The billing feature will help us to stop doing off-system work. It's painful when employees have to work with multiple software solutions. I don't want my staff to need multiple subscriptions, training, and access. I also want my clients to be able to access invoices in the same place they use the portal."

Mindy Wirkus, Owner of Ledgers Inc.Getting client work done can be hard. Getting paid for it shouldn’t be.

Financial Cents knows that billing is more efficient when done in the same software for clients, projects, and team management.

That is why WE ARE EXCITED TO ANNOUNCE OUR NEW BILLING FEATURE.

Thanks to the precious insights from our community of accounting firm owners, this feature enables accounting firms to:

- Bill their clients on time.

- follow up on invoices automatically.

- Get paid faster, and

- Improve their accounts receivable turnover.

The billing feature comes at NO ADDITIONAL COST and brings us closer to our goal of becoming a one-stop software for your practice management needs.

Features of Financial Cents Billing

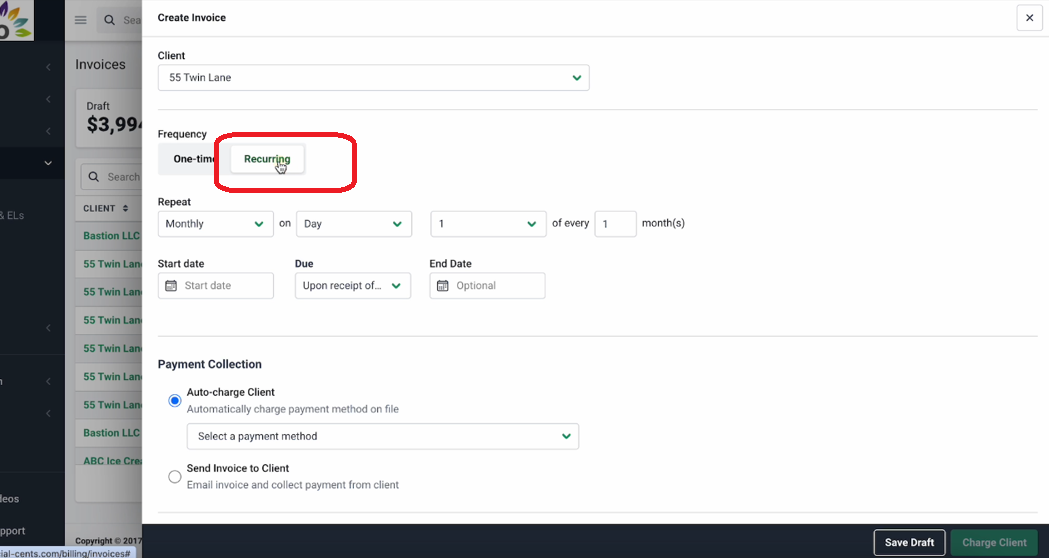

a. Ability to Create One-off & Recurring Invoices

The billing feature lets you create invoices for your one-off projects, but that’s only one aspect. You can also automate recurring invoices to save you the administrative burden of remembering (and creating) these invoices from scratch every week or month.

To create a one-off or recurring invoice:

Click Create Invoice.

- Select the client to bill.

- Choose between one-time and recurring.

- Select client reminders (to automate your receivables)

- Send or Schedule the invoice.

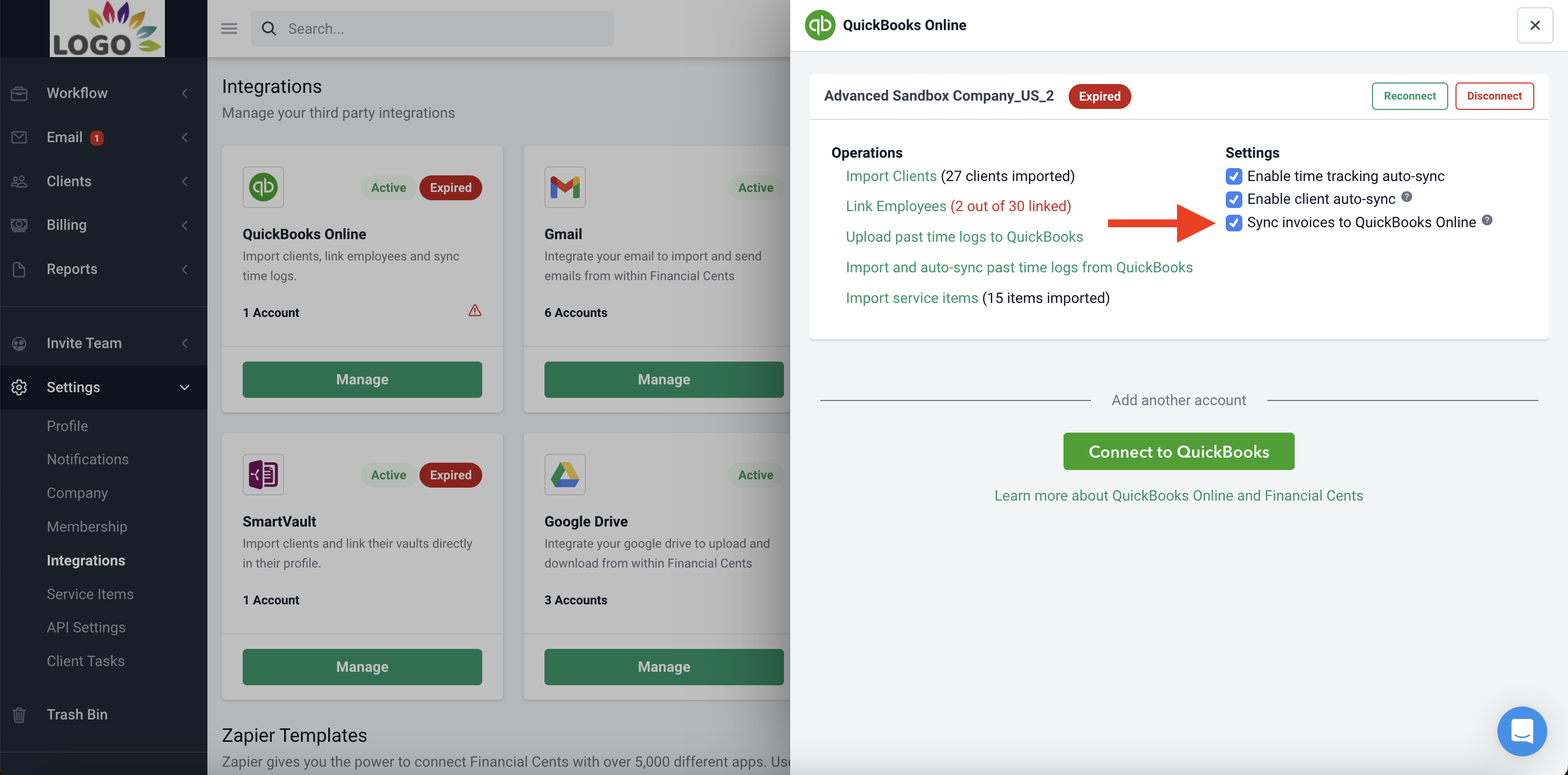

b. Sync Invoices and Payments with QuickBooks Online

Going back and forth between your billing and accounting solutions can break your workflow process.

Thanks to Financial Cents integration with QBO, your payment data in Financial Cents synchronizes with your QBO account.

With this feature, the status of your invoice and payment in Financial Cents will appear in QBO to prevent duplicate information and ensure complete and accurate financial records.

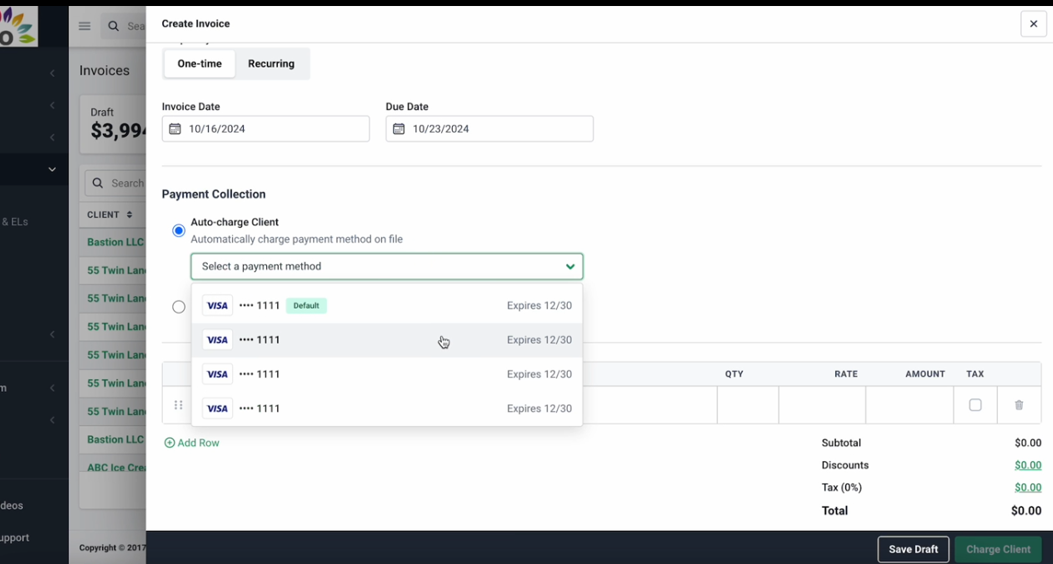

c. ACH & Credit Card Payment Options

Whether you prefer ACH payment (for its affordability, security, and convenience), credit card payment (for its ease of use, processing speed, and availability), or both; the Financial Cents billing feature accepts both payment methods.

The processing fees are:

- ACH transactions: 1% capped at $5.00.

- Credit & Debit Card transactions: 2.9% + 30 cents.

d. Saved Payment Methods

When your client uses a method to make a payment, Financial Cents automatically saves and authorizes it for future payments.

With this feature, Financial Cents improves your accounts receivable by eliminating the need for clients to remember (and manually enter) their payment information before making payment, which improves your overall client experience.

e. Automatic Payments & Authorized Payments

Some of your clients might be too occupied with their core business operations to authorize your payment every month.

That is why this feature provides the option of automatically charging your client’s account as and when due.

The feature uses your client’s payment information on file to automatically charge them for your services. Financial Cents will send your client the invoices after each payment.

f. Automated Client Reminders

Your clients can forget to make payments for any number of reasons. That’s where the Financial Cents payment reminders come in.

The reminder feature automates your receivable collections by following up with your clients until they send your payment. This frees up your time to focus on meeting client deliverables.

Getting Started with the Billing Feature: Step-by-Step Guide

You can start using the Financial Cents billing feature in three (3) steps:

-

Set Up Online Payments

Accepting payments in Financial Cents begins with filling out the merchant application.

Click the billing tab to provide relevant information and start processing payments inside Financial Cents.

-

Connect with QuickBooks Online (Optional)

This syncs your service items and payment information between Financial Cents and QuickBooks Online.

Here are the steps to connect your Financial Cents with QBO.

- Go to settings

- Select Integrations

- Click +Integration

- Select Connect to QuickBooks

- Select “Sync Invoices to QuickBooks Online” on the integrations page here

-

Schedule a Call with Our Payments Team

If you need additional help setting up the billing feature, our payments team will assist you by showing you the billing platform in more detail and migrating your invoices and payment methods.

Book a call with us here.

Key Benefits of the Billing Feature

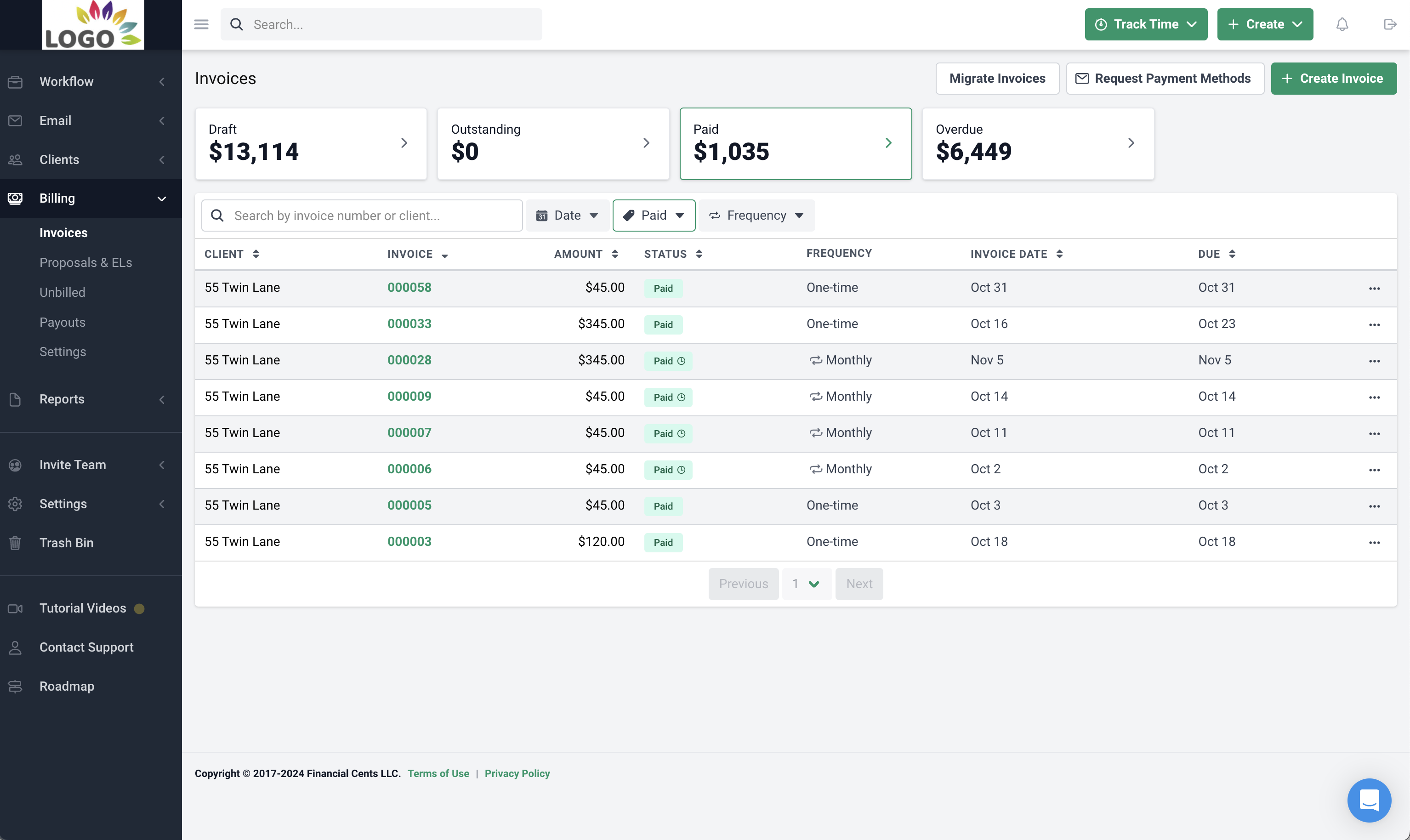

a. Centralizes Billing and Payment Collection

Having all your data in one platform gives you better reporting and more insightful internal auditing to make smarter decisions for your firm."

Shahram Zarshenas, CEO of Financial CentsAn inefficient billing process causes late payments and bad debts that affect more than half of American businesses.

The first step to encouraging timely payment is to centralize your billing and payment collection processes, which helps you track your paid and unpaid invoices in one place.

Financial Cents makes billing and payment information more accessible with:

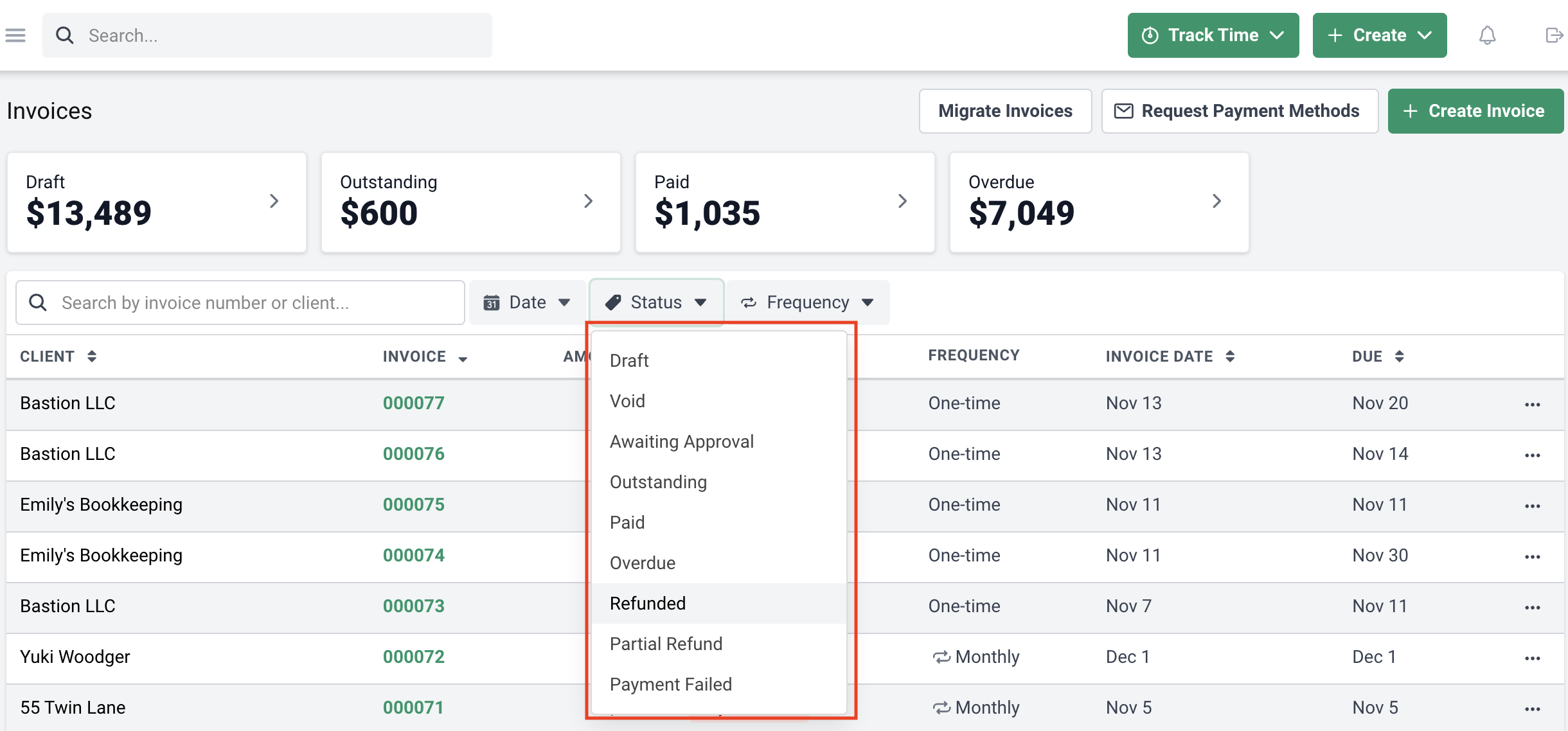

- An Invoice Dashboard

The billing tab shows all your invoices and their statuses (draft, outstanding, paid, and overdue) in one central place.

To view individual invoices, open an invoice with the click of a button to see more granular details or go to the client’s profile to see their active invoices (with their saved payment methods).

- Filter

You can filter your invoice dashboard to see invoices by particular due dates, statuses, or recurrences.

b. Saves Money

This billing feature saves you money by consolidating your tech stack so you can pay fewer subscriptions. Moreover, the billing and proposal feature in Financial Cents comes at no extra cost for all subscription plans—Solo, Team, or Scale."

Shahram Zarshenas, CEO of Financial CentsThe Financial Cents billing feature helps you save money by reducing ACH processing fees and giving you the ability to pass credit card fees to your clients.

ACH Payment processing in Financial Cents is 1% of the transaction (with the maximum fee capped at $5). This is lower than QBO’s ACH payment processing, which is not capped. Although the QBO ACH fee is also 1% per transaction, eventual charges can be significantly higher.

For credit card transactions, Financial Cents allows you to pass on the fees to your clients to pay for it.

Since the Financial Cents billing feature does not attract any extra cost, it saves you the hundreds of dollars you would have spent on a separate billing solution.

c. Saves Time

Using a manual billing system (or even a separate software for your billing) requires time to enter billing data and verify that they are accurate across the board.

The Financial Cents billing feature stores your client’s payment information after their first payment, enabling the automation of subsequent payments. With our QBO integration, you can pull service items from your QBO account.

This helps you regain time for client work that generates revenue.

d. Streamlined Operations and Tools

The billing feature will reduce the time we need to set up and manage clients through multiple platforms"

Jordan Kevin, Accounting Firm OwnerBilling your clients in Financial Cents gives you one platform to manage every aspect of your firm. This means fewer software applications to learn and keep up with.

This prevents information silos and enhances collaboration and productivity in your firm. It also improves client collaboration by providing clients with one place to access documents and communicate with you.

-

Improved Client Experience

You’re already communicating and collaborating with your clients in the Financial Cents client portal. It only makes sense to also manage their invoices there because it's where they're already working with you. This will create a single source of truth for your clients.

You don't want to overwhelm them with going to different places to collaborate with you. That's where they might get confused and stop answering your questions."

Easy payment processing is as important for client experience as your client onboarding processes.

Having one place for all client-facing processes helps your clients interact with your firm more easily. Communicating with your clients in Financial Cents and sending them elsewhere for billing creates too many touchpoints that can ruin the client experience.

-

Reduced Admin Overload

Between data entry, verification, and payment collections, the billing process can be a handful. Each of these tasks can increase your unbillable time by several hours.

With the Financial Cents billing feature, you can create estimates, verify billing information, follow up (with clients), and process payments with a few clicks.

This will not only reduce your administrative burden but also eliminate human errors that might lead to late payment or bad debt.

Financial Cents Billing Feature: What’s Next?

Now that the billing feature is live, we will spend the next weeks adding features that will make it more comprehensive for our users. These include:

-

Invoicing off billable time (WIP REPORT)

[Now available]

The work in progress (WIP) report in Financial Cents shows how much resources it has cost your firm to do a client’s project to its current stage.

This will give you reliable data to bill your clients accurately.

-

Proposals & Engagement Letters (Now available)

This feature will enable you to create professional proposals and engagement letters to close deals faster, define the scope of work, and manage client expectations for a smooth business relationship.

-

Ability to Pass Credit Card Fees On to clients (Now available)

Paying for all credit card transactions will cost your firm thousands of dollars annually.

This feature will enable you to push that cost to your clients by automatically adding credit card processing fees to their invoices.

-

Ability to Lock Time Entries Once Invoiced

(Now available)

Editing time entries after a bill has been sent to a client can create confusion and make your billing system inaccurate.

This feature will allow you to prevent your employees from editing their time entries once the client has been billed for it.

-

Ability to Lock Deliverables Behind a Paywall

(Now available)

This feature will optimize your receivable collections, by rendering the documents and reports you created for clients inaccessible until they pay their outstanding bills.

-

AR Report

(Now available)

The AR Report feature will help you see your outstanding invoices and how long they are overdue. This will help you find the best ways to follow up on your unpaid invoices.

-

Client Utilization Report

(Now available)

Every firm wants to provide all the services they can for each client, but how can you tell how many more services you can offer a client without the right data?

The client utilization report will help you understand how many services you currently provide for your clients versus how many more of your services they need.

-

Staff Utilization Report

(Now available)

The Financial Cents billing feature will enable us to add billing information to the timesheet and calculate the realization rate for the team’s performance. "

Sam Kan, Managing Director of SK Accountancy CorporationThis report will show how much time your team spends on billable work.

Apart from accurate billing, this information empowers you to make decisions that make your staff more profitable.

-

Project Utilization Report

(Now available)

Accounting and bookkeeping firms spend more time than necessary on work they can’t bill for.

With the Financial Cents’ project utilization report, you can monitor how much of your firm’s billable hours is generating revenue.

Learn more about our advanced Financial Cents reporting features here.

FAQs About the Billing Feature

1. Will there be any additional costs for the billing feature?

No. Using the Financial Cents billing feature does not require any additional cost.

The only payment associated with the feature is the standard processing fees, which are:

- 2.9% + 30 cents for Credit & Debit Card transactions.

- 1% capped at $5.00 for ACH transactions.

2. What plans include the new Billing feature?

The new billing feature is available on all Financial Cents subscription plans—Solo, Team, and Scale.

3. Is the Billing feature available to customers outside the United States?

The Billing feature is only available to Financial Cents users based in the United States and Canada FOR NOW.

4. How do I get started with the billing feature?

Follow the instructions in this link.

5. Do you have tutorials on the new billing feature?

Yes. Click this link to learn more about the new billing feature.

6. What is the merchant application (KYB verification) process, and how long does it take?

The application review process is required by law to verify the identity of customers and prevent financial crimes.

Your application should be approved within 72 hours. Many times, it is instant.

Additional information may be required in cases of:

- Data mismatch

- Business entity verification

- Enhanced verification (usually when your business volume or type warrants additional review).

7. Who do I contact about my merchant application?

Chat with our payments team.

8. Do I need to connect to QBO to use the new Billing feature?

No. The billing feature is independent of QBO. Connecting it with QBO is optional.

9. What payment methods can my clients use?

The payment options are credit and debit cards or through ACH bank transfers (direct bank deposits).

10. Is my clients’ payment information secure?

We use a third-party payment provider, Rainforest, to securely collect sensitive data and keep our network out of PCI scope when processing transactions.

Our payment provider is annually audited using the SOC2 and PCI-DSS standards to ensure maximum security of the payment process.

11. Can I send invoices in different currencies?

We only support USD billing AT THE MOMENT. We should release CAD and other currencies in the next few months.

12. Can I migrate existing invoices and payment methods from another system?

Yes. Our payments team can help you do that. Schedule a call with them here.

13. What should I do if a payment fails or declines?

If a payment fails or declines, check for the reason it failed by:

- Opening the invoice where the payment failed.

- Scroll to the Payments section (at the bottom of the page).

- Scroll to the failed payment.

- You will see the reason for failure there.

- Contact your client or try making the payment again.

14. How can I provide feedback or report an issue with the billing feature?

Register for our weekly group call to share your feedback and help us to improve the feature.

You can also reach us via chat.

15. What is the Financial Cents payout schedule?

Our payout schedule is:

- Credit & Debit Cards: Next business day

- ACH: 4 business days

Daily cut-off times:

- Credit Card: 11 PM EST.

- ACH: 9 PM EST.

If your client makes a card payment at 11:30 PM EST on Monday, it will not get to your account until Wednesday because it was made after the cut-off time.

Financial Cents: An All-in-One Practice Management Software to Save Time and Money for Accounting Teams

Accounting firms often use disparate software solutions (with many features they don’t need) to manage individual aspects of their firms. This is time-consuming and increases their administrative workload.

With the addition of the billing feature, Financial Cents enables you to collaborate with clients, manage your projects, and receive payments in one place.

The feature automates invoice creation and payment collection and generates data that helps you optimize your billing and payment process.

Our payments team can help you migrate your invoices and payment methods to the Financial Cents billing platform. So, log into your Financial Cents today to start using the billing feature.

If you’re new to Financial Cents, check out the billing feature today. Click here to start your 14-day FREE TRIAL.