5 Capacity Management Strategies to Combat Team Burnout

Author: Financial Cents

In this article

A good capacity management strategy could be all your firm needs to brave the great resignation as accounting talents continue to quit their jobs for firms that give them better work-life balance.

The Society for Human Resources Management has found that 42% of employees quit their jobs—not just for better pay or any of that good stuff. But because work stress has eaten so deep into their personal space, they are losing their minds.

Like Maggie.

Your newest hire, Maggie, is excited about her new job and feels she can move mountains to help your firm grow. You decide to make the most of her motivation by dumping tasks on her, almost indiscriminately.

After eleven months of completing deadline-driven client work, Maggie’s motivation has dropped. She’s exhausted from working her fingers to the bone over several sleepless nights. The tasks she used to jump at now feel like chores, and she now spends up to two hours on what used to take her 50 minutes to complete.

Not only that.

Maggie makes too many errors these days, some of which have cost your client a fortune. Worse still, Maggie’s team members need to review her work to correct errors with the time and resources that could have gone into other work. Maggie was one of your best employees a few months earlier, but she now wants to quit.

When your employees are burnt-out, their sense of judgment, efficiency, and productivity affect your firm’s productivity and profitability. Because your firm is only as profitable as your most underperforming employee.

That’s why employers insist on their employees using their annual leave. They know that a stitch in time saves nine. But beyond annual leave, there are more sustainable ways to approach capacity management in accounting teams.

We’ll talk about them shortly, but how can you spot employee burnout before it takes a toll on your firm’s productivity and profitability?

SIGNS OF BURNOUT IN A TEAM

You may never have to deal with the effects of employee exhaustion if you can spot it early enough.

Here are the common signs:

Exhaustion

It’s Okay for employees to deny themselves rest and sleep to get work over the line sometimes. It becomes a problem when this is standard practice, as work fatigue will set in quickly.

And because stress tolerance differs from person to person. You can’t tell when someone is nearing their limit until their body begins to give up on them. But including adequate rest in your employees’ schedule will prevent them from working too many long hours to exhaust their energy.

When employees start complaining about sleeplessness, falling asleep at work, and looking out of shape, those are tell-tale signs that they are exhausted and need rest.

Irritability

Stress makes people irritable. When an employee begins to get agitated with little things clients or their colleagues do or say, you should take that seriously.

Because work fatigue has altered their state of mind, an employee can become too sensitive to the words and actions of others. Especially in a negative sense.

Frequent Illness

Do you know why there is a stress-induced version of almost any illness? There is stress-induced headache, stress-induced seizure, and stress-induced heart attack. It’s because stress weakens the immune system and leaves it vulnerable to sickness.

So, when an employee is falling ill too frequently, you may want to look into it to be sure their body is not sending a stress alert.

Errors

Since accountants need to do so much in a short time. Work stress deprives them of the sense of clarity they need to process, analyze and remember the information they need to help clients manage their financial records.

Lack of concentration will lead to forgetfulness and will make your employees forget small tasks that could cost your client a fortune in penalty.

Isolation

When an employee is burnt-out, they may begin to skip happy hours and team-building meetings that enhance workplace culture.

If they are not doing this to meet up with deadlines, they are just not interested in such meetings anymore.

When it gets to this point, your staff is suffering burnout already. If you don’t take serious steps to address it, your team will suffer from it.

Here’s how you can leverage capacity management to turn things around for them.

More resources for you:

Accounting Workflow Software: The 5 Best Options for Accountants

FIVE WAYS TO MANAGE YOUR TEAM CAPACITY BETTER

While effective communication, employee appreciation, and positive work culture help with employee burnout, they are the icing. Capacity management is the cake. If you don’t manage your team’s operating capacity well enough, your well-intended communication will stress your exhausted employees more. Here’s how you can manage your team better.

SET UP YOUR WORKFLOWS

Workflows are the steps your employee needs to complete each task in your firm. They include all the information anyone in your team will need to complete the tasks assigned to them. The benefits are many:

- They help to streamline your accounting processes so that employees can easily follow laid-out steps. Instead of reinventing the wheel each time they need to perform the tasks.

- They make completing client work faster.

- They take the guesswork out of tasks by letting your employees know what to do—and what they need to do—at each stage of a task.

- They help to reduce human error, so your team can maintain consistent client deliverables.

The best way to maximize workflows is to use project management software for accounting firms. For example, Financial Cents has a library of workflow templates that you can use instantly to complete almost any accounting task in your firm. From monthly bookkeeping to year-ends and client onboarding, you can customize the workflow templates to guide your employees from the start of work to the finish.

If you prefer to create your workflow templates, you can do that inside Financial Cents.

All you need to do is:

- Outline all the steps that go into the task.

- Click into each step to add notes to describe it.

- Add walkthrough videos (if you have one).

- Add the apps they need for that task.

- Set your dependencies (if necessary).

- Add subtasks and assign them to employees.

TRUST YOUR TEAM TO DELIVER ON TASKS

Even the most enjoyable task can feel like a chore if your employees feel micromanaged. Many team leaders get too attached to a particular way of doing things, even though other methods are as effective, if not more.

If you have employees whose approach to work is different from yours—which you will, you need flexibility—not micromanaging.

All you need to know is whether they will complete the task on time. If you are afraid their mistake will cost your firm its clients, setting up your workflows will reduce the margin of error significantly.

Once your workflows are set up and they have every information they need (due dates, log-in details to relevant apps, etc.), trust them to get the task done on schedule. That way, they can get creative within the boundaries you have set.

Micromanaging your employees amidst the stress of the accounting industry will wear them out. And they will lack the confidence they need to work and represent your team appropriately.

You may be interested in: Can accountants work from home? Here’s how.

AUTOMATE YOUR PROCESSES

Digital tools enable accounting teams to automate repetitive tasks to focus on the big-picture aspects of their firms. For example, having your employee chase down a client for information in 2022 makes no productive sense. Instead, set up and automate client tasks in your accounting firm management software. It’ll ‘auto-nag’ your client until they send whatever your team needs to complete their work.

You can also set your client work to automatically recur for all the accounting periods you’ll need to perform them.

Your team is just the right tool away from getting back up to 9 hours to boost their mental health while achieving more results with less.

One mistake you can make with software is neglecting training. Always train your employees on any software you buy so they can maximize every benefit it offers.

MANAGE CAPACITY

It’s hard to prevent burnout when an employee needs several sleepless nights to complete the tasks assigned to them. Especially when other employees are not working enough hours.

When it comes to managing your team’s workload, make sure all employees are equally working. You don’t want some employees working extra hours while others have so much time on their hands.

But as well-intentioned as that appears, you can’t track how much work is on each team member’s plate if your team still manages their work with spreadsheets.

A good accounting practice management software, will let you see exactly how much work is assigned to each team member now and in the future..

Financial Cents’ Capacity report shows all tasks assigned to each team member so that you can see who’s overworking and who has room for more work. That way, you can reassign work between employees as you see fit.

You can also set time limits so that an employee does not work beyond the set number of hours each week.

MANAGING TIME MORE EFFECTIVELY

Time management takes many forms but we’ll look at it from how it allows you to identify over budget and time consuming clients. This helps you adjust your rates accordingly, boost profitability and possibly hire more people so your team is not overworked.

For example, if a client’s work takes ten hours to complete, and you estimate it to take five hours when calculating your fixed fee, you are losing money.

But you wouldn’t know when your client is over budget and putting stress on your team unless you are tracking time.

From Financial Cents’ workflow dashboard, you can see the time your team spends on client work and if it is over budget or not.

Financial Cents allows you to track time from anywhere on the App. You can pause and resume the time tracker as you work across different clients. That way, you can identify unprofitable clients for your firm and renegotiate your fees if you charge a flat fee.

If you can’t renegotiate a higher fee, you can find ways to reduce the cost of serving those clients. One way is to create better workflows to move their work from start to finish quicker.

You can learn more about time tracking software for accounting firms.

More resources for you:

A Guide To Hiring And Retaining Remote Employees For Your Firm

CONCLUSION

Managing your team’s capacity is a moving target. You will need to keep adjusting to stay efficient. The changing work culture and great resignation may make managing your team’s workload more difficult in the coming years. But implementing these capacity management strategies will give your accounting team an unfair advantage. They will help you prevent burnout, retain your best workers and attract the best talents in the industry.

However, none of these strategies will be of much benefit if you don’t have good practice management software that tracks everything and brings it all together. You can start enjoying everything we’ve discussed in Financial Cents today.

Sign up For our 14 Days Free Trial

Better Collaborate With Your Remote Team to Meet Client Deadlines

Try Financial Cents Free For 14 Days

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

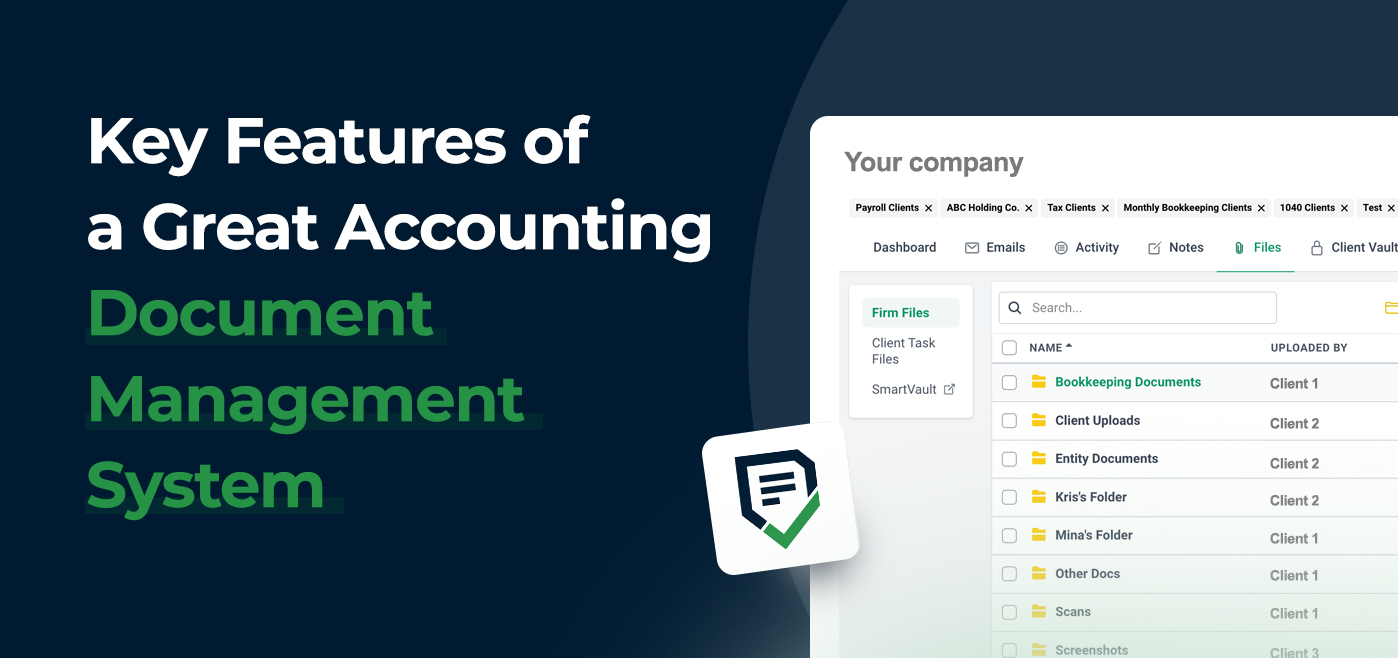

Key Features of a Great Accounting Document Management System

Here’s all you need to know about an accounting document management system and how it can make you more organized and save…

Apr 26, 2024

5 Simple Time-Saving Tips for Managing Uncategorized Transactions

Manually resolving multiple uncategorized transactions steals valuable time from accountants and bookkeepers. But there’s a solution. Here are five simple, time-saving tips…

Apr 24, 2024