What is Fractional Accounting? (and How to Offer it)

Author: Financial Cents

Reviewed for accuracy by: Alexis Sadler

In this article

No business can do without accounting. They all need accurate financial data, but the extent of their needs varies from business to business.

—

Many are looking for accountants to help them with a specific accounting service (such as paying bills, making sense of their financial data, or closing their books quickly and accurately).

They can’t afford the services of a full-time accounting professional (or team), so they rely on fractional accounting to meet their accounting needs.

The demand for fractional accounting is growing because it gives these businesses access to quality accounting services when needed.

What is Fractional Accounting?

Fractional accounting is an arrangement where an accounting professional (or team) provides services to a client part-time. The number of services they receive from you depends on their needs and budget.

Some businesses may not know what they need but will ask you to review their finances and tell them what they need to do.

Other times, you may need to help a business’s accounting department streamline its processes and analyze data to enable its owners to understand their performance.

Some Examples of Fractional Accounting Roles and Responsibilities

1. Fractional CFO

Fractional CFOs (or virtual cfos) are needed to help their clients address specific challenges that their internal accounting has been unable to resolve.

The role of a fractional CFO is more strategic (than other accounting professionals) in that they are responsible for helping a business understand how to leverage its resources to move from point A to point Z.

The responsibilities of the fractional CFO involve setting up systems that help businesses achieve their goals efficiently.

Other responsibilities of a fractional CFO include:

- Assess and Manage Risks: identify risk factors and find the most effective solutions.

- Forecasting: analyze past and current data to make predictions and help shape the company’s decisions to maximize the future.

- Cash Flow Management: recognize the sources of cash and how to use it to optimize the company’s cash flow.

- Financial Planning & Analysis: create financial plans and models that help the business achieve its goals.

2. Fractional Controller

As a financial controller, you can be hired to head your client’s accounting department part-time. In this role, clients might require you to be the link between the CFO and the accounting team.

During that time, you will manage your client’s accounting team by:

- Streamlining Accounting Operation: ensure that your client’s financials tell the right business story and that the CFO has accurate data to work with.

- Compliance: run compliance audits to test the internal controls.

- Preparing their financial statements: review them for accuracy and communicate with your clients in a way non-accountants can understand.

3. Fractional Accountant

Every business needs accurate record-keeping, and as a fractional accountant, you will use your accounting knowledge to help clients manage their bookkeeping and give them accurate data to make business decisions.

Some of your responsibilities as a fractional accountant include:

- Accounts payable/receivable: managing their cash flows by paying bills for vendors and collecting funds from customers

- Coding Transactions: Recording all expense transactions and categorizing them appropriately

- General Ledger Reconciliation: ensuring all accounts are correct and reconciled regularly

How to Offer Fractional Accounting Services

a. Define Your Ideal Client

There are more clients to serve than you can take on. The quicker you understand the kind of clients you want to serve, the better your chances of being successful.

Without an ideal client established, you may take on too many bad-fit clients and not have the capacity for the type of clients you enjoy working with.

The key to understanding your ideal clients lies in asking the right questions. Here are some questions you can ask yourself to understand and optimize your marketing and client services for them.

- What service is my ideal client looking for?

- How can my service help them?

- In what industry do they operate?

- What is the size of their organization?

- Where are they based?

Questions like this will help you nail down your ideal client profile (ICP). The more detail you have, the better your chances of creating a great process, great marketing, and easily training your team.

b. Develop Service Packages

Fractional accounting is more profitable when you can provide more than a single service to your clients, and the secret to doing that is bundling your services for clients.

Bundling your services requires you to group all your services. Are there services that complement one another? Group them in the same band as one service.

For example, general ledger reconciliation and reporting could be your basic package (Bronze). Another package (Silver) can include everything in the Bronze plus inventory management with A/R and A/P. A third package can be everything in Silver plus cash flow and budgeting.

Since each package is more expensive than the previous one, it can also include more personalized support and access.

You can group your services in any way that enables your client to choose the services most appropriate for their needs and budget.

Bundling your service packages also enables you to give your clients more options. In that way, clients can choose a package that suits their needs and budget while you optimize your firm for your most profitable service package.

Packaging your services allows you to promote multiple services while giving your clients a better understanding of your rates.

c. Set Your Pricing Structure

Setting a pricing strategy enables you to bill clients adequately. Usually, researching market rates gives you a general idea of what’s obtainable. This allows you to set yours within those ranges and balance value and affordability.

Ultimately, understanding your positioning in the market and the services that drive profits for other firms will inform your rates.

For example, bookkeeping and tax returns drove the highest revenue and profits in this Financial Cents survey of accounting (and bookkeeping) firms.

Click here to learn how other accounting, bookkeeping, and tax firms drove revenue and profits in 2023.

Here are some popular pricing strategies you can use:

- Time-based pricing

Time-based pricing sets prices by the hours a project takes. This strategy is best for projects where you can’t estimate time. Your total fee increases as the work continues.

If a monthly bookkeeping project takes four hours and you charge $50 per hour, the project will fetch you $200. But if the project needs six hours, your fee increases to $300.

The challenge with this system is that your hours decrease as your team gets better at doing a project–so will your earnings.

- Fixed pricing

Fixed pricing sets standard rates for your services, regardless of the hours a project takes or the value the services provide for the client.

This pricing strategy is best for services that take virtually the same resources (time and creativity) to complete. It also allows your clients to plan their budget.

The problem is that your team may spend more time on a project than the amount earned.

This pricing system allows you to bill your clients based on the value you create for them rather than the hours you’re working or the resources it takes you to serve them.

This strategy is best for projects that require your accounting creativity and expertise, such as client advisory.

If your service will save a client $2000 in operational costs every month, value-based pricing uses this as a basis for setting your rates instead of using the hours it will cost your team to complete the work.

This pricing strategy works because the client can see how much value you provide. They are usually happy to pay your quoted fee. In this way, you get more value for your expertise. Learn more about value-based pricing here.

- Subscription-based Billing

This pricing model enables clients to pay you for ongoing accounting services. Once you agree with your client on the accounting tasks you’ll do for them monthly, you’ll come in at set times, do the job, and get paid.

d. Create a Clear Onboarding Process for New Clients

A good onboarding process builds quality client relationships by increasing time-to-value, which shows how quickly clients get value from a service after their first interaction with a firm.

A clunky onboarding process will make your clients question their decision to use your services. However, an engaging process provides clients with the necessary information and resources to maximize your services. It builds understanding and leads to satisfactory client service.

A well-designed onboarding process relies heavily on templates and documented standard operating procedures. A client onboarding template documents the activities involved in your client onboarding process.

It shows your team members what to do at each stage of the onboarding process, ensuring that every piece of information is provided (and collected), every document is signed, and access to every relevant app is secured.

In Financial Cents, every task in the client onboarding template has its due dates, assigned staff member, and a space for comments:

You can edit the template to suit your process by adding and removing the steps as you see fit.

e. Marketing and Client Acquisition

Marketing puts you in control of getting clients who will pay well for your expertise without questioning your price. "

Amanda C WattsMarketing can be overwhelming to undertake, but it boils down to:

- Knowing who your target audience is.

The ideal client profile you created in step one will be helpful here.

- Where they hang out.

This could be:

Facebook, Instagram, Twitter, and LinkedIn bring your firm and services before your target audience.

These platforms allow you to select the location, gender, workplaces, interests, Etc. of your ideal client so that your content (paid or free) will be shown to them, boosting your chances of capturing their interest in your services.

- Blog

Blog enables you to educate your audience about their challenges for free. Each pain point you help potential clients address (with content) increases your chances of converting these potential clients into clients.

Without creating value through content, your ideal clients will always compare you (on price) with the accountant down the road, and they will choose them over you because they are cheaper."

Amanda C WattsWhichever channel you choose, the key to effective marketing and client acquisition is a deep knowledge of your ideal client and their challenges.

If you don't have a clear idea of your ideal client. If you don't understand their pains, frustrations, and the things that keep them up at night, your marketing won't work. It doesn't matter how many times you post on Social Media."

Amanda C Watts- Creating and Executing a plan to reach them with your marketing messages:

When you understand where your target audience spends their time, begin to draw their attention with engaging marketing assets.

- Measuring results and applying the lessons

Marketing data tells you where you got it right, got it wrong, and what you might be missing. Implementing this data in your marketing program will increase your ROI.

f. Leverage Technology to Facilitate Your Work Remotely

Fractional accounting works better with cloud technology. Working with a different crop of clients (and likely a distributed team) requires being able to manage client work remotely.

Thanks to cloud technology, your clients can grant you access to their data remotely without needing you to leave your location.

Other benefits of cloud technology include:

- Automation

With machine learning and artificial intelligence, technology can perform tasks, especially repetitive tasks, without human input. Examples of the tasks you can automate include data entry, expense management, and accounts receivable. Here’s a list of the top ai tools for performing accounting tasks.

- Virtual Collaboration

Cloud-based accounting software has collaboration features that help you and your clients exchange files and information.

- Integration with Mission-critical Apps

Cloud technology also enables you to use features from other relevant apps in your accounting practice from one place.

- Real-time Reporting

Most cloud accounting software provides data that you can use to measure how much work your team is getting done and where your time is going. This data will help you make informed decisions that make your firm more profitable.

g. Build Strong Client Relationships

Business owners are not just looking for accountants; they are looking for trusted advisors.

Since fractional accounting is flexible (in that your engagement is based on the needs and budget of your client), building strong relationships is critical for ongoing engagements.

Building strong client relationships requires you to:

- Set the stage for effective client communication

Your clients need up-to-date information about the work you’re doing for them. Establishing the best communication methods enables you to communicate with them effectively.

Moreover, maintaining communication with your client will enable you to stay up-to-date with their changing needs. That way, you can tell when they need your other services.

- Share valuable content

Your clients will always need your accounting services, but whether they keep coming back to you depends on how valuable they perceive your firm.

Seek to be a valuable source of advice and business insight for your clients beyond your paid engagement.

One way to demonstrate your expertise is to share content that helps them solve financial problems beyond the services you provide.

For example, Erica Goode gives her clients tons of value for free through E-books and newsletter content.

- Personalize client service

Being intentional about your clients’ little details will make them feel seen and heard, making it easier for them to refer their friends to you.

- Ask for feedback

Don’t be afraid to ask your clients what they think about your services and what areas they think you should improve.

It will help you adjust your practice and improve your client service.

Read: How to Use Accounting CRM to Build Strong Client Relationships

Accounting Project Management Software Is a Force Multiplier for Fractional Accounting Firms

One good work deserves another (in fractional accounting), and there’s no chance of doing quality work without a system for organizing work, team, and client information.

That is where accounting project management tools comes in.

It is built for the specific needs of accounting and bookkeeping teams. They include:

1. A Centralized platform to manage all client work

Accounting project management software enables all your team members to understand what needs to be done, when, and their roles. It provides:

- Workflow Dashboard: gives your team visibility into accounting projects with tasks and assignees.

- Progress Bar: each project on your dashboard is color-coded to show how much work is needed to complete it.

- Due Dates: show the deadline for each project on the dashboard.

- Tags: automate the status of each project.

- Team Chat: show project-related team conversations on each project on the dashboard.

- Workflow Filters: find specific client information in one click.

2. A Client Relationship Management Feature to Manage All Clients Information (CRM)

Storing client information in multiple apps is a recipe for poor work quality. Going into different places for information costs your team valuable time and makes it harder for everyone to access up-to-date client information.

The client relationship management feature in accounting software provides a single platform for all things client-related.

From contact details to client projects, client documents, interactions, and EIN to SSN, accounting CRM centralizes all this information so that your team can access the most accurate client information for work.

In Financial Cents, this feature has:

- Client Vault: this stores your clients’ sensitive information like logins, passwords, and credit card information.

- Activity: an audit trail of interactions with clients.

- Client Notes: for talking about client updates with your team.

- Emails Tab: helps you track client communication (in Gmail or Outlook) through Financial Cents.

- Custom Fields: for storing client-specific information that is relevant to the client relationship.

3. A client Portal for Collaborating with Clients on Documents

Client portals are secure platforms for sharing documents, communicating and collecting E-signatures from your clients.

Its communication features also ensure clients know what you need them to do inside the portal.

The features of Financial Cents’ client portal include:

- Password-less Entry: it uses magic link technology to verify clients before accessing the portal.

- Client Chat feature: for communicating with clients.

4. Workflow Automation to Reduce Manual Tasks

Workflow automation allows you to complete manual accounting processes with little human input.

In Financial Cents, this includes:

- Recurring Projects: It allows you to create your repetitive work automatically, allowing your team to focus on completing the projects rather than struggling to remember them.

- Task Dependency: helps to pass work off between team members automatically.

- Workflow Templates: enable you to automate work creation and standardize execution to maintain consistency of work quality.

5. Automated client requests

Client data collection costs most hours of billable work weekly. This feature automates that process.

With Financial Cents, you can create a list of the information and documents you need from your clients.

Its Automated reminders help to keep your requests at the top of your client’s mind.

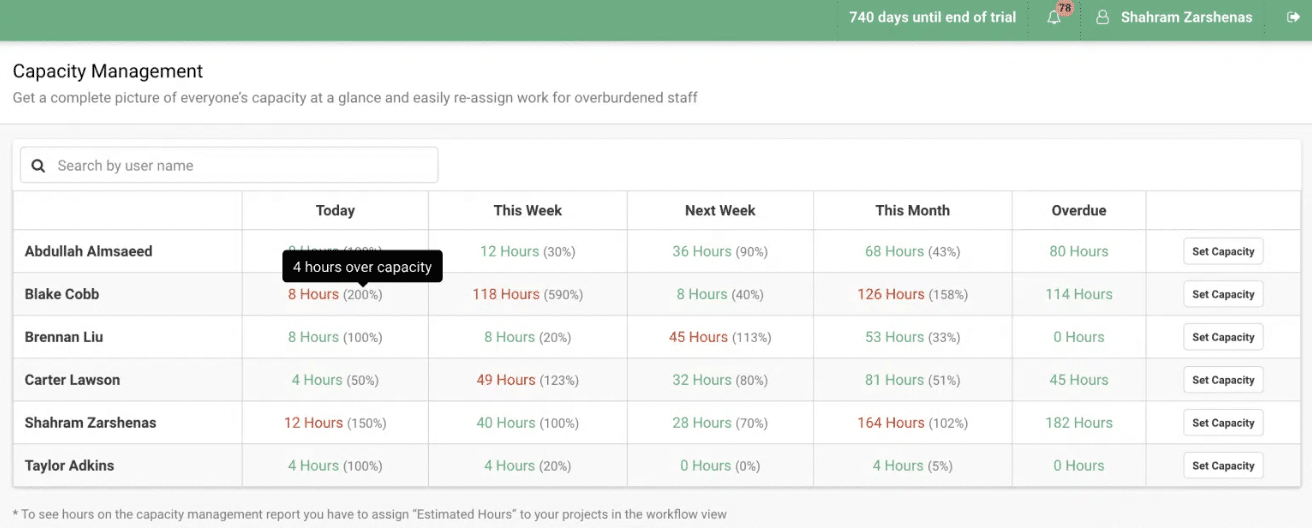

6. Capacity management

The capacity management feature helps to manage your team’s time and workload.

In Financial Cents, this feature has:

- The Capacity Report: for viewing your team members’ workload (by hours) in one view. It allows you to reassign work from one team member to another.

- Capacity Limit: allows you to set the maximum hours your team member can work weekly, helping you prevent any staff from overworking and burning out.

7. Document Management

Financial Cents stores your documents in the cloud so everyone can find them to get client work done.

With this feature, you can:

- Create Folders to categorize related documents together.

- Organize Documents by moving them from one folder to another.

Centralize Your Fractional Accounting Team with Financial Cents

Your profits as a fractional accountant depend on your team’s ability to manage multiple projects simultaneously without sacrificing work quality.

Financial Cents’ workflow, client management, and capacity management features will help you streamline and automate your firm to meet client deliverables consistently.

Use Financial Cents to manage your fractional accounting firm and clients.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to our newsletter for an awesome dose of firm growth tips.

Subscribe to our newsletter for an awesome dose of firm growth tips.