Tax season is stressful for just about everyone but it’s especially overwhelming for self-employed individuals. Unlike W-2 employees whose employers handle most of the paperwork, sole proprietors, freelancers, and gig workers are responsible for reporting their own income and expenses. And that means understanding exactly which forms to file and how to do it right.

One of the most important forms for self-employed taxpayers is Schedule C (Form 1040). It’s the IRS form used to report income and deductible expenses from a sole proprietorship or single-member LLC. If your clients earn income through a business they operate as individuals, they likely need to file Schedule C with their personal tax return.

In fact, Schedule C is one of the most frequently filed forms during tax season. The IRS received over 35 million Schedule C filings in 2022, roughly 22% of all 161,336,659 individual returns filed that year

In this guide, we’ll walk through everything you need to know about Schedule C, who needs it, and how to file it.

What is Schedule C?

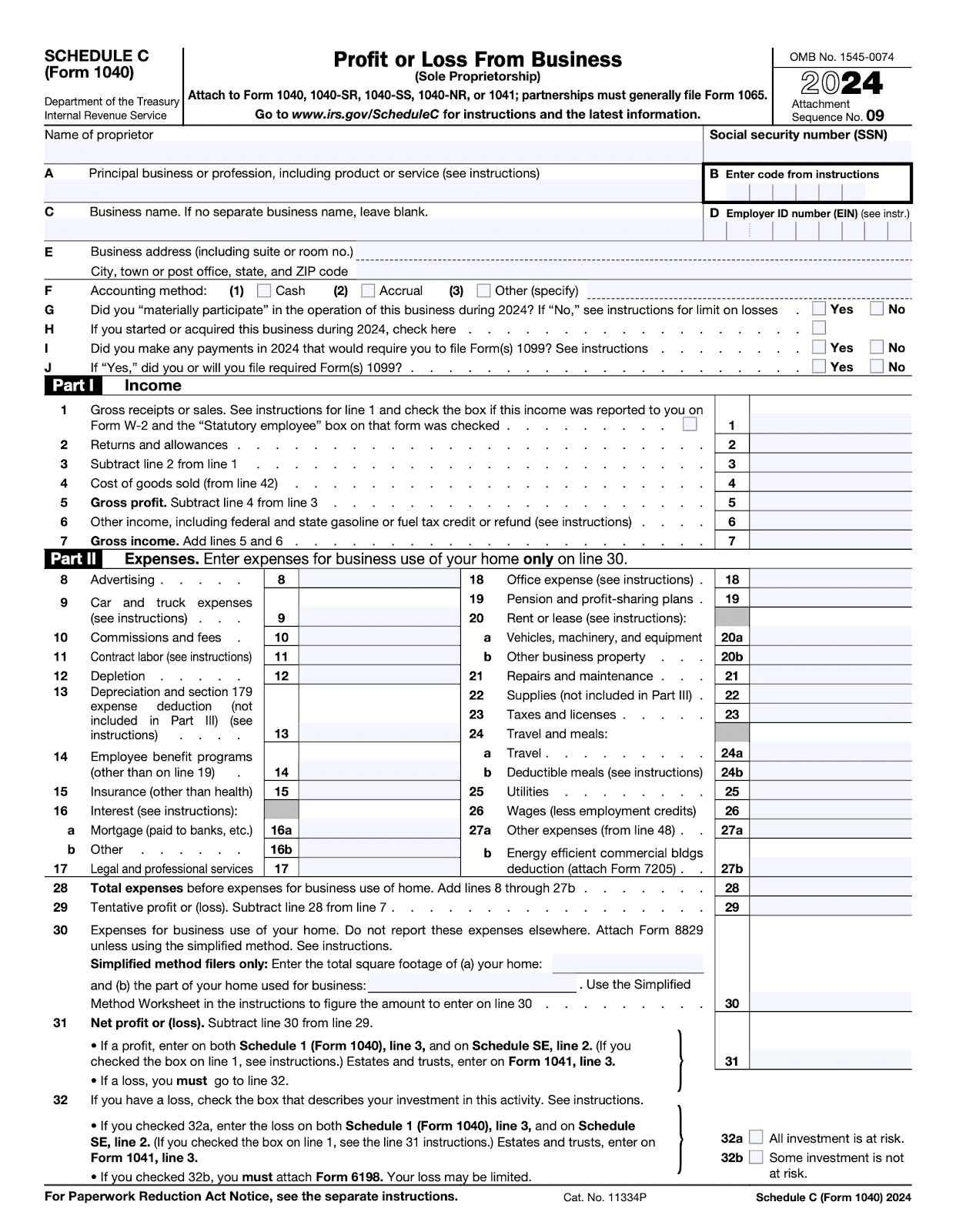

Schedule C (Form 1040), Profit or Loss From Business, is the IRS tax form used by sole proprietors and certain single-member LLCs to report their business income and expenses. It’s how self-employed individuals tell the IRS how much money they made (or lost) from their business during the tax year.

The form’s main function is to calculate net profit or loss from business activity by listing gross income and then subtracting allowable business expenses like office supplies, travel, or professional services. The result is net income, which is subject to self-employment taxes in addition to the regular tax.

It’s important to note that Schedule C is filed as part of the client’s personal tax return (Form 1040). If the business shows a profit, it increases total taxable income. If it shows a loss, it can sometimes reduce overall tax liability, though certain limits apply.

Here’s what the Schedule C form looks like (2024 version):

Who Needs to File Schedule C Tax Form?

If your client fits any of the categories below, you’ll most likely need to prepare Schedule C for them.

Sole Proprietors

These are clients who operate a business on their own without forming a separate legal entity like a corporation or partnership. In most cases, there’s no formal registration required, just a business license or local permit if applicable.

Because the business is legally indistinct from the individual, all income and expenses pass through to the personal return. The IRS requires Schedule C to report the business activity, which then flows into Form 1040 via Schedule 1.

Independent Contractors

Clients in this category provide services to others as non-employees, typically paid via Form 1099-NEC instead of a W-2.

They must file Schedule C to report income and deduct business-related expenses. The net profit from Schedule C is also used to calculate self-employment tax (Social Security and Medicare), which isn’t withheld like it would be for traditional employees.

Freelancers and Gig Workers

This overlaps with independent contractors but often includes project-based or platform-based work like writing, rideshare driving, food delivery, or content creation.

Even if the work is part-time or seasonal, Schedule C is required as long as the client is operating with a profit motive and some regularity.

The IRS treats this as self-employment income, requiring both income reporting and eligible deductions. You’ll also use the net profit figure to determine self-employment tax liability (Social Security + Medicare).

Single-Member LLCs

If your client owns a single-member LLC and hasn’t elected to be taxed as an S or C corp, the IRS treats the entity as disregarded for federal tax purposes. That means the business activity is reported on Schedule C, just like a sole proprietor.

If the client has made an election (via Form 8832 or Form 2553), they’ll need to file corporate tax forms instead of Schedule C.

Side Hustles or Part-Time Businesses

Clients often assume casual or part-time business income doesn’t require full tax reporting, but if the activity has a profit motive, involves repeat transactions, or incurs deductible expenses, it must be reported on Schedule C.

Even if the income is secondary to a full-time job, it still counts. If net earnings reach $400 or more, it may also trigger self-employment tax.

Who Does Not Need to File Schedule C

That said, it’s equally important to recognize when Schedule C doesn’t apply to avoid IRS issues or unnecessary filings. Here are common categories where Schedule C isn’t the right form:

Partnerships

These entities file Form 1065. Individual partners receive a Schedule K‑1, which reports their share of the business income or loss. That income is then included on the partner’s 1040, but Schedule C is not used.

Corporations, S and C

Corporations file separate business tax returns, Form 1120 for C-corps or 1120‑S for S-corps. Even if the owner works in the business, their wages and distributions are taxed differently. Expenses are deducted at the corporate level, not on a Schedule C.

Hobby Income

If the client’s activity doesn’t meet the IRS definition of a business (i.e., there’s no profit motive, and the activity is irregular or informal), it may be considered a hobby. In which case, income is reported differently (often on Schedule 1 of Form 1040) and deductions are limited. You need to assess facts: how often the activity occurs, how much effort/time is invested, whether business records are kept, whether there’s a business plan, etc

Sole Proprietor Without Profit or Loss All Year

According to IRS guidance, if a business was inactive, meaning it had no income and no deductible expenses during the full year, you do not need to file Schedule C. However, if there were any payments related to the business (e.g. insurance, reimbursements, etc.), those must still be reported.

What Information Do You Need to File Schedule C?

When preparing Schedule C for clients, it’s essential to collect the right information up front. Having these details ready makes the process faster, reduces errors, and ensures you’re claiming all allowable deductions under IRS rules.

Here are all the details you need for the process.

Personal information

These identifiers tie the Schedule C to the individual taxpayer’s Form 1040.

- Client’s full name

- Social Security Number (SSN)

- Employer Identification Number (EIN), if they have one

Business Information

This section determines how income and expenses are recognized, and how the IRS classifies the business.

- Business name

- Business address

- Principal business or profession (what the client sells or offers)

- Business activity code(found at the back of the Schedule C instructions),

- Accounting method (cash, accrual, or other)

- Date business started (if it began during the year)

Income Details

You’re reporting all business income here, whether or not it was reported on a 1099.

- Gross receipts or sales (from all sources)

- Cost of goods sold (which you’ll calculate and fill in later in the form)

- Forms 1099‑NEC, 1099‑K, or other 1099s received

- Other income (e.g., fuel tax credits or refunds)

- Returns or allowances, if applicable

Expense records

Receipts, statements, or reports for expenses such as:

- Advertising and marketing

- Supplies and office expenses

- Travel and meals

- Commissions and fees

- Legal and professional services

- Rent or utilities

- Software subscriptions

- Insurance, etc

Home office expenses for business use go only on Line 30 (not in the general expense categories)

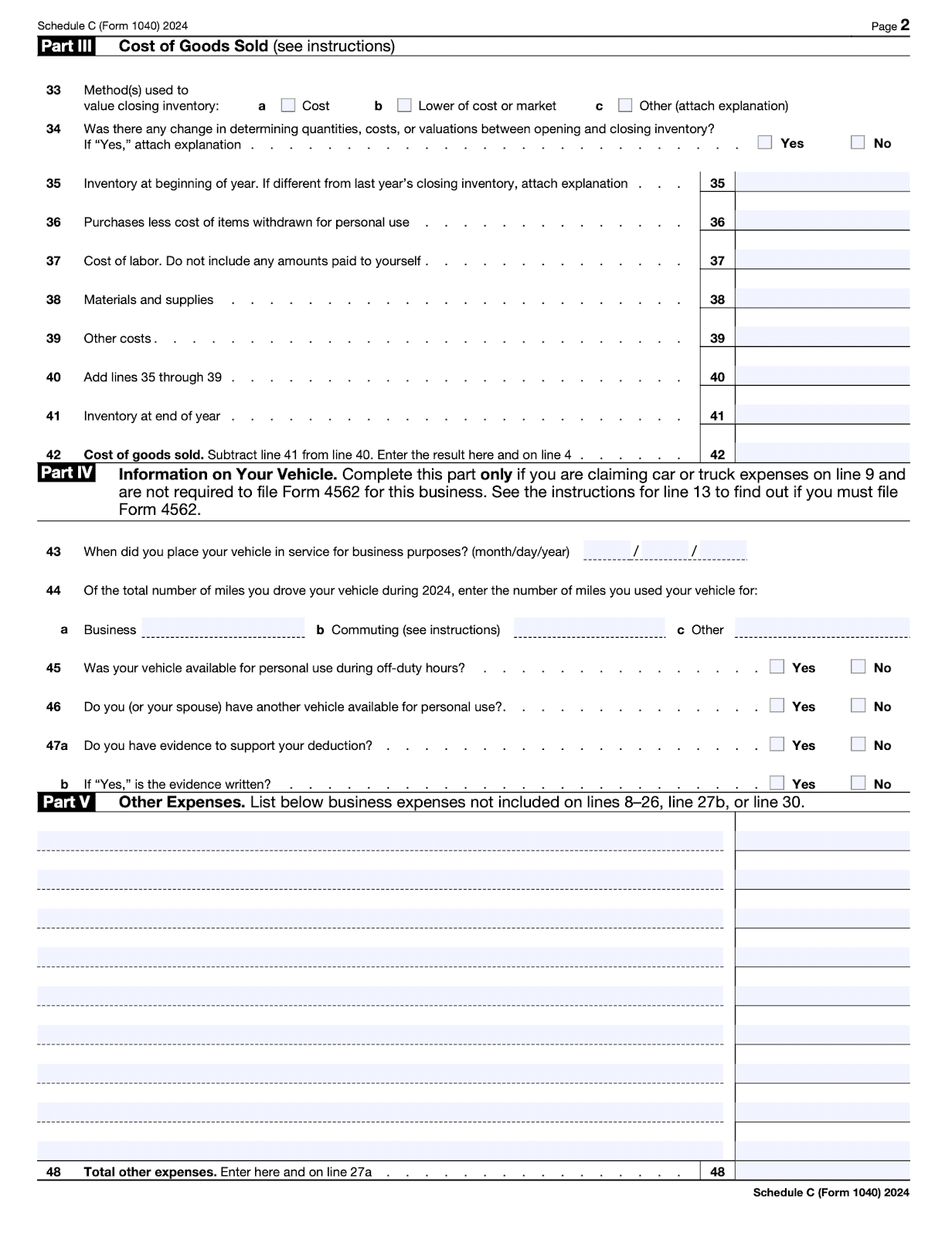

Cost of Goods Sold (if applicable)

If your client sells products or holds inventory, gather:

- Method used to value closing inventory (cost, lower of cost/market or other, etc.)

- Beginning and ending inventory

- Purchases (minus personal withdrawals)

- Cost of labor (exclude owner compensation)

- Materials and supplies

- Other costs

To get the cost of goods sold, subtract inventory costs from the sum of all the other costs, and enter it in the provided box.

Vehicle Expenses if applicable

If the client is claiming car or truck expenses on Line 9, but is not required to file Form 4562, collect:

- Date vehicle was placed in service for business purposes

- Total business miles vs. commuting miles

- Whether the vehicle is available for personal use during off-duty hours

- If they (or their spouse) have another vehicle available for personal use

- Mileage logs or other evidence to support deductions

Other expenses

Any legitimate business expenses that don’t fit into the standard categories in the expenses section of the form.

Pro Tip: Use a Tax Preparer Checklist

Because Schedule C pulls information from so many sources, it’s easy to forget to collect certain information. That’s why every firm should use a Tax Preparer Checklist to request information from clients. It helps:

- Reduce back-and-forth emails

- Standardize your documentation process

- Ensure you don’t miss critical details

Key Components of a Schedule C: Income and Expenses

Schedule C is divided into several parts, but Part I (Income) and Part II (Expenses) are the most important sections for determining your client’s net business profit or loss.

Here’s what goes into each part and what you need to track to file it correctly.

Gross Income (Part I)

This section includes all income the business earned during the tax year, regardless of how the client was paid or whether a 1099 was issued.

Make sure to include:

- Cash receipts

- Check payments

- Credit card sales

- Online platform payouts

- Bartered services or goods (must be reported at fair market value)

- Income reported on Form 1099‑NEC

While 1099‑NEC forms are helpful for documentation, they don’t capture everything. Clients must report all income earned, not just what’s reported to the IRS. The IRS matches 1099s with filed returns, so reported amounts must align

Also, if your client issued refunds or had product returns, those should also be reported as returns and allowances to reduce gross receipts.

Business Expenses (Part II)

This section is where your client’s business expenses are deducted from income to calculate net profit or loss. Accurate tracking and categorization of these expenses helps reduce taxable income and ensures IRS compliance.

Here are some of the most common and relevant expense categories your firm should track:

- Advertising & Marketing: Covers costs related to promoting the business, such as website hosting, domain registration, online ads, business cards, flyers, and print ads.

- Office Supplies: These are the everyday tools needed to run the business, like pens, paper, postage, printer ink, and small office tools.

- Home Office Deduction: If your client works from home and has a dedicated workspace, they may qualify to deduct a portion of rent or mortgage interest, utilities, repairs and maintenance.

- Travel and Meals: Travel must be business-related and take place away from the client’s tax home. Deductible expenses include: flights, lodging, rental cars/taxis, and 50% of qualifying business meals.

- Professional Fees: This includes services and tools used to operate the business professionally and legally, like legal and accounting fees, bookkeeping or payroll services, tax preparation fees related to the business, software subscriptions, and business licenses and membership dues.

Download Schedule the Schedule C Form from IRS

Common Mistakes to Avoid When Filing Schedule C

These are some of the most common issues to watch for when filing Schedule C.

Mixing Personal and Business Expenses

Many people often use personal accounts for business purchases or pay personal expenses from business funds. This blurs the line between deductible and non-deductible activity and makes audits harder to defend. To keep things clean, encourage clients to maintain separate bank and credit card accounts for their business or, at the very least, clearly document and categorize any mixed-use transactions.

Not Keeping Receipts or Records

A lack of records is one of the most common red flags. The IRS requires receipts, invoices, bank statements, canceled checks, and other documentation to support deductions. Without them, the IRS can deny or delay deductions. Encourage clients to adopt monthly or quarterly bookkeeping habits so they’re not scrambling during tax season.

Misclassifying Income or Expenses

Mislabeling income or putting expenses in the wrong category can either understate or overstate taxable income, both of which raise IRS flags.

Examples include:

- Forgetting to report cash or non-1099 income

- Overstating home office or vehicle usage

- Misclassifying personal purchases as business deductions

As their preparer, review income and expense reports closely and double-check high-risk areas like travel, meals, and vehicle use.

Forgetting Self-Employment Tax Implications

It’s easy for clients to focus only on income tax and forget about self-employment tax, which includes both the employer and employee portions of Social Security and Medicare. Net profit from Schedule C is subject to this tax, and if clients haven’t set funds aside, they may face a surprise bill.

To avoid this, help your clients estimate their self-employment tax during the year and claim the deductible portion of self-employment tax when calculating Adjusted Gross Income.

Stay Organized for Stress-Free Filing

If there’s one thing that makes or breaks tax season, it’s organization. Whether you’re filing one Schedule C or managing hundreds, accurate and consistent recordkeeping is the only way to stay compliant and minimize error during filing.

Throughout this guide, we’ve covered what information you need to collect to file Schedule C and how to file it, but none of it works if you don’t have a good workflow.

That’s where Financial Cents comes in.

Financial Cents is an accounting practice management software that helps firms like manage the tax prep process from end to end. With it, you can:

- Manage and automate your workflows: The Financial Cents Workflow Dashboard shows all your tax projects in one place, sorted by urgency, status, and assigned staff. You can instantly see what’s been done, what’s left, and who’s responsible without chasing updates manually.

Built-in workflow filters let you quickly find what you’re looking for, even during the busiest weeks of tax season. You can use prebuilt workflow templates to save time on repetitive processes, set up recurring projects that automatically regenerate when due, and apply task dependencies to make sure everything is completed in the right order.

- Track deadlines: The Due Date feature shows upcoming deadlines at a glance, helping you allocate resources where they’re needed most. You can filter by due dates, set internal deadlines for early reviews, and push dates forward if extensions are filed. You’ll also get automated reminders so your team never misses a submission.

- Request documents and follow up automatically: Through the client portal, your clients can upload requested documents directly. Once you’ve sent a request, Financial Cents follows up automatically with reminders via email or SMS at set intervals.

- Collaborate internally: Team members can leave comments, share notes, and even pin relevant client emails to the right projects so important details don’t fall through the cracks. Everyone stays aligned on what needs to be done, who’s doing it, and when it’s due.

- Track time and bill accurately: Financial Cents helps you track exactly how much time your team spends on tax projects, and flag which hours are billable or non-billable.

You can also create one-off or recurring invoices, sync with QuickBooks Online, accept ACH or card payments, and automate invoice reminders so you don’t waste time chasing payments during the busiest season.

If you’re tired of chasing documents, guessing who’s doing what, or stressing over deadlines, Financial Cents helps you organize and manage your entire workflow so you never miss a client deadline again.

Use Financial Cents to manage your processes.