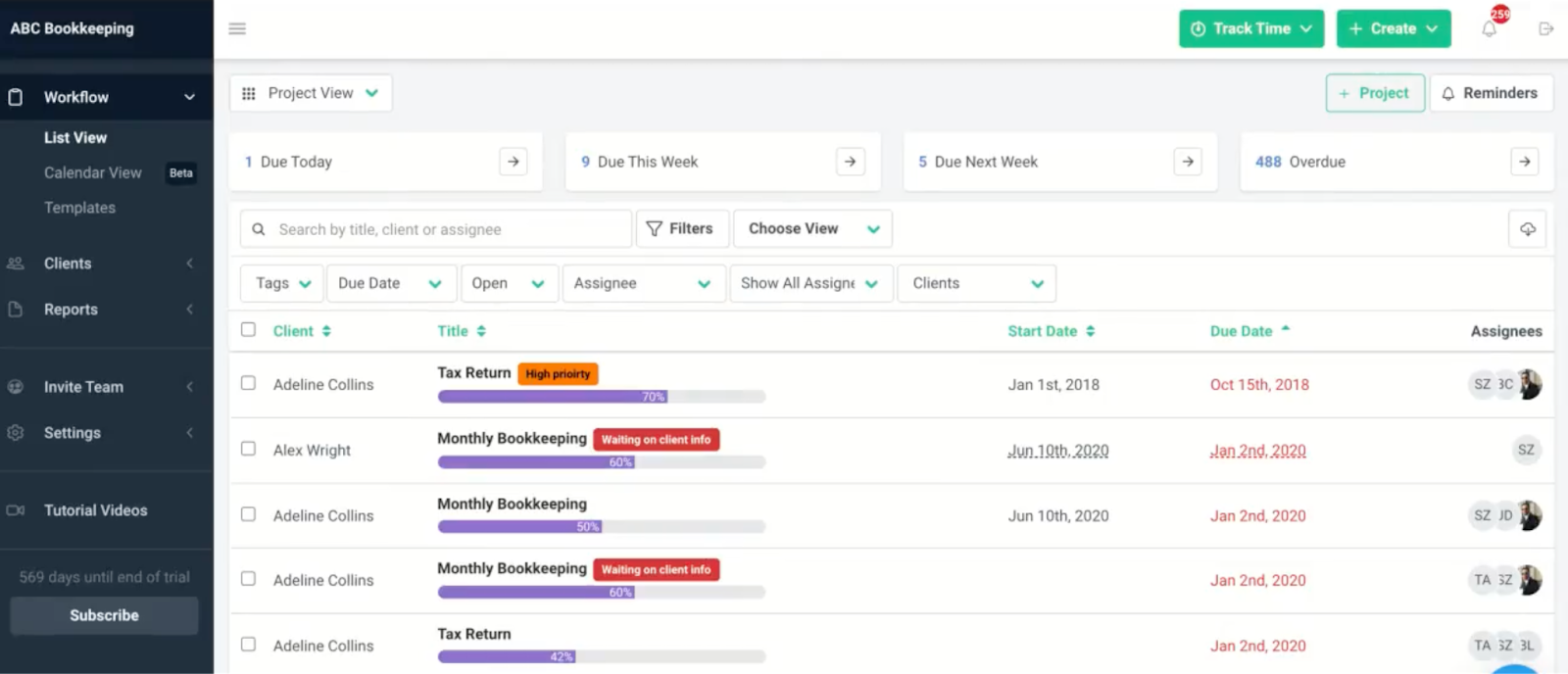

Financial Cents helps teams meet their deadlines in the following ways.

- Internal due dates which are earlier than the actual due date. Its aim is for your team to have enough time to complete the work despite any setbacks.

You may be interested in:

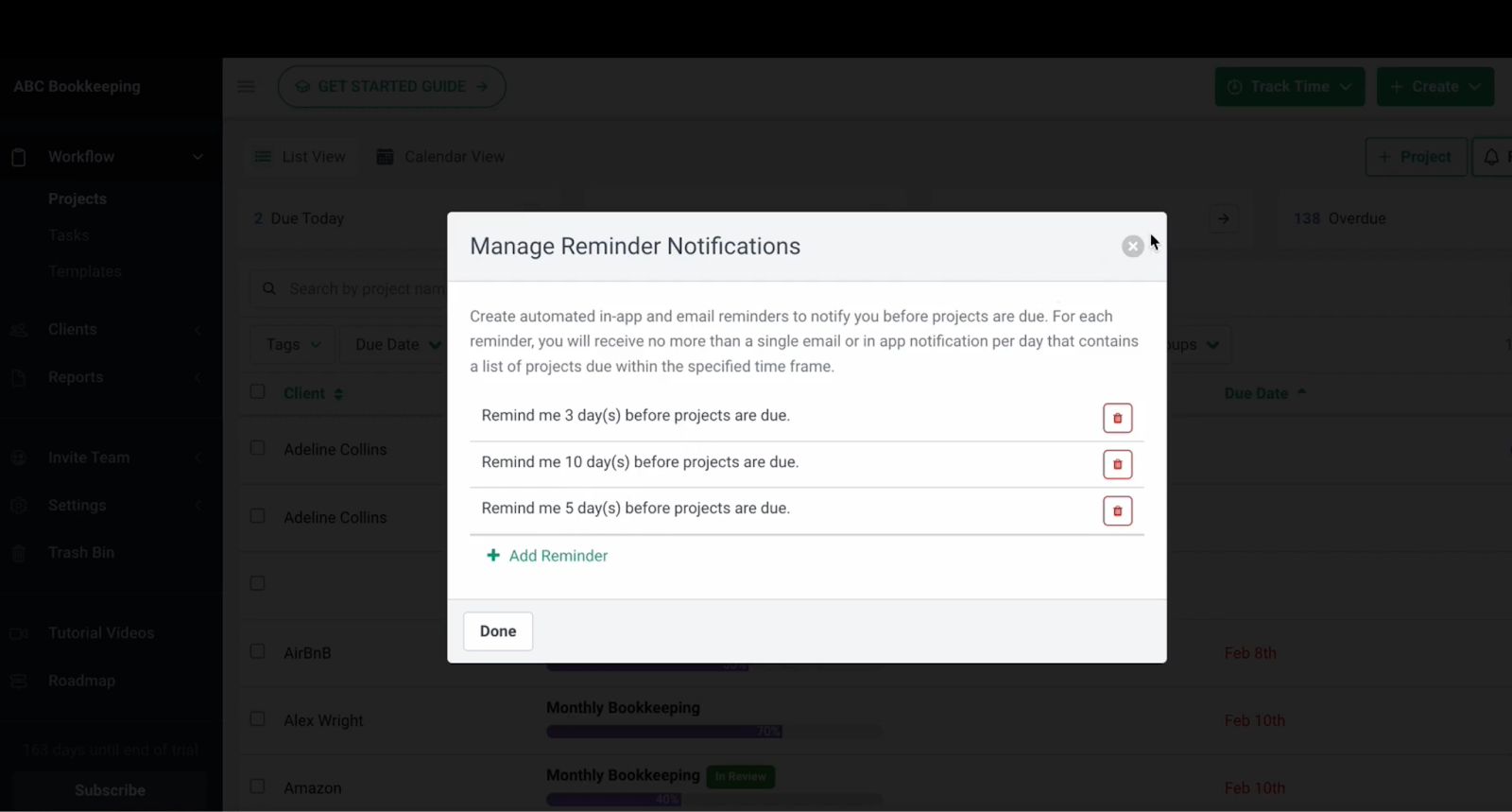

- Reminders are timely notifications alerting you to the looming deadline. You can set multiple reminders at intervals so you never forget to turn in a project.

- Option for calendar or list view so you can easily see all pending work and their due dates at any given time.

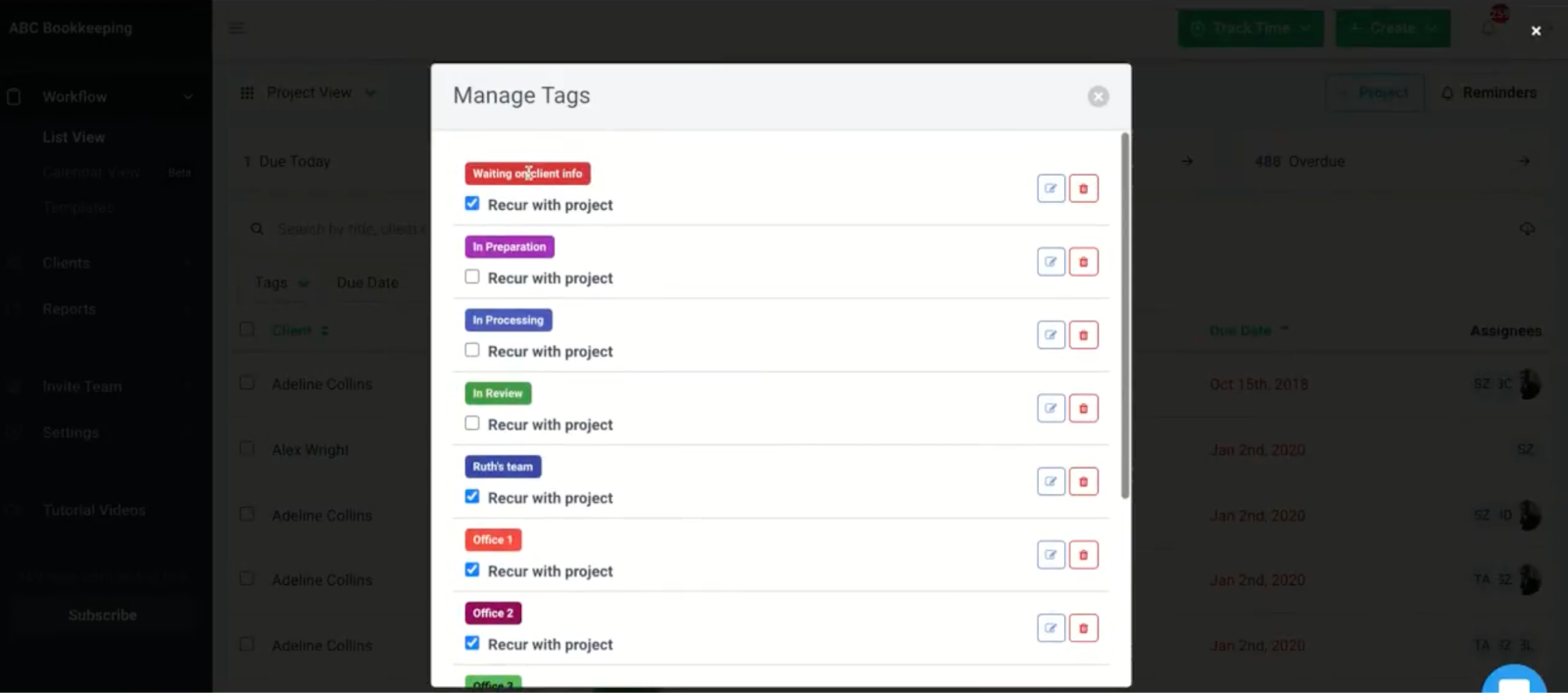

- Color-coded tags showing the status of each task as it progresses. You can have as many as you want and edit them (by color and name) as you see fit. You can also set these tags to recur with projects.

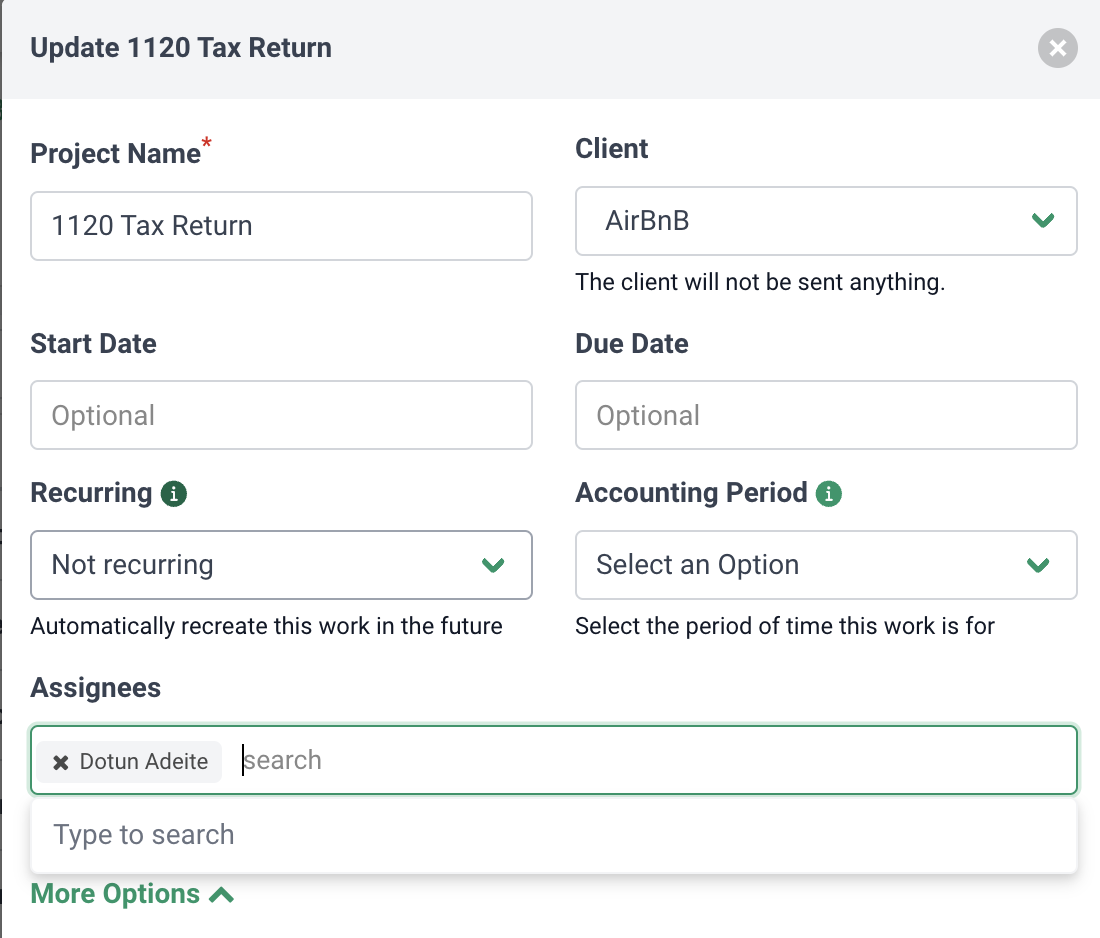

Use the ‘Assignees’ tab to list team members who will work on the project

To avoid chaos and confusion, everyone must know their responsibilities. Hence, you should delegate tasks and clearly state who will work on them for effective task management and collaboration.

You can use the Assignees tab in Financial Cents for this. With it, you can assign tasks to team members to specify who’s responsible for what.

See example below:

Send and receive signed engagement letters from clients

An engagement letter aims to establish a formal agreement between the accounting firm and the client. It outlines the scope of services, responsibilities, agreed-upon fee, and terms of engagement.

However, unless both parties sign it, it’s not enforceable. You can send a signed letter to the client for their signatures by email or physical mail. But this comes with its complications, like shuffling through a cluttered email thread, managing physical copies, potential delays in receiving the signed letter, and the risk of misplacing or losing paperwork.

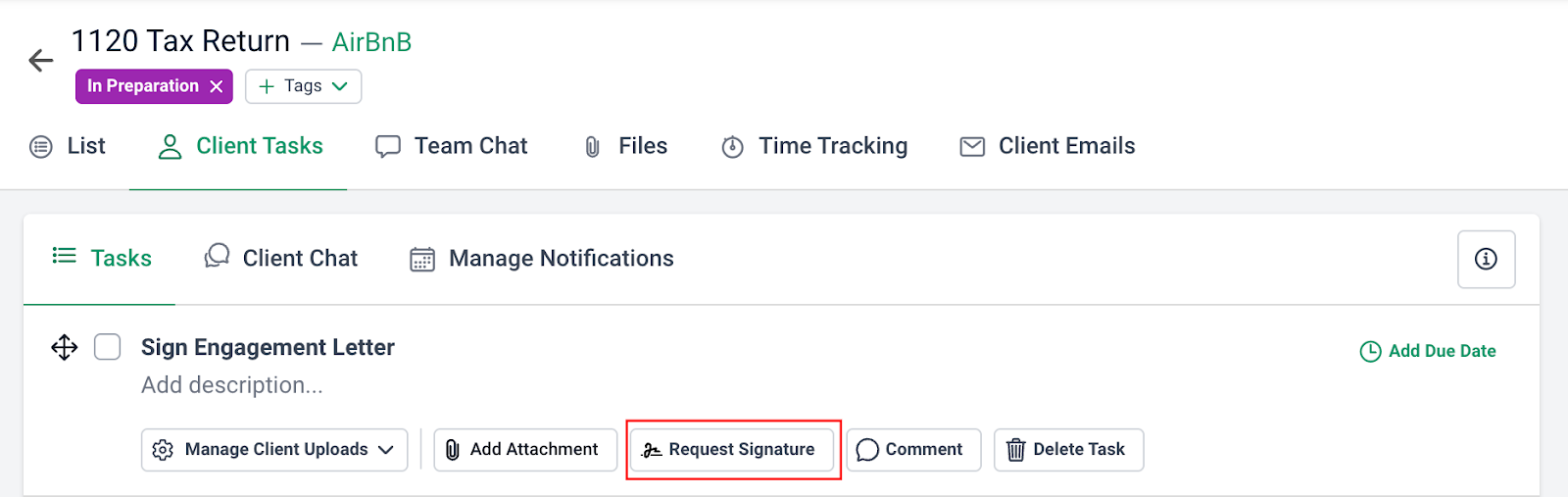

With Financial Cents, you can streamline this process by sending and receiving signed engagement letters via a secure client portal and our Adobe Sign integration—no need for an email thread. Just create a project, upload the digital copy of the engagement letter to the portal, “request signature”, and click “+.”:

The client will receive a notification so they can sign and send it back to you. The system automatically stores the signed copy in related work & the client’s profile in Financial Cents.

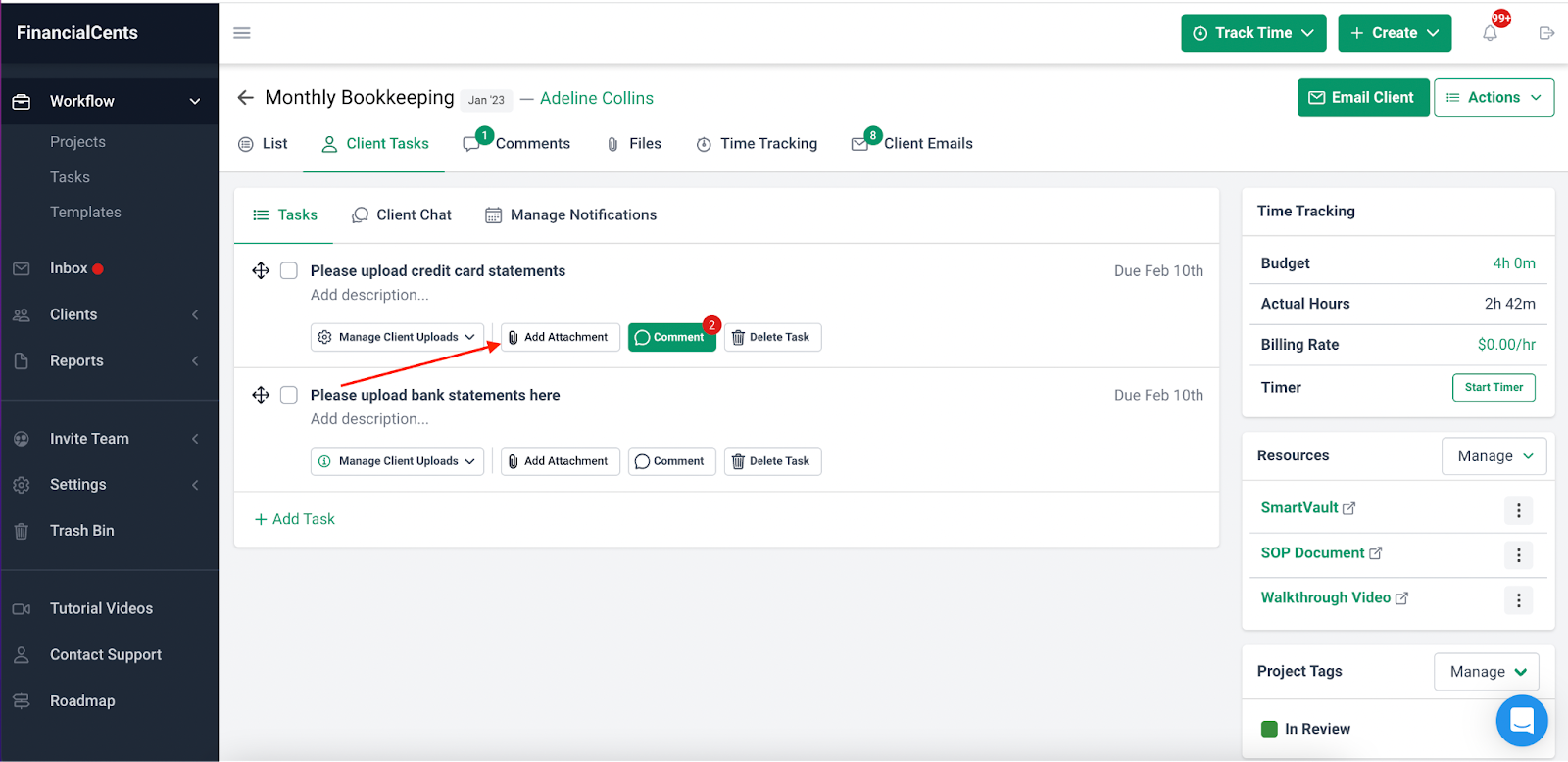

Automate client documents and signature requests for tax documents

According to our 2023 State of Workflow Automation Report, clients sending documents late is the second highest workflow issue firms face, with 53.8% of respondents struggling with this problem. Difficulties in collecting documents affect the tax preparation process’s efficiency and can cause filing delays.

To overcome this challenge, Financial Cents offers automation features to streamline the collection of client documents. You can create document request lists and set up automatic reminders at intervals until the client completes the request. This way, you don’t have to send follow-up emails or messages manually.

The same goes for signature requests. Click “Request Signature” on a client task, upload the document to Adobe, add “signature fields,” and send it. Once signed, the software will automatically attach a copy to the client task and store it in the Client Task Files under the client’s profile.

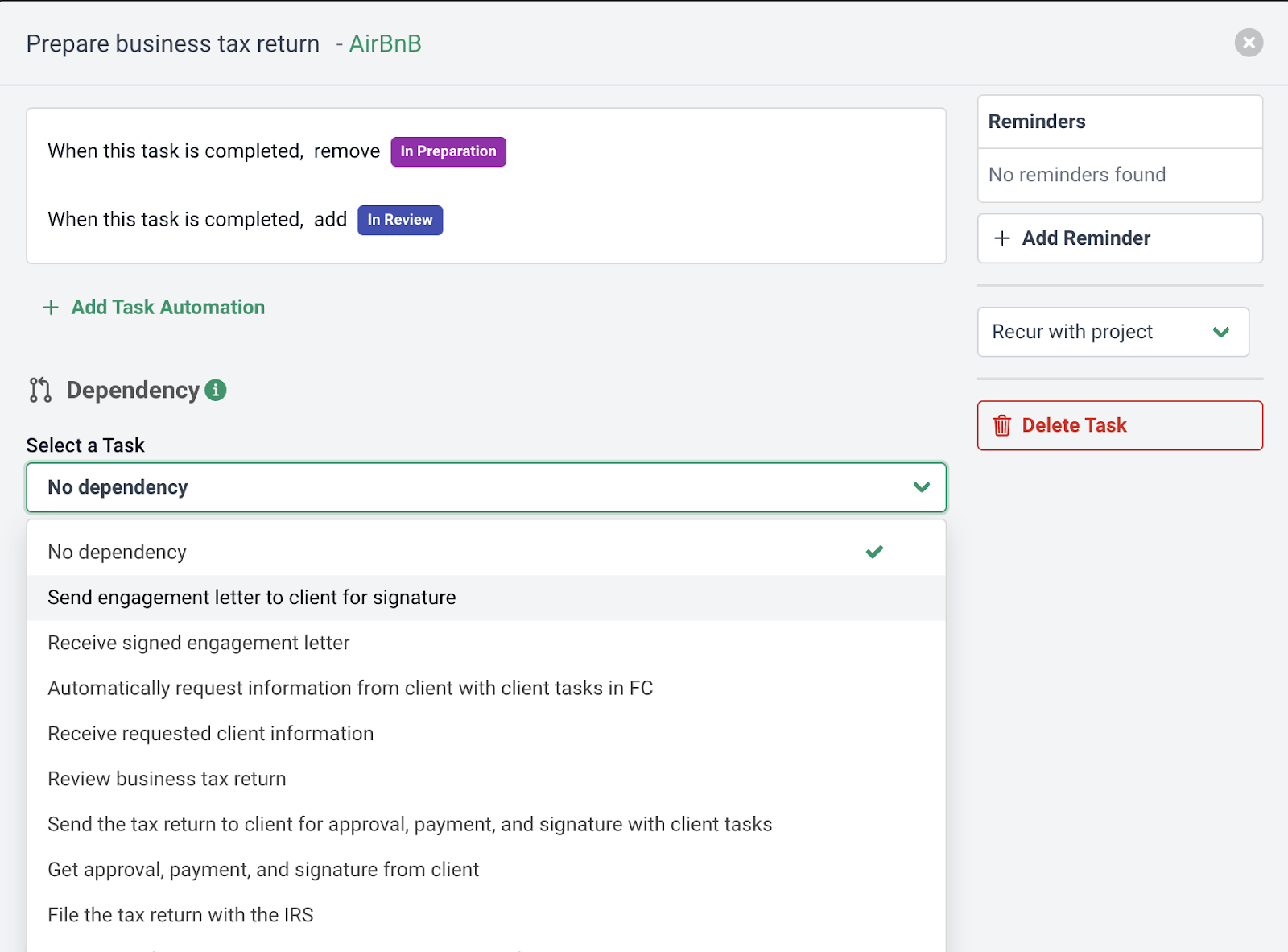

Automate Dependencies

Dependencies are designed for a project that has many assignees throughout the process. So, instead of sending individual messages to each assignee when their task is about to begin, you automate the process. When one assignee completes a task, it triggers an automatic notification for the next assignee so they can come in and do their part. This reduces the need for manual coordination and keeps the workflow moving smoothly.

Automating dependencies also prevents incomplete work and promotes order of work, as one can’t initiate a dependent task until the person responsible completes the previous one.

Financial Cents has this feature:

Send documents to clients for review

This feature in Financial Cents allows you to easily share completed tax documents with your clients for review. You can send the documents by attaching them to a task via the client portal, where the client can securely view and provide feedback on the documents. This streamlines the review process and eliminates email back and forth or printing and mailing physical copies.

Use Financial Cents to Automate Your Tax Preparation Workflow

As you can see, with its features and capabilities, Financial Cents is helpful in making your tax preparation workflow more efficient. Our tool does this by automating your manual processes. Create efficiency by sending automatic reminders for those pesky documents, creating recurring tasks for your clients (and your team), using tax templates, and requesting signatures in-app.

What are you waiting for? Give us a try today.

Gain control over your firm’s workflow. Use Financial Cents.