Client management should be top of mind for accounting firms. Successful client management results in higher client retention, smoother communication, and being able to complete tasks on time.

But there’s more that goes into accounting client management than staying on top of business updates and meeting notes. Another key element of client management that accountants must be aware of is properly storing and managing client information.

As an accounting firm, your clients are bestowing trust upon you to keep their financial data safe. Not only is it your duty as a financial professional to protect their information, but with the new FTC Safeguards Rule, it’s also a legal requirement. Recent amendments to the rule state that financial institutions (this includes CPA firms) with at least 5,000 customers must uphold the requirements of the Safeguards Rule. Some of these requirements include:

- Designating a qualified individual to implement and supervise the ISP (information security program)

- Conducting a risk assessment of how customer information is stored and updating it periodically

- Implementing a number of safeguards including multi-factor authentication, encrypting customer information, securely disposing of customer information when it’s no longer needed, and regularly training team members

You can read more about the FTC Safeguards Rule and how it impacts CPAs here.

All that to say, it’s more important than ever to have a client management software specifically created for the needs of the accounting industry. The best client management platform should make managing all of your client’s data seamless. It should also make it easy to securely store and access all of your client data in one place without having to use multiple apps and spreadsheets — which can put your firm more at risk of a data breach.

Below, let’s go over why you need accounting client management software and break down a few dealbreaker features your platform must have.

Why You Should Use a Client Management Software Built for Accounting Firms

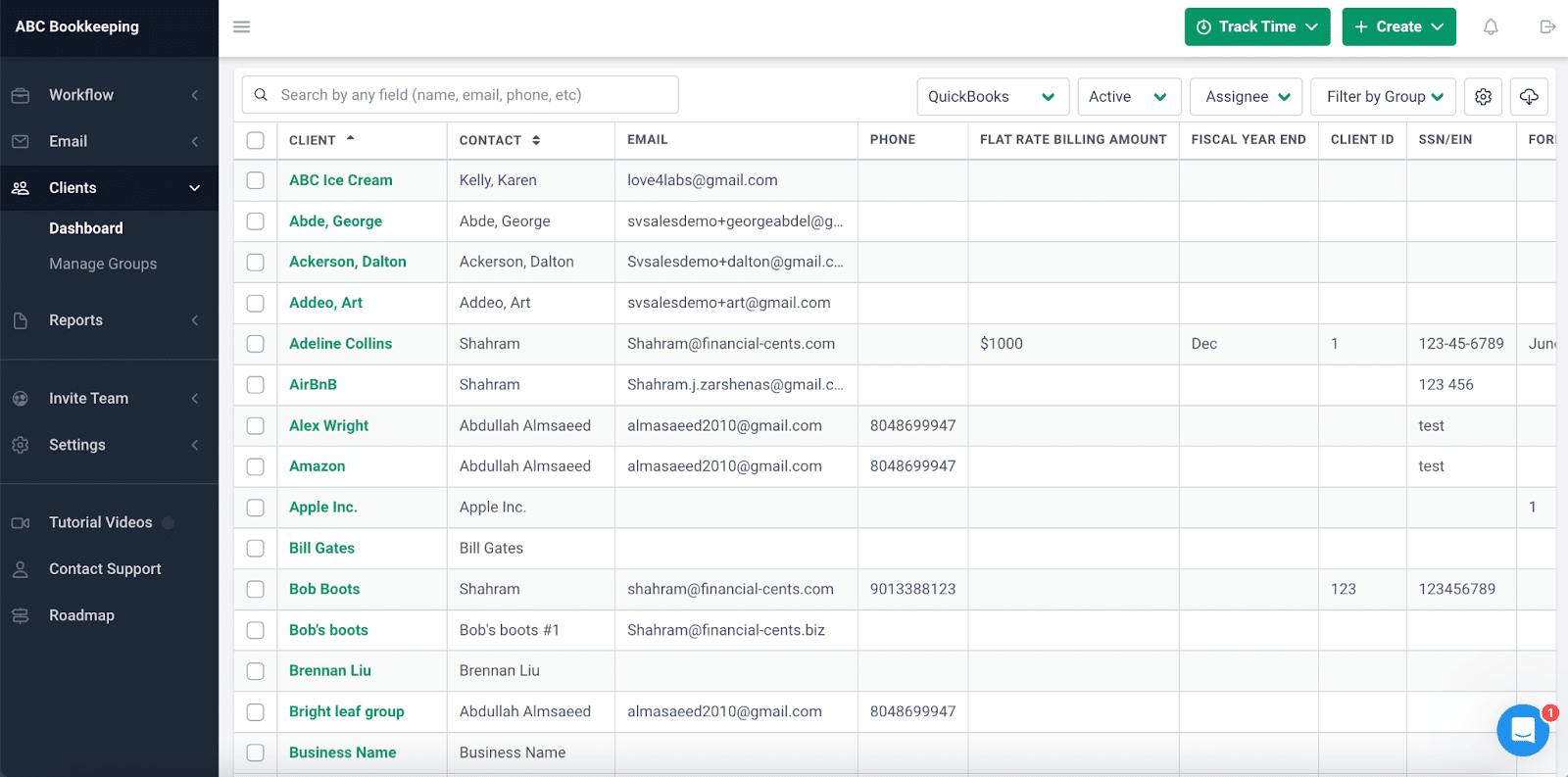

While there’s no shortage of broad client management software available to businesses of all industries, accounting firms have specific needs to address. Accountants manage countless documents, deadlines, and receipts, all while keeping track of client notes, tasks, and data. Without an accounting CRM to organize all of this, you run the risk of important details falling through the cracks.

Here are the top reasons you should be using a client management software built specifically for accounting firms.

-

It’s a central source for all your client information

The biggest benefit of having an accounting client management software integrated into your workflow is that it acts as the central source for all of your client information.

Think back to the early days of your firm before you had a proper CRM in place. You may have created desktop folders for each of your clients, used multiple spreadsheets to organize their information, and always had several email threads going on at once time. Without a central source for your client information, you had to manually piece together critical correspondence and client details which made every task much longer and more complicated to complete.

With a client management software in place, you’ll have one place to access all of your client information. This reduces the constant back and forth, limits the number of places you need to store information, and ultimately gets rid of the numerous spreadsheets, apps, and folders taking up space on your computer. Consolidate your information by using an accounting client management software.

-

An accounting CRM helps track progress on client tasks

Juggling multiple clients across your firm can get trickier the more your firm grows. It’s easy to miss a deadline or let a document request fall to the wayside if you don’t have insight into the status of each and every client task.

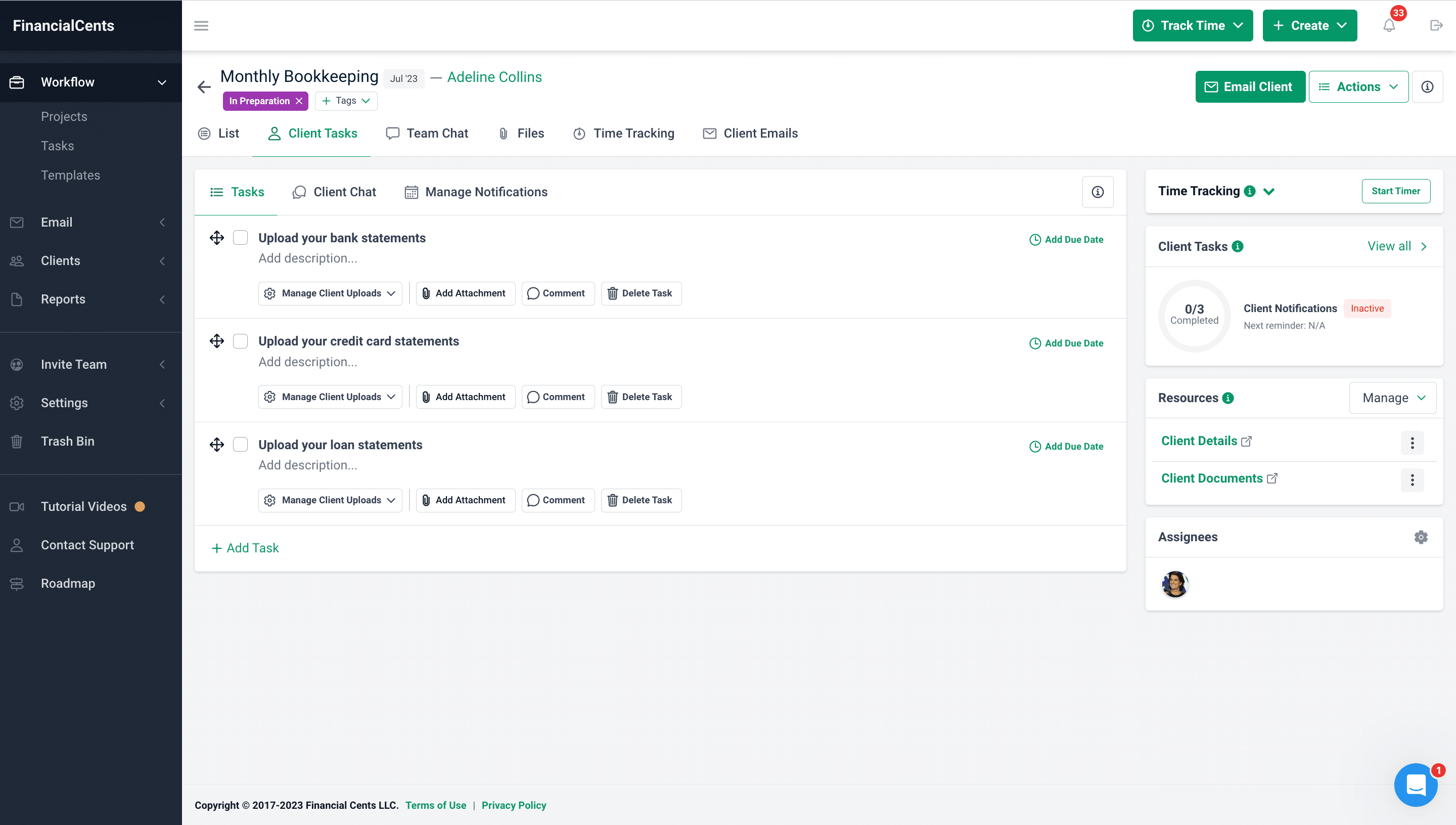

An accounting CRM should help you manage your firm’s clients by providing both an overview of your upcoming tasks as well as details for individual tasks for each client project.

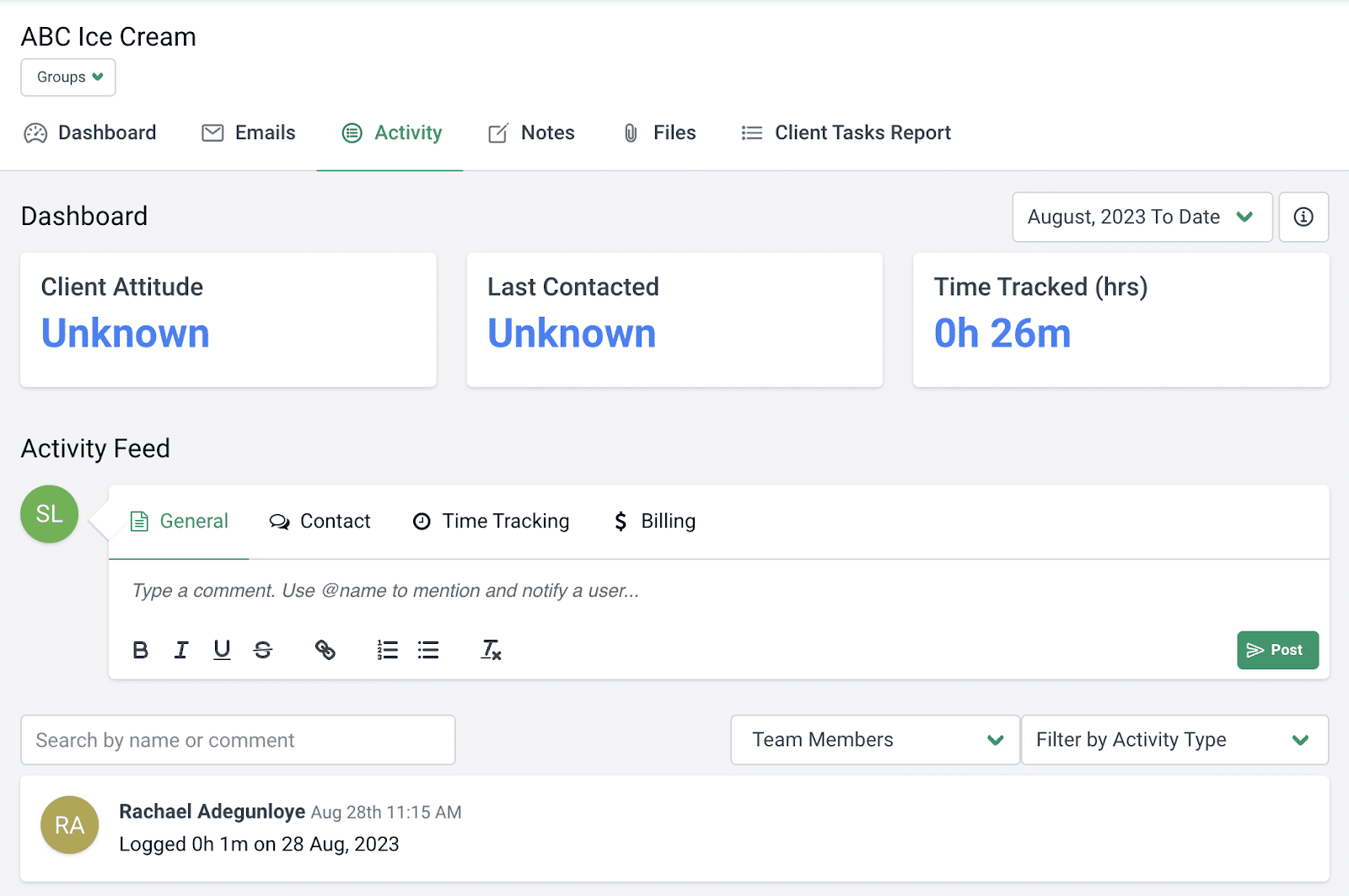

In Financial Cents, for instance, you can easily track the progress on all of your client tasks in a real-time activity feed. Seeing the status of each tasks as they’re being worked on by different team members helps ensure you don’t miss any deadlines or forget to request certain documents.

-

It helps you better collaborate with your team

As we mentioned, the more you scale, the bigger your team gets. While it’s beneficial to have extra support, it’s critical to have a clear accounting workflow and process in place *before* there are too many people involved.

As you bring on extra support for client tasks, use accounting software to collaborate with your team and assign tasks as needed. A client management software like Financial Cents makes it easy to collaborate and communicate with different team members across your firm, without interrupting your workflow. Instead of switching between email, Slack, and multiple spreadsheets to discuss assignments with your team, you can share updates directly within the platform.

-

Accounting client management software aids in client retention

If you’re one of the 26% of firms that say acquiring and retaining clients is your biggest challenge, then we have good news for you: accounting client management software can help solve that problem.

Managing your client workflow, communicating effectively, and staying on top of your client’s information are all factors that contribute to client retention. All of these things can be done more efficiently and seamlessly with a client management software platform.

When your processes, workflow, and communication are strong, your client will ultimately be happier working with you for the long-term. You can also use accounting crm software to build stronger client relationships. Learn more about it in this blog.

-

Improves productivity

In our 2023 State of Accounting Workflow Automation Report, we found that there were a number of challenges slowing down firms’ productivity. The biggest challenge firm owners faced was around workflow, specifically spending too much time on manual work.

When it comes to client management, there’s plenty of manual work that can dampen productivity if you don’t have a proper system or software in place. For instance, manually reaching out to clients to request documents — not to mention consistently following up to send reminders — can take up more time than accountants may realize.

This is why it’s essential to have a client management software that’s designed around the tasks that accountants handle day to day, like requesting documents.

In Financial Cents, you can automate client data collection. By setting up automations, you can save your team hours of time. Our platform will automatically request documents and send follow ups, and clients can securely upload and share their information in their own secure portal.

4 Dealbreaker Features Your Client Management Software Must Have

Once you’re ready to set up client management software at your accounting firm, here are the top features to look for.

-

Client information dashboard

At a glance, you should be able to refer to your client management software for all client information. If you open your client dashboard, you should instantly know what the status of their tasks is, any upcoming deadlines, and the latest meeting notes.

In Financial Cents, all of your client information is organized and easily accessible in the Client Information Dashboard. This overview is the first thing you see for each client when you visit their profile on the platform. The dashboard displays all the client information you need to know to help you serve them better including upcoming projects, meeting notes, and recent documents shared between your team and them.

-

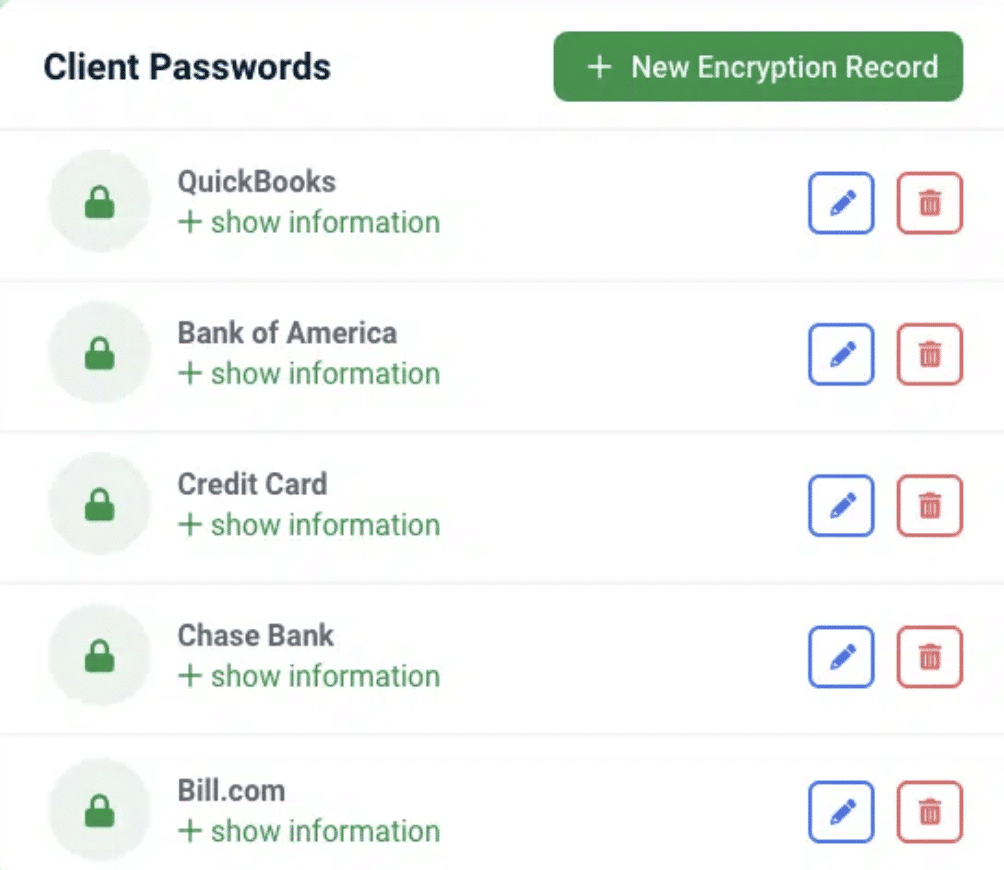

Secure client file storage

As we mentioned earlier, data breaches are a huge risk when dealing with your client’s sensitive financial data. To build trust with your clients and ensure their information is safe, your accounting client management software must be able to securely store and access their important documents, logins, passwords, and pin numbers.

Financial Cents’ Client Vault keeps your client’s sensitive information like usernames, passwords, and credit card information, secure and protected from cyber criminals. Our platform uses data encryption to convert natural language (plaintext) into code (ciphertext) so that only those you give the decryption key can decrypt and read them.

-

Client communication

Clear communication is one of the top factors that goes into smooth client management, so it makes sense that your accounting software should make this part of the job easy.

Even if your client management software doesn’t have direct lines of communication built-in, it should be able to integrate with the communication tools you use to reach your clients.

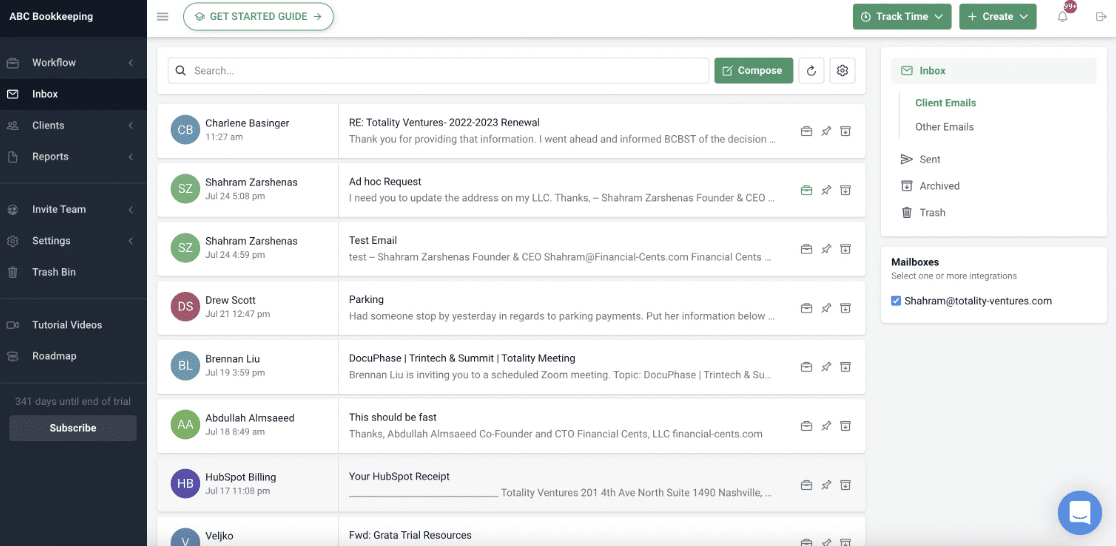

For instance, on Financial Cents, you can sync your email account — whether it’s on Gmail or Outlook — with your Financial Cents account so you can easily send and read emails within the platform. Seamless integrations like this reduce the number of tabs or platforms you need to switch between when communicating with your clients.

-

Automated client data collection

To make your client tasks even smoother, it helps if your client management software automatically collects client data.

This can happen if you have software that allows you to set up automated requests, as we mentioned earlier. Financial Cents makes automation easy. Simply set up automated requests so you don’t have to manually reach out to request documents over and over again. You can also use one of our email templates to save even more time when it comes to communication.

When there are so many moving parts involved in managing your clients and workload, accounting software is the key to successful client management. Look for a platform that securely stores and protects client data, makes it easy to clearly communicate with your clients, and automates the data collection process.

Looking for an accounting solution that makes client management a breeze? Financial Cents offers all of these client management features and more.