6 Ways to Avoid Working Overtime During the Next Tax Season

Author: Financial Cents

In this article

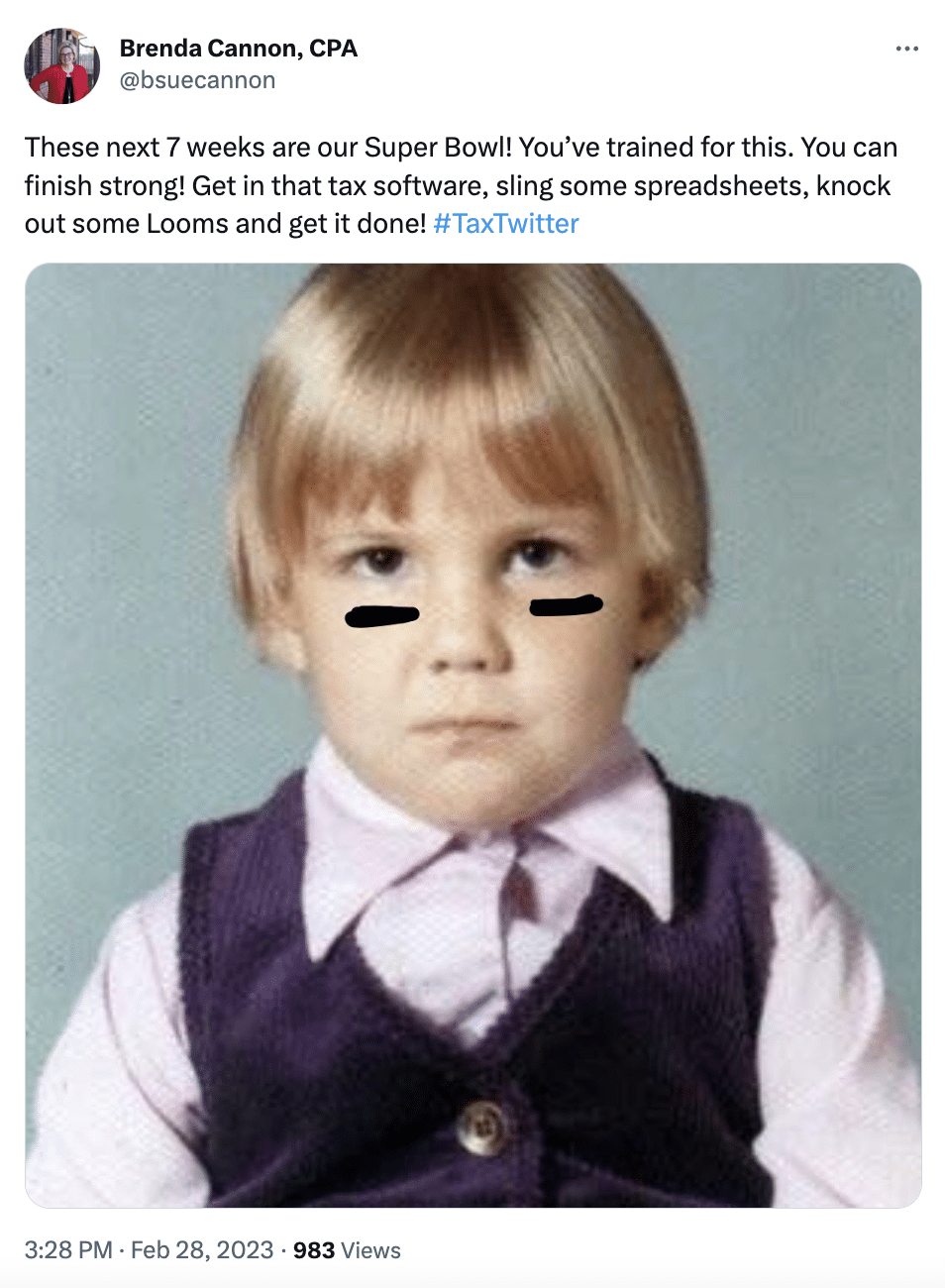

One scroll through this thread on #TaxTwitter tells you all you need to know about how exhausting tax season is for accountants. (TLDR; accountants are tired and look forward to sleeping, celebrating, and relaxing the moment tax season is over.)

From January through April each year, accountants spend countless hours working to complete and file tax documents for their clients, often working overtime in the process.

You may be interested in

40 Hilarious Tax Memes that Accountants Can Totally Relate To

While commiserating with your fellow accountants on #TaxTwitter is a temporary way to relieve your tax season stress, a long-term solution is to make efforts to reduce your workload throughout the year.

Tax season takes up a third of your entire year. Overworking for this period of time can lead to burnout which can result in many concerning outcomes. For one, if you have a team, overworking can impact your employees’ satisfaction and morale. A recent study by Future Forum found that employees who are burned out reported nearly two times lower overall satisfaction at work and are more than three times more likely to look for a new job.

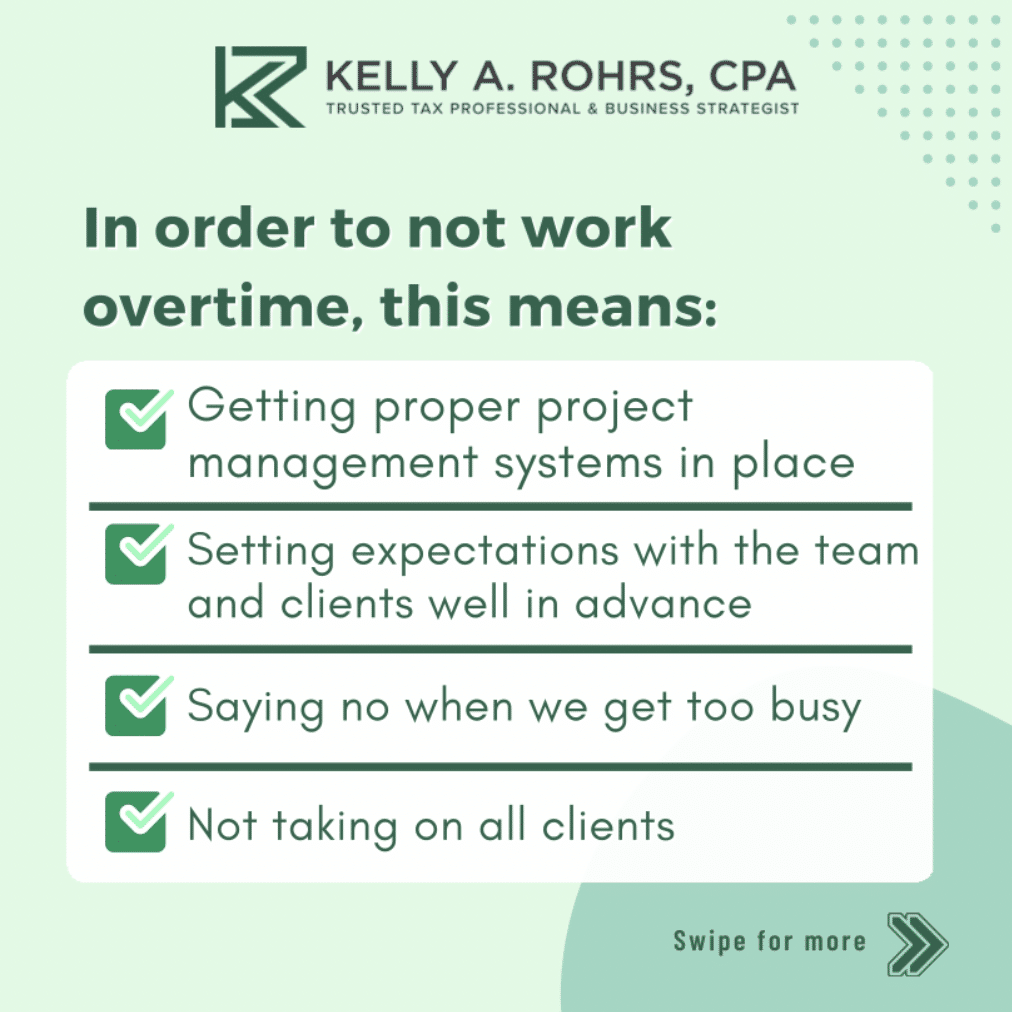

However, it’s more than possible to manage your team’s volume of work and avoid overworking during tax season. In fact, CPA and firm owner Kelly Rohrs recently shared that her team never works overtime during peak tax season. Work-life balance is a priority at her firm, and she ensures her team isn’t overworked by implementing the practices below:

If this balance is something you want to achieve at your accounting firm, keep reading as we dive into the different ways you can avoid overworking during tax season.

6 Ways to Avoid Overworking During Tax Season

Accountants aren’t immune to overworking, especially during tax season. But there are plenty of things you can do throughout the year that will help speed up your administrative tasks, streamline communication, and complete client work faster.

Here are six ways to avoid overworking during tax season.

1. Plan your firm’s capacity ahead of time.

One of the most impactful ways to avoid overworking during tax season is to plan your firm’s work capacity for the year. This means ensuring you have a balanced amount of work that you and your team can handle without feeling like you’re scrambling to meet deadlines or need to quickly hire someone to help with the workload.

In our playbook on streamlining your accounting firm, Ryan Lazanis, CPA and founder of Future Firm, says that capacity planning is the number one tool for ensuring that people aren’t overworked and that you have the available resources to complete work. “[At Xen Accounting] we engaged in that kind of time forecasting and capacity planning on a 12-month rolling basis so we would be able to see months ahead of time,” he says.

To successfully execute capacity planning, you need to have a forward-looking perspective on time. This means you should have an idea of how long it takes your team to complete tasks so you can accurately estimate how much time you have available for each client and whether or not you have the capacity for more projects. Use a workflow tool with integrated time tracking so you can get an accurate picture of the time it takes to complete client tasks.

2. Streamline your processes

A streamlined workflow is one of the top things accountants know they need to implement for a smoother tax season. Having solid systems in place for your day-to-day needs and processes can significantly cut down the time you spend on certain tasks.

Some of the systems Ryan suggests are the most important to streamline year-round are client onboarding and new employee onboarding. When you have solid onboarding processes, it not only helps get everyone up to speed but also builds trust in your relationships early on — which makes it easier to collect client information and complete tasks faster.

While onboarding is one of Ryan’s priorities when it comes to creating streamlined systems, every firm has different needs. There are other areas of your firm you can set up processes for like sales, marketing, administrative tasks, or financial reporting.

“It’s important to have a process for everything you do in your firm,” says Ryan.

Take a look at your current systems — or lack thereof — to see where you can build a process or look for a tool that will help streamline your tasks and save you time.

3. Accept fewer clients and work with only ideal clients

One of the easiest ways to become overworked is by taking on too many clients. There are only so many projects you and your team are capable of handling at once.

While it can be tempting to say yes to every client or project inquiry that comes your way, it’s important to be realistic about your firm’s workload capacity. If you’ve planned your capacity for the year or quarter, then you should already know whether or not you have room to accept a new client when an inquiry comes in. If your team realistically doesn’t have time to take on another project, then you’ll have to say no.

Another way to limit the number of client projects you have on your plate is to be more selective about who you work with. You should have an ideal client in mind. If a new client inquiry doesn’t fit your target, then get comfortable saying no. This helps immensely with your workload and workflows.

“If you have a million different ways to service a million different clients, you’re going to have a million different workflows,” states Ryan. “But if you have one way to service a client, and it’s a particular kind of client, you’ll be able to narrow down the amount of workflows you have.”

Get more insights by downloading our playbook for streamlining your firm.

4. Set up a profitable pricing strategy

Setting up a profitable pricing strategy is essential for the growth and success of your firm. Being selective about which services you offer and how you want to price them is a valuable way to ensure you’re getting paid enough for your time and services. It’s also a good idea to consider how you want to package your services.

“Productization of your services is how you can develop a repeatable way to offer something over and over again,” he says. I’m a big proponent of the productization of services. It was the basis of my firm and one of the reasons I was able to scale it up and get it acquired quickly.”

Ryan suggests streamlining the number of packages you offer. For his firm, the ideal number of services was three packages. “If you only have two packages, most people take the lower package,” says Ryan. “If you have four packages and up, it starts to get confusing. So the sweet spot is three.” He adds, “Productization of services is how you give yourself a lifestyle where you’re not working 80-90 hours a week.”

If you’re looking for more tips on setting up a profitable pricing strategy, download our pricing eBook.

5. Use automation to reduce time spent on manual work

For accounting firms, automation is your friend. There’s a lot that goes into running a business, from marketing to administrative tasks. Creating automated processes helps save time on all of those tasks so you can be more productive in other areas of the business.

To determine where you could benefit from automation, take a look at which areas of the business take up the most time. For example, if you spend a lot of your time collecting client documents, use automated client data collection to get the information you need faster. Financial Cents’ client tasks feature sends automated requests and reminders to your clients over text or email so you don’t have to manually reach out every time you need something.

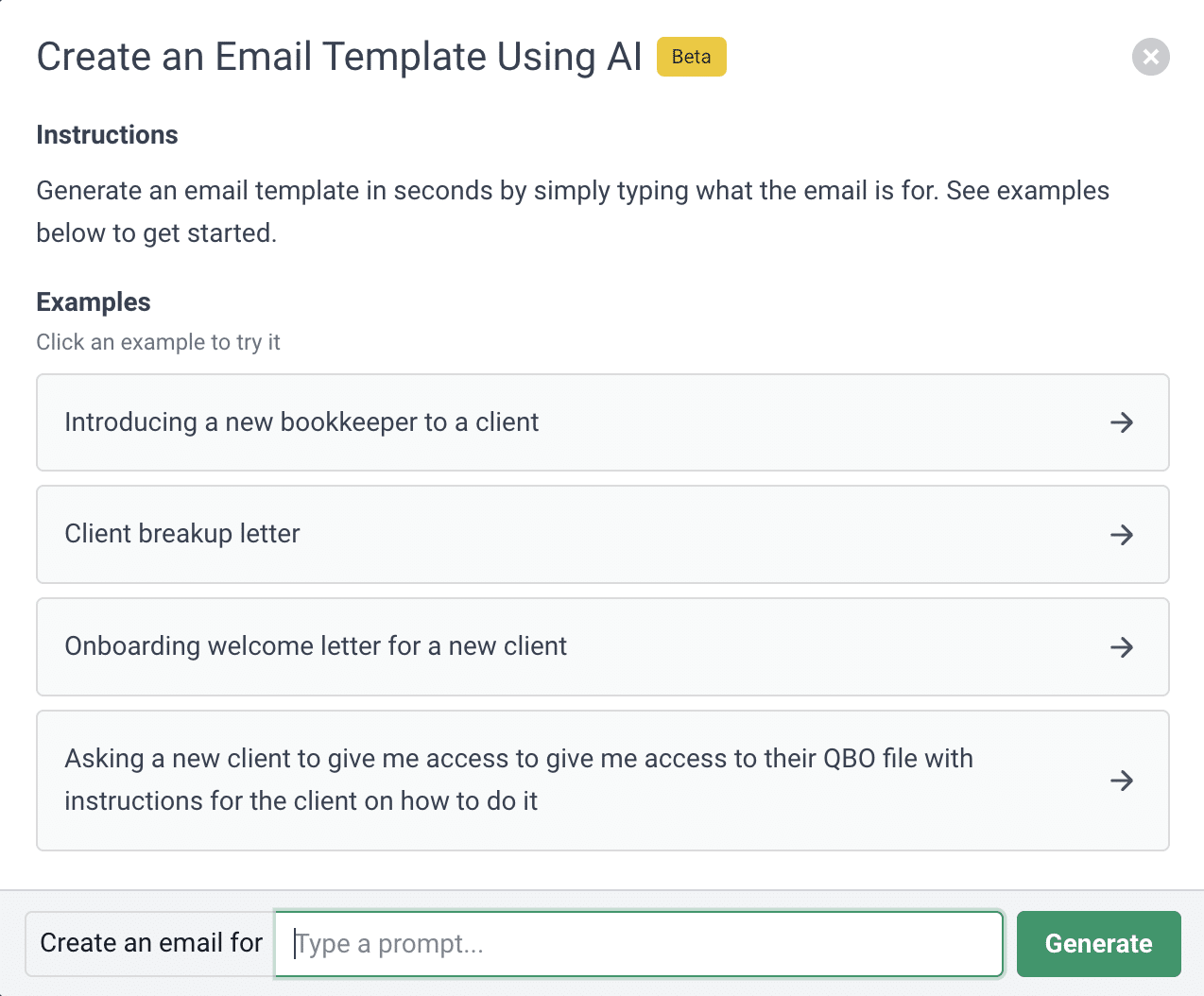

You can also use ChatGPT for accountants and bookkeepers. AI may not be able to calculate your client’s tax savings, but it can certainly help you complete administrative tasks faster. For instance, you can use Financial Cents’ AI integration to help compose emails to your clients and speed up the communication process. Simply create an email template using AI so you can quickly generate emails and responses to questions or requests that you frequently use.

Recommended Resource:

6. Build the right tech stack

To better streamline your firm’s processes and set yourself up for a successful tax season, you need to build a tech stack that supports your firm’s day-to-day needs.

Every firm is different when it comes to what you need the most support with. Maybe you’re looking to speed up administrative tasks or perhaps you need a better process for collaborating and communicating across your team.

Whether your firm’s tech stack priorities are tracking work or meeting your deadlines faster, a project management software like Financial Cents checks many boxes.

“Financial Cents is a very easy platform to use,” says Meghann M., CPA. “It has saved me a lot of time, helped me prioritize my work, and helped [me] identify [the] profitability of my clients.”

Use Financial Cents accounting project management software to improve efficiency.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features of a Great Accounting Document Management System

Here’s all you need to know about an accounting document management system and how it can make you more organized and save…

Apr 26, 2024

5 Simple Time-Saving Tips for Managing Uncategorized Transactions

Manually resolving multiple uncategorized transactions steals valuable time from accountants and bookkeepers. But there’s a solution. Here are five simple, time-saving tips…

Apr 24, 2024