Financial planning is often seen as an overwhelming chore by the ordinary individual, leading many to seek professional assistance from accountants or CPAs to navigate the intricacies of financial decisions for personal or business matters. This increasing demand has driven the popularity of Client Accounting Advisory Services (CAS).

CAS accounting encompasses a range of services provided by accountants to help businesses manage their finances, make informed decisions, and achieve their financial goals. You can read more about it in our guide on what CAS accounting is.

In the accounting industry, its popularity has grown over the years as more clients recognize the value of advisory services in navigating complex financial decisions.

Brandon Hall, Managing Partner at Hall CPA PLLC summarizes this perfectly when he stated that,

Advisory work is the work that clients actually want. Tax compliance services are services that clients NEED on an annual basis but don’t necessarily WANT."

Advisory services empower clients to reach their objectives, whether it’s reducing taxes, accumulating wealth, or boosting business profits. Moreover, 82% of accounting firms recognize the importance of expanding their service offerings beyond traditional accounting and bookkeeping.

This opens up firms like yours to additional sources of profit beyond traditional accounting functions.

As Brandon Hall asserts,

Advisory services come with a higher margin which enables firms to pay their staff better and ultimately service clients more effectively."

That’s why in this article, we’re providing 15 examples of client accounting services that you can offer to expand your firm’s service offerings.

Recommended Reading

15 Client Accounting Services You Can Offer in Your Firm

Tax Planning

Tax laws are constantly changing, which can make it difficult for individuals and businesses to keep up. That’s where you come in as a trusted professional who is up-to-date and in tune with all the regulatory changes.

Knowing that their tax affairs are in the hands of experienced professionals can provide clients with peace of mind, reducing stress and anxiety related to taxes.

This service is very common and by 2024, Statista projects that U.S. accounting, tax preparation, bookkeeping, and payroll services will generate 203.8 billion dollars.

As a CPA or accounting firm, this service will involve learning about your clients, analyzing their financial situation, identifying tax-saving opportunities, and developing a comprehensive plan that fits their unique needs.

You can offer this service as a one-off or on an ongoing basis depending on your clients, the industry you service, and the tax regulations that govern business practices.

Virtual CFO Services

Many firm owners and managers lack the financial expertise to make informed decisions about their businesses and hiring a full-time CFO can put a strain on their financial budget.

Many of them have turned to virtual CFOs in recent times. Why? They provide a more affordable option, as they can be hired on a part-time or as-needed basis to provide strategic advice that can impact long-term business goals – all without the associated costs and benefits of a full-time CFO.

As an accountant, virtual CFO services are a great way to tailor your expertise and outsource your skills to the specific needs of your clients. You’ll conduct an in-depth financial analysis to identify trends, opportunities, and potential risks. Then provide insights into how financial decisions impact the overall business strategy

For instance, if your client is considering expanding into new markets or simply wants to conduct an audit of its affairs, you can handle the financial planning and strategy to make this possible.

You May Be Interested:

Management Reporting

Before crucial decisions are made about a business or its offerings, a financial health check is typically conducted to ensure that the business is on track.

While many professionals from different departments might be involved in this process, accountants often play an important role in understanding and utilizing financial information for effective decision-making and strategic planning.

As a CAS service, management reporting involves breaking down all the complex financial data of your client’s business and creating clear, cut statements and reports that can help your clients make informed decisions.

You’ll often have to collaborate with top-level management to ensure that management reports are tailored to your client’s specific needs and provide the necessary information, key findings, and implications.

The goal of this client accounting service is to empower your clients in management positions with accurate and timely information to support informed decision-making.

Cash Flow Forecasting

Cash flow forecasting is a vital service that you can offer to clients, helping them project and manage their future cash inflows and outflows.

With this service, your clients can anticipate their short-term and long-term cash needs, enabling proactive decision-making and risk management.

This is important for businesses of all sizes, as it can help them make informed decisions about their finances, such as how much money they can borrow, how much inventory they need to purchase, and how many employees they can hire.

There are several different methods that you can use to forecast cash flow, but they all involve collecting historical data and using it to make predictions. This data can include sales receipts, accounts receivable, accounts payable, and inventory levels.

Industry Benchmarking

In the context of client accounting services, this involves comparing a client’s financial performance and operational metrics to those of similar businesses within the same industry.

Before an industry benchmark is reached, Key Performance Indicators (KPIs) are often set to measure the success or failure of a company in comparison to its competitors.

For accounting firms, that usually involves categorizing KPIs into financial or operational subsets.

For instance, measuring and reporting on profit margin, gross profit margin, net profit margin, revenue growth rate, and return on equity will help your clients decide on the profitability and financial health of their company.

With this service, you can help clients gain insights into how well their company is performing relative to industry norms and identify areas for improvement.

Business Performance Reviews

Business performance reviews are a valuable client accounting service as they’re aimed at evaluating and enhancing the financial health and overall effectiveness of a business.

They are particularly beneficial for businesses that are experiencing financial difficulties; undergoing significant changes, such as a merger or acquisition; or seeking to improve their financial performance and operational efficiency.

These reviews go beyond traditional financial reporting and compliance, providing a comprehensive analysis of various aspects of a company’s operations.

The primary goal of an accountant is to help businesses make informed decisions, identify areas for improvement, and achieve their strategic objectives.

Budgeting

As a CPA, offering budgeting services can be a valuable addition to your service offerings repertoire, providing clients with a comprehensive approach to financial planning and control.

Budgeting involves creating a detailed plan that outlines expected income and expenses over a specific period, typically on a monthly or annual basis.

As a part of this service, you could assist clients in developing customized budgets, regularly monitor the budget against actual performance, or help them adapt their budgets to changing business conditions and unforeseen circumstances.

The primary goal of budgeting is to provide a roadmap for financial decision-making, helping individuals and businesses allocate resources effectively, control spending, and achieve their financial objectives.

Wealth Management

While traditionally associated with investment professionals, accountants increasingly play a role in wealth management by offering specialized services to their clients.

How? It’s simple. Accountants generally provide value in the form of financial advice and sometimes that value extends beyond traditional accounting functions.

As a client accounting service, you can advise clients on tax planning, real estate planning, or investment planning with a holistic focus on building wealth over time. Depending on the circumstances, you may even partner with wealth managers and other finance professionals to assist your clients in achieving their financial goals.

Advisory and Consulting Services

There’s a growing demand from businesses for more niche, strategic, and proactive financial advice, and many of them are turning to accountants.

With specialized expertise in areas, such as mergers and acquisitions, financial planning, or risk management, many accountants have branched out to offer consulting and advisory services.

The steps to achieve this often include developing a niche – most likely within your area of specialization, partnering with other professionals, and marketing your services to highlight your experience and knowledge of any given industry.

Virtual Controller Services

Similar to virtual CFO services, you can offer virtual controller services that provide a level of financial management to your clients, often in a remote or virtual capacity.

The difference between VCFO services and virtual controller services is that the former takes a strategic, advisory role, guiding the business towards long-term financial success, while the latter is more focused on day-to-day financial operations, reporting, and compliance like documenting purchases/receipts for bookkeeping purposes; tracking and collecting payments from customers, etc.

Recommended Reading

Internal Control Implementation

As a CAS service, this involves collaborating with your clients and their companies to set up processes and procedures that improve operational efficiency, and regulatory compliance and prevent financial fraud.

Since the SOX Act of 2002 was passed, it has become mandatory for the management of companies to establish internal controls and reporting methods. Failure to do this amounts to breaking the law and results in punitive measures.

As an accountant, your financial expertise comes into play when companies are establishing, implementing, and monitoring these controls.

As a client accounting service, this can mean assisting in setting up controls for the segregation of duties within a company. For example, the person who authorizes a payment should be different from the person who approves it and the person who processes it. It could also include implementing information processing controls, risk assessments, or emergency response plans.

The internal controls set up will vary depending on the company’s policies and the needs of your clients.

Financial Risk Assessment

This is a service that you can offer to clients to help them identify, evaluate, and mitigate potential risks associated with their financial activities.

This process involves a thorough analysis of various factors – market risk, credit risk, creditworthiness, economic conditions, etc – that could impact the financial health and stability of an individual, business, or organization.

Cost Analysis

With this client accounting service, you aim to undertake a financial evaluation of your client’s business to assess and understand the various costs associated with operations, products, or services.

Clients value this service because it helps them enhance their understanding of cost structures and identify opportunities for cost optimization and efficiency improvement.

You can offer this as a single service or combine it with a range of financial services to provide a complete overview of the situation to your client.

Financial Statement Preparation

One of the most basic services provided by accountants is financial statement preparation. This involves preparing and presenting important financial records that summarize the financial situation and performance of a business.

For the sake of internal management, external stakeholders, and regulatory compliance, these statements are vital to business success.

Sales Tax Filing

Accountants offer sales tax filing services to ensure firms meet their sales tax responsibilities.

The sale of commodities and, in certain situations, services is subject to sales taxes levied by state and local governments, which are a kind of consumption tax.

In most cases, businesses must account for sales tax and send it to the relevant authorities according to where the sale took place.

Accountants are often needed to make proper filing and ensure adequate compliance.

Managing Accounting Services in Your Firm

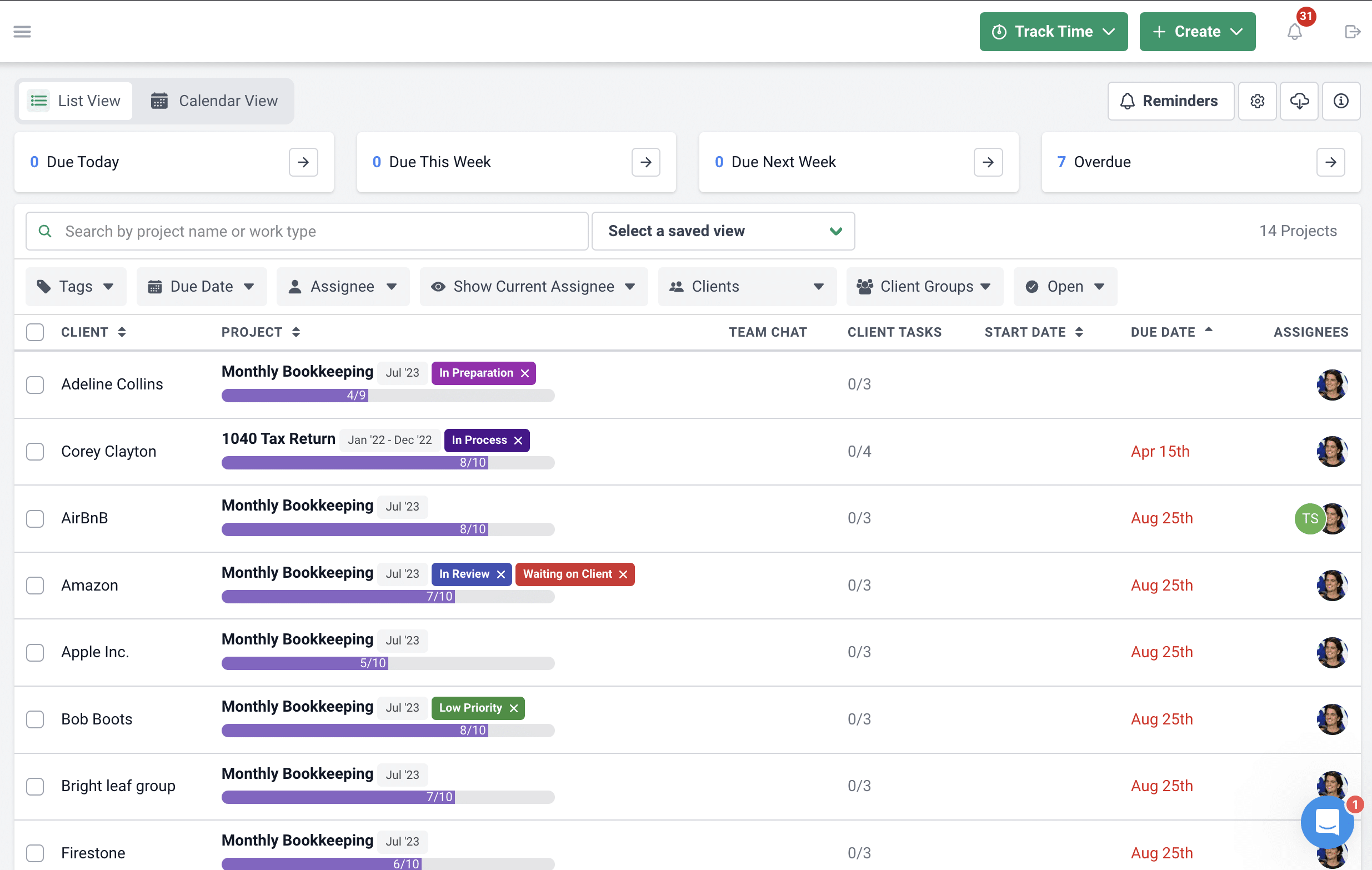

To truly excel at any of these services, simplifying your procedures for managing client information, reviewing and receiving client documents, receiving signatures, keeping track of client discussions and emails, tracking and meeting deadlines, and monitoring the progress of work done is essential.

To accomplish this, you’ll need an accounting practice management software that has workflow and client management capabilities. These features will assist you in keeping track of work, managing projects, retrieving client information, and monitoring the efficiency of your staff. You also need other client accounting services tools for your firm. You can learn more the about the list of CAS software here.

Financial Cents is the practice management software that can optimize all your practice management efforts, all in a single dashboard.

With intuitive workflow management features that never let you miss a client deadline, allow you to monitor your staff and stay updated on the progress of work, or simply track billable hours and send invoice payments, our practice management software is the ultimate trusted partner for scaling the profitability of your firm with any of these client accounting services.

Use Financial Cents to manage your accounting firm.