You can't scale (your tax practice) if you're not doing good work, and you can't do good work if you are inefficient. You can't be efficient if you're going to execute projects out of order."

Kellie Parks, CPB, Founder of Calmwaters Cloud AccountingDespite the tax season workload, your tax accountants should be able to file every tax return in your firm without requesting extensions.

But most of them wouldn’t be able to do it because you don’t have a workflow system that collects and organizes client documents and information to let them focus on applying their skills without operational constraints.

That is why the IRS collects billions in tax delinquency every year.

As a critical part of a good workflow system, tax preparation checklists allow tax firms to refine their procedures and complete tax projects, potentially saving their clients thousands of dollars yearly.

This article gives you nine (9) tax preparation checklists to standardize your tax workflows and make your tax preparers more productive in 2025.

What is a Tax Preparation Checklist?

A tax preparation checklist is a sequence of tasks, information, and documents you need to prepare and file your client’s taxes.

These checklists are so straightforward that any tax preparer can pick up a tax project and understand what they need to do to complete tax returns competently.

Why a Tax Preparation Checklist Is Essential for CPAs and Accountants

1. Reduces the Risk of Errors or Omissions in Client Filings

The heat of tax season is the worst time to realize what information you’re missing and chase clients for it. This can destabilize your team and result in incorrect and incomplete tax returns.

With a tax preparation checklist, your team can see every document and bit of information they need to receive from clients. It also shows you what you have received and what is outstanding so you can collect it before your team sits down to do the work.

This frees you up to accurately calculate incomes and deductions and add all relevant documents to your client’s tax return.

2. Saves Time by Organizing Tasks into a Logical Sequence

Checklists group the tasks that need to get done into milestones. You do this, and then the next thing falls in line."

Kellie Parks, CPB, Founder of Calmwaters Cloud AccountingThe tax preparation checklist presents information and tasks in order of performance, helping your team to see what comes before (and after) what.

This streamlines your tax workflow and helps track each tax project’s progress through the various stages, making it easier to spot bottlenecks in the process that are wasting your time and resources.

3. Ensures Compliance with Tax Laws and Regulations

Tax preparation checklists are tailored to satisfy all relevant tax laws and regulatory obligations. Plus, they are usually created or customized pre-tax season when you’re clearer about your client’s tax bracket and entity type and how the tax law applies to them.

Using them to prepare your clients naturally leads to the expected goal of compliant financial reporting.

4. Enhances Client Trust Through a More Systematic Approach

Imagine the stress (for your team and clients) of going to your clients to ask for three documents at three different times because you forgot to ask for all of them at once.

A good tax preparation checklist prevents this by enabling you to ask for the right files and information so that your client can send everything you need at once, making it more convenient to work with you.

Moreover, tax preparation checklists enable your team to complete tax work accurately. This produces better compliance outcomes that inspire client trust and satisfaction.

A Comprehensive List of Tax Preparation Checklists

A. 1040 Tax Return

Form 1040 reports your client’s personal tax liabilities to the IRS by showing your client’s tax bracket and subtracting their standard deductions from their taxable income.

The 1040 tax preparation checklist gives your team a single source of truth for the tasks, subtasks, and relevant opportunities for automation during the process.

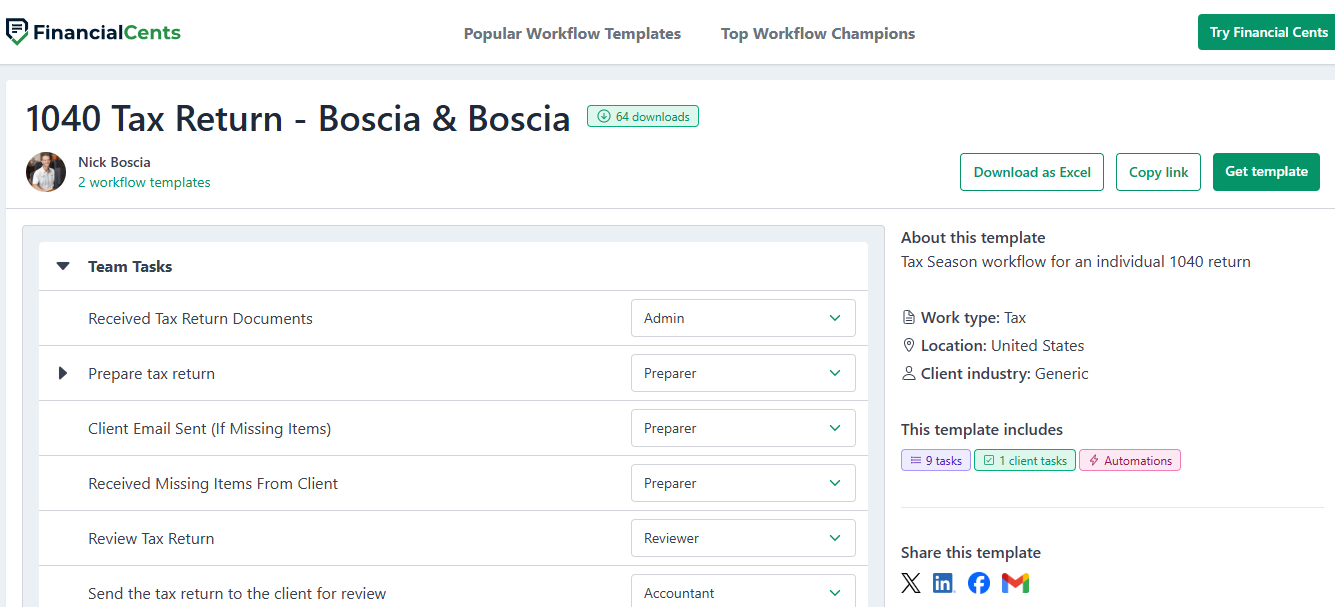

About This Checklist

This individual 1040 tax return is designed for CPAs and tax professionals serving taxpayers in the United States.

Created by Nick Boscia CPA, EA, managing partner at Boscia and Boscia PC, the template has nine steps covering the 1040 process from client data collection to verification, organization, and filing.

The accompanying client task requires the client to complete the tax organizer. You can also ask your client to sign the tax form online, provide additional information, or send additional documents using the Financial Cents’ Client Task feature.

Nick completes their process by sending the 1040 tax return to the client in SmartVault using Financial Cents’ secure Client Portal, but you don’t need a third-party app since you can take advantage of Financial Cents file-sharing features to share all tax returns and documents with your clients.

The template has been downloaded sixty-two (62) times by tax firm owners in preparation for the upcoming tax season.

Use Nick’s insights to organize your 1040 tax projects this year. Click here to get it.

B. 1099 Preparation

The 1099 tax return reports your client’s payments ($600 and above) to independent contractors not part of their W-2.

A workflow checklist for this process lets you gather your client’s Form W-9 at the beginning of the tax year. This helps to prevent a last-minute rush, which can disrupt your client’s operations and cost them revenue opportunities.

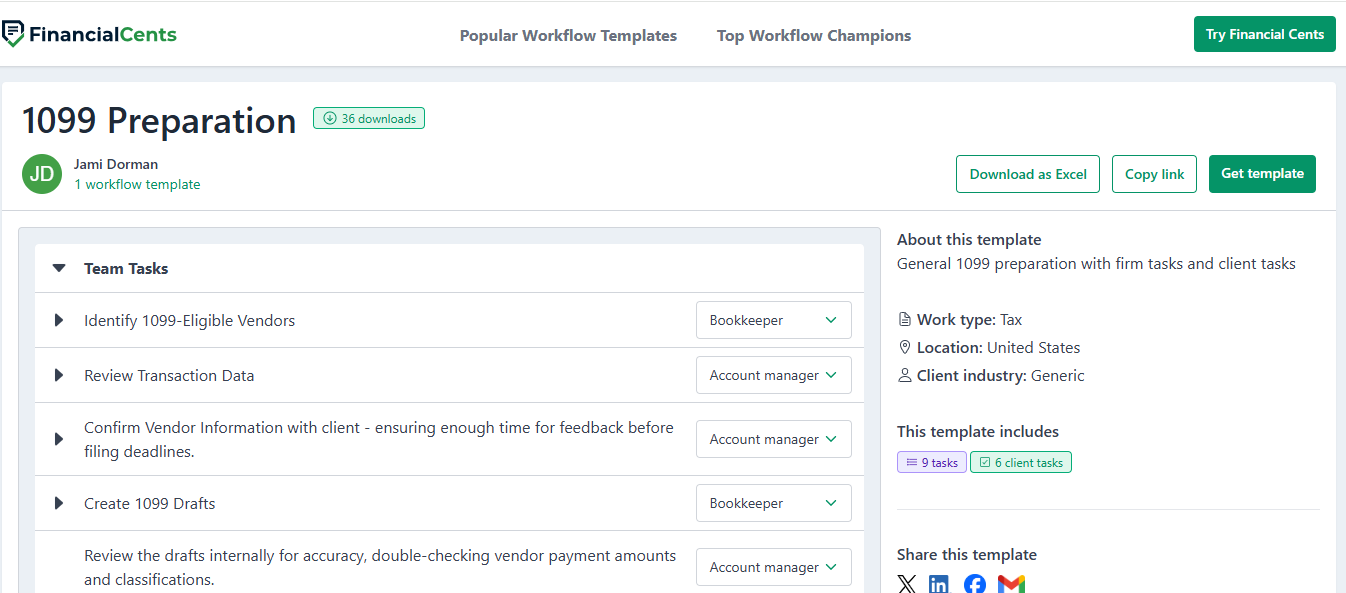

About This Checklist

Jami Dorman of Ashton Business Services LLC, created the 1099 tax preparation checklist to help you complete your client’s taxes in any industry in the United States.

The template has nine steps, which begin with identifying 1099-eligible vendors and end with filing the returns with the IRS and storing copies of the returns (together with other supporting documentation).

The template has two sets of client tasks for different stages of the work:

During Preparation: the client reviews the list of all identified contractors, gathers missing information from contractors, and reviews the numbers in the 1099 forms for accuracy.

Final Review: the client reviews the form and shares feedback.

This checklist has empowered thirty-one tax firm owners between October and December. Click here to use it in your firm today.

C. 990 Tax Return

As the tax return that helps tax-exempt, charitable, non-profit businesses report their financial information to the IRS, Form 990 allows for assessing your client’s compliance with tax-exempt regulations.

When your 990 tax preparation checklist is in place, you can focus on ensuring that your clients provide all relevant information, such as its leadership (directors, board of trustee, etc.), employee compensation process, and non-profit activities in a way that meets IRS standards.

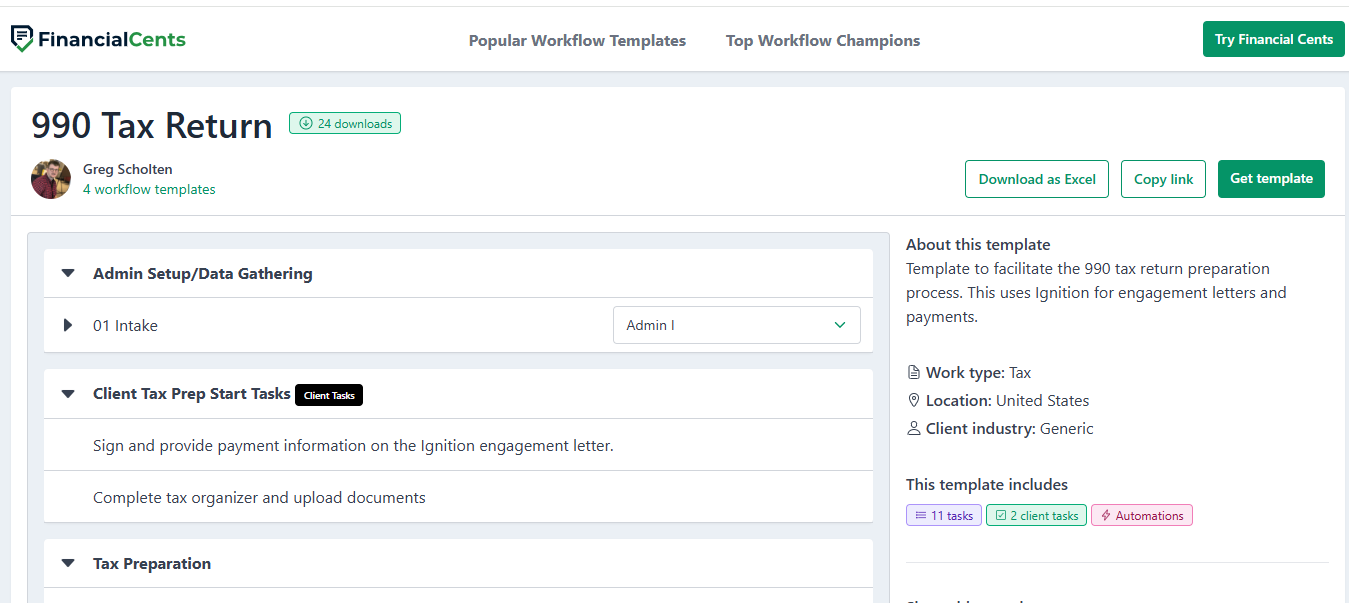

About This Checklist

The template was created by Greg Scholten, President of Ontrack Accounting Solutions, an accounting firm that provides non-profit organizations with tax, accounting, and bookkeeping services.

It has eleven tasks, two client tasks, and automation that automatically moves your non-profit tax projects to the next stage once a condition is met.

Greg used Ignition proposals for the template, but you can use the new Financial Cents proposal feature to keep your processes in a single software.

Twenty-four other tax accountants have used this template to guide their work for non-profit organizations. Click here to download it and use it for your firm today.

D. Sales tax

Serving clients that operate in more than one state requires your team to understand the tax requirements of each state and calculate your taxes accordingly.

The sales tax process can become so complex that working without a checklist will make it more likely to mix up what transactions are; for example, subject to sales taxes and those that are not.

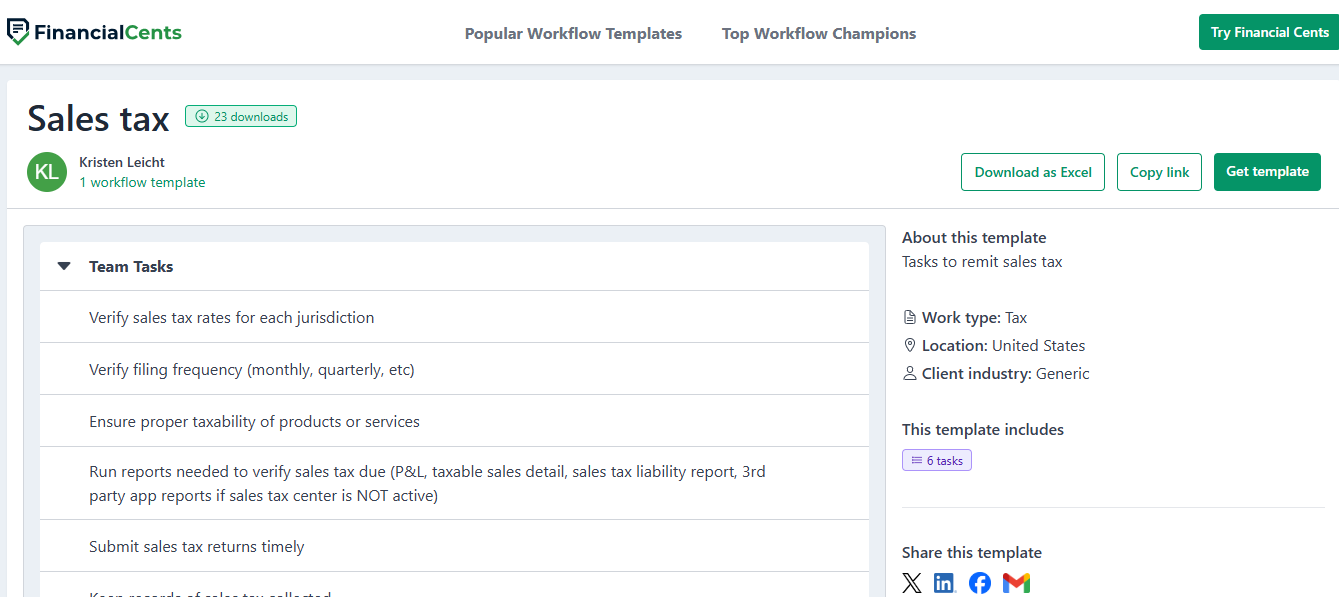

About This Checklist

The six tasks in this checklist will help you to remit your client’s sales taxes across all industries in the United States.

Created by Kristen Leight of K&L Business Solutions, the tasks in the template range from verification of sales tax across jurisdictions to the actual filing.

Twenty-one other Sales Tax Pros have used this checklist between October and December 2024. Click here to download and start using it immediately.

E. Business Tax Return

The major obstacle to filing business tax returns is incomplete or inaccurate books. While it will take a fair bit of time to review your client’s financials, a standard operating procedure (checklist) will help them complete each stage of the work to your standard.

The business tax return checklist gives them a frame of reference to work quickly, confidently, and accurately.

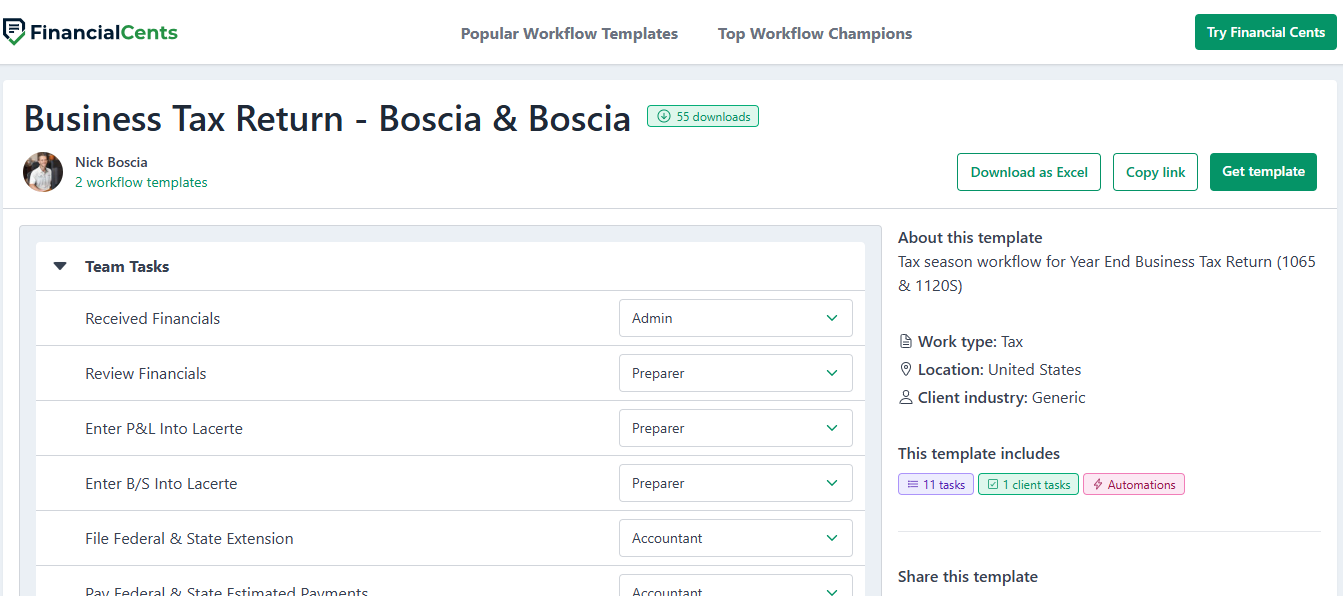

About This Checklist

This tax preparation checklist is tailored to the tax workflow needs of all firms filing taxes for businesses in the United States.

Created by Nick Boscia of Boscia and Bosicia PC, the checklist has eleven tasks, a client task, and automation that reduces manual work.

With 52 downloads in just two months, the template will help your team complete your tax projects quickly and confidently.

Click here to download or use it inside Financial Cents today.

F. 1120S Tax Return

The US Corporate Income Tax Return reports a company’s income, gains, losses, deductions, and credits to the IRS to maintain.

The 1120s tax preparation checklist streamlines the reporting of your deductions and filling out their Schedule K and Schedule M-2. This enables you to complete each section exhaustively to prevent incomplete tax returns.

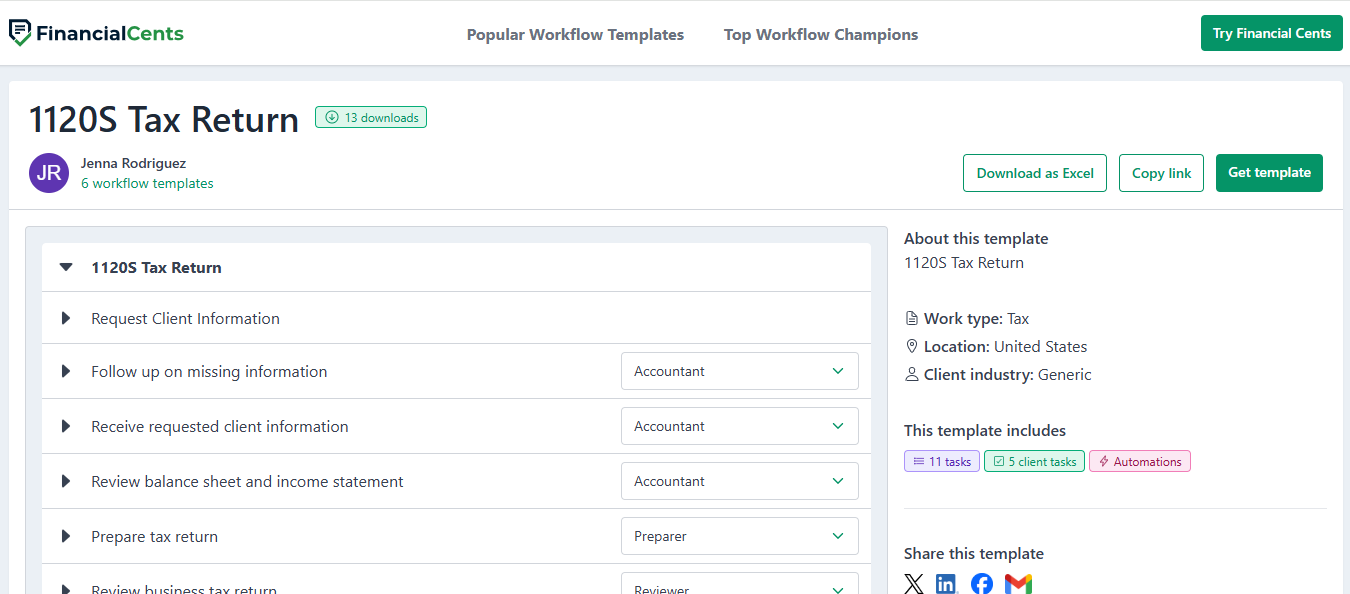

About This Checklist

Jenna Rodriquez, Senior Accountant at Pedante and Company, LLC, created this checklist drawing from 19 years of experience doing tax and accounting work for clients in the United States.

The checklist is broken down into eleven tasks: five client tasks (to collect the client’s balance, profit and loss, etc.) and automation.

No fewer than 13 tax firm owners have downloaded it for their tax workflows since it was created two months ago. Click here to use it to improve your processes today.

G. 1065 Tax Return

Your clients in a partnership business rely on you to help them accurately report the income, gains, and losses to pay their taxes.

It involves a series of administrative tasks leading up to a detailed review of the balance sheet, income statement, and filing.

Using a 1065 tax preparation checklist significantly reduces the manual work needed to meet the tax deadline.

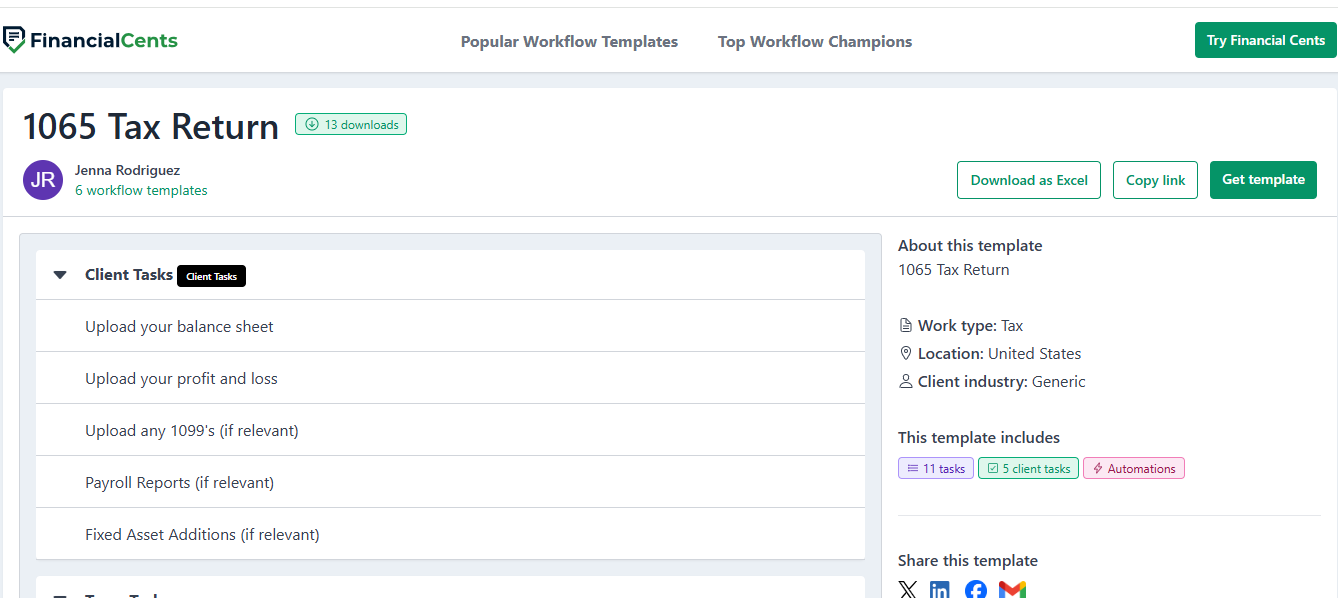

About This Checklist

Jenna Rodriquez of Pedante and Company, LLC created the 1065 checklist template. It is designed for accounting clients across all industries in the United States.

This checklist has eleven tasks and five client tasks, which cut across requests for various client documents, such as balance sheets, profit and loss, etc.

No fewer than 12 tax firm owners in the United States have found the template helpful across various niches. Click here to download it for your 1065 tax process.

H. T1 Tax Return

The T1 Tax Return is a Canadian tax form that calculates an individual’s taxable income, net income, and total income.

Your clients expect you to help them report their taxable income and claim all possible refunds and credits.

With a checklist template that shows which information and documents are needed to achieve this goal, your tax preparers are several steps closer to completing their T1 projects confidently.

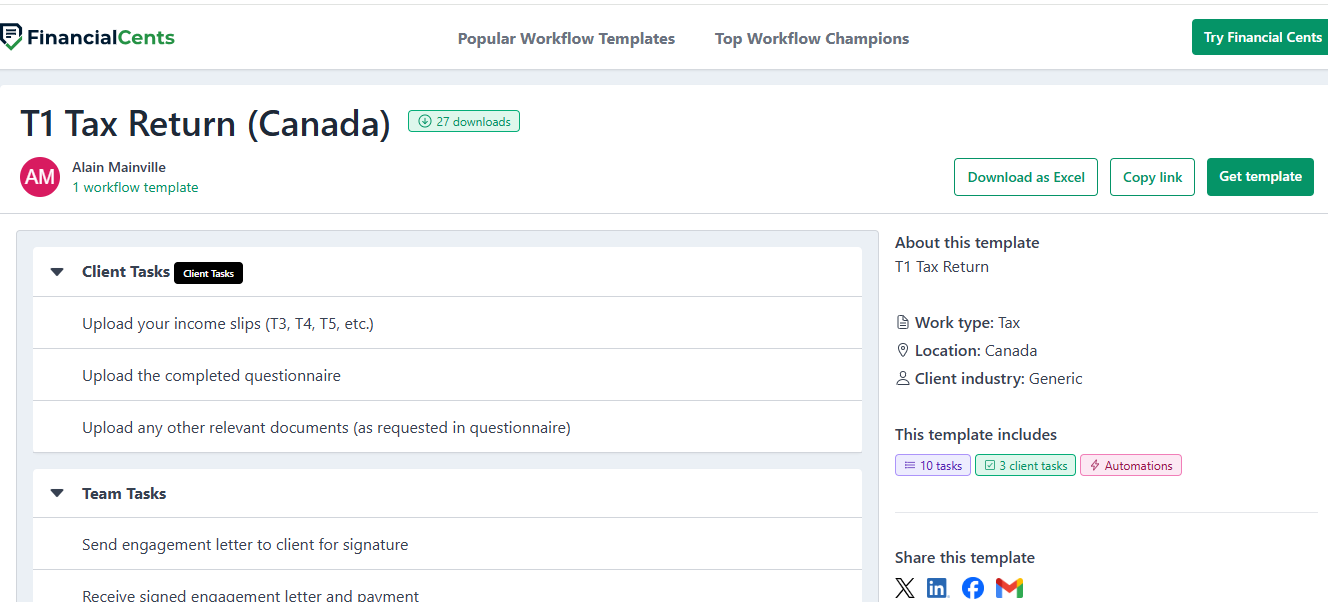

About This Checklist

Thanks to Allain Mainville, who brings his 30 years of taxation experience to bear in this tax prep checklist, the T1 checklist is designed for Canadian businesses.

It has 10 tasks, three client tasks, and automation, which prevent your team from drowning in manual work during tax season.

The T1 checklist has 27 downloads already.

Click here to start using it for your processes.

I. T2 – Corporate Tax Return

The Corporation Income Tax Return allows your Canadian corporate clients to report their income within six (6) months of their fiscal year end.

It is a lengthy process that requires great attention to detail to comply with the CRA standards (which includes submission of supporting schedules).

About This Checklist

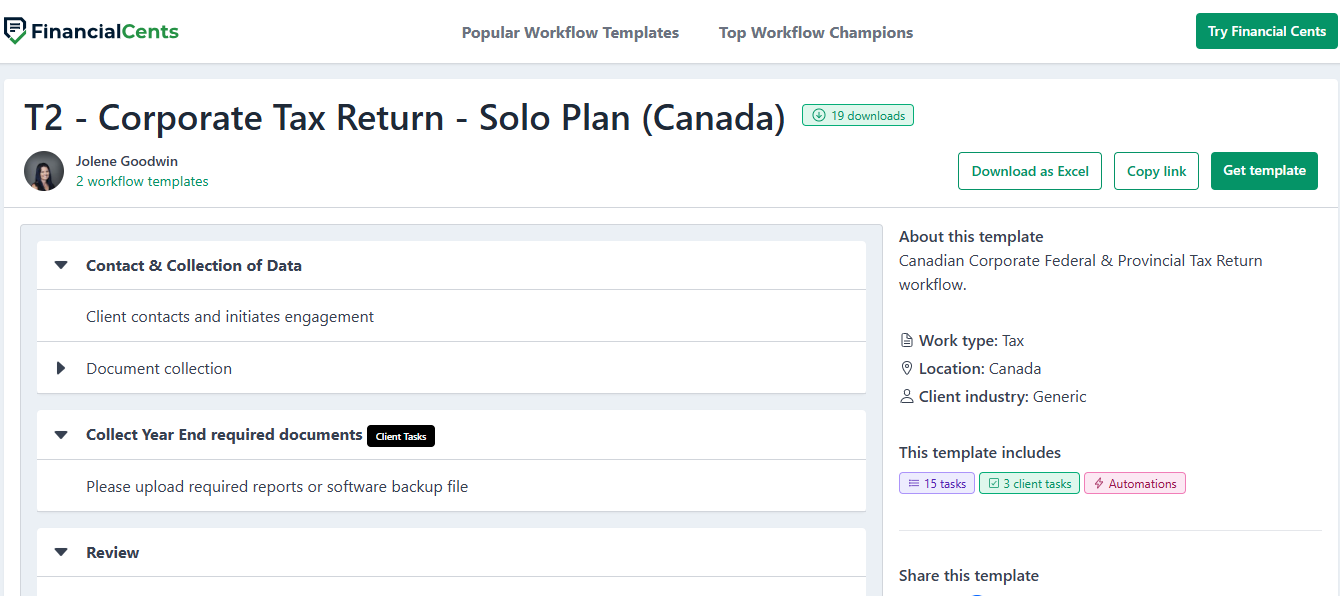

This checklist was created by Jolene Goodwin, a solo firm owner helping Canadian businesses meet their corporate tax obligations.

The template has 15 tasks, three client tasks, and automation.

It has been downloaded 17 times to help Canadian tax firms improve their corporate tax procedures.

Click here to use it in your firm or get inspiration from it.

Common Pitfalls in Tax Preparation and How to Avoid Them

i. Missing Client Information or Documents

Most tax clients do not know the file or information required to file their taxes, so they will bring incomplete information and documents for you to sort through.

If your tax preparers don’t have a checklist to tick off the file or information received, you will likely get to tax season with incomplete information, which could lead to last-minute requests.

Solution: Use Accounting Client Management Software to Store Client Information and Streamline Data Collection

Client relationship management (CRM) solutions organize all the information and documents you have collected from clients in one place.

In Financial Cents, the Custom Fields feature stores unique client information like entity type, formation date, social security number (SSN), and employee identification number (EIN) long before you need them for their tax returns.

Its client task feature sends your tax clients a list of the documents you need from each of them in advance, giving them ample time to gather and send them to you.

The Financial Cents Document Management Feature organizes all files from clients in the client’s profile. This helps you see what the client has sent and what is missing before you sit to do the work.

ii. Miscalculations Leading to Incorrect Tax Liabilities

Helping your clients claim all their tax benefits requires (1) a good grasp of applicable tax laws and (2) an effective tax workflow system, without which every tax project is a struggle.

The absence of an effective workflow system results in a lack of visibility into the status of each client’s work, which causes tasks to fall through the cracks.

Solution: Use the Right Tax and Practice Management Software to Streamline Tax Projects

You can streamline your tax work with tax preparation software. These tools will ask you a series of questions to do the heavy lifting and allow you to focus on quality control and strategy.

Similarly, accounting practice management software will help you manage your workflows and keep your team working at peak capacity.

For example, the Financial Cents’ client portal helps you to communicate with clients in real-time to plan and prepare their taxes confidently.

iii. Overlooking New Tax Law Updates or Deadlines

Tax laws are complex and constantly being modified.

Since violating them or missing their deadlines attracts sanctions, every measure taken to comply with the law consistently seems prudent.

Solution: Consider Joining a Community of Tax Pros to Stay up-to-date with Tax Laws and Workflow Solutions

The Financial Cents Templates Library is an accounting and tax community that provides information about tax workflows, taking into account all recent changes to the tax regulations.

Standardize Your Tax Preparation with Financial Cents

Here is how some of Financial Cent’s practice management features help you ensure consistency in your tax preparation.

Workflow Management and Automation

Workflow management is the foundation of all tax projects. It helps you to know where each tax work stands to manage your time and resources effectively and avoid the whirlwind of the busy season.

Financial Cents’ workflow solution provides:

Workflow Dashboard

The Financial Cents Workflow Dashboard is your homepage. It shows all your tax projects in order of urgency, status, assigned staff, and the team chat, which shows project-related conversations in your firm.

As the owner or manager, you can see which task has been done in a project and what is left. Your staff can see the tax projects assigned to them.

Financial Cents’ workflow solution has

- Workflow Filters: this feature sifts through your dashboard for specific tax or client information, making it easy to see only the information you want in the heat of tax season when your dashboard is filled with projects.

- Workflow Templates: these prebuilt process checklists make it easier and faster for your staff to complete tax projects.

- Recurring Project: automatically create repetitive projects when due.

- Task Dependencies: ensure all preceding tasks are completed before a task can be done.

Team Collaboration

Financial Cents collaboration features keep everyone on the same page by enabling team members to share information, ideas, and documents using:

- Comments: allows assignees to share ideas using the comments feature.

- Notes: you can share client information with your team in the client’s profile.

- Pin Client Emails to Tax Projects: this lets you add client emails to your projects, keeping time-sensitive client emails from falling through the cracks.

- Automated Notification: all relevant team members will receive an alert when mentioned in a comment or assigned a task.

Time Tracking and Billing

Financial Cents’ time tracking feature tells you where your firm’s time is spent, enabling you to determine where to spend your time.

These time-tracking features include:

- Time Budgets: the ability to allocate your time to tax projects and track your firm’s ability to stay within budget.

- Billable Rates: enables you to set the dollar amount of your tax projects.

- Multiple Timers: you can pause and resume time for your client’s projects as you move between client projects.

- Billable/Non-Billable Time: enables you to identify the hours you can bill clients.

- Time Tracking Reports: gives insights into your team’s time usage to help you make informed time management decisions.

Billing

The Financial Cents integrated billing feature brings your invoicing and payment processes into your practice management software.

It allows you to:

- Create One-off & Recurring Invoice: you can create one-off invoices manually and automate ongoing invoices for your repetitive tax projects on specified dates.

- Sync Invoices and Payments with QuickBooks Online: this is helpful when you want to pull service items from QuickBooks for your invoicing.

- Receive ACH & Credit Card Payments: gives clients the flexibility to pay via ACH or credit card.

- Save Payment Method: this keeps your client’s payment information inside Financial Cents for subsequent payments.

- Automate Client Payment: this helps you charge your client’s account automatically.

- Automate Client Reminders: Financial Cents chases clients for outstanding invoices while you focus on completing client work during tax season.

Client Tasks (with E-Signature Request)

This feature helps you request additional information or E-Signature before or during a tax project to complete tax returns on time.

This feature includes:

- E-Signature Request: your client will only need to review the tax form and add their signature online, bypassing the need to print and scan tax forms.

- Automate Reminders: auto-nag your clients to grant your outstanding requests by sending them Emails and SMS.

The link in the client task email grants your client access to the Financial Cents Client Portal, a secure place for your clients to use the:

- Client Chat: a feature that lets your client discuss projects, documents, and signature requests with you.

- Billing Tab: this shows them their paid and outstanding invoices so they can track their payment history.

- ReCats: a tab for resolving uncategorized transactions by pulling relevant transactions from QBO into Financial Cents and asking clients to provide supporting information to clarify them.

- Custom Uploads: the ability for clients to use the Financial Cents Client Portal to upload documents to your preferred third-party document management system.

Deadline Tracking

The Financial Cents’ Due Date feature displays your upcoming deadlines to enable you to allocate sufficient resources for them.

- Due Date Filter: displays the tax projects due by a certain date.

- Due Date Reminders: automated alerts for all due projects. Each of your team members should set theirs.

- Extension Due Date: this allows you to push the due date for tax projects further into the future.

- Internal Due Dates: lets you set an earlier deadline for tax projects to give you room to review all tax projects before their actual deadlines.

Template Library

The Financial Cents Template Library allows you to see how other tax professionals are addressing the tax workflow challenges you are struggling with. The templates are created by fellow accounting firm owners with years of practice management experience.

By taking advantage of their insights, you save yourself the need to reinvent the wheel to document your workflow processes and help your team members complete client work to your standard.

Join Dawn Brolin and Other Accounting Firm Owners Thriving Through Tax Seasons

Thanks to Financial Cents, Dawn Brolin, CPA, has gotten enough time back from running Powerful Accounting, Inc. to coach Softball teams during tax season.

Tracy went on vacation for two weeks during tax season, but because our workflow is so systematized, Nicole could jump in and help out. If we didn't have a defined workflow for new clients, Nicole wouldn't have been able to help out."

Dawn Brolin, CPA, Owner of Powerful Accounting