Finding new clients takes time, money, and a lot of effort. You’re competing for attention out of a dozen other firms, giving free consultations, following up endlessly… meanwhile, your existing clients are right there and with the right nurturing, can make you a lot of money. Keeping them happy is easier and also way more profitable in the long run than acquiring new customers. That’s because satisfied clients stick around longer, refer you to others, and are more likely to buy additional services.

But here’s the thing: client expectations have changed. In this age, they want faster responses, less back-and-forth, and more visibility into the work you’re doing for them.

That’s where modern accounting tools come in. They help you stay organized, deliver a smoother client experience, and stay ahead of deadlines. In this article, we’ll explore exactly how the right tools can make your firm more efficient, more transparent, and more client-friendly, so you can keep the clients you’ve worked hard to earn.

The Shifting Client Expectations

Today’s accounting clients are used to real-time updates from their banking apps, same-day deliveries, and instant customer support in other parts of their lives. So, it’s only natural they expect the same level of responsiveness from their accountant. They want quick answers, real-time financial insights, and an easy way to share and access documents, without the back-and-forth email chains.

Client portals, for example, are now a “must-have” for firms. They allow clients to upload documents, access reports, review invoices, and even ask questions, all in one place and on their own schedule. Automated processes, like reminders for upcoming tax deadlines or recurring invoicing, also reduce friction and show clients that you’re on top of things.

On the flip side, sticking to outdated practices, like relying solely on manual data entry or emailing PDFs can cause unnecessary frustration. It can also make your firm seem less professional and less efficient.

Modern clients are busy, tech-savvy, and expect a certain level of convenience. If your firm isn’t offering that, it won’t take long for them to start looking elsewhere.

How Modern Accounting Tools Improve Client Retention

The right accounting tool offers so many benefits to your firm, including:

Enhanced Communication & Collaboration

Effective client communication management is a crucial aspect of maintaining a smooth workflow. But without the right tools, it can quickly get overwhelming. Clients forget to send documents on time, emails get lost in crowded inboxes, and your team spends more time following up than actually doing the work.

This is where modern tools like Financial Cents come in to make a huge difference.

Automated client reminders—sent via email, in-app messages, or client task comments—help speed up document collection and drastically reduce the number of follow-ups your team needs to do. This streamlined process means clients know exactly when and what to send, and you get the info you need faster.

Client portals also make everything even easier. Clients can log in (they don’t need to remember a password; they get a quick login code via email or text), upload documents, and communicate with you in-app. This not only improves response times but also keeps everything organized, so there’s no digging through endless email chains to find the right file.

The result? Faster, more efficient communication that keeps clients happy and your team focused on what really matters.

Improved Workflow & Efficiency

Workflow is one of the biggest challenges firms face. In fact, 55.5% of firms we surveyed in our 2025 State of Accounting Workflow & Automation Report said they experience workflow inefficiencies like chasing clients down for information, manual administrative tasks, and onboarding new clients.

Poor workflow affects the client’s experience. It can cause you to miss deadlines, delay responses, or make errors, none of which inspires confidence or keeps clients coming back. “A broken workflow (or a bad one) = unhappy clients and an unhappy team,” says Dawn Brolin, CPA CF. On the other hand, “a good workflow that is consistent, clear, and effective will positively impact your relationship with the clients,” she concludes.

Modern accounting tools help create good workflows. With Financial Cents, for example, you can create standardized workflows for different services, assign tasks to team members, and set up automatic reminders for client requests. That way, nothing gets missed, and your team knows exactly what needs to be done and when.

You can also automate recurring work in Financial Cents to save time and stay on top of deadlines. For example, if you have a monthly bookkeeping project, the system can automatically recreate it each month, without you needing to do anything.

Recurring projects are triggered in two ways:

- When a project is marked complete

- When it becomes overdue

Once triggered, a new copy of the project is created for the next period. So if you close out January’s project, February’s will be generated automatically.

Greater Transparency & Trust

Clients want to feel like their work is in good hands. That means knowing what’s being worked on, what’s done, and where things stand at any given time. If they’re constantly left wondering, it can create doubt, even if you’re getting the work done behind the scenes.

Financial Cents helps you maintain transparency with clients by providing them with visibility into their projects. With client-facing work statuses, your clients can log in and check the status of their work anytime, whether it’s “waiting on client,” “in progress,” or “done.” They don’t have to follow up or wonder if things are falling behind; they get clear visibility into what’s done, what’s in progress, and what’s waiting on them.

This kind of transparency shows that you’re organized, dependable, and on top of your work. It gives clients peace of mind and helps build long-term trust, something that’s hard to win back once it’s lost.

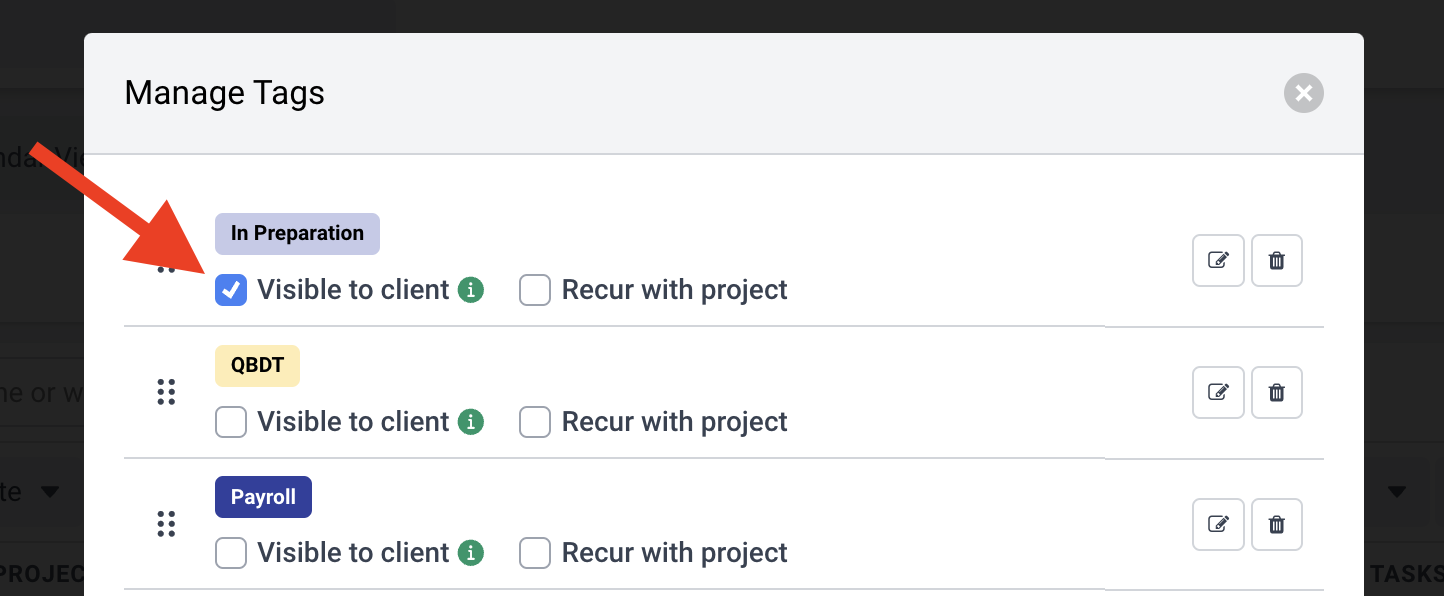

To add a tag to projects so clients can see your progress, first select “visible to client”:

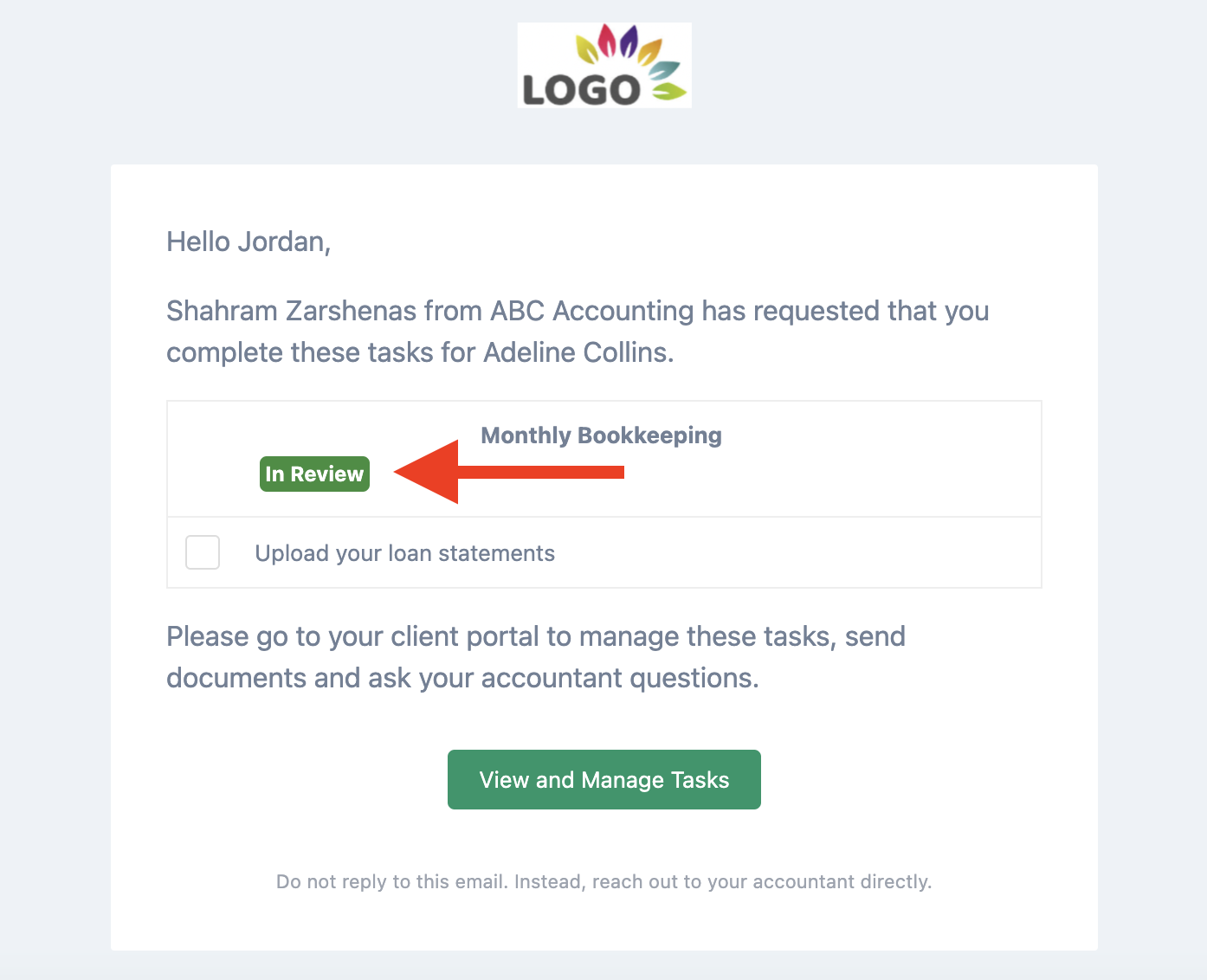

This will ensure the tag automatically displays on any client tasks in the client portal and in the client tasks email notifications:

They’ll also see the tag in their email notifications:

Personalized Client Experience

Every client is a little different. Some need weekly bookkeeping. Others just want a quarterly review. A few might be on your highest-tier package and expect faster turnaround times. If you’re treating everyone the same—same workflows, same timelines, same communication—it can cause clients to feel like they’re just another name in your system. And when this happens, they’re more likely to look for a firm that gives them more attention or better fits their expectations.

On the other hand, when clients feel like your processes are built around their needs, they’re more likely to stay loyal and even refer others.

But it’s difficult to personalize the client experience at scale without it overwhelming your team. Financial Cents makes it easier to do so. You can:

- Build specific workflows for each type of service

- Set deadlines based on how often each client needs work done

- Assign work to the right team members

- Keep and pin specific notes on how each client likes to work

- Set up specific task reminders for them for clients

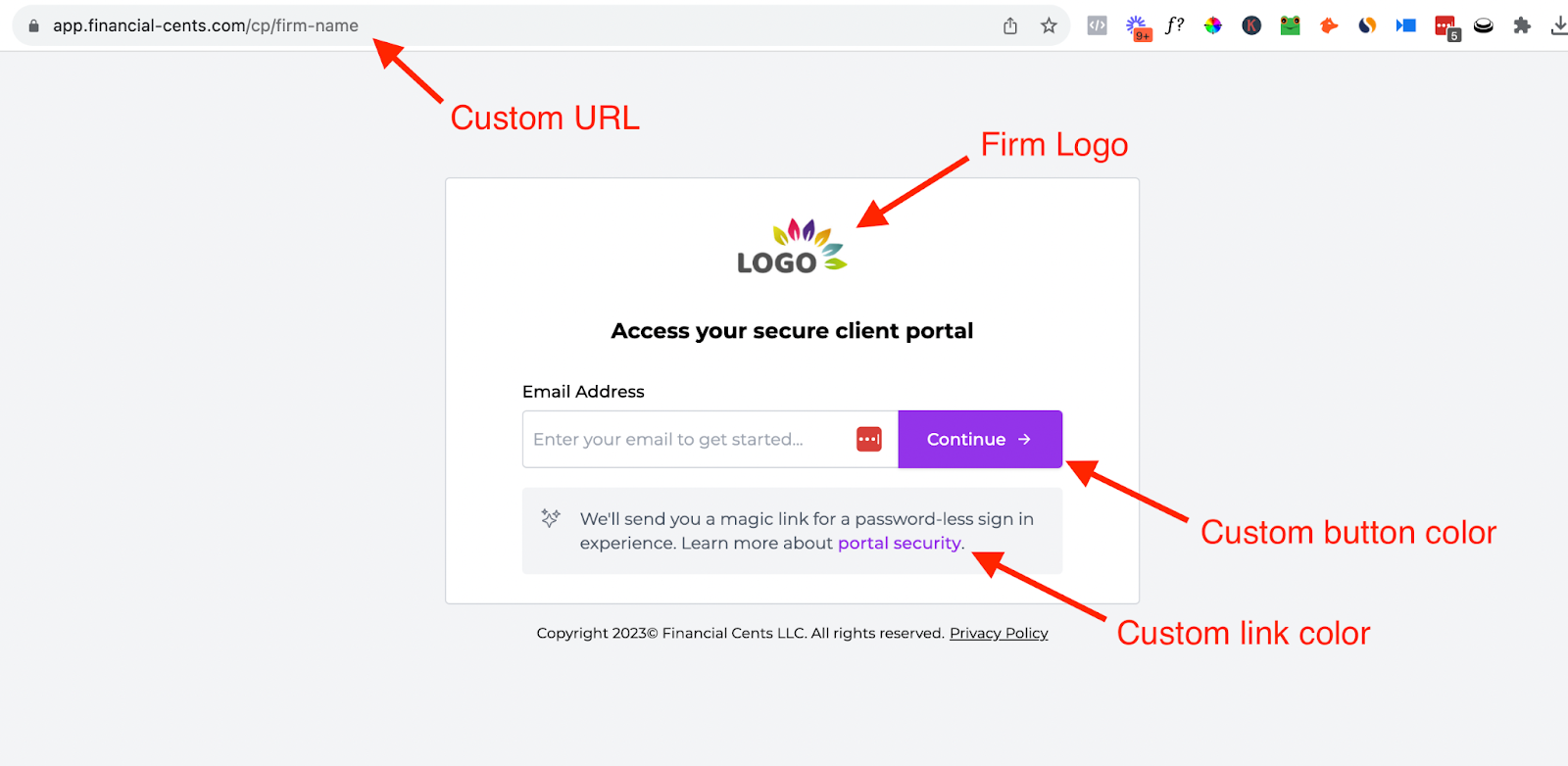

There’s also a custom-branded client portal that makes your firm look polished and consistent with your logo, your colors, and your domain. It’s a small thing, but it makes the experience feel more personal.

And since the portal lets you send and receive files, collect e-signatures, and even message clients directly, it’s super easy to stay in touch and respond quickly when they need something.

In short, Financial Cents gives you the tools to show up for each client in a way that feels thoughtful and organized, which goes a long way in building trust and keeping them around.

Compliance & Data Security

These days, clients are (rightfully) more concerned about how you’re handling their data. A breach could lead to financial loss, legal consequences, and serious damage to your firm’s reputation.

According to the 2024 Verizon Data Breach Investigations Report, there was a 180% increase in breaches involving the exploitation of system vulnerabilities compared to the previous year.

Now, a data breach doesn’t always mean a hacker from some foreign entity is trying to break into your firm. “It could also be, ‘Oops, I inadvertently uploaded the wrong document to the wrong client’s folder.’ It really means that information was shared with an individual who was not authorized to see it,” says Brad Messner, EA.

Note: It’s important for your firm to have a Written Information Security Plan (WISP). It includes the policies, procedures, and protocols your team follows to prevent data breaches, respond to security incidents, and comply with privacy regulations. Here’s a free template you can use.

To protect your clients’ most sensitive financial information use tools that are built with accountants and bookkeepers security in mind, like Financial Cents.

One of the reasons why I do really love Financial Cents, is it makes it so easy you don't even recognize that they're applying security behind the scenes at every step,"

BradFinancial Cents helps you manage your workflow and securely share files with your team and clients. It uses OpenSSL to provide AES-256 and AES-128 encryption, and all encrypted values are signed using a message authentication code (MAC), so they can’t be modified once encrypted.

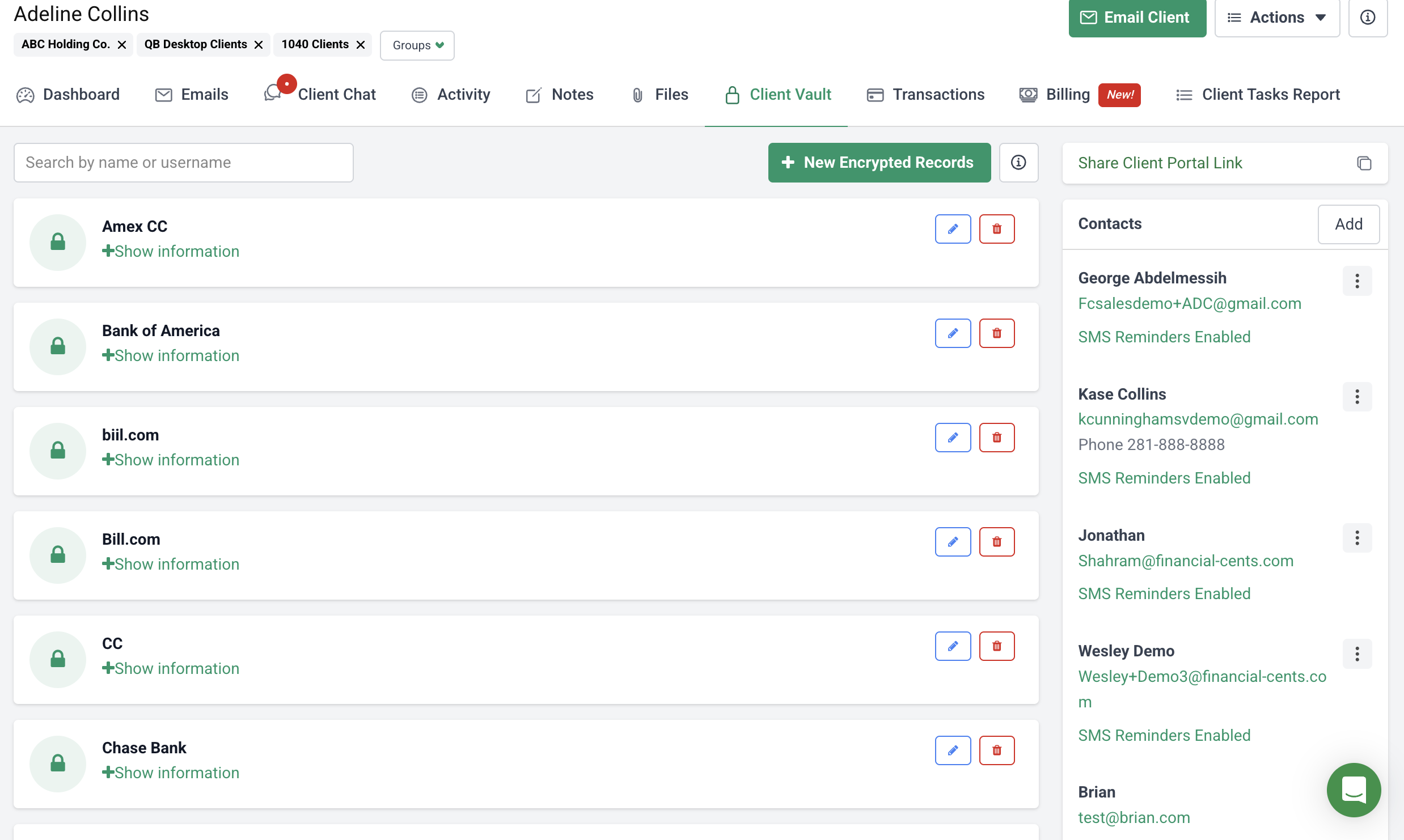

Financial Cents also has the Client Vault, which is a secure way to store and share client passwords and other sensitive information. This ensures your team has access to the data they need, without compromising security.

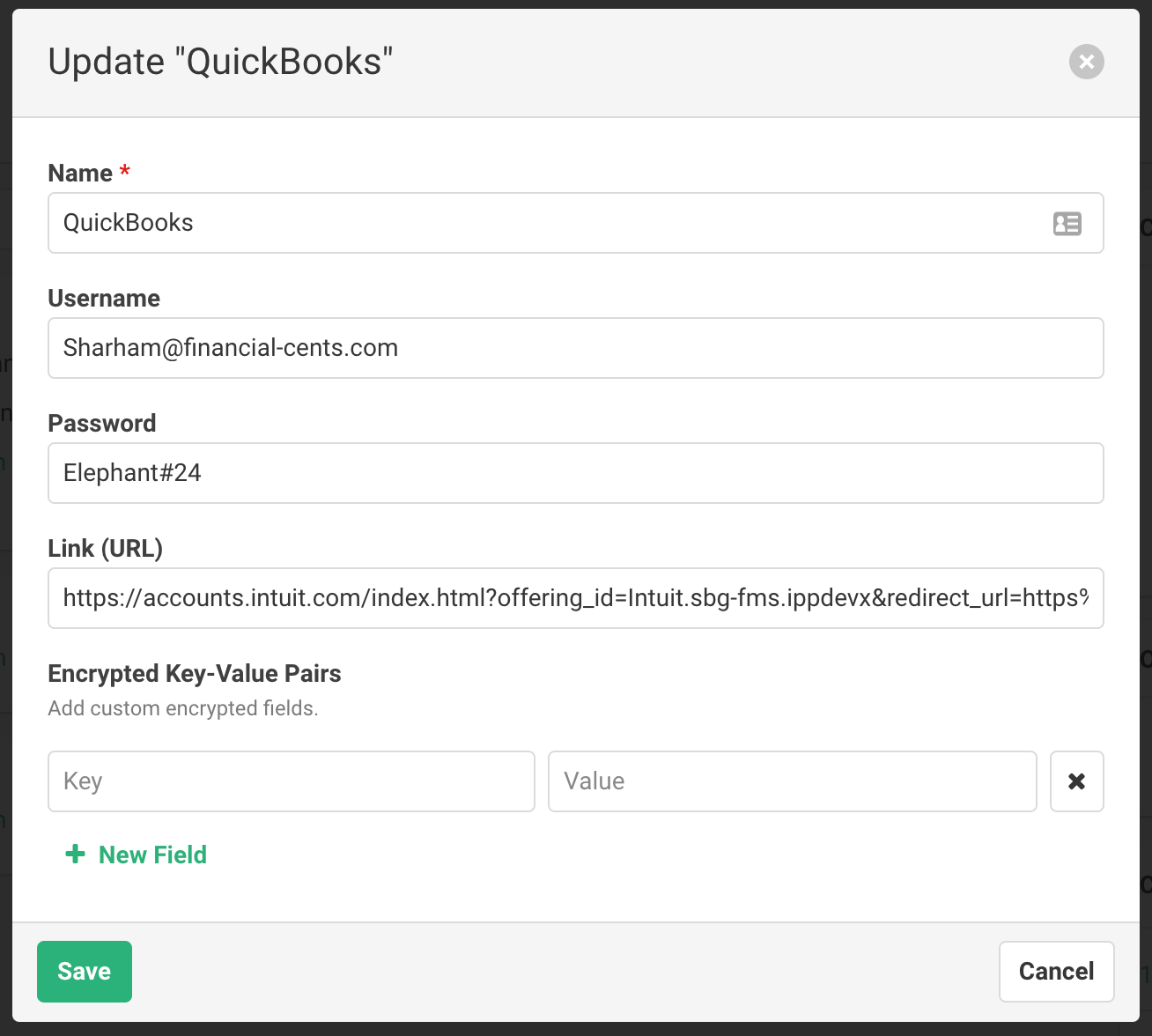

You can find the Client Vault in your Client CRM, under each client’s profile page:

To add a new encrypted record, click “+ New Encrypted Record” and input the necessary information.

- Name – Name of the app, bank, or credit card

- Username – Username for login

- Password – Password for login

- Link – Link to the app’s login page

- Encrypted Key-Value Pairs – Custom fields that store other information like security questions, etc.

With all these measures, clients don’t have to worry about who’s seeing their info or how it’s being handled. That peace of mind helps build loyalty.

You may be interested:

The Seven (7) Best Accounting Client Onboarding Software That Delivers Results

Best Practices for Using Modern Tools to Retain Clients

Modern accounting tools are powerful, but only if you use them well. Here are a few simple ways to get the most out of your software and keep clients happy long-term.

Regularly Update Clients With Progress Reports

Clients hate being in the dark. If they have to email you for updates or wonder if their books are done, that’s a bad sign. Choose a tool (like FInancial Cents) that automatically allows you to show clients what stage their work is in without you having to send manual updates. This makes clients feel taken care of and less anxious which builds trust fast.

Offer Self-Service Portals for Document Access

Sixty four percent of firms struggled with getting documents from clients according to our 2025 State of Accounting Workflow & Automation Report. They had to be chasing down clients, which slows the whole team down and increases inefficiency.

Offering clients a secure place to upload and access documents on their own makes the entire process smoother. With Financial Cents’ client portal, clients can easily log in, upload files, and download anything they need without sending a hundred back-and-forth emails or digging through old threads.

This saves time for your team and makes life easier for clients. They don’t have to wait on you to send documents or worry about lost files. Everything’s stored in one place, accessible whenever they need it.

Automate Client Reminders To Avoid Last-Minute Rushes

Manually reminding clients to send documents or respond to requests is exhausting, and there’s a chance you forget or make mistakes. That’s why you should automate these reminders so work gets done faster, and you don’t come off as pushy or disorganized.

Tools like Financial Cents let you set up automated client reminders that nudge clients without you lifting a finger. Just set a deadline on any client task, and Financial Cents will send polite reminders on a schedule (e.g., 3 days before, 1 day before, and day of). You control the frequency, so it fits your style.

Train Staff To Maximize Software Capabilities for Efficiency

Your software is only as useful as your team’s ability to use it. Invest time in training your staff to fully utilize features such as recurring workflows, task automation, and time tracking. The more confident your team is using your tech stack, the smoother things will run for your clients.

Continuously Improve Workflows Based on Client Feedback

Check in with clients from time to time: What’s working for them? What’s frustrating? Then use that feedback to update your templates, client workflows, or even the way you explain things. It also makes clients feel heard and can improve retention.

Improve Client Retention With Financial Cents

Keeping clients happy isn’t just about doing good work—it’s about how smooth and reliable the experience feels. Modern accounting tools help you provide a better customer experience. They help you communicate clearly, stay on top of deadlines, collect documents easily, and build the kind of trust that keeps clients staying year after year.

If you want to streamline your workflows and deliver a better client experience across the board, Financial Cents is a great tool to use. It’s an all-in-one practice management software built specifically for accounting and bookkeeping firms. From automated task tracking to client-friendly portals and easy-to-use workflows, it gives your team everything they need to stay organized, and gives your clients fewer reasons to leave.

Want to see how it works?