Quick question: Is your client onboarding process feeling more like a headache than a seamless start to a new relationship? You’re not alone. According to our accounting workflow report, 51.4% of accounting firms report that their onboarding process is clunky.

This can make clients feel neglected or uncertain about your services, causing them to lose confidence before your real work even begins. For your firm, it means wasted time on repetitive, manual tasks, slowing down your ability to get projects off the ground and impacting overall efficiency.

The longer the onboarding process drags out, the more resources it drains—resources that could be better spent on high-value client work.

But it doesn’t have to be this way. With the new Financial Cents and Anchor integration, client onboarding can be smoother and faster.

This integration is designed for firms using both Financial Cents and Anchor, making it easy to streamline your workflow without additional complexity.

The integration helps you automate key parts of your workflow from the moment the client accepts your proposal so there’s no more redundant data entry or scattered information. That way, you spend less time on administrative tasks and more on the strategic aspects of client relationships.

What does this integration entail? And how does it work? We discuss all that and more in this article.

Features of Financial Cents and Anchor Integration

Automatic Contact Creation

Once a client approves a proposal in Anchor, the integration automatically checks for an existing contact in Financial Cents. If the contact doesn’t already exist, it will create one seamlessly, saving your team time and eliminating the risk of manual entry errors.

Automatic Project Creation

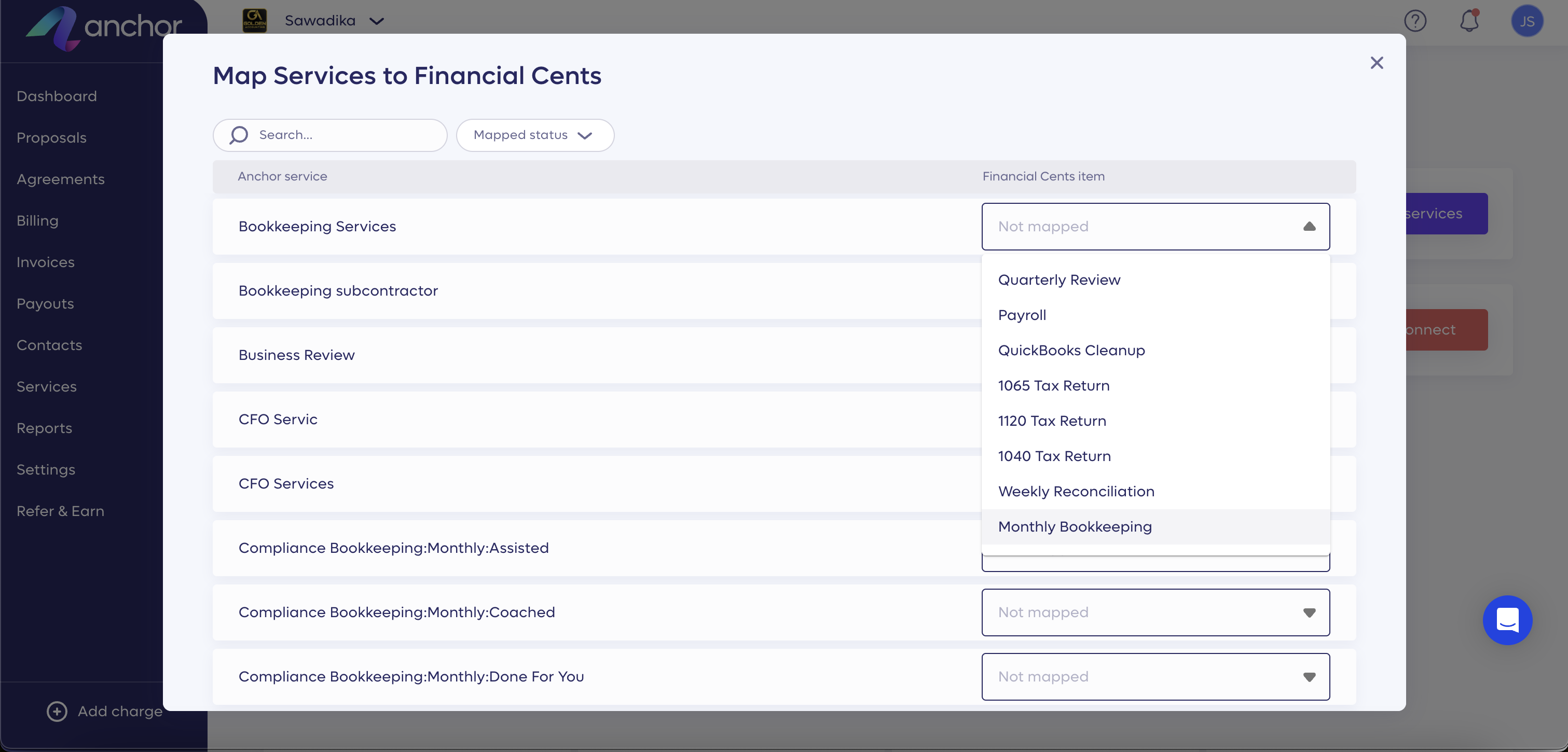

Following the contact creation, the integration generates projects using pre-mapped templates. This ensures consistency across your projects while also allowing you to customize the project details based on the proposal.

You can pull specific information, such as the start date, from the proposal or stick to your default template settings, giving you the flexibility to manage your projects effectively

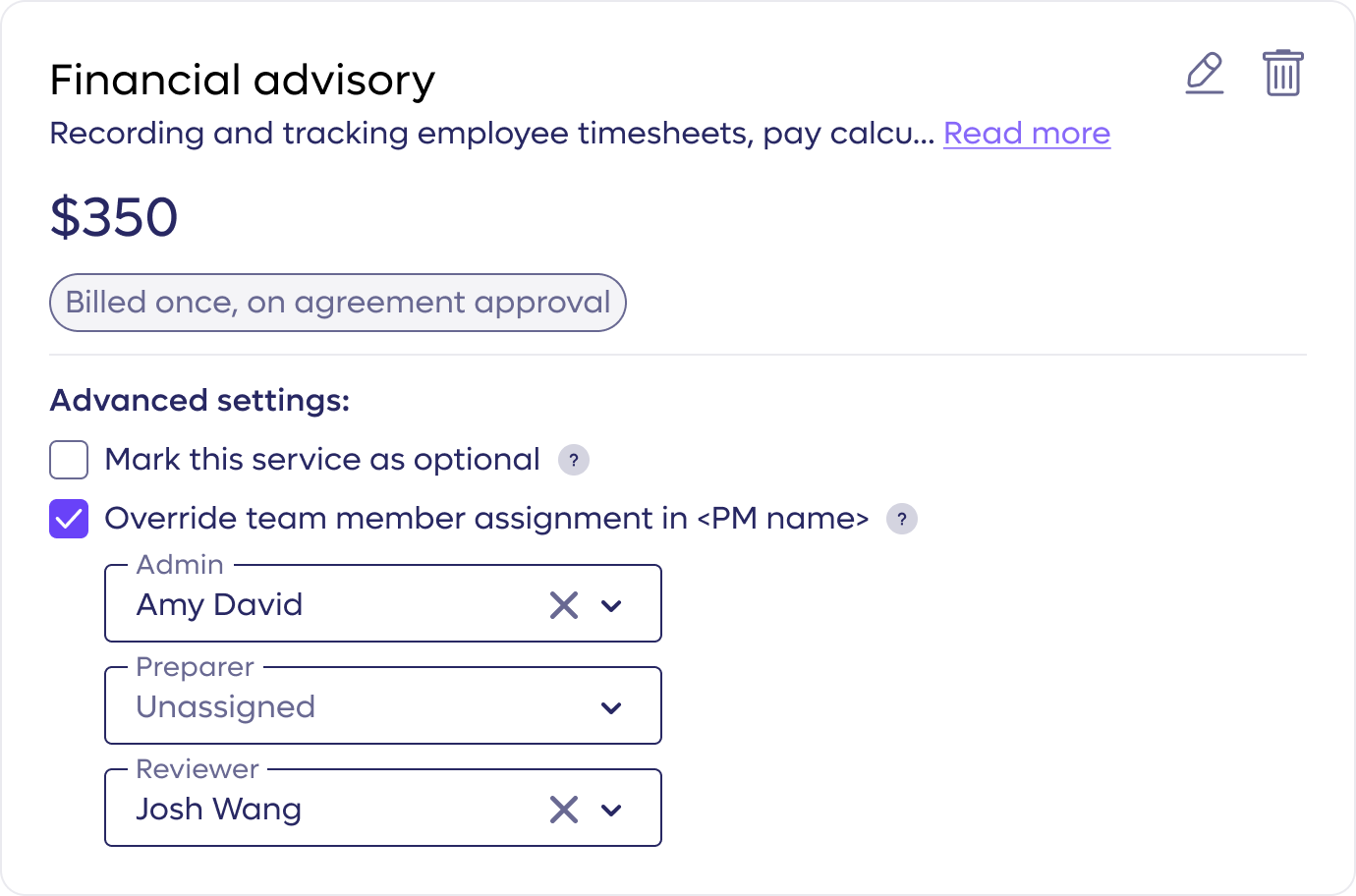

Team Member Assignment Customization

While Financial Cents assigns team members to projects using preset templates, Anchor allows you to override these assignments during the proposal stage. This flexibility ensures that the right people are assigned to the right projects, giving you better control over workload distribution and task management.

How To Use The Financial Cents and Anchor Integration

Here’s a detailed breakdown of how you can use this integration to streamline client onboarding.

Step 1: Create Contact in Financial Cents

Once your client approves a proposal in Anchor, this integration automatically checks Financial Cents if there’s an existing contact using the email address.

- If the contact doesn’t exist, Anchor will create both the contact and the associated client in Financial Cents.

- But if the contact exists, and the company name in Anchor matches exactly with the one in Financial Cents, the system will link the new contact to the existing client. If the names don’t match, the integration won’t create a duplicate. Instead, you’ll receive an email notification to resolve the issue manually.

Step 2: Create Project in Financial Cents

The integration automatically creates projects in Financial Cents for the contact linked to the agreement based on the mapping between Anchor services and Financial Cents templates. You can set up this mapping on the integration page.

Step 3: Assign team members

Financial Cents templates automatically assign team members, but Anchor lets you override these assignments when creating a proposal. This feature is available for both proposals and proposal templates.

You can assign specific team members to each role or leave roles unassigned if necessary. When multiple templates are linked to a service, Anchor displays all roles for easy selection.

And there you have it! Now, every time a client signs a proposal in Anchor, their profile and project details will automatically appear in Financial Cents, saving you time and reducing manual work in the onboarding process.

Benefits of the Financial Cents and Anchor Integration

There are multiple advantages this integration offers your firm and they include:

Save Time on Client Onboarding

This integration saves you valuable time that would otherwise be spent on data entry by automating contact and project creation. It allows you to onboard new clients quickly and efficiently without sacrificing accuracy.

Reduce Time Spent on Manual Tasks

Manual tasks eat up a significant portion of your workday, from entering contact information to setting up projects. The Financial Cents and Anchor integration helps you eliminate these repetitive tasks, giving you more time to focus on client strategy and value-added services.

Receive Payments Faster From Clients

Faster onboarding means faster invoicing and payments. Anchor’s automated payment and proposal tracking streamline the entire process, so you can receive payments sooner and maintain steady cash flow.

Increased Efficiency for Your Team

The integration enables automatic project creation and assignment of team members, so no task falls through the cracks. With a streamlined system, your team can focus on doing their best work, not chasing down details.

Streamline Your Tech Stack

Accounting firms often juggle multiple tools for different aspects of their workflow. The Financial Cents and Anchor integration reduces tool fatigue by combining the best features of both platforms into one seamless system. You’ll have fewer tools to manage and more clarity across your processes.

Start Using the Financial Cents and Anchor Integration Today

Ready to streamline your client onboarding and boost your firm’s efficiency? The Financial Cents and Anchor integration is your go-to solution.

It helps accounting firms automate client onboarding, reduce manual work, and create a more efficient workflow. Whether you’re a solo bookkeeper or part of a larger accounting team, this integration can help you save time, improve accuracy, and scale your services with ease.