It’s that time of year again when accountants and bookkeepers like you prepare accounts and close the books for the fiscal year. They do this to ensure financial accuracy and compliance and prepare for the tax season.

However, year-end accounting is often stressful, time-consuming, and pressures teams to meet tight deadlines. An APQC survey found that 75% of companies spend up to 35 days completing the annual close.

The good news?

A well-structured checklist can streamline the process, increase efficiency, improve accuracy, and boost productivity.

In this guide, we provide a clear, step-by-step checklist covering all the key end of the year accounting tasks to complete.

Why Year-End Accounting Matters

Year-end accounting involves closing out a company’s financial activities for the fiscal year. Here are some reasons why it’s important to do it.

Financial Accuracy

Businesses carry out numerous financial transactions throughout the year, including sales, purchases, payroll, and expenses. Year-end accounting ensures you’ve recorded and reconciled each transaction correctly.

An accurate financial statement provides insight into your client’s or company’s cash flow, debts, assets, and profit margins. Armed with this information, you can:

- Get a clear picture of your client’s or company’s financial health

- Comply with regulatory requirements.

- Allocate resources efficiently

- Recommend business decisions

- Maintain stakeholders’ trust

Tax Preparation

Tax season usually starts in the first month of the year, so it’s best to be prepared beforehand to avoid delays and penalties.

Addressing your tax responsibilities during year-end accounting ensures all necessary financial documents you’ll need are in place before filing deadlines.

Business Planning

Reviewing your firm’s financial performance at the close of the fiscal year allows you to identify trends, profitability, and areas of improvement.

This valuable insight helps you set realistic goals, forecast revenue, allocate resources efficiently, and make strategic decisions that could drive growth in the coming year.

Compliance

Reviewing and reconciling financial records allows you to produce accurate financial statements that are compliant with applicable accounting standards, regulatory requirements, and tax regulations.

That way, you can avoid legal issues and IRS penalties, which are costly and time-wasting.

The Complete Year-End Accounting Checklist

Human errors, missing documents, and miscommunication are common challenges accountants face when closing the books.

But a checklist resolves most of these problems. It provides you with a step-by-step list of essential tasks to complete for this process, and they include:

Step 1. Receive year-end statements from client

Your client’s year-end statements are crucial as they summarize financial activities over the past 12 months. When requesting these statements from clients, set clear submission deadlines and verify all documents are complete to prevent delay.

The documents to collect include the following:

- Bank statements

- Credit card statements

- Loan statements

- Year End tax statements (1098, 1099, W2, etc.)

- Last Year tax return

Step 2. Ensure monthly bookkeeping is complete

Complete all monthly bookkeeping tasks, such as bank account reconciliation, expense tracking, accounts payables, and receivables.

This will help identify errors and certify your bookkeeping is accurate and up to date.

Step 3: Prep the financials

The next step is to gather, review, and organize all relevant financial statements to ensure they reflect the company’s financial status. Some tasks to carry out in this step include:

- Update the bookkeeping (if needed): Review and adjust the financial records to show recent transactions and balances.

- Adjust entries: Correct omissions or mistakes to be sure all financial records are accurate and up to date.

- Run and match reconciliation reports with statement balances: Compare reconciled accounts with statement balances to identify discrepancies, ensuring all financial records are precise.

- Create and compile draft financial reports: Generate reports summarizing your client’s financial health and performance.

Step 4. Process year-end data

Collate and verify all financial data for the fiscal year is accurate. This process is essential to evaluate your client’s financial performance and plan effectively for the year ahead. There are four major things to do here:

- Verify prior year financials match prior-year tax return: Make sure the previous year’s financial data matches its tax return. Doing this helps maintain compliance and reduces the risk of penalties.

- Review current year financials and reconcile accordingly: Verify the financial statements for the current year and reconcile any discrepancies to ascertain accuracy on all accounts.

- Find and fix any errors uncovered (if applicable): Identify and correct mistakes or omissions. This process is crucial to maintaining reliable financial records and preventing potential tax filing or audit issues.

- Close the books: Finalize all accounts to lock in the financial data and generate final reports in preparation for the upcoming fiscal year.

Step 5: Review and share

Once you’ve finalized the financial reports, it’s time to review and share them with your client.

- Prepare and share year-end financial summary: Create and share a detailed overview of your client’s annual financial performance. You can highlight key insights to help them understand their financial position and prospects.

- Archive year-end financial reports: File year-end reports to ensure they are safe and secure for future reference. Proper archiving helps maintain organized records, making them easily accessible for audits.

- Share year-end reports: Send your clients the financial reports so they can share them with other stakeholders and make informed business decisions for the upcoming year.

Step 6: Meet with client (if required)

Now, schedule a meeting to discuss the report, address concerns, and plan for the year ahead. This is not always necessary, but you might want to do it to guarantee everyone is on the same page.

Step 7: Collect all W-9s

Gather all W-9 forms to complete the 1099 process. This step is essential for tax reporting to prevent unnecessary delays or penalties and maintain compliance with the IRS.

Pro tip: This isn’t a one-size-fits-all year-end accounting checklist. Feel free to customize it to suit your client’s or firm’s needs.

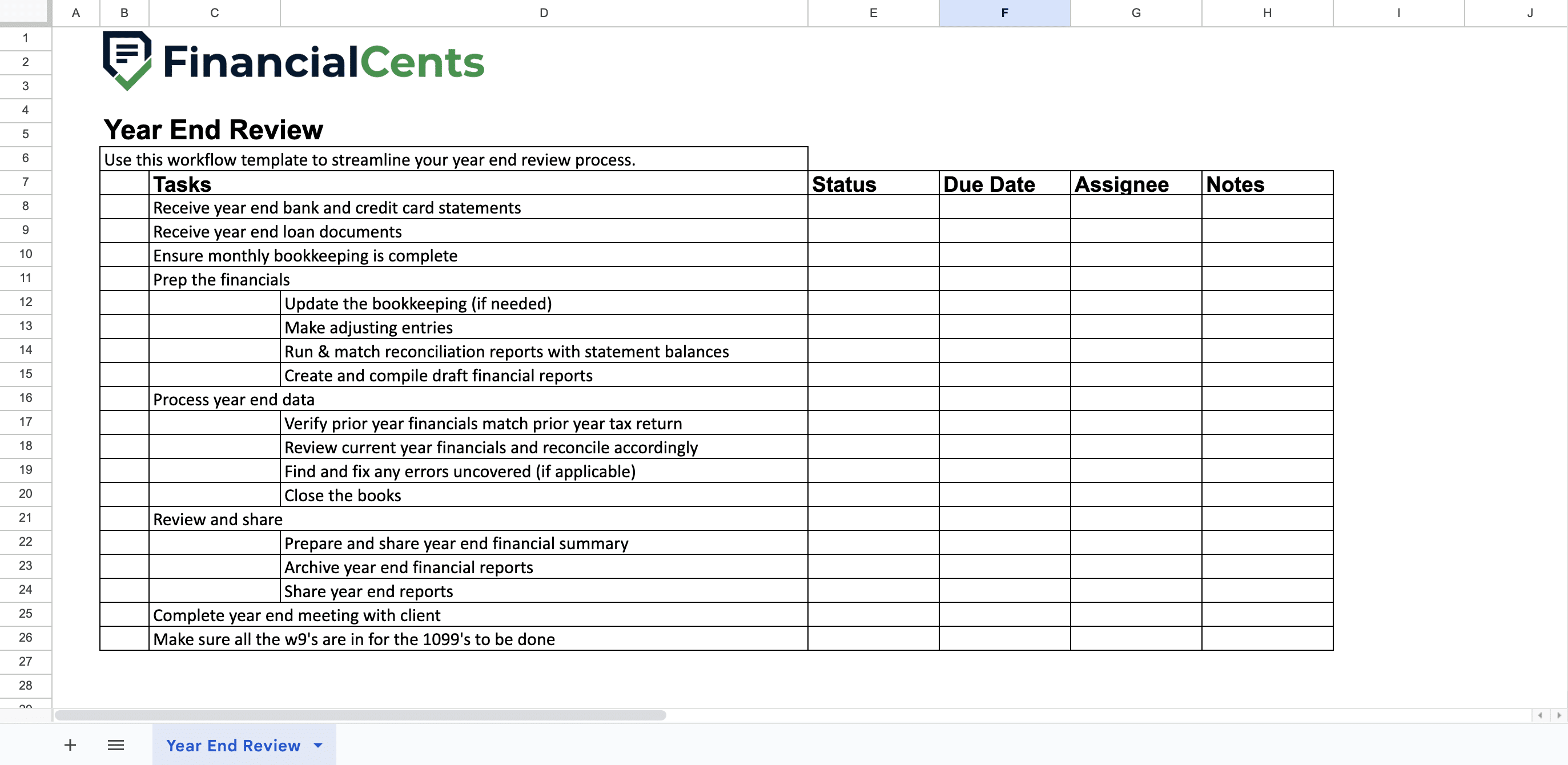

Download Template

Common Year-End Accounting Mistakes to Avoid

As the pressure to close the books mounts, mistakes can occur. Identifying these pitfalls could help you prevent them. Here are common year-end mistakes to watch out for.

1. Failing to reconcile accounts regularly

Sometimes, the workload can get overwhelming, and you neglect minor tasks like account reconciliations, leading to inconsistencies between your financial records and bank statements.

The result? Inaccuracies in your year-end financial reports, making it difficult to assess your financial performance and close the books.

Reconcile accounts regularly to prevent such issues from arising. You can set reminders for this task so you don’t overlook it. This practice helps identify errors early, ensures financial accuracy, and contributes to a stress-free year-end close.

2. Overlooking small expenses or receipts that weren’t recorded.

Small expenses, especially cash expenses, can easily slip through the cracks, especially when they seem insignificant. However, failing to record these expenses can accumulate over time, causing inaccurate year-end financial statements.

You can prevent this by consistently tracking and recording all expenses or receipts, regardless of their size. This approach will guarantee an accurate financial report and a straightforward year-end closing process.

3. Not reviewing financial reports for errors or discrepancies

Accounting is a sensitive process where minor errors can have long-term consequences. One such error is failing to review financial reports for errors or inaccuracies, which can mislead stakeholders, impact decision-making, and complicate regulation compliance.

To maintain financial integrity, carefully review all data to identify and correct errors before finalizing and sharing year-end reports with clients. You can enlist a second pair of eyes to verify all financial records are accurate and updated.

4. Forgetting to write off bad debts or outdated inventory

Another mistake to avoid is not writing off bad debts or obsolete stock. This can overstate your client’s assets and misrepresent their financial health, leading to inaccurate profit margins.

However, regularly reviewing accounts receivable and inventory helps identify items you should write off so the financial reports accurately reflect the business.

5. Not standardizing your year end-close process

In the aforementioned APQC survey, 25% of businesses complete their annual close within 10 days. One primary reason is that they follow a standardized process to close their books.

However, without a clear and structured approach, you may overlook some tasks, omit some documents, and miss deadlines.

Also, the lack of a standardized process can create unnecessary stress during this critical period, making it difficult to produce correct financial reports.

One effective way to prevent this issue is to use a checklist to develop and adhere to a standardized year-end close process. You can also use software like Financial Cents to streamline operations, ensuring all necessary tasks are completed, and you have an accurate financial record.

Best Practices for a Stress-Free Year-End Close

Follow these tips for an easy, stress-free, year-end close.

1. Start Early

Begin preparing for year-end accounting well before the close of the fiscal year to prevent last-minute stress. Start early to identify and resolve any issues so the process is smooth.

2. Delegate and Automate

Assign responsibilities to team members and leverage accounting technology to automate repetitive tasks like collecting documents or sending follow-up reminders. This approach boosts efficiency and accuracy while reducing manual errors.

3. Perform Monthly Closings

You don’t have to wait till the year ends before closing the books. Monthly closings help maintain accurate records and catch issues early, making the year-end closing process less daunting.

Use Financial Cents to Manage and Automate Your Year-End Close Process

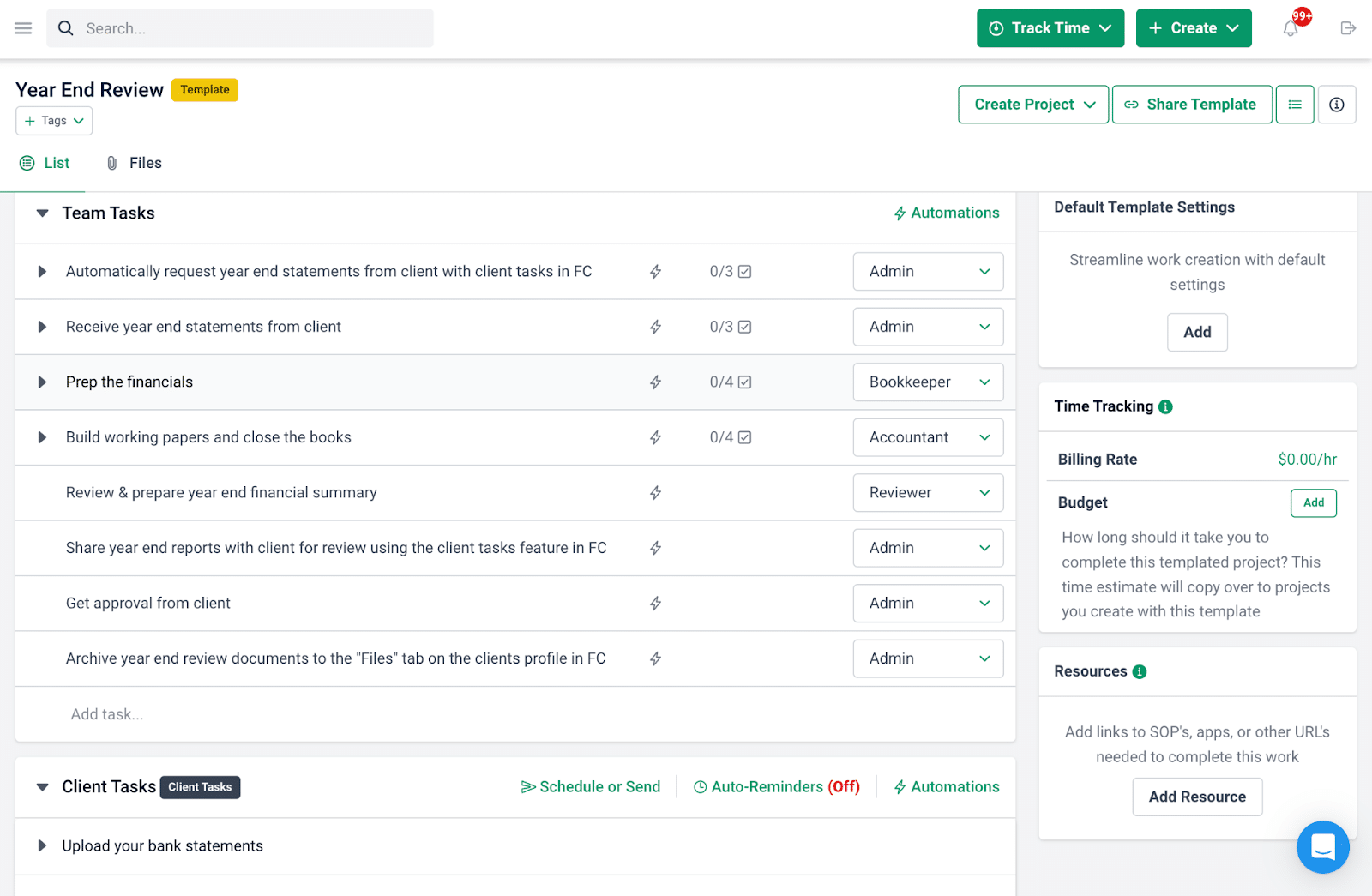

Besides a checklist, workflow automation software is another excellent way to stream your year-end accounting tasks. It helps to increase efficiency, accuracy, and productivity. Financial Cents is an example of an accounting workflow software, and it contains the following valuable features:

Automation and Workflow Management

Automate recurring tasks, manage accounting workflows, and set deadlines to increase efficiency and productivity. You can also create workflow templates, such as a year-end review template (pictured below), enhancing your ability to standardize your closing process and maintain work quality.

Financial Cents has over 50+ free workflow templates you can use to streamline your accounting processes. You can also create custom templates if you wish.

Work Tracking and Collaboration

Enables users to assign work and track their progress. It also fosters collaboration, allowing team members to update everyone with real-time notifications.

Automate client requests

Users can receive necessary documents and information promptly from clients. They can also set up automated reminders to follow up with clients at intervals until they provide the requested documents.

This feature reduces back-and-forth communication and helps keep the year-end closing process on track.

Deadline Tracking and Management

It allows users to track and manage deadlines effectively, ensuring all tasks are completed on time.

Streamline Your Accounting Workflow with Financial Cents

Closing the books doesn’t have to be a tedious and time-consuming process. You can enjoy a stress-free year-end accounting process by using the checklist we’ve provided and Financial Cents to manage your firm and the year-end close process.

Our software has features such as workflow management, work tracking and collaboration, client request automation, and deadline management. These help you work with clients better and meet your deadlines.