An accountant tries to record an expense, but the system rejects the entry. At first, it looks like something is wrong with the general ledger (GL)— after all, that’s where every transaction is posted. But after digging deeper, the real issue turns out to be the chart of accounts (CoA). The account itself was set up incorrectly, which is why the posting wouldn’t go through.

This kind of confusion is common because the CoA and the GL are closely connected and often mentioned together. Many accountants even use the terms interchangeably. But they’re not the same thing. The CoA is the list of all the accounts you can use, while the GL is the record of actual transactions within those accounts.

It’s important to understand these differences. If you mistake one for the other, you risk misclassifying accounts, creating errors in reports, or spending hours cleaning up the books.

In this article, we’ll break down what the Chart of Accounts vs General Ledger is, how they differ, and how they work together so you can keep your clients’ books accurate and organized.

What Is a Chart of Accounts?

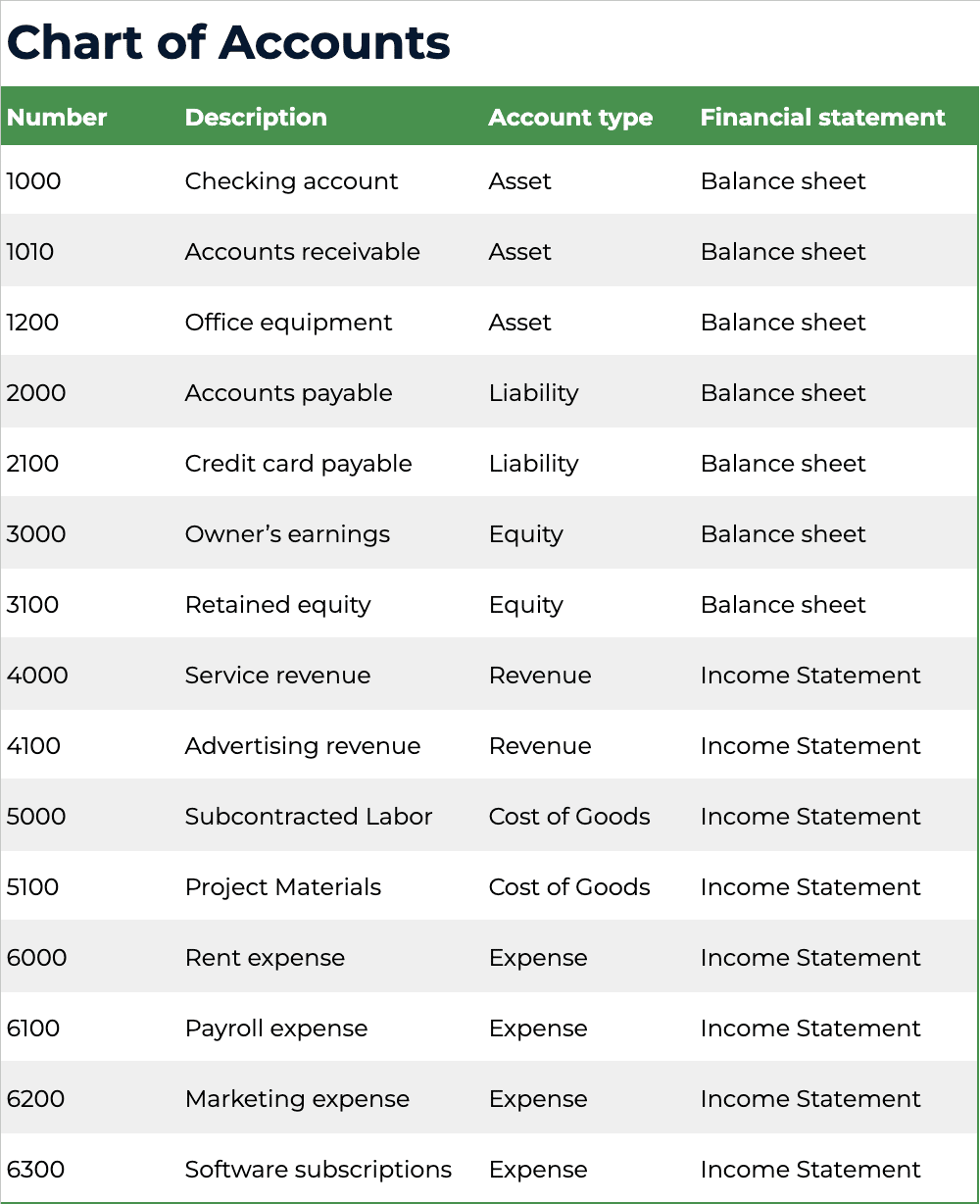

A chart of accounts (CoA) is the structured list of all the accounts a business uses to categorize its financial transactions. It categorizes accounts by type, including assets, liabilities, equity, revenue, and expenses, ensuring that transactions are recorded in the correct category.

Each account in the CoA has a name and a number, making it easier to stay consistent when recording and reporting transactions. The CoA itself doesn’t store transaction details. Instead, it defines the categories that the general ledger will later capture activity in.

Here’s an example of a CoA:

What Is a General Ledger?

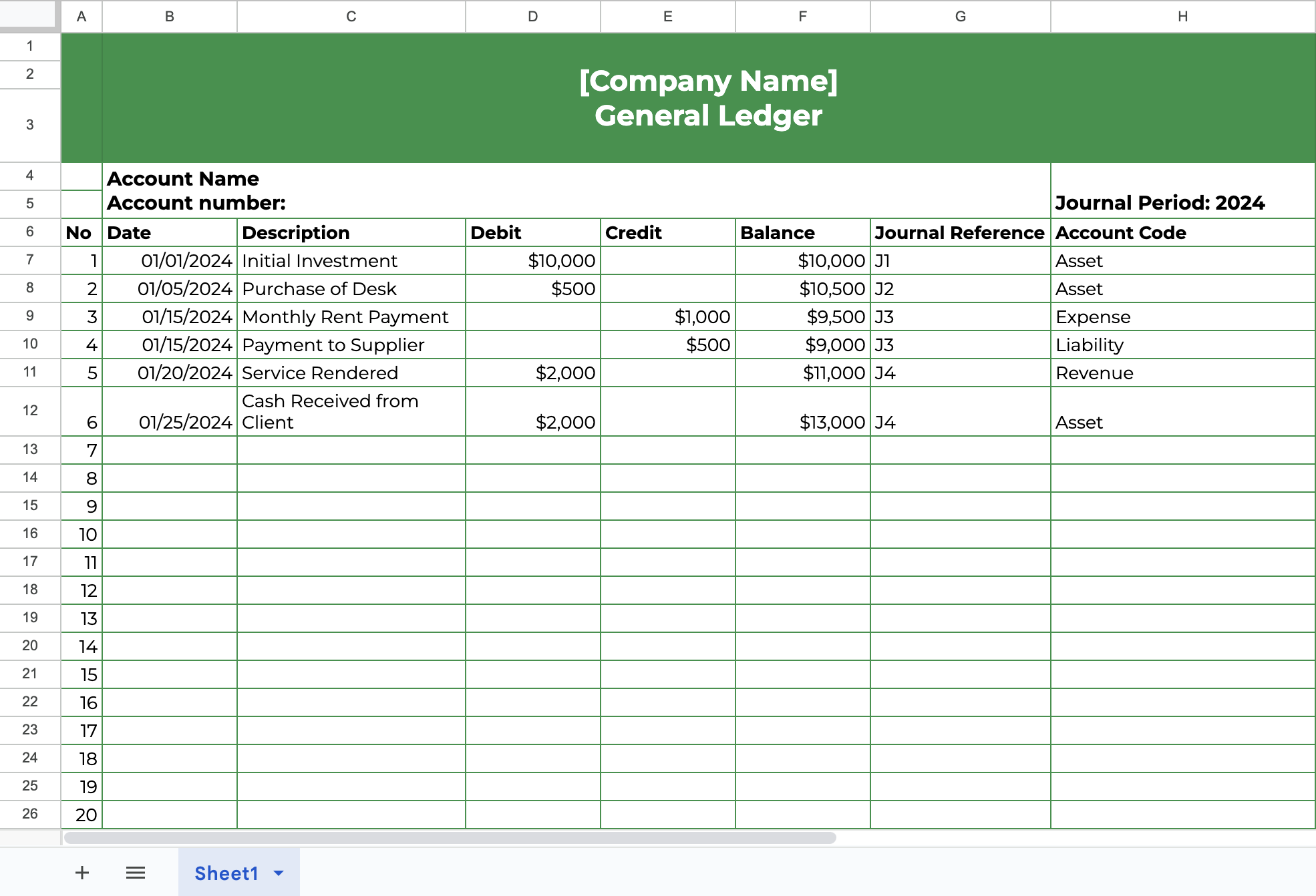

The general ledger (GL) is the complete record of all financial transactions for a business. It contains every debit and credit entry across all accounts, along with running balances, so you can see the full financial picture at any point in time.

Unlike the chart of accounts, which only lists account categories, the general ledger records the actual activity within those accounts. For example, if “Office Supplies” is an account in the CoA, the GL shows every purchase of pens, paper, or printer ink that was recorded under it.

Because it captures detailed activity, the GL is the foundation for preparing trial balances and financial statements. It’s also the first place you’ll look when investigating discrepancies or reconciling accounts.

Here’s an example of a GL:

Chart of Accounts vs. General Ledger: Key Differences

| Feature | Chart of Accounts (CoA) | General Ledger (GL) |

| Nature | A list or index of all accounts a business uses. It outlines the structure of the accounting system and defines what accounts are available. | A collection of all individual accounts with their transactions. It contains the financial history of the business across all categories, and every entry reflects a real-world transaction |

| Content | Contains account names, numbers, and descriptions, but no transaction details. Helps standardize how activity will be tracked. | Stores every debit and credit posted, along with dates, descriptions, and amounts. It also acts as the audit trail for all financial activity. |

| Level of Detail | High-level overview that makes it easy to see which types of accounts exist. It’s designed for planning and classification, not analysis. | Highly detailed (every transaction affecting an account).

Shows the who, what, when, and how much for each entry. Ideal for reconciliation, audit prep, and financial reporting. |

| Primary Purpose | Defines the structure and classification of accounts so that financial data can be organized consistently. | Records and summarizes actual financial activity to support reconciliations, trial balances, and financial statements. |

| Dynamism | Relatively static. It’s only updated when accounts are added, merged, or removed (e.g., creating a new expense category). | Highly dynamic. It’s updated daily or even in real time as transactions are posted, making it the most frequently used record. |

| Input For | Used when setting up accounting software, creating GL accounts, or ensuring industry-specific categories are included. | Provides the raw data for trial balances, financial statements, management reports, and compliance reviews. |

| Analogy | Like a table of contents, blueprint, or map legend. It shows the structure without the details. | Like the full book, the completed house, or the detailed map. It contains the actual information, activity, and history. |

How The Chart of Accounts vs General Ledger Work Together in Accounting

The CoA and the GL don’t exist in isolation. They work hand in hand to ensure that financial data is structured, accurate, and reliable for reporting. Here’s how they connect in practice:

COA Provides the Framework

Before you or your staff can record a single transaction for a client, you must first define which accounts exist. That’s the role of the CoA. It lays out every account category the business will use, like bank accounts, liabilities, expense types, revenue streams, equity accounts, and so on.

Each account is categorized and assigned a unique account number. This structure ensures transactions are categorized consistently across different team members, software, and reporting cycles.

For firm owners, this framework is especially important when onboarding new clients or standardizing books across multiple entities. Without a solid CoA, you risk duplicate accounts, vague naming conventions, and unclear classifications that complicate every downstream task from data entry to reporting.

GL Houses the Transaction Details

While the CoA defines which accounts exist, the GL captures what actually happens within those accounts. Every transaction from sales, purchases, payroll, and adjustments is posted to the GL and assigned to the appropriate CoA-defined account.

Each transaction entry includes a debit and a credit (or multiple), along with the date, amount, and description. Over time, the GL builds a complete history of financial activity, including running balances for every account. This level of detail is essential for preparing trial balances, reconciling accounts, and generating accurate reports.

Unlike the CoA, which changes infrequently, the GL is updated constantly. It’s the living record of your client’s financial health, and keeping it accurate is important.

Every GL Entry Maps to an Account in the COA

You can’t post a transaction to the GL without assigning it to an account listed in the CoA. That’s how the two systems stay connected.

For example, when your client pays for advertising, your team records the payment in the GL under the “Marketing Expense” account defined in the CoA. The CoA doesn’t track the amount or date of the payment, but it defines where that transaction should go.

This mapping ensures that all activities are properly categorized, which is essential for maintaining accurate records and creating financial reports that are clear and understandable to your clients.

COA Keeps the GL Organized

Because every GL entry is tied to a specific CoA account, the CoA acts as an organizing tool for the GL.

Without it, transaction data would be scattered and inconsistent. You might see the same vendor payment categorized under “Consulting,” “Professional Services,” and “Contractor Fees” just because different staff or clients used different labels.

A clean CoA prevents this. It forces consistency, which helps your team close the books more efficiently, avoid misclassifications, and minimize the need for back-and-forth communication with clients during cleanup or reporting periods.

COA Enables Accurate Financial Reporting from the GL

Financial statements pull their data from the GL, but how that data is structured depends entirely on the CoA.

If your CoA is too vague or overloaded with redundant accounts, your income statements and balance sheets will be messy and hard to interpret. On the flip side, a well-structured CoA ensures that GL data flows into clean, easy-to-read financial reports grouped logically and labeled clearly.

This matters not just for your internal team, but for how clients experience your service. Clean reporting builds trust and makes advisory work more effective.

Together, They Ensure Consistency Across Accounts

When both systems are working together, CoA as the structure, GL as the data, you create consistency across all your accounting workflows.

Every transaction goes into a predefined bucket. Every account has a clear purpose. And whether you’re preparing monthly reports, doing cleanup, or onboarding a new team member, you’re working with a system that’s standardized and predictable.

That consistency is what allows you to scale. Without it, small mistakes multiply fast across multiple clients, and your team spends more time fixing problems than delivering value.

Why Both Matter for Accountants and Bookkeepers

The CoA and GL have a direct impact on how well your firm can serve clients. Here’s why both matter:

Clean CoA Helps Maintain Clarity

A well-structured CoA gives your team and your clients a clear view of how financial activity is categorized. Without it, you’ll see duplicate or vague accounts like “Miscellaneous Expense” or “Income Other,” which make reporting confusing and open the door for misclassification. Clean CoAs keep accounts consistent across reporting periods and make it easier for your staff to record transactions correctly the first time. This saves you time on reviews and client cleanup work.

Accurate GL Enables Financial Reporting

The GL is the master record of a client’s financial activity. If it’s not accurate, trial balances, income statements, and balance sheets will all be off. This can mean longer close cycles, more reconciliations, and reduced client trust. On the other hand, a properly maintained GL ensures that every debit and credit is in its place, so that reports reflect reality.

Better Decision-Making

When the CoA is structured and the GL is accurate, you’re able to deliver financial statements that clients can actually use. Clear categorization, combined with accurate data, helps business owners understand where their money is going, identify trends, and make informed decisions about growth, cost-cutting, or investment. This also strengthens your advisory role, since you’re not just cleaning up data but also providing insights backed by reliable books.

Best Practices for Managing Your Chart of Accounts vs General Ledger

Below are best practices for managing CoA and GL, so you can reduce errors, simplify reporting, and scale your client work more efficiently:

Customize the CoA to Client-Specific Industries

Avoid using the same default chart of accounts for every client. A retail business, a law firm, and a nonprofit organization will all require different account categories to accurately reflect their unique operations. Tailoring the CoA to each client’s industry helps ensure transactions are categorized correctly, reporting is relevant, and financial statements are actually useful for decision-making.

Regularly Review and Clean up Unused or Duplicated Accounts

Over time, it’s easy for CoAs to become cluttered with accounts that are no longer used or worse, with multiple versions of the same type of account. This makes reporting more challenging and increases the risk of misclassification.

Set a regular cadence (e.g., quarterly or during year-end preparation) to review and archive unused or redundant accounts.

Reconcile the General Ledger Frequently

A clean ledger doesn’t stay clean by accident. You should reconcile bank accounts, credit cards, and balance sheet accounts regularly, ideally on a monthly or even weekly basis for high-volume clients. This ensures that the GL reflects real-world activity and flags discrepancies before they become bigger issues.

Use Naming Conventions and Number Systems for Consistency

Clear, consistent naming and numbering in the CoA make it easier for your team to work across multiple client files without confusion.

Use a logical numbering system (e.g. assets = 1000–1999, liabilities = 2000–2999, expenses = 5000–5999) and stick to standardized naming formats (“Advertising Expense” vs. “Ad Exp”). This also makes it easier to train new staff and spot errors during review.

Create SOPs for Transaction Entries

Everyone on your team should follow the same process when entering or reviewing transactions. Without clear SOPs, you’ll run into inconsistent categorizations, messy ledgers, and inefficient cleanup work later. Document step-by-step processes for posting journal entries, assigning expenses, handling bank feed imports, and reviewing client-submitted data. You can create and save your checklists as templates in Financial Cents, so every member of your team can access them whenever needed.

Serve Clients Better by Getting the Chart of Accounts and General Ledger Right

As we’ve discussed, the CoA and GL are closely linked, but they serve very different roles. The CoA defines your accounting system’s structure i.e it tells you which accounts exist and how they’re categorized. The GL captures what actually happens: every transaction, debit, credit, and running balance tied to those accounts.

Understanding both and how they work together is essential for delivering accurate reports, maintaining clean books, and avoiding unnecessary rework. For accounting and bookkeeping firms, this kind of clarity leads to better decision-making, more efficient workflows, and stronger client relationships.

But knowledge alone isn’t enough. To stay on top of multiple clients and maintain consistency, your firm needs standardized, repeatable processes. When your team follows the same workflow every time, you reduce errors, close books faster, and stay audit-ready every time.

That’s where Financial Cents helps. Our accounting practice management software is built specifically for firms like yours. Here’s how it keeps your CoA, GL, and client work organized:

- Workflow Management & Automation feature: Assign tasks, set recurring workflows, and send automatic client reminders so nothing slips through the cracks.

- Client CRM: Store client details securely and give clients a simple portal to upload documents and messages.

- Time Tracking & Billing: Track billable hours, generate invoices, and manage work from one system.

- Custom Templates: Create reusable checklist templates for performing tasks in your firm to ensure consistency in the quality of work across all clients, all the time. You can also access hundreds of workflow templates created by accounting professionals.

Start using Financial Cents to manage your accounting processes.