Best for firm owners who want to:

-

Firm owners and managers frustrated with slow, disorganized, and outdated proposal processes.

-

Firm owners looking to create a consistent brand experience for new and existing clients.

-

Firm owners struggling with defining engagement terms and eliminating scope creep.

Proposals should be clear, visually appealing, and easy to sign. Traditional proposals fail in all three criteria because:

- They are Time-consuming: creating proposals from scratch every single time increases manual work and makes it harder to send proposals and close deals quickly.

- They can be Complex: creating proposals from scratch increases the likelihood of omitting important information and failing to define the engagement terms clearly, which leads to out-of-scope projects.

- They Require Traditional Signature: Your clients will need to download and scan documents to sign a proposal, which delays approvals and onboarding.

Financial Cents enables you to create modern proposals that clarify expectations, automate approvals (to close deals faster), and collect client information for automatic billing and payment.

Here’s how it works 👇

Step-by-Step Guide:

Step 1: Create a Modern Proposal in Financial Cents

The first step to creating a modern proposal is to define the services you’ll provide for the client and clarify the terms of engagement.

This video shows how 👇

Step 2: Use Proposal Packages to Simplify Offerings

Proposal Packages allow you to bundle your services according to the different levels or types of client needs.

This enables clients to choose the option that best suits their current or future situation. It also helps to communicate your prices more clearly and eliminate out-of-scope work.

Here’s how to create packages for your services in Financial Cents 👇

Step 3: Automate Client Approvals and Signatures

Modern proposals enable clients to sign proposals online electronically. By eliminating the need for clients to download or print documents before signing, these proposals create richer client experiences.

See how here 👇

Additional Automation:

Automatically Generate Client Projects When Clients Sign Your Proposal

This auto-creates projects for new clients, helping your team focus on the work that counts more for client satisfaction.

Here’s how👇

Sam S., CPA

Brianna Goodman

Angela Brewer

Step 4: Track Proposals in One Central Dashboard

This auto-creates projects for new clients, helping your team focus on the work that counts more for client satisfaction.

Here’s how👇

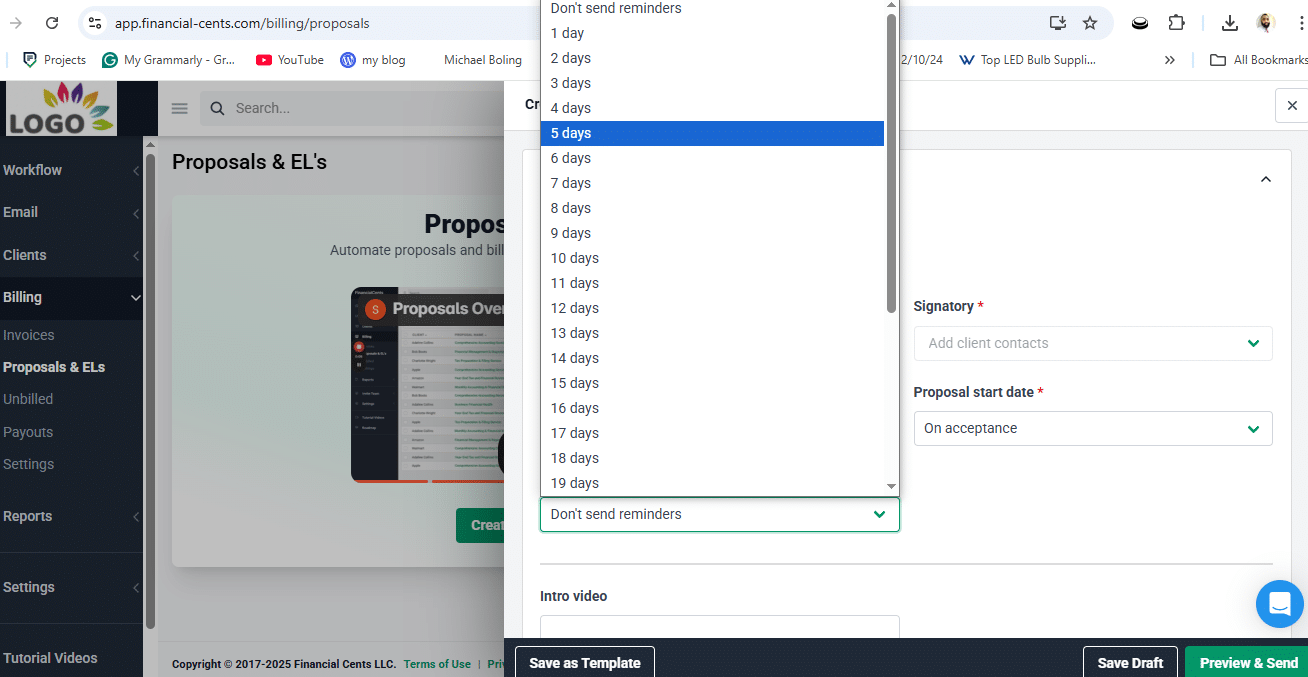

- PRO TIP: Set up Reminders to Auto-Chase Clients and Potential Clients to Sign Pending Proposals

Any delay in proposal signing predisposes your ideal client to a change of mind (to go with another firm). That is why Financial Cents lets you auto-remind potential clients to sign your proposals.

All you have to do is turn on the reminder feature (when setting up the proposal), and Financial Cents will send the potential client email reminders every one, two, or few days (depending on your preferred frequency).

Step 5: Secure Payment Information at the Proposal Stage

Your clients are busy. Asking for their payment information during the proposal signing stage helps you to maximize the moment by collecting the information you need to improve your accounts receivables.

Here’s how👇

Why You Should Collect Your Client’s Payment Information at the Proposal Stage

Collecting a client’s payment information at the proposal stage enables you to automatically charge the client’s account for recurring invoices.

This is a win-win for you and the client seeing as it:

- Saves your firm the manual work involved in following up with clients, leading to late payment.

- Saves your client the stress of entering their payment information whenever they need to pay you.

Why Modern Proposals Are a Game Changer

Modern proposals are effective because of their ability to:

- Win More Business with Attention-Grabbing Proposals: Modern proposals enable you to strike while the iron is hot by sending proposals quickly and making it convenient for clients to sign on the dotted lines before their momentum grows cold.

- Pull Payments Automatically: Modern proposals enable you to collect client payment details from the outset to auto-charge them as and when payment is due.

- Automate Recurring Revenue: Modern proposals also help you send automatic invoices on a repeated, regular basis, saving your firm admin time, maintaining a predictable cash conversion cycle, and keeping your cash flow healthy.

- Manage Project Scope: Modern proposals help you to define terms of engagement to prevent conflicting expectations. This ensures that any extra work your team does is well paid for, which makes your firm more profitable.

Improve Team and Client Experience with Financial Cents Proposal Solution

Apart from the manual work involved in traditional proposals, there’s a higher chance of errors, which gives the negative impression that you’re not organized or detail-oriented.

Financial Cents reduces human input in your proposal management system by:

- Providing digital proposals and templates you can easily fill out.

- Enabling your clients to sign proposals online without downloading or scanning documents.

- Giving you a dashboard to track your proposals and know which client needs follow-up.

- Auto-reminding your clients (or potential clients) to sign the proposals.

Financial Cents gives you the tools and resources needed to transform your client relationships at scale—from proposals through onboarding to payment collection.

Book a Personalized Demo to see how this works today.

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!