What is Accrual Accounting?

Accrual accounting is a method of recording financial transactions based on when they occur, not when cash is received or paid. Revenue is recognized when it’s earned, meaning the business has delivered the goods or completed the services. And expenses are recorded when they’re incurred, even if the business hasn’t paid the invoice yet.

For example, if a client completes a $5,000 project for their customer in December but doesn’t get paid until January, under accrual accounting, you would record that revenue in December, when the work was performed, not when the cash hits their account.

Likewise, if that same client receives a vendor invoice in January for supplies used in December, you’d record the expense in December, since that’s when the cost was incurred.

Accrual accounting gives a more complete and accurate picture of a business’s financial health. It matches income and expenses to the periods they relate to, regardless of when cash moves, so financial reports reflect the true performance of the business.

It’s also the preferred method under Generally Accepted Accounting Principles (GAAP) in the United States as public companies and most large private businesses are required to use accrual accounting.

As a firm owner, offering accrual accounting helps ensure your clients’ books are accurate, GAAP-compliant, and actually useful for budgeting and forecasting.

We explain everything you need to know about accrual accounting in this guide.

The Core Principles of Accrual Accounting

Accrual accounting is built on two key principles: revenue recognition and matching principle. These work hand in hand to align income and expenses with the periods they actually occur, giving a more accurate view of profitability and operations.

The Revenue Recognition Principle

The revenue recognition principle states that you should recognize (i.e. record) revenue when it is earned, not necessarily when payment is received. Under GAAP, revenue is considered earned when the business has satisfied its performance obligations, meaning it has delivered the agreed product or service.

As a firm, you’ll often help clients apply this principle across different types of billing structures:

- Milestone-based contracts: Recognize revenue when a milestone or deliverable is completed.

- Ongoing services: Spread revenue recognition evenly or proportionally over the time services are provided.

- Subscriptions or retainers: Recognize monthly (or based on usage) throughout the contract period.

The Matching Principle

The matching principle dictates that expenses should be recorded in the same period as the revenues they help generate. This keeps the client’s profit margins accurate and avoids overstating or understating performance.

In practice, this means:

- If an expense is directly tied to revenue (e.g., cost of goods sold, freelancer payments), record it in the same period as the related income.

- If the cost benefits multiple periods (e.g., annual software licenses, prepaid rent), spread the expense over those periods using amortization or allocation.

- If your client incurs a cost but hasn’t received the invoice yet (e.g., month-end utilities or wages), accrue the expense so it still shows up in the correct period.

Together, these two principles form the foundation of accrual accounting. They help your firm produce financial reports that are more accurate and useful for decision-making. And they give your clients the financial clarity they need to make smarter, data-driven business decisions.

Accrual Accounting vs. Cash Accounting

Here’s a side-by-side comparison of the two main accounting methods companies use:

| Category | Accrual Accounting | Cash Accounting |

| Revenue recognition | Record revenue when it’s earned, i.e after goods or services are delivered, even if payment hasn’t been received yet. | Recognize revenue only when the business receives payment from customers. |

| Expense recognition | Record expenses when incurred, even if payment hasn’t been made yet. | Record expenses only when cash is paid. |

| Compliant with GAAP | Fully compliant with GAAP. Required for audited financial statements and preferred by lenders, regulators, and investors. | Not GAAP-compliant. Allowed only for certain small businesses that meet IRS thresholds. |

| Complexity | More complex. Requires tracking of receivables, payables, prepaid expenses, deferrals, and accruals. | Simpler to manage. Follows cash flow in and out of the business. |

| Accuracy | Provides a more accurate view of financial performance by aligning revenue and expenses to the correct periods. | May distort profitability, especially for businesses with delayed payments or future obligations. |

| Common use | Used by mid-sized and growing businesses, especially those with inventory or external reporting needs. | Common for small businesses, sole proprietors, and cash-based operations with limited receivables or payables. |

You may be interested:

Generally Accepted Accounting Principles (GAAP): A Complete Guide

Key Components of Accrual Accounting

Accrual accounting involves several key accounts that make it possible to record financial activity when it happens, not when cash changes hands. Understanding how these accounts work will help your firm maintain accurate client records and keep financial statements aligned with actual business activity.

Accounts Receivable (AR): Revenue Recorded Before Payment Is Received

Accounts receivable tracks money your client is owed for work they’ve already completed. Under accrual accounting, you record the revenue in the same period the service is delivered, not when the customer pays. You do this by creating a journal entry that debits Accounts Receivable and credits Revenue.

Accounts Payable (AP): Expenses recorded before payment is made

Accounts payable records what your client owes vendors for goods or services they’ve already received but haven’t paid for yet. Under accrual accounting, you record the expense in the same period the cost is incurred, not when the payment is made. This ensures monthly or quarterly financials reflect actual activity and give a more accurate view of profitability.

You do this by creating a journal entry that debits Expense and credits AP.

Deferred Revenue and Prepaid Expenses

These accounts handle situations where cash moves before the revenue or expense is earned.

Deferred revenue is payment received before delivering a product or service. The revenue is not yet earned, so you record it as a liability.

In the initial journal entry, debit cash and credit deferred revenue. Then for the monthly revenue entry debit deferred revenue and credit revenue.

Prepaid expenses are cash paid for goods or services to be received in the future. You treat this as an asset and expense it over time.

In your initial journal entry, debit prepaid expense and credit cash. Then for the monthly revenue entry debit expense and credit prepaid expense.

Both accounts help prevent overstatement of revenue or expenses in a single period.

Accrued Liabilities and Accrued Income

These accounts capture income or expenses that have been earned or incurred, but not yet invoiced or paid by the end of the reporting period.

Accrued liabilities are payments your client owes for work already performed but for which no invoice has yet been received. This is sometimes also called unbilled revenue. In your journal entry, debit expense and credit accrued liabilities.

Accrued income is revenue earned by your client for services provided but not yet invoiced. In your journal entry, debit accrued income (or unbilled AR) and credit revenue.

These accruals ensure financial statements fully reflect the period’s activity even if billing or payment happens later.

Advantages of Accrual Accounting

Accrual accounting delivers several key advantages for your clients, and by extension, strengthens the value your firm can provide. Below are the major benefits it offers:

More Accurate Financial Picture

Accrual accounting provides a more realistic view of profitability for any given period. You avoid situations where delayed payments inflate or deflate results. The balance sheet reflects actual receivables, payables, and deferrals, not just current bank activity. That transparency gives business owners the confidence to make informed business decisions.

Better Matching of Income and Expenses

By applying the matching principle, accrual accounting ensures expenses appear in the same period as the revenue they support. This alignment reveals the actual cost of delivering services or products and results in more accurate profit margins.

It also allows businesses to compare performance across months, quarters, and years consistently.

Easier Compliance With Reporting Standards

Accrual accounting is required under GAAP and is the standard for audited financial statements. It’s also preferred by banks, investors, and regulators because it offers consistent, comparable data.

If your clients ever need funding, seek an audit, or plan to sell their business, having accrual-based books in place means they’re already prepared. You won’t need to retroactively clean up or convert cash-based records, saving you time and effort.

Supports Long-Term Strategic Advisory Services

Accrual accounting allows your firm offer more than just basic bookkeeping work. With clean, period-based data, you can help clients analyze profitability by service line or project, track trends in revenue and expenses, and build more accurate budgets and forecasts.

This allows you to advise clients on real business decisions, like when to hire, where to cut costs, or how to price their services more effectively. And this makes you a trusted and valuable partner.

Disadvantages of Accrual Accounting

Here are the key challenges to be aware of when managing accrual books for your clients:

More Complex Than Cash Basis Accounting

Accrual accounting requires tracking a variety of accounts and making periodic adjustments, unlike cash accounting, which simply records cash inflows and outflows, accrual accounting involves managing AR and AP, prepaid expenses and deferred revenue, amortization and depreciation schedules, period-end adjustments and reversing entries, and estimates and provisions.

Because of this, the bookkeeping process is more involved. You need experienced staff, reliable documentation, and structured workflows to maintain accuracy.

Also switching a client from cash to accrual often involves complex restatements, catch‑up entries, and reconciliation of balances going back months or years.

Requires Careful Record-Keeping

Accrual accounting depends on accurate, timely documentation. Each journal entry needs clear support, such as a contract or delivery confirmation for earned revenue, an amortization table for prepaid expenses or a payroll schedule or invoice for accrued liabilities.

If your team misses deadlines, mistimes entries, or fails to reverse accruals properly, financial reports will be off. This can distort margins, affect tax filings, or trigger unnecessary rework.

Can Obscure Short-Term Cash Flow Issues

Accrual accounting shows how profitable a business is, but not how much cash it actually has. A client might show a profit on paper while struggling to cover payroll because the revenue is tied up in unpaid invoices.

This disconnect can lead to poor decisions if clients don’t monitor cash flow alongside their income statement. That’s why it’s important to pair accrual reports with real-time cash flow tracking and help clients understand the difference between profit and liquidity.

Examples of Accrual Accounting in Practice

Below are three real-world scenarios to show how accrual accounting works in client settings. These examples can help your team understand how to apply accrual principles accurately.

1. Service Firm Bills in December, Gets Paid in January

Say you manage the books for a consultancy. They complete a $5,000 deliverable on December 20 and invoice it the same day with Net 30 terms and the customer pays on January 15.

Accrual treatment:

- December 20: Record revenue and AR

- Debit: Accounts Receivable $5,000

- Credit: Revenue $5,000

- January 15 – Record payment

- Debit: Cash $5,000

- Credit: Accounts Receivable $5,000

(This clears the receivable once payment is received.)

Result: The $5,000 revenue appears on December’s income statement, even though the client didn’t get paid until January. This gives a more accurate view of December’s performance and updates the AR aging report until payment arrives.

2. Business Uses Supplies in August, Gets Invoice in September

One of your clients, say a small retail business, uses $3,000 worth of packaging supplies in August. The supplier ships the goods on August 25, but doesn’t issue the invoice until September 5, and the client pays on September 20.

Accrual treatment:

- August 31: Record expense and AP

- Debit: Supplies expense $3,000

- Credit: AP $3,000

- September 20: Record payment

- Debit: AP $3,000

- Credit: Cash $3,000

(This clears the liability when the invoice is paid.)

Result: The $3,000 expense is correctly recorded in August—the month the supplies were used—giving an accurate view of that month’s costs and margins, even though the invoice and payment came later.

3. Subscription Services Recognizing Monthly Revenue

A SaaS client sells a 12-month subscription for $12,000, paid in full on January 1.

Accrual treatment:

- January 1: Record cash received and deferred revenue

- Debit: Cash $12,000

- Credit: Deferred Revenue $12,000

- Each month (January–December): Recognize earned revenue

- Debit: Deferred Revenue $1,000

- Credit: Revenue $1,000

(Revenue is recognized evenly across the service period.)

Result: The client recognizes $1,000 in revenue each month. This aligns income with service delivery and avoids overstating January’s revenue. By December, all $12,000 has been recognized properly, and the deferred revenue balance is $0.

Best Practices for Firms Using Accrual Accounting

Here are six best practices to make accrual accounting more accurate and efficient in your firm.

Standardize Client Onboarding with an Accrual Focus

Start every engagement with a clear, standardized onboarding process. This reduces confusion, speeds up implementation, and ensures every client’s books are accrual-ready from day one. Your onboarding process should include collecting necessary information, setting up the client’s chart of accounts (CoA), documenting revenue and expense recognition rules, establishing closing and review expectations, etc

This ensures your reports stay consistent and audit-ready and makes it easier for anyone on your team to take over the account later.

Train Staff on Accrual Rules and Adjustments

Many bookkeeping errors come from team members not fully understanding how to apply accrual principles, especially when entries don’t involve cash. That’s why it’s important to educate them on what the accrual principle is. Hold regular training sessions on revenue recognition, matching, cutoff procedures, and adjusting entries (prepaid, accruals, deferrals).

You can also pair newer team members with experienced reviewers until they consistently meet your quality standards. Keep internal guides or SOPs updated so your training stays consistent as your team grows.

Ensure Compliance With GAAP and IRS Regulations

Accrual accounting is GAAP-preferred and often IRS-mandated for businesses with inventory or revenue above specific thresholds.

To keep your clients compliant:

- Follow GAAP standards for revenue recognition (ASC 606) and expense matching.

- Maintain clear documentation to support accrual entries.

- Track and reconcile book-to-tax differences regularly so your tax filings align with accounting records.

- Document your policies and keep them updated for audit prep, lender requests, or due diligence.

Automate Tracking of AR, AP, and Deferred Items

Manual tracking of accruals can quickly lead to errors or wasted time. That’s why it’s important to automate the process.

Use software like Netsuite Bill Capture or Dext to auto-capture vendor and client invoices to reduce manual data entry and ensure AR and AP are always up to date. Also set up recurring journal entries for items like prepaid expenses, deferred revenue, and monthly accruals so they post automatically at the start or end of each period.

Align Reporting With Client Business Models

Different industries have different accrual needs. Customize your reporting based on how each client earns and spends money:

- Service firms: Emphasize WIP (Work in Progress), unbilled revenue, and realization rates.

- Subscription businesses: Track deferred revenue, MRR/ARR, and churn.

- Retail or inventory-based businesses: Focus on COGS, inventory valuation, and vendor accruals.

Standardize Closing Processes With Checklists

A standardized checklist reduces errors and keeps your month-end close process consistent across all clients. It also makes it easier to train new team members and delegate tasks.

Store your month-end checklist in a shared, easily accessible location like Financial Cents so your entire team can follow the same process each month without confusion or delay.

Manage & Standardize all Your Accounting Projects With Financial Cents

Accrual accounting records revenue when it’s earned and expenses when they’re incurred giving your clients a more accurate view of their financial performance than cash accounting ever could. It’s also the preferred method under GAAP because it aligns revenue and expenses with the periods they actually relate to, supports smarter business decisions, and ensures compliance with financial reporting standards.

While managing accrual accounting takes more effort, especially across multiple clients, it offers a more accurate view of a company’s financial performance than cash accounting.

If you’re looking for a tool to help manage accrual projects, meet deadlines, and stay organized, Financial Cents is a great option. Here are some of its features:

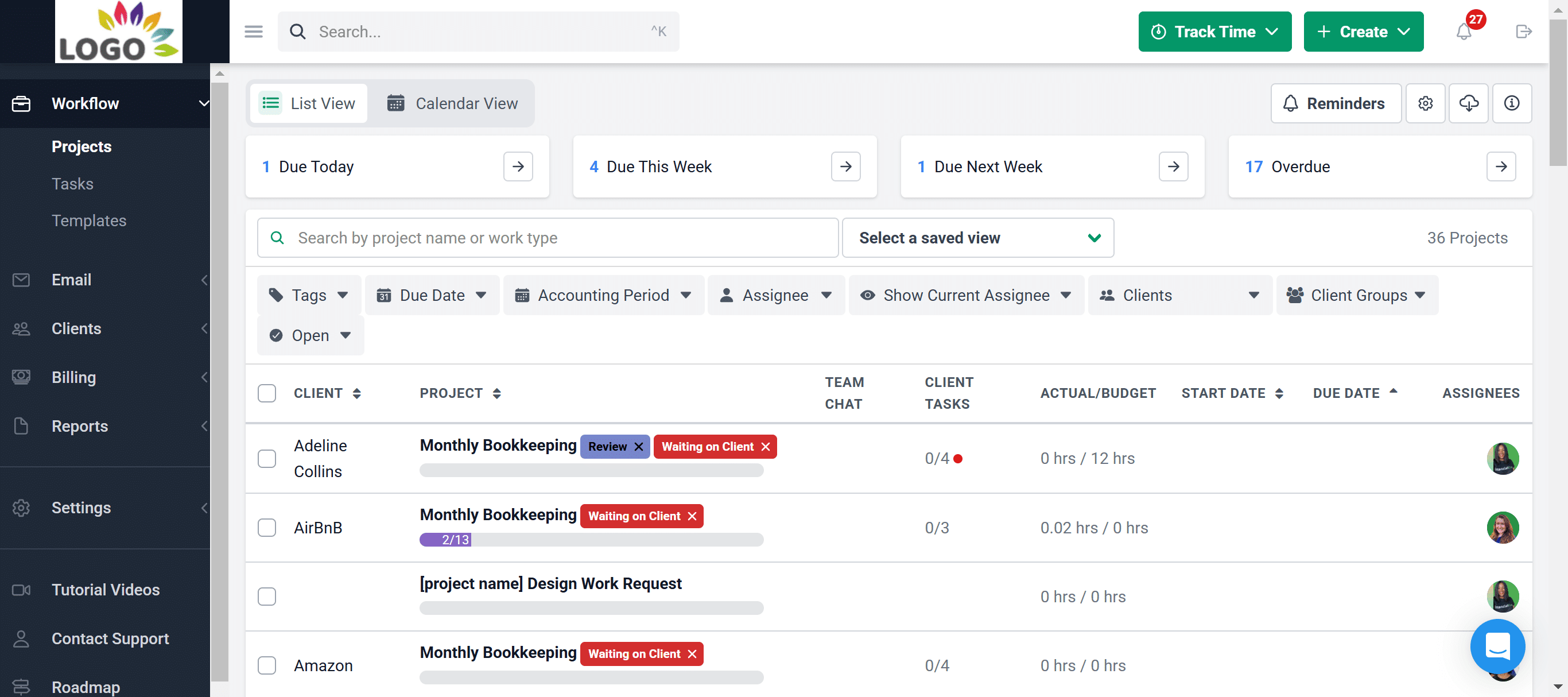

- Workflow management and automation

Financial Cents gives you a central dashboard to track all projects, tasks, deadlines, and team assignments. This makes it easy to assess team capacity, prioritize urgent work, and keep client deliverables on schedule. If you manage recurring work, like month-end close or payroll, Financial Cents can automatically generate those projects so you don’t have to recreate them manually each time.

- Easy Client Document Collection

Financial Cents makes it easier to collect documents from clients through its secure client portal. You can request the specific files you need, and clients can upload them directly to the portal. No email attachments or back-and-forth needed. You can also set automated reminders to follow up at regular intervals until clients complete your request, ensuring you get everything on time without manual chasing.

- Centralized communication

Communication and collaboration is seamless with Financial Cents. All emails, notes, internal chats, and project comments are stored in the client’s record, so you don’t need to juggle multiple tools or search through inboxes. Anyone on your team can quickly get up to speed on a client’s status without needing a full handoff.

With features like @mentions, team chat, and in-app comments, collaboration stays clear, organized, and tied directly to the work in progress.

Want to stay organized and meet deadlines? Try Financial Cents’ for free.