How to systemize your solo accounting firm and get work done

Author: Financial Cents

In this article

Meet Sarah.

She’s an accountant who decided to leave her corporate job and start her own solo accounting firm.

With over a decade of experience and a loyal client base, she was confident that she could manage everything on her own.

But as her client list grew, so did her workload.

Sarah found herself juggling client calls, preparing financial statements, managing invoices, and trying to stay on top of deadlines—all while handling the administrative side of her business. Her once-orderly life quickly became a chaotic mess.

The stress began to take a toll on her health and personal life, and she realized that this wasn’t the dream she had envisioned when she started her firm.

Sarah’s story is not uncommon.

Many solo accounting firm owners find themselves overwhelmed by the demands of running a business on their own. However, with the right systems in place, it’s possible to transform a chaotic operation into a well-oiled machine.

This article will guide you through the steps to systemize your solo accounting firm, allowing you to get work done more efficiently and scale with ease.

Why Systemization is Key

For solo accountants, the challenges are unique.

Without a team to delegate tasks to, the burden of managing every aspect of the business falls squarely on your shoulders.

Watch:

This can lead to burnout, missed deadlines, and a decline in the quality of work. Systemization offers a solution by streamlining processes, reducing manual work, and freeing up time to focus on higher-value tasks.

- Increased Efficiency: Systemization allows you to create repeatable processes for routine tasks. For example, client onboarding, data entry, and invoicing can all be streamlined using standardized procedures. This reduces the time spent on these tasks and minimizes the risk of errors.

- Better Time Management: With systems in place, you can manage your time more effectively. By automating certain tasks, you free up time to focus on critical work that requires your expertise. This also allows you to maintain a healthier work-life balance.

- Consistency: When you have standardized processes, you ensure that every task is completed consistently. This leads to higher-quality work, improved client satisfaction, and a stronger reputation for your firm.

- Scalability: As your business grows, the systems you’ve put in place will help you handle an increased workload without feeling overwhelmed. Systemization makes it easier to onboard new clients, manage larger projects, and even hire staff if needed.

Steps to Systemize Your Solo Accounting Firm

Systemizing your solo accounting firm may seem daunting, but breaking it down into manageable steps can make the process much more achievable. Here’s a more detailed look at how to systemize your firm, ensuring that every aspect of your business is optimized for productivity.

1. Identify Key Processes: The first step in systemizing your firm is to identify the key processes that make up your day-to-day operations. These are the tasks and workflows that are repeated regularly and are crucial to the functioning of your business. Common processes in an accounting firm include tax preparation, invoicing, monthly reporting, client communications, etc.

2. Document Your Processes: Once you’ve identified the key processes, the next step is to document each one in detail. This documentation serves as a blueprint for completing tasks, ensuring everything is done consistently and efficiently. Here’s how to approach this:

- Break Down Each Process: Start by outlining each step involved in the process. For example, in the client onboarding process, steps might include initial consultation, collecting client information, setting up their account in your system, and scheduling regular check-ins.

You may be interested in:

- Include Tools and Resources: For each step, note the required tools or resources. For instance, you might use a CRM system to manage client information or specific software to prepare financial reports.

- Detail Specific Instructions: Be as detailed as possible. If certain tasks require specific formatting or communication styles, include those details in the documentation. This ensures that anyone following the process, including yourself, can do so without confusion.

- Create Checklists: For complex processes, creating checklists can be particularly helpful. Checklists ensure that every step is followed and nothing is overlooked.

Creating a Standard Operating Procedure (SOP) not only helps in systemizing your work but also provides a reference point for training new staff if you decide to expand your firm in the future.

Get your firm into order; same way you can’t invite a guest into your home without making sure it is clean and tidy, you shouldn’t hire if your firm is not in good shape."

Nicole Davis, CPA.3. Leverage Technology and Automation: As a solo accounting firm, you wear many hats—accountant, marketer, administrator, and more. With so much on your plate, leveraging technology and automation can be a game-changer. It’s not just about staying current with trends; it’s about making your life easier, reducing manual tasks, and allowing you to focus on what truly matters: serving your clients, growing your business, and having more time for yourself.

- Automate Repetitive Tasks: Time is your most valuable resource. Automating repetitive tasks can free up hours of your day, reduce the risk of errors, and ensure that essential tasks are completed on time.

If you have three clients with the same deal, you don't have to do it all over and over again; technology should be implemented to make the firm run well and faster"

Ryan Lazanis, Founder of Future Firm.- Implement Workflow Automation Tools: When selecting your firm’s workflow tools, consider factors such as ease of use, feature availability, and pricing. Additionally, it’s essential to choose cloud-based software, which enables remote access and collaboration. Financial Cents, for example, has a solo plan dedicated to solo firm owners. With a customized plan starting at just $9 per month (on the annual plan), this will help you stay organized and productive without breaking the bank.

Its suite of features includes:

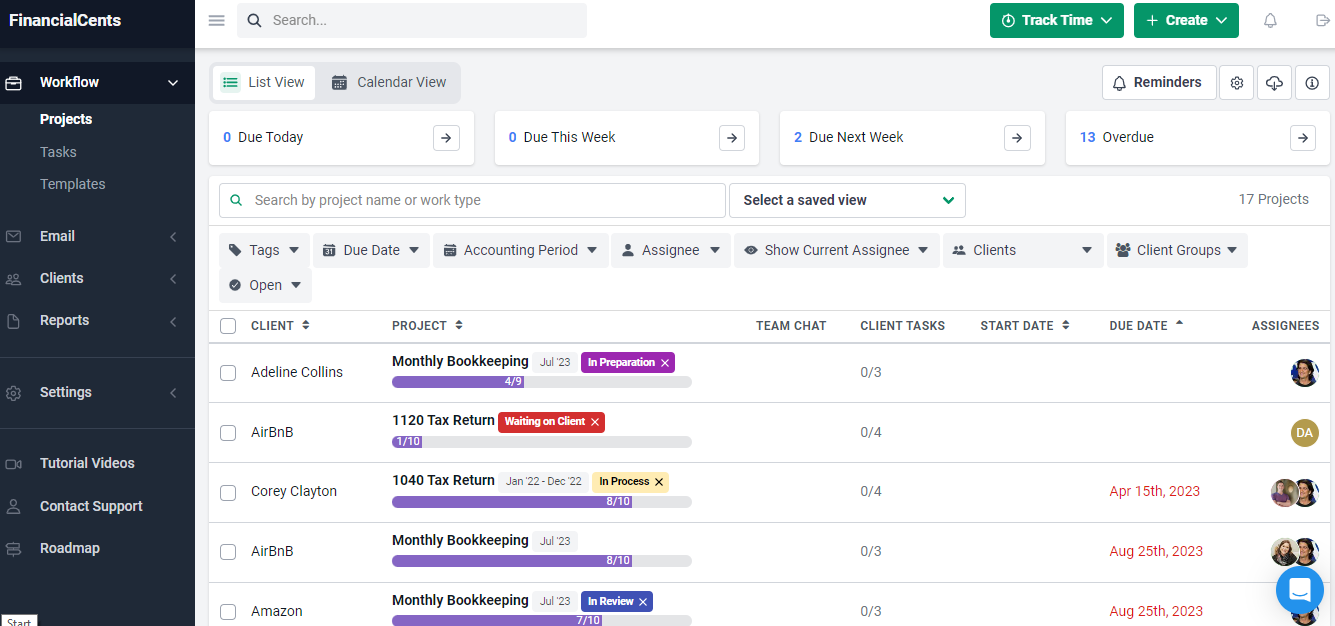

- A Workflow dashboard that allows you to track the progress of each task so you always know what’s been completed and what still needs attention. This helps you manage your time more effectively, stay focused, and meet your deadlines consistently.

- Email integration to manage and organize communication with your clients. Turn emails to projects and automatically organize client emails separately from other emails.

- Client profiles to store and organize client information.

- Client Vault to store sensitive information (like social security numbers, credit card information, etc.) securely.

- Client Tasks to automate data collection and reduce time spent chasing clients for information.

- QuickBooks Integration: Import and auto sync your clients, time tracking and invoicing to Financial Cents in one click. You can also sync your time-tracked, invoices and online payments from Financial Cents to QBO.

- ChatGPT integration to create workflow templates within seconds.

- Templates Sharing: this feature makes it easy to share and receive workflow templates from your peers. Instead of creating workflows from scratch, you can quickly access and use templates others have already created.

4. Implement and Test: With your processes documented and tools selected, the next step is implementation. This involves integrating the tools into your workflow and ensuring that they function as expected. Here’s how to go about this:

- Start Small: Begin by implementing systems for one or two key processes rather than trying to overhaul everything at once. For example, you might start with task management or client onboarding. This allows you to focus on getting each system up and running smoothly before moving on to the next.

- Test Thoroughly: Once a system is implemented, test it thoroughly to ensure it works as intended. This might involve running through the process multiple times, simulating different scenarios, and adjusting as needed. Testing is crucial for identifying potential issues before they become bigger problems.

- Gather Feedback: If you have a team, involve them in the testing process and gather their feedback. They may notice issues or suggest improvements that you hadn’t considered. If you’re working alone, consider running the system with a mentor or peer for their input.

5. Train Yourself and Your Team: Once your systems are in place, it’s essential to ensure that everyone involved is trained on how to use them. Even if you’re a solo practitioner, taking the time to thoroughly understand your systems will pay off in the long run. If you have or plan to hire staff, training becomes even more important.

- Self-Training: As a solo accountant, it’s important to invest time in learning how to use your new systems effectively. This might involve attending webinars, taking online accounting courses, or reading user manuals. The more proficient you are with the tools, the more efficiently you can manage your firm.

- Team Training: If you have a team, create a training program to ensure everyone understands the processes and tools. This might involve creating training materials, holding workshops, or providing one-on-one coaching. The goal is to ensure that everyone can perform their tasks efficiently and consistently.

- Create a Training Manual: Consider creating a training manual that includes all the documented processes and instructions on using the tools. This manual can serve as a valuable resource for current and future team members, ensuring continuity and consistency.

6. Monitor and Improve: Systemization is an ongoing process. Once your systems are in place, it’s essential to monitor their performance and make regular improvements as needed. Here’s how to approach this:

- Regular Reviews: Set aside time each quarter to review your systems and processes. Are they still meeting your needs? Have any inefficiencies or bottlenecks emerged? Regular reviews allow you to identify and address issues before they become significant problems.

- Solicit Feedback: Encourage feedback from clients and team members about your systems. Clients, in particular, can offer insights into how user-friendly your processes are from their perspective. For example, if clients find your invoicing process cumbersome, it may be time to simplify it or switch to a different tool.

- Stay Updated on Technology: The accounting industry constantly evolves, with new tools and technologies emerging regularly. Stay informed about these developments and be open to adopting new solutions to improve your systems. This might involve upgrading your software, automating additional tasks, or integrating new tools into your workflow.

- Plan for Scalability: As your firm grows, your systems must evolve to handle increased demand. Planning for scalability might involve expanding your use of automation, hiring additional staff, or upgrading your software to a more robust platform. By planning for growth, you ensure that your systems can continue to support your business as it expands.

The Path to a Systemized Solo Accounting Firm

The time and effort you invest in systemizing your solo firm will pay off in the long run, allowing you to focus on what you do best—providing exceptional service to your clients. Remember, systemization is not a one-time task but an ongoing process that evolves as your firm grows.

With an efficient workflow software like Financial Cents, you are well on your way to putting streamlined processes in place.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to our newsletter for an awesome dose of firm growth tips.

Subscribe to our newsletter for an awesome dose of firm growth tips.

Thanks for the article! These systemization tips regarding your own accounting firm seems useful for my own financial services UK business.