Why Generic Project Management Software Aren’t a Good Fit for Accounting Firms

Author: Financial Cents

Reviewed by: Kellie Parks, CPB

In this article

The demand for project management software is growing faster than ever. According to Mordor Intelligence, its market size in 2023 is $5.91B. With a Compound and Annual Growth Rate (CAGR) of 10.67%, it’s estimated to reach $9.81B in 2028.

These huge numbers are happening because more businesses are realizing how much proper project management practices contribute to the success of an initiative.

That’s all fine and good, but here’s the thing. As an accounting firm owner that wants to improve productivity, popular project management software like ClickUp, Asana, Monday.com, or Trello are not the best options for you. Yes, they are great for managing projects. But they are for general use, not specific niche needs. In other words, they aren’t tailored to the accounting industry.

Take Asana, for instance. Sarah Landrum, Office Manager, Ascension CPA, used the software to manage her accounting firm’s project for a while, but it was ineffective. She said,

Asana wasn't designed for the bookkeeping or tax industry. For example, it was super complicated to get the due dates to populate, so I was having to go in and do a lot of work to manually change these due dates."

That’s just one of many limitations of general-use project management tools we’ll be discussing below. Along with the key requirements and benefits of an accounting project management software like Financial Cents.

Drawbacks of Using a Generic Project Management Software

1. No automated client reminders

If you’re running a moderately successful practice, there are always a million and one things you need to contact your clients about. If it’s not to remind them about upcoming deadlines, it’s so they can send necessary documents.

Doing this manually is an awkward option, as it’s time-consuming and leaves room for mistakes. For example, a missed reminder could lead to a missed deadline for tax filing, which can cause issues with the client.

That’s why we recommend using a tool designed just for this purpose. Generic project management software doesn’t have this feature. They can’t automatically remind clients to perform their tasks in an actionable and traceable way, specifically for accounting collaboration.

This feature is available with accounting project management software like Financial Cents. You can automate follow-up reminders at specified intervals until the client completes your request. No need to add it as a task in your calendar so you don’t forget. You can also set the reminders to be recurring if it’s a document you need monthly. Learn more here.

2. No integration with accounting software like QuickBooks

Clickup, Trello, Asana, and others boast integrations with hundreds and thousands of apps. Yet, none of their integrations are with accounting software. Meaning for some basic accounting tasks like invoicing clients or managing payroll, you’ll need to get a different tool and continually switch between them.

This can be inconvenient and stressful.

Financial Cents offers integration with tools like QuickBooks to provide the best experience. It’s as Amanda Owens, Firm Administrator at Badger CPA, said.

That’s why we like Financial Cents, it’s an all-in-one work management system for Accounting firms."

3. Little to non-existent CRM feature

Accounting firms rely heavily on client interactions and maintaining long-term partnerships to grow. An accounting CRM is a great way to manage these relationships. With it, you can store customer’s information for easy retrieval, collaborate, and communicate with them seamlessly.

Most project management tools don’t have a robust CRM function. They usually only have the ‘message’ and/or comment feature for communication, which is insufficient for accounting firms. There’s no way to organize and centralize all client data, making teamwork harder.

4. Inadequate client portal

A client portal makes collaboration between business and customer possible. To invite clients to projects on generic software, you have to convince your clients to create an account, which they might be reluctant to do. They now agree to come on board, only to meet a platform with inadequate functionality.

Other industries might not need a robust, secure client gateway, but the accounting ones do. In these portals, clients can see the tasks you’ve delegated to them, like certain uploading documents (which they can do directly on the platform).

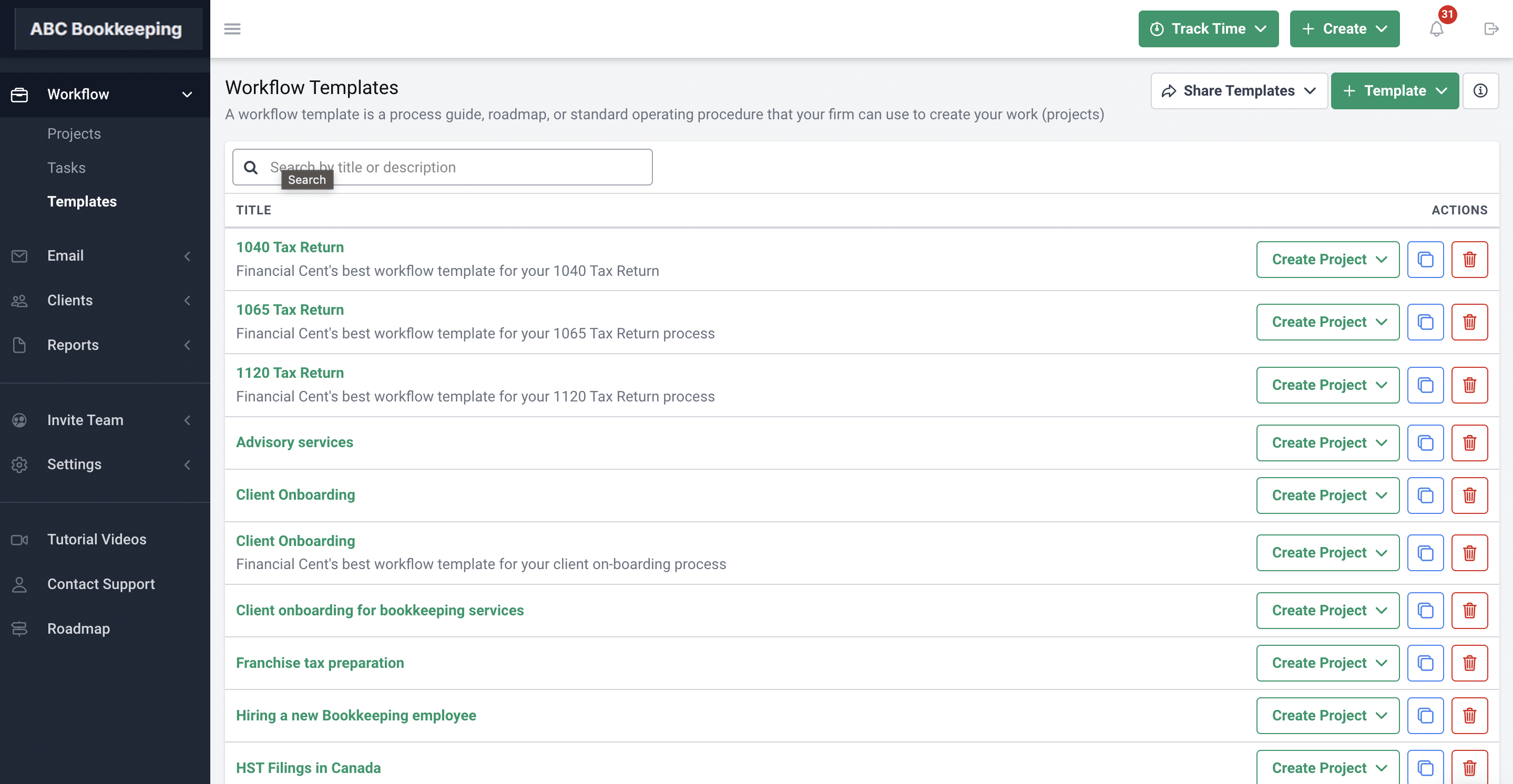

5. Generic workflow templates

Regular project management tools have simple, regular templates because they serve the general audience. Some of them, like ClickUp, have templates for different industries, but it’s still surface-level and not robust enough. Templates in their finance and accounting section include budget reports, feedback forms, finance management, etc. These are useful but are available everywhere on the internet.

For deep, unique accounting workflow templates, turn to accounting software.

6. Customer support isn’t industry-specific.

If you run into issues or require features specific to your daily operations, the generic software’s customer support might not have the necessary knowledge to provide meaningful assistance. Their support is generally trained to help with broad problems instead of industry-specific ones.

Financial Cents is in the finance industry, so we can help with any finance-project-related problems you have. And our support is fast, too! Here’s a review from Amanda Birch of Birch Accounting & Tax Services:

Customer support has been phenomenal. As Taya has mentioned previously, we can send an email, jump on Facebook and ask a question or report a bug or whatever it is. And we get heard, and it's either fixed or explained why it can't be fixed."

The Benefits of Using Accounting Project Management Software in Your Firm

Having something that was designed for an accounting or bookkeeping firm was extremely important. This last time I was looking for a solution, I only looked at ones that were designed for the accounting community, just because our needs are very niche. Using Asana and Trello means you have to make it work for you, as opposed to accounting-specific tools that get you halfway there already."

Amanda BirchUsing software designed for the accounting industry has numerous advantages, which we’ll look at now.

1. Streamlined accounting workflow templates

Templates are great because they ensure consistency and efficiency in project execution. This is crucial because as your firm gets bigger, it becomes harder to be personally involved in each one. You need ways to simplify processes while maintaining quality, which is where workflow templates come in.

We designed Financial Cents for accountants and bookkeepers, so we have almost 50 free customized accounting templates, and we’re always adding to them.

You can also create your own workflows. It’s part of what Shannon Theis, Owner of Payroll Solutions Plus, loves about Financial Cents.

We don’t need 100 hours of training to use Financial Cents like ClickUp. Because Financial Cents is intuitive, creating custom workflows is super-easy for the Payroll Solutions Plus team. This allows the entire team to use their time for the work that matters, which is fixing the broken payroll of their clients."

Recommended Reading

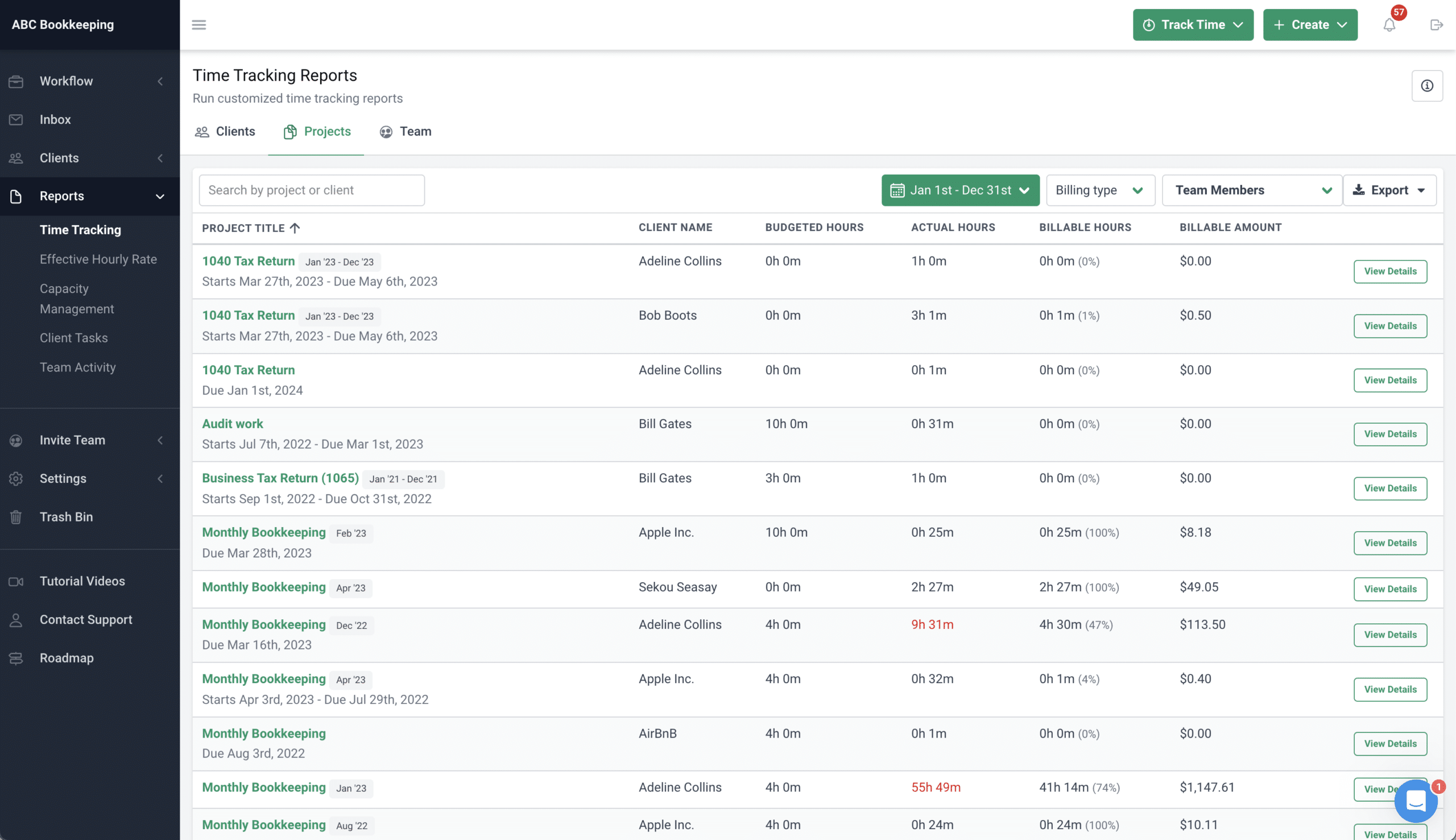

2. Time-tracking capabilities

Hourly pricing — where you bill your clients for the hours you’ve worked — is the most common form for accountants. This makes time-tracking essential. You need to accurately track how many billable hours your firm spends on a project so you don’t under or overcharge your clients.

But time-tracking isn’t beneficial only for those who bill per hour. If you’re operating the retainer or fixed price model, knowing the hours you put into a project is still helpful.

Regardless of your pricing model, with built-in time-tracking features, you don’t have to integrate an external tool into your project management software to track time. This saves you the stress of navigating multiple solutions.

Amanda Owens experienced a similar situation with Asana.

Asana did not have time-tracking abilities so we used an external time-tracking app called TSheets. This wasn’t convenient because we had to pull data from two systems to get workflow and time management."

She tried Monday.com, and while it could track time, it wasn’t effective for her needs:

“We wanted to track time by individual employees and each task, but we couldn’t.”

Finally, she stumbled on Financial Cents, with its background automatic or manual timer. Our software helped her log billable and non-billable hours seamlessly and understand and improve employee working habits. She said:

We use the time-tracking and capacity management reports to gain visibility on who has excess workload and know the status of a project."

Here’s what time-tracking with us looks like.

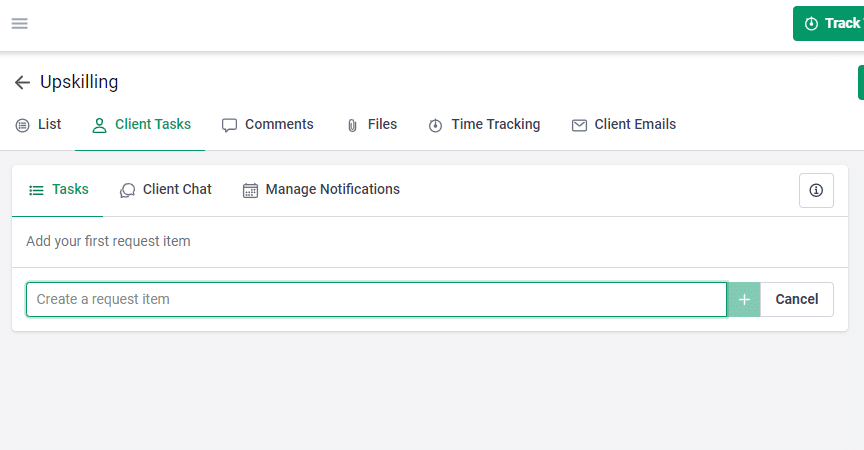

3. Receive documents from clients faster using automated client requests

Good accounting project management software provides a way to collect documents from clients easily and without delays. This is because they understand how necessary data collection is in an accounting firm. And how it causes delays, reducing the firm’s workflow efficiency.

You can get documents faster and store them in an organized way with Financial Cents. All you have to do is create a request list and describe the task you want clients to complete. The tool will automatically reach out to the client.

You can also set auto reminders until they complete the task.

4. CRM integration

A project management software for accountants will either integrate with a CRM or have CRM features. This tracks client interactions, organizes all client data in a straightforward view that team members can access, and personalized offerings according to analytics.

Our software shines here; you can do all that and more with it.

5. Never miss deadlines

The accounting industry revolves around ensuring timely compliance with various regulatory requirements and meeting critical submission dates.

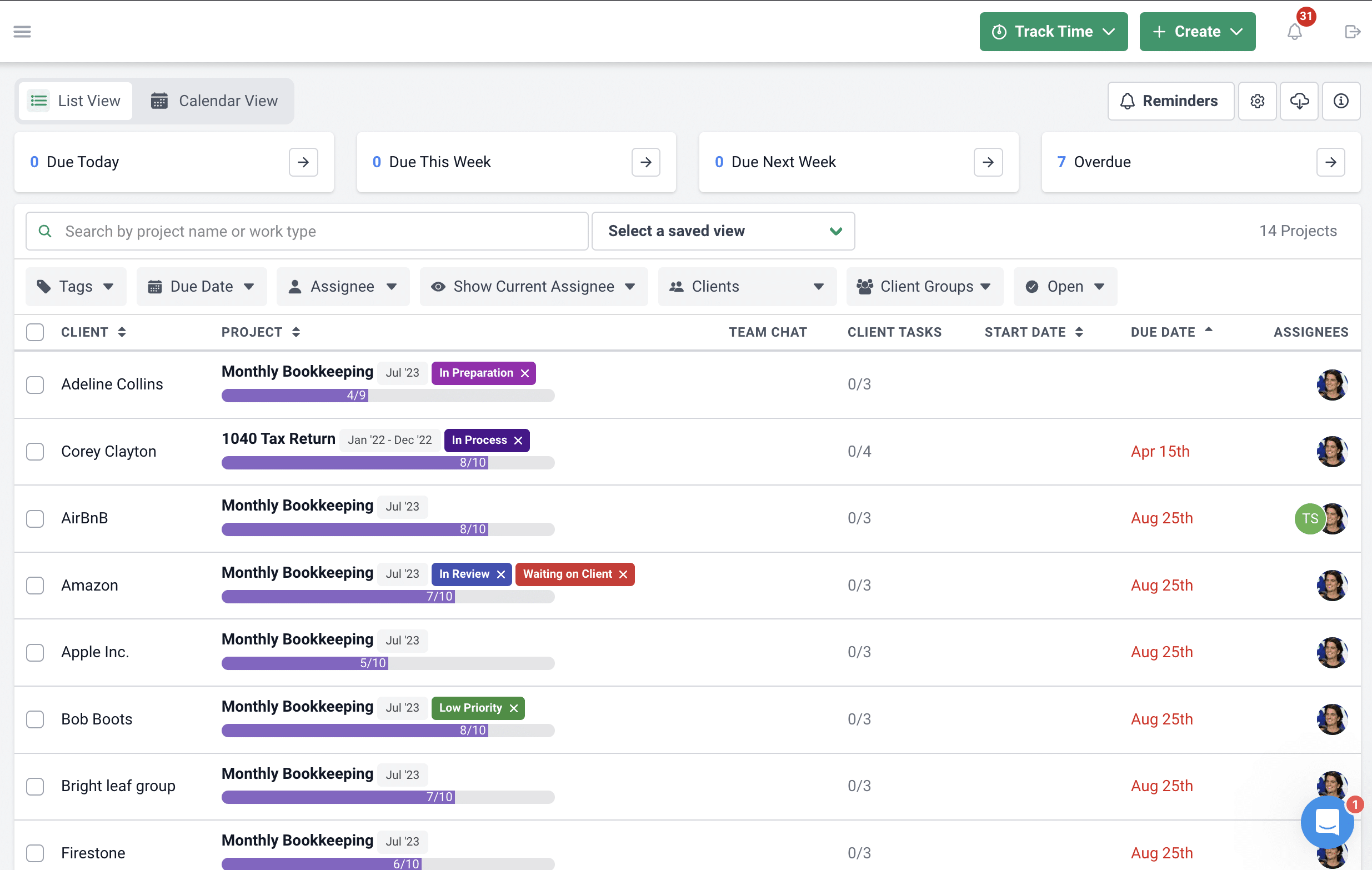

Therefore, industry-specific tools will help you manage your workflows so you stay on top of work. With many employees, it’s easy to miss when one employee is overburdened or isn’t on track to meet goals. But solutions like Financial Cents let you monitor progress, distribute work evenly, and prioritize tasks based on urgency via a public dashboard.

Other general software doesn’t give everyone access to the same information as Financial Cents.

-

Client portal

If you use Financial Cents, your clients no longer need a password and username before they can access their portal. We use secure magic links and verification codes, an easier way to log in.

Also, our client portal gives them full visibility into the project for accountability purposes.

-

Integration with other accounting software

Even an all-in-one accounting tool still needs to integrate with other tools. While they satisfy most firm needs internally, some functions might still be absent, necessitating them to integrate with external options to fully satisfy their customers.

Financial Cents has email integrations alongside other software like QuickBooks. And if you need any feature or integration, recommend it, and we’ll work towards it.

Start Using Financial Cents to Manage Your Projects

From time-tracking to workflow management to client requests and portals, we’ve shown you the many ways Financial Cents helps you manage projects so you can scale your firm.

What are you waiting for?

Start Using Financial Cents for project management in your accounting firm

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

How to Perform a Comprehensive QuickBooks Cleanup (+ Free Checklist Template)

QuickBooks cleanup drove the most profits for accounting and bookkeeping firms in 2023. Knowing how to bring order and clarity to the…

May 02, 2024

Key Features of a Great Accounting Document Management System

Here’s all you need to know about an accounting document management system and how it can make you more organized and save…

Apr 26, 2024