Schedule C is one of the most frequently filed IRS forms during tax season. In 2022 alone, the IRS processed over 35 million Schedule C filings, making up roughly 22% of all 161 million individual returns.

For accounting firms, helping clients file this form is one of the most common tax services you’ll provide. If you’re new to it, we’ve already covered the basics of what Schedule C is and how it works. But to summarize, Schedule C (Form 1040) is the IRS tax form used by sole proprietors and certain single-member LLCs to report their business income and expenses. It helps calculate the business’s net profit or loss, which flows into the taxpayer’s personal return.

In this guide, we share the official IRS Schedule C instructions for 2025 and highlight any new updates you need to know so you don’t make mistakes when reporting income, claiming deductions, or calculating your client’s tax liability.

Let’s get into it.

Key Sections of Schedule C

Here are some of the important sections of Schedule C that you need to know about.

Gross Income/Revenue

This section reports all the income your client earned through their business during the year. It includes more than just what’s reported on Form 1099, as the IRS expects taxpayers to report total earnings, including any income not captured by third parties.

You’ll need to gather and report three things:

- Gross receipts or sales: Total income before any deductions.

- Returns and allowances: Customer refunds or discounts that reduce total revenue.

- Other income: Including things like fuel tax credits, prizes, or any miscellaneous income related to the business.

To calculate gross income, first subtract the returns and allowances from gross receipts and this will give you net receipt. Then subtract the cost of goods sold (COGS) from the net receipt to get gross profit. Finally, add gross profit to other income. The result is the gross income for the Schedule C filing.

For example, let’s say your client runs a custom t-shirt business and reported the following for the year:

- Gross receipts (t-shirt sales): $100,000

- Returns & allowances: $2,000

- Other income (consulting): $5,000

- Cost of goods sold (materials, labor, inventory): $30,000

Gross income will be:

- Net receipts = $100,000 (gross receipt) − $2,000 (returns and allowance) = $98,000

- Gross profit = $98,000 (net receipt) − $30,000 (COGS)= $68,000

- Gross income = $68,000 (gross profit) + $5,000 (other income) = $73,000

Cost of Goods Sold

If your client sells physical products or creates goods as part of their business, they need to complete the COGS section. This section calculates the total cost of producing or purchasing the products sold during the year.

It includes:

- Beginning and ending inventory.

- Purchases of raw materials or finished goods.

- Cost of labor (excluding their own labor)

- Materials and supplies

- Other costs

To calculate COGS on Schedule C, add up all the direct costs related to the production or purchase of goods sold during the year, then subtract the ending inventory.

For example, let’s say your client runs a handmade soap business. Here are their numbers for the year:

- Beginning inventory: $4,000

- Purchases of raw materials (oils, fragrances, packaging): $12,000

- Direct labor (hired help): $6,000

- Other costs (factory rent for production area): $3,000

- Ending inventory: $5,000

COGS will be:

- Addition of all direct costs: $4,000 + $12,000 + $6,000 + $3,000 = $25,000

- Subtract ending inventory: $25,000 − $5,000 = $20,000

So the COGS is $20,000. That’s what you’ll report on Line 42 of Schedule C and what you’ll use to calculate gross income above.

Business Expenses

This section is often the most detailed and requires careful categorization. The IRS provides almost 20 expense categories, but some of the most common include:

- Advertising and marketing: Costs of promoting the business, such as digital ads or printed flyers.

- Car and truck expenses: Mileage or actual vehicle expenses used for business.

- Contract labor: Payments to freelancers or independent contractors.

- Depreciation: Deductions for assets like computers, office furniture, or equipment.

- Office expenses: Supplies, postage, and similar costs.

- Utilities: Business phone, internet, or electricity bills.

- Travel and meals: Deductible expenses include business flights, lodging, rental cars/taxis, and 50% of qualifying business meals.

- Professional fees: Services and tools used to operate the business professionally and legally, like legal and accounting fees and bookkeeping or payroll services.

Net Profit or Loss

This is another important section that is calculated and recorded in the expenses section of Schedule C, after listing all deductible business expenses.

This figure tells you how much the business earned (or lost) after accounting for all operating costs, and it directly affects the client’s taxable income on Form 1040. It also forms the basis for calculating self-employment tax.

To calculate net profit or loss, follow these steps:

- Add up all deductible business expenses, excluding expenses for business use of the home.

- Subtract total expenses from gross income (found in line 7, Part I) to get tentative profit or loss.

- Then subtract expenses for business use of home from tentative profit or loss.

- The final result is your client’s net profit or loss.

For instance, let’s say your client is a freelance video editor and reports the following:

- Gross income: $90,000

- Total business expenses: $35,000

- Business use of home expense: $3,000

Net profit or loss will be:

- $90,000 (gross income) – $35,000 (total expenses) = $55,000 (tentative profit)

- $55,000 – $3,000 (home expense) = $52,000 net profit

Vehicle Expenses, Home Office Deduction, and Other Key Line Items

The IRS allows specific deductions that require extra documentation:

- Vehicle expenses: Clients can deduct mileage for business use at the IRS standard rate (70 cents per mile in 2025) or actual expenses like fuel, repairs, and insurance. They must present mileage logs or other evidence to support deductions.

- Home office deduction: If a client uses part of their home exclusively and regularly for business, they can deduct a portion of rent or mortgage interest, utilities, and insurance.

- Other expenses: If business costs don’t fit into the standard categories, they go into Part V (“Other Expenses”). Accountants should attach a detailed list.

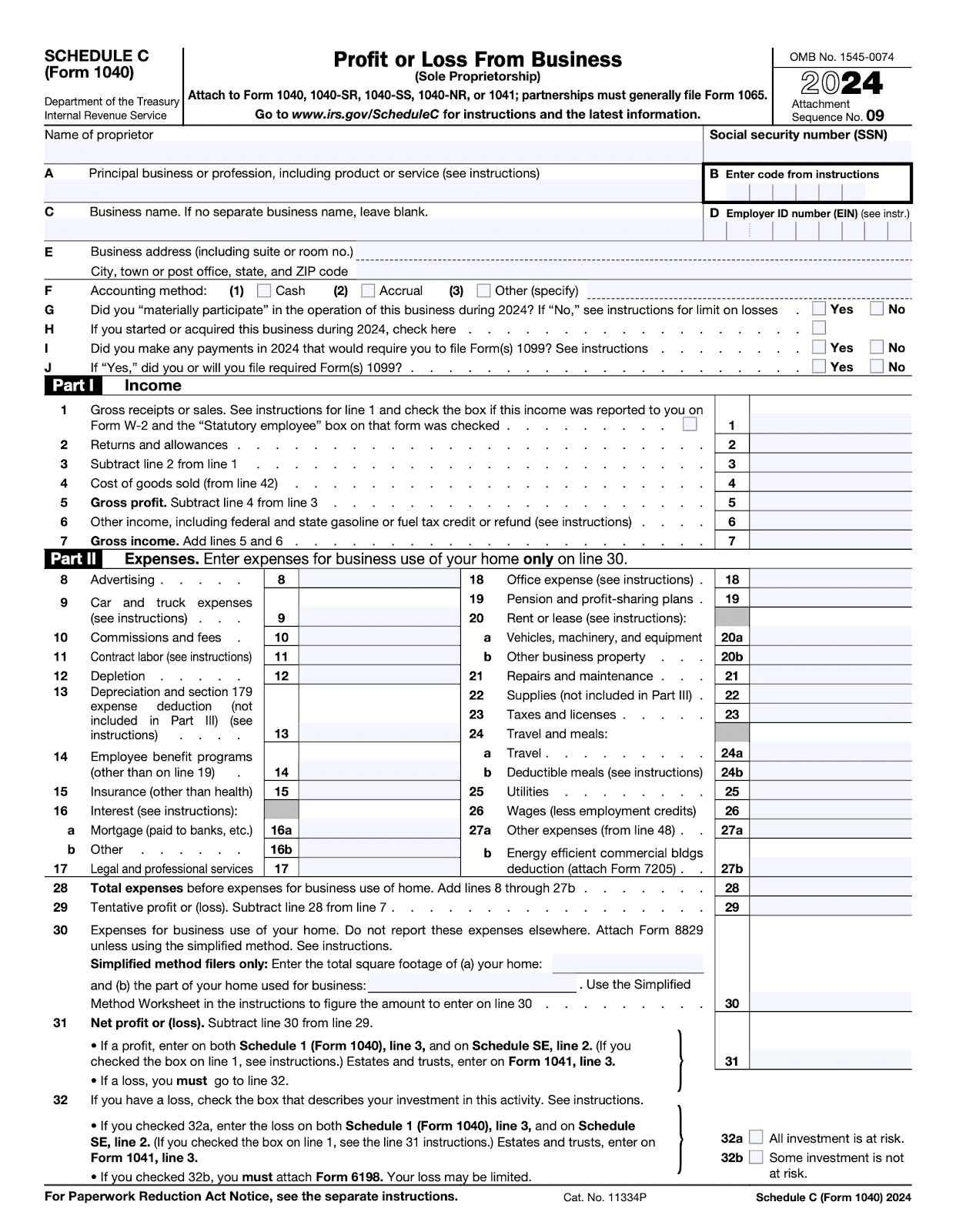

Schedule C 2025 Step-by-Step Instructions

Here’s a line-by-line breakdown of how to complete Schedule C for your clients in 2025.

Personal and Business Information (Line A-J)

This top section establishes basic details about the individual and business.

- Line A – Principal business or profession: Describe what the business does, e.g., “graphic design” or “residential cleaning services.” If the client owns more than one business, complete a separate Schedule C for each business.

- Line B – Code: Enter the 6-digit code from the Schedule C instructions that matches the business activity. For nonstore retailers, select the PBA code for the primary product that your establishment sells.

- Line C – Business name: If the business operates under a name other than the owner’s, enter it here. Otherwise, leave blank.

- Line D – Employer ID Number (EIN): Only include this if the client has one. Sole proprietors without employees may not need one.

- Line E – Business address: Must be the physical address where business is conducted, not a P.O. box. Include the suite or room number, if any.

- Line F – Accounting method: Choose between Cash, Accrual, or any other method permitted by the Internal Revenue Code. Most small businesses use the cash method, which reports income when received and expenses when paid.

- Line G – Material participation: Check “Yes” if the client was involved in running the business regularly and continuously during the year. Otherwise, check “No” if they passively participated.

- Line H – First year in business: Mark this box if the client just started or acquired the business, or if they are reopening or restarting this business after temporarily closing it and didn’t file a Schedule C the previous year.

- Line I – 1099 requirements: Check if the business made payments that require filing Form 1099 last year.

- Line J – Form 1099 filed: If “Yes” on Line I, indicate whether they actually filed the Form 1099 or will file it.

Part I: Income (Line 1-7)

This section reports total income earned through the business.

- Line 1 – Gross receipts or sales: Enter total revenue from all sources before any expenses or deductions, whether or not it was reported on a 1099.

- Line 2 – Returns and allowances: Include customer refunds, rebates, or discounts as a positive number.

- Line 3 – Subtract line 2 from line 1.

- Line 4 – Cost of goods sold: This comes from Line 42, Part III. Only fill this if the client sells products.

- Line 5 – Gross profit: Subtract line 4 from line 3.

- Line 6 – Other income: Include things like fuel tax credits, interest income from business accounts, or awards, bad debts recovered, scrap sales, finance reserve income, etc.

- Line 7 – Gross income: Add Line 5 and Line 6. This is the income before deducting any expenses.

Part II: Expenses (Line 1 -32)

This section covers all ordinary and necessary business expenses. These reduce taxable income, so it’s important to properly categorize them.

Here’s a breakdown of the most common lines:

| Line | Expense category | What to include |

| 8 | Advertising | Facebook ads, Google Ads, flyers, signage |

| 9 | Car and truck expenses | Deduct either the standard mileage rate (70 cents per business mile for 2025) or actual vehicle expenses (gas, insurance, repairs, etc.) |

| 10 | Commissions and fees | Total commissions and fees for the tax year. Do not include commissions or fees that are capitalized or deducted elsewhere on their return. |

| 11 | Contract labor | Total cost of contract labor for the tax year. File Form 1099-NEC for payments over $600. |

| 12 | Depletion | Enter deduction for depletion. Attach Form T (Timber) if you have timber depletion. |

| 13 | Depreciation and Section 179 expense deduction | Deduct the depreciation or Section 179 expense for business property that has a useful life longer than one year (e.g., computers, machinery, or office furniture). But you can’t depreciate inventory, land, or stock-in-trade. |

| 14 | Employee benefit programs | Deduct contributions your client made to employee benefit programs that are not part of a pension or profit-sharing plan (those go on Line 19), like accident and health plans, group-term life insurance, and dependent care assistance programs. |

| 15 | Insurance (other than health) | Deduct premiums paid for business insurance like Business liability and errors & omissions (E&O). |

| 16a and 16b | Interest | 16a: Report mortgage interest paid to banks or lenders that issued a Form 1098 (or similar statement).

16b: Report mortgage interest paid to lenders without a Form 1098. |

| 17 | Legal and professional services | Accountant and attorney fees. |

| 18 | Office expense | Expenses for office supplies and postage. |

| 19 | Pension and profit-sharing plans | Deduct contributions made to employee retirement plans like pension plans, profit-sharing plans, annuity plans, SEP, SIMPLE, and SARSEP plans. |

| 20a and 20b | Rent or lease | Office rent, coworking space, equipment rental |

| 21 | Repairs and maintenance | Deduct equipment repairs, software troubleshooting fees or any maintenance that doesn’t add to the property’s value. Don’t deduct the value of the client’s labor. |

| 22 | Supplies | Deduct cost of materials used in service or production within the year like books, professional instruments, equipment, etc. |

| 23 | Taxes and licenses | Deduct business licenses, state business taxes, real estate taxes on business assets, etc, not federal income taxes, estate and gift taxes, etc. |

| 24a and 24b | Travel and meals | Travel for business and 50% of qualifying meals |

| 25 | Utilities | Phone, internet, power (if used exclusively for business) |

| 26 | Wages (less employment credits) | Report the total salaries and wages paid to employees during the year, but reduce if the client claimed certain employer tax credits.

Don’t include wages already deducted elsewhere on the return or amounts paid to the business owner |

| 27a and 27b | Other expenses | Other expenses and energy-efficient commercial buildings deduction. |

- Line 28 – Total expenses before expenses for business use of home. Add lines 8 through 27b.

- Line 29 – Tentative profit or loss. Subtract line 28 from line 7.

- Line 30 – Business use of home deduction, which can be determined with simplified deduction. See Schedule C instructions for the simplified method worksheet.

- Line 31 – Net profit or loss. Subtract line 30 from line 29. If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. Estates and trusts, enter on Form 1041, line 3. But if a loss, you must go to line 32

- Line 32 – If you had a loss, check 32a: All investment is at risk, or 32b: Some investment is at risk. If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. Estates and trusts, enter on Form 1041, line 3. If you checked 32b, attach Form 6198. Client’s loss may be limited.

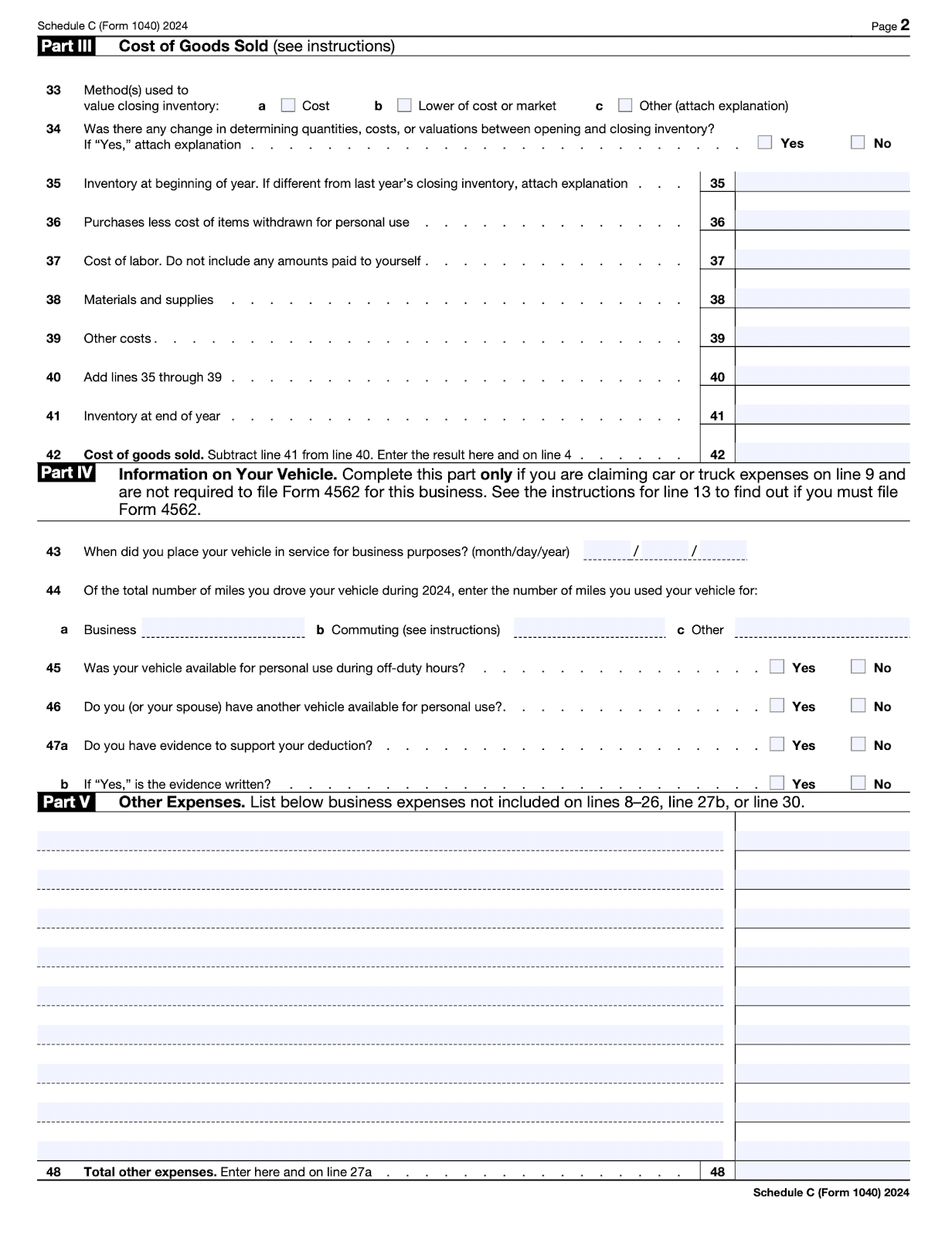

Part III: Cost of Goods Sold (Line 33-42)

Only complete this if the business sells physical goods or manufactures products.

- Line 33 – Inventory method: Cost, the lower of cost or market, or any other method approved by the IRS.

- Line 34 – Check ‘Yes’ or ‘No’ if there was any change in determining quantities, costs, or valuations between opening and closing inventory. If ‘Yes’, attach an explanation.

- Line 35 – Beginning inventory: Share inventory for the beginning of year. If different from last year’s closing inventory, attach explanation

- Line 36 – Purchases: Total product purchases for resale, minus items for personal use.

- Line 37 – Cost of labor: Wages paid to employees directly involved in production. Do not include any amounts paid to yourself

- Line 38 – Materials and supplies: Raw materials or components used in production.

- Line 41 – COGS: Subtract line 41 from line 40. Enter the result on line 41 and line 4.

Part IV: Information on Your Vehicle (Line 43-47)

You only complete this section if your client is deducting car and truck expenses on Line 9 and is not required to file Form 4562.

- Line 43 – Date placed in service: Enter the month, day, and year the vehicle was first used for business.

- Line 44 – Total miles driven during the year: Report all miles driven in 2024 (business, commuting, other).

- Line 45 – Check box if the vehicle was available for personal use during off-duty hours.

- Line 46 – Check box if spouse has another vehicle available for personal use.

- Line 47a and 47b – Check box if you have evidence to support your deduction, and if the evidence is written.

Part V: Other Expenses

If a business expense doesn’t fit any of the categories in Part II, report it here. List each expense separately with a short description.

Line 48 – Add the total of all other expenses and enter on line 48 and on line 27a.

What’s New in 2025 for Schedule C

- Mileage rate increased: The IRS raised the standard business mileage rate to 70 cents per mile in 2025 from 67 cents per mile in 2024. That changes how much deduction clients can claim under vehicle-use lines.

Process to Follow

Step 1: Onboard client onto a practice management software like Financial Cents, and request all necessary documents to file Schedule C via the client portal. You can set automated reminders until the client provides the documents with Financial Cents. If you prefer using manual processes such as checklist, grab this tax preparer info checklist for clients.

Step 2: Sort receipts, invoices, statements into categories matching Schedule C, like advertising, rent, supplies, etc.

Step 3: Ensure books/bank statements match income reported, check missing 1099s, and track outstanding expenses.

Step 4: Draft Schedule C using the latest form version. Fill in personal/business info, income, COGS, expenses, vehicle information, etc.

Here’s what the form looks like:

Step 5: Go over the draft with the client to catch omissions or misclassifications.

Step 6: Confirm totals, ensure the client knows self-employment tax and estimated taxes implications, and file.

Pro tip: Filing Schedule C gets easier and faster when you follow a consistent process every year. Create a checklist that outlines each step from collecting every document to following up with clients. This helps you avoid forgetting any step and ensures your team stays consistent across every client. You can build your own checklist from scratch or use a ready-made template inside Financial Cents, like this Schedule C prep template, which contains all the tasks and the person responsible.

How Schedule C Impacts Clients’ Taxes

Schedule C directly affects how much tax your clients owe and what they’ll need to pay throughout the year. Here’s how.

Connection to Self-Employment Tax

One of the biggest impacts of reporting income on Schedule C is that it subjects the client to self‑employment (SE) tax. Unlike W‑2 employees who split Social Security and Medicare taxes with their employer, sole proprietors pay the full 15.3% themselves. The net profit from Schedule C flows into Schedule SE, which computes how much SE tax is owed.

For 2025, the Social Security wage base limit is $176,100. That means clients pay 12.4% Social Security tax on the first $176,100 of self‑employment income, and 2.9% Medicare tax on all net earnings.

An additional 0.9% Medicare tax applies to earnings over $200,000 for single filers (or $250,000 for married filing jointly, etc.).

Tip: Remind clients that half of their self‑employment tax is deductible on Schedule 1 (Form 1040) as an adjustment to income. It reduces their adjusted gross income (AGI) but does not change their taxable business profit.

How Profit/Loss Affects the Individual’s 1040

The result from Schedule C—whether it shows a profit or a loss—flows directly into Schedule 1, Line 3 of Form 1040. This figure impacts your client’s AGI, which in turn affects their tax bracket, eligibility for deductions (like IRA contributions or student loan interest), and access to credits (such as the Earned Income Tax Credit or education credits).

Carrying Losses Forward

If your client’s business reports a net loss on Schedule C, that loss may reduce their overall tax liability but only under certain conditions, like active participation, passive activity loss rules, and at-risk rules.

It’s critical to document losses and participation status properly, as incorrect or unsupported losses can trigger IRS audits, especially if the business consistently shows negative income or operates more like a hobby than a real trade.

Estimated Tax Payments for the Next Year

Self-employed clients don’t have income tax withheld from their paychecks, so they usually need to make quarterly estimated tax payments to avoid IRS penalties.

These payments must cover both income tax and SE tax. Use Form 1040-ES to calculate estimated payments and encourage clients to estimate their expected net profit, deductions, and income from other sources early in the year. If their income changes significantly, they should update their estimates and adjust future payments accordingly.

Best Practices for Filing Schedule C

The more organized your firm’s processes are year-round, the easier it becomes to file Schedule C accurately and efficiently. Below are key best practices to build into your firm’s workflow:

Maintain Year-Round Bookkeeping, Not Just at Tax Season

Don’t wait until tax season to clean up the books. Keeping ledgers updated monthly makes it easier to identify missing income, uncategorized expenses, or unusual transactions long before deadlines approach.

Categorize Expenses Consistently To Prevent Miscoding

Use the same categories year-round that appear on Schedule C. This prevents miscoding at year-end and ensures deductions fall into the right IRS buckets. Consistency also reduces audit risk.

Reconcile Bank Accounts and Credit Cards Monthly

Bank and credit card reconciliations are critical. They confirm that all transactions were recorded, no duplicate charges exist, and balances match. Monthly reconciliations also make it easier to catch fraud or client errors.

Keep Digital Copies of Receipts and Documentation

Paper receipts fade and get missing. Encourage clients to scan or photograph receipts, invoices, and mileage logs. Digital storage creates a reliable audit trail and makes retrieval much faster if the IRS asks for proof.

Regularly Review Client Financials for Anomalies

Review financials regularly and look for red flags like negative income, unusually high expenses, or inconsistent trends. These reviews protect clients and make them trust you better.

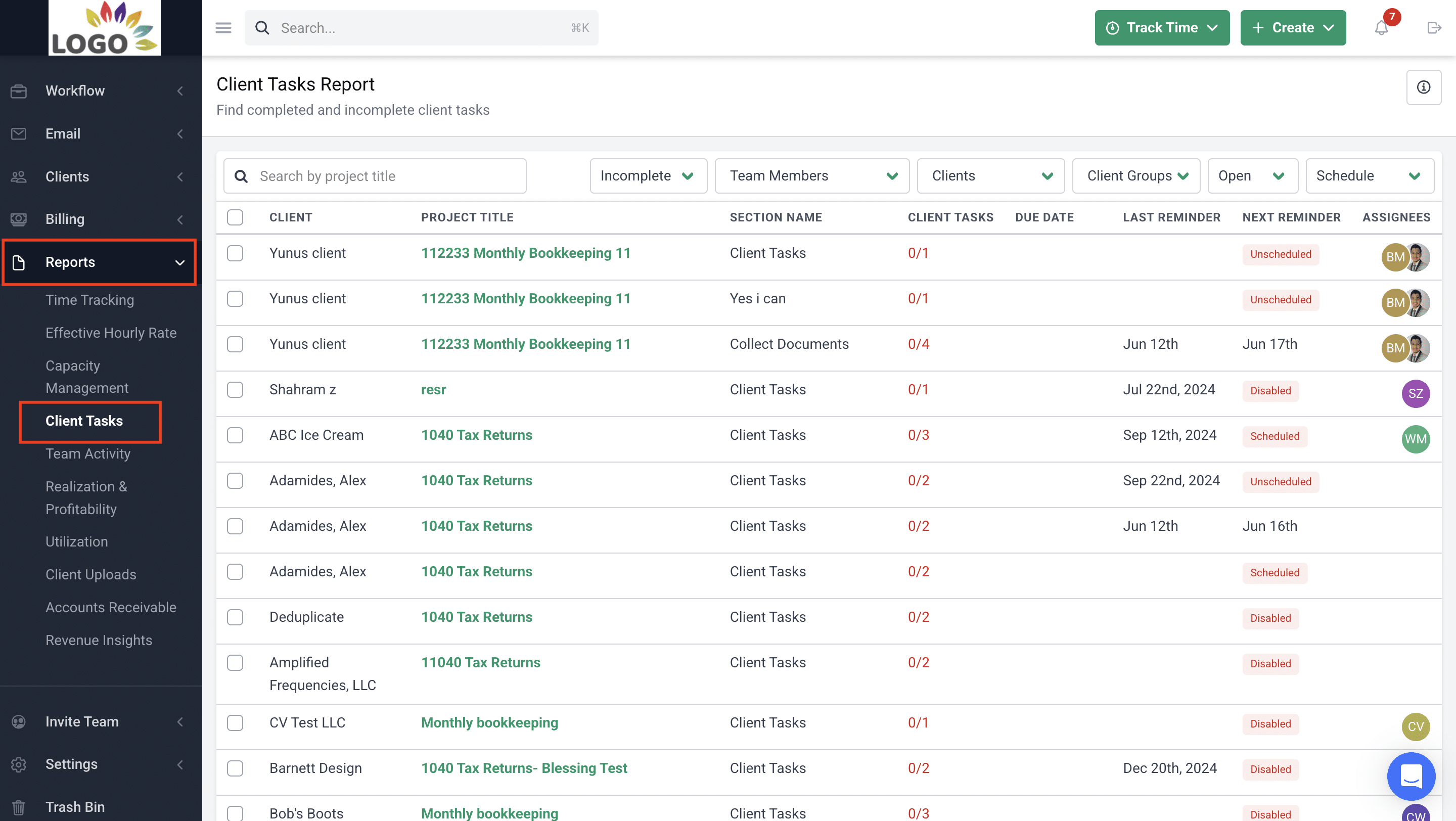

Using Financial Cents makes it easier to build these habits into your firm’s day-to-day operations. Our software helps you:

- Send and track client requests: Financial Cents makes it easy to stay on top of document collection by letting you send client requests directly through the platform. Clients receive the requests and upload documents through the Client Portal, eliminating the need for back-and-forth emails. You can also automate reminders, so you’re not manually chasing clients down when deadlines are approaching.

To stay on top of what’s still outstanding, use the Client Tasks Report, located under the Reports tab.

This report shows all projects with client tasks, with incomplete tasks displayed by default. You can filter by team member, client, or workflow to narrow your view and quickly identify what still needs attention.

- Standardize tax prep workflows: Workflow templates let you document and systematize your firm’s tax prep processes so your team can complete work efficiently and consistently, even as you scale and delegate more tasks. Financial Cents comes with a built-in library of almost 250 pre-built workflow templates you can use immediately. You can also customize these templates or build your own from scratch to match your firm’s processes.

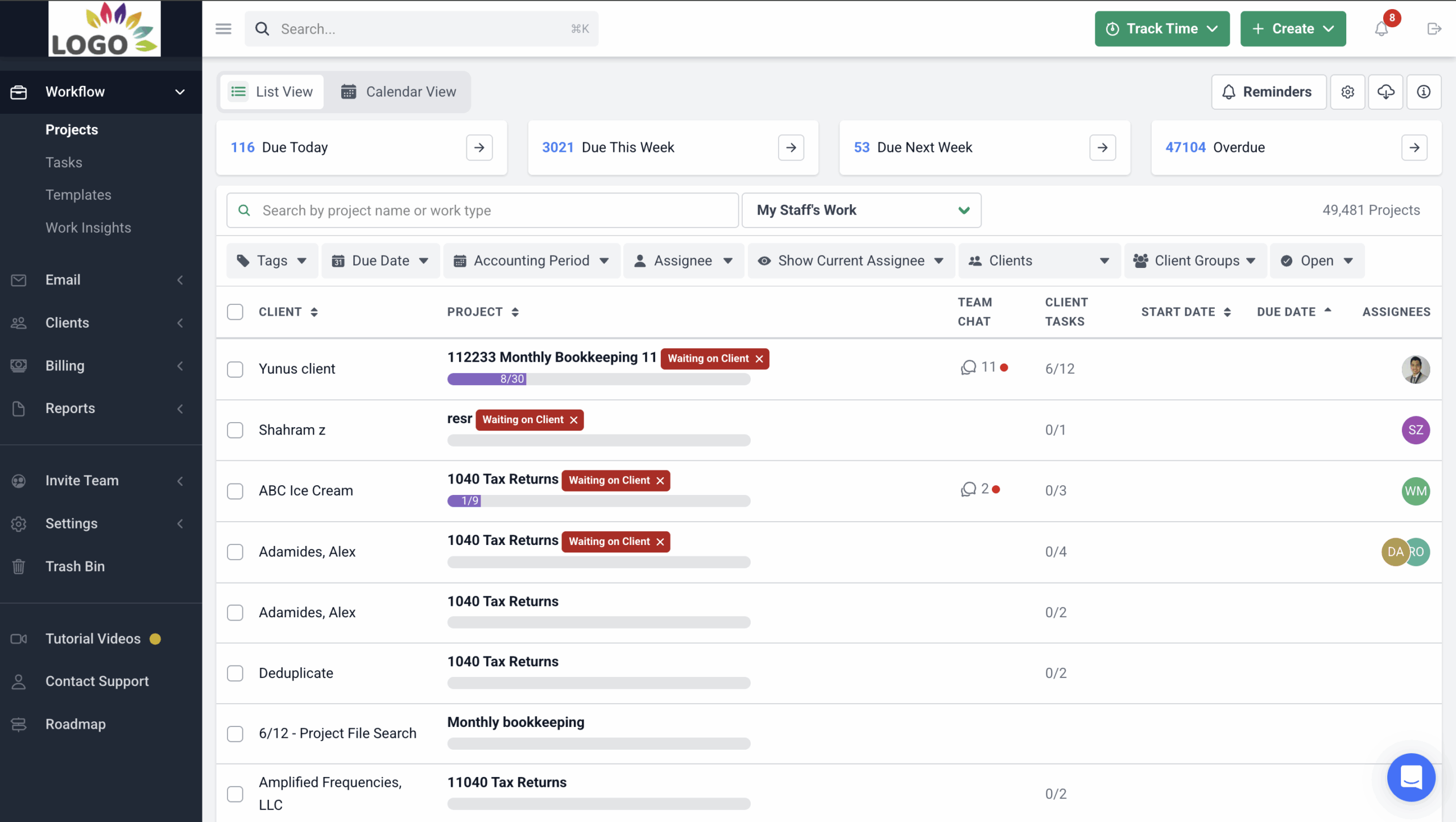

- Gain visibility into deadlines and responsibilities: The Financial Cents workflow dashboard gives you a clear view of all client work in one place. You can quickly see what’s due and when, who’s responsible, and what stage each task is in. Firm owners can track team progress and reassign work as needed, while staff can view their personal tasks and prioritize deadlines.

Here’s what the dashboard looks like:

Make Schedule C Filing Easier for Your Firm

Filing Schedule C is one of the most common tax services accounting firms provide for self-employed clients, and it’s important to be accurate to avoid IRS penalties.

The key to getting it right is staying organized and maintaining clean records. A standardized workflow ensures you can do this for multiple clients while maintaining the same quality and efficiency.

Financial Cents makes that possible. With checklist templates and a workflow dashboard to monitor deadlines, you can consistently file Schedule C for all clients without making mistakes.

Ready to streamline your tax prep process? Use Financial Cents to manage your processes.