Article reviewed for accuracy by Alexis Sadler, CEO Accounting Therapy Inc.

The lifeblood of every bookkeeping business is new clients. Without them, your business will stagnate, making scalability difficult.

Therefore, as the owner of a bookkeeping firm, you must always take steps to acquire new clients.

One of the things you need when trying to close prospects is a compelling proposal. A well-crafted proposal effectively showcases your expertise and the value you can provide to potential clients without overwhelming them with too much information. It increases your chances of winning new business.

So, if you desire to scale your bookkeeping business, you need a strong proposal.

Don’t know how to create one? We’ve got you covered. In this post, we share how to create a bookkeeping proposal, plus a template you can copy and use in your firm.

What is a Bookkeeping Proposal?

It is a document that outlines the services and benefits you can offer to potential clients as a bookkeeper.

A bookkeeping proposal is important because:

- It allows you to demonstrate professionalism by presenting your services in an organized manner.

- It sets client expectations by outlining the scope of your services, pricing details, and any terms and conditions. This would minimize future conflicts and misunderstandings.

- It helps you communicate your value by giving potential clients a clear picture of your offerings and how your services can benefit them.

- It gives you an edge over competitors.

- It is often the deciding factor between closing a deal or losing it to a competitor.

Essential Components of a Bookkeeping Proposal

A typical proposal usually consists of the following:

a. Cover Page and Introduction

The cover page and introduction create the first impression and set the tone for the entire document. Because the cover page is the first thing potential customers see, make it visually appealing and attention-grabbing by using:

- A professional design and high-quality images/graphics

- An eye-catching title

- Branding elements like your logo and brand colors

- Consistent typography

The introduction is where you provide an elevator pitch of your business. Introduce your bookkeeping business with a brief overview of what you do.

b. Problem Statement

Then, touch on the potential client’s bookkeeping pain points and state how you can help them solve their problems to achieve their desired goals.

This section shows you paid attention to the client, are empathetic, and are committed to offering a customized (not generic) solution for them. This builds trust and differentiates your services.

c. Services Offered

Clearly outline the specific bookkeeping services you can provide. This may include accounts receivable and payable management, bank reconciliation, financial reporting, payroll processing, general ledger maintenance budgeting, and tax return preparation.

Be specific about your services and explain how they can benefit the client’s business.

This section is important as you can use it to effectively communicate the value and expertise you bring to potential clients.

d. Qualifications and Experience

Highlight your team’s qualifications and experience in the bookkeeping industry. Also, mention any relevant certifications, years of experience, and specializations you or your team have.

Doing this validates your capabilities and positions you as a qualified and trustworthy bookkeeping service provider.

e. Pricing and Payment Terms

Next, state your pricing structure. This can be an hourly rate, a flat fee, value-based, or a customized package based on the client’s needs. Be transparent about any additional charges or fees that may apply.

Don’t forget to specify payment terms, like due dates, late fees, and accepted payment methods.

f. General Terms and Conditions

Include any terms and conditions that apply to your business to protect you and the client. These terms include confidentiality and non-disclosure agreements, scope of services, cancellation policies, and any other legal or contractual obligations.

g. Implementation Plan and Timeline

Make a note letting the prospect know you’ll develop a detailed and customized plan for implementing your bookkeeping services and the timeline for completion. This shows that you are organized and efficient.

h. Confidentiality and Security

Clients are more security conscious these days, so reassure them that you have measures in place to ensure the confidentiality and security of their sensitive information. Then, highlight some of these measures, like password protection, encryption protocols, data backup procedures, and any other security measures you have implemented to protect client data.

i. Call to Action (CTA)

End your proposal by including a clear CTA urging prospects to take the next step. It could be to reach out to you for further discussion, sign the contract, complete a form, or book a call.

Provide your contact information and encourage them to contact you if they need clarification. Remember, a compelling CTA increases your chances of converting the prospect to a paying customer.

Sign off with your name, title, and company name.

Bonus Tip

Proofread meticulously to ensure there are no grammatical or formatting errors. An error-riddled proposal is not a good look for your firm and could undermine your credibility.

Use spelling and grammar check tools like Grammarly to proofread. You can also have someone else on your team review the document.

Free Bookkeeping Proposal Template For You

Creating a proposal from scratch every time you want to send one to a prospective client is unrealistic. Not to mention, it’s a waste of time and effort.

Instead, it’s more efficient to use a template. Of course, you’ll need to customize them to align with each client and their requirements. But these templates serve as a great starting point and go a long way in streamlining the proposal creation process.

Below is a free template you can use.

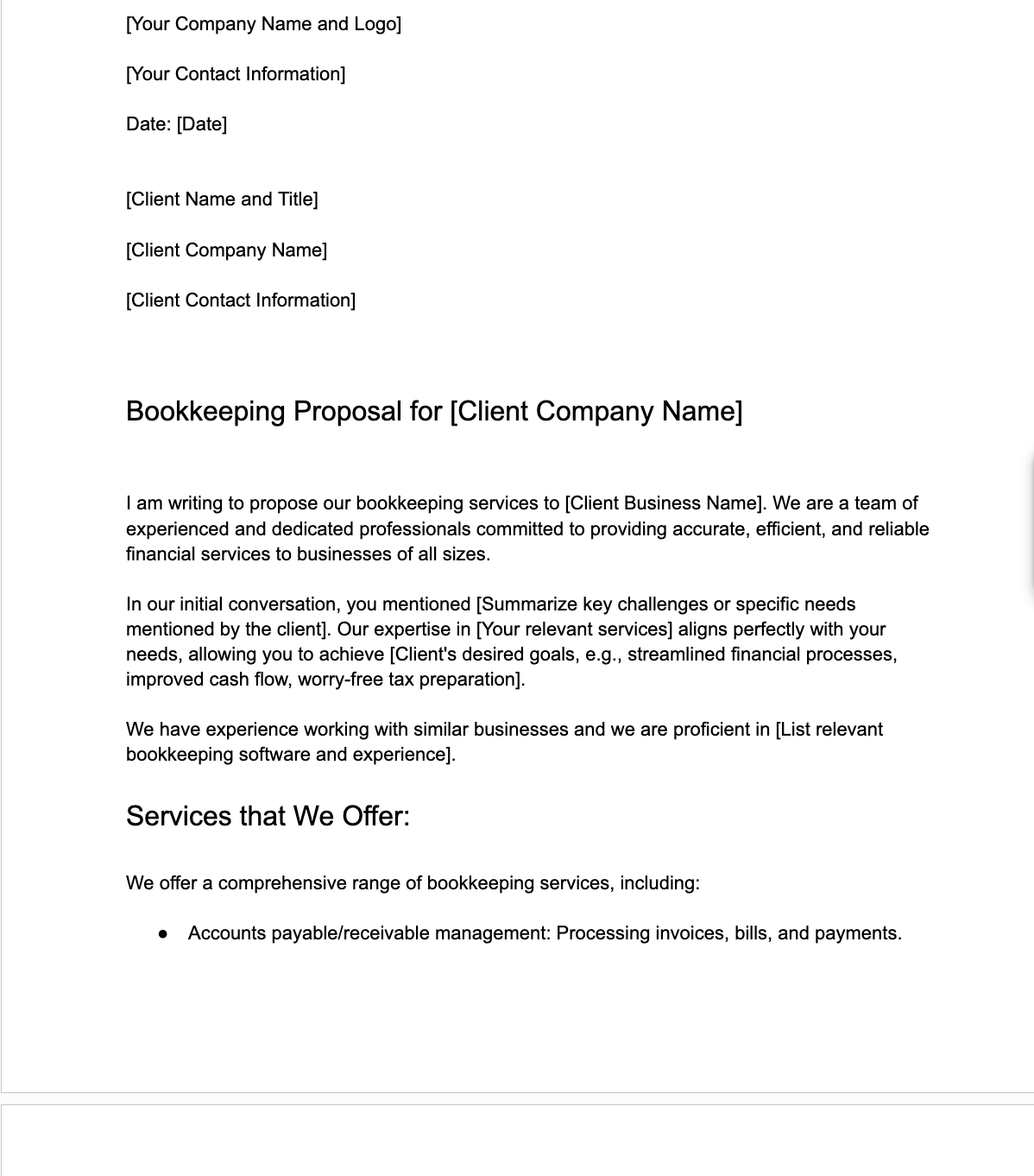

[Your Company Name and Logo]

[Your Contact Information]

Date: [Date]

[Client Name and Title]

[Client Company Name]

[Client Contact Information]

Bookkeeping Proposal for [Client Company Name]

I am writing to propose our bookkeeping services to [Client Business Name]. We are a team of experienced and dedicated professionals committed to providing accurate, efficient, and reliable financial services to businesses of all sizes.

In our initial conversation, you mentioned [Summarize key challenges or specific needs mentioned by the client]. Our expertise in [Your relevant services] aligns perfectly with your needs, allowing you to achieve [Client’s desired goals, e.g., streamlined financial processes, improved cash flow, worry-free tax preparation].

We have experience working with similar businesses and we are proficient in [List relevant bookkeeping software and experience].

Services Offered:

We offer a comprehensive range of bookkeeping services, including:

- Accounts payable/receivable management: Processing invoices, bills, and payments.

- Bank reconciliation: Ensuring accuracy and consistency between your bank records and your books.

- Payroll processing: Calculating and distributing employee wages, withholding taxes, and managing benefits.

- General ledger maintenance: Recording all financial transactions and preparing accurate financial reports.

- Tax preparation: Assisting with filing state and federal tax returns.

- [List any additional services you offer]

Qualifications and Experience:

Our team consists of highly qualified and experienced bookkeepers with [Number] years of combined experience in a variety of industries. We are proficient in using the latest accounting software and technologies, and we are committed to staying up-to-date on the latest accounting regulations and best practices.

[Highlight your team’s qualifications and experience, e.g., certifications, specific software expertise, relevant industry experience]

[Include client testimonials or success stories showcasing your impact]

Pricing and Payment Terms:

We offer a variety of pricing options to fit your budget. Our fees are based on the level of service required and the volume of transactions. We will provide you with a detailed fee proposal after discussing your specific needs.

[Outline your pricing structure, e.g., hourly rates, package pricing, etc.]

[Clearly state your payment terms, e.g., due dates, late fees, accepted payment methods]

General Terms and Conditions:

Please review our standard terms and conditions attached to this proposal. These terms cover the scope of services, confidentiality, and other important details.

Implementation Plan and Timeline:

We will work closely with you to develop a customized implementation plan that outlines the steps for onboarding your business and establishing our bookkeeping services. This will include:

- Initial data collection and analysis.

- Software setup and configuration.

- Account reconciliation and account set-up.

- Training and support for your staff.

- Regular reporting and communication.

We will provide you with a timeline for each step of the process to ensure a smooth and efficient transition.

Confidentiality and Security:

We take the security of your financial information very seriously. We have implemented rigorous security measures to protect your data, including [List of security measures, e.g., password protection, data encryption, secure servers]. We are committed to maintaining the confidentiality of your information and adhering to all applicable data privacy laws.

We are confident that we can be a valuable asset to your business. We are eager to learn more about your needs and discuss how we can help you achieve your financial goals.

Please do not hesitate to contact us if you have any questions or would like to schedule a consultation. We thank you for your time and consideration.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

Best Practices for Creating Bookkeeping Proposals

A well-crafted proposal can be the deciding factor in whether a prospect chooses to work with your firm or goes elsewhere. To increase your chances of winning new business, follow these proven best practices when creating your bookkeeping proposals:

1. Tailor Every Proposal to Each Client

Avoid sending generic proposals. Every client has unique needs, pain points, and goals. Take the time to research the client’s business, understand their challenges, and customize your proposal accordingly. Reference their industry, mention specific bookkeeping concerns they’ve raised, and offer solutions that feel personal and relevant.

2. Communicate Value Clearly

Don’t just list your services, explain how they solve the client’s problems and benefit their business. For example, instead of saying “bank reconciliation,” say “ensuring your books match your bank records so you can make confident business decisions.” Show clients the real-world results they can expect.

3. Use Clear, Simple Language

Not all clients understand complex bookkeeping or accounting terms. Avoid using technical jargon that may confuse them. Use straightforward, professional language to explain your services, pricing, and terms. Where technical terms are necessary, include quick definitions or examples.

4. Be Transparent with Pricing & Terms

Clients appreciate clarity. Break down your pricing structure, explain what’s included (and what’s not), and outline your payment terms upfront. This builds trust and reduces the likelihood of disputes later on.

5. Highlight Your Experience & Credibility

Use your proposal to establish authority. Mention certifications, software expertise, years of experience, and relevant industries you’ve served. If you have client testimonials or case studies, include a short quote or link them to build confidence in your services.

6. Proofread Everything

Errors in grammar, formatting, or numbers can cast doubt on your attention to detail. Always proofread your proposal thoroughly before sending it. Use AI tools like ChatGPT or Gemini to proofread them and consider having another team member review it as well.

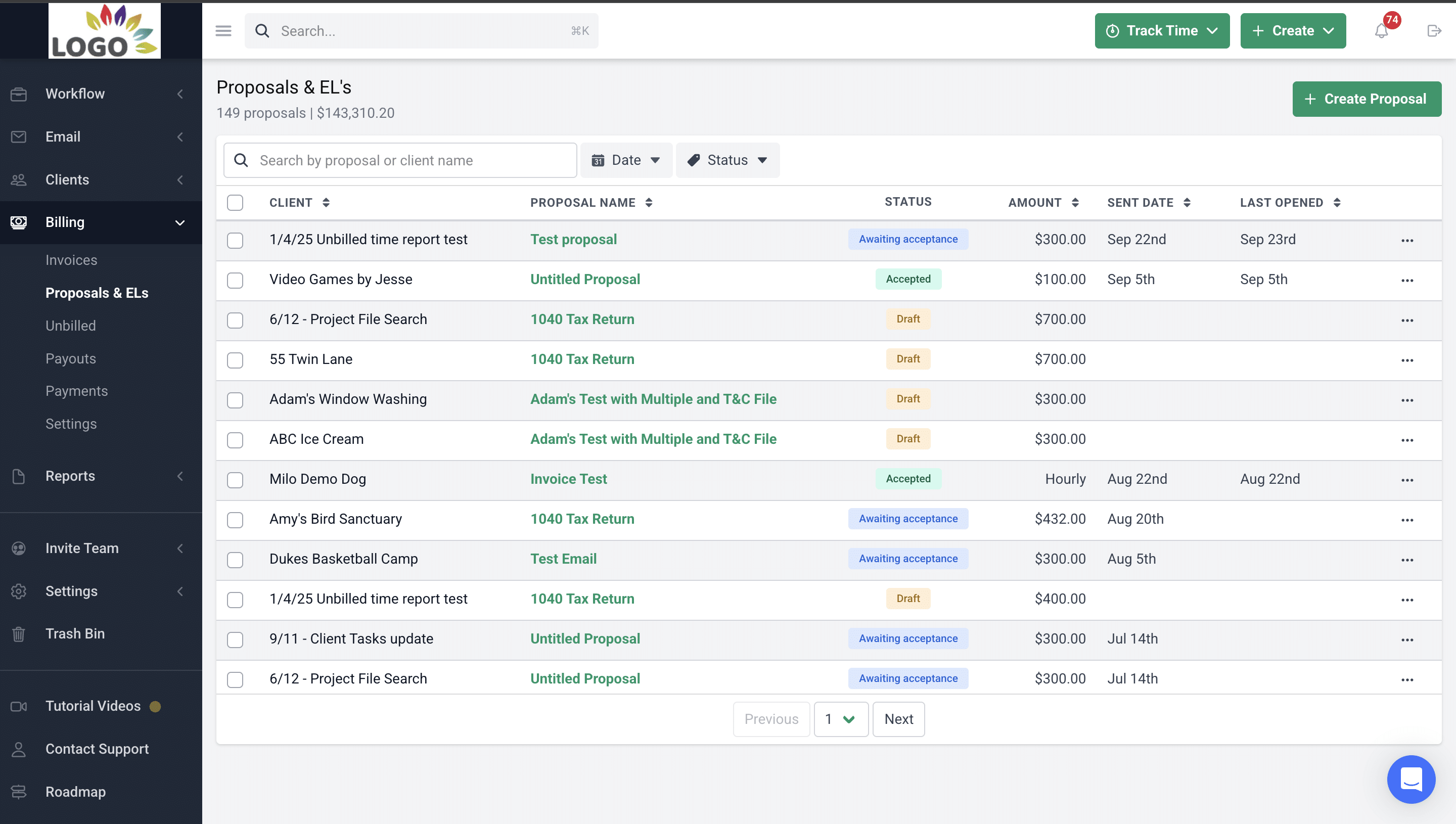

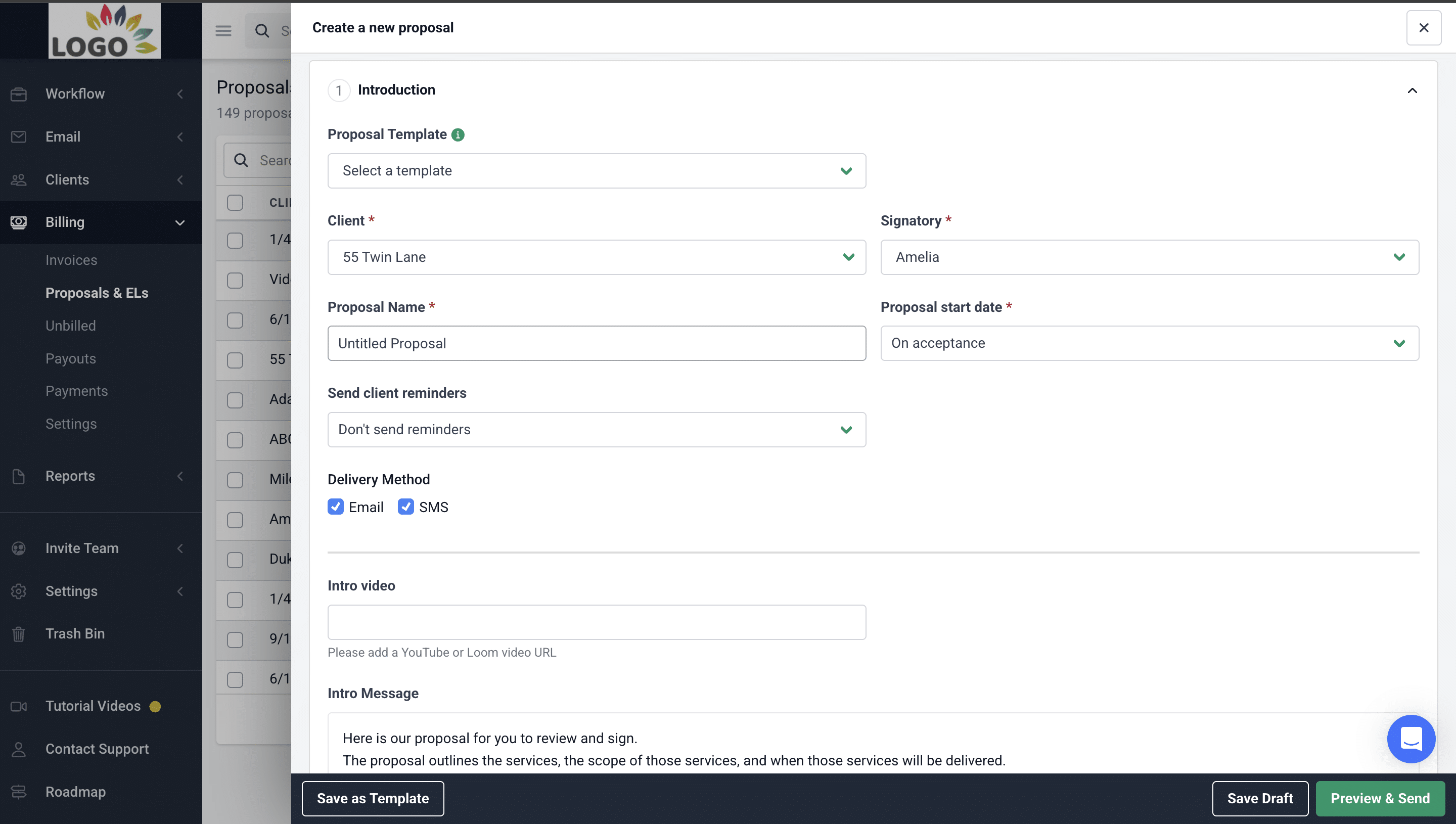

7. Consider Using Proposal Tools

Creating, sending and tracking proposals you send to everyone of your prospective clients can be overwhelming, especially as your bookkeeping firm grows.

Using a software for bookkeeping proposals helps simplify and automate the entire process. Instead of manually formatting documents, following up via email or using multiple tools to collect e-signatures and payment collection, you can manage everything from one place.

Close Bookkeeping Clients Faster with Financial Cents Proposals

Creating the perfect proposal is just the first step. Delivering it to your client in a professional, timely, and seamless way can make all the difference between a prospect saying “yes” or going with someone else.

That’s where the proposals feature in Financial Cents comes in.

Financial Cents allows you to create, send, and manage client proposals all in one place. It’s designed specifically for bookkeeping, accounting and tax firms, so everything, from services to pricing to engagement letters fits your workflow perfectly.

Here’s what you can do with Financial Cents proposals:

-

Create professional branded proposals that reflect your firm’s professionalism.

- Send proposals in bulk to multiple clients at once, this can be useful if you’re offering the same service to them.

- Save proposals as templates so you can reuse them in the future.

-

You can also include your engagement letter right inside the proposal, if needed.

-

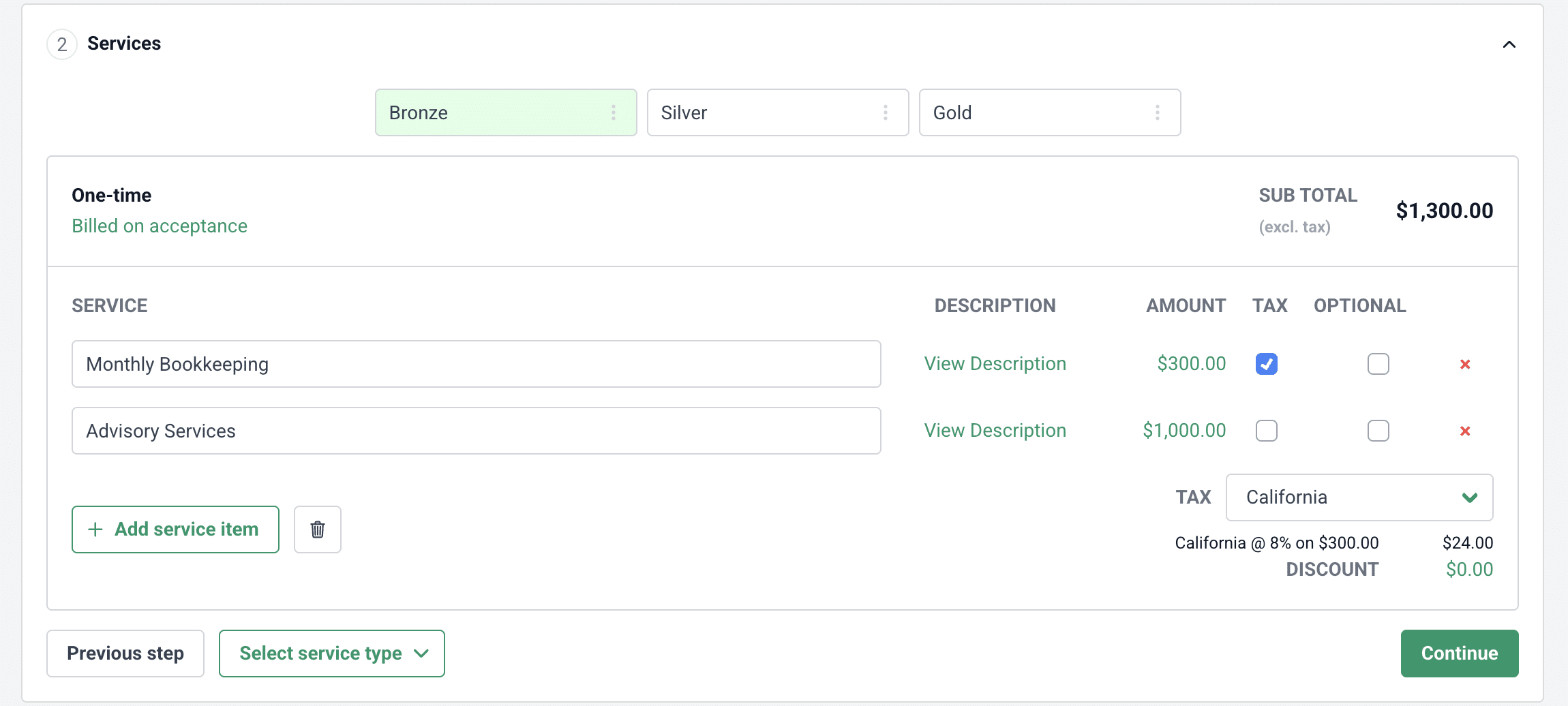

Customize your service packages and pricing based on the client’s needs. You can also include add-on services to upsell to clients.

-

E-signatures for clients to sign from any device instantly

-

Collect payment details upfront or set it to auto-charge once the proposal is signed

-

Send, track, and follow up on proposals effortlessly

This means less admin work, faster client onboarding, and fewer dropped opportunities. And because the process is automated, you can focus more on delivering great service, not chasing down signatures and payments.

Whether you’re onboarding one new client or fifty, Financial Cents helps you create a frictionless experience that keeps your firm moving forward.

What Next?

After closing the deal and winning new clients, ensure you live up to all the promises you made in the proposal. Deliver exceptional services that meet their needs and expectations. You can do this by having an organized onboarding process, communicating & collaborating with them well, and meeting all deadlines.

If you have multiple clients, you might find it difficult to manage all of them efficiently. That’s where Financial Cents comes in. We help bookkeeping firms get organized, manage client work, and never miss their deadlines.

Use Financial Cents to manage your bookkeeping firm.