As a trusted advisor, you help partnerships stay on top of their taxes. You know, those forms and deadlines the IRS wants to be filed on time. One important form is Form 1065, used to report income and taxes for partnerships.

Even the most diligent of advisors can miss the filing deadline due to peculiar circumstances. And that’s when late filing penalties come in, triggering a domino effect of complications.

We know you’d rather not have your clients in this situation, but sometimes, amidst the fast-moving deadlines and running your advisory services, it’s not unthinkable for Form 1065 to slip through the cracks and you find yourself with a late filing penalty for 1065.

There’s no need to panic as we’ll be showing how to avoid a late filing penalty for 1065 and provide a guide to navigate penalty abatement in the instance that your clients get penalized.

What is Form 1065?

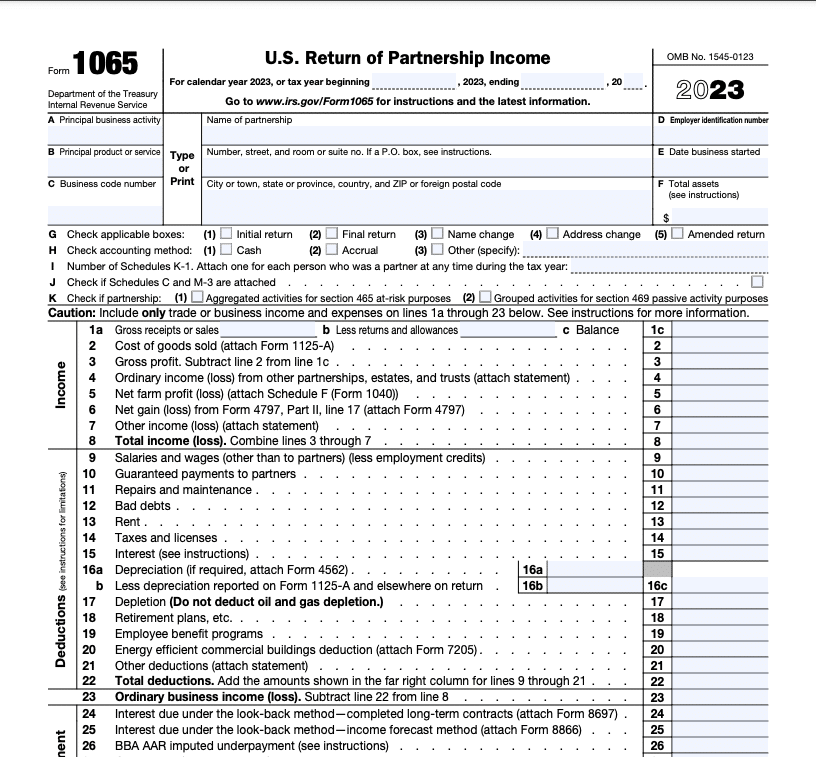

Form 1065, officially titled U.S. Return of Partnership Income, is a tax form used by partnerships to report their financial results for a tax year to the Internal Revenue Service (IRS).

According to the IRS, partnerships file an information return to report their income, gains, losses, deductions, credits, etc using this form.

As you probably know, the main purpose of Form 1065 is not to pay taxes for the partnership itself. Instead, it serves as an informational document that relays the partnership’s financial status to the IRS.

This information is then used to allocate the partnership’s income, deductions, and credits to each individual partner based on their ownership percentage. Each partner will then report their allocated share on their own personal tax return (usually using Schedule K-1).

Understanding the Late Filing Penalty for Form 1065

Failing to file or filing a partnership tax return improperly for your clients can be costly.

According to the IRS, a penalty is assessed against a partnership if it is required to file a partnership return and it;

(a) fails to file the return by the due date, including extensions; or

(b) files a return that fails to show all the information required, unless such failure is due to reasonable cause.

The IRS set out the criteria for a late filing penalty for 1065, but what does it really entail?

Firstly, the penalty is a hefty sum of $220 (for returns due after January 1, 2023) for each month or part of a month (up to a maximum of 12 months) if the return is late. This means missing the deadline by even a day triggers the full monthly penalty.

Secondly, the per-month penalty is multiplied by the total number of partners in the partnership during any part of the tax year. So, a late filing with 5 partners could incur a staggering $1,100 per month penalty.

However, there’s a cap on the penalty, equal to the smaller of two amounts:

- 5% of the unpaid tax per month (up to 25%): This applies if there’s unpaid tax on the return.

- $10,000: This is the overall maximum penalty, regardless of the number of partners or months late.

Let’s break this down with an illustration:

Imagine you’re the accountant for ABC Partnership, a thriving trio of consultants, who just wrapped up another successful year. You just realized that March 15th was 6 weeks ago, leaving ABC and you to face the consequences of a late filing penalty for 1065.

Penalty Time:

- Months Late: 2 months (April and May)

- Number of Partners: 3

- Per-month Penalty: $220

- Partner Multiplier: 3

Calculating the Penalty:

- Monthly Penalty: $220/month x 3 partners = $660/month

- Total Penalty before limits: $660/month x 2 months = $1,320

- 5% of Unpaid Tax per Month: Assume $0 unpaid tax for this illustration.

- Maximum Penalty: $10,000 (since no unpaid tax, this is the applicable limit)

The final penalty will be $1,320 (which is smaller than the $10,000 maximum penalty).

If there was an unpaid tax of $1000 for this same scenario, the partnership would end up with a $100 (5% of unpaid tax per month) penalty because it is the smaller of two amounts.

From this illustration, we can see several factors that affect the penalty amount:

- Length of delay: The penalty accumulates for each month the return isn’t filed.

- Number of partners: The higher the number of partners, the steeper the penalties get.

- Unpaid tax: If the partnership owes taxes with the late return, the 5% per month unpaid tax limit comes into play

These are not the only factors that can affect the penalty amount as the IRS can offer a penalty relief that waives or reduces the burden of the penalty.

These other factors include:

- Reasonable Cause: The IRS can waive the penalty entirely if the partnership can demonstrate reasonable cause for the late filing. This means proving that despite exercising due diligence, you were unable to file on time due to circumstances beyond your control.

- Filing History: The partnership’s past record of timely filings with the IRS can influence the IRS’s decision to waive the penalty.

- Extension request: Filing for an extension before the original deadline, even if you ultimately file late, demonstrates good faith and proactive effort to comply. While it won’t eliminate the penalty, it might influence the IRS to reduce or waive it based on the specifics of your situation.

Late filing penalties for Form 1065 can cost partnerships dearly, both directly and indirectly.

The penalty itself, the interest on the penalty, and the increased likelihood of scrutiny by the IRS are some of the direct consequences that your clients will face. Indirect consequences include damage to reputational standing, stress, lost time, and forfeiture of tax credits and deductions that may have accrued if the partnership return was filed on time.

In order to avoid a late filing penalty for 1065, it is pertinent to adopt proactive strategies that can protect your firm and your clients from the damning effects.

Strategies for Avoiding Late Filing Penalties for 1065

Prioritize Early Planning and Organization:

Planning and preparation are indispensable tools in your arsenal for combating and avoiding late filing penalties.

Let’s start with your calendar. Mark the Form 1065 due date, extension deadline, and estimated tax payment dates prominently in your calendar. Set automated reminders for these dates and consider color-coding or grouping tasks for extra visibility. This ensures you and your team are constantly aware of upcoming milestones.

Also, don’t wait until the last minute to collect all the necessary documents from your clients (i.e. partners). Request K-1s, financial statements, and other vital information needed to complete Form 1065 well in advance.

Break up the tasks for the entire filing process and delegate within your team to streamline your tax preparation workflow and ensure accountability before the due filing date.

For instance, one team member can be in charge of collating all the necessary documents for filing while another is responsible for vetting and authenticating the documents to prevent the return from being filed improperly.

Have a Process in Place to Check for Unaccepted Returns or Extensions

Missing out on a notification that your Form 1065 or extension wasn’t accepted by the IRS can be a recipe for late filing penalties.

To combat this, firstly, invest in automated tracking software or online tools that send you alerts about any issues with your filed returns or extensions.

But don’t ditch manual checks completely. Schedule regular visits to the IRS website or e-filing portal, especially during peak filing seasons. Double-checking the official source keeps you on top of any updates or notifications you might have missed.

You can download this IRS Form 2553 Checklist template and highlight the status, each time you double-check.

Recommended Reading

Maintain a clear communication log for each client’s Form 1065 and extension filing. Log the date and method of filing, any confirmation messages received, and any subsequent updates or notifications. This can help pinpoint any missed notices and facilitate quick troubleshooting.

Also, be sure to keep your clients informed about the filing process and potential delays. Let them know when you expect to receive confirmation of acceptance and ask them to notify you if they haven’t received any updates on their end.

File for an Extension

If you foresee challenges gathering information, processing complex transactions, or dealing with personnel issues that might hinder timely filing, filing for an extension is a noble strategy to adopt.

Filing for an extension is also great when circumstances are beyond your control – illness, death, natural disasters, or technology meltdowns.

With a form 7004, (Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns) you can request an automatic six-month extension for filing your Form 1065, providing valuable breathing room for you to get everything in order.

Afterward, you can file electronically through authorized e-filing providers or mail a paper copy to the designated IRS address.

It is important to remember that filing an extension grants you additional time to file, not to pay taxes. So, if your client owes taxes, consider making estimated payments to avoid further penalties and interest.

Utilize Electronic Filing:

Embracing electronic filing (e-filing) is a good strategy when it comes to avoiding late penalties for Form 1065.

Why?

E-filing transmits your return directly to the IRS, ensuring much quicker processing compared to physical mail. This means potential issues or errors are identified sooner, allowing for prompt corrections and avoiding late filing penalties altogether.

You can file through any authorized IRS e-file provider or through the IRS online filing platform.

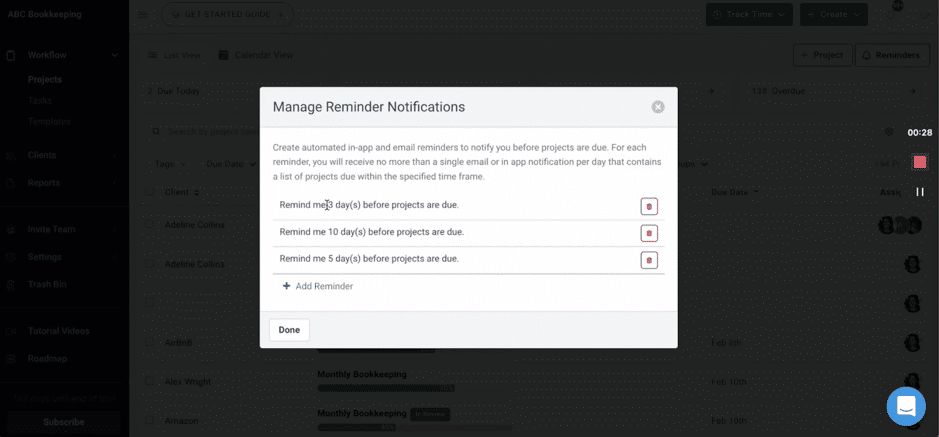

Use an Accounting Workflow Software to Set and Track Due Date

At the peak of tax season, it’s common to feel overwhelmed by the different needs and demands of your various clients, but if you use a workflow management software, you’ll be better prepared to manage your different priorities without missing a deadline.

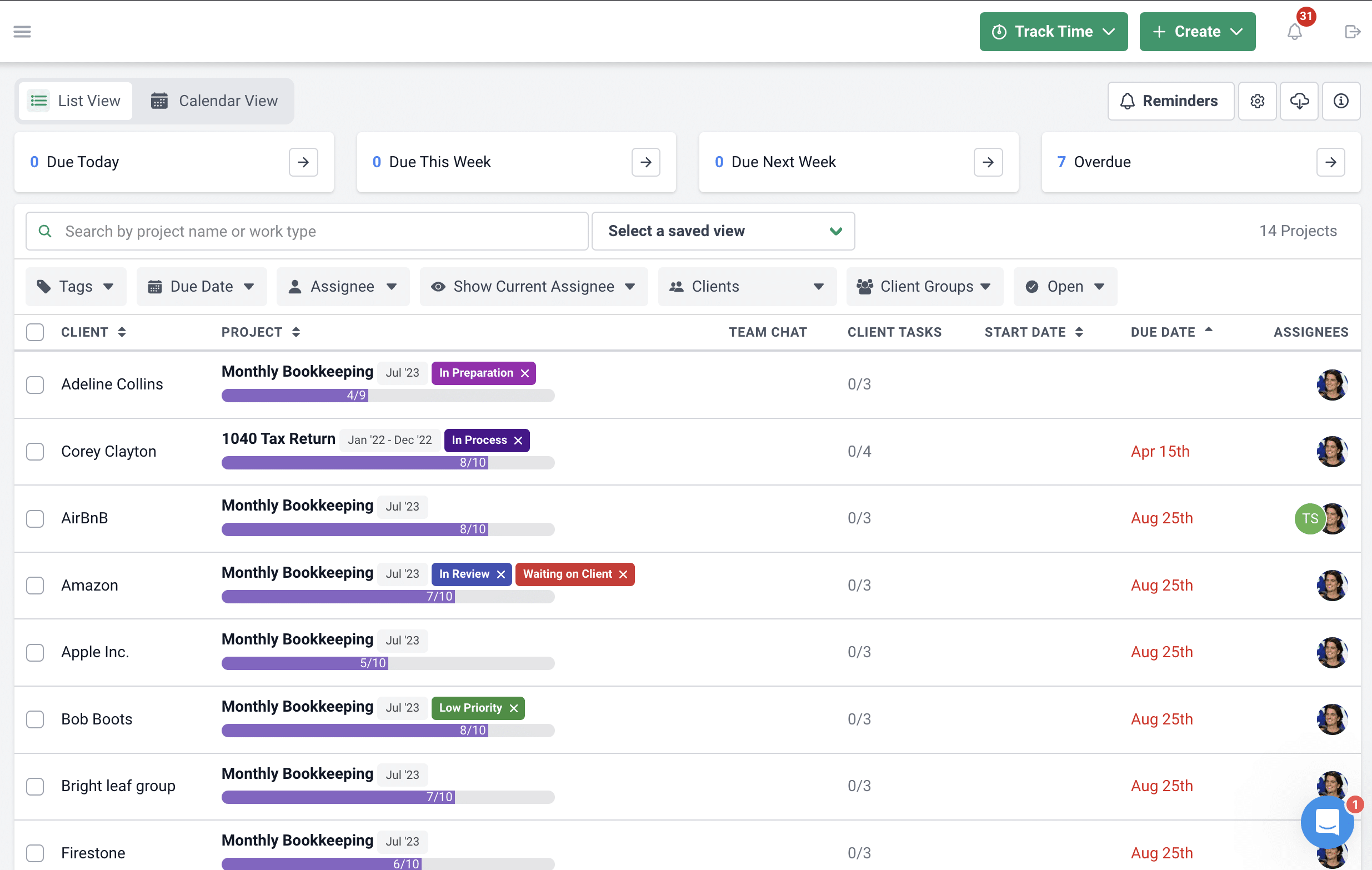

A great advantage of using Financial Cents to manage your workflow is that you can easily view your urgent tasks at the top of your project dashboard, allowing you to see what deadlines are fast approaching.

With our due date tracking feature, you can set up reminders for your partnership client tasks so you don’t eventually bog yourself with the headache of a late filing penalty for 1065.

All you have to do is log in to your Financial Cents account, navigate to “Projects” in your dashboard, click on the “Reminders” button in the top right corner, and set as many reminders as you need.

For instance, you can set up a reminder for 3 months, 1 month, and 2 weeks before the filing deadline. You’ll get both in-app and email notifications when a reminder is due.

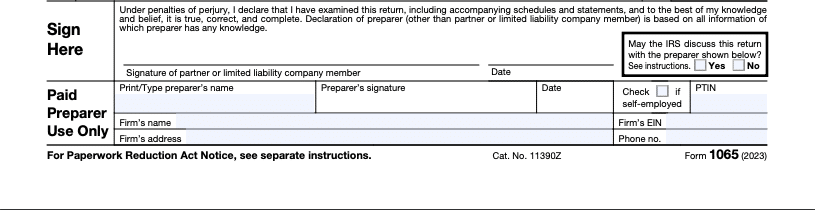

Also, you can save significant time when authenticating documents with the signatures of all the partners using our adobe e-signature integration. You simply request a signature by uploading the relevant document and sending it to the relevant client.

You may be interested in:

Requesting Penalty Abatement

In the instance that you did all you possibly could and still ended up with a late filing penalty for Form 1065, the IRS allows you to plead your case and request penalty abatement under certain circumstances.

The process for penalty abatement begins with filling out Form 843. This is your official “Abatement Request” form. Be sure to fill it out meticulously on behalf of your client, detailing the specific penalty you’re challenging and the tax year it pertains to. Attach a copy of the penalty notice received as well.

The next step is to provide documentation to support your case for abatement. Provide strong evidence demonstrating “reasonable cause” for the late filing. Documents may include medical records, proof of natural disasters, letters from third-party professionals involved in the delay, or any evidence supporting your claim.

Once you have all the relevant documents, you can submit your request via mail, fax, or online through the IRS portal. Choose the method most convenient for you, but ensure timely submission (typically within 30 days of the penalty notice).

The IRS will then review your request. You will get an answer within several weeks or even months. You’ll receive written notification of their decision, either granting or denying your abatement request.

If your request is denied, you have the right to appeal. This involves filing a formal appeal letter outlining your rebuttal and providing additional evidence, if applicable.

The key to successful abatement lies in demonstrating “reasonable cause” for the late filing. This means convincing the IRS that your client couldn’t file on time despite your best efforts.

In order to prove this, the circumstances must go beyond ordinary negligence.

- The nature and duration of the circumstance: Was it a serious illness, a natural disaster, or a unique, uncontrollable event? The more significant and unavoidable the circumstance, the stronger your case.

- The actions you took: Did you make any attempt to file on time or request an extension? Did you act promptly once the obstacle was overcome? Proactive efforts to comply strengthen your position.

- Your past filing history: A consistent record of timely filings demonstrates good faith and increases your chances of leniency.

Documenting Reasonable Cause

When documenting reasonable cause, you’ll have to prove through precise and detailed documentation that your case isn’t simply one of negligence but one that was simply beyond your control.

To do this, you need hard evidence to support your claim. Consider these tips when creating documentation for your case.

- Gather relevant paperwork: Medical records, insurance claims, weather reports, obituaries, letters from professionals, and any evidence supporting your claim.

- Create a timeline: Provide a clear chronology of events leading to the late filing, highlighting specific obstacles and dates.

- Write a compelling narrative: Explain the situation clearly and concisely, emphasizing the “beyond your control” aspect. Don’t minimize the seriousness of the circumstances.

- Be organized: Present your documentation neatly and logically, making it easy for the IRS to understand your claim.

Know that even with strong documentation, there’s no guarantee of success. However, demonstrating genuine good faith and providing robust evidence significantly increases your chances of achieving penalty relief.

Wrapping Up

In conclusion, the late filing penalty for Form 1065 can be a significant financial burden for partnerships. Missing the deadline by even a day can trigger a hefty $220 monthly penalty, adding up to a maximum of $2,640 for a full year. These penalties can quickly eat into your profits and create unnecessary stress for both you and your clients.

To safeguard your firm from these costly penalties and streamline your accounting workflow, consider using Financial Cents. Our powerful software is specifically designed for advisory firms like yours, offering a range of features including reminders and project tracking so you never miss deadlines relating to filing a 1065 for your clients.

Use Financial Cents to manage your accounting practice.