Is Accounts Receivable an Asset?

Yes, accounts receivable is an asset.

Your client made a sale, sent the invoice, and is now waiting to get paid. But until the money shows up in the bank, what exactly do you do with it in the accounting books? Where does it sit, and does it even count as an asset?

It’s a common point of confusion, especially when clients assume that money not yet received doesn’t exist on paper. But in accounting, it does, and that’s what makes accounts receivable a relevant topic.

In this article, we’ll answer the question of whether accounts receivable is an asset and also show how it fits into your client’s financial picture. You’ll see how it affects the balance sheet and what best practices to follow, so you’re not just tracking what’s owed, but managing it smartly.

What Is Accounts Receivable?

Accounts receivable (AR) refers to the money your client expects to collect from their customers. It’s a financial placeholder for work that has been done or products that have been delivered, but payment hasn’t arrived yet. In short, it’s not cash in hand, but it’s cash that’s legally on the way.

You’ll typically see AR show up when your client extends credit to customers, meaning they deliver the service or product now and agree to get paid later. This is common in industries like consulting, design, marketing, construction, legal services, and wholesale trade. In each case, there’s a lag between the moment the value is delivered and the moment the payment is received.

The most important point is that just because the cash isn’t in the bank yet, it doesn’t mean the business hasn’t earned it. That future payment has real value and is backed by either a contract, a signed agreement, or simply standard payment terms.

Let’s say your client runs a design agency. They complete a website project and send a $5,000 invoice to the client, payable in 30 days. From the moment that invoice is issued, the $5,000 is recorded as accounts receivable. It’s not “potential” revenue, it’s earned revenue waiting to be converted to cash.

Is Accounts Receivable an Asset?

Yes, accounts receivable is an asset, and more specifically, a current asset. That means it’s something the business expects to convert into cash within a short time frame, typically within one year.

When your client sends an invoice, the unpaid amount immediately becomes something the business owns: the legal right to receive money. That right has measurable value, and accounting rules recognize it as part of what the business possesses. So even though the cash hasn’t landed, it’s already reflected in the books as an asset.

Current assets are short-term resources, things a business expects to use up, sell, or convert into cash within one operating cycle or within a year, whichever is longer. Accounts receivable fits this definition perfectly because it’s tied to revenue that’s already earned and cash that’s expected to arrive soon.

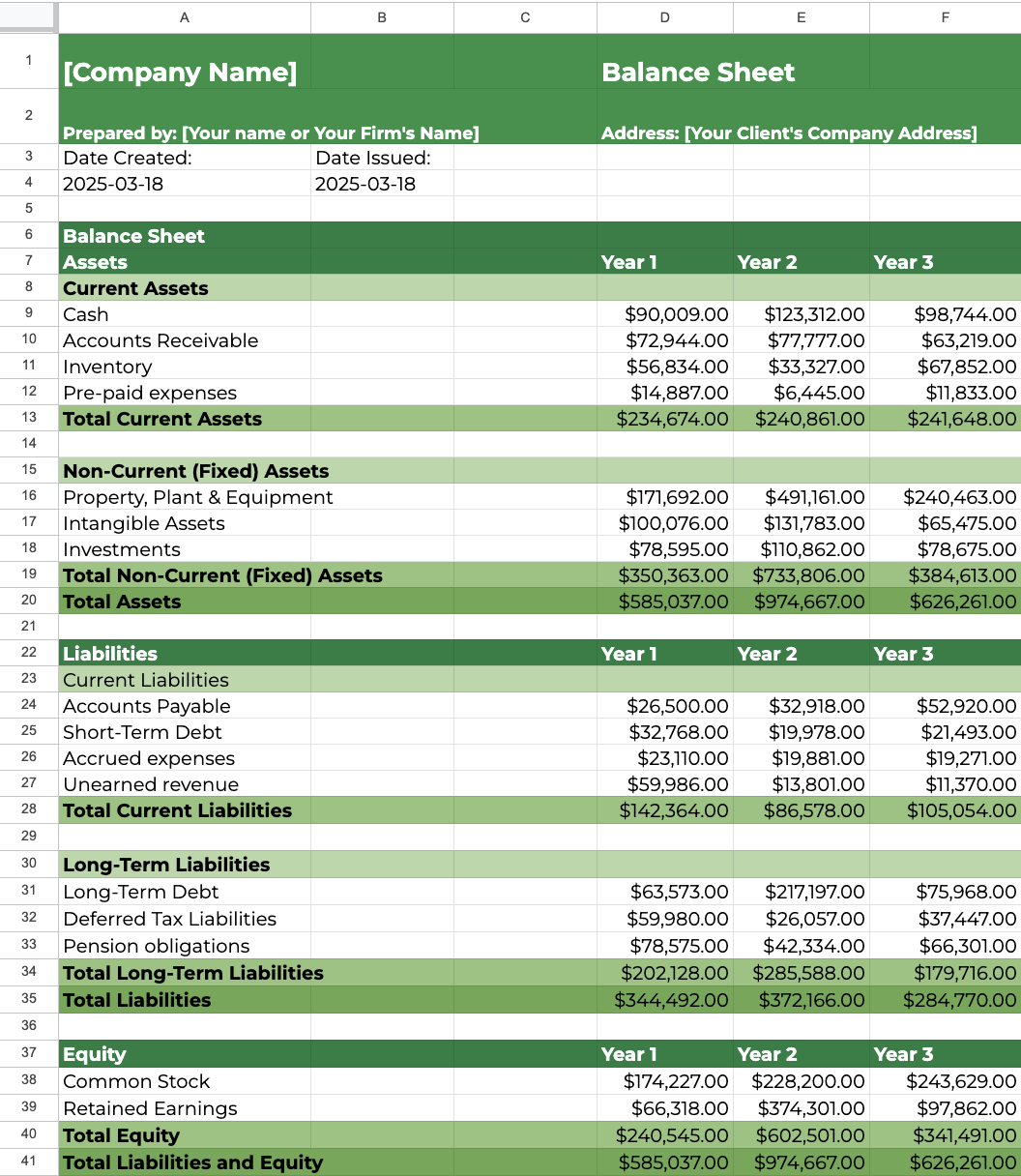

On the balance sheet, AR is grouped with other current assets like:

- Cash and cash equivalents – funds that are immediately available

- Inventory – goods that are ready to be sold

- Prepaid expenses – upfront payments for things like rent or insurance

But accounts receivable stands out from the rest. It’s not cash yet, but it represents money that’s on its way. It’s not inventory, because the product or service behind the invoice has already been delivered. There’s no additional work left to do, only the wait for payment.

Unlike fixed assets, such as machinery, buildings, or office equipment, accounts receivable isn’t a long-term investment. Fixed assets are used over multiple years and depreciate over time. AR, on the other hand, is a short-term claim on cash. It doesn’t depreciate. It doesn’t generate long-term value on its own. It simply moves through the business cycle and (ideally) turns into cash quickly.

Also, while the general ledger gives you the total accounts receivable balance, it doesn’t show the full story. AR is usually tracked in a subledger because it involves detailed transactions for multiple individual customers, and summarizing all that directly in the general ledger would be impractical.

The subledger breaks things down by individual customer, giving you a clear view of:

- Who owes what

- When each invoice is due

- Which invoices are overdue or partially paid

- Where follow-up is needed

This level of detail is essential, especially if you’re managing receivables across multiple clients or entities. It helps you stay proactive with collections, maintain accurate records, and ensure your reports (and audits) hold up under scrutiny.

Why Is Accounts Receivable an Asset?

If you go back to the textbook definition of an asset, it is a resource controlled by a business as a result of past events, from which future economic benefits are expected to flow to the entity. AR qualifies as an asset because these three things hold:

- It provides future economic benefits

AR represents the money your client will receive. The client expects to collect cash from the customer in the near future. This future inflow of cash represents the economic benefit. - It’s controlled by the entity

Your client has a legal right to collect that money. It’s a resource that the business controls, and it is tied to a contract, invoice, or delivery of service that’s already happened. - It results from a past transaction

Accounts receivable arise from a past event: the business has already sold the goods or provided the service.

Because it ticks all three boxes, accounts receivable earns its place on the asset side of the balance sheet. And understanding that helps your client make better decisions, not just about what they’ve earned, but what they still need to collect.

Where Does Accounts Receivable Appear? (The Balance Sheet)

You’ll find accounts receivable sitting under current assets on the balance sheet, usually right after cash. It’s a core part of your client’s short-term financial position because it represents money that’s expected to come in soon.

To put it in context, let’s revisit the accounting equation: Assets = Liabilities + Equity. Accounts receivable fit neatly on the left side of that equation. It adds to the total value the business owns, just like cash, inventory, or equipment. The key difference? It’s a promise of payment rather than something already in hand.

Here’s a quick snapshot from our Balance Sheet Template to show you exactly where it shows up:

That ‘Accounts Receivable’ line may look simple, but behind it could be dozens—or hundreds—of outstanding invoices. Managing it well keeps the balance sheet strong and cash flow steady.

Download our free Balance Sheet Template

The Lifecycle of Accounts Receivable: How It Works

From the moment a sale is made to when (hopefully) the cash hits the account, here’s what happens step by step:

- Sale on Credit

Your client delivers a product or service but agrees to get paid later, 30, 45, sometimes even 90 days down the line. This is the starting point of the AR cycle. - Invoice Issued

The client sends out an invoice, officially documenting the amount owed, the due date, and the payment terms. This step triggers recognition of the revenue and the creation of the AR entry. - Accounts Receivable is Created

On the books, the sale is recorded, and the receivable amount shows up under current assets. The client now has a legal claim to that money. - Collection Efforts

If payment isn’t made on time, it’s time to follow up. Emails, reminders, phone calls, this is the stage where many small businesses drop the ball and let receivables age longer than they should. - Cash Collection

When the customer pays, the AR balance goes down, and cash goes up. - Uncollectible Accounts

Sometimes, despite all efforts, a client won’t pay. At that point, the receivable may be written off as a bad debt expense. It’s not ideal, but it’s part of managing risk and keeping the books honest.

If you want to a visual aid, check out our Accounts Receivable Flowchart Guide.

Understanding the lifecycle of AR helps you not just track the numbers but actively manage them. The sooner the cash comes in, the healthier your client’s financial position.

Recording and Tracking Accounts Receivable

Since accounts receivable represent money owed by customers for goods or services delivered on credit, it impacts both the balance sheet (as an asset) and the income statement (as revenue). But more importantly, it plays a central role in double-entry accounting, where every transaction affects at least two accounts.

As a quick refresher, the general ledger is the master record of all financial transactions for a business. It houses all the major accounts (assets, liabilities, equity, revenue, and expenses) and serves as the foundation for preparing financial statements. Every journal entry, including those related to accounts receivable, flows through the general ledger.

Accounts receivable has its own account within the general ledger. So when your client records a credit sale, that transaction hits two places: a debit to the Accounts Receivable account (to show the increase in assets) and a credit to the Revenue account (to reflect income earned). These entries keep the books balanced and ensure the client’s financials reflect what’s been earned and what’s still expected in cash.

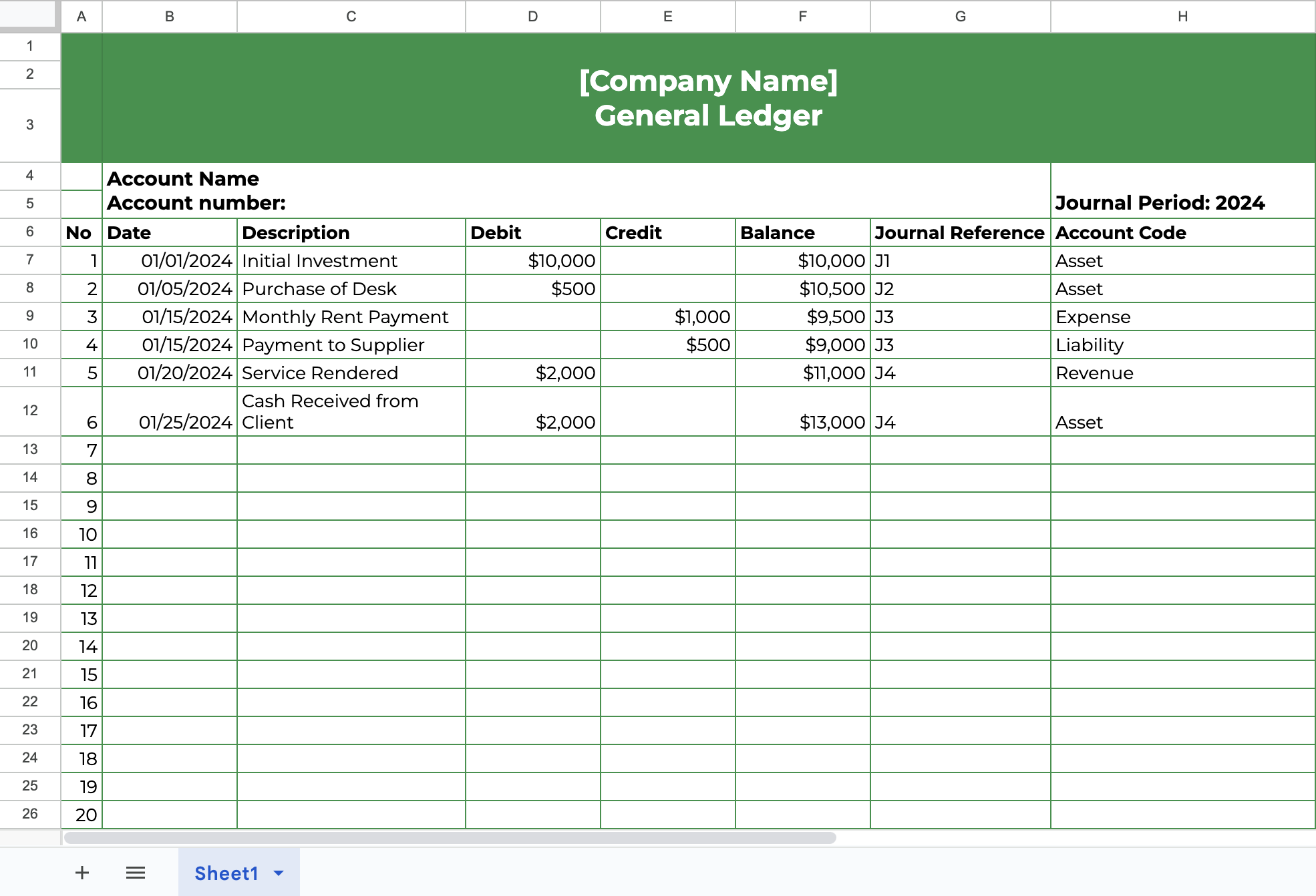

Let’s walk through how it’s recorded and tracked properly using our accounting general ledger template below.

On the General Ledger

On January 20, 2024, the business completed a $2,000 service for a client, but no cash was received at the time. This creates an accounts receivable: a legal claim to payment that hasn’t been collected yet.

To record the transaction in the general ledger, you would:

- Debit Accounts Receivable: $2,000 (to increase assets)

- Credit Revenue: $2,000 (to recognize earned income)

This entry increases both the asset total and revenue total, reflecting income earned and the expectation of future cash inflows. In the general ledger, the accounts receivable account balance increases to $11,000, incorporating this new transaction.

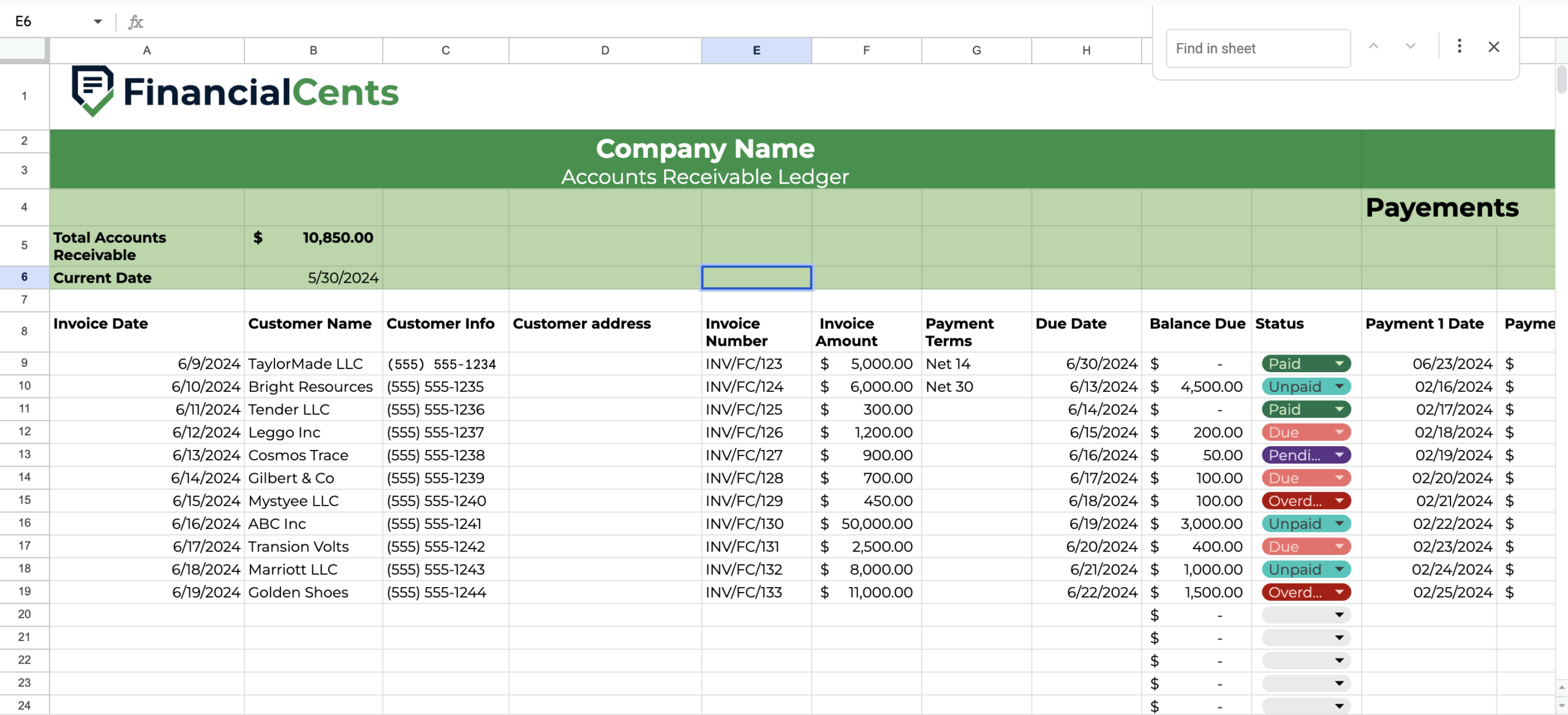

On an Accounts Receivable Subledger

While the general ledger shows the total balance of all accounts receivable and other accounts, the accounts receivable subledger breaks it down by individual customers. Let’s walk through the subledger using our accounts receivable template.

At the top of the subledger, we see a summary:

- Total Accounts Receivable: $10,850.00

- Current Date: May 30, 2024

This means that, as of this date, customers collectively owe the business $10,850 for past sales.

Each row in the subledger represents an individual invoice sent to a customer. The columns track key information such as:

- Invoice Date: When the invoice was issued

- Customer Name and Info: Who owes the money

- Invoice Number: For internal tracking

- Invoice Amount: The full amount billed

- Payment Terms: How long the customer has to pay (e.g., Net 14 or Net 30)

- Due Date: When the payment is expected

- Balance Due: The remaining amount the customer hasn’t paid

- Status: Indicates whether the invoice is paid, due, overdue, or unpaid

- Payment Dates: Records of when payments were made

Download our free Accounts Receivable Template

Managing Accounts Receivable Effectively (Best Practices)

The longer invoices go unpaid, the more they strain your client’s cash flow. Here are the best practices to help you stay on top of receivables and reduce the risk of overdue accounts:

- Clear Invoicing

Make sure your invoices are easy to understand. That means no vague descriptions, hidden fees, or unclear due dates. A clean, professional invoice helps avoid disputes and gets payments in faster. - Define Your Payment Terms (and stick to them)

Whether it’s Net 15, Net 30, or custom terms for certain clients, be consistent, and always include the terms on every invoice. Train your clients to respect those timelines. - Set a Credit Policy

If your client offers credit, help them define who qualifies and how much they’re willing to extend. A solid credit policy protects against overexposure to customers who may not pay on time. - Use an AR Automation Software

Manual tracking is risky and time-consuming. Tools like QuickBooks, Xero, or specialized AR software can automate invoicing, reminders, and payment tracking. If you’re using Financial Cents, you can even integrate AR follow-ups into your workflow system. - Perform Regular Follow-Up

Don’t wait until an invoice is 60+ days overdue. A quick reminder a few days before the due date (and again right after if unpaid) can make a big difference. - Offer Multiple Payment Options

Make it easy for clients to pay, credit card, bank transfer, online payment portals, even mobile money, if it’s relevant. The fewer barriers to payment, the faster the cash hits your client’s account.

Keeping Track and Managing Multiple ARs for Clients

Accounts receivable isn’t just another line on the balance sheet; it’s the engine behind a healthy cash flow. And when you’re managing books for multiple clients, keeping AR organized becomes essential.

The reality is, manually tracking dozens of invoices, due dates, and follow-ups across different businesses can quickly become unmanageable. One missed reminder or delayed task can create cash flow issues for your client and unnecessary stress for your team.

This is where the right system makes all the difference.

With a practice management platform like Financial Cents, you can streamline your AR process across your entire client base. The platform allows you to:

- Build standardized AR workflows to maintain consistency across clients

- Assign tasks to team members and track progress in real time

- Set automatic reminders and recurring AR tasks based on invoice schedules

- Gain visibility into what’s due, what’s overdue, and what’s already completed

You no longer have to rely on scattered spreadsheets or memory. With the right tools in place, you can stay in control, keep your team aligned, and help your clients maintain a strong financial position.

Use Financial Cents to manage accounts receivable more efficiently and build a proactive, well-organized accounting practice.