Starting a profit and loss statement from a blank sheet isn’t the best use of your time.

Between setting up categories, formatting rows, and writing formulas, the process is repetitive and time-consuming. And until it’s done, you can’t even get to the part that really matters, interpreting the results for your clients.

The P&L itself, of course, is non-negotiable. It’s one of the clearest ways to track your client’s financial performance over time, showing revenue, expenses, and net profit in black and white. Without it, it’s hard to spot trends, uncover issues, or provide clients with the insights they rely on you for.

Instead of reinventing the wheel, you can start with a framework that’s already built for accuracy and ease of use, a template. All you need to do is input the numbers, and the calculations and structure are ready to go. It’s a simple way to save time, reduce errors, and keep your focus on interpreting the results and guiding your clients.

What is a Profit and Loss Statement Template?

A profit and loss statement template is a pre-built spreadsheet designed to help you quickly prepare and organize financial data. With the categories and formulas already in place, you only need to enter the revenue and expense figures; the calculations update automatically.

Beyond saving setup time, a template also ensures consistency. You’re working with the same framework every time, which makes reporting cleaner and more reliable across clients. It also facilitates comparisons, whether you’re tracking monthly performance or reviewing year-over-year results.

Why Use a Profit and Loss Statement Template?

Saves time and ensures accuracy

With a template, you don’t waste hours setting up. Everything is already in place. You just add the numbers, and the calculations update automatically. This not only saves you time but also reduces the chance of mistakes that can creep in when you build a spreadsheet from scratch.

Provides consistency across reporting periods

When you use the same template month after month, your reports follow a consistent format. This makes it much easier to track performance, compare results, and highlight changes over time. You get a clear picture without having to adjust to a new layout every time.

Helps you standardize client reporting

If you manage multiple clients, a template keeps all their reports uniform. Each P&L looks and feels the same, which makes your process smoother and helps you deliver professional, reliable reports every time.

Easy for business owners to understand

Even if your clients are not accountants, they can still follow a P&L created with a simple template. The structure breaks down revenue, expenses, and profit in a way that makes sense. This helps you explain results clearly and makes it easier for clients to act on your insights.

Simplifies tax preparation

Tax season can be stressful, but a template helps you stay organized. All the key figures are already captured in one place, so pulling the information you need for returns takes less effort. You spend less time chasing details and more time focusing on accuracy and compliance.

What Should Be Included in Your P&L Template?

Every profit and loss template should capture the key areas of income and expenses so you can see the full financial picture at a glance. Here are the essential components to include:

a. Revenue Section

This is where you record all the money coming in. It usually includes sales of products, service income, and any other revenue streams. Laying this out clearly helps you track how much your client is earning and where the income is coming from.

b. Cost of Goods Sold (COGS)

COGS covers the direct costs of producing goods or delivering services. This includes materials, direct labor, and production costs. Having this section in your template allows you to quickly calculate gross profit by subtracting these costs from total revenue.

c. Operating Expenses

These are the day-to-day expenses required to keep a business running. Typical items include salaries, rent, utilities, marketing expenses, insurance, and depreciation. By keeping this section separate from COGS, you can better understand the difference between production costs and overhead costs.

d. Other Income and Expenses

Not all financial activity comes from regular operations. This section is where you track items like interest income, tax expenses, or extraordinary gains and losses. Including this in your template gives you a more complete picture of overall profitability.

e. Subtotals

A good P&L template should automatically calculate subtotals such as gross profit, operating income, and net profit or loss. These figures provide quick insights into financial performance and make it easier to explain results to clients.

f. Notes Section

Numbers alone do not always tell the full story. A notes section gives you space to add clarifications, adjustments, or comments that provide context. This can be especially helpful when reviewing reports with clients or preparing for tax season.

Your Free Profit and Loss Template

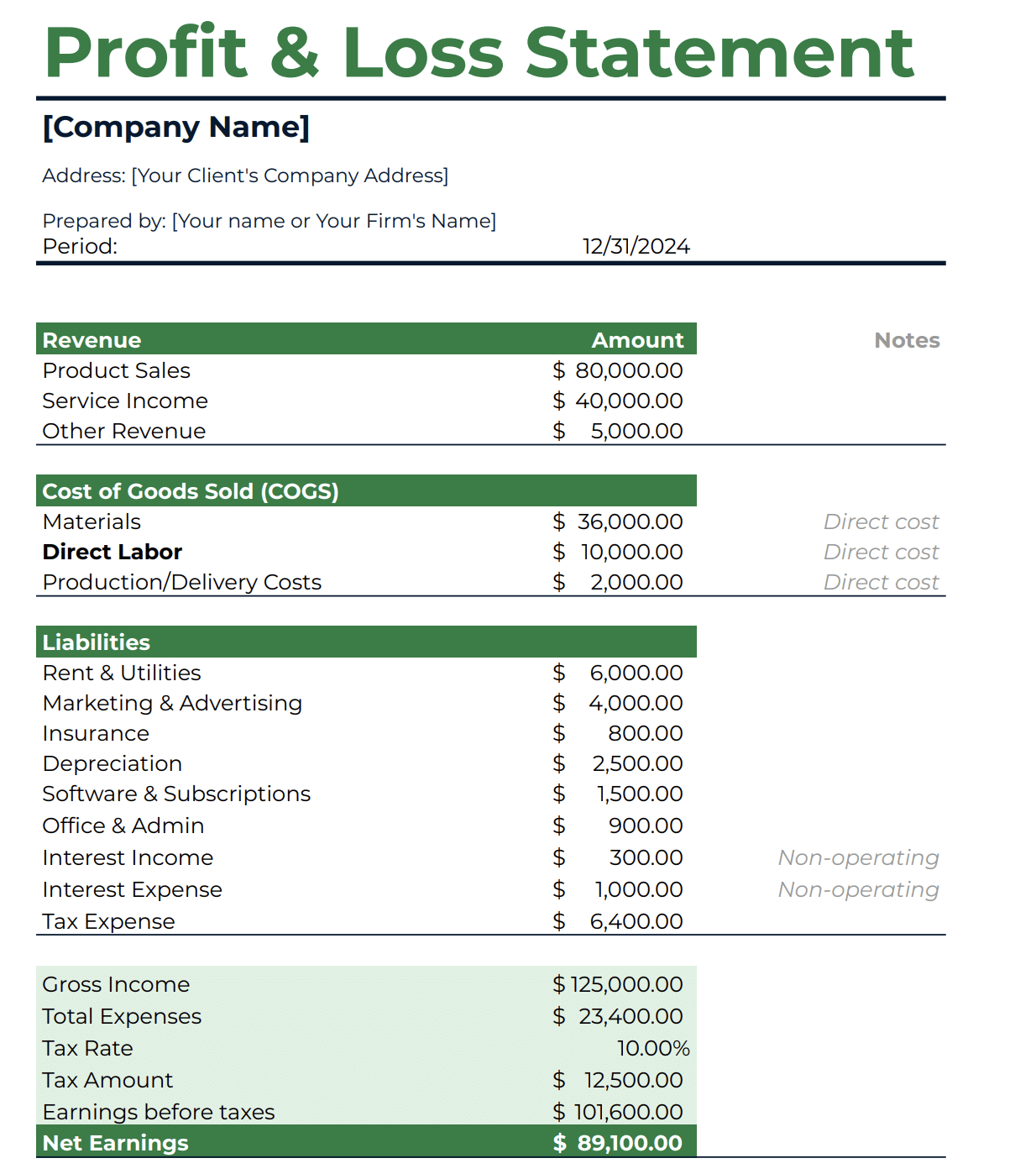

Our free Profit and Loss (P&L) Statement Template is designed to give business owners and accountants a simple, structured way to track income and expenses while automatically calculating profitability. The template is organized into key sections: Revenue, Cost of Goods Sold (COGS), and Liabilities (Expenses). Within these sections, you can enter values such as product sales, service income, direct costs like materials and labor, and operating expenses including rent, utilities, and marketing. The clear layout helps you see exactly where money is coming from and where it’s being spent.

To make reporting easier, the template comes with built-in formulas that automatically calculate Gross Income, Total Expenses, Tax Rate, Tax Amount, Earnings Before Taxes, and Net Earnings. This means you don’t have to manually run calculations; the template updates everything for you as you enter data. Whether you’re preparing financial reports for clients or analyzing your own business performance, this tool saves time, reduces errors, and delivers a professional-looking P&L statement in minutes.

How to Use P&L Templates Effectively

Using a profit and loss template can make your reporting more efficient, but you will only get accurate results if you approach it the right way. Here are some best practices to keep in mind:

Maintain accurate bookkeeping before filling in

A profit and loss statement is only as reliable as the data you put into it. Make sure your bookkeeping is up to date before entering figures into the template. This includes recording all transactions, reconciling bank statements, and categorizing expenses correctly. When your records are accurate, the P&L will give a true reflection of financial performance.

Update regularly (monthly or quarterly)

To get the most value from a P&L, you should update it on a consistent schedule. Monthly updates are ideal because they allow you to track trends, spot issues early, and provide timely advice to your clients. At the very least, updating the template quarterly ensures that you have an accurate view of performance throughout the year.

Compare with prior periods for insights

A template is not just about recording numbers. Use it to compare current results with prior months, quarters, or years. This helps you identify patterns such as rising costs, seasonal fluctuations, or steady revenue growth. With these insights, you can provide more meaningful recommendations to your clients.

Share with clients or stakeholders

One of the strengths of a well-structured P&L template is that it is easy to share. Clients, business partners, or other stakeholders can quickly understand the breakdown of revenue, expenses, and profit. Use the report to walk them through the numbers, highlight key trends, and explain what the results mean for their decisions.

Transition From Manual Templates To Accounting Software

Templates are a practical starting point. They help you produce clean P&L statements without spending hours setting up categories or formulas. But as the volume of transactions grows, accounting software makes the process faster, easier, and far more reliable.

One of the biggest advantages of accounting software is automation. Calculations are handled for you, transactions are posted to the right accounts, and recurring items like depreciation or sales tax are managed without extra effort. This reduces the risk of errors that often creep into manual spreadsheets and ensures your reports are accurate.

You also gain real-time financial insights. With automated posting, you can access up-to-date P&L statements, balance sheets, and cash flow reports at any time without the need for typing in transactions line by line. Many accounting tools even let you customize P&L statements by month, quarter, or year, so you always have the latest numbers at your fingertips instead of waiting until month-end.

Reporting becomes much simpler as well. Instead of rebuilding layouts, accounting software lets you generate standard or comparative P&Ls in just a few clicks. You can filter results by department or project, and run budget-versus-actual reports without extra formatting.

The transition itself is straightforward. Once you set up your chart of accounts, import opening balances, and connect bank feeds, the system begins categorizing transactions automatically. As you refine your rules, recurring items are handled in the background, which reduces manual entry and makes the month-end close far smoother.

You can still keep downloadable templates on hand for quick summaries or client-facing presentations. But for day-to-day bookkeeping and ongoing reporting, general ledger accounting software delivers automation, accuracy, and real-time visibility that spreadsheets cannot match.

Conclusion

Your profit and loss statement is one of the clearest ways to track performance and guide client decisions. When you keep it updated, compare it with past periods, and use it to explain the story behind the numbers, it becomes a powerful tool for your clients.

Over time, as your client base grows and the volume of data increases, moving to general ledger accounting software will make the process even more efficient by automating calculations, minimizing errors, and giving you real-time insights.

Alongside that, you also need a way to manage the rest of your firm’s operations. This is where Financial Cents comes in. While it is not a general ledger accounting software, it is built to help you standardize processes, manage client work, automate workflows, send client requests, collect payments, and meet every deadline.

If you’re ready to save time, work more efficiently, and build a scalable firm, explore how Financial Cents can support the bigger picture of your practice.