In the context of accounting firms, visibility means having clear, real-time insight into your firm’s operations, resources, and performance. It’s about knowing what’s happening, where it’s happening, and how efficiently it’s being done—across clients, projects, and teams.

For any accounting firm, especially larger ones, a lack of visibility can be more than just an inconvenience—it can be a major problem. When your firm lacks clear insight into key areas, it opens the door to costly mistakes and risks, including fraud. A prime example is the case of CHS Inc., which faced significant fines due to poor internal accounting practices that led to fraudulent activities.

Without clear visibility, your firm could face inefficiencies, increased risks, and missed opportunities. This could result in wasted time, avoidable financial penalties, and lost revenue—all of which can seriously impact the growth and reputation of your firm.

Now, let’s get into the 5 ways a lack of visibility can negatively impact your firm.

The 5 Key Impacts of Lack of Visibility in Large Accounting Firms

1. Inefficient Resource Allocation

When you don’t have clear visibility into your operations, it’s easy to mismanage your resources, including your human capital. Without accurate data on client projects, you might overload certain team members while others sit underutilized, affecting both productivity and morale.

Take, for example, Angela Main Robert’s experience with Asana. While it was great for task management, it didn’t give her the ability to track monthly fees versus time worked—something she relied on to monitor efficiency and profitability in her firm. This was especially important as she continued to grow her firm.

That insight is crucial to knowing when it’s the right time to bring in additional help. Without this visibility, she risks either overworking her team or missing the opportunity to hire before workloads become unmanageable.

Asana was great for task management but did not allow us to track monthly fees vs time worked. This is important to us because we're continuously growing our company."

Angela Main Robert, Main Accounting Services.2. Delayed Decision Making

Without real-time data, you’re forced to make decisions based on guesswork or old information. This is a problem because things change quickly, and if you don’t have the latest insights, you’ll miss the chance to act when it matters most.

For instance, if you can’t see the accurate status of your projects in real time, you might miss critical warning signs—like a project running over budget or a client account falling behind schedule, as in Denise May’s case.

The most that Excel did was I could look at the dashboard and see that a client was at 50% or 30% or whatever. But that was 50 or 30% for the year, not a particular project. So basically, every client had 12 months going across. And if they had four months marked off, it updated my dashboard that we're at 40% or 30%, but there's no way to track tasks in Excel without things falling through the cracks."

Denis May, Owner - BookPro.Asana was great for task management but did not allow us to track monthly fees vs time worked. This is important to us because we're continuously growing our company."

Angela Main Robert, Main Accounting Services.Delayed decisions can have serious consequences. It might mean losing a valuable client because you didn’t respond quickly to their needs or overspending on resources because you couldn’t identify and adjust an issue in time.

Having clear and current data means you can act fast, make confident decisions, and keep your firm on track for growth and success. Without it, you’re operating in the dark—and that’s a risky place to be.

3. Increased Risk of Errors and Fraud

If you don’t have clear visibility into your firm’s finances, it becomes much harder to catch errors—or worse, fraud—before they cause significant damage. Visibility allows you to monitor processes, track performance, and spot irregularities early. Without it, you’re leaving your firm vulnerable to costly mistakes and potential misconduct.

For example, if you don’t have a clear view of your financial data, errors like duplicate invoices, incorrect billing, or missed expenses can slip through unnoticed. These mistakes may seem small at first, but over time, they add up and can hurt your profitability.

Lack of visibility also creates opportunities for fraud. When systems and processes aren’t transparent, it’s easier for unethical behavior to go undetected. An employee could manipulate financial records or misuse company resources, and the damage could already be done by the time you catch it.

With proper visibility, you can put the right checks and balances in place, making it harder for errors and fraud to occur. You’ll gain peace of mind knowing you can spot issues before they spiral out of control—protecting your firm’s finances, reputation, and long-term success.

4. Diminished Client Satisfaction

Poor visibility in your firm’s operations often leads to delays, miscommunication, and even errors —none of which inspire confidence or satisfaction in your clients and can directly impact the quality of service you provide.

If a client asks for an update on their project’s status or a quick answer about billing, and you don’t have the right information on hand, your response may be delayed—or worse, inaccurate. This can make your firm look disorganized and unreliable, leaving the client frustrated and questioning whether they’re in the right hands.

This adds up over time, damaging trust and weakening client relationships – which can be costly to your firm. Clients expect you to be proactive, responsive, and precise. If you can’t deliver on those expectations because you lack visibility, they might start looking for another firm that can.

Improving visibility ensures you’re always prepared to deliver timely, accurate information and maintain strong, lasting client relationships. It’s the difference between being a trusted partner and just another accounting firm.

5. Reduced Profitability

Poor visibility can hit your bottom line harder than you might expect. When you don’t have clear insight into your operations, financials, and resources, inefficiencies start to add up—and those inefficiencies cost money.

Think about how much time and budget can be wasted due to poorly managed processes. For example, billing errors, inaccurate time tracking, or missed deadlines can lead to revenue loss or dissatisfied clients. Similarly, if you don’t see where resources are being misallocated, you could overspend on low-value activities like manual invoicing while high-value opportunities slip away.

Also, without visibility into firm profitability, you might overlook chances to take on more profitable work, expand relationships, or nuke your client list to save costs. Over time, these small missteps compound, leaving you with higher expenses and lower profits.

Strategies to Improve Visibility

1. Adopt a Proactive Communication Framework

To improve visibility in your firm, it’s important to establish clear, ongoing communication across all levels. Transparency plays a key role in achieving this. Why? Because it’s essential to build a culture that encourages proactivity.

As Randy Crabtree points out,

When people feel like a part of the organization, they rally around it."

Encourage your team to share updates, ask questions, and bring up issues as soon as they arise, rather than waiting until problems become bigger. Regular meetings or check-ins can help keep everyone on the same page, ensuring that you have the right information at the right time to make better decisions.

With proactive communication, you won’t be left in the dark about what’s happening in your firm, and you can address issues before they affect your bottom line.

2. Establish KPIs and Reporting Standards

To improve visibility in your firm, start by setting clear Key Performance Indicators (KPIs) and reporting standards. KPIs are specific measurements that track how well your firm is doing in different areas—like client satisfaction, project completion times, or revenue growth.

By defining these key metrics, you can keep a close eye on performance and identify areas that need attention.

Along with KPIs, it’s important to create consistent reporting standards. This involves setting up a system for regularly gathering, sharing, and assessing data against your KPIs. For example, how long does it take to complete projects? How many billable hours are being invested? What is your quarterly revenue from client work? Are you experiencing consistent growth year-over-year, or are you running at a loss?

Using time tracking, team activity, or capacity management reports can help standardize how you measure these metrics. These reports give you a clear view of project timelines, employee productivity, and resource allocation, allowing you to evaluate your firm’s performance against your KPIs and make data-driven decisions for improvement.

3. Leverage Technology and Automation Tools

To improve visibility in your firm, using the right technology and automation tools is key. Automation can handle repetitive tasks and provide valuable data, giving accountants like yourself, the chance to be more strategic—something many enjoy but don’t often have the opportunity to focus on, as Mike Whitmire notes.

One tool you can use to improve visibility is an accounting practice management system, like Financial Cents. Here’s how it can help:

Workflow Management and Automation

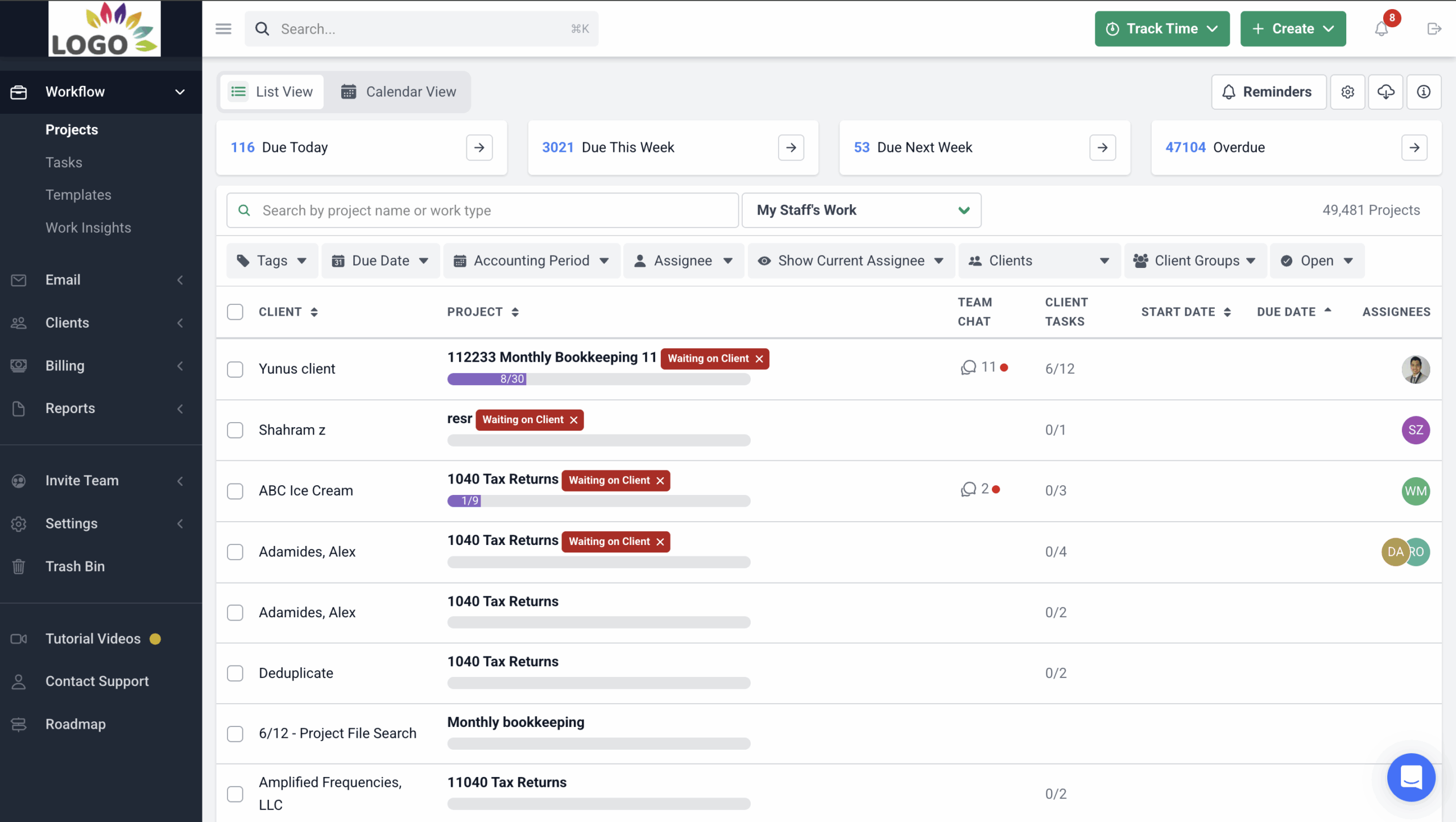

With the workflow dashboard, you can easily monitor the progress of all your projects. You’ll see who is responsible for each task and how work is progressing. The dashboard provides a clear overview of all ongoing tasks, so you can quickly check the status of projects, plan for upcoming deadlines, and identify any tasks that are pending or overdue.

Additionally, it allows you to automate recurring projects, setting them to repeat at specific intervals—whether daily, weekly, monthly, quarterly, or annually. The system automatically generates these tasks whenever they are due, eliminating the need for manual tracking and ensuring consistency across your firm.

Due Date and Deadline Tracking

Financial Cents offers a due date tracking feature that significantly improves visibility across your firm’s projects. With this tool, you can easily track all upcoming deadlines and ensure that nothing is missed. Each task or project is assigned a specific due date, and the system automatically notifies you and your team members as these deadlines approach.

This feature gives you a clear view of when tasks are due, helping you prioritize and allocate resources efficiently. You can see which projects are on track and which ones might need extra attention, allowing you to adjust plans in real-time.

Recommended:

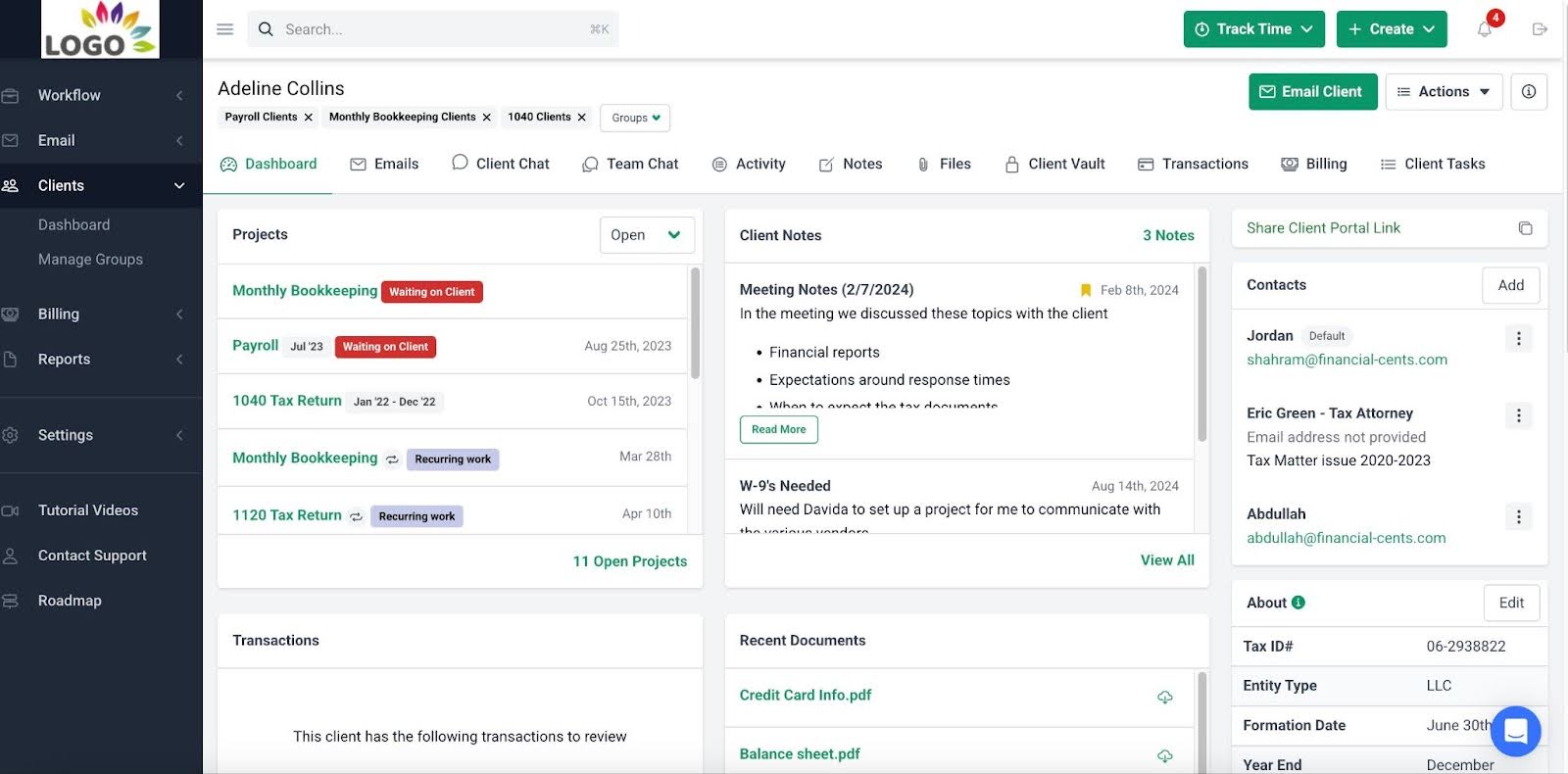

Client Relationship Management (CRM)

The Client Relationship Management (CRM) feature in Financial Cents helps improve visibility by giving you a clear, organized view of all your client interactions and details. With this accounting CRM, you can easily track the history of your communication with each client, including project details, upcoming deadlines, client documents, assigned team representatives, and notes. This helps you stay informed and maintain strong, personalized relationships with your clients.

Additionally, you can connect to your clients through a secure client portal, reducing the need for back-and-forth emails. Clients can view real-time updates on their accounts, review documents, and communicate with your team all in one place.

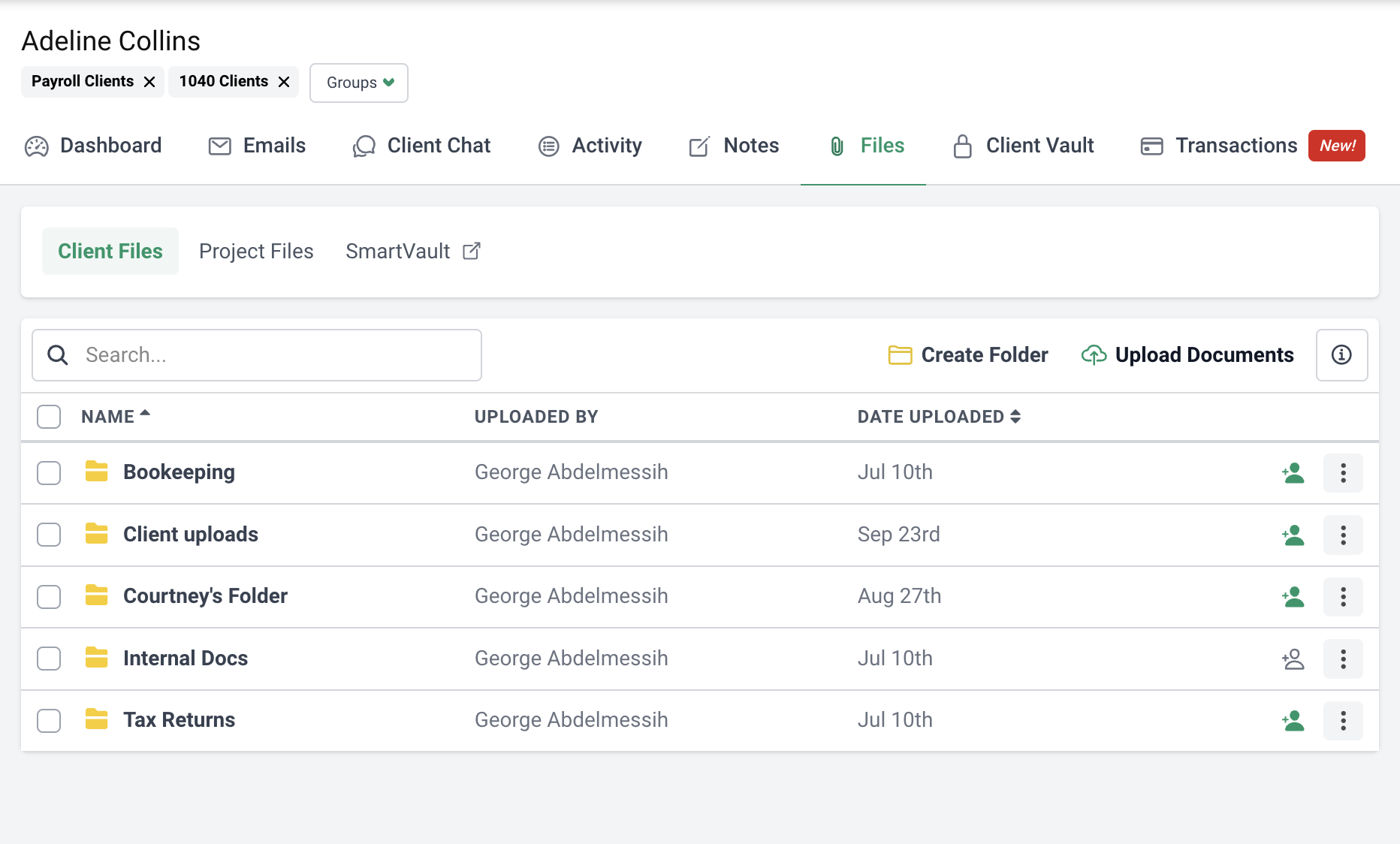

Document Management and Secure Storage

This feature allows you to securely store, organize, and easily access important client documents, contracts, reports, and other files in one centralized location.

With secure storage, your firm can ensure that sensitive information is protected with encryption and controlled access, reducing the risk of unauthorized access or data breaches. At the same time, the document organization feature enables you to quickly locate documents when needed, with search functionality and categorization features that make it simple to find files across different clients and projects.

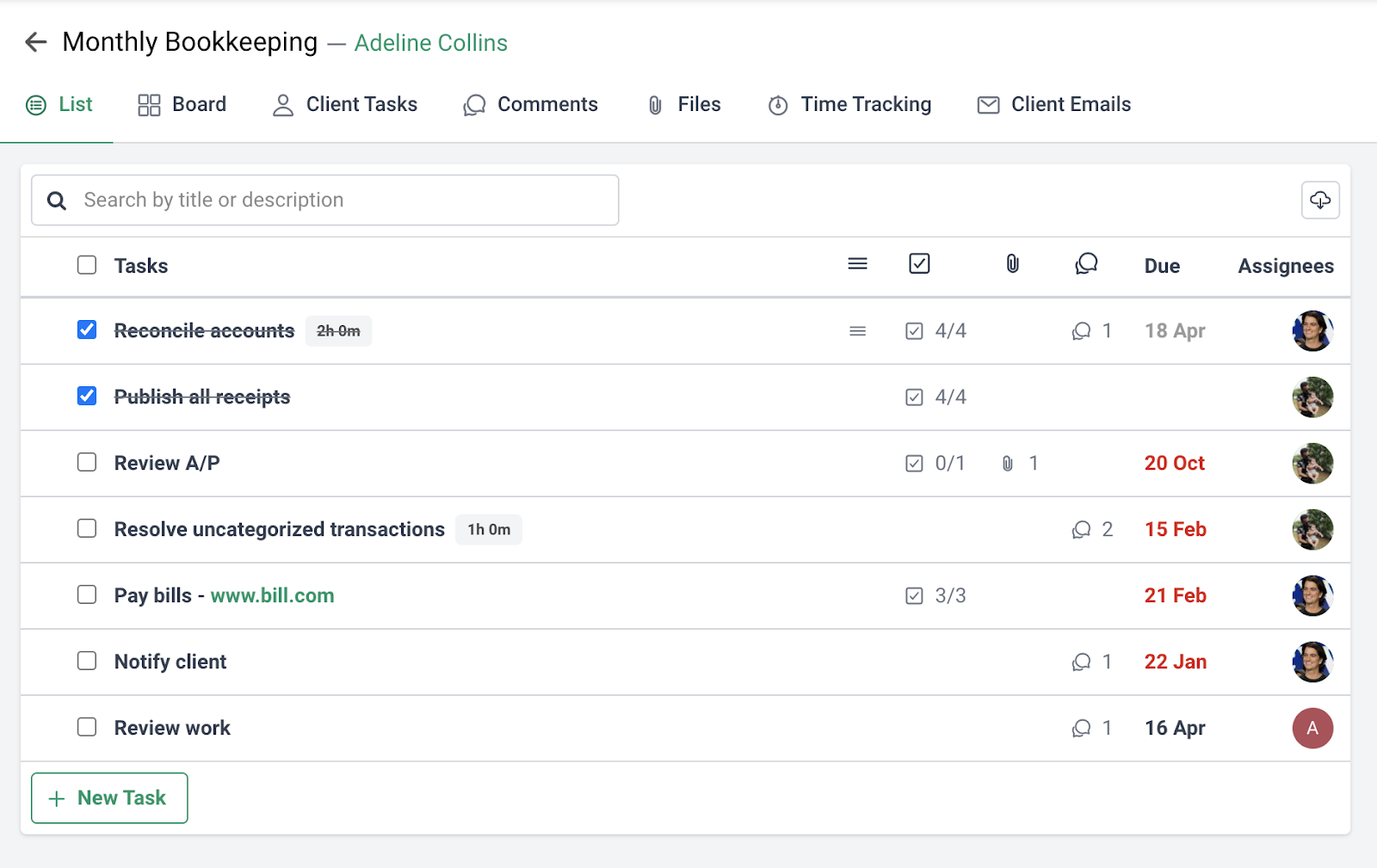

Team Communication and Collaboration

Financial Cents enhances team communication and collaboration by providing a centralized platform where everyone can easily share updates, discuss tasks, and stay informed on project progress. This feature improves visibility by allowing team members to communicate directly within the platform, reducing the need for scattered emails or meetings.

With Financial Cents, you can assign tasks to specific team members, attach relevant files, and leave comments or updates on each task. This ensures that everyone involved in a project has the same information, reducing the risk of misunderstandings.

Automated Client Requests

One powerful feature of Financial Cents is the ability to automate client requests, including the collection of signatures. This feature improves visibility by streamlining communication and ensuring that all client-related tasks are completed on time.

For example, if you need client approvals, signatures on documents, or responses to specific requests for a client task, Financial Cents lets you set up automated notifications that send these requests directly to your clients. You can choose to send these requests immediately, on a specific date, or based on the completion of tasks within a project.

You can also easily request e-signatures from your clients by uploading the relevant documents, filling in the necessary signature fields, and sending the request. Clients will receive an email with the document, and once it’s signed, it will be automatically attached to the corresponding client task in your system.

Capacity Management

This helps improve visibility into how your team is utilizing their time and resources. This feature allows you to see at a glance who is available, who is overloaded, and where your resources are being stretched. By tracking the capacity of each team member, you can make more informed decisions about workload distribution.

Time Tracking and Billing

This feature in Financial Cents helps improve visibility by giving you real-time insights into how time is being spent across projects and clients. With this feature, you can easily track billable hours and monitor team productivity.

You can record time spent on each task, ensuring that all work is accounted for and accurately billed. This helps prevent missed billable hours and ensures clients are invoiced correctly.

Billing

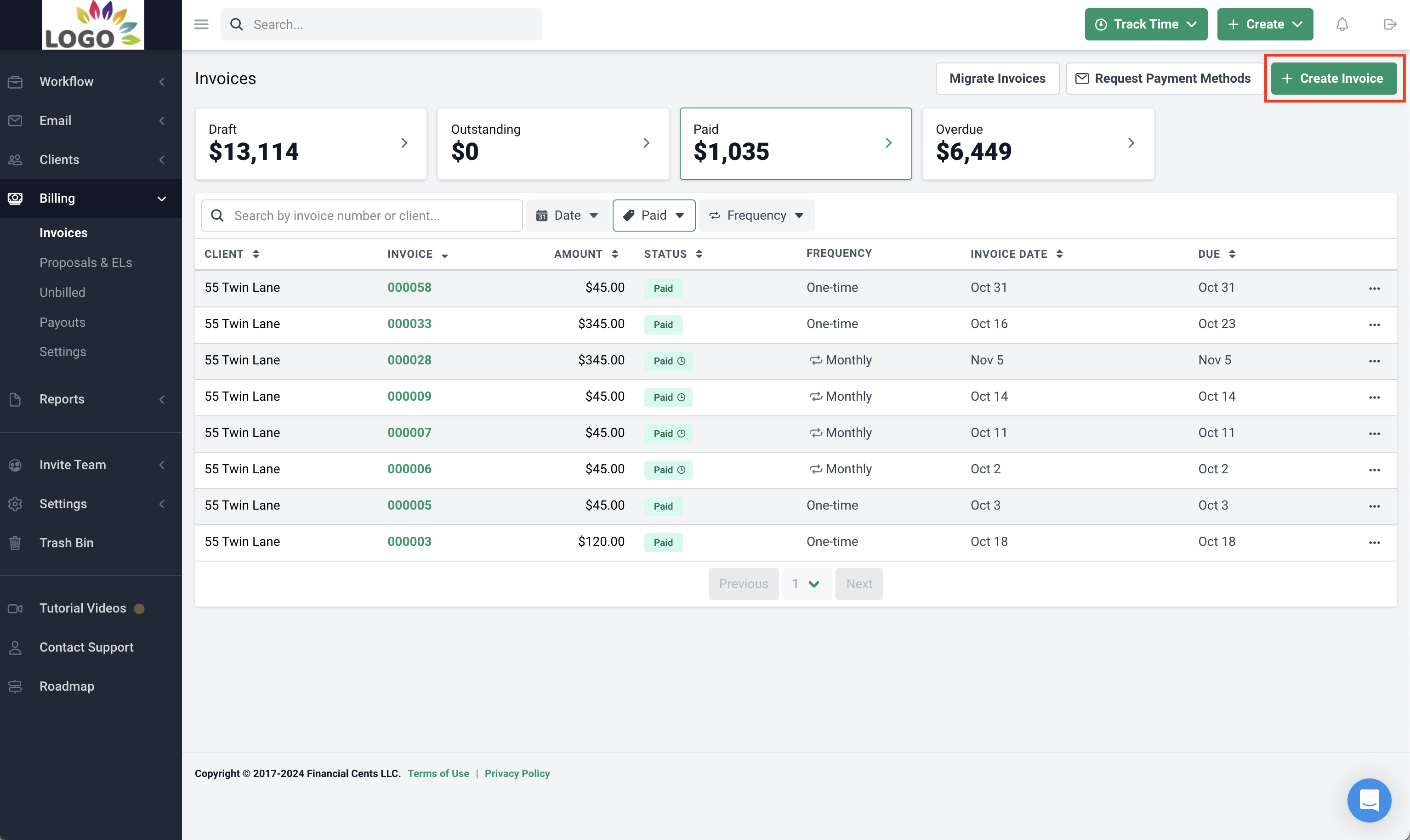

With the billing feature, managing your invoices and payments is easier. It helps you streamline your workflow and save time on administrative tasks. You can create one-time or recurring invoices, automatically charge clients using their saved payment information, and quickly check if invoices are paid or still outstanding. It’s all designed to make your billing process smoother so you can focus more on your clients and less on paperwork.

Integration

Financial Cents integrates seamlessly with a variety of tools and platforms, centralizing your firm’s operations and data in one place. Key integrations include QuickBooks Online, email syncing, SmartVault, and Zapier, helping streamline your workflow and enhance efficiency.

Use Financial Cents to Monitor Work in Your Accounting Firm

To take control of your firm’s operations and improve visibility, consider using Financial Cents. With its powerful features like workflow management, automation, and seamless integrations, you can easily monitor projects, track progress, and ensure your team stays on top of tasks.

Financial Cents provides the insights you need to make informed decisions, improve efficiency, and keep your firm on track for growth.

Start using Financial Cents today and see how it can transform the way you manage your accounting firm.