IRS Form 2848 – Power of Attorney: A Guide for Accountants

Author: Financial Cents

In this article

With this form, you can access your client’s tax information, represent them during tax disputes, and handle other tax-related matters. Being a taxpayer’s representative before the IRS is a big deal as your mistakes can cost them money, affect their reputation, and even mar your reputation as a professional.

Hence, due diligence is needed before you step into that role, which is why we’ve put together this piece to walk you through all there is to know about IRS Form 2848. If you want to file it, we cover Form 2848 instructions for filing Power of Attorney here.

What is IRS Form 2848?

An IRS Form 2848, also known as “Power of Attorney and Declaration of Representative,” is a document used in the United States by a taxpayer giving a third party, i.e., a qualified representative, the authority to represent them on tax-related matters before the Internal Revenue Service.

As a holder of Form 2848, you can access confidential details about your client’s taxes.

The document exists because a taxpayer’s information is to be kept private by the IRS, so before the body can allow a third party to stand in for a taxpayer and make decisions on their behalf, a legally binding permit has to be made available.

Here are some reasons why an individual or corporate entity can request for a form 2848:

- Track tax refunds

- Dispute a tax return

- Access tax transcripts

- Stand in for a sick or mentally unwell taxpayer

- Provide professional assistance with tax compliance issues

- Settling tax debts, discussing payment terms, or negotiating penalties for defaulting tax payments.

However, even as a representative using form 2848, you’re not allowed to do the following for your client:

- Sign tax returns

- Represent a taxpayer in court

- Change the taxpayer’s information

- Authorize or make payments on behalf of a taxpayer.

Power of Attorney Validity Period

The power of attorney is valid for seven years unless you or your client revokes it before seven years. To revoke it, the taxpayer must get a new form 2848 and write the word “Revoke” across the top of the form. After that, they can submit the revoked form with the new form.

IRS Form 2848: Who is Qualified to be granted the Power of Attorney

Only qualified persons can represent a taxpayer using the IRS form 2848, and this access has some limitations. Below is a list of individuals allowed to use the Power of Attorney and Declaration of Representative.

- Lawyers: licensed lawyers, even those not specialized in tax matters, can stand in for a client before the IRS

- CPAs: Certified Public Accountants with active and valid licenses are called upon to handle corporate institutions’ tax resolutions and can save their clients thousands of dollars in taxes.

- Enrolled agents: these are persons with previous experience as an IRS employee or have passed the IRS three-part test on individual and tax returns. So, their status and knowledge give them the privilege to represent others on tax issues.

- Enrolled actuaries: these are professionals certified by the Joint Board for the Enrollment of Actuaries in the US. Apart from their functions as actuaries, they can represent clients before the IRS during tax audits and in resolving compliance issues.

- Unenrolled return preparers: ideally, these people are not qualified to represent taxpayers before the IRS. However, they can step in as a representative to handle the tax returns they prepared and signed for taxpayers. And in the form, it must be specified that they’ll represent a taxpayer for that specific purpose.

- Corporate officers or full-time employees (used for business tax matters): under certain conditions, a corporate officer or full-time employee will be allowed to represent a taxpayer before the IRS. For this to work, a written notice authorizing this, together with form 2848, must be submitted to the IRS.

- Enrolled retirement plan agents: this only applies to retirement plan tax matters.

- Representatives who work in a qualified Low Income Taxpayer Clinic or Student Tax Clinic Program: before using form 2848, these representatives must have been vetted and approved by their groups first.

Guiding Your Client to Grant You the Power of Attorney

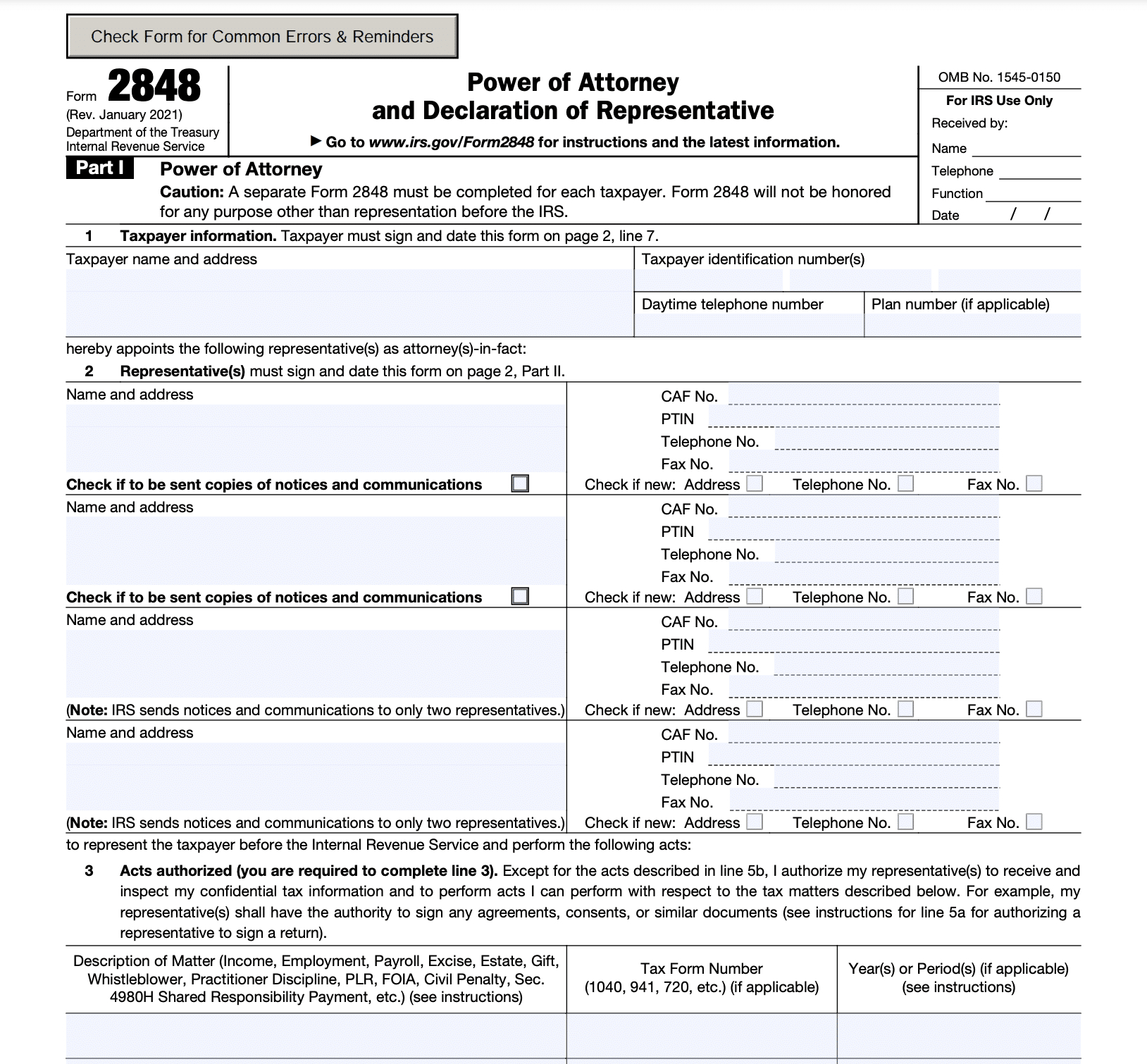

The IRS form 2848 is divided into two parts. The first part concerns both parties, i.e., your client and you as the representative. In part 1, the taxpayer will need to fill in personal details, while the second part is for you, the representative, to fill in.

Here’s a picture of what the form looks like

Now, as easy as this may seem, some clients may not be sure how to go about this, and it is your responsibility as their accountant to ensure they can permit you to represent them.

Before doing anything on the form, ensure your client has already authenticated their identity using a government-issued ID. Then verify their Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN), name, and address using their federal or state tax return or an IRS notice.

If you or your firm will be representing a corporate entity, you should also verify:

- Confirm the individual signing on behalf of the organization

- Inspect a valid government-issued photo identification (ID) of the individual and compare this to a photo of that individual via a self-taken picture or video conferencing.

- Record the name, Employer Identification Number (EIN), and address of the business entity taxpayer

- Verify the business entity taxpayer’s name, EIN, and address through secondary documentation, such as a tax information reporting form (e.g., W-2, 1099, etc.), IRS notice or letter, or utility statement.

When that’s done, follow this simple process to follow to access the power of attorney from your client:

Step 1: Download or print IRS form 2848

Visit the IRS website to download the latest version of the document. The most recent version was reviewed in 2021, so that’s the one to use.

Once you are ready to file form 2848, you should read our detailed step by step IRS Form 2848 Instructions for Filing Power of Attorney.

Step 2: Your client fills in their information in Part 1, line 1.

Your client must fill in their name, address, identification number, and telephone number.

Step 3: On Part 1, line 2 (list of representatives), you will be required to fill in your details as a representative and sign.

These details include your name, address, Centralized Authorization File (CAF) number, and PTIN number.

Step 4: Specify the acts your client authorizes you to carry out in part 1, line 3.

In line with your engagement agreement with your client, fill in the acts you’ll be standing in for them.

Step 5:

If your power of attorney designation is one-time or specific use that would not be recorded on Centralized Authorization File (CAF), check the box on line 4.

Step 6: Add in the extras

Include any other additional act authorized in Part 1 line 5a and acts not authorized in Part line 5b.

Step 7: Retention/revocation of prior Power(s) of Attorney

If your client had previous representatives, filing this new IRS form 2848 automatically revokes the Power of Attorney given to previous representatives. If they intend to retain their previous representative, they must tick the box. Similarly, you have a right to withdraw as a representative for your client.

Step 8: Taxpayer declaration:

This is for your client to sign.

Step 9: Representative declaration:

This is for you to sign.

PS: signatures are to be done electronically or using an ink signature. You can find more information about electronic signatures under the “Instructions for Form 2848” section of the IRS website.

After completing the form, go through it and check for any mistakes before submitting it to the IRS. Submission can be online, via fax to a fax number assigned to your state, or by mail to select locations in Memphis, Philadelphia, and Ogden, Utah. You can find more information on this on the instructions page of the IRS website. For online submissions, save the document in a file size of at most 15MB and in a .pdf, .jpeg, .jpg, or .gif file format.

What happens after submitting Form 2848 to the IRS?

After submitting, the IRS will send a confirmation to the email associated with your Secure Access account. After that, you wait for one week or more for the application to be processed, as forms are handled according to the order of submission. If the form is rejected, the IRS will send you and the taxpayer a letter via the U.S. Postal Service.

However, if the IRS reviews the document, verifies the taxpayer’s authorization and your status as the representative, and accepts it, they’ll send you and the taxpayer a letter of acknowledgement. This letter will state your scope of representation, i.e., tax matters, tax forms, and tax years. Once you confirm the details on the acknowledgment letter align with your client’s needs, you can access their tax records and correspond with the IRS on their behalf.

You may be interested in:

What is the Difference Between IRS Form 8821 and 2848?

In certain spaces, there’s no clear distinction between form 2848 and form 8821, which confuses people on what both forms are used for. The difference between Form 2848 and Form 8821 is that the former allows you to relate with the IRS on behalf of a taxpayer, while this authority is not granted with the latter. This is because a tax professional does not always need to correspond directly with the IRS to resolve a taxpayer’s issue. Sometimes, having access to their tax details and going through it privately is the best type of help needed at a point in time. This is where Form 8821 comes in.

Form 8821 is a tax information authorization document that allows professionals to access a third party’s tax details without the power to represent them before the IRS. This makes it less powerful than Form 2848. You can also use the form to revoke or withdraw previous tax information authorizations.

Limitations of Form 8821

If you or your firm are appointed to access tax information using form 8821, you cannot use it for the following purposes:

- Speak on behalf of a taxpayer

- receive a taxpayer’s refund via direct deposit.

- endorse or negotiate a taxpayer’s refund check

- execute waivers, consents, closing agreements

- advocate your position regarding federal tax laws

- execute a request to allow disclosure of return or return information to another third party.

Apart from using the form to access tax payer’s information, seeing payments made to an account, and receiving IRS notices, one interesting fact about the form 8821 is that it can be assigned to a firm in general. This means anyone in your firm can handle the client’s needs instead of limiting it to just one individual. So, if you’re unable to obtain your client’s tax information, your colleague can handle the task for you.

We discuss in detail everything you need to know about IRS Form 8821 in this article, in case it’s more suitable for your client needs. You can also read the filing instructions here.

Getting Form 2848 Submission Right

To increase your chances of a successful Form 2848 submission, you must stay professional throughout the process, both in your dealings with the client and the IRS. So, observe the following practices:

- Ensure your client has all their complete details before they start filling in the form

- Check the form thoroughly for mistakes or omissions before submission to avoid delays while processing

- Keep a copy of the completed form to help with follow-up and for a record of your authorization when meeting with the IRS

- Keep your client’s tax dealings private. Failure to abide by the confidentiality rules on tax matters can lead to penalties affecting your professional standing.

Simplify your accounting tasks with Financial Cents

Your everyday work life will come with different obligations and challenges that can be easy to lose sight of without a system for overseeing your obligations. For instance, forgetting to update your client on the progress of a dispute on their tax returns can reduce their trust in your ability to handle their tax matters or even lead to more issues between them and the IRS.

But with Financial Cents, you can set reminders for such tasks and easily automate checkups with different stakeholders and clients. Use Financial Cents to manage your accounting practice by signing up for a free trial.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features Your Accounting Client Portal Must Have

By utilizing a client portal, you can eliminate the inefficiencies of manual methods and create a smoother workflow for both you and…

May 15, 2024

The 5 Best Avii Workspace Alternatives for Modern Firms

If, for whatever reason, Avii does not meet your long-term workflow needs, this review of the best Avii workspace alternatives should help…

May 08, 2024