You’ve probably been there: sorting through a client’s scattered financial records, trying to piece together an accurate balance sheet so they can see where they stand and make informed decisions. But the data is spread across multiple spreadsheets, or the records are incomplete. What should be a straightforward task turns into a time-consuming process. Hours later, you’re still on one report, with several more waiting for other clients.

Balance sheets are essential for financial reporting, but manually creating them for multiple clients can be tedious and error-prone. There’s also the problem of inconsistent formatting or missing data that comes with this method.

That’s where a standardized template helps. Instead of building each report from scratch, a structured balance sheet template saves time, improves accuracy, and keeps financials consistent.

To help, we’ve put together a free, fully customizable balance sheet template, which we’ll share in this article. We’ll also break down its key components, best practices for using it, and how it can streamline your workflow.

What Is a Balance Sheet?

A balance sheet helps a business assess its financial position at a specific point in time for internal decision-making and external evaluation by stakeholders such as investors and lenders. It provides insights into how a company’s assets are financed—whether through debt (liabilities) or equity (shareholders’ or owners’ equity)—and helps assess its liquidity, solvency, and overall financial stability.

Businesses need the balance sheet for:

- Financial analysis and ratios: Balance sheets are used to calculate key financial ratios that help assess a company’s efficiency, liquidity, and leverage. For instance, the debt-to-equity ratio and current ratio are derived from balance sheet data.

- Strategic decision-making: Companies use balance sheets to evaluate their capital structure and make informed decisions about future investments or financing strategies.

- Risk assessment: Lenders and investors rely on balance sheets to gauge a company’s risk profile. By examining the balance sheet, they can assess the likelihood of loan repayment or investment returns.

- Compliance and reporting: Businesses need balance sheets to stay compliant with accounting standards, tax regulations, and financial reporting requirements like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), reducing the risk of regulatory issues. It also plays a key role in tax compliance, as authorities often require accurate financial statements to verify income and deductions.

Key Components a Balance Sheet Should Have

A balance sheet consists of three main components: assets (what the business owns), liabilities (what the business owes), and equity (the owner’s stake in the business). Let’s look at each in depth.

1. Assets

Assets in accounting represent resources owned by the company that are expected to provide future economic benefits. They are typically categorized into:

- Current assets: These are assets that are expected to be converted into cash or used up within one year. Common examples include:

- Cash and cash equivalents: Physical currency, bank balances, and short-term investments that can be readily converted to cash.

- Accounts receivable: Money owed to the company by customers for goods or services delivered but not yet paid for.

- Inventories: Raw materials, work-in-progress, and finished goods intended for sale.

- Prepaid expenses: Payments made in advance for goods or services to be received in the future, such as insurance premiums or rent.

- Non-current assets (fixed assets): These are long-term investments that are not expected to be converted into cash within a year. They include:

- Property, plant, and equipment (PP&E): Tangible assets like land, buildings, machinery, and equipment used in operations.

- Intangible assets: Non-physical assets such as patents, trademarks, and goodwill that provide long-term value.

- Long-term investments: Investments in stocks, bonds, or other securities intended to be held for more than one year.

2. Liabilities

Liabilities in accounting are obligations that the company owes to external parties, representing claims against the company’s assets. They are divided into:

- Current liabilities: Obligations that are due to be settled within one year. Examples include:

- Accounts payable: Amounts owed to suppliers for goods or services received but not yet paid for.

- Short-term loans: Loans and borrowings that are repayable within a year.

- Accrued expenses: Expenses incurred but not yet paid, such as wages payable.

- Unearned revenue: Payments received in advance for goods or services to be delivered in the future.

- Long-term liabilities: Obligations that are due after one year. These include:

-

- Long-term debt: Loans and bonds payable over a period longer than one year.

- Deferred tax liabilities: Taxes accrued but will not be paid until future periods.

- Pension obligations: Commitments to pay employee retirement benefits in the future.

3. Equity

Equity in accounting represents the residual interest in the company’s assets after deducting liabilities, reflecting the owners’ claim on the company’s assets. It includes:

- Owner’s equity (Shareholders’ equity): The initial capital invested by the owners or shareholders, including common stock and additional paid-in capital.

- Retained earnings: The cumulative net income retained in the company rather than distributed to shareholders as dividends.

For an in-depth look into equity (definition, types, examples & calculations), read this blog.

Understanding these components and their subcategories is crucial for analyzing a company’s financial health, making informed investment decisions, and assessing its ability to meet short-term obligations (liquidity) and long-term obligations (solvency). Each component provides insights into different aspects of a company’s financial position:

- Assets indicate what the company owns and can use to generate income.

- Liabilities show what the company owes and must pay.

- Equity reflects the ownership stake and retained profits, which can be reinvested or distributed.

Download the Free Balance Sheet Template (Excel & Google Sheets)

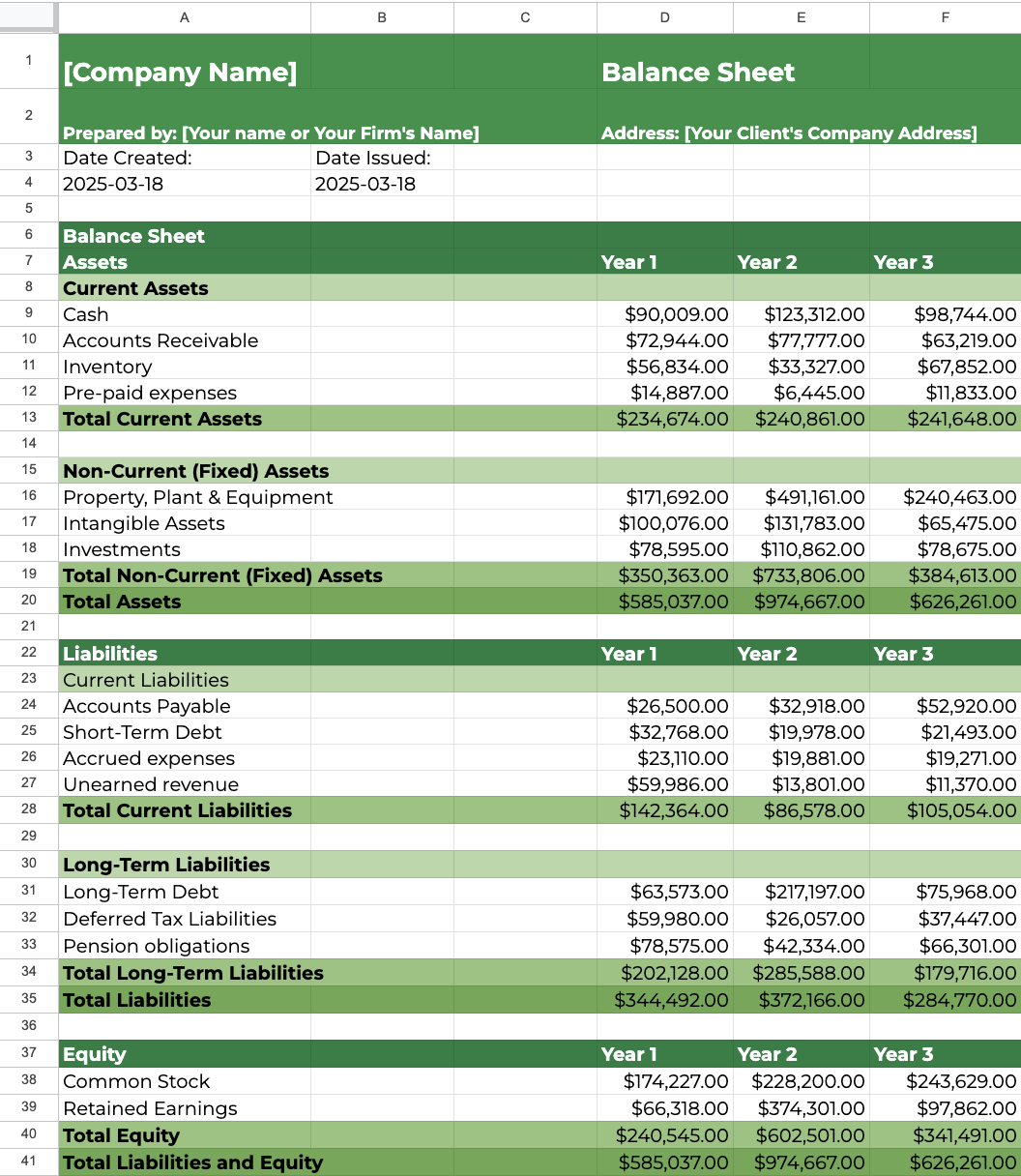

Our balance sheet template is designed to help you quickly organize and present financial data without the hassle of manual formatting.

It includes:

- Pre-formatted sections for assets, liabilities, and equity, making it easy to input and review financial data.

- Automatic calculations for total assets, total liabilities, and equity to ensure that your balance sheet always aligns with the accounting equation (assets = liabilities + equity).

- Customizable branding options like your firm’s logo, adjusting colors and modifying fonts to personalize the template.

Free Balance Sheet Template

Benefits of Having a Standardized Template for Your Balance Sheet

Using a balance sheet template offers several advantages that improve efficiency, accuracy, and consistency in financial reporting. Here are some of them:

Consistency in Client Reporting

A structured template ensures that every balance sheet follows the same format, making it easier to compare financial data across different clients and reporting periods. This consistency makes your firm more professional and improves readability.

Time-Savings

Manually formatting balance sheets for each client is time-consuming. With a ready-made template, you only need to input financial data, and the calculations update automatically. This allows you to focus on higher-value tasks instead of repetitive formatting.

Error Reduction

Built-in formulas reduce the risk of miscalculations and ensure that total assets always align with liabilities and equity. Pre-formatted sections also help prevent missing or misclassified entries.

Client Communication

A well-organized balance sheet makes it easier for clients to understand their financial position. With a clean layout and automated calculations, you can quickly explain key figures and help clients make informed business decisions.

Common Mistakes to Avoid When Preparing a Balance Sheet

Even with a structured template, errors can still happen. Some of the most common mistakes to watch out for include:

Not Balancing Assets, Liabilities, and Equity Correctly

A balance sheet must always follow the fundamental accounting equation:

Assets = Liabilities + Equity

If this equation doesn’t hold, it indicates an error in the financial data, which can lead to inaccurate financial reporting and compliance issues. Common reasons for an unbalanced balance sheet are:

- Missing or incorrect entries.

- Data entry mistakes like duplicated or omitted figures.

- Misclassifying an asset as a liability or vice versa.

- Errors in retained earnings calculations

To avoid this mistake:

- Double-check all entries and calculations.

- Use accounting software with built-in balancing checks.

- Verify that all transactions are recorded accurately and in the correct accounts.

- Reconcile all accounts and cross-reference with other financial statements.

- Ensure that retained earnings are calculated correctly, accounting for net income and dividends.

Misclassifying Expenses

Not all expenses belong on the balance sheet. Some should be recorded on the income statement instead. Otherwise, you’ll have inaccurate financial statements and distorted financial ratios.

Common misclassification errors include:

- Recording operating expenses as assets. Costs like rent, utilities, and salaries should go on the income statement, not under assets.

- Classifying capital expenditures as expenses. Large purchases like equipment or company vehicles should be listed as assets and depreciated over time, not expensed immediately.

- Misallocating costs between current and long-term liabilities. Some expenses, like loan payments, include both principal and interest. The principal portion should be recorded as a liability, while interest is an expense.

To avoid this mistake:

- Ensure that employees entering expenses understand the accounts and descriptions used in the accounting system.

- Regularly review entries to spot misclassifications by comparing descriptions with items or current entries with previous years.

- Compare actual expenses to budgeted amounts to detect discrepancies that may indicate misclassifications.

Forgetting to update financial data regularly

A balance sheet is only as accurate as the data entered. If you don’t update the records regularly, you may end up working with outdated or incorrect numbers. This can lead to inaccurate analysis and missed opportunities for cost savings, revenue generation, and strategic adjustments.

To avoid this mistake:

- Implement a regular schedule for updating financial data, whether daily, weekly, or monthly.

- Use financial dashboards that provide real-time visibility into key metrics and financial health.

- Conduct frequent reviews of financial data to identify and correct any discrepancies or errors.

Best Practices for Managing Balance Sheet Tasks Efficiently

Use Accounting or General Ledger Software

Instead of manually tracking assets, liabilities, and equity, you can use general ledger tools like QuickBooks, Xero or Sage to update financial records in real-time. These platforms automatically categorize transactions, reconcile bank statements, and generate balance sheets with minimal effort. They also reduce the risk of human error, ensuring that financial reports remain accurate and compliant.

Additionally many of these software are cloud-based, allowing your team to collaborate efficiently and providing instant access to up-to-date financial data from any location.

Standardize and Document Your Process

A well-defined process ensures that all team members follow the same steps, reducing errors and promoting clear communication.

To document your process,

- Develop a comprehensive manual that outlines each step of the balance sheet preparation process. Include instructions for data collection, account reconciliation, and report generation.

- Use flowcharts: Visually map out the workflow to provide a clear understanding of each task and its sequence.

- Keep documentation up-to-date to reflect any changes in procedures or software.

Also, standardize your process with templates, checklists, and practice management software like Financial Cents. This tool will help you manage and automate balance sheet workflows, track the status of work, and complete tasks on time.

Perform Regular Reconciliations

The more frequently you reconcile, the more accurate your balance sheets will be. By comparing recorded transactions with actual bank and financial statements, you can identify errors, missing entries, or fraudulent activities before they become larger issues. Regular reconciliation also helps maintain consistency and ensure that assets, liabilities, and equity are properly accounted for.

Maintain a Historical Record of Balance Sheets

Keeping past balance sheets on file allows you to track financial trends, spot inconsistencies, and provide better insights to clients. It’s also essential for audits, tax filings, and financial reviews. Without proper documentation, you may struggle to verify past financial data, leading to compliance issues or inaccuracies in reporting. Storing balance sheets in a secure, cloud-based system ensures easy access and protects against data loss.

Collaborate with Your Team & Clients Efficiently

When preparing balance sheets, you might require input from multiple team members and clients. Without a streamlined system, there’ll be communication gaps which can cause delays and errors.

Financial Cents helps streamline communication, task management, and document sharing in one centralized platform. With the software, you can assign tasks, track progress, and set deadlines. Team members can collaborate in real-time, reducing the need for back-and-forth emails or status meetings.

Additionally, clients can securely upload financial documents, respond to requests, and review reports within the platform, making the process smoother and more transparent.

Automate Recurring Entries & Reports

Many balance sheet items, such as depreciation, loan payments, accruals, and prepaid expenses, require recurring journal entries and this is tedious.

Automation eliminates these repetitive tasks and helps you save significant time, which you can redirect to other tasks. Furthermore, it results in faster processing times, better accuracy, and improved overall efficiency for these balance sheets.

Manage Your Balance Sheet Process With Financial Cents

Preparing balance sheets can quickly become time-consuming and tiring without the right processes and tools.

A standardized balance sheet template (like the free one we provided) can help ensure accuracy, save time, and improve consistency in financial reporting. But to take efficiency a step further, you need a centralized system to manage all client work seamlessly.

That’s where Financial Cents comes in. With our tool, you can:

- Automate certain balance sheet workflow tasks like requesting documents or information from clients, following up with them at specific intervals, or set the project to be recurring every month.

- Track the project’s status in real time to ensure everything is going as planned.

- Collaborate with your team and clients without endless email chains.

- Store historical financial reports securely for easy access and reference.

If you’re looking to streamline your balance sheet tasks and improve overall firm efficiency, sign up for a free 14-day trial of Financial Cents.