You’ve likely encountered the terms subledger and general ledger while managing books or reviewing client accounts. Maybe it was during the month-end close, or while trying to track down a missing transaction. You paused for a second…Wait, what’s the difference again?

It’s a common moment of confusion, and even the best of accountants sometimes need a little reminder. Understanding the difference between a subledger and a general ledger is essential for accurate and efficient financial management. It helps you spot errors faster, streamline reporting, and keep your records audit-ready.

In this guide, you’ll get a clear breakdown of a subledger vs a general ledger, how they work together, and why both matter. At its core, the general ledger gives you the big picture, while subledgers give you the supporting details behind that picture. Let’s break it down.

What Is a General Ledger?

The general ledger is the master book of accounts for a business. It’s where all financial activity comes together in one place.

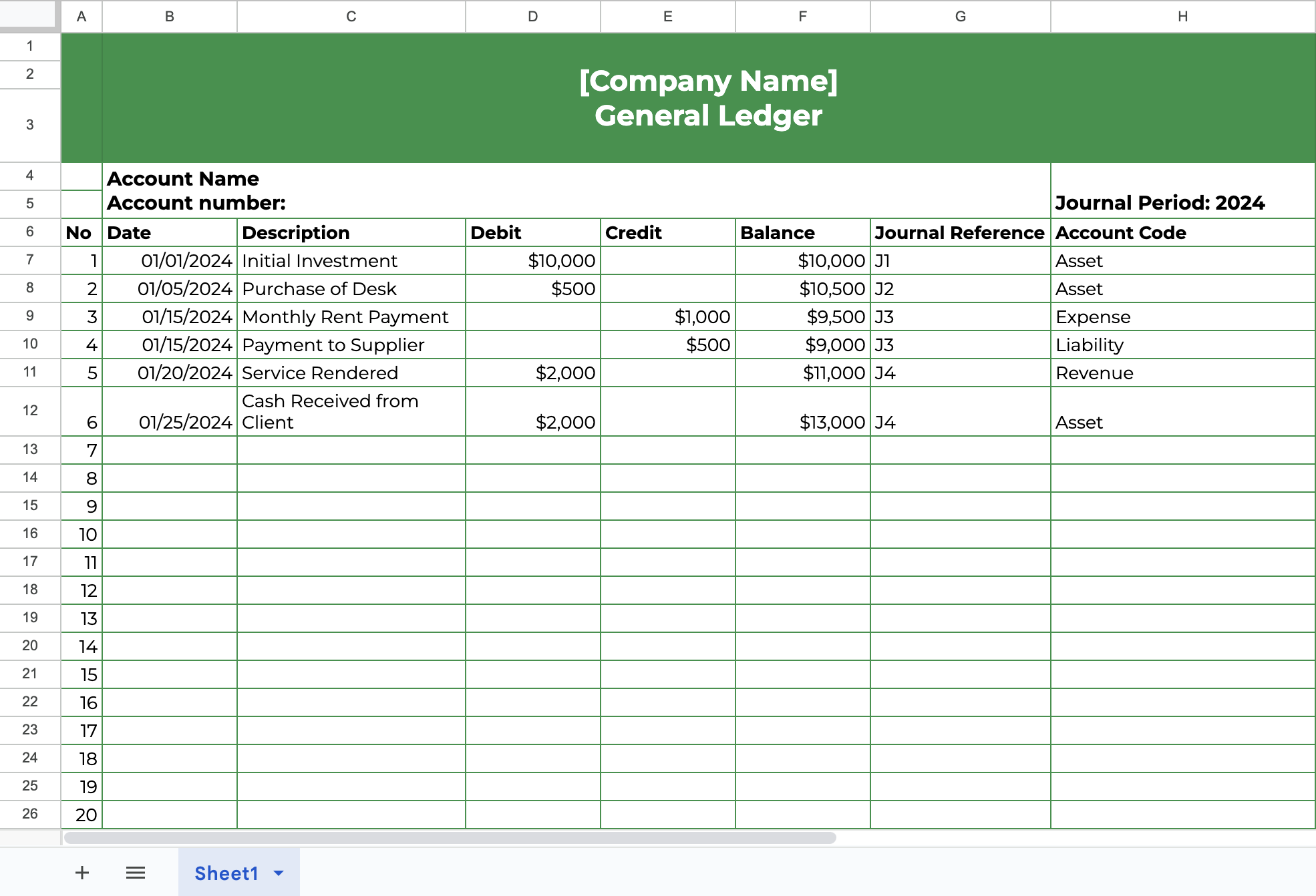

It is often referred to as the GL, and it records every financial transaction a business makes, organized by account, such as cash, accounts receivable, revenue, or expenses. It’s the central source used to prepare your client’s key financial statements: the balance sheet, income statement, and cash flow statement.

The general ledger doesn’t usually track every little detail. Instead, it summarizes transactions that often come from more detailed subledgers. For example, individual sales or vendor payments are first recorded in the sales or accounts payable subledgers, and then the totals are posted to the general ledger.

It also plays a crucial role in double-entry accounting. That means for every transaction, two accounts are affected, one is debited, and the other is credited. The general ledger ensures that everything remains balanced.

If you’re looking to go deeper, we’ve broken down how the general ledger works in real-world scenarios and why it’s so important to accurate financial reporting and decision-making.

What Is a Subledger?

A subledger, or subsidiary ledger, is like a supporting book that holds the nitty-gritty details behind a specific type of transaction. Instead of crowding your general ledger with every single customer payment or vendor bill, subledgers help keep things clean and organized.

Each subledger focuses on a specific category, like accounts receivable, accounts payable, fixed assets, or inventory. So, for example, your accounts receivable subledger would track every invoice you’ve sent and every payment you’ve received from customers. Then, it feeds the summarized totals into the general ledger under the appropriate account.

While subledgers aren’t always required, they’re essential when you’re dealing with a high volume of transactions or need more detailed tracking. Without them, your general ledger would quickly become overwhelming and hard to manage.

Types of Common Subledgers

Now that you know what a subledger is, let’s look at some of the most common types you’ll use in day-to-day accounting.

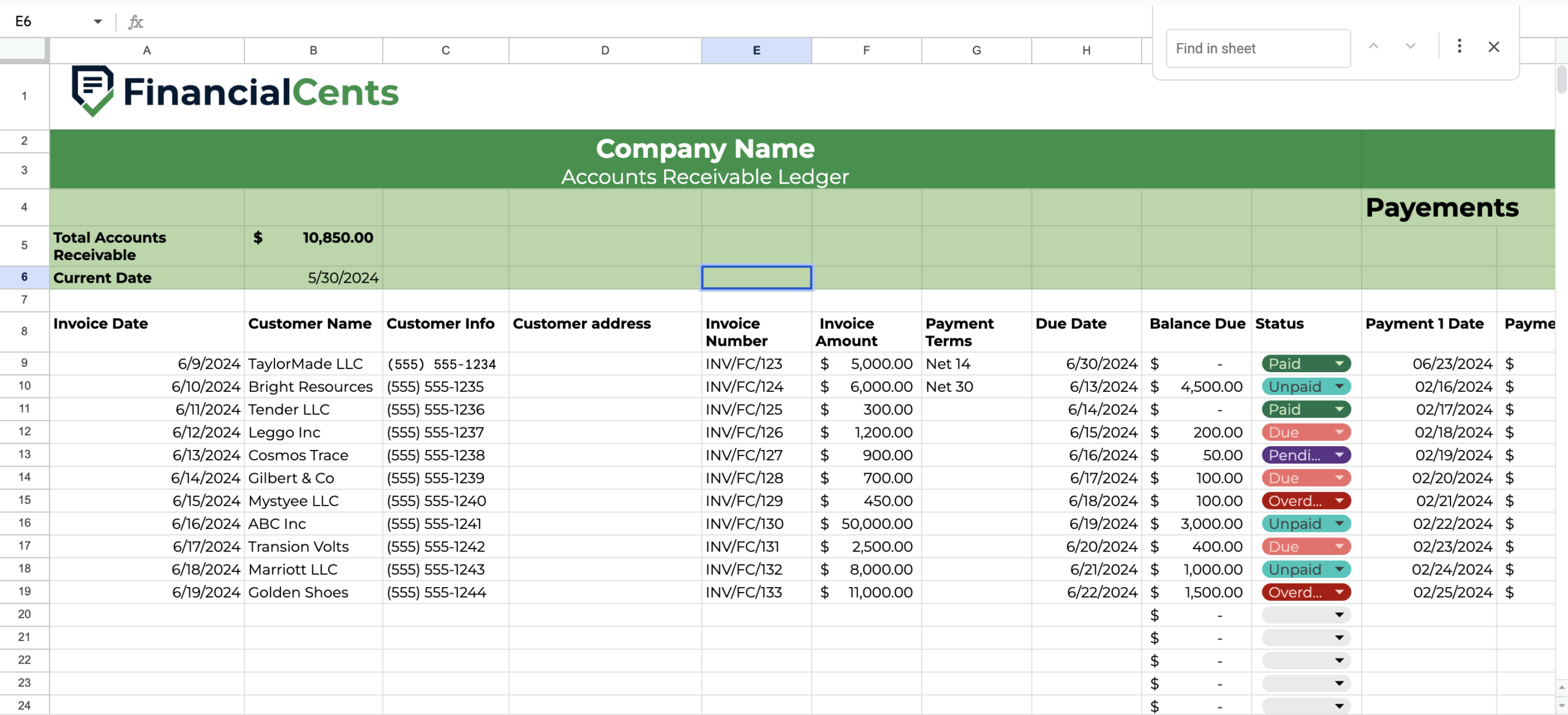

1. Accounts Receivable (AR) Subledger

This subledger tracks the money your client expects to receive from their customers. Each entry in the accounts receivable (AR) subledger represents a specific invoice that was sent out, along with any payments received against it. This helps your client monitor who has paid, who hasn’t, and how much is still outstanding.

Download the accounts receivable template

For example, if your client runs a dental clinic, the AR subledger will show a list of patients who have received services but haven’t completed their payments. You might see Jane Doe listed with a $200 charge for a routine cleaning and John Smith with a $1,000 charge for a crown procedure. These individual balances are recorded in the subledger and then summarized into a single total in the general ledger under the “Accounts Receivable” control account.

This setup enables your client to manage customer payments with precision while keeping the general ledger clean and organized for financial reporting.

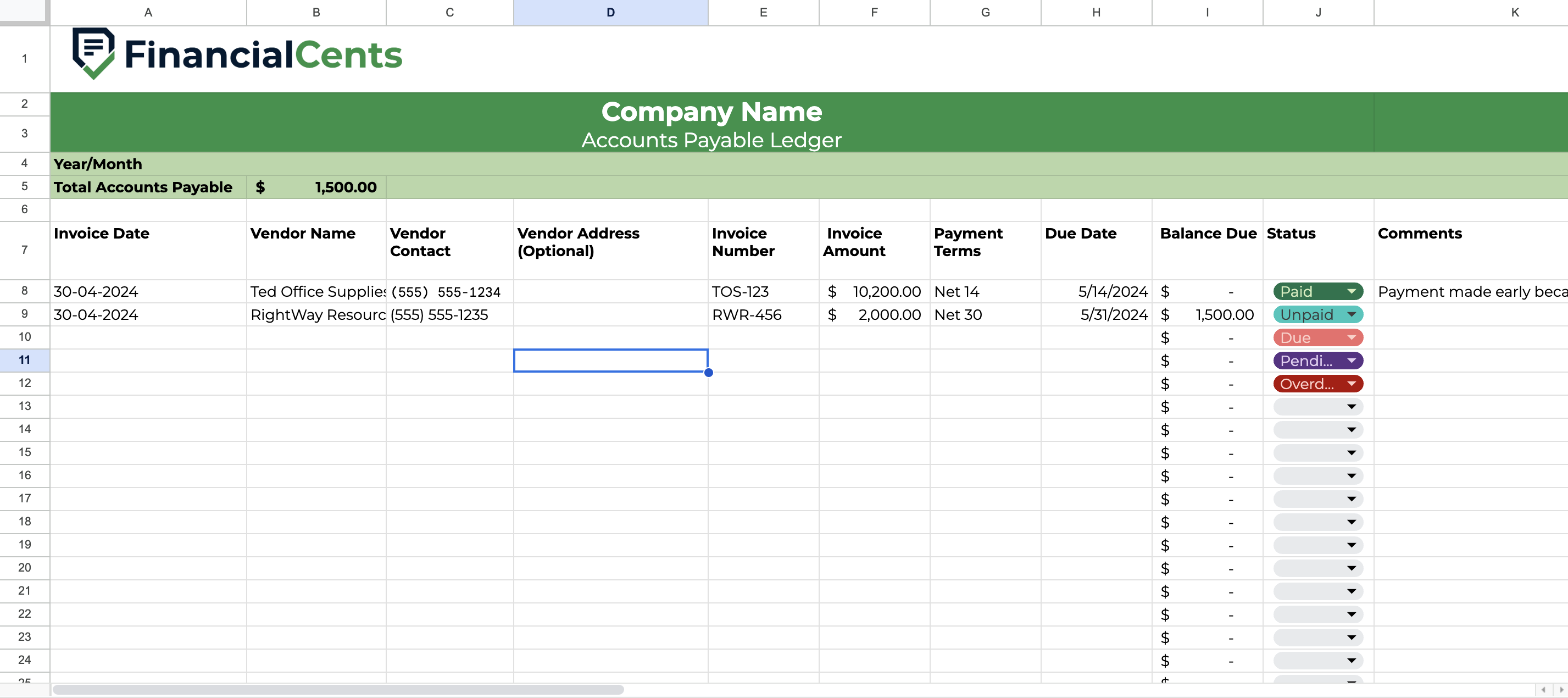

2. Accounts Payable (AP) Subledger

The Accounts Payable (AP) subledger tracks all the money your client’s business owes to others. This includes payments due to vendors, suppliers, service providers, or contractors. Each time your client receives an invoice for goods or services, that transaction is entered into the AP subledger. It stays there until the invoice is paid.

Download the accounts payable template

For example, let’s say your client runs a dental clinic and regularly orders supplies. If they purchase gloves from Vendor A for $500, that invoice is recorded in the AP subledger under Vendor A. Later, they might buy equipment from Vendor B for $1,200, which is also recorded in the subledger under Vendor B.

The AP subledger allows you to see exactly how much is owed, to whom, and when each payment is due. This level of detail helps prevent missed payments, manage cash flow, and maintain strong vendor relationships.

3. Fixed Assets Subledger

The fixed assets subledger is used to track high-value items that your client’s business owns. These are long-term assets, such as equipment, vehicles, machinery, or office furniture, that are not intended for immediate resale. This subledger records important details for each asset, including the purchase date, original cost, expected useful life, depreciation schedule, and current book value.

For example, if your dental client purchases a new X-ray machine for $15,000, that transaction is recorded in the fixed assets subledger. Over time, the subledger will track the annual depreciation of the machine’s value. It will also reflect the updated value of the asset as it ages.

4. Inventory Subledger

If your client sells physical products, the inventory subledger is essential for tracking stock levels. It maintains a detailed record of the items in stock, those that have been sold, and what needs to be reordered. This helps prevent stockouts, overstocking, and confusion during busy periods.

For example, your client is managing a warehouse for a logistics company. They might have 1,000 units of Product A, 500 units of Product B, and smaller quantities of several other items. Each time a product is sold or shipped, the activity is recorded in the inventory. This ensures the inventory count stays accurate at all times.

5. Payroll Subledger

This subledger maintains a detailed record of all employee compensation-related activities. That includes wages, bonuses, tax withholdings, health insurance deductions, pension contributions, and any other payroll-related costs. Instead of logging a single total in the general ledger, the payroll subledger breaks it down by employee and by pay period.

For example, your firm has five employees. In a given month, the payroll subledger might show that you paid $3,000 to your administrative assistant. It would also record that $400 was withheld for taxes, along with any other deductions like health insurance or retirement savings. This level of detail makes it easy to verify payroll calculations and respond to questions from employees, auditors, or tax authorities.

At the end of the period, the payroll software or accounting system takes the totals from the subledger and posts them to the appropriate accounts in the general ledger.

Subledger vs. General Ledger: The Key Differences

By now, you’ve probably picked up that subledgers and the general ledger work hand in hand, but they serve very different purposes. To make it easier to see how they compare, here’s a side-by-side breakdown of the key differences between the two:

| Feature | Subledger (Subsidiary Ledger) | General Ledger (GL) |

| Level of Detail | High detail—tracks individual transactions (e.g., every invoice or payment) | Summarized—shows totals by account, not individual entries |

| Purpose | To track specific types of transactions in detail | To provide a complete, high-level view of the company’s finances |

| Accounts | Specific accounts like AR, AP, payroll, inventory, etc | All charts of accounts, including assets, liabilities, equity, income, and expenses |

| Frequency of Updates | Updated frequently, often daily or in real time as transactions occur | Typically updated at the end of an accounting period or after subledgers are posted |

| Balance Check | Not always self-balancing. It relies on reconciliation with the GL | Must always be balanced (total debits = total credits) |

| Financial Statement Role | Supports financial statements by providing backup data | Feeds directly into financial statements like the balance sheet and income statement |

| Primary Users | Accountants managing day-to-day transactions and reconciliations | Controllers, CFOs, and auditors reviewing overall financial health |

In simple terms, subledgers are where the action happens, tracking day-to-day activity in granular detail. The general ledger, on the other hand, is where all those details get rolled up to give you the big picture.

So, when you’re preparing a financial statement or presenting a summary to stakeholders, you’ll rely on the general ledger. But if you need to dig into a discrepancy or trace a specific transaction, you’ll go straight to the subledger.

Both play a critical role. Subledgers make sure the data is accurate and organized. The general ledger makes sure that data is complete and ready for reporting.

Download our Free General Ledger Template

How They Work Together in Accounting

So, how do subledgers and the general ledger connect? It all comes down to something called a control account.

A control account lives in your general ledger and acts like a summary bucket for a specific type of transaction. For example, you might have a control account called Accounts Receivable in your GL. But that account doesn’t show you who owes you money or how much each customer owes; it just shows the total outstanding amount across all customers.

That’s where the subledger comes in.

Your accounts receivable subledger holds the detailed breakdown: every customer’s name, their invoices, payments, due dates, and balances. So if the control account in your GL says you’re owed $50,000, your AR subledger should show exactly how that $50,000 breaks down across all your customer accounts.

It works the same way with other categories, such as accounts payable, inventory, or payroll. The general ledger provides the overall total; the subledger provides the transaction-level detail that supports it.

You can run financial statements from your GL and still trace any number back to its source in a subledger.

The Reconciliation

One of the most important things to keep in mind is that the total balance in the subledger must match the balance in the control account in the general ledger. Always.

For example, if your accounts receivable control account in the GL shows a $50,000 balance, the sum of all individual customer balances in the AR subledger should also add up to $50,000. If it doesn’t, that’s a red flag, which indicates that something’s off, and it’s time to investigate.

This matching process is called reconciliation, and it’s key to keeping your books accurate and your financial statements trustworthy.

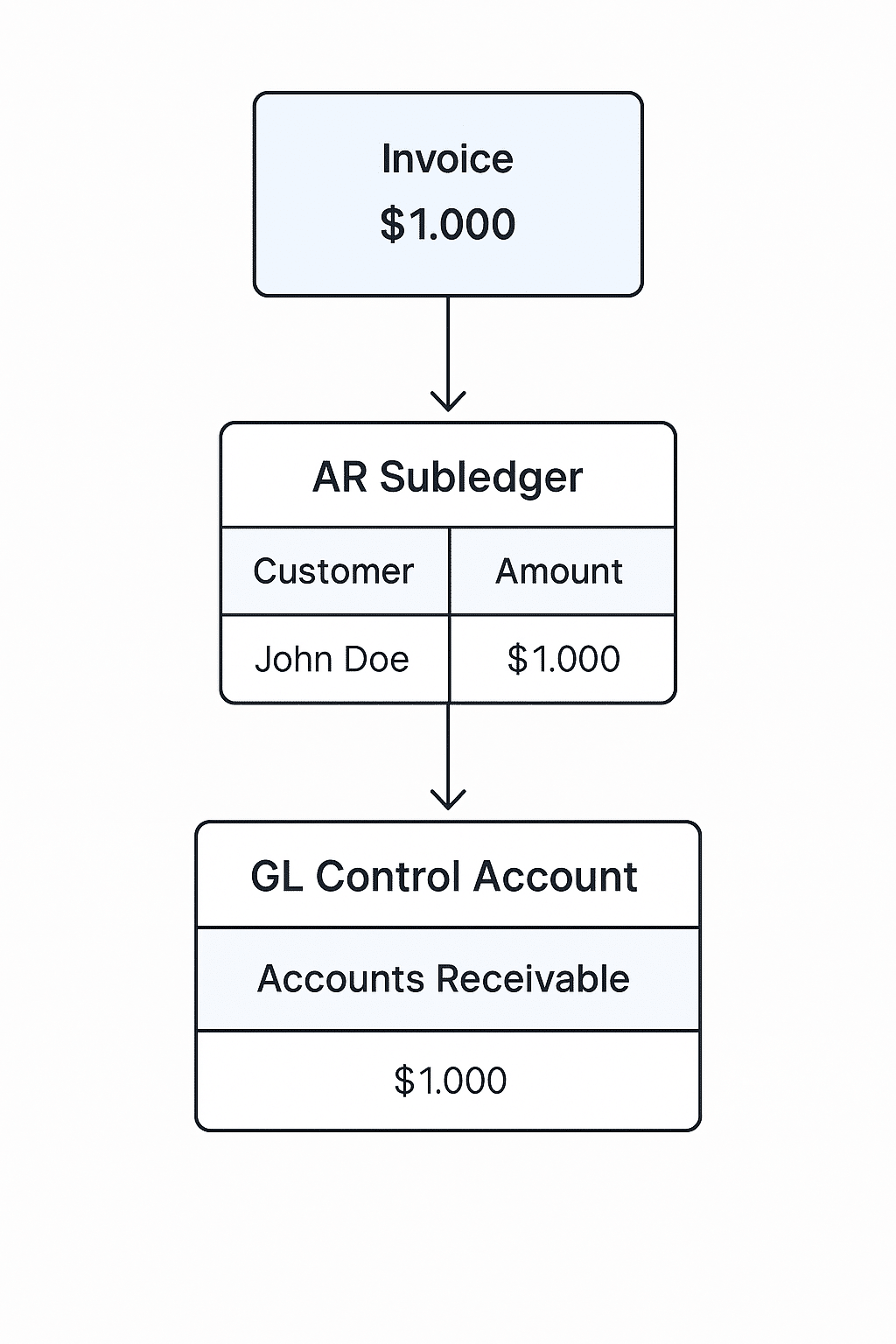

The Flow

When a transaction occurs, such as sending an invoice to a customer for $1,000, it’s first recorded in the subledger. In this case, it is recorded in the accounts receivable (AR) subledger, which is linked directly to that specific customer’s account.

The subledger holds all the details tied to that transaction. You can track the due date, any partial payments, discounts, or adjustments over time. It gives you a full picture of what’s happening with that individual invoice.

Then, the total from the subledger is summarized and posted to the control account in the general ledger. That same $1,000 invoice is now reflected in the accounts receivable control account, adding to the overall balance the business is owed.

This flow happens for every transaction, whether it’s related to AR, accounts payable, payroll, or inventory.

Here’s a simple diagram to visualize it:

This flow helps ensure your accounting system stays structured, scalable, and accurate, especially when you’re managing hundreds or even thousands of transactions.

Benefits of Using Subledgers in the Accounting System

Subledgers aren’t just about keeping things tidy; they improve how your entire accounting system works. Here’s how:

Enhanced Detail & Specificity

Trying to track every transaction inside your general ledger is like trying to find one file in an overstuffed cabinet. With subledgers, you don’t have to. Want to know how much a specific customer owes? Or what you paid a vendor last month? You just check the right subledger; everything is sorted by category, and the details are right there.

Improved Accuracy & Error Detection

Since subledgers track each transaction individually, it’s much easier to spot when something’s off. Perhaps an invoice was entered twice, or a payment was missed. When examining the detail level, these kinds of errors become apparent before they’re recorded in your general ledger and impact your reports.

Stronger Internal Controls

Subledgers also help tighten up your process. One person can handle the detailed entries in the subledger, while someone else reviews the totals in the general ledger. This kind of separation helps prevent fraud, boosts accountability, and gives you better oversight.

Efficiency

Instead of clogging up your general ledger with hundreds (or even thousands) of daily transactions, subledgers handle the volume. That means faster data entry, easier reconciliations, and smoother month-end closes. If you’re juggling a lot of transactions, this organization is a game-changer.

Better Reporting

Need to generate a report that shows which customers are overdue or which vendors you still owe? Subledgers make that easy. Because the information is already grouped and detailed, you can create focused reports that help you manage cash flow, plan ahead, and make better decisions.

Clear Audit Trail

Subledgers create a transparent link between individual transactions and your general ledger. Auditors (and you) can easily trace numbers on financial statements back to their source documents. That transparency makes financial audits process smoother and helps prove your books are accurate and compliant.

Using Software to Manage Subledgers and General Ledgers

In the past, managing subledgers and general ledgers manually could be time-consuming and prone to errors. Flipping through spreadsheets, tracking down missing entries, and manually reconciling balances was tedious, and it also left plenty of room for mistakes.

Today, modern accounting software makes this process much easier and more efficient. Most general ledger systems now include built-in subledger functionality. You can link specific subledgers, such as accounts receivable, accounts payable, or payroll, directly to their control accounts in the general ledger. As transactions are entered into the subledgers, the software automatically summarizes and posts the totals to the correct GL accounts. This reduces manual data entry and speeds up reconciliation, while also improving accuracy.

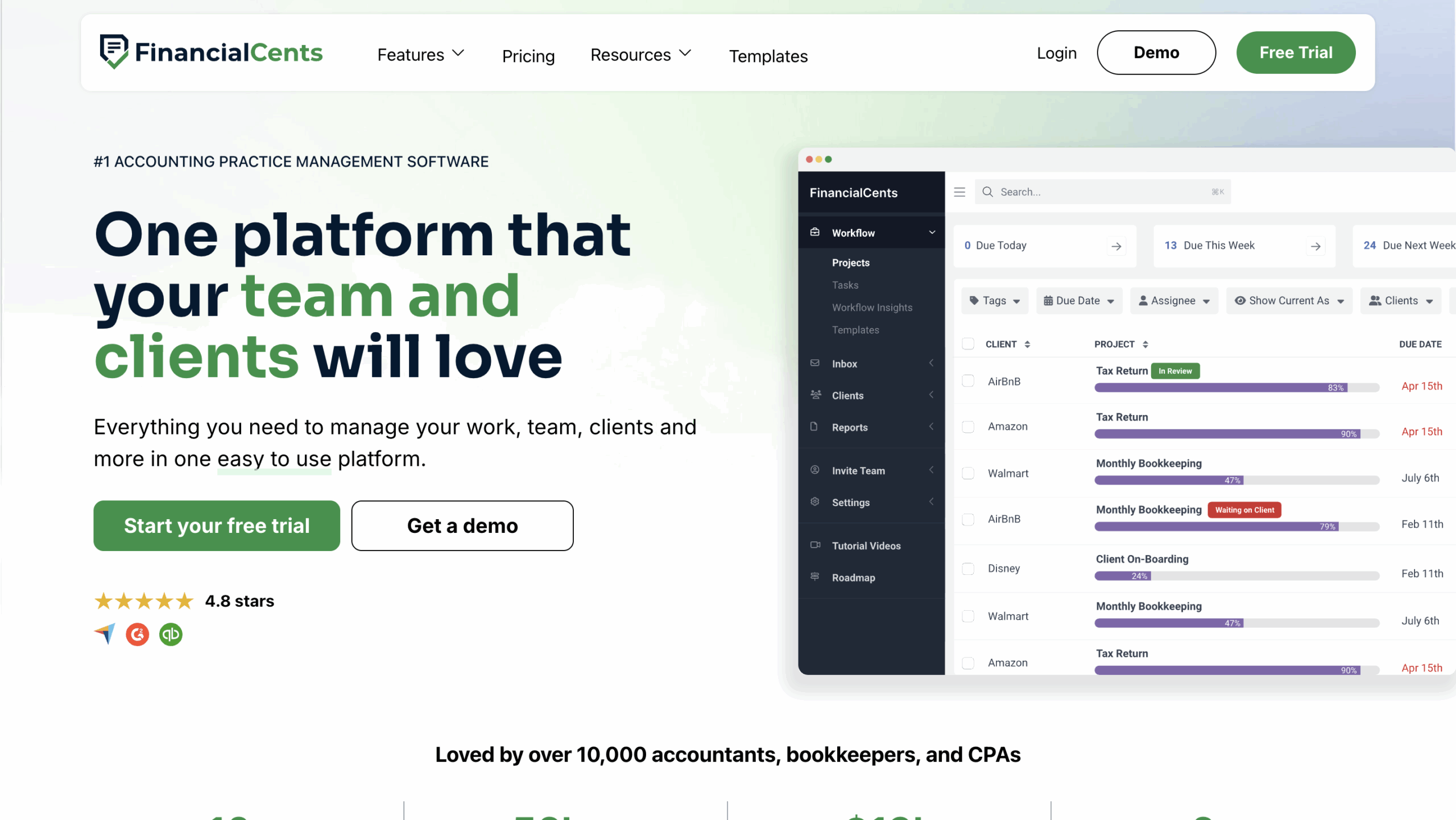

For firms handling these tasks across multiple clients, accounting practice management software like Financial Cents adds another layer of control and organization. It helps you not only maintain accurate ledgers but also manage the workflows that keep everything running smoothly.

Think about all the recurring tasks that come with maintaining general and sub-ledgers: monthly closes, reconciliations, report generation, and review processes. With Financial Cents, you can create standardized workflows for each of these tasks, assign them to team members, and set up automated reminders and deadlines to keep everything on track.

You can also track progress in real time, so nothing slips through the cracks. Documents can be attached directly to client records, which makes it easier to reference subledger details when needed. Internal notes and centralized communication improve collaboration, whether your team is remote or in the office. Financial Cents also includes time tracking features, helping you understand how long each task or engagement takes so you can manage billing and capacity more effectively.

Conclusion

Subledgers and general ledgers do different things, but both are essential. Subledgers handle the day-to-day details. The general ledger pulls it all together for reporting, compliance, and big-picture decisions.

When you understand how data flows from subledgers into control accounts, you can maintain accurate books, produce sharp reports, and conduct smooth audits.

For firms juggling multiple clients, staying organized isn’t optional. Financial Cents makes it simple. With task automation, workflow templates, deadline tracking, and built-in collaboration, you can manage everything, from subledger reconciliations to GL reviews, without the stress.

Ready to simplify your workflow? Start managing your firm (and your clients’ ledgers) with ease using Financial Cents.