Changing laws, regulatory updates, and a challenging economic environment are some of the reasons your clients are exploring accounting advisory services.

As we said earlier in a breakdown of what accounting advisory services were, there’s a greater need for these kinds of services.

As a CPA, this is good news because your firm could potentially gain immense benefits – strengthened client relationships, competitive advantage, increased revenue, etc – from offering these services.

To fully appreciate these benefits, you must strategize and design a boutique service that fits your scope of work and meets your client’s needs.

Roger Knecht, President of Universal Accounting Center, who has helped thousands of accounting professionals build their businesses for 20+ years, advises

Before transitioning into this space, ensure you have an effective and standardized way of managing processes which gives you time to explore advisory services"

Is there a Market for these Services?

The short answer is yes.

As globalization continues to advance thanks to cross-border trade, more and more company leaders are thrown into the murky waters of competing legislation, convoluted procedures, and unutilized business data.

They like running their businesses day-to-day, but most of them don’t want to spend their limited resources trying to keep up with complicated finance or accounting regulations. Instead, they prefer to leave it to the professionals – you.

How true is this? Well, listen to the one-third of small businesses that have outsourced a business process, of which accounting and IT services are listed as the most common.

Take notes from the nine in ten accountants who agree that clients expect greater flexibility and higher service levels from their accountants, without an increase in fees. (Sage)

It’s no surprise that more than half of respondents to the Sage report believe that accountants joining the profession today need financial business advisory skills such as cash flow and growth modeling.

While 63% are training or planning to train around financial business advisory services.

The overwhelming majority of accounting firms (82%) report that clients expect a wider range of services and resources from accountants today than they did five years ago. (Sage)

These accountants have seen it firsthand, and they’re not only shaping up the industry but demonstrating its immense potential, as evidenced by the 50% increase in monthly client revenues that accounting firms can achieve by embracing this strategic approach.

Now that you’re convinced, let’s show you how to design your accounting advisory service.

Steps to Design and Offer Accounting Advisory Services

1. Select A Niche

We’ll tell you this for free, the accounting advisory services market is crowded, so it is important to find a way to stand out from the crowd.

Invest your time and resources in carving out your niche. Think about how you intend to advertise your business. It could either be:

- Industry-specific: hospitality, technology, healthcare, etc.

- Service-specific: tax planning, forensic accounting, benchmarking and analysis, etc

- Client-specific: family businesses, multinationals, startups, etc

Map out the services you currently offer and determine which of them you enjoy doing the most or which ones bring the most revenue to your business.

As you think of niching down, ask yourself these questions:

- How much growth do I want my business to have?

- What does scaling look like for my niche business?

- How relevant are my advisory services to the industry or clients that I work with?

- Is the industry being affected by external forces beyond my control (e.g. Covid-19)?

If you have answers to these questions, then you’re on the right track.

In this video accounting professionals Alisa Mccabe, Tonya Schuttle and Jamie Finfrock discuss how to identify and dominate your firm’s niche

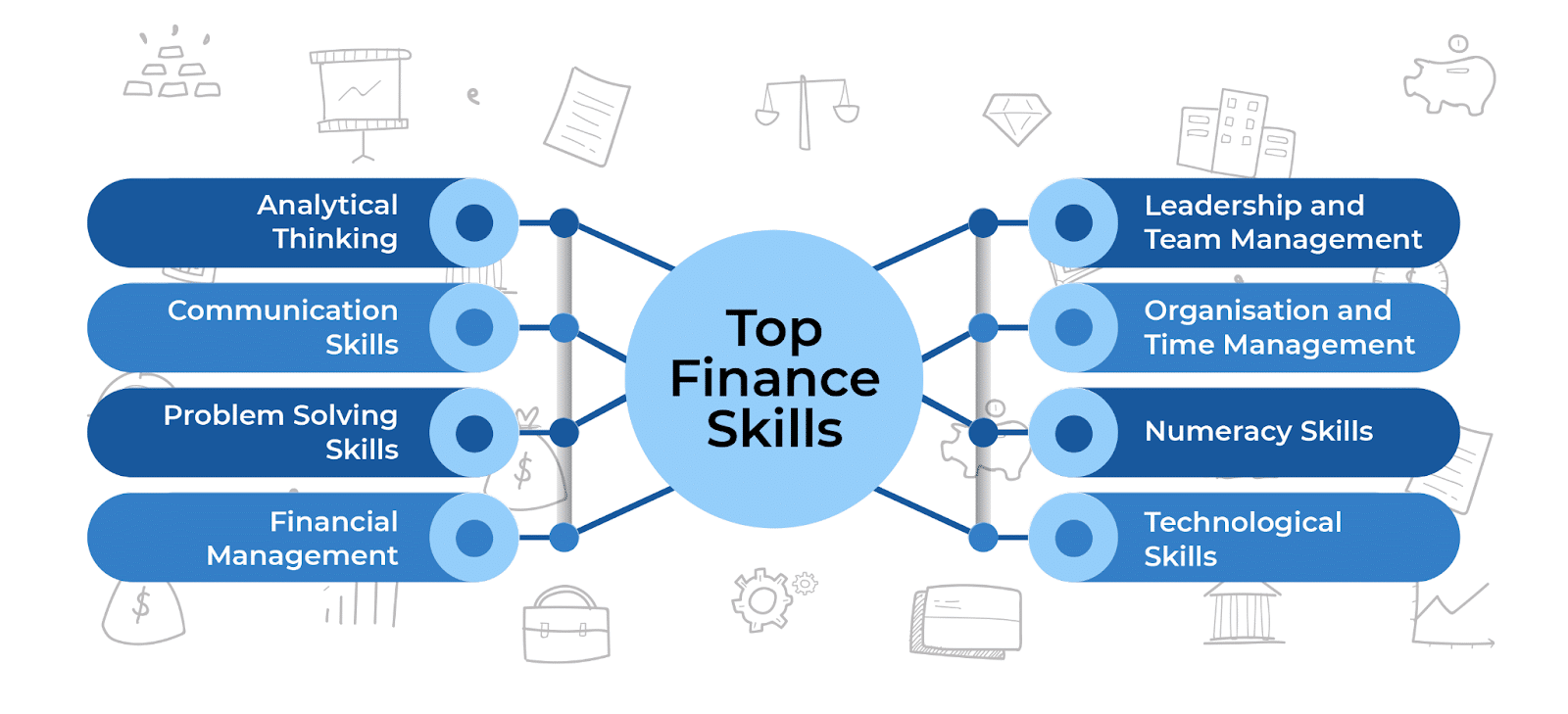

2. Acquire Relevant Skills

Every bookkeeper or accountant should have a good grasp of accounting principles, financial reporting, and tax law. However, these aren’t the only skills you’ll need if you want to expand your business to offer advisory services.

Clients rely on you to provide accurate and compliant advice that can improve profitability and enhance their decision-making. As such, your skill set should expand beyond traditional accounting skills.

Here are some skills to consider:

- Communication: Helps you listen effectively to clients’ needs and communicate complex financial information & data in simple terms.

- Relationship management: Knowing your client’s needs, potential risks, and problems, you can upsell your services or provide your expertise in new areas.

- Research: Stay up to date with changing regulations to proffer relevant advice.

- Presentation: Great speaking and presentation skills can convince your clients about your findings and recommendations.

- Analytical & problem-solving: Divergent thinking, mind mapping, and other creative thinking methods can improve the quality of your solutions.

- Project management: Managing multiple clients, keeping track of all projects, and reporting in record time will give you an edge over your competitors.

- Industry knowledge: Keeps you in the know about your client’s industry and makes you a trusted expert for relevant issues.

You may be interested in:

3. Outline Your Service Offerings

Whether you’re running your practice remotely or working from an office, it’s important to determine what kinds of activities will fall under your service offerings.

Below are some activities to consider.

Financial Forecasting

This is a big part of financial planning and analysis, and it’s all about guessing what will happen with finances in the future by looking at past data and making some assumptions. It often involves preparing financial projections and models, conducting scenario planning, and assessing the impact of changes in the business environment.

In this case study, a German high-tech photonics business was looking for a good way to change their predictions for important financial numbers.

They hired a group of experts who showed them hidden potential through an AI-based, standardized, and automated forecast solution. The solution integrated models and forecast methods to provide automated revenue forecasts for all markets, regions, and products of the business.

This set the stage for making good decisions based on data and predictive analytics.

Risk Management

As part of advisory services, financial risks like operational or liquidity risks are found and evaluated. Risk reduction strategies are made and put into action, risk audits are carried out, and advice is given on risk transfer methods.

Let’s imagine you’re an expert in this field and are looking to convince an existing retail client, who you know is concerned about liquidity risk during seasonal downturns.

You conduct a risk assessment to identify problematic areas and proffer cash flow management solutions that reroute cash to keep the retail business functioning even during the off-season. The client is pleased and has decided to hire you on an ongoing basis to lower their financial risks.

Process Optimization & Improvement

The main goal of this service is to improve and streamline a business’s financial and accounting procedures so that they work better, are more accurate, and cost less.

It involves:

- assessing an organization’s current accounting and financial processes

- working with the client to identify inefficiencies, bottlenecks, and areas of redundancy

- suggesting ways to improve the processes and;

- implementing accounting software solutions that can automate repetitive tasks, reduce the risk of errors, and provide real-time access to financial data.

Tax Advisory Services

This focuses on helping companies, and organizations find their way through the complicated world of taxes by giving them expert advice and support.

In this case study, an investor wished to take over only one of the ongoing businesses of a client. Your services in this instance would include advising parties on the tax liabilities, navigating complex international laws, and available tax credits, incentives, and deductions that accrue as a result of such liquidation.

Forensic Accounting

This focuses on investigating financial irregularities, fraud, and financial misconduct within organizations. It uses legal knowledge, auditing skills, investigative skills, and accounting knowledge to find, analyze, and show financial evidence in court or other settings.

Other advisory services that could be added to your services include:

- Profitability Analysis

- Business Valuation

- Financial Restructuring

- Financial Reporting and Compliance

- Fraud Detection

- Mergers and Acquisitions Advisory

- Capital Structure and Financing Strategy

You may be interested:

3 Core Services Your Accounting Firm Should Be Offering In 2024

4. Determine Your Pricing Strategy

Once you have your niche down, and your service offerings chosen, the next step is to determine how you’ll be pricing your services.

The best pricing model for a firm will depend on several factors, such as the type of services offered, the target market, and the firm’s cost structure. Your services may be offered on an ongoing basis, or a one-off basis.

Several pricing models can be used for accounting advisory services:

- Hourly rate: You charge an hourly rate for the time spent on engagement.

- Fixed fee: You charge a fixed fee for a specific scope of work.

- Value-based pricing: You charge a fee that is based on the value of the services provided.

- Retainer fee: Clients pay you a monthly retainer for a set number of hours of services.

- Contingency fee: You charge clients a fee, only if the engagement is successful (often used in litigation support)

If you’re unsure of which pricing strategy to adopt, you can check out this playbook on how to set up profitable pricing for your firm.

For a streamlined pricing strategy for accounting advisory services, we cover this in detail here: An Essential Guide to Pricing Accounting Advisory Services.

5. Map Out Your Marketing and Branding Strategy

When marketing advisory services, it’s often best to use both online and offline means to reach and engage your target audience.

But, don’t focus on pushing the “buy my services now” narrative while devising strategies. Approach your target audience from a strategic ‘helpful’ standpoint. Sell your benefits and not your services.

Remember, people buy from those they know, like, and trust. Here are some strategies to consider:

- Build an online presence. Use social media to create a strong brand that distinguishes you from the competition.

- Offer free consultations. Give potential clients a chance to learn more about your firm and see if you are a good fit for their needs

- Create relevant, useful content that builds relationships with your potential clients.

- Speak at industry events or conferences. Attend client events and grow your client base through referrals or networking.

- Organise webinars and workshops that highlight your niche-specialty.

- Leverage LinkedIn to form new relationships & discover potential leads for your business.

- Form vertical partnerships with other businesses (e.g supporting a legal firm’s client workshop)

You may be interested:

6. Consider Your Legal and Ethical Duties

When providing accounting advisory services, it is crucial to consider the legal and ethical duties owed to your clients. These duties stem from various sources, including professional accounting standards, codes of conduct, and law.

For instance, in the United States, all licensed accounting professionals—certified public accountants (CPA) or public accountants—and the services they are authorized to perform are regulated by the state boards of accountancy, coordinated under the watchful eye of the National Association of State Boards of Accountancy.

Each state board has ethical rules and regulations that its licensees are obligated to observe as a condition of their licensure.

Furthermore, if your services extend to public businesses, you’re also accountable and regulated by the Public Company Accounting Oversight Board (PCAOB).

When designing your services, take into full consideration, your legal and ethical duties to your clients whether it be a duty of care, confidentiality, professionalism, unbiased behavior, or avoidance of conflicting interests.

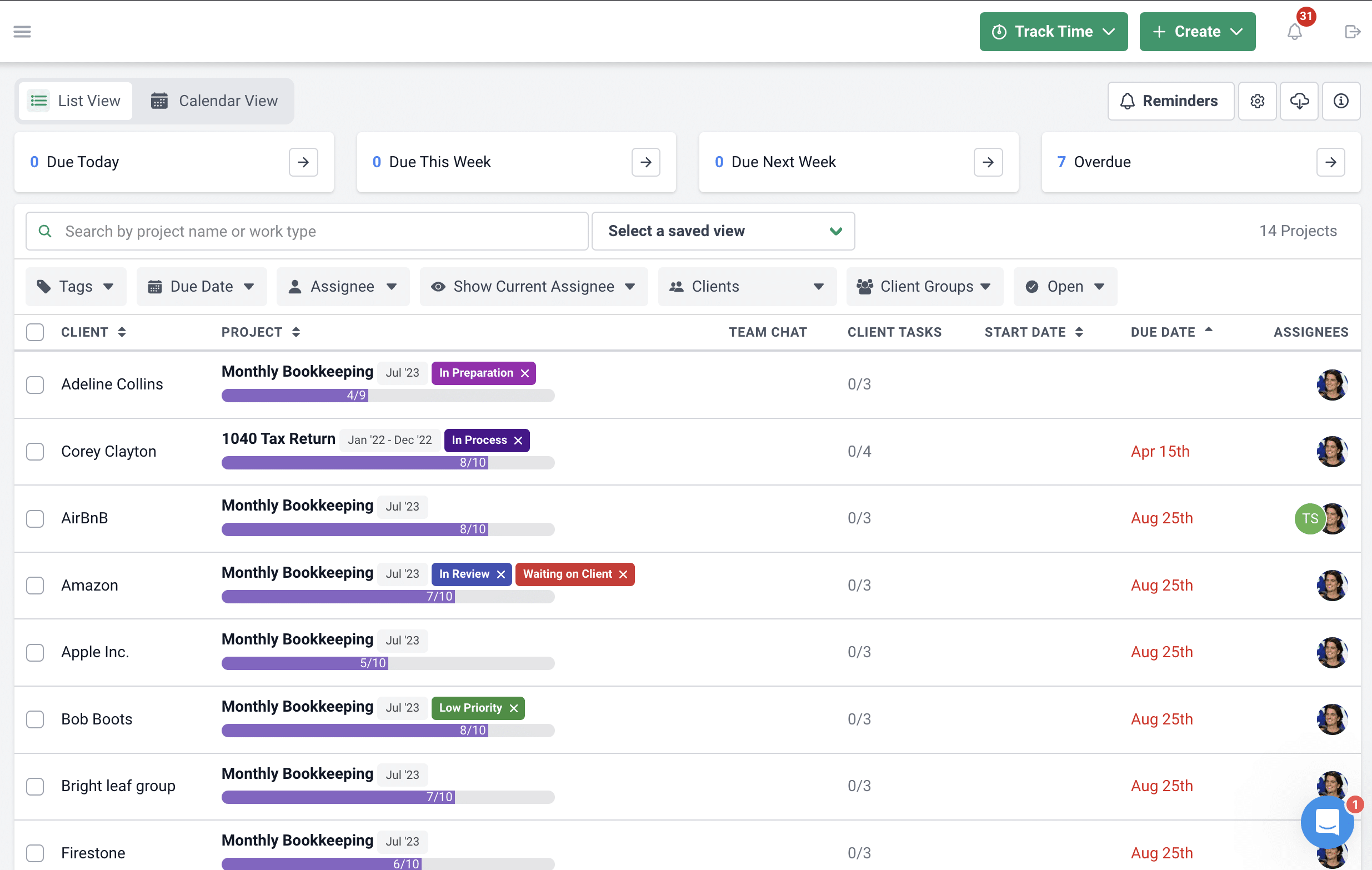

7. Choose Your Technology and Tools

Picking the right tech and tools to back up your practice is crucial if you want to stay ahead of the curve.

Before setting up your accounting firm’s tech stack or choosing a tool, consider the specific needs of your practice. What types of services do you offer? What are the pain points of your clients? Once you have a good understanding of your needs, you can begin to research different technologies and tools that can help you address them.

Next, consider the cost. These tools can be expensive in some cases, so it is important to make sure that you are getting the most value for your money.

Do your research and compare different options before making a decision. This article on the best accounting practice management software options should make your decision easier.

For instance, when selecting an accounting practice management software, certain features are non-negotiable. You want to select software that automates your workflow, organizes your client information in a single location, and offers time tracking and invoicing options to better manage your client’s accounting needs.

Luckily, Financial Cents does all that and more.

8. Team Building

Clients expect a high level of service from their advisors, and this can only be achieved through a well-functioning team. Such a team will feature different roles that team members can play in accounting advisory services. Some of these include technical experts, project managers, communication specialists, practice owners, and client engagement managers.

When building your team, use these strategies to set yourself apart:

- Set clear expectations for your team members. Define each role and responsibility.

- Establish mutual respect and trust and foster a culture of open communication so nothing slips through the cracks without you noticing.

- Encourage collaboration and teamwork using team-building activities and projects.

- Set up reward systems for team members to feel appreciated for their contributions.

9. Client Relationship Management

For your accounting advisory service to achieve success, it is essential to establish and nurture robust client relationships as a final step.

To do this, you need to show that you care about your clients’ businesses and their specific goals. Know their problems and goals, and then make your services fit those needs. This will ensure that you provide answers that are useful and have an impact on them.

Building strong relationships with clients also requires good communication. This means answering questions quickly, keeping people up to date on progress, and describing complicated financial ideas in a way that is easy to grasp.

Some handful tips for effective communication and client satisfaction:

- Be an active listener

- Be clear and concise in client communication

- Be responsive and provide regular updates on progress

- Be proactive and offer solutions before they are asked or thought of

- Be flexible in your approach to meet the individual needs of each client.

- Be respectful even when they are expressing challenging concerns.

- Be honest and upfront about potential problems or challenges, and avoid making promises that cannot be kept.

- Express appreciation for clients’ business and show them that you value their relationship.

- Use an accounting CRM to manage client information, documents and communication.

You may be interested in:

How to Use Accounting CRM Software to Build Strong Client Relationships

Wrapping Up

Designing an accounting advisory service that suits you perfectly might take some strategizing and planning but the rewards will reflect on your bottom line. Be strategic about your efforts and obligations. Choose the right marketing tactics, team members, and most importantly accounting software, to make your journey seamless.

And what better accounting software partner to go with you on this journey than us?

Use Financial Cents Accounting Practice Management Software to manage your firm.