“We’re sorry this slipped through the cracks, and we missed it.”

No accountant wants to say these words to their clients, no matter how brave they are. The heavy silence that descends after such a statement is almost deafening. That silence is usually followed up by phone calls filled with apologies and explanations: “We understand the inconvenience,” or “We’re working to minimize the impact…

Missing deadlines, even for well-organized teams, can have serious consequences, such as financial losses for clients, damaged trust, and a negative impact on your accounting firm’s profits.

To prevent this from happening, let’s discuss five steps you can take to prevent your accounting firm from missing important deadlines.

Steps To Save Your Accounting Firm From Missing Important Deadlines

1. Implement a Workflow Management System

Managing deadlines across spreadsheets, emails, and sticky notes is a surefire way to miss deadlines. Implementing an accounting workflow management system is the key to keeping your head on a swivel.

A workflow is something constant; it is moving, it is interconnected, and it will be updated. It is based on other things that are happening within an organization"

Roman Villard, Full Send Finance.Your workflow is essentially everything you must do within a given period – data collection, bookkeeping, tax preparation, client communication, reporting, emails, internal meetings, etc.

When creating your workflow, think about the outcome. What do you want to solve? This will lead you to make checklists and use project management software to maximize your time and efforts. Your checklist will form the basis of your workflow. You start with one thing, check that off, and go on to the next one.

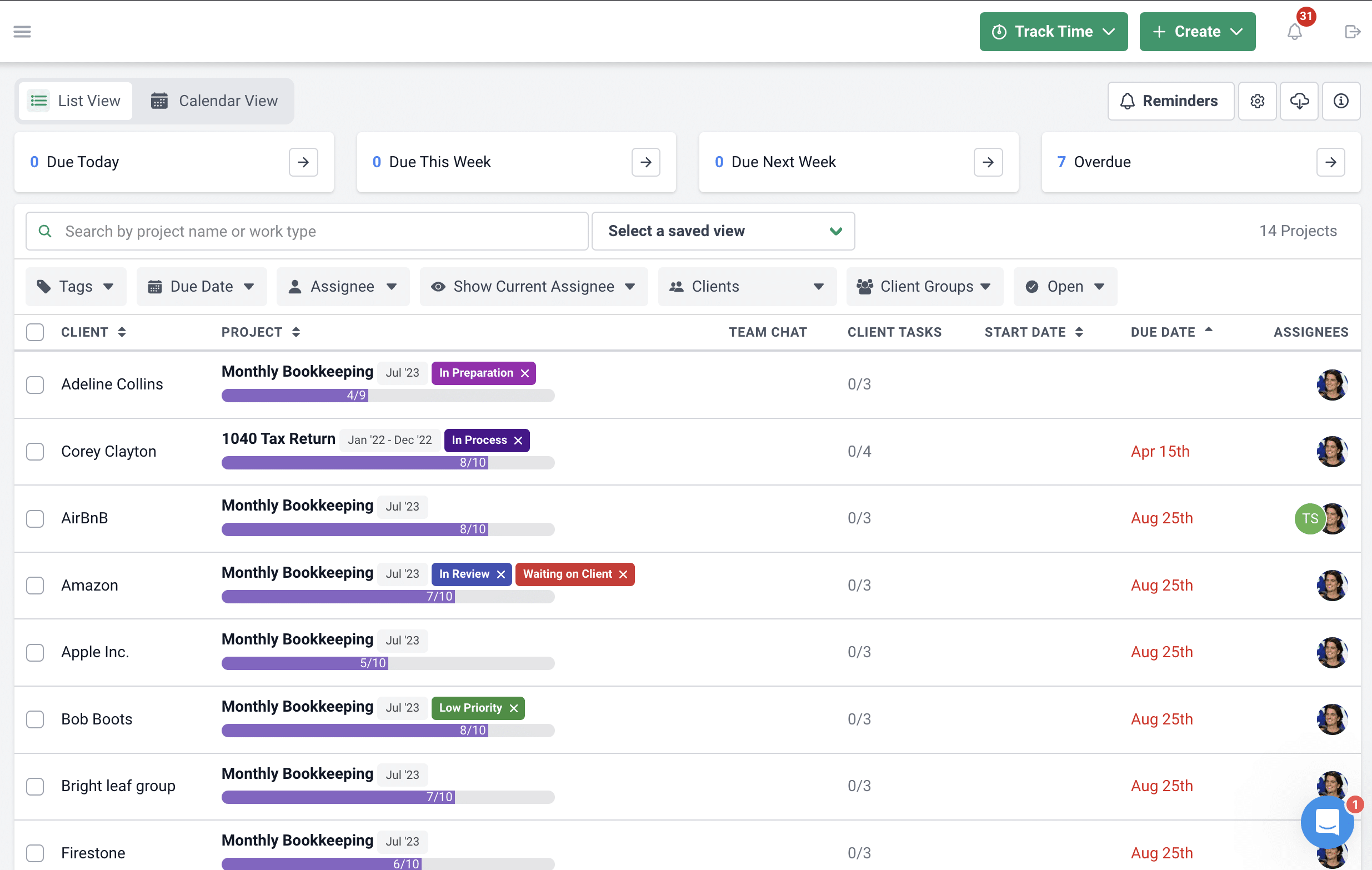

A workflow management software specifically allows you to view all tasks, deadlines, and project details in one central location.

For instance, Financial Cents offers a streamlined dashboard that makes it easy to see all your tasks in order of priority. At a glance, you can see how many tasks are due in a week, the project details, who the client is, and the due date.

You can set deadlines for each task within a project and get automatic reminders, keeping everyone on track and accountable.

An accounting workflow system like Financial Cents essentially helps you centralize your workflow, so you have one place to track work and deadlines, store client files, and get documents and information from clients, among other things.

When shopping for such software, look for features that make your life easier—a workflow dashboard, date tracking, automatic recurring tasks, project assignments, time tracking, preset workflow templates, and a client request feature.

2. Establish Clear Communication Protocols

Open communication with clients is an important cornerstone of managing deadlines effectively. To ensure everyone stays on the same page regarding deliverables, you must communicate openly and effectively. This goes for client-facing communication as well as internal communication.

Take a cue from Marie Greene, founder of Connected Accounting LLC, who created a unique overtime workflow that keeps her clients in the loop.

On the client-facing side, we use a lot of different tools. If you contact us, it will go through sales at connectedacounting.co which is in a ticketing system. That means every time we get an email, a ticket number gets created and we have preset templates that are the answers you receive back"

Marie Greene, Founder of Connected Accounting LLC.Also, consider the size and complexity of the project when setting deadlines. Be as realistic as possible, and don’t be afraid to communicate this to your clients during meetings. Don’t underestimate the time required to gather information, complete tasks, and meet quality standards.

Involve your clients in the deadline discussion. This is especially important when penalties or late submission fees are involved, e.g., when filing tax returns. Use a tax preparer checklist to outline all documents that must be retrieved before the due date to prevent late filing.

Take things a step further by discussing expectations and any external factors that might affect the timeline with your team. This helps you prepare ahead of time and build in some buffer time for unforeseen issues or delays in receiving client information.

3. Plan and Prioritize Workflows

Setting realistic deadlines is key to meeting them and building trust with clients. Overly ambitious deadlines can damage your credibility if missed, forcing you to sacrifice time for other priorities like family and exercise.

We cannot overemphasize the importance of setting internal deadlines for different stages of your tasks.

List out the process for the service you’re offering. This will help you figure out which parts you want to automate, delegate, or eliminate"

Nayo Carter-Gray.If you’re filing taxes, for example, set deadlines for gathering client documents, organizing and categorizing tax documents, calculating tax liabilities, reviewing tax documents, and filing tax returns.

When you proactively plan, you can enjoy all the benefits that come with it. You’re not rushing to meet unrealistic deadlines, meaning there’s less room for errors. You can dedicate more time to quality control and ensure accurate deliverables. With a clear plan in place, you can confidently communicate project timelines and potential roadblocks to your clients, fostering trust and transparency.

Here are some techniques you can implement to improve your workflow:

Break Down the Big Picture: Don’t just focus on the final due date. Divide the project into smaller, more manageable tasks. This makes the workload less daunting and helps you identify potential bottlenecks early on.

Allocate Time Wisely: Be realistic about how long each task will take. Consider factors like information gathering complexity, review processes, and potential communication delays. Don’t overload yourself or your team.

Set Internal Milestones: Establish internal deadlines for completing each project stage. These milestones act as checkpoints to ensure you’re on track for the final deadline.

Track Your Progress: Monitor your progress regularly. Are you meeting your internal deadlines? If not, identify adjustments needed to get back on track and avoid last-minute stress.

4. Utilize Technology for Automation

Accounting technology is your friend in the fight against missed deadlines. Most of its features are designed to do some of the heavy lifting and repetitive tasks for you so you don’t wake up in a sweat in the middle of the night.

(Source: finway)

Take cloud-based accounting software, for example. It often comes packed with automation features that can perform many tasks, including automatically importing information from bank statements, receipts, and invoices. This saves you countless hours and reduces the risk of errors.

With Financial Cents specifically, you can track your billable tasks, generate invoices from those tasks, and send them to your clients in just a few seconds.

There are different software options out there that offer automation abilities to make your life easier, improve your work-life balance, and make you stand out from the competition.

Whether you’re a small or mid-sized accounting firm, your competition is determined by how efficient you are and how well you differentiate your firm from your competitors"

Joshua Lance, Head of Accounting at Ignition.Financial Cents can significantly improve your efficiency with its range of features. For instance, you can automate client data collection using automated reminders that prompt clients to share documents, as well as a secure accounting client portal that allows your clients to see what pending tasks they need to complete. This eliminates the need for endless emails, calls, and follow-ups to retrieve important client documents.

5. Foster a Culture of Accountability

Deadlines in accounting can come with immense pressure, leading to burnout. This can make team members prone to errors and struggle to meet deadlines, creating a domino effect.

Once you establish your culture and everybody buys into it, that helps a lot with external communication "

Angela Main Roberts, Main Accounting Services LLC.This team-oriented approach fosters a sense of shared responsibility. While everyone has tasks, everyone is aware of the overall workload. This allows for better task allocation, preventing situations where one person drowns in work while others have lighter loads. The team can work together effectively when everyone is informed about the project’s progress through open communication.

If you want to promote open communication in your firm, you must encourage team members to feel comfortable raising concerns about their workloads or potential roadblocks. This allows for proactive solutions, like task redistribution or seeking help from colleagues, before deadlines become at risk.

Also, schedule regular meetings or check-ins with your internal team. These meetings allow teams to discuss progress, identify any looming issues that could threaten deadlines, and ensure everyone is on the same page.

Additionally, fostering a culture where team members are encouraged to communicate any potential delays or resource limitations as soon as possible allows for adjustments and prevents last-minute scrambling.

Conclusion

The constant pressure to meet deadlines can be a heavy burden for accounting firms. A missed deadline, however, can have serious consequences.

The good news is that you can take proactive steps to prevent these situations. You can transform your deadline management by following the five steps outlined in this article – implement a workflow management system, establish clear communication protocols, prioritize planning, use technology automation, and build a culture of accountability.

Consider implementing robust financial workflow management software like Financial Cents to streamline your operations and conquer deadlines.

With features specifically designed for accounting firms, Financial Cents can help you:

Manage Your Workflow: Organize and automate tasks associated with different client projects.

Manage Projects Effectively: Visualize project progress, track deadlines, and identify potential bottlenecks.

Client Portals: Provide a secure platform for clients to upload documents, share information, and track the progress of their projects.

Automated Reminders: Set automated reminders for upcoming deadlines, missing documents, or important client touchpoints.

Time Tracking: Track the time spent on different tasks and projects. This allows for better billing accuracy and helps identify areas where workflows can be optimized to save time.

Remember, conquering deadlines isn’t just about meeting dates – it’s about building a culture of excellence and trust within your team and with your clients. There’s no better partner to help you build that trust than Financial Cents.

Get started with Financial Cents today!