11 Must-Have Features for Your Tax Practice Management Software

Author: Financial Cents

Reviewed for accuracy by: Kellie Parks, CPB

In this article

Tax practice management software is most beneficial because of its ability to put everything tax professionals need for work at their fingertips.

Managing workflow, client information, and staff capacity were among the challenges tax firms faced in 2023, which led to missed deadlines, poor work-life balance, and revenue loss.

However, the number of problems you can solve with software depends on the relevance of the features your tax practice management software affords you.

Otherwise, you’ll need multiple apps to manage different aspects of your tax process, costing you more time and money.

This article discusses and provides examples of the essential features your practice management software must have to reduce the time you spend preparing your clients’ tax returns.

Benefits of Using a Tax Practice Management Software

a. Increased Efficiency and Productivity

When your team has one place to onboard tax clients, access their information (and documents), and manage their work (rather than switching between different apps), it becomes easier to get work done (accurately and efficiently) in the busiest season of the accounting calendar.

b. Improved Client Communication and Satisfaction

Tax practice management software integrates with email service providers, enabling you to track client communication in your workflow dashboard.

This prevents information from slipping through the cracks, helps to align client expectations between your team and clients, and sets you up to meet client deliverables consistently.

c. Enhanced Security and Data Protection

Tax practice management software uses encryption technology, access control, and regular security updates to protect the information you exchange between your firm (especially in remote work systems) and your clients.

d. Track Client and Tax Deadlines

Most tax practice management software has workflow dashboards that provide visibility into client work. These dashboards allow you to see where each tax client’s work stands and when to allocate more resources to get work done more quickly and meet deadlines.

They also enable you to track your team’s time and workload to ensure everyone completes their tasks as expected.

e. Scalability and Growth

The time tracking feature in tax practice management solutions enables tax firms to bill their clients more accurately to get adequate values for your team’s time.

Moreover, using a single tool in place of several others helps you to cut costs and save money, which you can reinvest in the business.

f. Reduces Time Spent on Manual Tasks

Tax practice management software automates tasks to reduce the time your team spends on their daily operations.

For example, Financial Cents’ automated reminder enables tax accountants to keep their clients automatically follow with clients for the additional information they need or the forms they need to sign.

The 11 Features Your Tax Practice Management Software Must Have

1. Workflow Management (and Tax Workflow Templates)

Having to check off tasks before we can close a project forces us to be more disciplined and leave an accurate status of projects. Also, Financial Cents helps us to collaborate more in the middle of tax season. When we see all the tasks checked off, we are confident that a project is complete."

Kim Ritter, Owner of Ritter’s Tax & Accounting ServicesEach tax project represents a set of forms to be signed, a series of conversations, and a set of tasks to manage. This process becomes disorganized and unwieldy when managed in spreadsheets and sticky notes.

A solid workflow management feature gives visibility over these moving parts of a tax workflow by bringing all tax projects, assignees, and relevant documents into one central place. This keeps your firm organized and your priorities aligned during the busy season.

Without it, you will struggle to understand who’s assigned what, where each tax project is, and what is needed to complete it.

Tax practice management software also smoothens workflow management by providing free templates. Templates are checklists of steps needed to complete every tax project, which keeps your team from missing critical steps so that your work quality can stay consistent.

Financial Cents keeps us on track. When completing work, we get tempted to say, 'Oh, this client didn't fill out an intake form. Let's skip it.' But since it's a project in Financial Cents, we're more likely to get every step of the work done accurately to stay consistent and keep a high work quality standard. And that keeps us accountable and disciplined."

Kim Ritter, Owner of Ritter’s Tax & Accounting ServicesWith these templates, you can assign tasks to your team members without worrying about accuracy because they have a step-by-step guide for your tax work.

Not to mention the gains in productivity because they don’t have to second-guess themselves while doing the work.

2. Client Relationship Management (CRM)

Efficient client relationship management encompasses everything a tax firm does to manage its client relationships, giving clients a good impression of the firm.

The best tax practice management solutions come with the ability to store and manage client information (and interactions), which empowers your team to provide more personalized client services.

This is important because client management constituted 51% of the challenges tax and accounting firms dealt with in 2023.

This could be due to their use of separate tools to manage clients and workflow, which makes it time and energy-consuming to refer to client information when doing client work.

With solutions like Financial Cents, client and workflow management happens in one platform.

For Financial Cents users, this feature includes:

- Client Profile (and Vault): for storing all client information (such as contact information, logins, EINs, and SSNs).

- Activity Feed: to understand when your team last interacted with a client, by whom, and about what.

- Client Emails: to access all emails between your team and clients from Financial Cents.

- Effective Hourly Rate: to measure which client is taking more of your time than their fee allows.

3. Due Date & Deadline Tracking

![]()

Financial Cents has kept us more organized. It keeps projects from falling by the wayside. Sometimes, we forget things because we are too busy. For example, we may lose important information in an email, but if it is a project with the due date in Financial Cents, it'll bring it back up."

Kim Ritter, Owner of Ritter’s Tax & Accounting ServicesThe due date feature enables you to manage project deadlines by creating a visual timeline of your projects to prevent your team from forgetting important details.

With the due date feature, your tax workflow tool will show all your due dates alongside the respective tax projects. This makes it easy for your team to see at a glance when they should complete the task assigned to them.

Otherwise, they will struggle with remembering the due date of their assigned tasks to know which one is most urgent. When used well, the due date feature will save you last-minute rush that results in errors.

For example, Financial Cents Due Date features include:

- Due Date Reminders: This will automatically remind your team about upcoming deadlines according to the predetermined number of days.

- Internal Due Dates: This allows you to set shorter deadlines for your team before the actual due date for the project. This will help your team complete the project sooner, meet deadlines, and move on to other projects.

4. Team Collaboration and Communication

Financial Cents helps with communication in terms of presence. Our admin personnel writes tax return dates so that we can find the information when she's not at work."

Kim Ritter, Owner of Ritter’s Tax & Accounting ServicesTeam collaboration thrives when you create an environment of open communication where your team can ask questions, share files, and gain clarity on their tax work. This is important because it helps them get work done to the client’s satisfaction.

Many tax firms use Slack, emails, and Microsoft Teams to manage internal communication. But these tools increase the number of apps your team uses for work, not to mention the additional cost you will have to bear and the login information you will have to manage.

Tax practice management software uses cloud-based file-sharing technology to enable your team to share and collaborate on documents in real-time.

In Financial Cents, team communication and collaboration work with these features:

- Team Chat: for sharing information with your team as comments on the client’s project.

- @Mention: to tag team members in your comments in Team Chat.

- Client Emails tab: helps to centralize your email communication with your clients in the client’s profile.

- Client Notes tab: for sharing important client updates (on the client’s profile).

5. Automated Client (Signature) Requests

Financial Cents' client task allows us to follow up with clients to send the required documentation. These automated emails prevent us from forgetting about it. And we don't have to worry about the client forgetting it. Automated emails continue to go out to them (at the frequency we set) until they send in the required information."

Kim Ritter, Owner of Ritter’s Tax & Accounting ServicesAutomated client tasks are the answer to tax client data collection. It saves you the time and additional work of chasing clients to provide the information you need to complete their tax returns.

With this feature, you can save 14 hours per employee every week.

Here’s how this works in Financial Cents.

After onboarding your tax client, Financial Cents allows you to set up a list of the information and documents you will need from them to file their taxes.

Depending on the time you choose to send the requests, your client will receive an email (and text) notifying them of the requests.

This feature also works for client signatures. Thanks to Financial Cents’ integration with Adobe Sign, you can share proposals and tax returns for your clients to sign inside Financial Cents.

This feature comes with Automated Reminders that follow up with them until they grant your request (usually with a click).

6. Secure Document Management

A secure document management feature protects your client’s information from unauthorized access. Tax practice management software uses some or a combination of the following measures to protect your clients’ data.

- Access Control empowers you to control the client information your staff can access. Firm owners and managers usually use the need-to-know principle to restrict their employees’ access to only the information they need to complete client tax projects.

- Data Encryption: makes your clients’ data useless to unauthorized persons. It turns data into cryptic information that requires a passcode to be legible.

- Storage Backup: protects your client information in the case of a security threat.

- Regular Security Update: tax practice management tools are regularly updated to fix emerging security vulnerabilities.

- Multi-factor Authentication: requires alternate means of verification to give access to information from new devices.

With these security measures, you can organize your clients’ documents and tax information into folders without worrying about their safety.

For example, any document a tax client sends in Financial Cents is automatically added to the client’s profile so your team can access it on demand.

You can also redirect the documents your clients upload in Financial Cents to your favorite third-party DMS, such as SmartVault, Dropbox, Sharefile, etc.

7. Client Portal

The client portal is a platform for receiving and collaborating with clients on tax documents. By uploading a tax return into the portal, the client can sign the document in seconds (without downloading and scanning it).

With the Financial Cents client portal, clients do not need to create or manage a password and username. Its client portal uses secure magic link technology to verify clients’ identities before granting access.

Clients are already overwhelmed with numerous passwords for their other apps. This password-less access improves their chances of responding to your request for information and documents.

Where your client needs help understanding what you need from them, they can use the chat feature to ask for clarity instead of leaving the portal without granting your request. Once a client uploads the documents you requested, your team will receive an email notification.

With a solution like Financial Cents, you can customize your client portal to look and feel like your firm by adding your logo, color, and other brand assets.

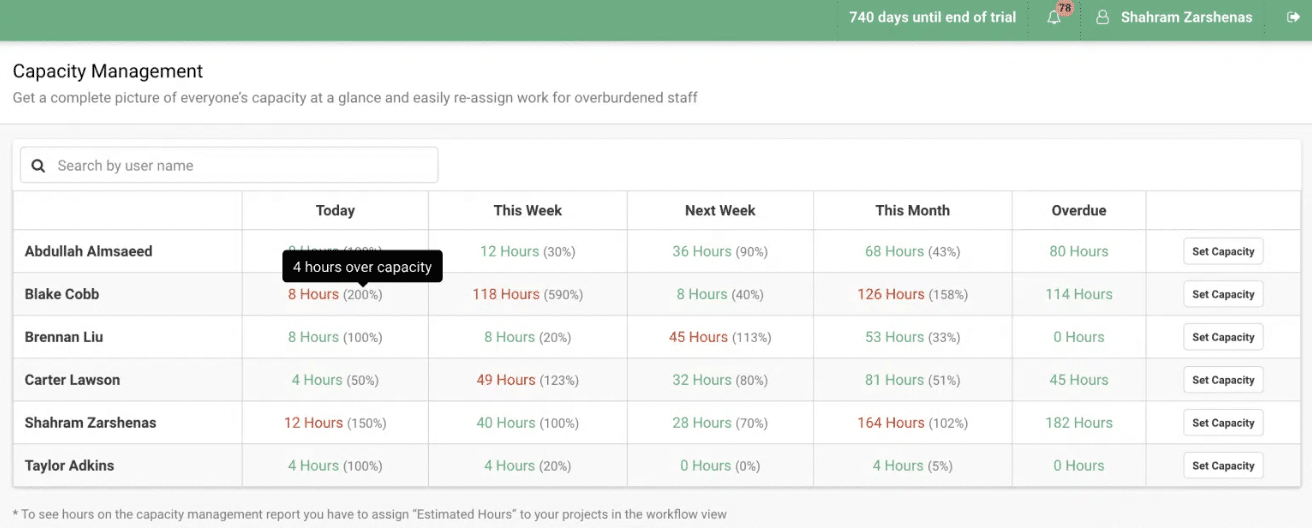

8. Capacity Management

The capacity management feature helps you understand your team’s workload and who has enough room for more work. It helps to ensure that your resources are well managed to meet increasing client demands during the busy season.

Without this feature, some of your employees will be:

- Underworking: you’re paying them for the work they are not doing.

- Overworking: can lead to employee burnout and turnover.

With the Financial Cents’ capacity management feature, you have all the data you need to maximize your employees’ skills and time. It gives you the ability to:

- View your team’s workload in a dashboard to see their workload and capacity for more work.

- Set capacity limits for them to ensure no staff works more than a certain number of hours in a week.

- Reassign work from overworking employees to other employees to maintain the balance in your team.

11. Uncategorized Transactions

This feature lets you collaborate with clients from your practice management tool instead of downloading uncategorized transactions in spreadsheets.

Called ReCats in Financial Cents, this feature includes reminders that constantly present your requests for information before the client’s eyes, leaving little room for them to forget.

If your tax firm also offers bookkeeping services, here’s how ReCats can help:

- Auto-pull uncategorized transactions from QBO: you can access all uncategorized transactions in QBO from Financial Cents instead of exporting the data to a spreadsheet.

- Categorize uncategorized transactions: Financial Cents uploads transaction categories, notes, and related files to QBO directly, so you can recategorize with just a click.

- Collaborate on details with clients: The Financial Cents client portal feature allows you to receive transaction descriptions, notes, and documents from clients.

10. Time Tracking

![]()

The time tracking feature enables tax firm owners to manage their employees’ time and bill clients adequately to stay profitable.

It shows you where your team is spending its time so that you can cut time leakages, get more work done, and find accurate data to justify your rates.

When you track time in a separate tool from your workflow tool, you give your team more reasons to switch between apps and contexts—which kills productivity.

In Financial Cents, the time tracking feature is side-by-side with the workflow tool, enabling firms to track time on the go.

- QuickBooks integration: allows you to export your time entries into QBO, bill your clients quickly, and improve your chances of getting paid on time.

- Effective Hourly Rate feature: shows how much you charge your clients versus how much time your team spends on their tax work. This information helps you adjust your rates to stay profitable.

- Time Budgets: allow you to estimate the time a tax project will take and see when you’ve exceeded it. They’re great for identifying and fixing time-wasting activities.

11. Integration with Other Software

No software solution can meet all the tax practice management needs of every tax firm.

The right software will connect you with other relevant solutions so that you do not need to purchase (learn or manage the login information of) more apps.

Any software worth considering should integrate with accounting and tax-relevant software like:

- Your general ledger accounting software.

- Proposal software.

- Document management system.

- Zapier to connect to 5000+ other apps you may need now or later.

With integration, you can link clients and transactions and automate manual tasks across your mission-critical tools from one platform.

Financial Cents: One Place For All Your Tax Workflows, Client Information, and Team Workload.

Technology should buy you time to focus on the work that counts the most.

If you spend a lot of time managing your tax processes across different apps, your tax practice management software may be problematic.

With the features above (and a handful of integrations), your tax practice management solution will bring all your work and client information in one place.

With Financial Cents, your team members will access the same information anytime (and from anywhere) to hit client deadlines.

Use Financial Cents to manage your tax practice.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to our newsletter for an awesome dose of firm growth tips.

Subscribe to our newsletter for an awesome dose of firm growth tips.