Preparing business tax returns requires collecting detailed financial and operational information from clients, often across multiple documents, emails, and conversations. Our business tax organizer template is designed to simplify and standardize this process by giving accounting and tax professionals a structured way to gather everything needed in one place.

Organized into clear, easy-to-follow sections, this template helps you collect essential business information, income details, expenses, deductions, and tax payments efficiently. Whether you’re working with sole proprietors, partnerships, S corporations, or corporations, this organizer provides a comprehensive framework to ensure no important information is missed.

Available in both Excel and Google Sheets, the template is fully customizable and can be branded with your firm’s logo before sharing with clients digitally or using internally during tax preparation.

If you are interested in the individual tax organizer template, you can grab it here:

Free Individual Client Tax Organizer Template

Benefits of Using This Business Tax Organizer

a. Standardizes Your Tax Preparation Process

Create a consistent intake system for all business clients, regardless of entity type.

b. Reduces Back-and-Forth Communication

Clearly outlined categories minimize follow-up emails and missing documentation requests.

c. Improves Accuracy & Completeness

Structured sections ensure you capture all relevant income, deductions, and payment information.

d. Saves Time During Busy Season

Spend less time chasing information and more time reviewing and preparing returns.

e. Enhances Client Experience

Clients appreciate a clear, professional checklist that tells them exactly what is required.

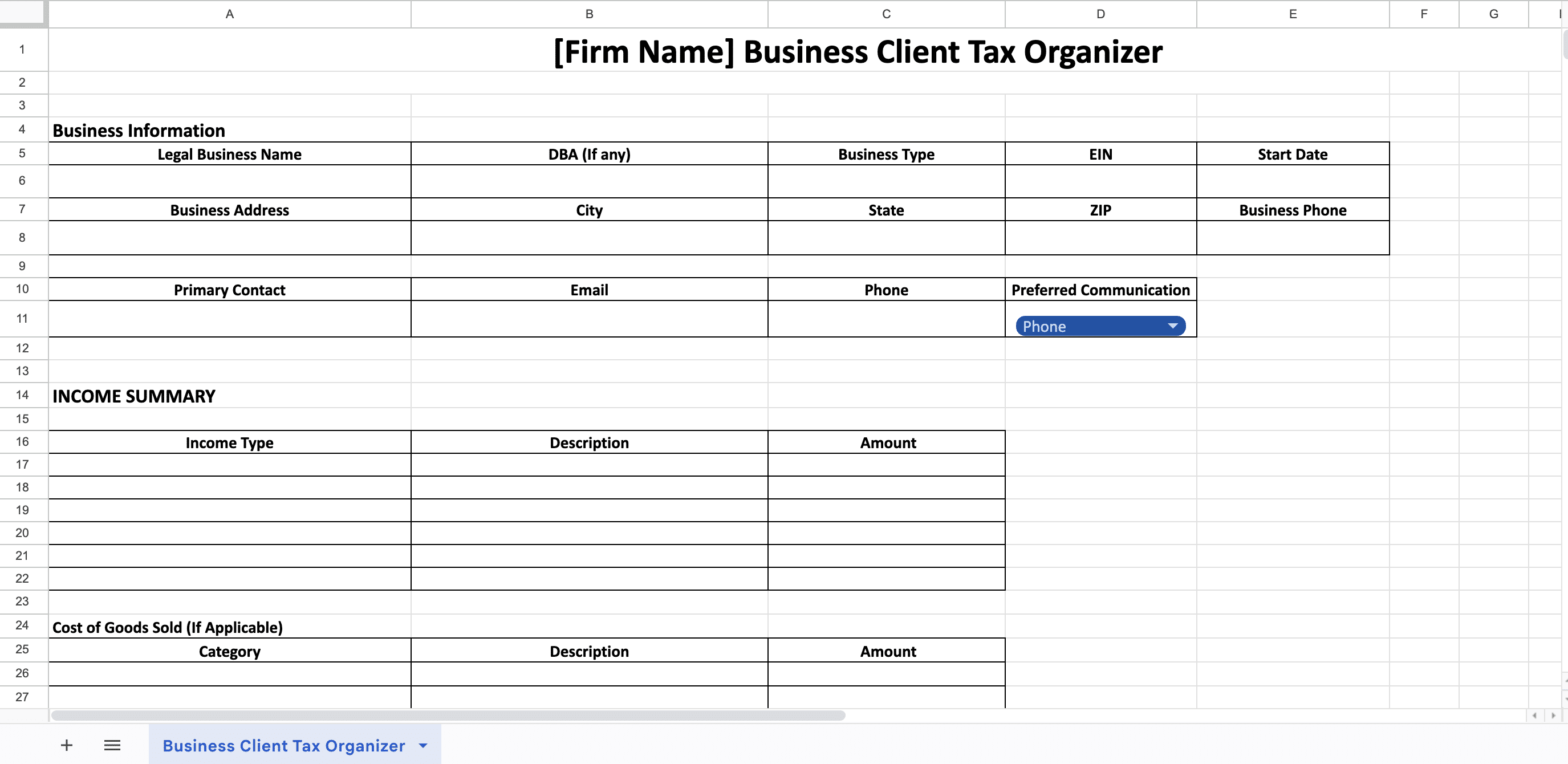

What’s Included in the Business Organizer Template

The Business Tax Organizer Template is divided into comprehensive sections to cover all major components of a business tax return:

1. Business Information

- Legal business name

- DBA (if applicable)

- EIN

- Business address

- Entity type

- Principal business activity

- Ownership details

2. Income

- Gross receipts or sales

- Returns and allowances

- Other income

- 1099 income received

- Rental or investment income (if applicable)

3. Cost of Goods Sold (if applicable)

- Beginning inventory

- Purchases

- Cost of labor

- Materials and supplies

- Ending inventory

4. Expenses & Deductions

- Advertising & marketing

- Office expenses

- Rent or lease payments

- Utilities

- Insurance

- Payroll & contractor payments

- Professional fees

- Travel & meals

- Depreciation

- Other ordinary and necessary expenses

5. Payments & Tax Information

- Estimated tax payments made

- Prior-year overpayments applied

- Payroll tax filings

- State tax payments

- Extension payments

How to Use the Template

i. Customize With Your Firm Branding

Add your logo and firm name before sharing with clients.

ii. Send Before Tax Preparation Begins

Provide the organizer early to allow clients time to gather documentation.

iii. Review for Completeness

Ensure all applicable sections are filled out before starting the return.

iv. Maintain Secure Records

Store completed organizers within your document management system.

v. Use Annually

Reuse the template each year to maintain consistency and efficiency.

This Business Tax Organizer Template helps your firm stay organized, improve efficiency, and deliver accurate, stress-free tax preparation for your business clients.