The finance and accounting industry is in a challenging position. Currently, 85% of companies are struggling to hire finance managers. Moreover, between 2020 and 2022, a staggering 300,000 accountants left the field, as reported by the Wall Street Journal. On top of that, there is a decline in accounting graduates. Simply put, the demand for skilled accountants far exceeds the supply, and firms are feeling the repercussions.

How can firms adapt to this challenging landscape and continue to serve clients effectively? AI accounting software offers a compelling solution. By automating manual, repetitive tasks, reducing errors, and crunching data fast, AI can handle essential yet tedious work.

As Logan Graf, CPA, puts it,

AI is taking our jobs.. No, AI is only taking the work that we don’t want to do. So let's try to reframe how we think about AI"

By handling these routine tasks, AI helps firms work smarter with fewer people on board.

AI is no longer optional or a nice-to-have; it’s a necessity for accounting or bookkeeping firms who want to scale and remain competitive.

The 10 Smart Ways to Use AI Accounting Systems in Your Firm

Here are ten smart and efficient ways to incorporate AI into your processes.

1. Creating Accounting Workflow Processes in Seconds

Having a workflow process is important. Without clear processes in place, things can quickly spiral into chaos: missed deadlines, tasks falling through the cracks, and team members not knowing what’s next.

But here’s the problem: setting up those processes often feels like a task in itself. It can be time-consuming and sometimes overwhelming, especially if you have to create multiple to accommodate different clients, services, or projects.

But with AI, you can create as many detailed accounting workflows as you want instantly.

For example, Financial Cents, an accounting practice management software, has a ChatGPT integration, which lets you easily create templates documenting your processes in seconds. This ensures your team is efficient and maintains a high standard of work consistently. It also helps you scale.

2. Automating Data Entry and Reconciliation

Data entry is one of the most tedious aspects of Accounts Payable (AP). In fact, a 2019 survey found that 46% of finance professionals listed it as their biggest pain point. Not far behind, with 16% of respondents, is the headache of matching invoices to purchase orders—a process known as invoice reconciliation or PO reconciliation.

It’s time-consuming, prone to errors, and, let’s be honest, no one enjoys sifting through piles of paperwork.

AI accounting software like Sage Intacct and Ramp takes the heavy lifting off your plate by automatically extracting data from invoices, receipts, and bank statements and then cross-checking it against purchase orders and other documents.

This saves time and reduces the chances of errors, such as duplicate payments. And the best part? The AI learns from your firm’s historical data, getting better at recognizing patterns and spotting discrepancies over time. This way, no more mundane tasks or manual data entry, buying you time to focus on providing strategic advice to clients.

3. Enhancing Accounts Payable and Accounts Receivable Management

Managing accounts payable (AP) and accounts receivable (AR) can feel like an endless juggling act. It takes a whole lot to track due dates and send invoices, chase down payments, and monitor cash flow.

According to IFOL Research, 56% of finance professionals spend more than ten hours a week processing invoices and supplier payments. Add to that the frustrations of excessive manual data entry (21%) and delays caused by processing invoice exceptions (22%), and it’s clear this is an area ripe for improvement with AI.

For AP, AI-powered tools like Airbase or Nanonets can automatically process and categorize invoices, flag duplicate entries, and even set up payment schedules to ensure nothing slips through the cracks. Need to approve payments quickly? The system can alert you when an invoice requires review, saving time and reducing delays.

On the AR side, AI simplifies invoice generation, tracking, and follow-ups. For instance, the software can automatically send reminders to clients before a payment is due or nudge them when an invoice becomes overdue—without you lifting a finger. It can also generate real-time reports on outstanding payments, helping you or your clients maintain better cash flow visibility.

4. Facilitating Client Communication and Support

Managing communication manually with clients takes much time and effort. There are always emails to respond to, follow-ups to send, and reminders to draft. And with multiple clients, it’s easy for messages to pile up or slip through the cracks entirely. Missed emails or delayed responses can damage relationships, frustrate clients, and create unnecessary stress for you and your team.

Clear and timely communication is the backbone of excellent client service, and AI can help you provide that to your clients.

As Shahram Zarshenas, CEO of Financial Cents, says,

I believe that a lot of the firms that don't adopt AI could fall behind because other firms that adopt it will be able to provide a better client experience. They will be more efficient and profitable and can reinvest their time to grow more effectively."

Tools like Financial Cents’ AI email template generator can help you craft professional, client-specific emails in seconds. If you need to request missing receipts, follow up on overdue payments, or provide a quick project update, simply input the context, and the AI generates a polished, ready-to-send email.

You can then save the template within Financial Cents for future use. This saves time, ensures consistency, and eliminates the stress of drafting communications from scratch.

In general, AI allows you to respond faster, stay organized, and maintain a professional tone in every interaction, all while spending less time glued to your inbox. It’s a simple way to deliver exceptional support and keep your clients happy without overloading your team.

5. Marketing Your Services

Marketing often takes a backseat in accounting firms, and we get why. You’re so busy managing clients, balancing books, and meeting deadlines that you just don’t have the time to write blog posts, draft newsletters, or plan social media campaigns. But the problem is that in today’s competitive market, you can’t afford not to market your firm.

Without consistent marketing, it’s harder to attract new clients, build your brand, or stay top of mind with existing ones. Producing high-quality, engaging content takes time, creativity, and effort, but with AI, marketing becomes faster and more manageable.

As Mark Wickersham, Chartered Accountant and #1 best-selling author, Value Pricing Academy, explains:

It is particularly useful in marketing because one of the most powerful forms of marketing is content creation, content marketing, whether that is creating blog posts, articles, social media posts, and ChatGPT is great for that."

AI can help you brainstorm topics, draft blog posts, create social media captions, or even write client newsletters in minutes. For instance, say you need to craft a LinkedIn post highlighting your firm’s tax planning expertise. AI can generate a professional and engaging draft that you can tweak and publish right away.

By automating the heavy lifting of content creation, AI lets you maintain a strong marketing presence without eating into your valuable time. It’s like having a virtual marketing assistant who works around the clock to keep your firm visible, credible, and growing.

6. Streamlining Tax Compliance and Filing

Tax season is often the most stressful time of year for accounting firms. The mountain of paperwork, tight deadlines, and ever-changing tax regulations can leave even the most organized teams scrambling. Missing a deadline or misunderstanding a rule isn’t just inconvenient; it can result in penalties for your clients and damage your firm’s reputation.

However, tax compliance requires absolute precision, and the manual processes traditionally involved are prone to errors.

This is where AI technology comes to the rescue.

It can analyze financial records with speed and accuracy, categorize transactions, and even flag deductions or credits that might have been overlooked. It can also stay up to date with changing tax laws, ensuring every return is compliant with the latest regulations. What’s more, these systems can identify inconsistencies or errors early, giving you ample time to correct them before submission.

By streamlining the tax process, AI reduces the pressure on your team, eliminates costly mistakes, and allows you to handle more clients with less stress. Tax season may never be a breeze, but with AI in your corner, it’s a lot easier to manage.

7. Improving Financial Forecasting and Budgeting

Projecting future revenue, expenses, or cash flow often involves a lot of manual effort. The process can be painstaking—gathering data from multiple sources, analyzing trends, and accounting for market variables—all while trying to ensure nothing important is missed.

Unfortunately, it’s easy to make mistakes with traditional methods of forecasting and budgeting. And a single miscalculation can snowball, leading to inaccurate projections that impact strategic decisions, client trust, and long-term planning.

But with advanced algorithms and real-time data analysis, AI takes the guesswork out of forecasting and budgeting. It can analyze historical financial data, identify patterns, and incorporate market trends to create highly accurate predictions.

For example, instead of manually compiling spreadsheets to project cash flow, this technology can instantly generate forecasts based on up-to-date financial inputs. It can also simulate different scenarios, like what happens if sales drop 10% or expenses rise 15%, giving you actionable insights in minutes to build budgets for clients.

AI helps save time and delivers more precise and reliable forecasts. This enables your firm to offer clients better financial planning, helping them make informed decisions about their future.

8. Detecting fraud and data breaches and managing risk

Accountants handle some of the most sensitive financial data out there, which puts firms at risk of cyberattacks. In fact, the financial services industry reported 744 data compromises in 2023 alone, ranking second among all industries, according to the ITRC data breach report. Worse still, the total number of data compromises in the U.S. that year hit an all-time high.

It’s not just data breaches that pose a threat. Fraud is another serious issue. Fraudulent transactions can easily slip through the cracks of manual review processes, leaving firms scrambling to identify and mitigate risks.

Advanced AI tools excel at detecting fraud, preventing data breaches, and managing risks in ways traditional methods simply can’t match.

AI-powered systems can monitor financial data in real-time, analyzing patterns and flagging anomalies like unexpected transactions or unusual account activity that could indicate fraud. These tools can also help identify vulnerabilities in your systems, offering proactive solutions to shore up your defenses against cyberattacks.

When it comes to managing data breaches and risk, these tools can detect suspicious activity or vulnerabilities early, limiting the damage and ensuring you meet compliance requirements. Additionally, they provide detailed audit trails, making it easier to investigate and resolve issues when they arise.

9. Automating Payroll Processing

Payroll processing is an essential task businesses need help with, but it can be complicated. You have to track hours, calculate taxes, deduct benefits, and ensure compliance with ever-changing labor laws, all while meeting strict deadlines. In addition to that, there are challenges of managing payroll for a growing team or clients with employees in multiple jurisdictions.

This can cause costly mistakes, as a miscalculation could lead to overpaying or underpaying employees, triggering penalties, or causing issues with the client.

By automating payroll processes, AI eliminates many of the manual tasks that make payroll such a headache. It calculates wages, tax withholdings, and benefits with precision, ensuring employees are paid accurately and on time.

Some systems even offer features like auto-generated pay stubs and direct deposit setups, saving time and reducing administrative hassle. Plus, AI can flag potential discrepancies so you can resolve them before they become bigger problems.

10. Optimizing Client Expense Management

For many accounting firms, helping clients manage their expenses feels more reactive than proactive. It’s a constant cycle of chasing documentation and clarifying questionable transactions.

Without clear oversight, clients can overspend, miss opportunities to reduce costs, or even fall out of compliance with tax regulations. It’s frustrating for your team and potentially costly for your clients.

AI-powered expense management systems take the guesswork out of tracking and categorizing expenses. By integrating with bank feeds, credit card transactions, and receipt scanning apps, AI can automatically record and organize expenses with Optical character recognition (OCR). No more sifting through piles of receipts or manually entering data into spreadsheets.

AI doesn’t just make the process faster. It also makes it smarter. It can flag duplicate or unusual expenses, identify cost-saving opportunities, and provide real-time insights into spending trends. For example, if a client’s travel expenses suddenly spike or a subscription fee doubles, AI alerts you, allowing you to address the issue promptly.

By streamlining expense management, AI reduces errors, saves time, and empowers clients with better financial insights. For your firm, it means fewer headaches and more capacity to offer strategic advice. It’s a win-win that transforms a tedious task into a smooth, efficient process.

How Financial Cents Supports AI-Driven Efficiency for Accounting Firms

When it comes to managing client work and keeping everything on track, Financial Cents offers an all-in-one solution built specifically for accountants and bookkeepers. It’s designed to help you handle task management, client communication, and workflow automation from one easy-to-use platform.

But here’s where it gets even better: with AI features integrated into the software, Financial Cents doesn’t just organize your work; it boosts it.

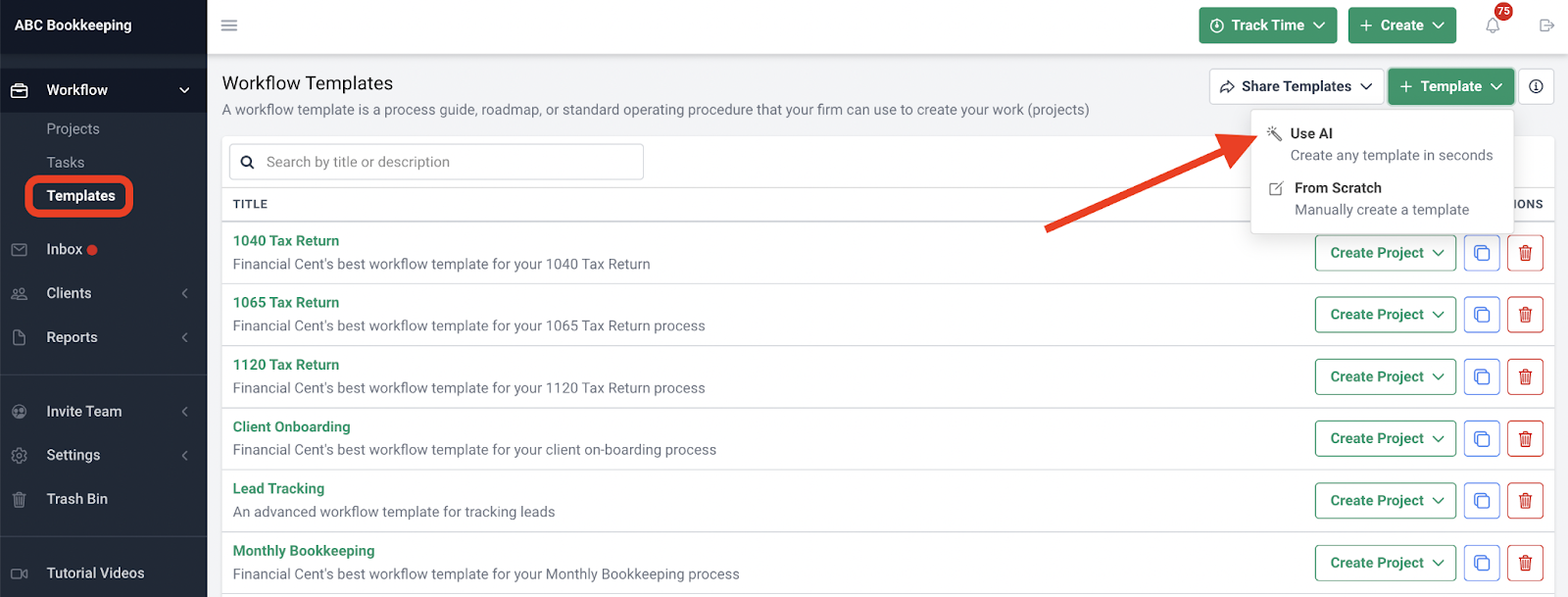

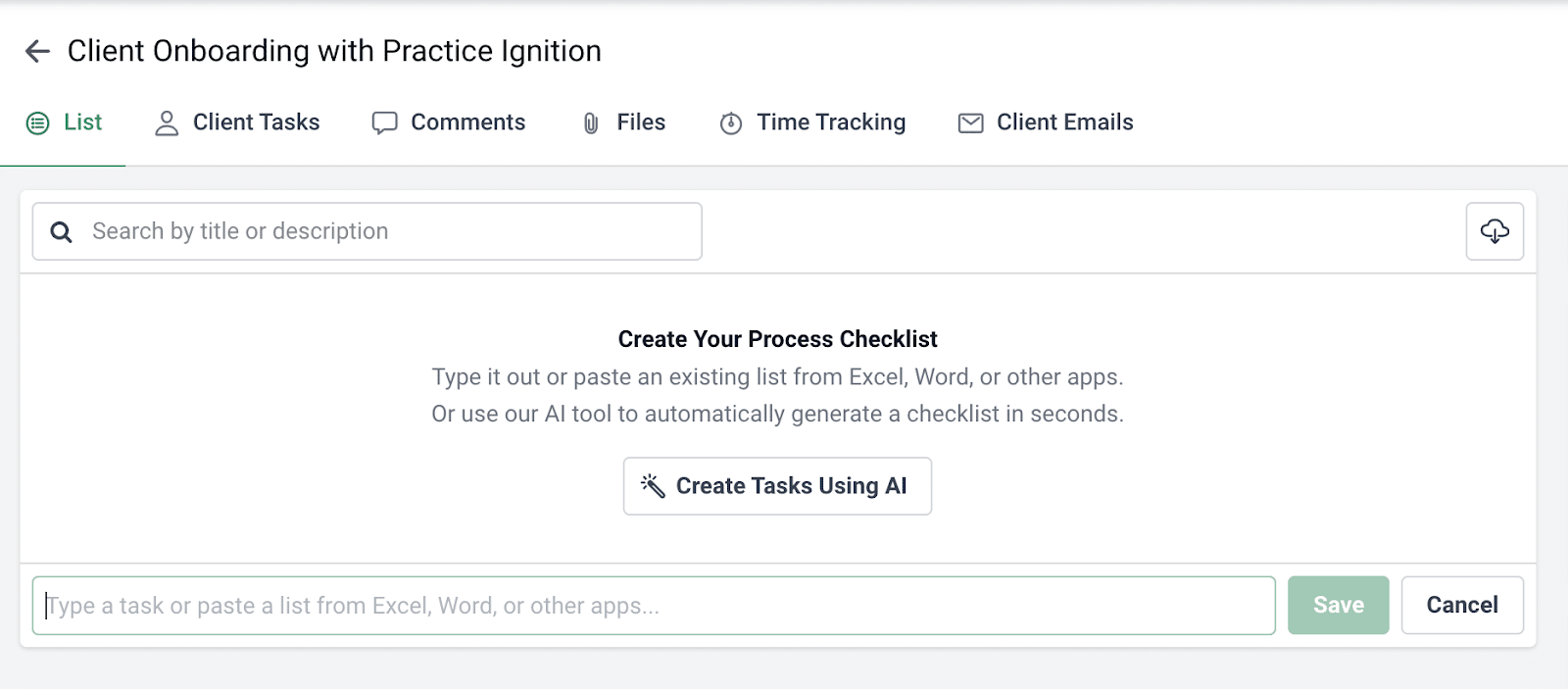

Our ChatGPT integration allows you to easily create templates within seconds. All you need to do is first click “Templates,” then click “+ Template,” and select “Use AI”:

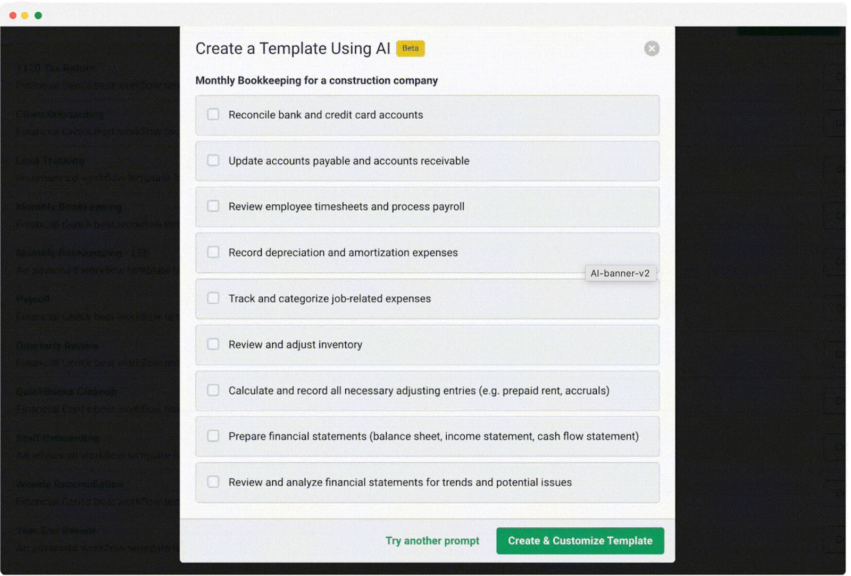

Then, simply describe the workflow you want (e.g., monthly bookkeeping tasks or tax preparation for small businesses), and the AI will generate a detailed checklist immediately. You can then customize it further to match your firm’s exact needs:

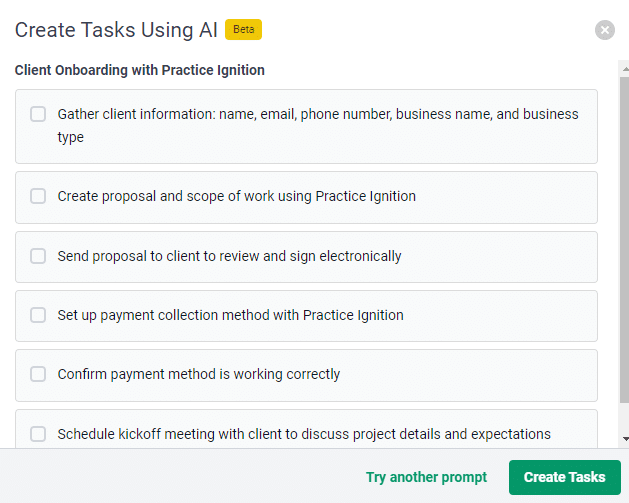

You can also use it to create tasks within projects instantly. Simply open the new project and select “Create Tasks using AI”:

Then click “create tasks”:

That’s it! The system will populate the page with the tasks you need to complete the project, which you can customize to suit your specific needs.

Embrace AI To Prepare Your Firm for the Future

Incorporating AI into your accounting processes isn’t just about keeping up with the latest technology but investing in your firm’s future. It automates time-consuming tasks, reduces errors, and streamlines your workflow so you can shift your focus away from repetitive tasks and spend more time on strategic services that add real value for your clients.

You can use software like Financial Cents to be even more efficient. Our platform helps you simplify client work management, enhance communication, and optimize your daily operations while delivering a better experience for your clients.

Ready to take your firm to the next level?

Use Financial Cents to Manage Your Firm.