Accounting firms face a unique set of challenges when it comes to managing their internal operations. The demands of client accounting services, regulatory compliance, and maintaining profitability can be overwhelming. To alleviate some of these burdens, many accounting firms are turning to outsourcing. Accounting firms may also outsource some of their accounting services in order to continue serving low paying clients in order to serve high value clients. About 40% of CPA firms outsource their accounting services.

In this article, we will explore the 10 accounting services your accounting firm can outsource to enhance efficiency, reduce costs, and focus on core competencies.

Benefits of Outsourcing for Accounting Firms

Before diving into the specific services that accounting firms can outsource, let’s first understand the benefits of this approach:

1. Cost-Effectiveness

Outsourcing can significantly reduce your operational costs. Instead of hiring and training in-house staff, you can leverage the expertise of outsourcing partners without the associated overhead costs. This cost-saving strategy allows firms to maintain healthy profit margins while providing quality services.

2. Scalability

Accounting firms often experience fluctuations in workloads, particularly during tax season. Outsourcing enables firms to scale their services up or down as needed, ensuring that they can meet client demands without the need to hire or lay off staff.

3. Access to Specialized Skills

Outsourcing providers are experts in their fields, offering specialized skills and knowledge. You can tap into this expertise to provide your clients with high-quality services, even in niche areas of accounting.

4. Focus on Strategic Growth

Outsourcing non-core tasks frees up time and resources for your firm to concentrate on strategic growth initiatives, client relationships, and business development. This shift in focus can lead to a more profitable and competitive firm.

10 Accounting Services Your Accounting Firm Can Outsource

Let’s explore the specific accounting services that accounting firms can consider outsourcing:

1. Bookkeeping

Bookkeeping is the foundation of all accounting processes, but it can be time-consuming. It involves the detailed recording of financial transactions, maintaining accurate ledgers, and ensuring that financial records are up-to-date. Outsourcing bookkeeping tasks can offer several advantages:

- Accuracy and Consistency: Professional bookkeepers are experienced in data entry and can ensure high accuracy and consistency in financial records.

- Time and Resource Savings: Outsourcing bookkeeping allows your accounting firm to focus on higher-level services, client interactions, and strategic growth initiatives.

- Cost Reduction: Avoid hiring and training in-house staff for bookkeeping tasks, which can be a cost-effective solution.

2. Payroll Processing

Managing payroll involves calculating and distributing employee salaries, handling tax withholdings, and ensuring compliance with labor laws. Outsourcing payroll processing provides numerous benefits:

- Error Reduction: Professional payroll providers have the expertise to accurately calculate payroll, minimizing errors and the potential for legal issues.

- Time Efficiency: Free up your staff from time-consuming payroll tasks to concentrate on more strategic activities.

- Tax Compliance: Outsourcing ensures that your firm remains compliant with ever-changing tax laws and regulations.

This payroll processing checklist

3. Tax Return Preparation

Preparing and filing tax returns is a core service for accounting firms. Outsourcing tax return preparation offers various advantages:

- Expertise: Tax experts can navigate complex tax codes, identify tax-saving opportunities, and provide advice on optimal tax strategies for clients.

- Efficiency: Outsourcing ensures that tax returns are prepared accurately and filed on time, eliminating the stress and rush associated with tax season.

- Quality Control: Tax experts maintain a high level of quality and accuracy in tax preparation, which helps build client trust.

4. Auditing and Assurance Services

Auditing and assurance services are essential for evaluating the accuracy and reliability of financial statements. Outsourcing these services can have several benefits:

- Independence and Objectivity: Independent professionals can conduct unbiased assessments, enhancing the credibility of financial reports.

- Expertise: Auditing experts have in-depth knowledge of auditing standards and can ensure that your clients’ financial statements are free from material misstatements.

- Efficiency and Timeliness: Outsourcing can speed up the auditing process, allowing for timely financial reporting.

5. Data Entry and Reconciliation

Data entry and reconciliation tasks, though essential, can be repetitive and time-consuming. Outsourcing these functions can provide the following advantages:

- Data Accuracy: Skilled professionals are proficient in data entry, minimizing errors and discrepancies in financial records.

- Time Savings: Your staff can focus on analyzing and interpreting data instead of spending time on data entry and reconciliation.

- Improved Decision-Making: Accurate and well-organized data facilitates better decision-making for both your firm and your clients.

6. Financial Statement Preparation

Preparing financial statements, including balance sheets, income statements, and cash flow statements, is a fundamental accounting service. Outsourcing financial statement preparation offers the following benefits:

- Accuracy and Compliance: Professional service providers can ensure that financial statements are prepared accurately and in compliance with accounting standards.

- Efficiency: Outsourcing streamlines the financial statement preparation process, allowing for faster access to crucial financial information.

- Consistency: Maintaining consistent and professional financial reporting enhances the credibility of your firm.

7. Compliance and Regulatory Reporting

Compliance with industry-specific regulations and government requirements is a legal obligation for most businesses. Outsourcing compliance and regulatory reporting can provide various advantages:

- Specialized Knowledge: Regulatory experts can ensure that your firm and clients remain compliant with complex and ever-changing regulations.

- Risk Mitigation: Avoid legal and financial risks by outsourcing compliance reporting to professionals who understand the intricacies of regulatory compliance.

- Timely Reporting: Outsourcing can help ensure that all required reports are submitted promptly, preventing costly penalties and legal issues.

8. Accounts Payable and Receivable Management

Efficient management of accounts payable and receivable is vital for managing cash flow. Outsourcing these functions offers numerous advantages:

- Cash Flow Optimization: Professional accounts payable and receivable managers can optimize cash flow and minimize working capital requirements.

- Vendor Relations: Improved accounts payable management can lead to better vendor relationships, potentially offering discounts for early payments.

- Minimized Late Payment Penalties: Avoid costly late payment penalties by managing accounts payable more effectively.

9. Tax Planning and Consulting

Outsourcing tax planning and consulting services to experts in tax matters can benefit your firm in several ways:

- Expert Advice: Tax experts can provide valuable advice to your firm and clients, especially in complex tax matters.

- Tax Efficiency: Identifying tax-saving opportunities and optimizing tax strategies can result in significant cost savings for your clients.

- Comprehensive Tax Solutions: Outsourcing provides access to a wide range of tax services, from tax planning and consulting to tax return preparation.

10. Budgeting and Forecasting

Budgeting and forecasting are essential for financial planning and decision-making. Outsourcing these services can offer the following advantages:

- Accurate Financial Projections: Professional forecasters can provide accurate financial projections, allowing clients to make informed decisions.

- Optimal Budgets: Outsourced budgeting experts can help clients create budgets that align with their financial goals and objectives.

- Better Decision-Making: Well-prepared budgets and forecasts serve as valuable tools for strategic decision-making.

Incorporating outsourcing into your accounting firm’s strategy for these 10 services can lead to improved efficiency, cost savings, and the ability to provide high-quality services to your clients. By identifying the specific needs of your firm and clients, you can make informed decisions about which services to outsource and select the right outsourcing partner to enhance your accounting practice.

You may be interested in:

The 13 Best Accounting Practice Management Software Options in 2025.

Selecting the Right Outsourcing Partner

Choosing the right outsourcing partner is crucial for the success of your firm’s outsourcing strategy. Consider the following factors when making this decision:

1. Experience and Reputation

Evaluate potential outsourcing partners’ experience and reputation within the industry. Look for client reviews, references, and case studies to gauge their reliability.

2. Data Security

The security of financial data is paramount. Ensure that your chosen provider has robust data protection measures in place and complies with data security regulations.

3. Compatibility

Seek a partner that aligns with your firm’s values and goals. Compatibility in terms of work culture and communication can make the outsourcing relationship more effective.

4. Communication

Effective communication is key when outsourcing. Ensure that you can easily communicate with your partner through email, phone, or a dedicated portal.

5. Scalability

Choose a partner that can scale their services as your firm grows and evolves, accommodating your changing needs.

6. Service Level Agreements (SLAs)

Define clear SLAs in your contract to establish expectations regarding service quality, response times, and other critical factors.

Potential Challenges and Mitigation Strategies

While outsourcing offers numerous advantages, it’s essential to be aware of potential challenges and how to mitigate them:

1. Loss of Control

Outsourcing means relinquishing some control over certain processes. Mitigate this by clearly defining expectations and maintaining regular communication with your outsourcing partner.

2. Data Security Concerns

Address data security concerns by selecting an outsourcing partner with robust data protection measures and a firm commitment to safeguarding your information.

3. Quality Control

To maintain quality control, define clear SLAs in your contract and regularly review the quality of work to ensure it aligns with your firm’s standards. You can also create and use standardized accounting workflow templates that fit your firm’s needs.

4. Transition Period

Plan for a smooth transition by providing your service provider with access to all necessary data and ensuring they understand your firm’s business processes.

Trends and Innovations in Accounting Outsourcing

The accounting outsourcing industry is continually evolving. Here are some emerging trends and technologies that are shaping the industry:

- Cloud-Based Accounting: Cloud accounting software allows for real-time access to financial data, improving collaboration between firms and outsourcing partners.

- Data Analytics: Data analytics tools are enabling more in-depth financial analysis, helping firms make data-driven decisions.

- Artificial Intelligence (AI) and Automation: AI and automation are streamlining routine accounting tasks, reducing errors, and increasing efficiency.

- Blockchain Technology: Blockchain is enhancing the security and transparency of financial transactions and record-keeping.

A Step-by-Step Guide to Getting Started

If your accounting firm is considering outsourcing accounting services, here’s a step-by-step guide to help you get started:

- Identify Your Needs: Determine which accounting services are essential for your firm.

- Research Providers: Research potential service providers and evaluate their credentials, reputation, and compatibility.

- Define Expectations: Establish clear expectations, SLAs, and communication channels with your chosen partner.

- Data Transition: Provide your partner with access to the necessary data and processes.

- Monitor and Review: Regularly monitor the quality of work and review performance to ensure it aligns with your firm’s expectations.

Risks and Disadvantages of Outsourcing for Accounting Firms

While outsourcing accounting services can offer substantial benefits, it’s important to be aware of potential risks and disadvantages. Some common drawbacks include:

- Client Confidentiality: Sharing client data with an external partner can raise concerns about confidentiality. Ensure your partner has robust data protection measures in place.

- Quality Assurance: Maintaining quality control can be challenging. However, defining clear SLAs and reviewing performance can help mitigate this risk.

- Hidden Costs: The costs of outsourcing may not always be straightforward. Carefully evaluate pricing models and consider any potential hidden costs.

- Communication Challenges: Effective communication is crucial. Overcome this challenge by establishing clear communication channels and expectations.

Outsourcing accounting services offers accounting firms the opportunity to enhance efficiency, reduce costs, and concentrate on core competencies. By understanding the 10 accounting services your firm can outsource and the benefits of doing so, you can make informed decisions about how to optimize your firm’s internal operations and enhance your ability to provide quality services to clients. Carefully evaluate potential service providers, mitigate challenges, and stay informed about industry trends to ensure a successful outsourcing partnership that benefits your accounting practice and the clients you serve.

Use Financial Cents to Manage Your Outsourced Partners

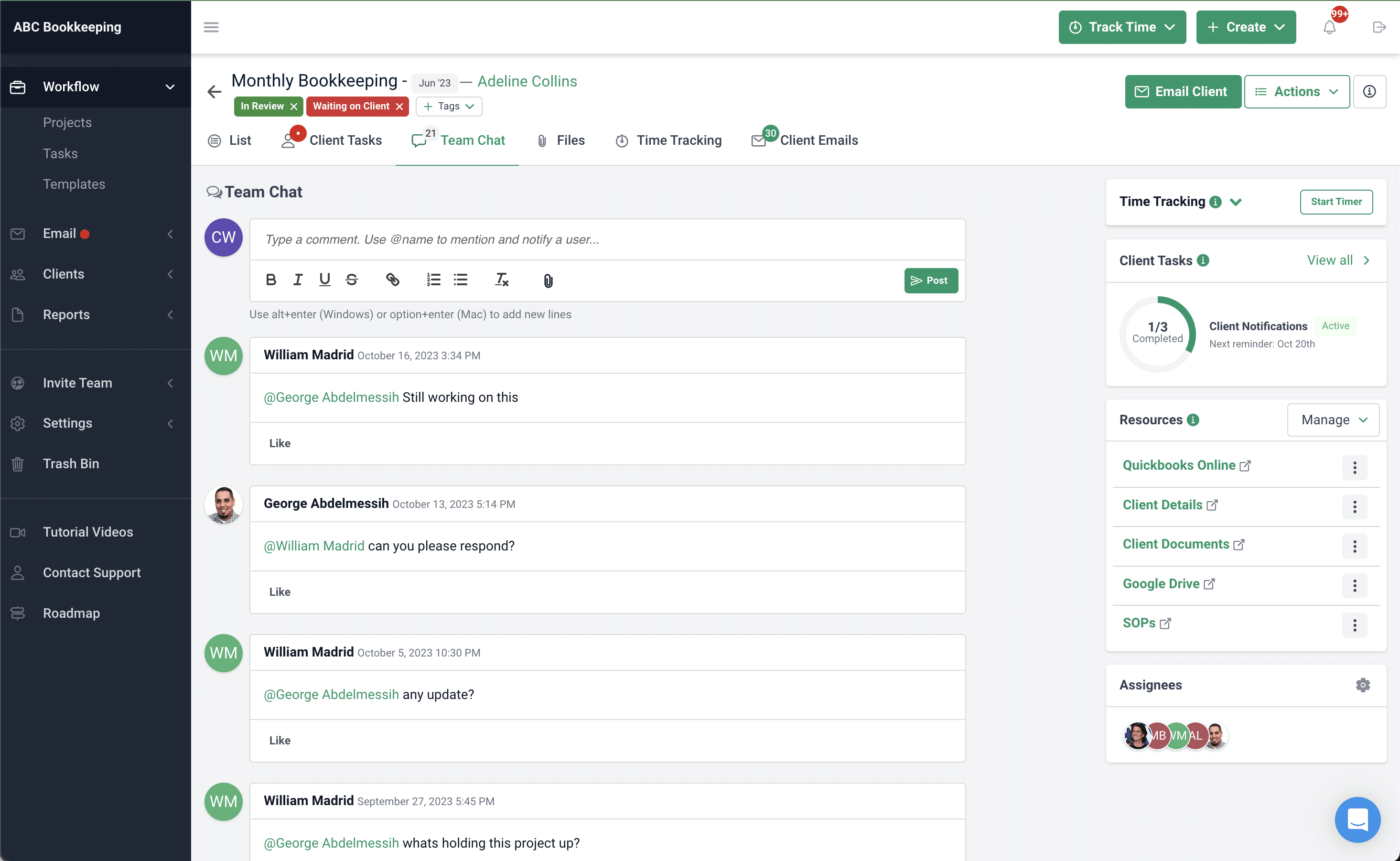

Maintaining a high level of quality in your clients’ tasks and meeting deadlines, regardless of whether your staff members or outsourced partners are handling the task, is crucial for a firm’s success. With Financial Cents accounting practice management software, you can ensure that your outsourced partners can execute tasks at the same quality level your clients expect.

You can create and use accounting workflow templates tailored to your firm’s needs and share them with your outsourced partners. Monitor and track the status of your clients’ tasks to ensure you consistently meet deadlines and much more.

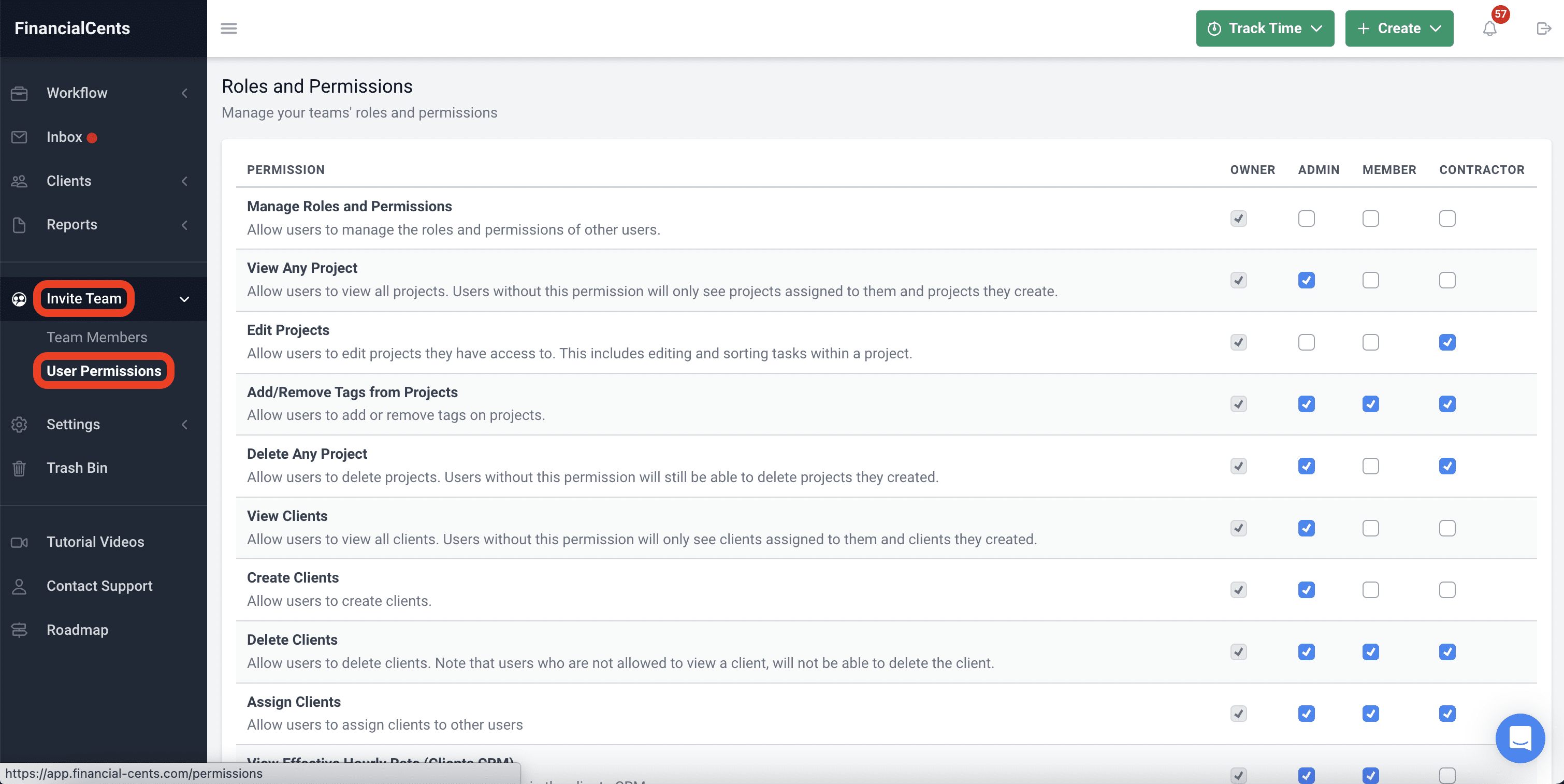

Outsourced partners can be added toFinancial Cents as contractors so you can manage their access to certain information.

Financial Cents also makes it easy for you to have effective collaboration between both your internal and external teams, ensuring that work is done to your firm’s standards, and no one feels left out on important client updates.