As an accountant or bookkeeper, your invoices don’t just document the services you’ve provided — they reflect your brand and professionalism.

A well-designed, easy-to-understand invoice can make all the difference in getting clients to pay on time and maintaining a positive relationship. On the other hand, a sloppy or confusing invoice can undermine your credibility or cause late payments.

According to a report, 53.4% of businesses report spending four or more hours chasing late payments, which is time they could have spent on more revenue-driving activities.

In this guide, we’ll walk you through the steps to create a polished, professional accounting invoice and provide a free, customizable invoice template to make the process quick and easy.

What is an Accounting Invoice?

An accounting invoice is a formal record that itemizes and documents a transaction between an accounting professional or firm and their client. However, its role extends far beyond a simple request for payment.

In the context of financial transactions, an accounting invoice has multiple purposes.

- It provides a detailed record of services rendered, serving as a critical piece of the audit trail for you and your client.

- For accounting professionals it helps you manage and project your cash flow (based on terms and conditions you set), allowing for better financial planning and business management.

- For clients, it serves as a source document for their own accounting records, helping them accurately track expenses and manage their books.

- It helps both parties maintain accurate records for tax reporting purposes, ensuring compliance with relevant tax laws and regulations.

Furthermore, a precise, error-free invoice leaves no room for misinterpretation. It communicates the services provided, the rates charged, and the total amount due. This clarity can significantly reduce payment delays caused by confusion or disputes over invoice details.

It also helps with communication by reiterating your payment terms and conveying important messages or updates to your clients.

Essential Components of an Accounting Invoice

A professional accounting invoice should have certain elements to make it effective. Below, we break down each element, its importance, and how it contributes to a complete and professional document.

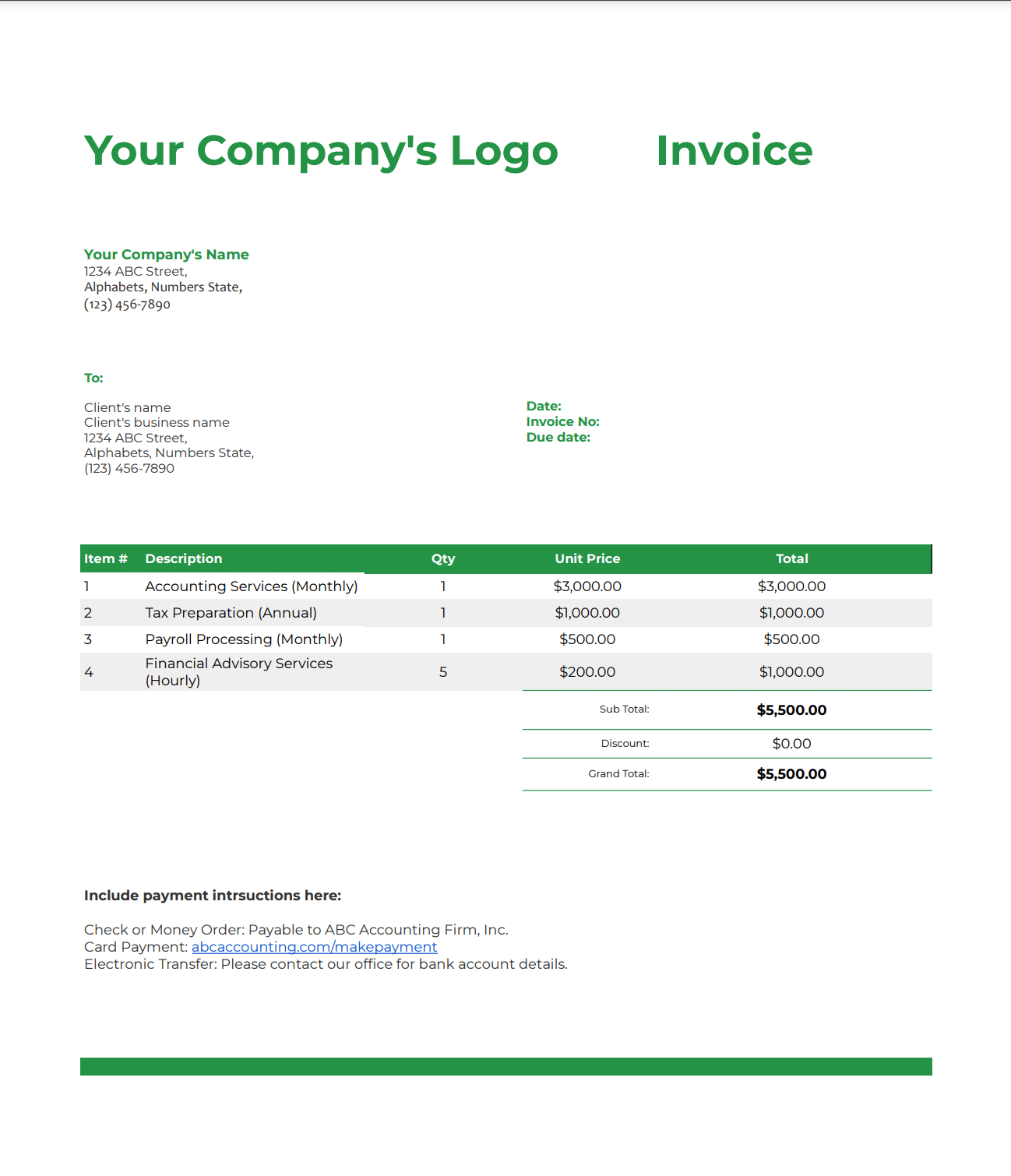

Header with Your Business Information

Your invoice header immediately identifies you as the invoice issuer, so it should include key details like your logo, company name, vendor or supplier number (if the client requires it), address, and phone number.

Your contact information makes it easier for clients to easily reach you if they have questions or concerns.

Pro Tip: Ensure your logo is high-resolution and your contact details are up-to-date. This header is often the first thing a client sees, so make it count.

Client’s Information

Next, add the name, business name, address, and phone number of the person responsible for payment.

Accurate client information ensures the invoice reaches the right person or department. It also serves as a record of who the services were provided to, which is crucial for your own bookkeeping and potential audits.

Pro Tip: If you’re dealing with a large organization, always clarify and include the specific department or contact person responsible for processing payments.

Invoice Number and Date

Every invoice should have a unique number to help you and your client track and reference it. This is especially important if you issue multiple invoices over time.

The invoice date (that you issued it) is also necessary, as it establishes when the payment is due based on your stated payment terms.

Pro Tip: Use a consistent numbering system (e.g., INV-2024-001) and you can add the date of service completion if it differs from the invoice date.

Description of Services Provided

Now, the fun part: the invoice body. This is where you provide a pithy description of the accounting services you rendered, such as payroll processing (monthly), tax preparation (annual), or bookkeeping (quarterly).

This section justifies the charges by outlining what work was performed. It helps prevent disputes by ensuring the client understands exactly what they’re paying for.

Pro Tip: While your description should be short (so the invoice is not cluttered), it should also be precise so your client can easily grasp what the charge is for.

Itemized List of Charges

For each service you outlined, provide the corresponding costs, including hourly rates or flat fees, quantity or hours worked, and subtotals for each line item.

Itemization provides transparency and makes it easy for clients to understand how the total amount was calculated. It also helps in case of any discrepancies or if a client needs to allocate costs to different departments or projects.

Pro Tip: If you offer different rates for different types of services, make sure this is clearly reflected in your itemized list.

Total Amount Due

Round up the invoice body by including the subtotal of all charges, any applicable taxes or fees, and the final total amount due.

Pro Tip: If you’re applying any discounts, clearly show the original amount, the discount, and the final amount due to emphasize the value you’re providing.

Payment Terms

Now, share your payment terms. This includes the due date and late payment penalties like late fees or interest charges.

Stating your payment terms sets expectations and can motivate timely payment.

Pro Tip: To encourage prompt payment and improve your cash flow, consider offering a small discount for early payment (e.g., 2% if paid within ten days).

Payment Methods

Finally, add your accepted payment methods, including bank account details for direct transfers, online payment options, and information for checks.

Multiple payment options make it easier for clients to pay, potentially speeding up the payment process.

Pro Tip: If you use online payment platforms, include direct links to make the payment process as frictionless as possible.

Free Accounting Invoice Template

Below is our free template, which incorporates all these essential elements. You can download it to easily create top-notch invoices for your accounting practice.

Accounting Invoice Template

Instructions

The invoice is in Excel formal (you’ll also receive the Google sheets version via email). After downloading and customizing the invoice, to download it as PDF, do the following:

- Click on the “File” tab in the top left corner of Excel.

- Select “Print.”

- This will open the Print Preview window, allowing you to see how the invoice will look when printed.

- There should be a dropdown menu or button labeled “Printer.”

- Click on this option and select “Microsoft Print to PDF.” or “Save as PDF”

- Click on save.

Tips for Effective Invoicing

Here are some tips for streamlining your invoicing workflow, reducing payment delays, and maintaining good working relationships.

1. Use Clear and Concise Language

Use simple, easy-to-understand language throughout your invoice. Avoid jargon or overly technical terms that could confuse your clients. They shouldn’t need an accounting degree to understand what you’re billing them for.

Be specific in your descriptions and itemizations to leave no room for ambiguity. This clarity helps ensure timely payment and reduces the likelihood of disputes.

2. Timely Invoicing

The adage “time is money” is particularly relevant in invoicing. The more you delay invoicing a client, the more money you lose. So, invoice them immediately after you complete the project or as per your terms. This helps you maintain a healthy cash flow.

If you have a lot going on, set aside a specific time each week or month dedicated to invoicing to ensure you get everything out and don’t overlook any invoices.

3. Follow Up on Unpaid Invoices

Be proactive in following up on delayed payments. Create a schedule for following up on unpaid invoices. For example, send a friendly reminder a few days before the due date, another on the due date if it’s still owed, and then follow up weekly after that.

Your follow-up communications should be professional and courteous but also clear about the expectation of payment. If a client is having difficulty paying, you might discuss a mutually beneficial solution, such as a payment plan or something else. Also, keep records of all follow-up attempts incase you need to escalate the issue later.

4. Accept Various Payment Methods

Offering multiple payment options like checks, bank transfers, online payment platforms (PayPal, Stripe, Venmo, etc), or credit cards.

The easier you make it for clients to pay, the more likely you are to receive prompt payment. Just be sure to consider any processing fees when deciding which payment methods to accept.

5. Use Invoicing Software

Invoicing software can be a game-changer for your accounting practice. It can automate the invoicing process, from creating invoices to sending reminders for unpaid bills. This saves time and reduces the risk of human error.

They often integrate with other accounting and business tools, making it easier to manage your overall finances. They also provide features for tracking payments and generating reports, giving you better insights into your cash flow.

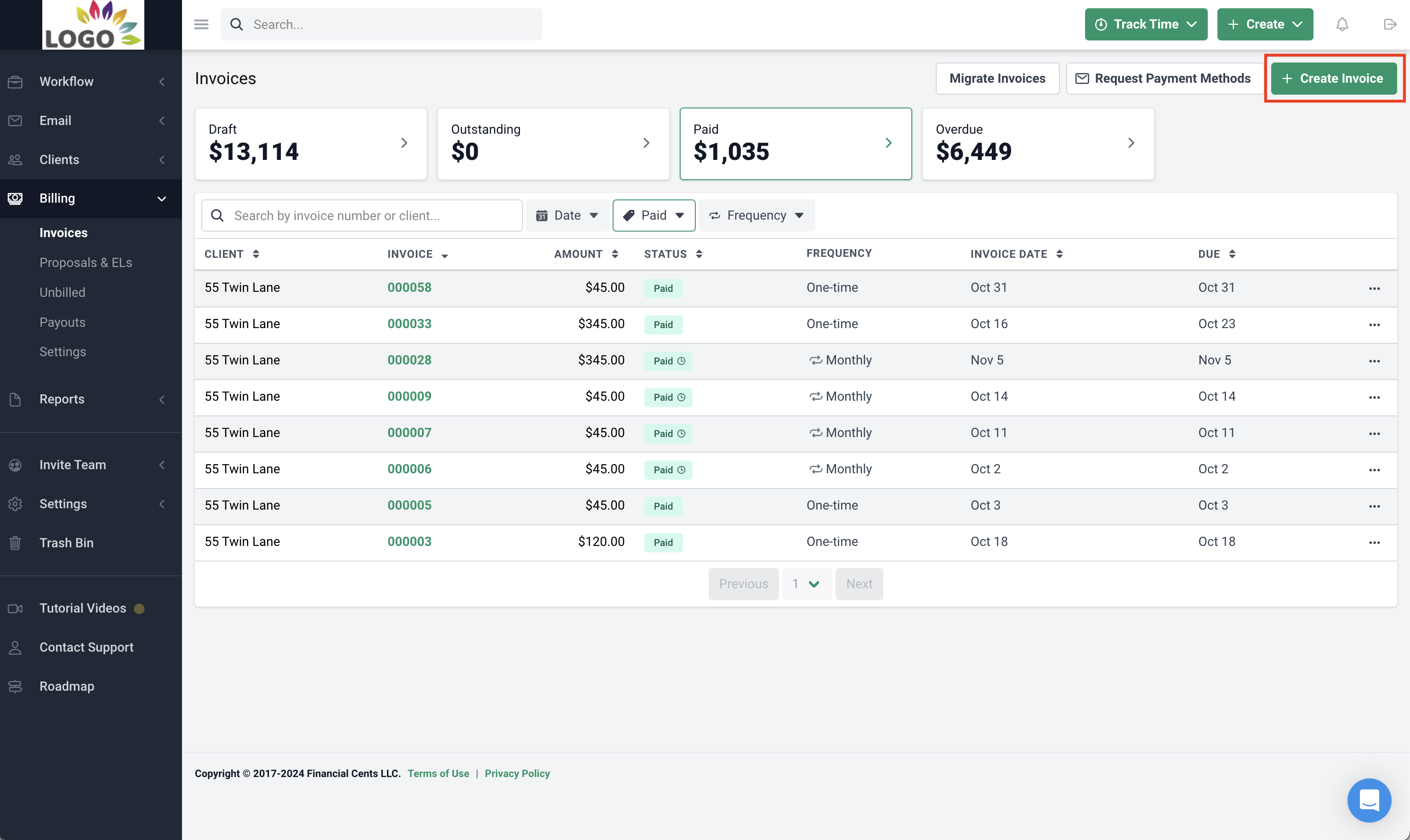

An example of such software is Financial Cents with its billing feature, as well as a time tracking & invoicing feature. The billing feature allows you to automate your invoice creation process and receivables. You can also send automated payment reminders to clients, set payments to recur automatically, offer client various payments methods and more.

Learn more about the billing feature here or start a free trial to get started.

The time traking feature allows you to track your billable and nonbillable time, invoice clients based on the time spent or work done, and even track what your firm spends most of its time on to measure profitability.

Manage your firm with Financial Cents

Aside from its time tracking and invoicing abilities, Financial Cents is a practice management software. This means it also handles other tasks and operations like workflow management and automation, client communication, document management, and automated reminders.

By consolidating these functions in one platform, Financial Cents helps accounting firms streamline their operations, improve efficiency, and focus more on serving clients.