Best for:

-

Firm owners looking to build customer trust, loyalty, and retention through effective client communication.

-

Firm owners who spend too much time manually updating clients on their project status.

-

Accounting and bookkeeping firms that do not want to repeatedly create (and send) the same type of email.

As important as timely client updates are, every hour your team spends drafting (and sending) emails to clients is an hour they could have spent on high-value tasks.

The Financial Cents client update feature automates client updates, enabling accounting and bookkeeping firms to maintain regular client communication without losing focus.

Here’s how to apply this automation to your workflow to ensure consistent client updates throughout your firm.👇

Step-by-Step Guide:

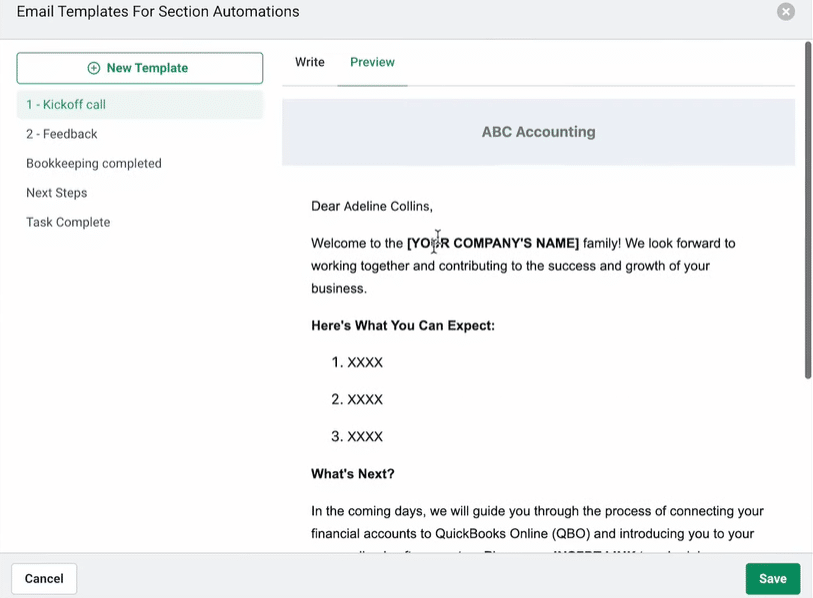

Step 1: Create Email Templates

This automation starts with creating and saving email templates for the different updates your clients need.

With Financial Cents AI features, you can create these email templates in seconds. But you can also create yours from scratch.

Here’s how to create an Email Template (From Scratch and with AI):

- Add Specific Client and Project Information to Personalize Client Updates

The steps above will give you a generic email template you need to customize for each of your clients.

Step 2: Set Up the Automation

With the email templates ready, you can now create the automation. That way, completing a task or section will trigger an email to the client.

Here’s how to do it:

PRO TIP: Preview Emails Before They are Sent

Preview your email updates before sending them to the client. This allows you to see how it will look from the clients angle, enabling you to adjust any section of the email as you see fit.

Sam S., CPA

Brianna Goodman

Angela Brewer

Step 3: Monitor and Optimize Updates

While this automation saves time and mental energy, it’s not all you need to get clients to complete the required next steps.

That’s why you need to monitor the process to ensure

- They’re receiving the updates.

- They can respond in the easiest way possible.

For example, if your emails are not clear enough, your clients will not know how to respond, and that makes it more difficult to get their responses on time.

PRO TIP: examine (and reduce) your use of technical jargon. They make your updates too technical and less actionable for your clients.

An accounting client portal is also helpful here. Apart from giving your clients one place to exchange files and information, it enables them to ask questions and build clarity.

- When are the Updates Too Few or Many?

Sometimes, email frequency might be the problem with your updates. As much as your clients want to hear from you, they are busy with their core business functions.

It is then critical to understand how many updates are too frequent and how many are not.

Whether you send weekly, biweekly, or monthly updates depends on a few factors, but the urgency and importance of the update should take priority.

You wouldn’t want to stick to a weekly update schedule when you don’t have something important to say every week.

Start a free trialWhy Automatic Client Update is a Game Changer

More clients appreciate regular client communication updates than you think. Timely updates promote transparency, improve client relationships, and drive client retention.

But your team has a million and one thing to do every day. Drafting and sending emails to each client will be a huge administrative undertaking.

Outsourcing this critical function to your practice management software gives your staff the mental clarity to meet client deliverables and grow your practice without breaking their back.

Provide Timely Client Updates Without Losing Your ‘Flow State’

Striking the right balance between providing timely client updates and focusing on quality work is never easy for any accounting firm.

With our automated client update feature, you will not only delight clients with deliverables but also make them feel seen, heard, and valued throughout the project life cycle.

Even better, Financial Cents allows you to create emails you can reuse for all clients, reducing the hours you’d have spent drafting emails from scratch each time.

See how this will work in your firm. Start a Free Trial Now or Book a Personalized Demo to learn more.

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!