In recent times, many accounting firms have come to see the value in offering financial advice to startups and small to medium-sized enterprises, who seek financial experts to help manage their processes, and promote their long-term success.

This is because most of these startups are unable to afford a full-time financial officer without significantly impacting their annual income. And that’s why many of them have turned to the services of virtual CFOs who can provide guidance, advice, and much-needed expertise in financial matters.

If you’re not sure what these services are about, you can learn who a virtual CFO is and how to become one.

The surging demand for virtual CFO services presents a golden opportunity for accounting professionals like you to broaden their service portfolio and cater to the changing requirements of businesses.

As a firm owner, incorporating virtual CFO services into your business not only opens doors to increased revenue but also establishes yourself as a trusted and credible advisor in strategic planning and financial growth.

That’s why in this article, we’ll be delving into the process of how to design and offer virtual CFO services in your firm.

What Are Virtual CFO Services?

Virtual CFO services provide remote or part-time strategic financial management and high-level financial expertise, offering the same skills as a traditional CFO but with a more flexible delivery model.

Rather than hiring a full-time CFO, businesses can engage virtual CFOs to fulfill critical financial functions, including financial planning, risk management, budgeting, financial analysis, and strategic decision-making.

Unlike traditional in-house CFOs, virtual CFOs typically work remotely, leveraging technology to communicate with clients, access financial data, and provide insights to help businesses make informed financial decisions.

This approach has gained popularity in light of the growing remote work trend, allowing companies to engage experienced professionals like you with diverse expertise and industry knowledge, regardless of location.

In so many ways, this is advantageous to both companies and accounting professionals who run their practice. For instance, companies are no longer confined to hiring talent within a specific geographic location, enabling them to engage virtual CFOs with diverse expertise and industry knowledge.

Also, cloud-based accounting systems, accounting practice management software, video conferencing, and accounting project management tools enable seamless communication and real-time collaboration between the virtual CFO and the client, regardless of geographical distances.

Moreover, Virtual CFOs from different backgrounds and cultures can bring unique perspectives to financial decision-making, contributing to a more well-rounded and adaptable approach to financial management.

Benefits of Offering Virtual CFO Services

As an accounting professional, there are so many potential benefits from offering these services. Let’s discuss some of them below.

Diversified Revenue Stream

These services provide a valuable source of recurring revenue, expanding your income stream beyond traditional accounting, payroll, compliance, advisory, and bookkeeping services.

This diversification can help to stabilize your practice and reduce reliance on a single revenue stream.

You may be interested in:

Strengthened Client Relationships

Your existing clients trust you to provide strategic solutions that fit their needs. When you add virtual CFO services to the mix, you don’t just become their strategic financial partner, providing insights and guidance.

You become a much more valuable partner that intimately understands their business fostering a deep level of engagement, stronger relationships, increased loyalty, and referrals for your business.

Cost-Effective Solutions for Clients

Small and medium-sized businesses (SMBs) often lack the resources to hire a full-time CFO. Which is why a virtual CFO might be more appealing to them.

These services offer a cost-effective alternative, providing access to experienced financial expertise without the burden of a full-time salary and benefits.

For instance, a client with multiple product lines may desire to understand which products are most profitable and hire a virtual CFO on a one-off basis for a profitability analysis project. The virtual CFO can assess the profitability of each product line, considering factors such as production costs, pricing strategies, and market demand, to inform decisions on resource allocation and product focus.

The client gets the financial advice needed and the virtual CFO gets experience and a successful sale.

Specialized Expertise

Virtual CFOs often possess specialized expertise in specific industries or areas of finance, such as tax planning, mergers and acquisitions, or international business.

This specialized knowledge can position you as an industry expert and equip clients with a competitive edge, empowering them to navigate complex financial challenges.

Access to International Talent Pool

Virtual CFOs have the freedom to work from any location. This means your firm can seamlessly recruit financial professionals from around the world, matching the expertise of virtual CFOs to the precise requirements of your clients, regardless of location.

This approach expands the range of skills and expertise available, fostering diversity, and innovation and positioning your firm as a leader in your industry.

Objective Financial Analysis for Clients

Free from internal biases and conflicts of interest that often exist within a company, virtual CFOs offer an objective financial lens and an impartial perspective that can lead to more accurate assessments and recommendations, which guides clients towards informed and unbiased decision-making.

Enhancing Focus on Value-Added Activities

The utilization of virtual CFO services enables businesses to redeploy their internal resources towards high-value activities, innovation, and essential business functions, contributing to overall organizational growth.

Project-Based Expertise

Firms providing Virtual CFO services can deliver specialized expertise for targeted financial projects. This approach enables clients to leverage expert skills for specific initiatives without the long-term obligation of hiring a full-time CFO.

For example, a client might engage your Virtual CFO services for a cost reduction analysis project in response to an economic downturn, supplementing your regular tax planning and bookkeeping services.

Now that we’ve discussed the many benefits of offering virtual CFO services, let’s show you how to design and offer them.

Designing and Offering Virtual CFO Services in Your Firm

Have a Standard Operating Procedure in Place

Assuming you’re already managing a bookkeeping or accounting practice, adding virtual CFO services to your repertoire might raise questions about time commitment. The pressure to balance day-to-day operations with new responsibilities can be overwhelming. It’s natural to wonder how you’ll effectively manage your workload with the expansion of your business.

To ensure a smooth transition to virtual CFO services, it’s essential to have robust standard operating procedures in place before rolling out the new service.

SOPs are essential for upholding consistent, high-quality service delivery and maintaining a professional reputation. They provide a clear roadmap for employees, ensuring that key services and processes within the company run smoothly and consistently, even as the team expands. This scalability ensures that the company can maintain high-quality services for a growing client base.

Whether it’s onboarding clients, managing finances, or handling payroll, having SOPs in place guarantees that tasks are completed accurately, efficiently, and consistently, regardless of who is performing them.

Ensure that every aspect of your existing workflow functions smoothly and independently, even in your absence, especially if you are the owner of the firm.

Your other business operations should not experience any disruptions or setbacks solely due to the addition of virtual CFO services to your portfolio.

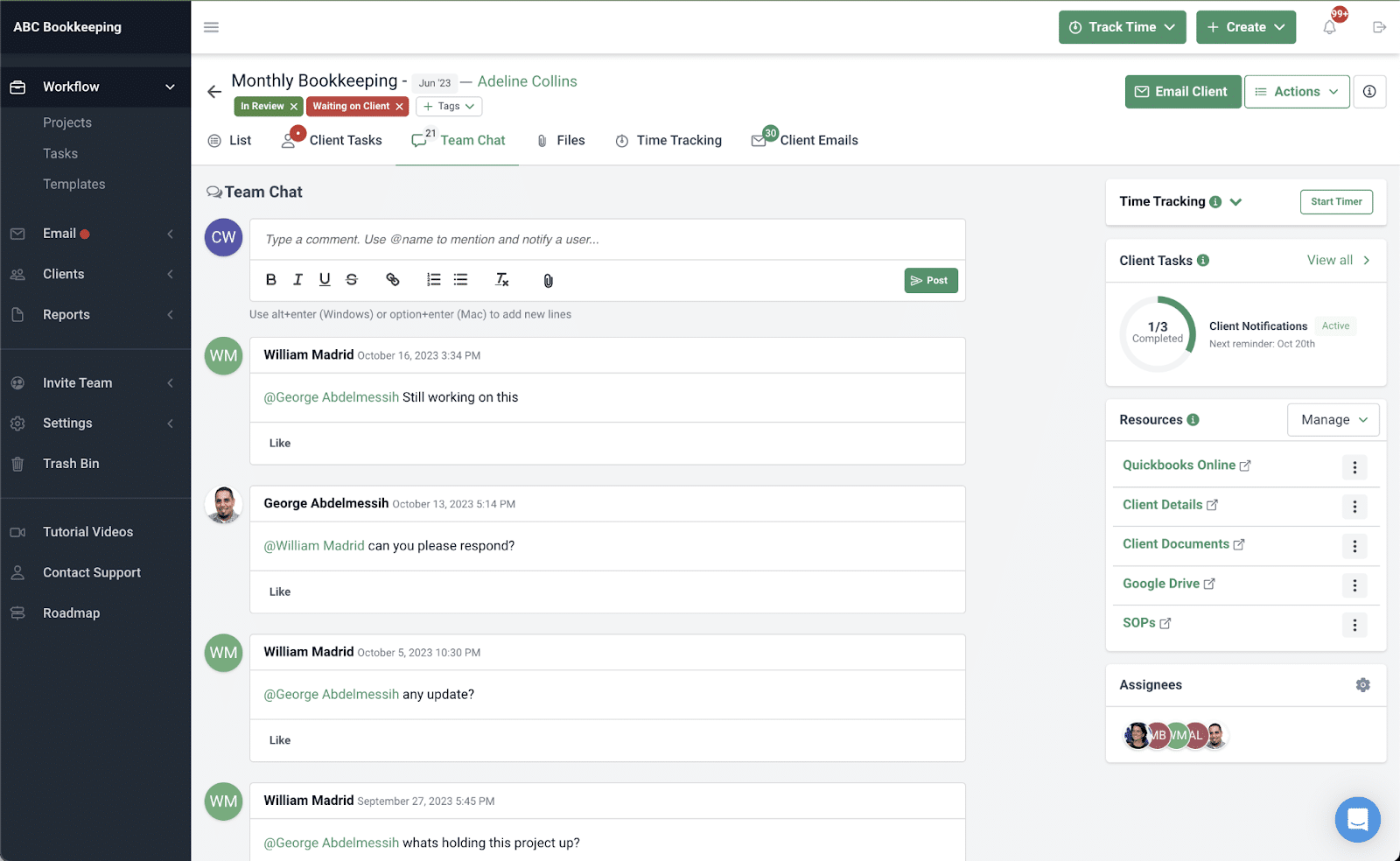

Use Practice Management Software to Systematize your SOPs

As you implement your standard operating procedures to enhance efficiency, it’s crucial to maintain regular communication, updates, and check-ins with your client’s needs.

While spreadsheets may seem like a convenient option for managing this information, the sheer volume of data and the need for manual updates can quickly become overwhelming.

Moreover, spreadsheets can impede the creation of scalable and systematic processes that support business growth.

Roger Knetch, emphasizes the significance of this in his statement:

Documentation and process-building are so important for you to maintain a life outside your accounting practice. As an accounting professional, this is so important in the instances where your business scales to the point where you need to bring in new people, or even when you need to just simply take a break from work."

An accounting practice management software can eliminate all these challenges.

When you’re building a business, it’s not just the book of business that has value, it is the culture you have with the staff that you’ve employed and the systems that you’re using to get the work done."

Roger KnetchIt streamlines the management of your standard operating procedures by providing a centralized platform to handle client relationships, workflows, documentation, billing, information exchange, client reporting, appointments, and deadlines.

This software automates repetitive tasks and processes, enhancing efficiency and alleviating the manual workload for you and your team.

It’s taking what you’re so good at to the point that you can document it, duplicate it, and ultimately, delegate it. And once, you have those processes in place, it doesn’t necessarily matter who is doing it"

Roger KnetchRecommended Reading:

Educate your Clients on the Benefits of Virtual CFO Services

Once you’ve automated your processes with accounting practice management software, the next step is to pitch your services to your clients.

Don’t approach it like a salesman looking to meet a monthly target. Educate them on the benefits that a virtual CFO service will have for them.

Start with understanding their specific needs and challenges. This involves conducting thorough assessments of their financial operations, growth aspirations, and resource constraints.

Then emphasize the financial advantages of virtual CFO services, such as reduced overhead costs, flexible pricing models, and access to specialized expertise without the burden of a full-time salary and benefits package.

If possible, show them case studies or testimonials of real-world examples of how businesses have achieved their business goals with virtual CFO services.

Understand the Needs of Your Clients

A comprehensive assessment of your client’s financial operations should reveal areas where they may be struggling. Once you understand this, you can tailor your virtual CFO services to improve their existing financial processes or offer advisory services that navigate through complex tax regulations. It all depends on the specific skills that you can offer as a virtual CFO.

You may also consider the client’s constraint in terms of resources. Small businesses may have limited in-house financial expertise, necessitating more comprehensive virtual CFO services.

They may also have smaller budgets for this level of expert advice and a firm owner needs to create flexible pricing models and packages that are tailored to their specific needs.

Provide Financial Analysis and Forecasting

The next step is to show them the inherent value that you can bring as a virtual CFO by providing clients with valuable insights into their financial performance, potential risks, and future growth opportunities.

This can help them make informed decisions about resource allocation, investment strategies, and operational efficiency. It can also contribute to identifying potential risks and developing contingency plans or develop long-term strategic plans aligned with their financial goals and growth aspirations.

Develop a Strategic Plan

A well-crafted strategic plan serves as a blueprint for a client’s financial journey, aligning your virtual CFO services with their long-term aspirations and fostering a basis for enduring collaboration.

Let’s say you are working with a client who is a small business owner. The client is looking to grow their business and is considering expanding into a new market.

You can help the client develop a strategic plan that outlines their goals and objectives for growth. This plan may include targets for revenue growth, profitability improvement, and market share.

If the client is pleased with the plan, you’ll probably be signing your first contract as a virtual CFO.

Wrapping Up

Adopting virtual CFO services can be a game-changer for any accounting firm looking to expand their offerings and better serve their clients – including yours.

If you’re unsure about pricing these services, our comprehensive Playbook: How to Price Accounting Services for Ultimate Profitability can help you navigate the pricing process.

Lastly, as you venture into the realm of virtual CFO services, consider utilizing cutting-edge accounting practice management software to enhance your firm’s efficiency and streamline operations.

We are proud to recommend FinancialCents to you.