Payroll is one of the most essential functions of any business. When processed accurately and on time, it boosts employee satisfaction, motivation, and retention.

But, issues like late or incorrect payments can lead to employee attrition. About half (49%) of the American workforce say they’ll look for another job after two payroll mistakes, according to a survey from The Workforce Institute at Kronos Incorporated.

Efficient payroll also ensures compliance with tax regulations. If you fail to meet payroll tax deadlines or submit incorrect filings, you can face penalties, audits, or even legal action. For instance, businesses paid nearly $10 billion in civil penalties to the IRS in 2023 due to payroll tax issues, including late fees, fines, and overdue tax payments.

However, managing payroll is not straightforward. It involves numerous tasks, from calculating wages to handling tax withholdings, benefits, and deductions.

Doing all this manually or without a clear system increases compliance and error risks. It’s also time-consuming, especially if you manage payroll for multiple clients — mistakes or mismanagement of clients’ payroll can cause them to lose trust in you and hurt your firm’s reputation.

That’s why you need an efficient process, which is where this guide comes in. In it, we provide a payroll checklist that simplifies payroll management for you, whether it’s for clients or for internal use. It streamlines and standardizes the process for your accounting firm.

What Is a Payroll Checklist and Why Is It Important?

A payroll checklist is a step-by-step guide that outlines all tasks involved in managing payroll, from collecting employee data to processing payments and filing taxes. Its purpose is to create a clear, repeatable process that ensures accuracy, compliance, and efficiency.

It has numerous benefits like:

- Reducing Errors: A structured guide helps you avoid common payroll mistakes, like incorrect calculations, missed deductions, or filing errors. Fewer mistakes mean fewer corrections and reduced risk of penalties.

- Ensuring Compliance: Payroll regulations and tax laws are complex and subject to change. A checklist helps you stay compliant by keeping you on track with deadlines, reporting requirements, and local, state, or federal law updates.

- Saving Time: A clear process makes payroll tasks faster and more efficient, allowing you to dedicate more time to high-value activities like financial analysis or client advisory services (CAS).

- Building Client Trust: Providing error-free, timely payroll services strengthens your reputation as a reliable partner and builds stronger client relationships.

- Improving Efficiency: A checklist minimizes the need for rework and reduces delays, helping you complete payroll runs on time and with minimal effort.

- Standardizing Processes: Whether you’re managing payroll for multiple clients or training new team members, a checklist standardizes your processes and ensures consistency and smooth onboarding.

- Minimizing Stress: A well-organized payroll system eliminates guesswork, making payroll management less overwhelming, even during busy seasons.

- Supporting Scalability: A payroll checklist makes it easier to handle increased workloads without sacrificing quality or accuracy as your firm grows and takes on more clients.

In summary, a payroll checklist simplifies the process and ensures that every payroll run meets the highest standards of accuracy and compliance.

The Ultimate Payroll Checklist: Step-by-Step Guide

Here’s a step-by-step guide on how to streamline your payroll operations.

Step 1: Request timesheets and payroll info from clients with client tasks

Start by requesting all necessary payroll data from your client. This includes:

- Timesheets for hourly employees.

- Updates on overtime, bonuses, or commissions.

- Information on deductions, such as health benefits or retirement contributions.

You can use the Client Tasks feature in Financial Cents to easily request information from clients and set up automatic follow-ups to ensure they provide it before the deadline.

Step 2: Receive Payroll Information From Client

Once the client submits the payroll information, review it to ensure it’s complete and accurate. Confirm that they’ve included all employees and their statuses (new hires, terminations, or role changes) and that the hours worked match the timesheets they provided.

Step 3: Prepare Payroll Based On Client Information

Begin calculating payroll based on the submitted data. This includes gross pay for each employee, tax withholdings (federal, state, and local taxes), and any additional deductions or contributions. Ensure the calculations align with the latest tax regulations and company policies.

Then, update the payroll system with any new employees or other changes like promotions or terminations.

Add the correct employee details like names, Social Security numbers, and tax forms (e.g., W-4s) are accurate. Also, add their pay rates and benefit deductions into the system.

Review approved time-off requests and adjust their pay to reflect paid time off (PTO), vacation days, and unpaid leave, if applicable. This helps prevent overpayment or underpayment due to absences.

Step 4: Send Draft To Client For Approval With Client Tasks

Before finalizing payroll, send a draft summary to the client. This should include:

- Total hours worked and gross pay for each employee.

- Deductions, taxes, and net pay details.

- Any irregularities or adjustments (e.g., bonuses or deductions).

The client has to review the draft and provide approval or feedback promptly.

Step 5: Get Approval From Client

Wait for the client to approve the draft payroll. Do not proceed until you have (written) confirmation to ensure accountability and avoid errors.

Step 6: Submit Payroll Upon Approval

Once you receive approval, finalize the payroll and process it through your system. This step ensures that you’re ready to pay the employee wages.

Step 7: Print & Deposit Paychecks Or Use Direct Deposit

Distribute wages to employees either by:

- Printing and depositing physical paychecks.

- Processing direct deposit through your payroll software or banking system.

Direct deposit is often faster and reduces the chance of errors or delays.

Step 8: Send Pay Stubs To Employees

Provide employees with their pay stubs, which include details like gross pay, deductions, and net pay. Tools like ADP or Gusto automatically send this to employees, so you don’t need to worry about it.

Step 9: Share a Copy Of The Payroll Summary With The Client

After processing payroll, send the client a summary report containing a breakdown of all employee payments, total taxes withheld, employer costs (e.g., Social Security, Medicare, or benefits), and any other relevant financial information related to payroll processing. This report helps the client stay informed and ensures transparency in your payroll process.

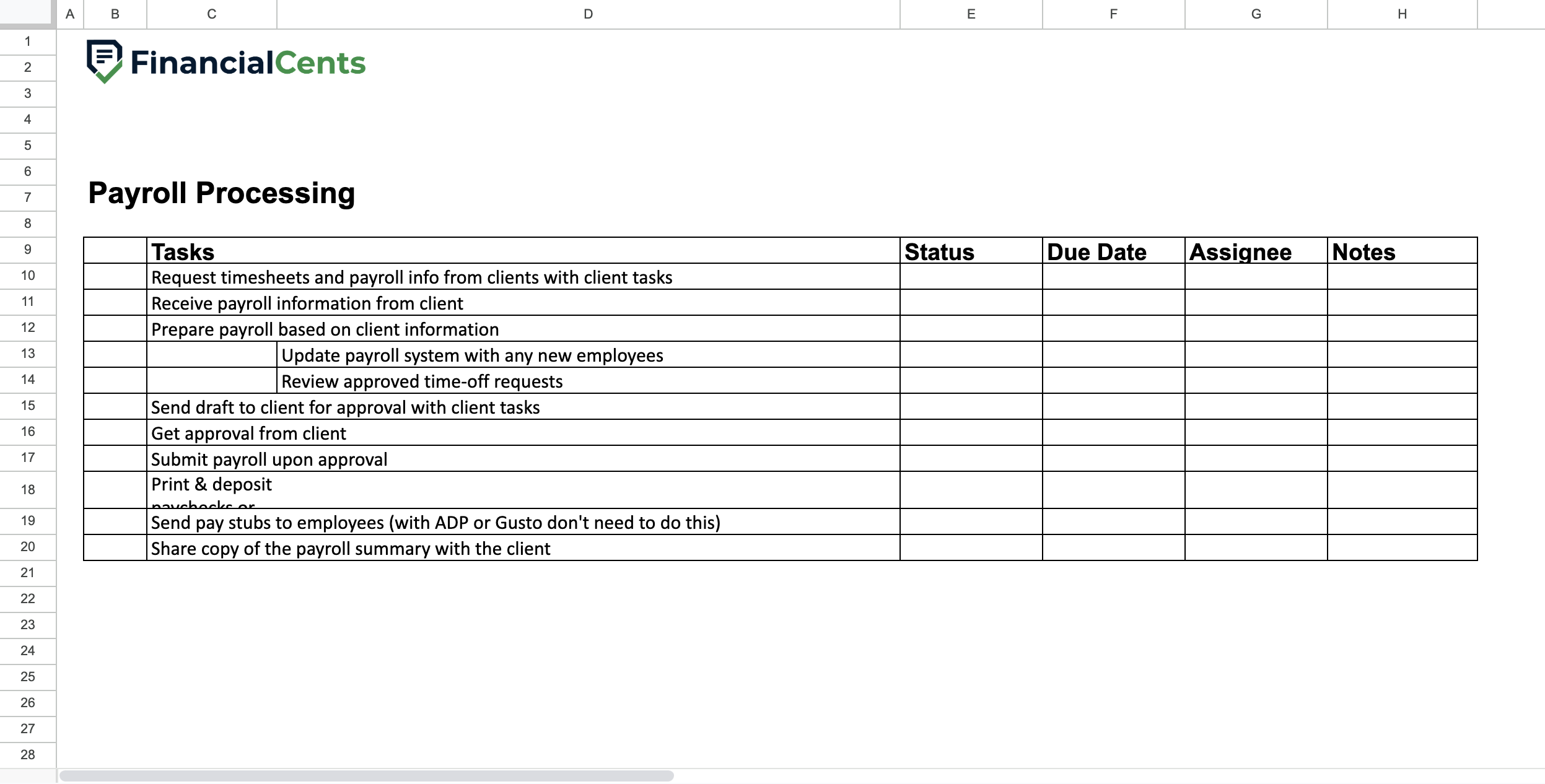

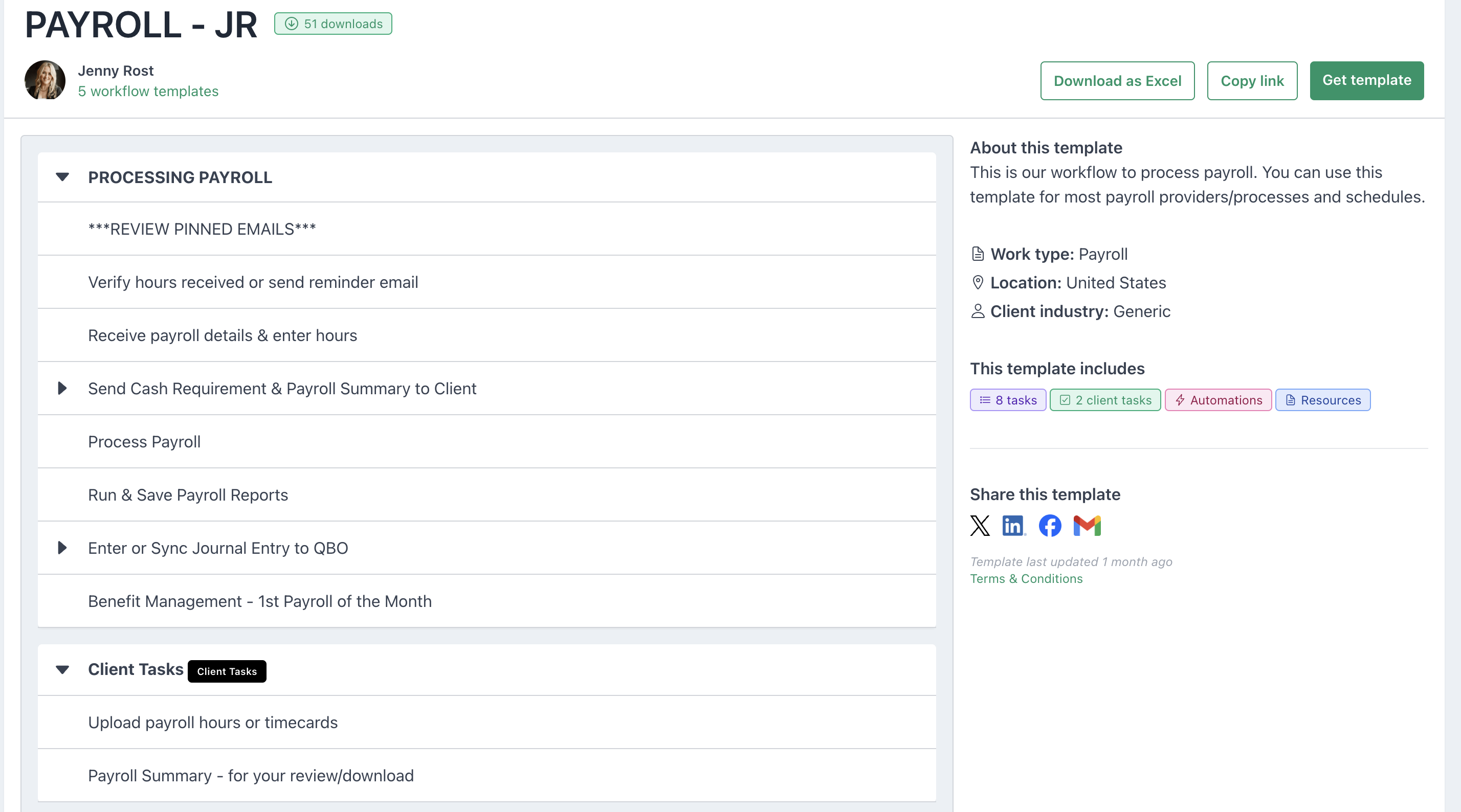

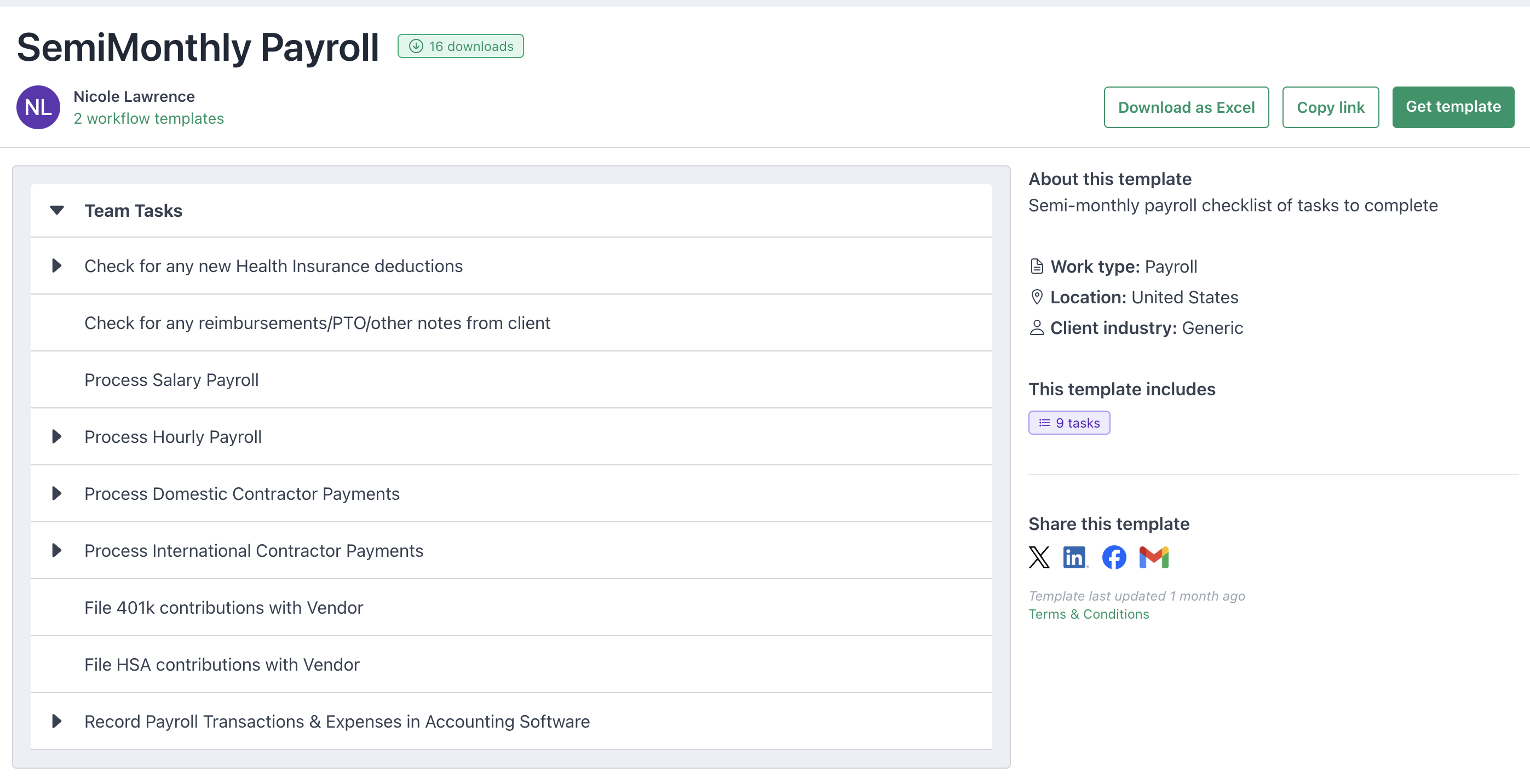

Free Payroll Checklist Templates To Download

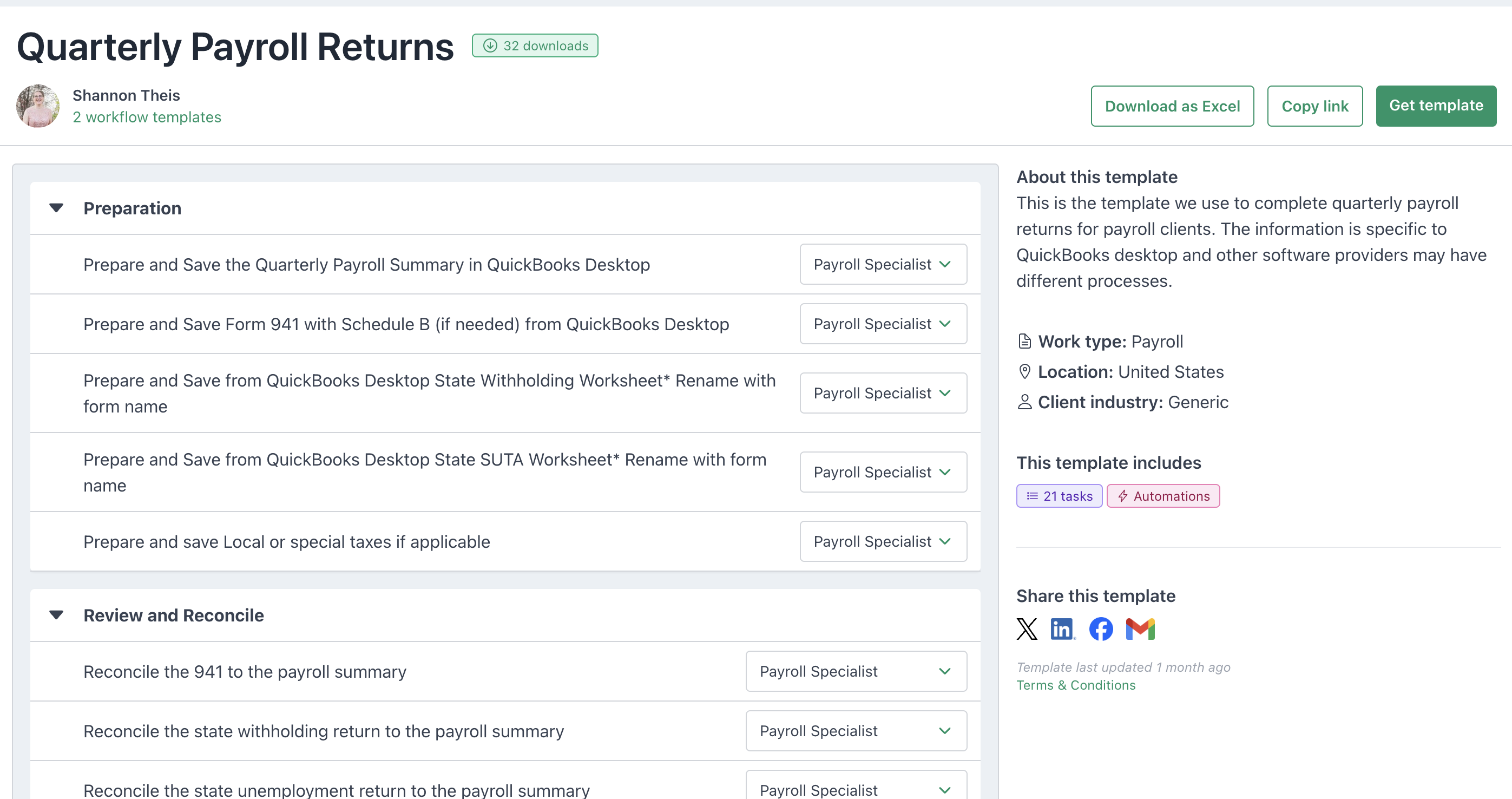

Below, we’ve provided four types of payroll checklist templates (one created by us and three created by accounting professionals): accounting or bookkeeping firms’ payroll checklist, general payroll checklist, semi-monthly payroll, and quarterly payroll return.

Accounting Or Bookkeeping Firms’ Payroll Checklist

Best Practices for Payroll Processing

Below are some tips to refine payroll operations and improve accuracy, efficiency, and compliance.

Standardize Payroll Schedules

Consistency is important in payroll management. Establish a regular schedule for processing payroll, paying employees, and filing taxes to limit errors and operate more efficiently.

Sharing this schedule with clients keeps them informed and reduces the likelihood of missed deadlines or miscommunication.

Double-Check Employee Information

The employee records must be accurate for error-free payroll. So, before preparing the payroll, review details such as names, social security numbers, tax forms, pay rates, and benefit deductions to ensure they’re correct.

Verify this information regularly, especially when onboarding new employees or processing changes, to reduce errors and ensure compliance with tax regulations.

Leverage Technology

Use modern payroll software to streamline your operations. Tools like Gusto, ADP, and QuickBooks automate time-consuming tasks such as calculating wages, processing deductions, and filing taxes.

Many tools also offer secure data storage and encrypted communication, protecting sensitive payroll information from potential threats like data breaches.

Stay Updated on Compliance

Payroll regulations and tax laws frequently change, and staying compliant is essential. Regularly review federal, state, and local tax updates, changes to minimum wage laws or overtime rules, employee benefit regulations, etc.

Attend industry webinars, subscribe to regulatory updates, or use payroll software that adjusts for compliance changes automatically.

Conduct Regular Audits

Periodic payroll audits can help identify discrepancies and improve processes. Review pay calculations, tax filings, and deduction records to ensure they align with the information provided by clients.

Proactive audits prevent small issues from turning into costly mistakes.

Secure Sensitive Information

Payroll data is highly sensitive, and protecting it should be a top priority.

Use encryption to secure stored or shared data, restrict access to authorized personnel only, and communicate payroll details through secure portals or systems. These measures not only protect employee and client information but also enhance your firm’s credibility.

Educate Clients

Educating clients about their role in the payroll process improves your collaboration and working relationship. Provide clear instructions on submitting payroll data, meeting deadlines, and understanding compliance requirements.

Training clients on using payroll portals or tools ensures they can collaborate effectively, reducing errors and delays in the process.

Automate client information requests

Automating the collection of client payroll data makes the process seamless and efficient.

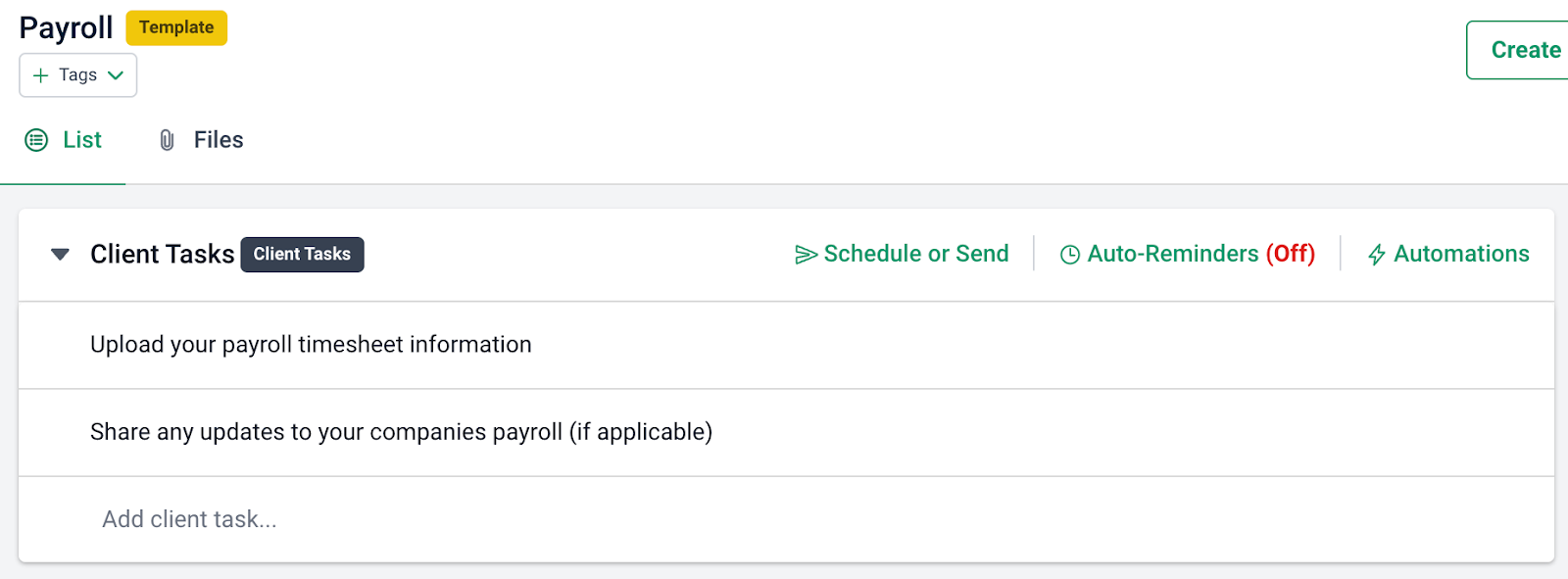

With Client Tasks in Financial Cents, you can easily request project-related information and organize it directly within the specific project it pertains to.

For instance, if you need to request payroll records for a payroll processing project, you simply set up the client task request list within the payroll processing project in Financial Cents.

To create a client task request list, first click into the project, then click the + New Section. Next, click Client Tasks and Add Client task. Select the type of request you want to send the client, and hit Send or Schedule.

To notify the client, select one of the three notification options:

- Schedule the notification to go out on a specific date.

- Send the notification immediately with Send Now.

- Use Dependency to automatically trigger it to send to a client when a certain task section in the project is completed.

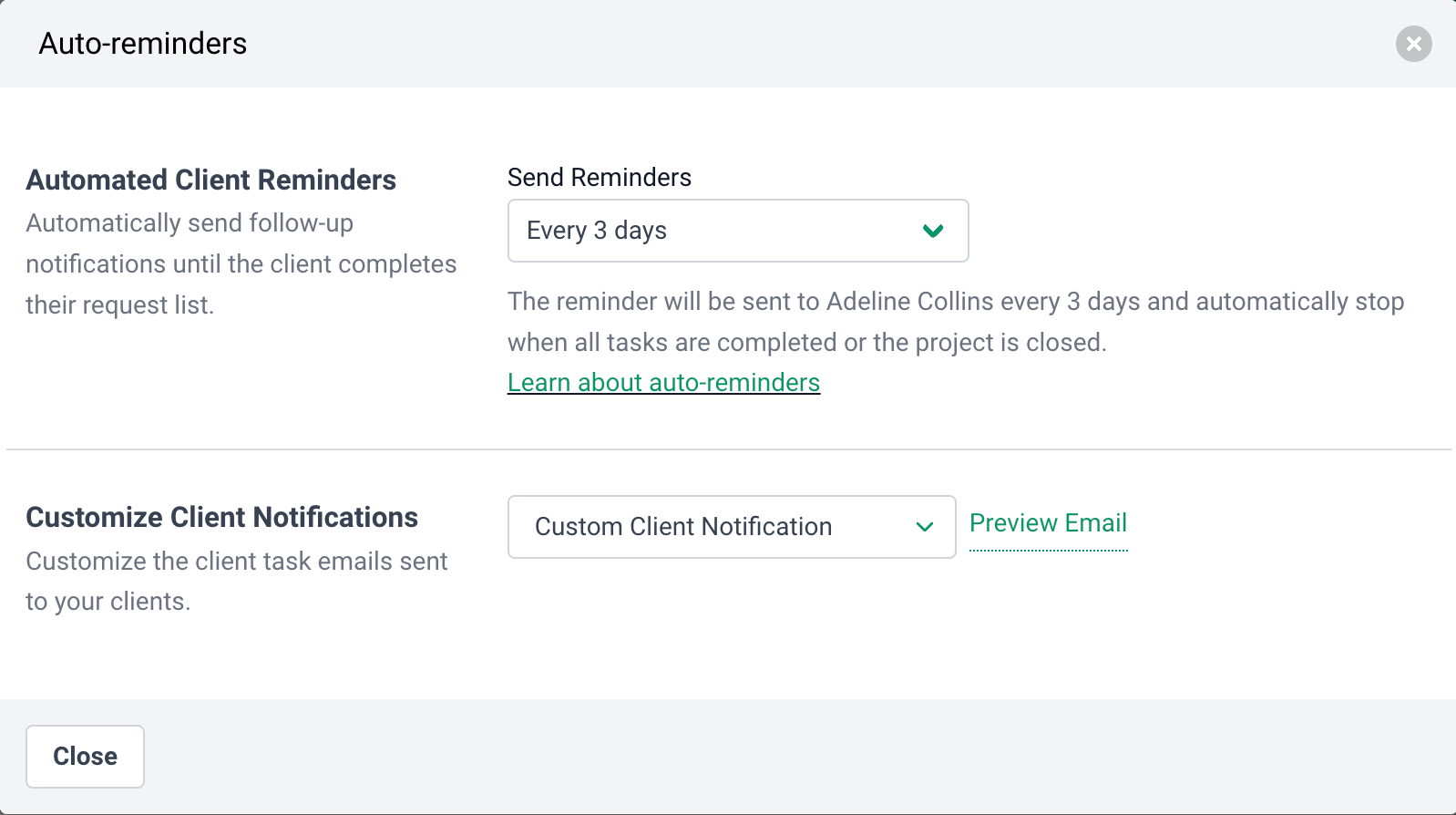

For automated follow-ups, click Auto-reminders and select how often you want to remind the client.

Client Tasks save you time and reduce stress by automating follow-ups, minimizing back-and-forth communication, and ensuring you have the necessary information to process payroll on time.

Use Financial Cents to Manage Your Payroll Process Efficiently

Financial Cents is a practice management software that helps firms manage every aspect of their operations including payroll processing. Here’s how:

Workflow Management and Automation

Financial Cents enables you to create workflow templates for your payroll process. These templates can outline every step, from requesting client timesheets to finalizing payroll and sharing reports.

This allows you to standardize your process so your team follows consistent procedures and always delivers the same quality.

Automate Recurring Projects

Payroll tasks repeat periodically, whether weekly, biweekly, or monthly. Financial Cents allows you to automate recurring payroll tasks based on your client’s payroll frequency. Once set up, the system automatically generates these tasks, ensuring you never miss a deadline or key step in the process.

For example, you can configure a payroll project for a monthly client to recur on the 25th of every month, while a weekly payroll project recurs every Friday. This automation eliminates the manual effort of recreating tasks and ensures timely processing for all your clients.

Tasks Delegation

Managing payroll efficiently often requires team collaboration. Financial Cents makes it easy to delegate tasks to the right team members. You can assign tasks to others when creating a project or add task dependencies to automatically notify teammates when it’s their time to come in.

Clear task assignments reduce confusion and ensure accountability. Each team member knows exactly what is expected of them, which leads to faster task completion and a more streamlined workflow.

Work Tracking and Collaboration

Tracking progress in real-time is essential for meeting payroll deadlines. Financial Cents provides a central dashboard where you can monitor all ongoing tasks and their statuses. This visibility allows you to identify bottlenecks or delays and address them quickly.

The collaboration features also make it easier for your team to communicate. You can:

- @mention team members to get their attention, ask questions, and record important notes.

- Pin important emails to projects so teams can easily organize emails pertaining to their work.

- Share important documents related to the work under the “Files” tab so team members can find important documents easily.

- Create a checklist of tasks that your team must follow to complete the work. This makes it easy for an employee to pick up where someone left off if they are sick or out of the office.

Due Date Tracking

Missing payroll deadlines can have serious consequences for your firm and clients. Financial Cents helps you stay on top of due dates by setting automatic reminders for each task or project.

These reminders ensure that no step is overlooked, whether it’s submitting payroll, filing taxes, or distributing pay stubs. Staying ahead of deadlines improves your firm’s reliability and reduces stress during busy payroll periods.

All these use cases show how Financial Cents can streamline your payroll process. Why not take the tool for a spin?

Manage the payroll process successfully for your clients with Financial Cents.